Академический Документы

Профессиональный Документы

Культура Документы

2013 J.P. Morgan The Deal Competition - Competition Instructions

Загружено:

helpperman89773456Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2013 J.P. Morgan The Deal Competition - Competition Instructions

Загружено:

helpperman89773456Авторское право:

Доступные форматы

2013 J.P.

Morgan Asia Investment Banking The Deal Competition

Group Project Description For your group project you will work in groups of 3-5 members each and assume the role of the financial advisor to the Board of Directors of a publicly listed consumer product company (the Company or the Acquiror) in connection with a strategic cross -border acquisition of another public listed company in the same industry in Emerging Asia (the Target). The 3-5 of you will collectively choose the Acquiror and the Target and analyze this hypothetical acquisition which you think makes strategic sense. The transaction value should exceed US$200 million. You are required to prepare a PowerPoint presentation to the Board on the strategic alternatives available to the Company, recommendation of a strategic acquisition, strategic rationale of the transaction, valuation of the target, key issues to consider in this transaction, and the work scope and project process tailored for this transaction. You are also required to covers the following aspects in the valuation section of your proposal: What are the valuation drivers for the Target? o What factors have a significant impact on its earnings? o How sensitive is the Target to different variables? What is your assessment of valuation for the Target? o You should consider a discounted cash flow (DCF) analysis, and a valuation based on precedent transactions and comparable company multiples o Clearly explain the assumptions underlying your valuation model o Analyze the benefits and limitations of the various valuation methodologies Discuss the synergies that the Acquiror and the Target may achieve and the valuation of these synergies. Recommend the appropriate acquisition premium for the Target.

Lastly, you should also cover the following: Discuss how the proposed transaction is going to be financed Will this proposed transaction create value for the shareholders of the Acquiror? o You should consider a merger analysis, and analyze the pro-forma impact on earnings accretion/dilution and credit ratios Discuss other relevant approach and execution considerations (e.g. bid tactics)

Your presentation can also cover points which you think are relevant or necessary.

2013 J.P. Morgan Asia Investment Banking The Deal Competition

Guidelines Research Skills You are expected to utilize your research skills to collect public information on the Acquiror and the Target, including but not limited to: Companys public filings to the Stock Exchange Recent industry news and company news Industry report or research reports that are available in the public domain

Where you can usually look for public information: Company website, specifically the Investor Relations section Stock Exchange websites all the public filings are there Bloomberg if you have access to one Google, Yahoo! (or Baidu if you are searching information on a Chinese company)

Presentation Skills The presentation should be comprehensive in content but concise in presentation style. The suggested length of the presentation is 20-25 slides of content (i.e. excluding title page, table of contents). The presentation to the panel will be limited to 30 minutes, including 5 minutes of Q&A, which is expected to be a bilingual session in English and Mandarin (only if there are member in the group who indicat ed Mandarin as their second language) You should think about your response to all of the transaction issues, as they may come up in questions which the panel poses to you Within each group you can decide the speaking role for each member in front of the panel

Team Captain By default, the team captain will be the member that has registered the group through the online application system. He/she is responsible to manage the communication between the group and J.P. Morgan The Deal Competition, as well as to submit the final case presentation.

Case Submission Team Captain needs to submit the case study via email in the form of PowerPoint document by 00:00am (midnight) August 18, 2013 (US EST). No changes or updates will be allowed once the case has been submitted. Any late submission of case study will not be considered. The submission must be a team effort and the teams original work The case study submission format must be a PowerPoint document If you need to zip the presentation, please zip it only in .zip format. Please do not zip using .rar format Please submit your PowerPoint presentation via email to jpmorgan.thedeal@jpmorgan.com

2013 J.P. Morgan Asia Investment Banking The Deal Competition

Final Group Presentation During late-September to October, we will notify the selected groups which have been chosen to present to J.P. Morgans Asia Investment Banking senior bankers. Exact date and time of the presentation will be emailed to you closer to date.

Result Announcement The result of the competition will be announced before the end of November. The winning team will be automatically invited to the final round interview for a position in our Asia Investment Banking Summer Internship program

Important Timeline

June 10, 2013: Confirmation of participation and release of case details August 18, 2013: Case submission via email September 2013 (exact date TBC): Invitation of selected groups for presentation Late September - October 2013 (exact date TBC): Selected groups' presentations to J.P. Morgans Asia Investment Banking senior bankers (Exact venue and time will be emailed to you closer to date) End of November: Winning team announcement

Questions If the team comes across any questions during the competition, the Team Captain can email us at: jpmorgan.thedeal@jpmorgan.com

Вам также может понравиться

- JP Morgan Interview QuestionsДокумент14 страницJP Morgan Interview Questionshussien80% (15)

- Competency and Motivational Interview Questions for Finance RolesДокумент11 страницCompetency and Motivational Interview Questions for Finance RolesTodd CollinsОценок пока нет

- Top 20 Corporate Finance Interview Questions (With Answers) PDFДокумент19 страницTop 20 Corporate Finance Interview Questions (With Answers) PDFDipak MahalikОценок пока нет

- 2022 Video Interview Prep - J.P. MorganДокумент3 страницы2022 Video Interview Prep - J.P. MorganLilia Fatma KrichèneОценок пока нет

- Internship Offer by GOLDMAN SACHSДокумент5 страницInternship Offer by GOLDMAN SACHSNitesh mishraОценок пока нет

- Top Interview Questions For Finance ProfessionalsДокумент4 страницыTop Interview Questions For Finance ProfessionalsSuresh KumarОценок пока нет

- J.P. Morgan Application Guidance 2022Документ7 страницJ.P. Morgan Application Guidance 2022Lilia Fatma KrichèneОценок пока нет

- Investment Banking Interview Guide: Course OutlineДокумент20 страницInvestment Banking Interview Guide: Course OutlineTawhid SyedОценок пока нет

- Finance Interview QuestionsДокумент15 страницFinance Interview QuestionsJitendra BhandariОценок пока нет

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesОт EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesОценок пока нет

- How to structure investments to protect downsideДокумент6 страницHow to structure investments to protect downsidehelloОценок пока нет

- M&a Interview QuestionsДокумент1 страницаM&a Interview QuestionsJack JacintoОценок пока нет

- Day Z Summer Interview 2005Документ37 страницDay Z Summer Interview 2005Amit RanaОценок пока нет

- Valuing A Business: Corporate Finance Directors' BriefingДокумент4 страницыValuing A Business: Corporate Finance Directors' BriefingRupika SharmaОценок пока нет

- Consolidated Interview Questions (IB) PDFДокумент7 страницConsolidated Interview Questions (IB) PDFEric LukasОценок пока нет

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondОт EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondОценок пока нет

- Accounting Equations and Concepts GuideДокумент1 страницаAccounting Equations and Concepts Guidealbatross868973Оценок пока нет

- Sales TrainingДокумент19 страницSales TrainingAashish PardeshiОценок пока нет

- Case Interviews 2 11-12 PDFДокумент194 страницыCase Interviews 2 11-12 PDFPoojaKumariОценок пока нет

- Corporate Financial Planning and ForecastingДокумент51 страницаCorporate Financial Planning and ForecastingTetyanaОценок пока нет

- Financial Modeling Fundamentals QuizДокумент10 страницFinancial Modeling Fundamentals QuizdafxОценок пока нет

- 43-Interview-Tips-Asset ManagementДокумент2 страницы43-Interview-Tips-Asset ManagementAdnan NaboulsyОценок пока нет

- PDFДокумент124 страницыPDFadsfОценок пока нет

- FAQs Recent College Graduate Job Opportunities Morgan StanleyДокумент13 страницFAQs Recent College Graduate Job Opportunities Morgan StanleydianwenОценок пока нет

- MBA Investment Banking Resume TemplateДокумент2 страницыMBA Investment Banking Resume TemplatesensibledeveshОценок пока нет

- TTS - Trading Comps PrimerДокумент6 страницTTS - Trading Comps PrimerKrystleОценок пока нет

- Askivy Article List of Competency Interview Questions PDFДокумент4 страницыAskivy Article List of Competency Interview Questions PDFEkrem SafakОценок пока нет

- Bank VivaДокумент6 страницBank VivamoshiurОценок пока нет

- Finance Interview Questions For Financial AnalystДокумент3 страницыFinance Interview Questions For Financial Analystnishi100% (1)

- Financial Analyst Interview Questions and AnswersДокумент18 страницFinancial Analyst Interview Questions and AnswersfitriafiperОценок пока нет

- Insights on momentum investing strategy in correction phasesДокумент84 страницыInsights on momentum investing strategy in correction phasesvatsal shahОценок пока нет

- Case Study BriefingДокумент5 страницCase Study BriefingZohaib AhmedОценок пока нет

- AP 5904 InvestmentsДокумент9 страницAP 5904 InvestmentsJake BundokОценок пока нет

- Finance Interview QuestionsДокумент4 страницыFinance Interview QuestionsRohan ShirdhankarОценок пока нет

- Investment Management Interview QuestionsДокумент5 страницInvestment Management Interview QuestionsPierreОценок пока нет

- London 2011Документ32 страницыLondon 2011Amandine JayéОценок пока нет

- Spring Week GuideДокумент32 страницыSpring Week Guidevimanyu.tanejaОценок пока нет

- Wind farm project NPV and LCOE analysisДокумент5 страницWind farm project NPV and LCOE analysisPedro Galvani72% (32)

- Industrial Plant Solution & Services Company ProfileДокумент20 страницIndustrial Plant Solution & Services Company ProfileSlamet Purwadi S.T100% (1)

- Finance and Research Analyst Interview Question 1568208407Документ7 страницFinance and Research Analyst Interview Question 1568208407Hitesh PunjabiОценок пока нет

- Oblicon Syllabus 2014-2015 (Second Semester)Документ11 страницOblicon Syllabus 2014-2015 (Second Semester)Anthony GoquingcoОценок пока нет

- The IB League 2018 - IIMIndore - Indori-2 - ABHISHEK VERMA PGP 2017-19 BatchДокумент10 страницThe IB League 2018 - IIMIndore - Indori-2 - ABHISHEK VERMA PGP 2017-19 BatchRishabh JainОценок пока нет

- Login to careerclap.com and build your profileДокумент9 страницLogin to careerclap.com and build your profileAnonymous 1aCZDEbMMОценок пока нет

- FS Consulting Capital Markets - Case Study 1 (Regulatory Change)Документ1 страницаFS Consulting Capital Markets - Case Study 1 (Regulatory Change)FabrizioОценок пока нет

- Some Insights Into IPO Underpricing in IndiaДокумент2 страницыSome Insights Into IPO Underpricing in IndiaSuneesh LazarОценок пока нет

- Investment Banking Resume II - AfterДокумент1 страницаInvestment Banking Resume II - AfterbreakintobankingОценок пока нет

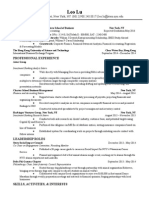

- Lu Leo ResumeДокумент2 страницыLu Leo ResumeLeo LuОценок пока нет

- Finance and Economics - 22 CasesДокумент35 страницFinance and Economics - 22 CasesSeong-uk KimОценок пока нет

- Tricky Interview Questions Asked by Goldman Sachs - Business InsiderДокумент22 страницыTricky Interview Questions Asked by Goldman Sachs - Business InsiderSheren DevinaОценок пока нет

- M&A Review QuestionsДокумент2 страницыM&A Review Questionsowen sherryОценок пока нет

- VFC Meeting 8.31 Discussion Materials PDFДокумент31 страницаVFC Meeting 8.31 Discussion Materials PDFhadhdhagshОценок пока нет

- 1978-1985 Class Results Adam Baxter 4-12-16 Mastering Negotiation - PrintДокумент4 страницы1978-1985 Class Results Adam Baxter 4-12-16 Mastering Negotiation - PrintDivyaОценок пока нет

- Cover Letter TemplateДокумент2 страницыCover Letter Templatemagicgero100% (4)

- Breaking into Wallstreet GuideДокумент3 страницыBreaking into Wallstreet GuidezzzzzzОценок пока нет

- CPG Corp Win Local Markets With Customized ProductsДокумент4 страницыCPG Corp Win Local Markets With Customized ProductsAnmol KapurОценок пока нет

- Analyzing credit risk profiles, portfolio management, and financial modeling techniquesДокумент2 страницыAnalyzing credit risk profiles, portfolio management, and financial modeling techniquesharshadspatilОценок пока нет

- How to prepare for a Corporate Banking InterviewДокумент3 страницыHow to prepare for a Corporate Banking InterviewsensibledeveshОценок пока нет

- InterviewsДокумент10 страницInterviewsKristel Jean SalvadorОценок пока нет

- 123Документ16 страниц123Prakhar AroraОценок пока нет

- Relative ValuationДокумент29 страницRelative ValuationOnal RautОценок пока нет

- Empirical Studies in FinanceДокумент8 страницEmpirical Studies in FinanceAhmedMalikОценок пока нет

- Ibig 04 08Документ45 страницIbig 04 08Russell KimОценок пока нет

- Crisil Interview QuestionsДокумент7 страницCrisil Interview QuestionsNagarajanRKОценок пока нет

- HSBCДокумент7 страницHSBCSomnath KarmakarОценок пока нет

- 26 Basel III and European Banking PDFДокумент32 страницы26 Basel III and European Banking PDFhelpperman89773456Оценок пока нет

- Valuation metrics for key sectorsДокумент1 страницаValuation metrics for key sectorshelpperman89773456Оценок пока нет

- Treasury RateДокумент34 страницыTreasury Ratehelpperman89773456Оценок пока нет

- Excel PivotДокумент348 страницExcel Pivothelpperman89773456Оценок пока нет

- All The Graphs You Need To Know For Macro5Документ5 страницAll The Graphs You Need To Know For Macro5helpperman89773456Оценок пока нет

- A Value Investing Analysis of Omnova Solutions - Seeking AlphaДокумент2 страницыA Value Investing Analysis of Omnova Solutions - Seeking Alphahelpperman89773456Оценок пока нет

- All Weather StoryДокумент6 страницAll Weather StoryRohit ChandraОценок пока нет

- Barcap WorkshopДокумент29 страницBarcap Workshophelpperman89773456Оценок пока нет

- 2 Buys and 2 Sells From Value Investor Ruane Cunniff of Sequoia FameДокумент4 страницы2 Buys and 2 Sells From Value Investor Ruane Cunniff of Sequoia Famehelpperman89773456Оценок пока нет

- LorealДокумент36 страницLorealShivya GuptaОценок пока нет

- Chapter 1 Securities Operations and Risk ManagementДокумент32 страницыChapter 1 Securities Operations and Risk ManagementMRIDUL GOELОценок пока нет

- Pure CompetitionДокумент19 страницPure CompetitionKirth PagkanlunganОценок пока нет

- Understanding Financial Statements, Taxes, and Cash Flows:, Prentice Hall, IncДокумент50 страницUnderstanding Financial Statements, Taxes, and Cash Flows:, Prentice Hall, IncYuslia Nandha Anasta SariОценок пока нет

- SbiДокумент55 страницSbiJaiHanumankiОценок пока нет

- Chey Khana Research by Arif HussainДокумент17 страницChey Khana Research by Arif HussainArif KhanОценок пока нет

- E Book SeewbanДокумент102 страницыE Book SeewbanGeorge Diamandis1Оценок пока нет

- Ali Jahangir SiddiquiДокумент6 страницAli Jahangir SiddiquiPakistanRisingОценок пока нет

- Investment Banking ProjectДокумент51 страницаInvestment Banking ProjectpbasanagoudaОценок пока нет

- Ekuator Profile ColourДокумент11 страницEkuator Profile ColourDevelopmentОценок пока нет

- UKML3043 BECG Tutorial Q WBLEДокумент13 страницUKML3043 BECG Tutorial Q WBLE--bolabolaОценок пока нет

- Entrepreneurial Finance ResourcesДокумент6 страницEntrepreneurial Finance Resourcesfernando trinidadОценок пока нет

- Cancelled NBFCДокумент336 страницCancelled NBFCAAОценок пока нет

- 5 6294322980864393322Документ10 страниц5 6294322980864393322CharlesОценок пока нет

- TNT PreMarketCapsule 22august22Документ13 страницTNT PreMarketCapsule 22august22IMaths PowaiОценок пока нет

- Overview of IFSДокумент21 страницаOverview of IFSMaiyakabetaОценок пока нет

- Dit ProjectДокумент24 страницыDit ProjecthvnirpharakeОценок пока нет

- Adr, GDR & IdrДокумент21 страницаAdr, GDR & IdrAnupama P Shankar100% (1)

- Evidence 7 Workshop Business Plan AnalysisДокумент6 страницEvidence 7 Workshop Business Plan AnalysisFJohana Aponte MorenoОценок пока нет

- Cma 051812Документ16 страницCma 051812Beer0% (1)

- Partnership Formation GuideДокумент6 страницPartnership Formation GuideLee SuarezОценок пока нет

- Learnovate Ecommerce Financial Statement MCQsДокумент5 страницLearnovate Ecommerce Financial Statement MCQsNikita DakiОценок пока нет