Академический Документы

Профессиональный Документы

Культура Документы

Questionair

Загружено:

mrchavan143Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Questionair

Загружено:

mrchavan143Авторское право:

Доступные форматы

A] QUESTIONNAIRE 1.Name: 2.

Age : a) b) c) d) 25-35 36-45 46 55 Above 55

3. Educational Qualification: a) Graduate b) Post Graduate c) Others 4. Designation: 5. Your Gross Annual Income Will Be? (p.a) a) 50,000 1,00,000 b) 1,00,000 3,00,000 c) 3,00,000 & Above 6. What percentage of your annual income do you save to invest? a) 5 to 10% b) 10 to 20% c) 20 and above 7. Do you prefer to invest for long term or short duration? a)Short term b) Long term

8..Do you think MUTHOOT FINCORP LTD is trusted brand to invest in Debentures? a)Yes b) NO

9. Do you have knowledge about secured debenture and Non -convertable debenture which is specially for NBFC Eg. MUTHOOT FINCORP LTD ? a) Yes b) No

10. What do you expect from an Investment? FACTORS HIGHLY IMPORTANT HIGHLY IMPORTANT NEITHER IMPORTANT OR NOT IMPORTANT NOT IMPORTANT HIGHLY NOT IMPORTANT

TAX BENEFITS RETURN LOW RISK SAFETY SAVINGS

11. Till now, Your Investment made in? a) b) c) d) e) Fixed DepositsMutual Funds- Stocks InsuranceOthers

12. Incase if you invest in Insurance, Which would you opt for Accumulation? a) Endowment b) Money Back c) ULIP d) Whole Life Plan e) Retirement Plan 13. Do you have the Knowledge about the Mutual Fund Market? a) Some Knowledge b)Sufficient Knowledge c)More Knowledge

14. What Do you look in from a Mutual Fund ?

FACTORS

HIGHLY HIGHLY NEITHER NOT HIGHLY IMPORTANT IMPORTANT IMPORTANT IMPORTANT NOT OR NOT IMPORTANT IMPORTANT

REGULAR INCOME CAPITAL APPRECIATTION TAX BENEFITS SAFETY SAVINGS

15. Do you think Stock Market Knowledge is necessary for Trading? b) Essential c) Not essential d) Brokers Knowledge is enough 16. Convey your idea about nature of Return in the following investment Avenues (Rank 1 = High Returns)

Mutual Fund Stock Insurance Fixed Deposits Government Securities Real estate

B) CONCLUSION AS PER QUESTIONNAIRE AGE OF THE RESPONDENTS

INFERENCE: it can be inferred that 30% of the respondents belongs to age between 35-45 years of age .Very few belong to the age group of above 55 years.

EDUCATION QUALIFICATION

INFERENCE: From the above table it can infer that 37% of the respondents possess UG qualifications. 10% are however professional

KNOWLEDGE LEVEL IN MUTUAL FUNDS:

INFERENCE: From the above chart it is clearly stated that the knowledge level of the investor in Mutual Fund is considerably low, since it is a recent avenue.

INVESTMENT FACTORS (As per Investors choice):

INFERENCE: From the above table that the risk and the return are considered to be the mostimportant factor for an investment about 43% have said that returns are important and around 45says that low risk in investment places a major role. Safety, Savings and Tax benefits are also taken in to consideration for making an investment decision.

INVESTOR PREFERENCE IN INSURANCE POLICY

INFERENCE: From the above table it can be seen that there is a more important given to Endowment and Money Back policies in the case of Accumulation.

C) BIBLIOGRAPHY

Websites www.bseindia.com www.mutualfundsindia.com www.crisil.com www.gold.org.com www.moneycontrol.com www.investopedia.com www.licofindia.com

Text Books

Investment Analysis and Portfolio Management Investments Security Analysis and Portfolio Management

- Prasanna Chandra - Sharpe & Alexander - Fischer & Jordan

Magazines Business world Business Today

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- FIN571 Working Capital Simulation WK6Документ7 страницFIN571 Working Capital Simulation WK6Dina100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Coca Cola Company AnalysisДокумент35 страницThe Coca Cola Company AnalysisSalah Uddin50% (2)

- Law of ContractsДокумент102 страницыLaw of Contractsrajjuneja100% (5)

- BHI SEC Cert & Amended Articles of Incorporation PDFДокумент9 страницBHI SEC Cert & Amended Articles of Incorporation PDFkimberly_uymatiaoОценок пока нет

- Law On Partnerships (General Provisions)Документ3 страницыLaw On Partnerships (General Provisions)Citoy LabadanОценок пока нет

- Internship Report On National Bank of PakistanДокумент99 страницInternship Report On National Bank of Pakistanbbaahmad89100% (1)

- EntrepreneurshipДокумент98 страницEntrepreneurshipmrchavan143100% (1)

- Revised Option Money AgreementДокумент3 страницыRevised Option Money AgreementZhanika Marie Carbonell100% (1)

- NPC Dama vs. NPCДокумент2 страницыNPC Dama vs. NPCIyah0% (1)

- Acquisition: of Bank of Rajasthan by ICICI BankДокумент12 страницAcquisition: of Bank of Rajasthan by ICICI Bankmrchavan143Оценок пока нет

- Group Members: Jayshree Varsha Melanie Abhishek Priyanka Rekha HardikДокумент27 страницGroup Members: Jayshree Varsha Melanie Abhishek Priyanka Rekha Hardikmrchavan143Оценок пока нет

- Sunshine Resort: Live in Real NatureДокумент36 страницSunshine Resort: Live in Real Naturemrchavan143Оценок пока нет

- Fact FofeitДокумент34 страницыFact Fofeitmrchavan143Оценок пока нет

- Unique Identity ProjectДокумент17 страницUnique Identity Projectmrchavan143Оценок пока нет

- Maruti Suzuki's Manesar Plant Faces Lockout Car Industry Braces For SlumpДокумент2 страницыMaruti Suzuki's Manesar Plant Faces Lockout Car Industry Braces For Slumpmrchavan143Оценок пока нет

- Impact of Information Technology On Business: Presented By: Samrudhi GadveДокумент11 страницImpact of Information Technology On Business: Presented By: Samrudhi Gadvemrchavan143Оценок пока нет

- SEO (Disambiguation) : Internet MarketingДокумент8 страницSEO (Disambiguation) : Internet Marketingmrchavan143Оценок пока нет

- Executive Summary of KraftДокумент4 страницыExecutive Summary of Kraftmrchavan143Оценок пока нет

- Khidki VadaДокумент2 страницыKhidki Vadamrchavan143Оценок пока нет

- Introduction To BPRДокумент16 страницIntroduction To BPRmrchavan143Оценок пока нет

- Management and Its EvolutionДокумент14 страницManagement and Its Evolutionmrchavan143Оценок пока нет

- TQM EvolutionДокумент69 страницTQM EvolutionVijayakumarОценок пока нет

- Rough MKTNG Insrnce PRCT FinalДокумент68 страницRough MKTNG Insrnce PRCT Finalmrchavan143Оценок пока нет

- Shift The Narrative by Russell RedenbaughДокумент1 страницаShift The Narrative by Russell RedenbaughEddie Vigil VОценок пока нет

- A Project Report On "A Consumer Buying Behaviour": Bachelor of Business AdministrationДокумент41 страницаA Project Report On "A Consumer Buying Behaviour": Bachelor of Business AdministrationVikas KumarОценок пока нет

- 2017-07-13 St. Mary's County TimesДокумент32 страницы2017-07-13 St. Mary's County TimesSouthern Maryland OnlineОценок пока нет

- CILДокумент31 страницаCILHemant GaurkarОценок пока нет

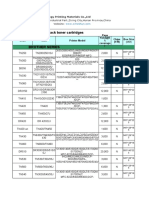

- Product List From Heshun-Lynn 2017Документ226 страницProduct List From Heshun-Lynn 2017kswongОценок пока нет

- Fictitious Business Name Statement: Frequently Asked QuestionsДокумент1 страницаFictitious Business Name Statement: Frequently Asked QuestionsJames FolmerОценок пока нет

- Legistify Compliance Checklist Companies PageДокумент3 страницыLegistify Compliance Checklist Companies Pageakshayjain93Оценок пока нет

- Kotak Mahindra BankДокумент4 страницыKotak Mahindra BankPriyanka GargОценок пока нет

- Small Business 1Документ2 страницыSmall Business 1abrarОценок пока нет

- MC No. 03 s.2017: Consolidated Schedule of Fees and ChargesДокумент3 страницыMC No. 03 s.2017: Consolidated Schedule of Fees and ChargesMae Richelle Dizon DacaraОценок пока нет

- An Analysis of One Person Company Under Companies ActДокумент4 страницыAn Analysis of One Person Company Under Companies ActafiqahazizОценок пока нет

- The Testament of A Furniture Dealer PDFДокумент8 страницThe Testament of A Furniture Dealer PDFpaulmuresanОценок пока нет

- Abstract MPBConferencePaperДокумент3 страницыAbstract MPBConferencePaperNalayiramОценок пока нет

- Corporate Regulation and AdministrationДокумент17 страницCorporate Regulation and AdministrationRahul Jacob KuruvilaОценок пока нет

- Walmart Job ApplicationДокумент2 страницыWalmart Job Applicationapi-386838041Оценок пока нет

- MBA Syllabus III SemesterДокумент59 страницMBA Syllabus III SemesterSharmilaОценок пока нет

- 1 Pdfsam Delhi Company 1Документ503 страницы1 Pdfsam Delhi Company 1ankitОценок пока нет

- Solutions To Chapter 6 Valuing StocksДокумент20 страницSolutions To Chapter 6 Valuing StocksSam TnОценок пока нет

- Designing Internal Control Systems For SMEsДокумент40 страницDesigning Internal Control Systems For SMEsShahida SallehОценок пока нет

- Paytm Postpaid Statement-February 2019Документ2 страницыPaytm Postpaid Statement-February 2019Amol WaghadeОценок пока нет

- Chap 9 MCДокумент18 страницChap 9 MCIlyas SadvokassovОценок пока нет

- Interview With Nelly Fishbinder An Employee at TecholaДокумент2 страницыInterview With Nelly Fishbinder An Employee at TecholaFrancisco DíazОценок пока нет

- Aditya Birla Group Under KumarДокумент10 страницAditya Birla Group Under KumarDimas Radhitya Wahyu PratamaОценок пока нет