Академический Документы

Профессиональный Документы

Культура Документы

Demand Deposits - : Cheque

Загружено:

Ryan SanitaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Demand Deposits - : Cheque

Загружено:

Ryan SanitaАвторское право:

Доступные форматы

Slide 3 - Example is production of marketable surplus.

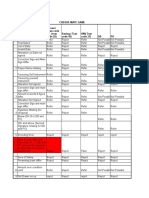

Slide 4 Unit of account common unit for measuring value Store of value - Any form of commodity, asset, or money that has value and can be stored and retrieved over time. Slide 5 - Travelers check - is a preprinted, fixed-amount cheque designed to allow the person signing it to make an unconditional payment to someone else as a result of having paid the issuer for that privilege. They were generally used by people on vacation instead of cash as many businesses used to accept traveller's cheques as currency. Demand Deposits - Funds held in an account from which deposited funds can be withdrawn at any time without any advance notice to the depository institution. Slide 7 Time deposit is a money deposit at a banking institution that cannot be withdrawn for a certain "term" or period of time. Under 100,000 deposits Savings deposit - A deposit account held at a bank or other financial institution that provides principal security and a modest interest rate. Money Market Accounts - A savings account that offers the competitive rate of interest (real rate) in exchange for larger-than-normal deposits. Money market mutual fund shares - is an open-ended mutual fund that invests in short-term debt securities Slide 8 Institutional money market- high minimum investment, low expense share classes which are marketed to corporations, governments, or fiduciaries. They are often set up so that money is swept to them overnight from a company's main operating accounts. Repurchase - A form of short-term borrowing for dealers in government securities. The dealer sells the government securities to investors, usually on an overnight basis, and buys them back the following day. Slide 11 Central Bank- the government agency that oversees the banking system and is responsible for the conduct of monetary policy Banks - institutions)the financial intermediaries that accept deposits from individuals and institutions and make loans: commercial banks, savings and loan associations, mutual savings banks, and credit unions Depositorsindividuals and institutions that hold deposits in banks Borrowers from banksindividuals and institutions that borrow from the depository institutions and institutions that issue bonds that are purchased by the depository institutions Slide 14 - Currency in circulation - is the amount of currency in the hands of the public. Reserves Assets of banks but liabilities of the Central Bank Slide 15 A government bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date Discount loan - The Fed can provide reserves to the banking system by making discount loans to banks. An increase in discount loans can also be the source of an increase in the money supply. The interest rate charged banks for these loans is called the discount rate.

Вам также может понравиться

- Introducing Money and Interest RatesДокумент3 страницыIntroducing Money and Interest RatesJrlyn DaneОценок пока нет

- Cap 13 Managing Nondeposit and Borrowed FundsДокумент13 страницCap 13 Managing Nondeposit and Borrowed FundsJared QuinnОценок пока нет

- "Money Makes The World Go Around": Ex. Stock - Another Name For An Equity SecurityДокумент3 страницы"Money Makes The World Go Around": Ex. Stock - Another Name For An Equity SecurityLede Ann Calipus YapОценок пока нет

- Assignment Yael Mae BangayanДокумент2 страницыAssignment Yael Mae Bangayanmae bangayanОценок пока нет

- Chpater 5 - Banking SystemДокумент10 страницChpater 5 - Banking System21augustОценок пока нет

- International Financial Reporting StandardsДокумент23 страницыInternational Financial Reporting StandardsAneela AamirОценок пока нет

- Chap 2Документ54 страницыChap 2Yeshiwork GirmaОценок пока нет

- Deposit Sources of FundsДокумент6 страницDeposit Sources of FundsSakib Chowdhury0% (1)

- Investment Key TermsДокумент32 страницыInvestment Key TermsAnikaОценок пока нет

- FinanceДокумент9 страницFinanceTushar KhatriОценок пока нет

- Local Media6085112185595323389Документ2 страницыLocal Media6085112185595323389Frecilla SanchezОценок пока нет

- Bank JobДокумент17 страницBank JobDanielle MartinezОценок пока нет

- Unit 6 Money and BankingДокумент70 страницUnit 6 Money and BankingTrần Diệu MinhОценок пока нет

- NotesДокумент49 страницNotesMatthew MullalyОценок пока нет

- Glossary of Terms Glossary of TermsДокумент4 страницыGlossary of Terms Glossary of TermsDaisy Nana MillerОценок пока нет

- Financial MarketДокумент11 страницFinancial MarketRetemoi CookОценок пока нет

- Assighnment of Principles of FinДокумент3 страницыAssighnment of Principles of Finafnan huqОценок пока нет

- Bank BalancesheetДокумент10 страницBank BalancesheetwubeОценок пока нет

- Overview of Financial SystemДокумент33 страницыOverview of Financial SystemmengistuОценок пока нет

- Services That Are Offered by Financial Companies Are Called Financial ServicesДокумент8 страницServices That Are Offered by Financial Companies Are Called Financial ServicesPari SavlaОценок пока нет

- Short Term and Long Term FinancingДокумент48 страницShort Term and Long Term Financingagrawalrohit_228384Оценок пока нет

- Viraj Vikas Salvi - 065327Документ8 страницViraj Vikas Salvi - 065327Pratiksha PatelОценок пока нет

- Fim - 7 Commercial BankingДокумент16 страницFim - 7 Commercial BankinggashukelilОценок пока нет

- Chapter 2: Overview of The Financial SystemДокумент43 страницыChapter 2: Overview of The Financial Systememre kutayОценок пока нет

- Saint Mary'S University: Faculty of Accounting and FinanceДокумент10 страницSaint Mary'S University: Faculty of Accounting and FinanceruhamaОценок пока нет

- Saint Mary'S University: Faculty of Accounting and FinanceДокумент10 страницSaint Mary'S University: Faculty of Accounting and FinanceruhamaОценок пока нет

- Lending and Borrowing in The Financial SystemДокумент4 страницыLending and Borrowing in The Financial Systemtekalign100% (2)

- Financial Markets HandoutДокумент7 страницFinancial Markets HandoutHAKUNA MATATAОценок пока нет

- Fin 2 Prelim NotesДокумент8 страницFin 2 Prelim NotesChaОценок пока нет

- CH 18Документ11 страницCH 18Huten VasellОценок пока нет

- Part One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemДокумент22 страницыPart One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemSeid KassawОценок пока нет

- Chapter Four FinalДокумент18 страницChapter Four FinalSeid KassawОценок пока нет

- Module 5 - Credit Instruments and Its Negotiation PDFДокумент13 страницModule 5 - Credit Instruments and Its Negotiation PDFRodel Novesteras ClausОценок пока нет

- Assientment 3Документ6 страницAssientment 3anvithapremagowdaОценок пока нет

- CH 04Документ44 страницыCH 04Md.Rakib MiaОценок пока нет

- 5.1 Alternative Sources of FundsДокумент6 страниц5.1 Alternative Sources of FundsJerson AgsiОценок пока нет

- Fundamentals of Corporate Finance 8th Edition Brealey Solutions ManualДокумент6 страницFundamentals of Corporate Finance 8th Edition Brealey Solutions ManualEmilyJohnsonfnpgb100% (10)

- Banking Functions: Navjeet Parvez Rakesh Majid NavjotДокумент13 страницBanking Functions: Navjeet Parvez Rakesh Majid Navjotharesh KОценок пока нет

- Credit InstrumentsДокумент21 страницаCredit InstrumentsJoann SacolОценок пока нет

- Types of Credit TransactionДокумент2 страницыTypes of Credit Transactionjoshua aguirre0% (1)

- Equity Shares: A Study OnДокумент10 страницEquity Shares: A Study OnHarikrishna MallaОценок пока нет

- Chapter 2-Sources of Fund-Part 2Документ17 страницChapter 2-Sources of Fund-Part 2Pháp NguyễnОценок пока нет

- The Indian Banking SystemДокумент16 страницThe Indian Banking SystemAryan KumarОценок пока нет

- Source of CreditДокумент2 страницыSource of Creditkhaireyah hashim100% (1)

- Unit VДокумент9 страницUnit VJayОценок пока нет

- Loans and AdvancesДокумент6 страницLoans and AdvancesAnusuya Chela100% (1)

- BAP 4 Capital Market L1-3Документ17 страницBAP 4 Capital Market L1-3Mabel Jean RambunayОценок пока нет

- Bbs Thesis 4 TH Year FinalДокумент42 страницыBbs Thesis 4 TH Year FinalBINOD POUDEL100% (2)

- Reviewer BfoiДокумент14 страницReviewer BfoiXeleen Elizabeth ArcaОценок пока нет

- Finance Chapter 1Документ11 страницFinance Chapter 1MayОценок пока нет

- POF Assignment 01Документ5 страницPOF Assignment 01Dhoni KhanОценок пока нет

- Financial MarketДокумент8 страницFinancial Marketshahid3454Оценок пока нет

- Money & Banking: Topics: Lesson 1 To 09Документ13 страницMoney & Banking: Topics: Lesson 1 To 09lushcheese100% (1)

- Topic 4 - Cash Management & Marketable SecuritiesДокумент7 страницTopic 4 - Cash Management & Marketable SecuritiesZURINA ABDUL KADIRОценок пока нет

- Ch. 1 Introduction To Financial InstitutionsДокумент35 страницCh. 1 Introduction To Financial Institutionsteshome dagne100% (2)

- GlossaryДокумент5 страницGlossarysimonlucasdinkyОценок пока нет

- FM Assignment AnswersДокумент4 страницыFM Assignment Answerskarteekay negiОценок пока нет

- M11 - Sources and Uses of Short Term and Long Term FundsДокумент7 страницM11 - Sources and Uses of Short Term and Long Term FundsMICHELLE MILANAОценок пока нет

- Module 1: The Investment SettingДокумент28 страницModule 1: The Investment SettingakwoviahОценок пока нет

- Dependency and Economic DevelopmentДокумент12 страницDependency and Economic DevelopmentRyan SanitaОценок пока нет

- FA Vol.3 Operating SegmentsДокумент7 страницFA Vol.3 Operating SegmentsRyan SanitaОценок пока нет

- How Does The Internet Work?: FromДокумент7 страницHow Does The Internet Work?: FromRyan SanitaОценок пока нет

- 1.1.a-Science and Technology in The Iron AgeДокумент16 страниц1.1.a-Science and Technology in The Iron Agetwinkledreampoppies100% (1)

- Syllabus Ba114.12012syllabusДокумент9 страницSyllabus Ba114.12012syllabusRyan SanitaОценок пока нет

- 2.1 Summary Microelectronics and PhotonicsДокумент4 страницы2.1 Summary Microelectronics and PhotonicsRyan Sanita100% (1)

- Corpuz vs. PeopleДокумент6 страницCorpuz vs. PeopleewnesssОценок пока нет

- Internship Report On Credit Management of MTBLДокумент61 страницаInternship Report On Credit Management of MTBLtanvir100% (1)

- Forensic Investigation: Appendix - M. Sack CompaniesДокумент63 страницыForensic Investigation: Appendix - M. Sack CompaniesSipekne'katikОценок пока нет

- Mesina Vs IAC GR 70145Документ4 страницыMesina Vs IAC GR 70145カルリー カヒミОценок пока нет

- Claims in US PayrollДокумент24 страницыClaims in US Payrollsrikanthyh1979100% (2)

- Capgemini - World Payments Report 2013Документ60 страницCapgemini - World Payments Report 2013Carlo Di Domenico100% (1)

- Preventive VigilanceДокумент12 страницPreventive Vigilanceeknath2000Оценок пока нет

- Journal Entries Questions 123Документ3 страницыJournal Entries Questions 123aparajita agarwalОценок пока нет

- Detailed Record of ExperienceДокумент31 страницаDetailed Record of ExperienceJosiah MwashitaОценок пока нет

- A Report On Standard Chartered BankДокумент56 страницA Report On Standard Chartered BankRumana AhmadОценок пока нет

- An Internship Report On General Banking Operation of EXIM Bank LimitedДокумент64 страницыAn Internship Report On General Banking Operation of EXIM Bank LimitedNafiz FahimОценок пока нет

- Assignment 3Документ2 страницыAssignment 3Sudhir SinhaОценок пока нет

- Sap Payroll: Payroll SpecificationsДокумент4 страницыSap Payroll: Payroll SpecificationsmuraliОценок пока нет

- P2P AccountingДокумент22 страницыP2P AccountingHimanshu MadanОценок пока нет

- Banking Course OutlineДокумент13 страницBanking Course OutlineShravan ReddyОценок пока нет

- Cheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Документ1 страницаCheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Nandini JaganОценок пока нет

- Rep. Lesser July 10 SEEC FilingДокумент231 страницаRep. Lesser July 10 SEEC FilingCassandra DayОценок пока нет

- Hand Out NO 11 Clearing and SettlementДокумент9 страницHand Out NO 11 Clearing and SettlementAbdul basitОценок пока нет

- CH 3 - BrsДокумент0 страницCH 3 - BrsHaseeb Ullah KhanОценок пока нет

- Complaint-Affidavit: Republic of The Philippines Department of Justice Office of The City Prosecutor City of ManilaДокумент7 страницComplaint-Affidavit: Republic of The Philippines Department of Justice Office of The City Prosecutor City of ManilaBarbie CueОценок пока нет

- Negotiable Instruments Act, 1881Документ104 страницыNegotiable Instruments Act, 1881Tania SethiОценок пока нет

- Combined - Out Icai MCQДокумент1 195 страницCombined - Out Icai MCQShivaniОценок пока нет

- TDDPresentation2013d Presentation 2013Документ52 страницыTDDPresentation2013d Presentation 2013Hammad ChohanОценок пока нет

- Part I: Multiple Choice: Choose The Best Answer From The Given Alternatives and The Correct Letter On The Answer Sheet ProvidedДокумент2 страницыPart I: Multiple Choice: Choose The Best Answer From The Given Alternatives and The Correct Letter On The Answer Sheet ProvidedGetahun FantahunОценок пока нет

- Application For Convocation 37906 Gadage Sourabh ParmeshwarДокумент2 страницыApplication For Convocation 37906 Gadage Sourabh ParmeshwarAshlesh KulkarniОценок пока нет

- Fy Bcom 2013 FormattedsДокумент44 страницыFy Bcom 2013 FormattedsAnamika Rai PandeyОценок пока нет

- 2016 New Coach Registration Form.1aДокумент3 страницы2016 New Coach Registration Form.1aPab Ronald Rafanan CalanocОценок пока нет

- Baroda Rajasthan Gramin Bank AdДокумент14 страницBaroda Rajasthan Gramin Bank AdvidyasagarkallaОценок пока нет

- Peace Corps OST Task Analysis - CashierДокумент10 страницPeace Corps OST Task Analysis - CashierAccessible Journal Media: Peace Corps DocumentsОценок пока нет

- WeAccess Enrollment and Maintenance Agreement Form 2Документ12 страницWeAccess Enrollment and Maintenance Agreement Form 2Krizzia SiosonОценок пока нет