Академический Документы

Профессиональный Документы

Культура Документы

DCF FCFF Valuation

Загружено:

Sneha SatyamoorthyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DCF FCFF Valuation

Загружено:

Sneha SatyamoorthyАвторское право:

Доступные форматы

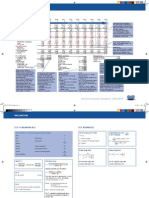

DCF FCFF VALUATION

2008

1

Unlevered tax on operations

Capex

Capex to depn

Free cash ow to rm

FCFF growth

Terminal value

FCFF to be discounted

Discount factors

PV of FCFF

PV of visible period

PV of terminal value

Implied rm value

Net debt

Minority interest

JV and associates

Implied equity value

Number of shares

Implied equity value per share

Equity value breakdown:

Ideally the equity value breakdown

should use market values for net debt,

minority interest and joint ventures

& associates, using the latest available

nancial information.

However, if the reconciling items are

immaterial to the overall valuation,

book values are often used as an

approximation to market value.

Additional adjustments can be included

in this breakdown for pension

scheme decits and operating lease

commitments as long as the treatment

on the cashows is consistent.

58,622

62,078

(41,700)

3,300

300

3,600

(46,571)

3,504

376

3,880

(50,988)

3,637

463

4,099

(54,921)

3,701

560

4,261

(450)

3,150

(420)

3,460

(300)

3,799

(270)

3,991

8.00%

7.00%

7.75%

7.78%

6.91%

9.84%

7.50%

5.65%

6.96%

9.81%

7.27%

3.94%

2016

9

2017

10

65,027

67,514

69,595

71,323

72,750

(58,377)

3,702

669

4,370

(61,382)

3,644

789

4,434

(63,915)

3,600

924

4,524

(66,006)

3,589

1,074

4,663

(67,785)

3,538

1,241

4,779

(69,324)

3,426

1,427

4,852

(200)

4,170

(150)

4,284

(120)

4,404

(70)

4,593

(40)

4,739

(10)

4,842

6.81%

5.04%

5.90%

7.04%

2.56%

6.72%

4.49%

4.75%

6.82%

1.45%

3.83%

6.70%

2.02%

6.59%

2.72%

6.52%

2.79%

3.08%

6.70%

3.08%

6.60%

4.30%

2.48%

6.70%

2.48%

6.64%

3.17%

2.00%

6.67%

1.54%

(830)

(1,002)

(912)

(1,093)

(958)

(1,172)

(1,001)

(1,242)

(1,028)

(1,301)

(1,057)

(1,350)

(1,102)

(1,392)

(1,137)

(1,427)

(1,162)

(1,455)

1,494

1,628

1,795

1,861

1,928

1,955

1,996

2,099

2,175

2,225

3.00x

2.66x

2.36x

2.09x

1.86x

1.65x

1.46x

1.30x

1.15x

8.97%

10.25%

3.66%

3.61%

1.42%

2.11%

5.13%

3.63%

1,494

0.930

1,390

1,628

0.866

1,410

1,795

0.806

1,446

1,861

0.749

1,395

1,928

0.697

1,344

1,955

0.649

1,269

1,996

0.604

1,205

2,099

0.562

1,179

2,175

0.523

1,137

12,857

28,170

41,027

(5,000)

(64)

476

36,438

7,889

4.62

31.34%

68.66%

100.00%

Terminal value split calculation:

As a rough guide (for a mature

company) the split of rm value

generated by the visible cash ow

period and the terminal value should

be in the region of 30% - 70%.

Material deviations from this split may

suggest issues such as:

Inconsistent terminal value

assumptions

Inconsistent visible period

assumptions

High growth companies

WACC calculation

Risk free rate

Credit risk premium

Tax rate

Cost of debt

Risk free rate

Equity market risk premium

Beta

Cost of equity

Target capital structure

WACC

WACC calculation:

Sources of data:

UK/US 10 yr govt

bonds

DCM can advise

Alternatively:

Credit ratings can give an indication

of spreads

Recent company bond issues

(spreads)

Comparable bond yields (similar

duration & yields)

use an appropriate marginal

4.50%

1.20%

30.00%

3.99%

4.50%

5.00%

1.10

10.00%

42.00%

7.48%

Operating model assumptions:

The visible cash ow period forecasts

should be trending down to achieve the

long run growth rates assumed within the

perpetuity calculation.

The assumptions should also be

reviewed for consistency with the

business model, the market and with

each other e.g. sales growth may need to

be supported by capex growth.

6.66%

2.19%

(756)

(900)

setar xaT

Operating cash ow margin

Operating cash ow growth

54,624

7.32%

2015

8

1.02x

2.31%

57,928

60,154

0.486

29,252

Terminal value calculation

Terminal free cash ow

Perpetuity growth rate

WACC

Terminal value

Capex/Depn multiples drivers:

Capex / depn multiples normally will

trend towards 1.00x

FCFF drivers:

Review the FCFF drivers for exceptional

trends, spikes and troughs make sure

that these can be supported by the

business model and market expectations.

2,225

3.50%

7.48%

57,928

tax rate

Terminal value calculation:

Cash ow growth perpetuities should reect the

long run growth rate of the free cash ow to rm

beyond the visible period.

Estimating this number will involve comparison

to long economic growth rates (economy

and/or sector).

historic

premium analysis

(Premiums currently ranging between

3.25% to 5.5%)

can be sourced from a number

of providers (Bloomberg, LBS and

Barra). Normally will range between

0.6 to 1.40

WACC is a weighted

average normally using market values

of debt and equity and often assuming

a long run target capital structure

Return on capital:

If a fully integrated model is used, compare the

return on capital gures over the years as a check

on the integrity of the inputs and the model.

Enormous growth may suggest that growth is

being derived without the necessary investment.

Additionally, Gordons Growth Model suggests

that the terminal growth can be derived from the

return on capital and the reinvestment rate

(g = rb, where g =growth,

r = return on capital and b = reinvestment rate)

gnithgieW

Changes in NWC

Operating cash ow

50,075

9.09%

2014

7

muimerp ksir tiderC

EBITDA margin

EBITDA growth

45,000

11.28%

2012

2013

5

6

Visible cash flow period

ateB

Operating costs

EBITA

Depreciation

EBITDA

2011

4

setar eerf ksiR

Sales growth

2010

3

smuimerp tekram ytiuqE

Sales

2009

2

The Corporate Training Group www.ctguk.com +44 (0)20 7490 4770

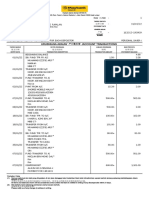

VALUATION

DCF FUNDAMENTALS

DCF ADVANCED

Gordons growth model

Free Cash Flow for Firm or Enterprise Value calculation

EBIT

rxb=g

Add

Depreciation

r = return on equity

Add

Amortisation

b = proportion of earnings retained

g = growth

Implied growth rate FV

EBIT

in exit multiple

EBITDA

Deduct

Capital expenditure

Tax paid (pre interest)

(X)

Deduct

Increase in working capital

(X)

FV x EBIT + FCF

EBIT

(X)

Deduct

g=

FV x EBIT x WACC FCF

EBIT

Free Cash Flow

WACC =

Ke x

Terminal value

debt value

equity value

+ Kd (post tax) x

firm value

firm value

TV =

Delevering beta

u =

1 + (1 Tc) D

E

Relevering beta

L = u 1 + (1 Tc) D

E

D/E current leverage ratio

FCF (in final forecast year) x (1 + g)

(WACC g)

D/E new target leverage ratio

Assumes debt beta is zero

Assumes debt beta is zero

Standard perpetuity growth method

Ke =

Rf + x (EMP)

TV =

[CAPM]

NOPAT x (1 g/ROIC)

(WACC g)

This is the value driver approach per Valuation,

Koller, Goedhart and Wessels, 4th edition,

McKinsey and Company Wiley

.

Rf + CRP (use post tax in WACC calculation)

NOPAT = net operating profit after tax

(in period T + 1)

(T = last forecast time period)

CRP = credit risk premium

ROIC = return on invested capital

Kd =

The TV calculated in both formulae above

will need to be discounted to establish its

Present Value.

The Corporate Training Group www.ctguk.com +44 (0)20 7490 4770

Вам также может понравиться

- Critical Financial Review: Understanding Corporate Financial InformationОт EverandCritical Financial Review: Understanding Corporate Financial InformationОценок пока нет

- Valuation - DCFДокумент38 страницValuation - DCFKumar Prashant100% (1)

- DCF ModellДокумент7 страницDCF Modellsandeep0604Оценок пока нет

- Valuation - NVIDIAДокумент27 страницValuation - NVIDIALegends MomentsОценок пока нет

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesДокумент5 страницIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenОценок пока нет

- McKinsey DCF Valuation 2005 User GuideДокумент16 страницMcKinsey DCF Valuation 2005 User GuideMichel KropfОценок пока нет

- JAZZ Sellside MA PitchbookДокумент47 страницJAZZ Sellside MA PitchbookSamarth MarwahaОценок пока нет

- LBO ModelingДокумент31 страницаLBO Modelingricoman1989Оценок пока нет

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Документ18 страниц1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeОценок пока нет

- Bank ValuationsДокумент20 страницBank ValuationsHenry So E DiarkoОценок пока нет

- Apple Model - FinalДокумент32 страницыApple Model - FinalDang TrangОценок пока нет

- Walmart Valuation ModelДокумент179 страницWalmart Valuation ModelHiếu Nguyễn Minh HoàngОценок пока нет

- Jazz Pharmaceuticals Investment Banking Pitch BookДокумент20 страницJazz Pharmaceuticals Investment Banking Pitch BookdaniellimzyОценок пока нет

- Bond Problem - Fixed Income ValuationДокумент1 страницаBond Problem - Fixed Income ValuationAbhishek Garg0% (2)

- Southland Case StudyДокумент7 страницSouthland Case StudyRama Renspandy100% (2)

- SOTP ValuationДокумент26 страницSOTP ValuationRishabh KesharwaniОценок пока нет

- Danske Bank - Credit Research Bane Nor Eiendom As PDFДокумент21 страницаDanske Bank - Credit Research Bane Nor Eiendom As PDFDiego García VaqueroОценок пока нет

- A Note On Valuation in Entrepreneurial SettingsДокумент4 страницыA Note On Valuation in Entrepreneurial SettingsUsmanОценок пока нет

- ValuationДокумент7 страницValuationSumit Pol0% (1)

- Cash Flow Estimation: Given DataДокумент4 страницыCash Flow Estimation: Given DataMd. Din Islam Asif100% (2)

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Документ74 страницыSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojОценок пока нет

- 2.3 Fra and Swap ExercisesДокумент5 страниц2.3 Fra and Swap ExercisesrandomcuriОценок пока нет

- Business Valuation PresentationДокумент43 страницыBusiness Valuation PresentationNitin Pal SinghОценок пока нет

- Axis Bank ValuvationДокумент26 страницAxis Bank ValuvationGermiya K JoseОценок пока нет

- FCFF Vs FCFE Valuation ModelДокумент5 страницFCFF Vs FCFE Valuation Modelksivakumar09Оценок пока нет

- 10 BrazosДокумент20 страниц10 BrazosAlexander Jason LumantaoОценок пока нет

- 3 - FCF CalculationДокумент2 страницы3 - FCF CalculationAman ManjiОценок пока нет

- Free Cash Flow ValuationДокумент46 страницFree Cash Flow ValuationLayОценок пока нет

- LBO Model - ValuationДокумент6 страницLBO Model - ValuationsashaathrgОценок пока нет

- Equity Valuation Techniques: Shazia Farooq, CFAДокумент54 страницыEquity Valuation Techniques: Shazia Farooq, CFAAnonymous EmV44olmОценок пока нет

- Risk Premium DamodaranДокумент208 страницRisk Premium DamodaranVeronica GetaОценок пока нет

- Dell CaseДокумент3 страницыDell CaseJuan Diego Vasquez BeraunОценок пока нет

- Calculating WACCДокумент9 страницCalculating WACCgourabbiswas1987Оценок пока нет

- DCF ModelДокумент7 страницDCF ModelSai Dinesh BilleОценок пока нет

- Work Sample 1Документ79 страницWork Sample 1api-337384142Оценок пока нет

- Valuation 2021 DAMODARAN NotesДокумент32 страницыValuation 2021 DAMODARAN NotesadityaОценок пока нет

- ConAgra Presentation Backing Its Ralcorp BidДокумент10 страницConAgra Presentation Backing Its Ralcorp BidDealBookОценок пока нет

- The Structure of The Equity Research ReportДокумент14 страницThe Structure of The Equity Research ReportBALAJI RAVISHANKARОценок пока нет

- Facebook - DCF ValuationДокумент9 372 страницыFacebook - DCF ValuationDibyajyoti Oja0% (2)

- Goldman Valuation TelemigДокумент44 страницыGoldman Valuation Telemigarvindrobin9835100% (1)

- Morgan Stanley ModelwareДокумент60 страницMorgan Stanley Modelwareusikpa100% (2)

- Defining Free Cash Flow Top-Down ApproachДокумент2 страницыDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- Valuation Report Q Free ASA Deloitte 30.06.2018 PDFДокумент25 страницValuation Report Q Free ASA Deloitte 30.06.2018 PDFAli Gokhan KocanОценок пока нет

- Box IPO Financial ModelДокумент42 страницыBox IPO Financial ModelVinОценок пока нет

- Equities Crossing Barriers 09jun10Документ42 страницыEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- Bank ValuationДокумент34 страницыBank ValuationwathanaОценок пока нет

- Research Challenge Acb Report National Economics UniversityДокумент21 страницаResearch Challenge Acb Report National Economics UniversityNguyễnVũHoàngTấnОценок пока нет

- Axial Discounted Cash Flow Valuation CalculatorДокумент4 страницыAxial Discounted Cash Flow Valuation CalculatorUdit AgrawalОценок пока нет

- M& A Version 1.1Документ34 страницыM& A Version 1.1goelabhishek90Оценок пока нет

- Mini Case Chapter 3 Final VersionДокумент14 страницMini Case Chapter 3 Final VersionAlberto MariñoОценок пока нет

- Chapter 11 Valuation Using MultiplesДокумент22 страницыChapter 11 Valuation Using MultiplesUmar MansuriОценок пока нет

- Masonite Corp DCF Analysis FinalДокумент5 страницMasonite Corp DCF Analysis FinaladiОценок пока нет

- Whole Foods Market ValuationДокумент126 страницWhole Foods Market ValuationCommodityОценок пока нет

- Corporate Professionals Sum of Parts ValuationДокумент4 страницыCorporate Professionals Sum of Parts ValuationCorporate Professionals100% (1)

- Equity Valuation Report - LVMHДокумент3 страницыEquity Valuation Report - LVMHFEPFinanceClubОценок пока нет

- Numericals On Stock Swap - SolutionДокумент15 страницNumericals On Stock Swap - SolutionAnimesh Singh GautamОценок пока нет

- Merger Arbitrage: A Fundamental Approach to Event-Driven InvestingОт EverandMerger Arbitrage: A Fundamental Approach to Event-Driven InvestingРейтинг: 5 из 5 звезд5/5 (1)

- DCF TakeawaysДокумент2 страницыDCF TakeawaysvrkasturiОценок пока нет

- VebitdaДокумент24 страницыVebitdaAndr EiОценок пока нет

- FIXML Average Price Specification v1 5 1Документ85 страницFIXML Average Price Specification v1 5 1entrumОценок пока нет

- SEBI - Guidance To General Public About Effective Ways To Redress TheirДокумент10 страницSEBI - Guidance To General Public About Effective Ways To Redress Theirrajit tillaniОценок пока нет

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesДокумент10 страницFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousОценок пока нет

- Split 162013 190909 - 20220331Документ5 страницSplit 162013 190909 - 20220331NUR FASIHAH BINTIОценок пока нет

- Chapter 8 ExamplesДокумент10 страницChapter 8 Examplesm bОценок пока нет

- Super AdxДокумент5 страницSuper AdxpudiwalaОценок пока нет

- Amazon Financial AnalysisДокумент6 страницAmazon Financial Analysisapi-315180958Оценок пока нет

- AlphaДокумент3 страницыAlphaSekhar KatkamОценок пока нет

- A Summer Internship Report ON Security Analysis and Portfolio Management AT "India Infoline Limited " (Iifl India)Документ34 страницыA Summer Internship Report ON Security Analysis and Portfolio Management AT "India Infoline Limited " (Iifl India)deepak tejaОценок пока нет

- Dwnload Full Multinational Business Finance 13th Edition Eiteman Test Bank PDFДокумент35 страницDwnload Full Multinational Business Finance 13th Edition Eiteman Test Bank PDFkerdonjawfarm100% (10)

- Business Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPДокумент8 страницBusiness Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPABMachineryОценок пока нет

- Peif Prospectus PDFДокумент54 страницыPeif Prospectus PDFJopoy CapulongОценок пока нет

- Executive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementДокумент21 страницаExecutive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementLarin V JosephОценок пока нет

- Barclays (7 February, 2020) PDFДокумент15 страницBarclays (7 February, 2020) PDFIshita GuptaОценок пока нет

- Felix Fernando - C13-Q2Документ3 страницыFelix Fernando - C13-Q2Steve IdnОценок пока нет

- CF ReformДокумент40 страницCF ReformJerry LoОценок пока нет

- Shikha Kanwar Diamond Chemicals PLCДокумент2 страницыShikha Kanwar Diamond Chemicals PLCShikha KanwarОценок пока нет

- Introduction To Corporations: Dr. Ronnie G. Salazar, Cpa, MbaДокумент140 страницIntroduction To Corporations: Dr. Ronnie G. Salazar, Cpa, MbaJuren Demotor Dublin100% (1)

- Methodology DJ Thematic IndicesДокумент21 страницаMethodology DJ Thematic IndicesJesus ValverdeОценок пока нет

- Midterm Tài ChínhДокумент4 страницыMidterm Tài ChínhTạ Huỳnh Hoàng AnhОценок пока нет

- Role of Stock Exchange in Economic Development With Reference To PakistanДокумент21 страницаRole of Stock Exchange in Economic Development With Reference To PakistanAshar Shamim70% (10)

- Berkshire Hathaway Annual MeetingДокумент18 страницBerkshire Hathaway Annual Meetingbenclaremon100% (8)

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesДокумент6 страницProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanОценок пока нет

- Unit-5. Introduction To Option ValuationДокумент21 страницаUnit-5. Introduction To Option ValuationNikita DakiОценок пока нет

- Case 22 Victoria Chemicals PLC (A)Документ2 страницыCase 22 Victoria Chemicals PLC (A)tipo_de_incognito75% (4)

- Girish B V, Final Project M.com (GB)Документ95 страницGirish B V, Final Project M.com (GB)Murali MОценок пока нет

- Part 2 - General Exercise On Corporate Finance - Qs 21 Aug 2021Документ13 страницPart 2 - General Exercise On Corporate Finance - Qs 21 Aug 2021Mharvie LorayaОценок пока нет

- Lesson 2 Financial Statement AnalysisДокумент81 страницаLesson 2 Financial Statement AnalysisRovic OrdonioОценок пока нет

- FM MST 3Документ2 страницыFM MST 3chuneshphysicsОценок пока нет

- BSL Frontline Equity Fund GrowthДокумент2 страницыBSL Frontline Equity Fund Growthanon-294068Оценок пока нет