Академический Документы

Профессиональный Документы

Культура Документы

Morning 17 Sep 13

Загружено:

yuyuwonoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Morning 17 Sep 13

Загружено:

yuyuwonoАвторское право:

Доступные форматы

Equity Research | 17 Sep 2013

INVESTOR DIGEST

Equity Research | 17 Sep 2013

Economic Data

HIGHLIGHT

Latest

2013F

BI Rate (%), eop

7.25

7.50

Inflation (YoY %)

8.79

8.20

11,380

10,500

US$ 1 = Rp, period avg

Stock Market Data

(16 Sep 2013)

JCI Index

4,522.2

Trading T/O ( Rp bn )

6,109.0

Market Cap ( Rp tn )

4,454.7

3.35%

STRATEGY

Strategy: Time to go bullish

A number of key event risks over the next few weeks that could hurt

the JCI have unexpectedly diminish: US bombing of Syria, impact of QE

tapering, the Current Account deficit. We upgrade our country rating

to Overweight (from Neutral), raise our 2013 year-end JCI target to

5,000. Add BSDE and ICBP.

Potential impact of QE tapering is not as dreadful as feared. We believe

the start of QE tapering is only a matter of time if not this month, then

over the next few months. However we see no real catalysts for the

dreaded bond market collapse in the US, as inflation remains tame. See

Figure 1. Hence while emerging markets may experience some jitters on

the actual start of the taper, we believe the markets will regain confidence

soon afterwards.

Improving Current Account balance and recovering rupiah. The

stabilizing August forex reserves signal that Indonesias current account

balance is improving. Long overdue is decline in fuel imports, thanks to the

fuel price hike in late June. This effect did not appear as expected in July as

PERTAMINA stocked up on its fuel inventory then. No such necessity

existed in August. These development and Lawrence Summers dropping

out of the Fed Chairman contention (which lessen negative market

sentiment on QE tapering) should ease pressures on the rupiah.

Upgrading to Overweight. While not truly cheap, and some risks remain

(the budget and debt ceiling vs Obamacare fight in the US Congress), the

JCI is likely to rebound strongly thanks to the high cash holding by local

funds. We add ICBP and BSDE to our Top BUY Portfolio, and drop our USD

hedge AALI and UNTR.

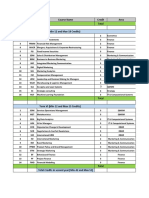

Market Data Summary*

EBITDA growth (%)

EPS growth (%)

Core EPS growth (%)

Strategy: Time to go bullish

Automotive: August 4W sales above indication

Property sector: Stricter mortgage regulation would be for second homes and

beyond

Banking industry - slow down in mortgage lending to be replaced by construction

loans

2013F

2014F

5.0

13.0

10.3

19.3

9.9

22.5

EV/EBITDA (x)

12.4

10.9

P/E (x)

15.8

12.9

P/BV (x)

3.0

2.6

Div. Yield (%)

2.5

2.9

Earnings Yield (%)

6.3

7.6

Net Gearing (%)

25.1

23.0

ROE (%)

22.7

27.1

* Aggregate of 71 companies in MS research universe,

representing 60.8% of JCIs market capitalization

John Rachmat (+6221 5296 9542)

Please see important disclosure at the back of this report

john.rachmat@mandirisek.co.id

Page 1 of 6

Equity Research | 17 Sep 2013

SECTOR

Automotive: August 4W sales above indication

August official 4W/2W sales were announced yesterday. Actual 4W volume came 8% ahead of earlier indication, while 2W

volume was relatively similar.

4W sales down 30.5%mom to 77,961 units on Ramadan seasonality, but up 2.0%yoy. This years 30.5%mom drop is worse

than the historical pattern of 18-25%, partially as current Ramadan holiday starts since the beginning of the month, not in

the middle. YTD, 8M13 sales up 10.9%yoy to 792,358 units, still on-track with our full-year 12.8%yoy growth forecast that

includes some LCGC sales. ASIIs market share remained at 50% level August or 53% YTD.

2W sales also down 30.4%mom to 488,893 units, but strongly up 13.9%yoy. 8M13 sales rose 8.6%yoy to 5.1mn units,

accounting for 69% of our FY13F forecast of 7.4mn units (+5.1%yoy). We continue to believe that rising lending rates

would have lesser impact to 2W sales, given the lower monthly installment. 2W also has lower FX risks, given much lower

portion of imported parts, thus theoretically lower ASP increase potential.

Honda continued to maintain its dominance with 60% market share in both August and 8M13. With YTD sales at 3.1mn

units (+13.5%yoy), Hondas full-year sales may end up higher than our 7.2% growth forecast.

We retain our Neutral call on ASII (TP: Rp7,300) and Buy call on IMAS (TP: Rp6,000).

Total Domestic Car Sales (Wholesale)

Aug-13

YoY

MoM

8M13

YoY

(%)

(%)

(units)

(%)

Toyota

24,944

(3.7)

(36.5)

279,583

5.6

Daihatsu

11,689

6.0

(24.5)

115,612

9.7

Nissan Diesel

156 (22.4)

18.2

1,280 (46.3)

Isuzu

1,962 (15.8)

(21.9)

20,700

(7.9)

Peugeot

25

8.7

(37.5)

231

6.0

Nissan

4,500 (15.2)

(24.3)

41,782

(9.3)

Honda

4,163 (17.4)

(51.1)

62,010

60.9

Mitsubishi

10,487

14.1

(25.1)

101,922

6.7

Suzuki

12,006

18.6

(28.7)

104,269

39.4

Others

8,029

10.1

(15.0)

64,969

1.5

Total

77,961

2.0 (30.5)

792,358

10.9

Source: ASII, Gaikindo

Brands

Brands

Honda

Yamaha

Suzuki

Kawasaki

TVS

Total

Source: ASII, AISI

Total Domestic Motorcycles Sales (Wholesale)

Aug-13

YoY

MoM

8M13

YoY

(units)

(%)

(%)

(units)

(%)

294,396

12.4

(29.1)

3,074,121

13.5

152,940

15.0

(33.4)

1,660,275

1.9

32,017

30.3

(23.9)

282,732

(1.2)

8,999

(0.2)

(39.0)

92,762

15.4

631

(7.9)

0.5

5,211 (28.8)

488,983

13.9 (30.4)

5,115,101

8.6

Adrian Joezer (+6221 5296 9549)

Please see important disclosure at the back of this report

Aug-13

(%)

32.0

15.0

0.2

2.5

0.0

5.8

5.3

13.5

15.4

10.3

Market shares

YoY MoM 8M13

(%)

(%)

(%)

(1.9)

(3.0)

35.3

0.6

1.2

14.6

(0.1)

0.1

0.2

(0.5)

0.3

2.6

0.0

(0.0)

0.0

(1.2)

0.5

5.3

(1.3)

(2.2)

7.8

1.4

1.0

12.9

2.2

0.4

13.2

0.8

1.9

8.2

YoY

(%)

(1.8)

(0.2)

(0.2)

(0.5)

(0.0)

(1.2)

2.4

(0.5)

2.7

(0.8)

Aug-13

(%)

60.2

31.3

6.5

1.8

0.1

Market Shares

YoY MoM 8M13

(%)

(%)

(%)

(0.8)

1.1

60.1

0.3

(1.4)

32.5

0.8

0.6

5.5

(0.3)

(0.3)

1.8

(0.0)

0.0

0.1

YoY

(%)

2.6

(2.1)

(0.5)

0.1

(0.1)

adrian.joezer@mandirisek.co.id

Page 2 of 6

Equity Research | 17 Sep 2013

Property sector: Stricter mortgage regulation would be for second homes and beyond

Mortgage distribution would be based on the construction in progress. In Investor Daily, the Central Bank Governor

stated his plan that the mortgage for the first home buyer may still be distributed based on construction in progress. The

purpose is to manage risk in the mortgage loan disbursement. For example, if the house is 50% completed, 50% of the

mortgage would be given out. If 80% of the house is already completed, 80% of the mortgage would be distributed.

Second home mortgage distribution would need to be 100% complete. For second homes and beyond, 100%

completion of the building is a requirement for the mortgages to be given out.

Less stricter compared to yesterdays plan of 100% for first homebuyer. The planned regulation is more lax

compared to yesterdays news, in which the mortgage loan disbursement for the first home buyer would only happened

if the house is 100% complete. We think the definition of 50% complete would need to be clarified, on whether the value

of the land would be included or not. Due to sharp land price increase, the value of the land is already 50% or more

compared to the total house value. If the value of the land is included, the cash-flow of the property companies could

remain relatively safe, as they do not have to put significant working capital upfront to build the house.

The new LTV rule would be implemented at end of September. The Central Bank Governor mentions that there is

slight delay on the implementation of the new LTV rule (stricter LTV for the second homebuyer). The new LTV rule would

be implemented at the end of September. Currently the new LTV rule is still in the legal review process.

Liliana S Bambang (+6221 5296 9465)

liliana.bambang@mandirisek.co.id

Banking industry - slow down in mortgage lending to be replaced by construction loans

Bank Indonesia will soon introduce a new regulation on mortgage which will rule the disbursement of first home

mortgage (for landed property and apartments) in stages, according to the completion of the property. For the mortgage

of second and more property, this ruling will not be valid and banks will only be able to finance the ready-made property.

Comment: we checked with several banks on their mortgage disbursement practices and only BTN indicated that most of

credit is given upon the completion of the property. The rest of the banks usually disburse the mortgage, for a new house or

apartment, during the construction or even when the property is yet to be developed. We believe the new regulation will slow

down the mortgage lending, which is growing at 16.5% y-y for landed property and 61.3% y-y for apartments. Both loans

account for 8.8% of total loans in June 2013, up from 8.0% two years ago. What the banks expect is a shift from mortgage into

working capital loans for property construction, which account for 3.7% of total loans.

The following shows mortgage loans exposure in some of the major banks:

Tjandra Lienandjaja (+6221 5296 9617)

Please see important disclosure at the back of this report

tjandra.lienandjaja@mandirisek.co.id

Page 3 of 6

Equity Research | 17 Sep 2013

MARKET

Market Recap September 16th 2013; JCI: 4,522.239 (+3.35%); USD/IDR: 11,380; Total Value: Rp7.06tn

Indo market registered the bulk of its gain during afternoon session, buoyed by optimism over light tapering as

Lawrence Summers withdrew as candidate for US Fed Chief. JCI edged higher for three straight session by 3.4% to close

at 4,522 level. All sectors traded in the green led by auto, cement, and consumer. Furthermore, despite potential stricter

mortgage regulation due end of this month, property sector remained favorite among players. Regular market

transaction was recorded at Rp6.1tn (USD536mn) and volume (excluding USD5.5mn BMAS crossing) was strong at

USD600mn. Foreign investor posted a net buy of Rp480.48bn (USD42.22mn) and foreign participants returned to 35%

and came up better buyer for 20%.

TOP TURNOVER: BBRI, ASII, ADHI, BMRI, SMGR, TLKM, LPKR, PGAS, WIKA, BBCA, BMTR, ASRI, BBNI, KLBF, ERAA (45% of total

T/O)

ADVANCING SECTOR: auto (+7.7%), cement (+5.5%), consumer (+4.5%), property (+2.9%), financial (+2.6%), telco (+2%),

infra (+1.5%), mining (+1.1%), plantation (+0.2%)

DECLINING SECTOR: NONE

The yield of 10-year government bond decreased to 8.03% (-3.8%) and Rupiah depreciated to Rp11,380 (-1.32%).

Sales Team

+6221 527 5375

FROM THE PRESS

Budget deficit could likely widened to 2% next year

On yesterday governments planned budget (RABPN 2014) meeting, the government and parliament agreed to revise several

macro assumptions and budget target for next year. Macro assumptions that have been revised are economic growth (earlier

assumption at 6.4% to 6.0%), exchange rate (Rp9,750/US$ to Rp10,500/US$) and inflation (4.5% to 5.5%). Moreover, the

government also changed its budget revenue and expenditure target. For the moment, it predicts that total revenue will trim

to Rp1640tn from prior target of Rp1662tn whereas total expenditure is expected to increase to Rp1850tn from Rp1817tn.

Based on the changes, the RAPBN 2014 deficit could widened to 2.02% of GDP from 1.49% of GDP. The numbers are not yet

finalize as the talks of RAPBN 2014 remains ongoing (Bisnis Indonesia).

Comment: We believe the revision on governments macro assumptions was owing to slightly higher-than-expected downside risk

and likely incorporating the impact of central banks recent tightening stance that will have bigger effect on 2014 economic growth.

Overall, we have also revised down several of our economic forecast. Growth and exchange rate is expected to reach 5.9% and

Rp10,400/US$ end-2014 from our earlier forecast at 6.3% and Rp9,780/US$.

BW Plantation cut capex due to unfavorable debt ratio

Due to pressure on operating cash flow and unfavorable debt ratio, BWPT is likely to cut next year capex allocation, which is

expected lower than current year capex allocation of Rp1tn. (Bisnis Indonesia).

Comment: We think reducing capex would help BWPT to curb its net debt ratio, but would decrease its new planting activities.

(BWPTs new planting cost is Rp100 mn per ha vs other Indonesian new planting cost of Rp70mn per ha).

Please see important disclosure at the back of this report

Page 4 of 6

Equity Research | 17 Sep 2013

Equity Valuation

Outstanding

JCI Code

Mandiri Universe

Banking

BCA

BNI

BRI

BTN

Danamon

Bank BJB

Bank Jatim

BTPN

Panin

Infrastructure

Holcim

Indocement

Semen Gresik

Adhi Karya

Pembangunan Perumahan

Wijaya Karya

Waskita Karya

Jasa Marga

Consumer

Gudang Garam

Indofood CBP

Indofood

Mayora

Unilever

Wismilak

Kalbe Farma

Dyandra

Retail

Ace Hardware Indonesia

ERAA

Matahari Department Store

Mitra Adiperkasa

Ramayana

Supra Boga

Tiphone Mobile Indonesia

Conglomerates

Astra International

IMAS

Heavy Equipment

Hexindo Adiperkasa

United Tractors

Plantation

Astra Agro Lestari

BW Plantation

London Sumatera Plantations

Sampoerna Agro

Property

Agung Podomoro Land

Alam Sutera Realty

Sentul City

Bumi Serpong Damai

CIPUTRA DEVELOPMENT

Modernland

Summarecon Agung

Energy

Adaro

Berau

Bumi

Harum Energy

Indo Tambangraya Megah

Bukit Asam

Energi Mega Persada *)

Medco *)

PGN *)

Metal

Antam *)

Bumi Resources Minerals *)

PT Inco *)

Telecommunication

EXCEL *)

Indosat *)

TBI *)

Telkom *)

Note :

Rating

Shares

(Mn) Price (Rp)

Price

Target

BBCA

BBNI

BBRI

BBTN

BDMN

BJBR

BJTM

BTPN

PNBN

Neutral

Buy

Buy

Buy

Neutral

Neutral

Buy

Buy

Buy

24,655

18,649

24,660

8,836

9,585

9,696

14,769

5,840

24,088

10,050

4,400

8,200

1,010

4,100

920

340

4,050

650

10,300

5,300

10,600

1,700

6,000

1,300

575

5,500

850

SMCB

INTP

SMGR

ADHI

PTPP

WIKA

WSKT IJ

JSMR

Neutral

Buy

Buy

Buy

Neutral

Neutral

Neutral

Buy

7,663

3,681

5,932

1,801

4,842

6,106

9,632

6,800

2,400

20,050

14,500

1,950

1,190

1,940

620

5,700

2,700

24,000

17,000

4,200

1,500

2,200

850

6,700

GGRM

ICBP IJ

INDF

MYOR

UNVR

WIIM

KLBF

DYAN

Neutral

Neutral

Buy

Buy

Neutral

Buy

Neutral

Buy

1,924

5,831

8,780

767

7,630

2,100

46,875

4,273

43,300

11,200

6,750

30,500

32,150

720

1,370

270

42,800

10,700

7,500

25,000

30,650

1,100

1,275

425

ACES

ERAA

LPPF

MAPI

RALS

RANC

TELE

Neutral

Buy

Buy

Neutral

Buy

Buy

Buy

1,715

2,025

2,918

1,660

7,096

1,564

5,367

760

1,500

12,300

5,650

1,190

610

510

800

1,730

15,600

5,700

1,850

980

810

ASII

IMAS

Neutral

Buy

40,484

2,765

6,900

5,100

7,300

6,000

HEXA

UNTR

Sell

Neutral

840

3,730

3,400

17,000

4,000

17,000

AALI

BWPT

LSIP

SGRO

Buy

Neutral

Buy

Neutral

1,575

4,052

6,823

1,890

19,750

840

1,390

1,880

21,200

785

1,700

1,700

APLN

ASRI

BKSL

BSDE

CTRA

MDLN IJ

SMRA

Buy

Buy

Buy

Buy

Buy

Buy

Buy

20,500

17,863

31,397

17,497

15,166

6,267

14,425

295

610

210

1,460

1,020

690

930

600

1,290

450

2,231

605

1,250

1,645

ADRO

BRAU

BUMI

HRUM

ITMG

PTBA

ENRG

MEDC

PGAS

Sell

Sell

Sell

Neutral

Neutral

Neutral

U/R

U/R

U/R

31,986

34,900

20,300

2,699

1,130

2,304

44,643

3,332

24,242

950

162

435

3,300

30,400

13,000

93

2,625

5,400

1,000

140

500

3,000

27,500

11,000

U/R

U/R

U/R

ANTM

BRMS

INCO

U/R

U/R

U/R

9,538

25,570

9,936

1,460

181

2,375

U/R

U/R

U/R

EXCL

ISAT

TBIG

TLKM

U/R

U/R

U/R

U/R

8,534

5,434

4,797

100,800

4,450

4,200

5,750

2,225

U/R

U/R

U/R

U/R

Mkt Cap

(Rp Bn)

2,603,851

635,133

247,783

82,054

202,287

10,460

39,297

8,921

5,021

23,653

15,657

244,061

18,393

73,809

86,007

3,513

5,762

11,845

5,972

38,760

543,455

83,313

65,307

59,265

23,381

245,305

1,512

64,219

1,154

74,954

13,034

4,350

35,890

9,379

8,444

954

2,902

293,439

279,337

14,103

66,268

2,856

63,412

47,542

31,101

3,403

9,484

3,553

82,291

6,048

10,896

6,593

25,546

15,469

4,324

13,415

261,893

30,387

5,654

8,831

8,910

34,350

29,959

4,152

8,748

130,904

42,153

13,926

4,628

23,599

312,661

37,978

22,823

27,580

224,280

Net Profit

2013

2014

164,850

53,889

13,189

7,985

20,154

1,666

3,924

1,381

978

2,353

2,259

15,166

1,207

5,237

5,703

375

367

581

360

1,335

17,761

4,556

2,474

2,080

895

5,559

125

1,987

85

3,273

491

353

1,129

403

518

49

330

21,692

20,885

807

5,529

617

4,912

2,920

1,897

261

657

105

7,691

1,178

1,730

353

1,696

783

1,001

950

15,125

2,234

209

(2,191)

533

2,382

1,983

417

287

9,272

2,708

1,301

38

1,369

19,097

2,312

780

1,257

14,748

197,106

65,914

15,708

9,997

24,426

2,252

4,973

1,714

1,140

2,907

2,799

17,360

1,344

5,860

6,514

457

457

656

456

1,617

22,095

5,259

2,728

4,193

1,274

6,214

155

2,137

135

4,169

598

417

1,597

475

598

68

417

24,295

23,259

1,036

5,932

504

5,427

4,204

2,593

321

968

322

9,265

1,498

1,892

581

1,917

1,006

1,179

1,192

18,644

2,147

515

(320)

723

2,655

2,279

450

197

9,998

3,433

1,125

148

2,161

21,794

2,837

1,280

1,630

16,047

EPS Growth

2013

2014

10.3%

10.2%

11.6%

13.3%

7.9%

22.1%

-2.2%

15.6%

20.6%

18.9%

7.2%

9.9%

-10.6%

9.9%

17.7%

77.4%

18.6%

27.0%

41.9%

-16.7%

5.5%

13.5%

13.5%

-36.2%

36.4%

14.9%

61.9%

14.6%

29.7%

19.1%

12.4%

-18.5%

46.5%

-6.9%

16.1%

35.0%

60.4%

7.3%

7.5%

0.7%

-14.1%

-11.7%

-15.0%

-29.1%

-21.3%

-0.3%

-41.1%

-68.1%

52.2%

45.1%

42.2%

59.4%

31.9%

70.6%

284.4%

19.0%

19.1%

-39.5%

N/M

65.8%

-57.9%

-42.6%

-31.6%

426.3%

155.8%

-5.0%

81.3%

7.4%

N/M

105.9%

11.1%

-21.9%

109.6%

40.8%

12.9%

19.3%

22.3%

19.1%

25.2%

21.2%

35.2%

26.7%

24.1%

16.5%

23.5%

23.9%

14.5%

11.3%

11.9%

14.2%

21.8%

24.4%

12.8%

26.5%

21.1%

24.4%

15.4%

10.3%

101.6%

42.3%

11.8%

24.1%

7.6%

59.1%

27.4%

21.7%

18.2%

41.4%

18.0%

15.3%

37.2%

7.8%

12.0%

11.4%

28.3%

7.3%

-17.7%

10.5%

44.0%

36.7%

22.9%

47.3%

206.6%

20.5%

27.2%

9.4%

64.7%

13.1%

28.5%

17.7%

25.5%

18.8%

-4.6%

144.6%

85.5%

34.8%

10.6%

14.9%

0.0%

-54.5%

5.3%

37.1%

-0.3%

0.0%

50.0%

14.1%

24.1%

50.9%

30.8%

9.3%

PER (x)

EV / EBITDA (x)

2013 2014 2013 2014

P/BV (x)

2013 2014

15.7

11.8

18.8

10.3

10.0

6.3

10.0

6.5

5.1

10.1

6.9

16.1

15.2

14.1

15.1

9.4

15.7

20.4

16.6

29.0

30.6

18.3

26.4

28.5

26.1

44.1

12.1

32.3

13.6

22.9

26.5

12.3

31.8

23.3

16.3

19.4

8.8

13.5

13.4

17.5

12.0

4.6

12.9

16.3

16.4

13.0

14.4

33.9

10.7

5.1

6.3

18.7

15.1

19.7

4.3

14.1

16.2

13.6

27.0

-4.0

16.7

14.4

15.1

4.4

22.7

13.5

16.1

12.0

n/a

16.2

16.0

17.6

26.1

22.6

14.7

3.0

2.3

3.9

1.7

2.6

0.9

1.3

1.3

0.9

2.3

0.8

3.5

2.0

3.2

4.2

2.4

3.0

3.9

2.6

4.2

6.7

2.9

5.1

2.7

6.5

52.3

2.0

8.1

1.3

6.2

6.4

1.5

-44.7

3.7

2.5

2.4

1.6

3.3

3.3

2.4

1.9

1.4

2.0

2.3

3.3

1.8

1.5

1.3

1.9

1.0

1.7

1.3

2.4

2.6

1.4

2.8

3.2

1.2

2.8

-11.9

2.8

4.0

3.3

n/a

0.8

4.9

0.9

1.1

0.3

1.2

3.0

2.3

1.2

5.3

3.6

13.1

9.6

15.8

8.2

8.3

4.6

7.9

5.2

4.4

8.1

5.6

14.1

13.7

12.6

13.2

7.7

12.6

18.1

13.1

24.0

24.6

15.8

23.9

14.1

18.4

39.5

9.7

30.0

8.6

18.1

21.8

10.4

22.5

19.7

14.1

14.1

8.2

12.1

12.0

13.6

11.2

5.7

11.7

11.3

12.0

10.6

9.8

11.0

8.9

4.0

5.8

11.4

13.3

15.4

3.7

11.3

13.7

14.2

11.0

-27.6

12.3

12.9

13.1

4.5

50.5

13.0

11.7

12.1

17.4

10.9

14.1

14.2

17.3

17.3

13.5

12.4

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

9.9

8.1

8.4

9.9

9.0

6.6

12.8

8.9

15.5

17.9

11.6

16.8

10.1

15.0

32.4

7.8

22.2

6.4

13.4

19.3

8.4

18.6

9.3

9.5

11.0

5.9

14.2

13.8

23.5

6.0

4.4

6.2

9.5

10.0

11.5

6.5

11.3

8.1

5.0

5.4

18.0

11.3

11.7

3.9

9.3

7.8

5.6

4.9

8.2

9.0

7.9

10.9

n/a

6.2

9.1

8.1

6.8

65.9

7.1

5.5

5.8

3.5

18.2

5.3

10.9

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

8.6

7.1

7.2

8.6

8.7

4.7

10.2

7.5

13.7

15.1

10.1

14.6

7.5

11.5

29.8

6.5

20.2

4.7

11.1

15.8

7.1

14.6

8.3

8.0

8.1

5.3

12.5

12.2

19.4

5.3

4.1

5.4

6.8

7.4

8.6

4.6

6.4

6.8

4.0

4.7

11.1

10.3

9.4

3.5

7.4

6.9

5.3

4.2

6.2

6.9

6.9

9.0

n/a

5.9

8.3

6.8

6.6

42.4

5.6

5.2

5.2

3.2

15.9

5.0

2.6

2.0

3.3

1.5

2.1

0.8

1.1

1.2

0.8

1.9

0.7

3.0

1.8

2.7

3.5

1.9

2.6

3.4

2.3

3.8

5.9

2.6

4.6

2.4

5.1

45.9

1.8

7.2

1.1

4.9

5.1

1.4

104.6

3.2

2.3

2.1

1.6

2.8

2.8

2.1

1.7

1.2

1.8

2.1

2.8

1.6

1.3

1.2

1.6

0.8

1.3

1.2

2.1

2.4

1.1

2.2

2.8

1.2

2.2

-8.3

2.5

3.6

2.9

n/a

0.9

4.2

0.9

1.1

0.3

1.2

2.8

2.1

1.2

4.1

3.3

Yield

2013

2014

2.5%

2.2%

1.5%

2.6%

2.8%

3.9%

3.1%

7.4%

11.6%

0.0%

0.0%

2.3%

3.3%

2.1%

2.8%

1.8%

1.6%

1.2%

1.3%

1.7%

2.0%

2.4%

1.7%

2.7%

0.8%

2.0%

2.5%

1.6%

0.0%

0.7%

0.5%

2.0%

0.0%

0.7%

2.5%

0.6%

1.7%

2.8%

2.9%

1.1%

4.1%

11.0%

3.8%

4.2%

4.7%

1.5%

4.7%

0.9%

0.5%

0.0%

0.5%

0.0%

1.3%

0.0%

1.2%

0.0%

3.5%

2.6%

0.0%

0.0%

3.6%

5.5%

3.3%

0.0%

0.4%

3.9%

2.3%

2.4%

0.0%

2.7%

3.6%

2.7%

1.6%

0.8%

4.3%

2.9%

2.9%

1.6%

3.9%

3.5%

4.8%

3.0%

8.0%

12.7%

2.5%

2.9%

2.4%

2.0%

2.3%

3.3%

3.2%

1.9%

1.5%

1.8%

1.4%

2.1%

2.7%

1.9%

1.8%

1.1%

2.3%

3.1%

1.9%

0.0%

1.3%

0.6%

1.6%

1.3%

0.7%

2.9%

1.0%

2.4%

3.0%

3.1%

1.1%

3.4%

6.4%

3.2%

3.3%

3.7%

1.5%

2.8%

2.8%

0.9%

0.0%

0.7%

0.0%

1.7%

0.0%

5.8%

0.0%

3.7%

2.5%

0.7%

0.0%

4.5%

6.2%

3.8%

0.0%

0.4%

4.0%

2.9%

2.7%

0.0%

3.5%

4.3%

3.3%

2.4%

1.2%

5.0%

- *) means Company Data is using Bloomberg Data

- U/R means Under Review

- n/a means Not Available

- N/M means Not Meaningful

- N.A. means Not Applicable

Please see important disclosure at the back of this report

Page 5 of 6

Mandiri Sekuritas A subsidiary of PT Bank Mandiri (Persero) Tbk

Plaza Mandiri 28th Floor, Jl. Jend. Gatot Subroto Kav. 36 - 38, Jakarta 12190, Indonesia

General: +62 21 526 3445, Fax : +62 21 527 5711 (Equity Research), +62 21 527 5374 (Equity Sales)

RESEARCH

John Rachmat

Adrian Joezer

Handoko Wijoyo

Hariyanto Wijaya, CFA, CFP, CA, CPA

Herman Koeswanto, CFA

Tjandra Lienandjaja

Liliana S Bambang

Ariyanto Kurniawan

Aldian Taloputra

Leo Putra Rinaldy

Satriawan

Janefer Amanda Soelaiman

Rizky Hidayat

Vanessa Ariati Tanuwijaya

Sylvia Tirtanata

Wisnu Trihatmojo

Head of Equity Research, Strategy

Automotive, Conglomerate,

Consumer, Retail

Construction, Toll Road

Plantation, Heavy eq., Energy

Coal and Metal mining

Banking

Property, Building Material

Telecommunication

Economist

Economist

Technical Analyst

Research Assistant

Research Assistant

Research Assistant

Research Assistant

Research Assistant

john.rachmat@mandirisek.co.id

+6221 5296 9542

adrian.joezer@mandirisek.co.id

handoko.wijoyo@mandirisek.co.id

hariyanto.wijaya@mandirisek.co.id

herman.koeswanto@mandirisek.co.id

tjandra.lienandjaja@mandirisek.co.id

liliana.bambang@mandirisek.co.id

ariyanto.kurniawan@mandirisek.co.id

aldian.taloputra@mandirisek.co.id

leo.rinaldy@mandirisek.co.id

satriawan@mandirisek.co.id

janefer.soelaiman@mandirisek.co.id

rizky.hidayat@mandirisek.co.id

vanessa.tanuwijaya@mandirisek.co.id

sylvia.tirtanata@mandirisek.co.id

wisnu.trihatmojo@mandirisek.co.id

+6221 5296 9549

+6221 5296 9418

+6221 5296 9553

+6221 5296 9569

+6221 5296 9617

+6221 5296 9465

+6221 5296 9682

+6221 5296 9572

+6221 5296 9406

+6221 520 8007

+6221 5296 9543

+6221 5296 9415

+6221 5296 9546

+6221 5296 9623

+6221 5296 9544

Co-Head Institutional Equities

Co-Head Institutional Equities

Institutional Sales

Institutional Sales

Institutional Sales

Institutional Sales

Institutional Sales

Institutional Sales

Institutional Sales

Equity Dealing

Equity Dealing

lokman.lie@mandirisek.co.id

silva.halim@mandirisek.co.id

andrew.handaya@mandirisek.co.id

oos.rosadi@mandirisek.co.id

vera.ongyono@mandirisek.co.id

yohan.setio@mandirisek.co.id

zahra.niode@mandirisek.co.id

santikara.salim@mandirisek.co.id

jane.sukardi@mandirisek.co.id

kusnadi.widjaja@mandirisek.co.id

edwin.setiadi@mandirisek.co.id

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

+6221 527 5375

Jakarta Branch

Kelapa Gading Branch

Mangga Dua Branch

Pondok Indah Branch

Bandung Branch

Pontianak Branch

Malang & Surabaya Branch

Medan Branch

ridwan.pranata@mandirisek.co.id

Yohanes.triyanto@mandirisek.co.id

hendra.riady@mandirisek.co.id

meta.prilyandari@mandirisek.co.id

boy.triyono@mandirisek.co.id

yuri.ariadi@mandirisek.co.id

irawan.es@mandirisek.co.id

ruwie@mandirisek.co.id

+6221 5296 9514

+6221 45845355

+6221 6230 2333

+6221 75818837

+6222 2510738

+62561 582292

+6231 535 7218

+6261 457 1116

INSTITUTIONAL SALES

Lokman Lie

Silva Halim

Andrew Handaya

Oos Rosadi

Vera Ongyono

Yohan Setio, CFA

Zahra Aldila Niode

Mirna Santikara Salim

Jane Sukardi

Kusnadi Widjaja

Edwin Setiadi

RETAIL SALES

Ridwan Pranata

Yohanes Triyanto

Hendra Riady

Meta Rama Prilyandari

Boy Triono

Yuri Ariadi

Irawan Endro Surono

Ruwie

INVESTMENT RATINGS: Indicators of expected total return (price appreciation plus dividend yield) within the 12-month period from the date of the last

published report, are: Buy (10% or higher), Neutral (-10% to10%) and Sell (-10% or lower).

DISCLAIMER: This report is issued by PT. Mandiri Sekuritas, a member of the Indonesia Stock Exchanges (IDX). Although the contents of this document may

represent the opinion of PT. Mandiri Sekuritas, deriving its judgement from materials and sources believed to be reliable, PT. Mandiri Sekuritas or any other

company in the Mandiri Group cannot guarantee its accuracy and completeness. PT. Mandiri Sekuritas or any other company in the Mandiri Group may be

involved in transactions contrary to any opinion herein to make markets, or have positions in the securities recommended herein. PT. Mandiri Sekuritas or

any other company in the Mandiri Group may seek or will seek investment banking or other business relationships with the companies in this report. For

further information please contact our number 62-21-5263445 or fax 62-21-5275711.

ANALYSTS CERTIFICATION: Each contributor to this report hereby certifies that all the views expressed accurately reflect his or her views about the

companies, securities and all pertinent variables. It is also certified that the views and recommendations contained in this report are not and will not be

influenced by any part or all of his or her compensation.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- New Heritage Doll - SolutionДокумент4 страницыNew Heritage Doll - Solutionrath347775% (4)

- Kgfs ModelДокумент24 страницыKgfs ModelgautamojhaОценок пока нет

- Ardra - MBA FINAL PROJECTДокумент90 страницArdra - MBA FINAL PROJECTKochuthresia JosephОценок пока нет

- Audit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZДокумент3 страницыAudit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZShaz NagaОценок пока нет

- Journal Article of EnterprunershipДокумент5 страницJournal Article of EnterprunershipSeleselamBefekerОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Syed SameerОценок пока нет

- Functional DocumentДокумент14 страницFunctional DocumentvivekshailyОценок пока нет

- CadburyДокумент43 страницыCadburyBabasab Patil (Karrisatte)Оценок пока нет

- 4PS and 4esДокумент32 страницы4PS and 4esLalajom HarveyОценок пока нет

- Laporan Magang BI MalangДокумент49 страницLaporan Magang BI MalangBlue NetОценок пока нет

- Chapter 1-Problems Problems 1 Problems 2Документ3 страницыChapter 1-Problems Problems 1 Problems 2Angela Ricaplaza ReveralОценок пока нет

- Mutual Fund: Securities Exchange Act of 1934Документ2 страницыMutual Fund: Securities Exchange Act of 1934Vienvenido DalaguitОценок пока нет

- Lesson 4 MARKET STRUCTURESДокумент21 страницаLesson 4 MARKET STRUCTURESJet SonОценок пока нет

- Chapter 7 Intangible Assets Exercises T3AY2021Документ4 страницыChapter 7 Intangible Assets Exercises T3AY2021Carl Vincent BarituaОценок пока нет

- Bangalore JustDial & OthersДокумент56 страницBangalore JustDial & OthersAbhishek SinghОценок пока нет

- TPM PresentationДокумент40 страницTPM PresentationRahul RajpalОценок пока нет

- The Role of Non-Executive Directors in Corporate Governance: An EvaluationДокумент34 страницыThe Role of Non-Executive Directors in Corporate Governance: An Evaluationsharonlow88Оценок пока нет

- Business Opportunity EvaluationДокумент26 страницBusiness Opportunity EvaluationAmirОценок пока нет

- Electives Term 5&6Документ28 страницElectives Term 5&6GaneshRathodОценок пока нет

- دور وأهمية إرساء ثقافة حوكمة الشركات على استدامة الشركات الناشئة دراسة ميدانيةДокумент22 страницыدور وأهمية إرساء ثقافة حوكمة الشركات على استدامة الشركات الناشئة دراسة ميدانيةChaouki Nsighaoui0% (1)

- Para BankingДокумент57 страницPara BankingAjyPri100% (1)

- Spyder Active Sports Case AnalysisДокумент2 страницыSpyder Active Sports Case AnalysisSrikanth Kumar Konduri100% (3)

- MB0045 Financial ManagementДокумент4 страницыMB0045 Financial ManagementAbhinav SrivastavaОценок пока нет

- Taylor Nelson Sofres: From Wikipedia, The Free EncyclopediaДокумент4 страницыTaylor Nelson Sofres: From Wikipedia, The Free EncyclopediaMonique DeleonОценок пока нет

- Is Enhanced Audit Quality Associated With Greater Real Earnings Management?Документ22 страницыIs Enhanced Audit Quality Associated With Greater Real Earnings Management?Darvin AnanthanОценок пока нет

- Managing Key Business ProcessesДокумент12 страницManaging Key Business ProcessesMОценок пока нет

- Case-Walmarts Expansion Into Specialty Online RetailingДокумент9 страницCase-Walmarts Expansion Into Specialty Online RetailingSYAHRUL ROBBIANSYAH RAMADHANОценок пока нет

- Capital Budgeting On Mercedes BenzДокумент3 страницыCapital Budgeting On Mercedes Benzashusingh9339Оценок пока нет

- 40 Easy Ways To Make Money QuicklyДокумент3 страницы40 Easy Ways To Make Money QuicklyDotan NutodОценок пока нет