Академический Документы

Профессиональный Документы

Культура Документы

Singapore, S Korea & Malaysia

Загружено:

Varun AgarwalОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Singapore, S Korea & Malaysia

Загружено:

Varun AgarwalАвторское право:

Доступные форматы

SINGAPORE

Advantages for retailers Changing consumer profile With the Generation Xs and Ys now having entered the job market, and with more of them taking on professional and managerial positions, the typical Singaporean consumer profile has changed. One of the noteworthy changes is that the proportion of women who are educated and who are earning income independently has increase significantly. This has placed a sizeable portion of disposable income in the hands of women, who have become more fashion and beauty conscious. This has contributed to a proliferation of beauty parlous, slimming centres and spas in recent years. With dual income households becoming increasingly common in Singapore, the family household income has increased exponentially over the last few years. Coupled with the decreasing size of nuclear families, parents are increasingly willing to splurge on their children more than ever before. The teenagers dollars have become one of the most sought after in the retail industry, leading to the glut of teenage street wear catering to the wide ranging and often fast changing fads of teenagers. The rise of the fashion-conscious, sophisticated and culture-savvy urban metrosexual male has birthed a whole new market. This presents exciting opportunities for retailers in the fashion and grooming business. Penetration rate of mobile phones According to figures recently published by the Infocomm Development Authority (IDA) of Singapore, mobile market penetration is expected to continue to increase. As of January 2004, the mobile market penetration rate is estimated to be around 84.2%, with 3.5 million subscribers. This, with the advent of Multimedia Messaging Services (MMS) and the propagation of MMS-enabled phones, presents retailers with an exciting new mode of advertising. Personalised MMS messages could potentially become a powerful marketing medium1. Disadvantages for retailers Intense competition Despite its small physical size, Singapore has a proliferation of retail outlets. The ratio of retail space to population size is much higher than in neighboring countries such as Hong Kong. Low entry barriers have made it easier for new players to enter the retail market. The industry is fragmented and competition is particularly intense among the local small- and medium-sized enterprises (SMEs) located on HDB estates. These HDB

1

From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , Singapore p 149-155

retailers offer undifferentiated products and services and often enjoy little consumer loyalty. Foreign retailers have also encroached into the HDB estates, offering greater choices to consumers.

High costs and low productivity The cost of doing business is high. In land-scarce Singapore, space is a luxury. Productivity is low compared to the manufacturing sector. The value added per worker of the retail trade sector (excluding retail of motor vehicles) is only about SGD30,000, less than a third of that in the manufacturing sector. From a productivity point of view, there is much room for improvement, particularly for SMEs located on HDB estates.

Service quality In the retail trade sector, there is a shortage of skilled personnel. Research by the Singapore Standards & Productivity Board shows that a lot of companies in the services sector do not have clear work performance standards and procedures. In most cases, there are only broad guidelines and instructions, and staff are left to do as they see fit. This results in differing levels of services standards throughout the retail sector. There is a need to raise the professionalism and image of the retail workforce, promoting service differentiation and attracting/ retaining staff.

Increasingly sophisticated and demanding consumers Singaporeans are becoming more affluent and educated, and most have traveled abroad. They have even more choices and are demanding more in terms of service, quality, convenience, variety and state-of-the-art technology. They will spend their shopping dollars where it offers the best experience, value and price. In the face of these changes, the retail sector is expected to restructure and rethink its strategy.

Brand marketing Brand marketing is becoming tougher due to the proliferation of products and brands. Product lifecycles are becoming shorter as consumers demand innovation and variety. Business practices in the Singaporean consumer packaged goods industry have also changed significantly in recent years. The entrenchment of category management has fundamentally changed the manufacturer/retailer dynamic.

Intense competition from overseas retailers

Recent developments in the airline industry have seen budget airlines offering consumers not only access to cheaper air tickets, but more subtly, the opportunity to travel to cities like Hong Kong and Bangkok to hunt for bargains. Together with the appreciation of the Singapore dollar against the currencies of its East Asian neighbors, the idea of shopping abroad has come to make economical sense and is very attractive to Singaporeans.

Cheaper air travel has also made duty-free shopping, both in Singapore and abroad more appealing. This factor is consequently expected to draw business away from retail outlets located outside the airport. The combined effect of these trends on the retail and consumer landscape is more intense competition. Not only must retailers contend with competition from within Singapore, they must now also examine the threat posed by overseas retailers located in popular tourist shopping havens.

SOUTH KOREA

Advantages for retailers Supply chain management improvement Given the focus on over-the-counter management, the corporate controls for supporting distribution centers and supply chain management (SCM) are not well established. Korean retailers have difficulties integrating logistics systems and communicating in a timely manner with suppliers regarding inventories and sales. 2 Disadvantages for retailers Intense competition Intense competition and an increasing number of retail stores effectively reduces the efficiency of each store. As the retail business grows and the larger companies take over, the small-and medium-sized retail companies have begun to struggle. The traditional and pre-modern way of retailing, i.e. buying and selling without invoices or receipts, represents a deep-rooted problem for the Korean retail industry as a whole. Many Korean retail companies are trying to establish own-label brands, but continue to face difficulties in developing and marketing these brands.

From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , S.Korea p89-90

As the number of convenience stores increases, daily sales per store have stopped growing. Convenience stores are trying to overcome this situation by increasing sales per visit and improving efficiency in relation to display space. Focus on merchandising and category management The Korean retail business is mainly focused on over the- counter management armed with points of sales (POS) and accounting systems. It lacks analytical and systematic merchandising for category management.

MALAYSIA

Advantages for retailers Development of mega malls Shopping malls are constantly being upgraded to cater to the increasingly fast-paced and cosmopolitan lifestyle of the Malaysian people. Among the shopping malls recently completed in Klang Valley are Berjaya Times Square (with the largest indoor childrens theme park), Ikano Power Centre (key anchor tenants like IKEA, Harvey Norman) and South City Plaza. The Curve and KL Sentral are among the others that are expected to be completed within the next three years. Furthermore, the top three largest malls in Malaysia, namely Mid-Valley Megamall, Sunway Pyramid and 1-Utama are all developing expansion plans.3

Disadvantages for retailers Intense competition The Malaysian retail scene is gearing up for intense competition with more new players and expansion plans undertaken by foreign players. Some retailers have managed to address the competition by focusing on locations (e.g. suburban residential areas) and targeting certain segments (middle-income groups). With the freeze on foreign hypermarket expansion in the medium term for Klang Valley, Penang and Johor, foreign players are expected to turn to the major east coast towns of Peninsula Malaysia such as Kuantan, Kuala Terengganu and Kota Baru. Nonetheless, with the minimum population requirement of 350,000 persons, only Ipoh and Kuching can qualify for new hypermarket openings. As consumers become more cautious with their spending, retailers have had to become extremely pricecompetitive. The ongoing price war among major retailers continues to have an adverse effect on the small

3

From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , Malaysia p 103-104

retailers, who may not be able to compete at lower prices. However, the intense competition posed by foreign players will provide additional impetus for local retailers to leverage on retail technology to better understand consumer purchasing behavior, streamline operational procedures and to enhance efficiency.

Reference

1) From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , Singapore http://www.pwc.com/gx/en/retail-consumer/pdf/singapore.pdf

2) From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , S korea http://www.pwc.com/gx/en/retail-consumer/pdf/korea_south_oct-12.pdf

3) From Beijing to Budapest ,New retails & Consumer Growth patterns in Transitional Economies PWC , Malaysia http://www.pwc.com/gx/en/retail-consumer/pdf/malaysia.pdf

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Shoppers Experience at FoodhallДокумент8 страницShoppers Experience at FoodhallVarun AgarwalОценок пока нет

- Customer Relationship Management: Session-3Документ27 страницCustomer Relationship Management: Session-3Varun AgarwalОценок пока нет

- Research Paper 1Документ13 страницResearch Paper 1Varun AgarwalОценок пока нет

- Bizpolicy RMДокумент4 страницыBizpolicy RMVarun AgarwalОценок пока нет

- Academic Calendar 2013-14Документ6 страницAcademic Calendar 2013-14Varun AgarwalОценок пока нет

- Entrepreneurship Management: Developing Start-Up StrategiesДокумент21 страницаEntrepreneurship Management: Developing Start-Up StrategiesVarun AgarwalОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Artificial Intelligence IBM FinalДокумент35 страницArtificial Intelligence IBM FinalnonieshzОценок пока нет

- AcadinfoДокумент10 страницAcadinfoYumi LingОценок пока нет

- Fashion OrientationДокумент7 страницFashion OrientationRAHUL16398Оценок пока нет

- CM - Mapeh 8 MusicДокумент5 страницCM - Mapeh 8 MusicAmirah HannahОценок пока нет

- Criticism On Commonly Studied Novels PDFДокумент412 страницCriticism On Commonly Studied Novels PDFIosif SandoruОценок пока нет

- Notes: 1 Yorùbá Riddles in Performance: Content and ContextДокумент25 страницNotes: 1 Yorùbá Riddles in Performance: Content and ContextDofono ty NísèwèОценок пока нет

- FDДокумент17 страницFDYash BhatnagarОценок пока нет

- Radical Feminism Enters The 21st Century - Radfem HubДокумент53 страницыRadical Feminism Enters The 21st Century - Radfem HubFidelbogen CfОценок пока нет

- BrochureДокумент10 страницBrochureSaurabh SahaiОценок пока нет

- Inbound Email Configuration For Offline ApprovalsДокумент10 страницInbound Email Configuration For Offline Approvalssarin.kane8423100% (1)

- Causes of UnemploymentДокумент7 страницCauses of UnemploymentBishwaranjan RoyОценок пока нет

- Apple Case ReportДокумент2 страницыApple Case ReportAwa SannoОценок пока нет

- RPH 1Документ2 страницыRPH 1Amor VillaОценок пока нет

- The Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Документ78 страницThe Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Eyuael SolomonОценок пока нет

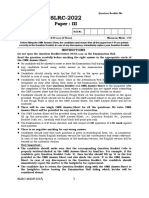

- SLRC InstPage Paper IIIДокумент5 страницSLRC InstPage Paper IIIgoviОценок пока нет

- Aac04 2017Документ153 страницыAac04 2017Panneer SelvamОценок пока нет

- Femi-1020315836-The Life Styles Hotel Surabaya-HOTEL - STANDALONE-1Документ2 страницыFemi-1020315836-The Life Styles Hotel Surabaya-HOTEL - STANDALONE-1Deka AdeОценок пока нет

- Cosmetics & Toiletries Market Overviews 2015Документ108 страницCosmetics & Toiletries Market Overviews 2015babidqn100% (1)

- Contrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesДокумент2 страницыContrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesTogay Balik100% (1)

- Case Study Little Enough or Too MuchДокумент2 страницыCase Study Little Enough or Too MuchMalik GhunaibОценок пока нет

- Safe Disposal of Hazardous Wastes Vol IДокумент290 страницSafe Disposal of Hazardous Wastes Vol IRodrigo BartoloОценок пока нет

- Animal AkanДокумент96 страницAnimal AkanSah Ara SAnkh Sanu-tОценок пока нет

- Revelry in TorthДокумент43 страницыRevelry in TorthArets Paeglis100% (2)

- Interim Financial ReportingДокумент3 страницыInterim Financial ReportingHalina ValdezОценок пока нет

- Ak Barnett Hart ThesisДокумент8 страницAk Barnett Hart ThesisWhereCanIFindSomeoneToWriteMyCollegePaperUK100% (2)

- Bookkeeping BasicsДокумент19 страницBookkeeping BasicsAbeer ShennawyОценок пока нет

- Geopolitical Assemblages and ComplexДокумент17 страницGeopolitical Assemblages and ComplexCarmen AguilarОценок пока нет

- The Game of KevukДокумент8 страницThe Game of KevukTselin NyaiОценок пока нет

- Literarture Review For New DesignДокумент2 страницыLiterarture Review For New Designsaumya irugalbandaraОценок пока нет

- Windelband, W. - History of Ancient PhilosophyДокумент424 страницыWindelband, W. - History of Ancient Philosophyolinto godoyОценок пока нет