Академический Документы

Профессиональный Документы

Культура Документы

VAT and Its Implication in Indian Economy

Загружено:

archerselevatorsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

VAT and Its Implication in Indian Economy

Загружено:

archerselevatorsАвторское право:

Доступные форматы

Indian Business Scenario - Opportunities and Challenges VAT and its Implication in Indian Economy *Ms. Kogila. N *Ph.

D Research Scholar in commerce, St.Josephs College (Autonomous), Tiruchirappalli 2 Abstract Value added tax (VAT) is a type of indirect tax that is imposed on goods and services. German was the first country in the world to introduce VAT in the year 1954 and remains confined to handful of countries until the 1960s. Today VAT is the key source of governments revenues in more than 132 countries and nearly 75 percent of the worlds population now lives in countries with VAT. VAT is one of the most radical reforms that have been proposed for the Indian economy after years of political and economic debates. The reasons for advocating VAT is that it replaces the complicated tax structure. From April1, 2005, 20 states have replaced the five decades-old sales tax regime with the modern pro-reform.VAT can be classified into five categories, under each of which a different rate is prescribed. The tax is levied not only on products but services that is the source of revenue for the government to plan for development activities in the country. Since, India is a developing country, the main source for revenue is generated through tax levied on the individual on the purchase of goods or services. The Indian consumer and the intermediaries involved in supply chain are suffered with financial crunch and price inflation. The general public is affected by tax rates simultaneously, as rich class people are only able to bear the burden. Introduction Value Added Tax (VAT) is a multi-stage tax levied on the value added at each stage as a proportion of the value added. The value added at each stage of production and distribution is taxed. Value added tax in simple terms could be defined as a tax on the value addition at different stages of manufacturing and distribution of goods and services. It is a form of indirect tax in the nature of a multi-point sales tax with a set off or credit for tax paid on purchases / services. Each transaction of goods sold in the course of business is taxed, thus providing revenue to the government on value addition at each stage. For computing the value of the tax, normally two approaches are added. The first approach is to calculate the base of the tax by deducting the expenses on intermediate goods incurred by a firm form its sales. In the second approach, a firm is permitted to deduct the tax paid by it in its purchases from other units. The primary objective is in the forefront of the evolution of value added tax Law, the State must ensure that barriers to inter-state trade should be eliminated in order to create a unified national market. It will agree that the VAT process must be simple, transparent, and consistent in structure and approach (NCAER, 2009). Concept of VAT German was the first country in the world to introduce VAT in the year 1954 and remains confined to handful of countries until the 1960s. Today VAT is the key source of governments revenues in more than 132 countries and nearly 75 percent of the worlds population now lives in countries with VAT. However VAT is the value added sales tax. It is the excess of tax collected on total output or sales over the tax paid on total factors input. In other worlds VAT is the tax on the value added by business firm through its own activity to the goods and services it buys

1 Archers & Elevators Publishing House www.aeph.in

Indian Business Scenario - Opportunities and Challenges from other business firms. The potential tax revenue of VAT is greatly dependent on the number and level of rates, scope of the tax and the degree of tax compliance. VAT in India It is unfortunate that our country did not designed extent despite having adequate resources and skilled work forces .To boost up the Indian economy government of India initiated economic reforms since July 1991. The government appointed a tax committee under the chairmanship of Dr Raja J Chelliah on 29th August 1991. The committee has suggested for reform. The tax system to make it more efficient and revenue yielding Dr Chelliah committee has recommended Value Added Tax (VAT) as the best option to the existing central exercise duty tax system. It can be aptly defined as one of the ideal forms of consumption tax taxation since the value added by the firm represents the difference between its receipts and cost of purchase inputs. VAT is one of the most radical reforms that have been proposed for the Indian economy after years of political and economic debates. The reasons for advocating VAT is that it replaces the complicated tax structure. From April1, 2005, 20 states have replaced the five decades-old sales tax regime with the modern pro-reform.VAT that faces strong resistance from traders. When VAT was introduced in India states like Uttar Pradesh, Tamil Nadu, Uttaranchal, and five BJP ruled states decided to continue with old tax regime but late Tamil Nadu and Uttar Pradesh has agreed to implement VAT. The VAT panel had announced broadly the VAT rates for over 550 items, 46 natural and unprocessed local products would be exempt from VAT. It is important that the commentators are optimistic that VAT will help increase revenue by getting more people in the tax net. Rate Structure and Classification of Commodity under VAT The white paper on VAT has made a road map of levy of uniform state level tax on more than 550 items would be covered under the new Indian VAT regime of which 46 natural and unprocessed local products would be exempt from VAT the items like petrol, Diesel, Liquor, Lottery, have been kept out of the VAT regime in India, which covers only marketable items.. About 270 items including drugs and medicines, all agricultural and industrial inputs, capital goods and declared goods would attract four per cent VAT in India. The remaining items would attract 12.5 per cent VAT. Precious metals like gold and bullion would be taxed at one per cent.

2 Archers & Elevators Publishing House www.aeph.in

Indian Business Scenario - Opportunities and Challenges RATES OF VAT ITEMS 550 Items, 0% Natural and un-processed produces in unorganized sector Good of social importance Life saving drugs, Newspapers, National flag barred from taxation. 1% Gold, Silver, Precious and semi-precious stones.

270 Items, 4% Basic necessities, Industrial and agricultural inputs, Declared goods, Medicines and drugs, AED items, Capital goods.

12.50% SPECIAL ADDITIONAL TAX (>20%)

RNR[revenue neutral rate] on other goods.

Aviation turbine fuel (ATF), Petroleum products Fuels, E-merit goods.

Traders with turnover of less than 500,000 rupees are exempt from the new tax. Considering the difficulties faced by the tea industry, it was decided that teaproducing states would be given an option to levy 12.5 per cent or four per cent subject to review in 2006. Owing oppositions from few states, it was decided that states would have option to either levy four per cent or totally exempt food grains but it would be reviewed after one year. Three items - sugar, textile and tobacco covered under Additional Excise Duties, will not be under VAT regime for one year but the existing arrangement would continue. The Indian VAT panel relaxed the threshold limit for traders coming under VAT regime from Rs 5-50 lakh of turnover from the previous stance of Rs 5-40 lakh. Traders within this limit can pay a composite VAT rate of one per cent but would not be entitled to input tax credit.

3 Archers & Elevators Publishing House www.aeph.in

Indian Business Scenario - Opportunities and Challenges Computation Procedure of Sales tax under VAT Regime VAT is most certainly a more transparent and accurate system of taxation. The existing sales tax structure allows for double taxation thereby cascading the tax burden. For example, before a commodity is produced, inputs are first taxed, the produced commodity is then taxed and finally at the time of sale, the entire commodity is taxed once again. By taxing the commodity multiple times, it has in effect increased the cost of the goods and therefore the price the end consumer will pay for it. The transaction chain under VAT assuming that a profit of Rs 10 is retained during each sale. SALE 'A' OF CHENNAI @ Rs. 100/ SALE @ Rs. 124/ 'B' OF BANGALORE 'D' OF BANGALORE SALE @ Rs. 114/ SALE @ Rs. 134/ 'C' OF BANGALORE CONSUMER IN BANGALORE

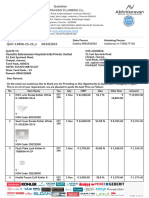

Tax implication under Value Added Tax Act Seller Buyer Selling Price (Excluding Tax) 100 114 124 134 Tax Rate Invoice value (Incl Tax) 104 128.25 139.50 150.75 Tax Payable Tax Credit Net TaxOutflow

A B C D

B C D Consumer

4% CST 12.5% VAT 12.5% VAT 12.5% VAT

4 14.25 15.50 16.75

0 0* 14.25 15.50 VAT CST

4.00 14.25 1.25 1.25 16.75 4.00

Total to Govt.

*Note: CST Paid cannot be claimed for credit. CST is assumed to remain the same though it could to be reduced to 2% when VAT is introduced and eventually phased out. VAT can be considered as a multi-point sales tax with set-off for tax paid on purchases (inputs) and capital goods. What this means is that dealers can actually deduct the amount of tax paid by him for purchase from the tax collected on sales, thereby paying just the balance amount to the Government. VAT and its Implication in Indian Economy In the VAT System of taxation a set-off is given for input tax as well as tax paid on previous purchases, whereas the existing sales tax structure faces the problems of double taxation of commodities and multiplicity of taxes. For example, in the existing tax system, before a commodity is produced, inputs are first taxed and then after commodity is produced with input tax load, the output is taxed 4 Archers & Elevators Publishing House www.aeph.in

Indian Business Scenario - Opportunities and Challenges again. Thus, resulting in unfair double taxation with cascading effects but with VAT coming into action it will be different ball game all together. There will be significant change in tax collections as well as prices in the long run. Nada opines, The immediate on the states and their citizens will be in terms of significant changes in the indirect tax collections taking place. For the citizens, the prices are expected to decline on the whole as the tax regime will be doing away with cascading effect of the VAT, other taxes, surcharge on sales tax additional surcharge and special additional tax (SAT) will be abolished. And going by the claims of the government, CST will also be phased out very soon which will finally reduced the tax burden and cause prices to decrease significantly. According to the white paper, VAT will also replace the existing system of simpler and transparent tax structure that will improve tax compliance and increase revenue growth. The Indian consumer is more burdened with financial crunch and price inflation. The poor are the most sufferers and their purchasing power is low. It has been identified that rural people are charged more tax than urban people due to subsidized rate provided to them in food products, transportation, electricity, water etc. for these facilities they are charged indirectly from their source of income like agricultural and allied activities. Its not only the consumer who are hit hard by the value added tax charges but the intermediaries involved in the chain, from producer to retailers have to pay taxes to the government and meet the legal and accounting standards to present a fair picture of their businesses (Hossain, 2003).The general public is affected by tax rates simultaneously, as rich class people are only able to bear the burden. Experts View on VAT Implication in Indian The following are the experts view on implication of VAT in India, Prof. D S Hegde who emphasized that the present system of taxation was complex and posed several hurdles to the development of the manufacturing sector in India due to the multiple taxation scenarios. He said that VAT would ensure a bigger cake of GDP for tomorrows India. Mr. Arif Siddiqui, Business Head Logistics, AFL highlighted VAT will lead to far reaching changes in almost all organizations since remodeling supply chains, and he predicted reduction in distribution system layer and evaluation of new logistics models in the post-VAT scenario. Mr. Vivek Bhimankar, Deputy Commissioner, Sales Tax, said, Earlier, tax system rewarded dishonesty. Now there is an incentive for being honest. VAT has not only refilled the treasuries but has also ensured better social life by decreasing the corruption levels. Ms. Renu Narvekar, Head Finance, P&G; Ltd. said that VAT puts FMCG companies in a spot of bother regarding decisions on who should bear the brunt of the additional tax which the distributors and retailers are forced to pay. Conclusion Value added tax would change the nature of trade in the coming years, but the medium level of trade would face problems as the companies would reduced the tier of marketing. The present provision of central sales tax and Value added tax cannot go together. After the abolition of central sales tax the direct marketing concept may gain ground and the necessity of having warehouse, go downs etc. in all states may decrease or finish. Value added tax in India has been introduced in modified variants over the past two decades. However, value added tax in its original form is yet to be introduced in India, at Central or State level. After the negative and 5 Archers & Elevators Publishing House www.aeph.in

Indian Business Scenario - Opportunities and Challenges positive impact on the Indian consumers, Value added tax has been identified as the real goal maker by the Indian government in the coming years to foster growth and prosperity in the country. The change in the standard of livings has increased the purchasing power of the high class society but the medium and the poor class society has to work hard in order to achieve their living and meet extravagances. References http://www.indiastudychannel.com/resources/140523-Types-taxes-Indiaadvantages.aspx http://finance.indiamart.com/taxation/items_covered_in_indian_vat.html http://www.academicjournals.org/jat/pdf/pdf2011/june/Tripathi%20et%20al.pdf http://www.pagalguy.com/news/vat-its-implications-india-inc-a-panel-discussionorganized-pgdie-nitie-a-308 http://finance.indiamart.com/taxation/impact_of_vat_in_india.html Hossain SM (2003). Poverty and social impact analysis: A suggested framework.IMF Working Paper, WP/03/195, October. http://www.pagalguy.com/news/vat-its-implications-india-inc-a-panel-discussionorganized-pgdie-nitie-a-308 http://www.slideshare.net/horizon8586/value-added-tax/ Government of India (2005).A white paper on State level.Value added tax Ministry of Finance, Empowered Committee of State Finance Ministers, January.

6 Archers & Elevators Publishing House www.aeph.in

Вам также может понравиться

- VAT NotesДокумент31 страницаVAT NotesAbinas Parida60% (5)

- Royale Business School: Project On VAT Subject of CPTДокумент8 страницRoyale Business School: Project On VAT Subject of CPTRabara AelisОценок пока нет

- Difference Between VAT & Sales TaxДокумент12 страницDifference Between VAT & Sales Taxdarshan1793Оценок пока нет

- Which Companies Are Required To File Vat in India: Vasu Vibhav Purohit MAY 27, 2016Документ9 страницWhich Companies Are Required To File Vat in India: Vasu Vibhav Purohit MAY 27, 2016Mohammad IrfanОценок пока нет

- Value Added Tax FaqДокумент9 страницValue Added Tax FaqroutraykhushbooОценок пока нет

- Advantages of VATДокумент9 страницAdvantages of VATAnkit GuptaОценок пока нет

- Project On Value Added TaxДокумент38 страницProject On Value Added TaxKavita NadarОценок пока нет

- Value Added TaxДокумент10 страницValue Added TaxLaxmi NarayanОценок пока нет

- Tax AssignmentДокумент11 страницTax AssignmentmanalОценок пока нет

- Changes Faces of Vat TaxДокумент103 страницыChanges Faces of Vat TaxArvind MahandhwalОценок пока нет

- Chap-Vat 29Документ4 страницыChap-Vat 29Tanya TandonОценок пока нет

- Taxation: Concept, Nature and Characteristics of Taxation and TaxesДокумент11 страницTaxation: Concept, Nature and Characteristics of Taxation and TaxesMohammad FaizanОценок пока нет

- Value Added Tax PPT PGDMДокумент23 страницыValue Added Tax PPT PGDMPuneet Srivastav100% (4)

- Value Added Tax (VAT) : Project OnДокумент20 страницValue Added Tax (VAT) : Project OnSumit SainiОценок пока нет

- Value Added Tax in PakistanДокумент6 страницValue Added Tax in PakistanMuhammad AwanОценок пока нет

- Value Added Tax PPT at Bec Doms Bagalkot MbaДокумент22 страницыValue Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)Оценок пока нет

- Value Added Tax (VAT)Документ20 страницValue Added Tax (VAT)Nitish KhuranaОценок пока нет

- Value Added Tax (VAT) : A Project OnДокумент24 страницыValue Added Tax (VAT) : A Project OnSourabh SinghОценок пока нет

- Mcom Part 2 Project of Mvat Cen VatДокумент53 страницыMcom Part 2 Project of Mvat Cen Vatrani26oct100% (4)

- Cascading Effect of TaxesДокумент5 страницCascading Effect of TaxesPraveen NairОценок пока нет

- Value Added Tax in Maharashtra - Project Report MbaДокумент72 страницыValue Added Tax in Maharashtra - Project Report Mbakamdica100% (12)

- GST RecordДокумент30 страницGST RecordThota KeerthiОценок пока нет

- Vat 220424091227Документ16 страницVat 220424091227vishal.patel250897Оценок пока нет

- Indirect TaxesДокумент6 страницIndirect TaxesNikita JainОценок пока нет

- Project Report On Value Added Tax (VAT)Документ77 страницProject Report On Value Added Tax (VAT)Royal Projects100% (6)

- Solutions For GST Question BankДокумент73 страницыSolutions For GST Question BankSuprajaОценок пока нет

- Sahil SOCI FileДокумент45 страницSahil SOCI FileSahil KachhawaОценок пока нет

- VatДокумент41 страницаVatRAM67% (3)

- GST Project PDFДокумент47 страницGST Project PDFjassi7nishadОценок пока нет

- Value Added Tax (VAT) : A Presentation by Sanjay JagarwalДокумент39 страницValue Added Tax (VAT) : A Presentation by Sanjay JagarwalJishu Twaddler D'CruxОценок пока нет

- Tax Law - Ii: " Background and Concept of VAT, Advantages of VAT."Документ13 страницTax Law - Ii: " Background and Concept of VAT, Advantages of VAT."Ishraque Zeya KhanОценок пока нет

- Vat InfoДокумент32 страницыVat InfoAnkit GuptaОценок пока нет

- Vat Presentation: Nikita GanatraДокумент26 страницVat Presentation: Nikita Ganatrapuneet0303Оценок пока нет

- Vat Presentation: Nikita GanatraДокумент26 страницVat Presentation: Nikita GanatraShubham GoyalОценок пока нет

- Problems & Prospects of VATДокумент10 страницProblems & Prospects of VATTHIMMAIAH BAYAVANDA CHINNAPPAОценок пока нет

- VAT Reform in BangladeshДокумент28 страницVAT Reform in BangladeshhossainmzОценок пока нет

- Taxation System in IndiaДокумент5 страницTaxation System in IndiaSiddharth NagarОценок пока нет

- Foreword: India'S Tax RegimeДокумент7 страницForeword: India'S Tax RegimeshreyОценок пока нет

- VAT in IndiaДокумент2 страницыVAT in IndiagundujumpuОценок пока нет

- Draft VAT FAQДокумент17 страницDraft VAT FAQreazvat786Оценок пока нет

- Basic Concepts of Value Added Tax: What Is VAT ?Документ9 страницBasic Concepts of Value Added Tax: What Is VAT ?Mayank JainОценок пока нет

- Tidal Power ReportДокумент20 страницTidal Power ReportksanklaZNCОценок пока нет

- GST Practical 1-39Документ88 страницGST Practical 1-39HarismithaОценок пока нет

- VAT - in IndiaДокумент10 страницVAT - in Indiasai500Оценок пока нет

- Value Added Tax (VAT)Документ33 страницыValue Added Tax (VAT)chirag_nrmba15Оценок пока нет

- Tax Basics: Types of TaxesДокумент8 страницTax Basics: Types of Taxeskrishanu1013Оценок пока нет

- Value Added Tax: Taxation Assessment For Companies (ACT4135)Документ12 страницValue Added Tax: Taxation Assessment For Companies (ACT4135)Sumon Parvej SakhilОценок пока нет

- Importance of VAT in India: Sales Tax Importer TraderДокумент5 страницImportance of VAT in India: Sales Tax Importer TraderKamal ChawlaОценок пока нет

- Value Added Tax: Characteristics of VatДокумент3 страницыValue Added Tax: Characteristics of VatBharat PrajapatiОценок пока нет

- 17 Vat Concepts and General PrinciplesДокумент10 страниц17 Vat Concepts and General PrinciplesPankaj TiwaryОценок пока нет

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024От EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Оценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Taxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsОт EverandTaxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsОценок пока нет

- Different Approaches in Pharmacological ResearchДокумент3 страницыDifferent Approaches in Pharmacological ResearcharcherselevatorsОценок пока нет

- International Journal of Exclusive Global Research - Vol 3 Issue 3 MarchДокумент17 страницInternational Journal of Exclusive Global Research - Vol 3 Issue 3 MarcharcherselevatorsОценок пока нет

- Input Tax Credit Under GST in India An OverviewДокумент8 страницInput Tax Credit Under GST in India An OverviewarcherselevatorsОценок пока нет

- Oil of Lavandula Angustifolia On Amyloid Beta PolymerizationДокумент7 страницOil of Lavandula Angustifolia On Amyloid Beta PolymerizationarcherselevatorsОценок пока нет

- Comparative Evaluation of Ethyl Acetate, Hexane and MethanolДокумент6 страницComparative Evaluation of Ethyl Acetate, Hexane and MethanolarcherselevatorsОценок пока нет

- Impact of GST On Small and Medium EnterprisesДокумент5 страницImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Implication of Demonetization On Indian EconomyДокумент4 страницыImplication of Demonetization On Indian EconomyarcherselevatorsОценок пока нет

- Demonetization-A Boon or BaneДокумент6 страницDemonetization-A Boon or BanearcherselevatorsОценок пока нет

- Financial Inclusion A Gateway To Reduce Corruption Through Direct Benefit Transfer (DBT)Документ7 страницFinancial Inclusion A Gateway To Reduce Corruption Through Direct Benefit Transfer (DBT)archerselevatorsОценок пока нет

- Demonetization 2016 Impact On Indian EconomyДокумент9 страницDemonetization 2016 Impact On Indian EconomyarcherselevatorsОценок пока нет

- Sanitation and Its Impact On HealthДокумент4 страницыSanitation and Its Impact On HealtharcherselevatorsОценок пока нет

- Post Impact of Demonetization On Retail Sector A Case Study On Retail Outlets at Malur Town of Kolar DistrictДокумент3 страницыPost Impact of Demonetization On Retail Sector A Case Study On Retail Outlets at Malur Town of Kolar DistrictarcherselevatorsОценок пока нет

- Managing Municipal Solid Waste Some SuggestionsДокумент2 страницыManaging Municipal Solid Waste Some SuggestionsarcherselevatorsОценок пока нет

- Eradication of Manual Scavenging Policy and PerspectiveДокумент1 страницаEradication of Manual Scavenging Policy and PerspectivearcherselevatorsОценок пока нет

- A Study On Swachh Bharat Abhiyan and Management LessonsДокумент2 страницыA Study On Swachh Bharat Abhiyan and Management LessonsarcherselevatorsОценок пока нет

- Role of National Service Scheme in Rural DevelopmentДокумент5 страницRole of National Service Scheme in Rural Developmentarcherselevators50% (2)

- Role of NSS in Cleanliness With Special Reference To Dakshina KannadaДокумент4 страницыRole of NSS in Cleanliness With Special Reference To Dakshina KannadaarcherselevatorsОценок пока нет

- Role of National Service Scheme and Educational Institutions in Sanitation and Cleaning Within in Kolar DistrictДокумент2 страницыRole of National Service Scheme and Educational Institutions in Sanitation and Cleaning Within in Kolar Districtarcherselevators100% (1)

- Swachh Bharat Abhiyan and The MediaДокумент4 страницыSwachh Bharat Abhiyan and The MediaarcherselevatorsОценок пока нет

- Living Conditions in Slums A Case Study in Bangalore CityДокумент3 страницыLiving Conditions in Slums A Case Study in Bangalore CityarcherselevatorsОценок пока нет

- Sanitation and HealthДокумент5 страницSanitation and HealtharcherselevatorsОценок пока нет

- Swachhatha Related To Children and Their EnvironmentДокумент3 страницыSwachhatha Related To Children and Their EnvironmentarcherselevatorsОценок пока нет

- Impact of Swachh Bharat in IndiaДокумент2 страницыImpact of Swachh Bharat in IndiaarcherselevatorsОценок пока нет

- Watershed Approach For Rainwater ManagementДокумент8 страницWatershed Approach For Rainwater ManagementarcherselevatorsОценок пока нет

- Thank You For Your CooperationДокумент1 страницаThank You For Your CooperationTadi Fresco RoyceОценок пока нет

- Plumbing Quote FeebacksДокумент13 страницPlumbing Quote Feebacksarchventure projectsОценок пока нет

- Mutov122164407 01062023-07082023Документ7 страницMutov122164407 01062023-07082023sreekanthОценок пока нет

- Dda A/C Statement: Review by Approved byДокумент2 страницыDda A/C Statement: Review by Approved byVirgelio AbarquezОценок пока нет

- Audit Working Papers ReceivablesДокумент3 страницыAudit Working Papers ReceivablesKeith Joshua GabiasonОценок пока нет

- Bl-Income Tax - FinalДокумент34 страницыBl-Income Tax - FinalMohd Yousuf MasoodОценок пока нет

- Date of AGM : Dd-Mon-YyyyДокумент129 страницDate of AGM : Dd-Mon-YyyyJamesОценок пока нет

- Stock Transaction TaxДокумент2 страницыStock Transaction TaxlyzleejoieОценок пока нет

- PA - 17 UPA 308 Income TaxДокумент28 страницPA - 17 UPA 308 Income TaxKASHISH CHOUDHARYОценок пока нет

- Salary: After Studying This Chapter, You Would Be Able ToДокумент67 страницSalary: After Studying This Chapter, You Would Be Able Torishikesh kumarОценок пока нет

- Statement of Account: PageДокумент6 страницStatement of Account: PageSyedFarhanОценок пока нет

- Acct Statement - XX2959 - 26062023Документ8 страницAcct Statement - XX2959 - 26062023Nikhil SinghОценок пока нет

- Recharge Amount: Mobile ServicesДокумент2 страницыRecharge Amount: Mobile ServiceskrupaОценок пока нет

- FTF 2022-03-23 1648079099327Документ14 страницFTF 2022-03-23 1648079099327Charles Goodwin100% (1)

- What Is Crypto-Currency ?Документ13 страницWhat Is Crypto-Currency ?charlied017Оценок пока нет

- PL Tax Compliance Sample Paper OneДокумент9 страницPL Tax Compliance Sample Paper Onekarlr9Оценок пока нет

- E-Payment System in Saudi Arabia PDFДокумент16 страницE-Payment System in Saudi Arabia PDFRohan MehtaОценок пока нет

- You Are The Auditor of Beaton and Gunter Inc The PDFДокумент2 страницыYou Are The Auditor of Beaton and Gunter Inc The PDFHassan JanОценок пока нет

- White Paper The Business Model of Apple Pay and Apple CardДокумент15 страницWhite Paper The Business Model of Apple Pay and Apple CardTBeaver BuilderОценок пока нет

- American Express Bank Statement Cythel M GomaДокумент4 страницыAmerican Express Bank Statement Cythel M Gomashirleysimone53Оценок пока нет

- InvertedДокумент2 страницыInvertedShrikant KeskarОценок пока нет

- Assignment 1 - Gimpex - Samra - Saif GroupДокумент15 страницAssignment 1 - Gimpex - Samra - Saif GroupsamraОценок пока нет

- Clubbing of IncomeДокумент2 страницыClubbing of IncomeNoopur BhandariОценок пока нет

- Levy and SupplyДокумент37 страницLevy and SupplydurairajОценок пока нет

- RSM Itrv 2019-20Документ1 страницаRSM Itrv 2019-20Rajesh KumarОценок пока нет

- ESSO v. CIR, 175 SCRA 149 (1989)Документ13 страницESSO v. CIR, 175 SCRA 149 (1989)citizenОценок пока нет

- My Sip 2021-22Документ28 страницMy Sip 2021-22Xenqiyj XyenttukОценок пока нет

- Income From Other SourcesДокумент7 страницIncome From Other SourcessristiОценок пока нет

- Income From SalaryДокумент26 страницIncome From SalaryAkash VisputeОценок пока нет