Академический Документы

Профессиональный Документы

Культура Документы

Bank of England - Monetary Policy and Forward Guidance

Загружено:

Eduardo PetazzeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bank of England - Monetary Policy and Forward Guidance

Загружено:

Eduardo PetazzeАвторское право:

Доступные форматы

Bank Of England - Monetary Policy and Forward Guidance

by Eduardo Petazze

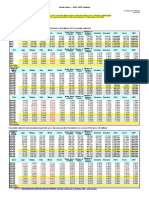

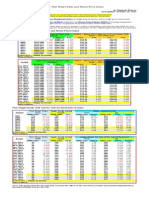

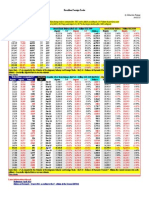

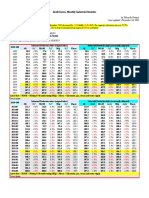

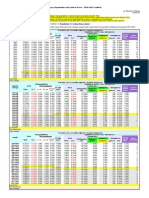

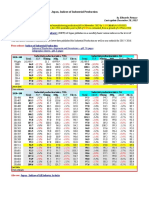

Increase transparency of how, when and why monetary policy is formulated is a highly positive aspect, in recent times, being taken by major central banks. It not only reduces the volatility of market movements, to reduce the possibility of unexpected decisions by the market, but also opens the opportunity for an interesting exchange of opinions. The following links to documents BoE are enrolled in these principles Forward Guidance Monetary policy trade-offs and forward guidance - August 2013 - pdf, 48 pages (It is a state-contingent, instead of a time-contingent, as a pledge from rate-setters to support the recovery) Minutes of the Monetary Policy Committee meeting held on 3 and 4 September 2013 - pdf, 10 pages Conditional guidance as a response to supply uncertainty speech by Ben Broadbent pdf, 12 pages Technical appendix - pdf, 8 pages Monetary policy and forward guidance in the UK a speech by David Miles pdf, 15 pages Monetary strategy and prospects - Speech by Paul Tucker pdf, 6 pages Postscript: In our paper "The UK employment situation" estimates that the unemployment rate will be located at 136K above the unemployment rate of 7% in 1Q2015. In our paper "UK - House Prices Situation" analyze the possibility to generate a bubble in the real estate market in the UK However, the difficulties and risks to the objectives of monetary policy, it is just a statement or association to a contingent state of affairs preferable to a time commitment. Also see: The usefulness of forward guidance - Speech by Benot Cur, ECB Slides pdf, 4 pages

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- India - Index of Industrial ProductionДокумент1 страницаIndia - Index of Industrial ProductionEduardo PetazzeОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- WTI Spot PriceДокумент4 страницыWTI Spot PriceEduardo Petazze100% (1)

- Turkey - Gross Domestic Product, Outlook 2016-2017Документ1 страницаTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- China - Price IndicesДокумент1 страницаChina - Price IndicesEduardo PetazzeОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Analysis and Estimation of The US Oil ProductionДокумент1 страницаAnalysis and Estimation of The US Oil ProductionEduardo PetazzeОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaДокумент1 страницаChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Germany - Renewable Energies ActДокумент1 страницаGermany - Renewable Energies ActEduardo PetazzeОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Highlights, Wednesday June 8, 2016Документ1 страницаHighlights, Wednesday June 8, 2016Eduardo PetazzeОценок пока нет

- India 2015 GDPДокумент1 страницаIndia 2015 GDPEduardo PetazzeОценок пока нет

- U.S. Employment Situation - 2015 / 2017 OutlookДокумент1 страницаU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeОценок пока нет

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Документ1 страницаCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Reflections On The Greek Crisis and The Level of EmploymentДокумент1 страницаReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- South Africa - 2015 GDP OutlookДокумент1 страницаSouth Africa - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- U.S. New Home Sales and House Price IndexДокумент1 страницаU.S. New Home Sales and House Price IndexEduardo PetazzeОценок пока нет

- China - Power GenerationДокумент1 страницаChina - Power GenerationEduardo PetazzeОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Mainland China - Interest Rates and InflationДокумент1 страницаMainland China - Interest Rates and InflationEduardo PetazzeОценок пока нет

- México, PBI 2015Документ1 страницаMéxico, PBI 2015Eduardo PetazzeОценок пока нет

- Singapore - 2015 GDP OutlookДокумент1 страницаSingapore - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- U.S. Federal Open Market Committee: Federal Funds RateДокумент1 страницаU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- US Mining Production IndexДокумент1 страницаUS Mining Production IndexEduardo PetazzeОценок пока нет

- Highlights in Scribd, Updated in April 2015Документ1 страницаHighlights in Scribd, Updated in April 2015Eduardo PetazzeОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesДокумент1 страницаUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeОценок пока нет

- European Commission, Spring 2015 Economic Forecast, Employment SituationДокумент1 страницаEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeОценок пока нет

- Brazilian Foreign TradeДокумент1 страницаBrazilian Foreign TradeEduardo PetazzeОценок пока нет

- South Korea, Monthly Industrial StatisticsДокумент1 страницаSouth Korea, Monthly Industrial StatisticsEduardo PetazzeОценок пока нет

- Chile, Monthly Index of Economic Activity, IMACECДокумент2 страницыChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeОценок пока нет

- US - Personal Income and Outlays - 2015-2016 OutlookДокумент1 страницаUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeОценок пока нет

- Japan, Population and Labour Force - 2015-2017 OutlookДокумент1 страницаJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Japan, Indices of Industrial ProductionДокумент1 страницаJapan, Indices of Industrial ProductionEduardo PetazzeОценок пока нет

- United States - Gross Domestic Product by IndustryДокумент1 страницаUnited States - Gross Domestic Product by IndustryEduardo PetazzeОценок пока нет

- See Statements - Barclays Online BankingДокумент5 страницSee Statements - Barclays Online BankingNadiia AvetisianОценок пока нет

- Online Shoppers - 30 Lack DataДокумент12 страницOnline Shoppers - 30 Lack DataRavee Unlikes RascalsОценок пока нет

- Regelaine R. Lucero: Work ExperienceДокумент3 страницыRegelaine R. Lucero: Work ExperienceJoanna PaulaОценок пока нет

- Car NB Documents (YOPH02PC02)Документ21 страницаCar NB Documents (YOPH02PC02)PaulОценок пока нет

- Op Transaction History 29!03!2018Документ2 страницыOp Transaction History 29!03!2018Avinash GuptaОценок пока нет

- CF Objective of Financial ReportingДокумент4 страницыCF Objective of Financial Reportingpanda 1Оценок пока нет

- Indian Depository ReceiptsДокумент11 страницIndian Depository ReceiptsZoheb SayaniОценок пока нет

- GPF Part Final Appendix oДокумент3 страницыGPF Part Final Appendix oteja ptoОценок пока нет

- Account Statement: Non-TransferableДокумент2 страницыAccount Statement: Non-TransferableYogi173Оценок пока нет

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosДокумент3 страницы201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HОценок пока нет

- Questioning Tool: Accounting Firm's Standards Are As High As They Should Be?Документ2 страницыQuestioning Tool: Accounting Firm's Standards Are As High As They Should Be?Jeremy Ortega100% (1)

- Regions Bank StatementДокумент2 страницыRegions Bank StatementGalarraga H AbrahamОценок пока нет

- Investment QuestionsДокумент4 страницыInvestment QuestionsGarima GarimaОценок пока нет

- HJKJK PDFДокумент1 страницаHJKJK PDFDocumentaries onlineОценок пока нет

- Quiz 4Документ7 страницQuiz 4Vivienne Rozenn LaytoОценок пока нет

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Документ109 страницA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Life Insurance Industry Executive Summary SummaryДокумент2 страницыLife Insurance Industry Executive Summary SummaryHitesh prajapatiОценок пока нет

- Commercial Bank Management Sem IIIДокумент11 страницCommercial Bank Management Sem IIIJanvi MhatreОценок пока нет

- Finacle Book For Bank Auditors-9Документ1 страницаFinacle Book For Bank Auditors-9avinash mangalОценок пока нет

- History of Mutual Fund IndustryДокумент5 страницHistory of Mutual Fund IndustryB.S KumarОценок пока нет

- Security Valuation: Meaning and FactorsДокумент7 страницSecurity Valuation: Meaning and FactorsRohit BajpaiОценок пока нет

- 7'p's of Marketing MixДокумент78 страниц7'p's of Marketing MixDharmikОценок пока нет

- Periodic MethodДокумент14 страницPeriodic MethodRACHEL DAMALERIOОценок пока нет

- Suggested Answers:: Answer: 1, 2 and 4Документ7 страницSuggested Answers:: Answer: 1, 2 and 4Huệ LêОценок пока нет

- Pru HI 6th Edition (4 Sets of Mock Combined)Документ51 страницаPru HI 6th Edition (4 Sets of Mock Combined)thth943Оценок пока нет

- HSBC Gold Visa: Kenneth C DuncanДокумент6 страницHSBC Gold Visa: Kenneth C DuncanKenny Diego ChenОценок пока нет

- Profitability NPL Analysis of United Commercial BankДокумент12 страницProfitability NPL Analysis of United Commercial BankImtiaz Mahmud EmuОценок пока нет

- Notary Signing Agent ScriptДокумент5 страницNotary Signing Agent ScriptMyaW731100% (4)

- Business Finance Semi ExamДокумент1 страницаBusiness Finance Semi ExamAimelenne Jay Aninion100% (1)

- Sep-22 302020Документ6 страницSep-22 302020itsyour vinESОценок пока нет