Академический Документы

Профессиональный Документы

Культура Документы

Seminar in Economic Policy: Term Presentation Economic and Financial Recession

Загружено:

Applecart23Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Seminar in Economic Policy: Term Presentation Economic and Financial Recession

Загружено:

Applecart23Авторское право:

Доступные форматы

=Seminar in Economic Policy= =Economic and Financial Recession=

Seminar in Economic Policy Term Presentation Economic and Financial Recession

Submitted By: Hasan Saeed Akbar ID No: 2005-1-56-5128 Date: 3rd October, 2009

Page 1 of 17

=Seminar in Economic Policy= =Economic and Financial Recession=

Table of Contents

Outline of Presentation................................................................................................................................. 4 Description .................................................................................................................................................... 5 Current Recession ......................................................................................................................................... 6 Causes of Recession ...................................................................................................................................... 7 Financial Crisis ........................................................................................................................................ 7 Sub-prime Mortgage Crisis.................................................................................................................... 7 Causes ....................................................................................................................................................... 7 Boom and bust in the housing market.......................................................................................... 7 High-risk mortgage loans and lending/borrowing practices ........................................................ 7 Inaccurate credit ratings ............................................................................................................... 7 Government policies ..................................................................................................................... 8 Investment in U.S. by foreigners of their proceeds from America's net imports ......................... 8 Boom and collapse of the shadow banking system ...................................................................... 8

Economic Imbalance ............................................................................................................................... 8 Commodity boom ................................................................................................................................. 8 Housing bubble ..................................................................................................................................... 9 Inflation ................................................................................................................................................. 9 Overproduction ..................................................................................................................................... 10 War ......................................................................................................................................................... 10 Effects of Recession .................................................................................................................................... 10 Bankruptcy............................................................................................................................................. 10 Credit Crunch ......................................................................................................................................... 10 Foreclosure ............................................................................................................................................ 11 Effect on Nations......................................................................................................................................... 12 Trade and trade prices ........................................................................................................................ 12 Remittances ........................................................................................................................................ 12 Foreign direct investment (FDI) and equity investment ..................................................................... 12 Commercial lending ............................................................................................................................ 12 Aid ....................................................................................................................................................... 13 Increased Unemployment................................................................................................................... 13

=Seminar in Economic Policy= =Economic and Financial Recession= Response to Recession................................................................................................................................ 14 Loans to banks for asset-backed commercial paper........................................................................... 14 Legislation ........................................................................................................................................... 14 European policy responses ................................................................................................................. 16 Conclusion ................................................................................................................................................... 17

=Seminar in Economic Policy= =Economic and Financial Recession=

Outline of Presentation

Introduction

Description Current Recession

Causes of Recession

Financial Crisis 2007-2009 Economic Imbalance War Overproduction

Effects of Recession

Bankruptcies Credit Crunch Foreclosure Unemployment

Effect on Nations

Developed Countries Developing Countries

Responses

United States Response European Response Asian Response

=Seminar in Economic Policy= =Economic and Financial Recession=

Description

A recession is defined as a period of time when the economy contracts (negative economic growth) for 2 consecutive quarters. A recession is characterized by

Lower Output Lower investment Higher Unemployment Increased PSNCR Lower Inflation

If there is a fall in AD then according to Keynesian analysis there will be a fall in Real GDP. The effect on Real GDP depends upon the slope of the AS curve if the economy is close to full capacity lower AD would only cause a small fall in Real GDP. AD is composed of C+I+G+X-M, therefore a fall in any of these components could cause a recession. For example, if the MPC increased interest rates sharply this would cause the cost of borrowing to increase and make saving more attractive. This would have the effect of reducing consumer spending. AD could also fall due to deflationary fiscal policy, for example higher taxes and lower government spending would also cause a fall in AD.

=Seminar in Economic Policy= =Economic and Financial Recession=

Current Recession

In the late 2000s - particularly since late 2008 - the industrialized world has been undergoing a recession, a pronounced deceleration of economic activity. This global recession has been taking place in an economic environment characterized by various imbalances and was sparked by the outbreak of the financial crisis of 20072009. Although the late-2000s recession has at times been referred to as "the Great Recession," this same phrase has been used to refer to every recession of the several preceding decades

This global recession has resulted in a sharp drop in international trade, rising unemployment and slumping commodity prices. In December 2008, the National Bureau of Economic Research (NBER) declared that the United States had been in recession since December 2007. Several economists have predicted that recovery may not appear until 2011 and that the recession will be the worst since the Great Depression of the 1930s. The conditions leading up to the crisis, characterized by an exorbitant rise in asset prices and associated boom in economic demand, are considered a result of the extended period of easily available credit, inadequate regulation and oversight, or increasing inequality.

=Seminar in Economic Policy= =Economic and Financial Recession=

Causes of Recession

Financial Crisis

Sub-prime Mortgage Crisis

The immediate cause or trigger of the crisis was the bursting of the United States housing bubble which peaked in approximately 20052006. High default rates on "subprime" and adjustable rate mortgages (ARM) began to increase quickly thereafter. An increase in loan incentives such as easy initial terms and a long-term trend of rising housing prices had encouraged borrowers to assume difficult mortgages in the belief they would be able to quickly refinance at more favorable terms. However, once interest rates began to rise and housing prices started to drop moderately in 20062007 in many parts of the U.S., refinancing became more difficult. Defaults and foreclosure activity increased dramatically as easy initial terms expired, home prices failed to go up as anticipated, and ARM interest rates reset higher. Falling prices also resulted in homes worth less than the mortgage loan, providing a financial incentive to enter foreclosure. The ongoing foreclosure epidemic that began in late 2006 in the U.S. continues to be a key factor in the global economic crisis, because it drains wealth from consumers and erodes the financial strength of banking institutions. Causes Boom and bust in the housing market The housing bubble that burst caused a negative wealth affect on the market as people began to panic and the situation rapidly deteriorated on the face of falling market prices and this led in turn to increasing foreclosures in the market from 2006 onwards. High-risk mortgage loans and lending/borrowing practices Credit ratings were manipulated to reduce the risk levels of the mortgages by combing numerous securities in one large group known as MBSS (Mortgage Backed Securities). This had the affect of effectively hiding the risk factor of the loans and allowing banks to sell them off to investors. Inaccurate credit ratings Credit ratings were being assigned by credit rating firms that were in private hands, these firms were being paid by banks and in order to continue a good relationship with their clients low level risk ratings were assigned to the special investment vehicles (SIVs) the banks were using.

=Seminar in Economic Policy= =Economic and Financial Recession=

At one point Moody had 40% of its income coming from the inflow of such credit rating activities. Government policies Extremely low interest rates, de-regulation and giving credit rating authority to the private sector. Investment in U.S. by foreigners of their proceeds from America's net imports This was especially true in the case of the Arab oil producing countries and countries such as China that were looking to gain a large piece of the American financial market that they perceived as booming. Boom and collapse of the shadow banking system The shadow banking systems were the mutual funds and their like that played an important role in providing funds to corporations and other enterprises, however, they lacked the regulation and oversight of the banking industry.

Economic Imbalance

Commodity boom The decade of the 2000s saw a global explosion in prices, focused especially in commodities and housing, marking an end to the commodities recession of 1980-2000. In 2008, the prices of many commodities, notably oil and food, rose so high as to cause genuine economic damage, threatening stagflation and a reversal of globalization. In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year. In July 2008, oil peaked at $147.30 a barrel. These high prices caused a dramatic drop in demand and prices fell below $35 a barrel at the end of 2008. There is concern that if the economy was to improve, oil prices might return to pre-recession levels. The years 20072008 saw dramatic increases in world food prices, creating a global crisis and causing political and economical instability and social unrest in both poor and developed nations. Systemic causes for the worldwide increases in food prices continue to be the subject of debate. Some causes include:

o o o o

World population growth Increased demand for more resource intensive food Impact of petroleum price increases Declining world food stockpiles

=Seminar in Economic Policy= =Economic and Financial Recession=

o o o o o o o o

Financial speculation Impact of trade liberalization Impact of food for fuel Biofuel subsidies in the US and the EU Idled farmland Agricultural subsidies Crop shortfalls from natural disasters Soil and productivity losses

Sulfuric acid (an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure due to flooding, precipitating similarly steep price increases. Housing bubble By 2007, real estate bubbles were still under way in many parts of the world, especially in the United States, United Kingdom, United Arab Emirates, Italy, Australia, New Zealand, Ireland, Spain, France, Poland, South Africa, Israel, Greece, Bulgaria, Croatia, Canada, Norway, Singapore, South Korea, Sweden, Finland, Argentina,[28] Baltic states, India, Romania, Russia, Ukraine and China. The Economist magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". [31] Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a housing price crash) that can result in many owners holding negative equity (a mortgage debt higher than the current value of the property). Inflation In February 2008, Reuters reported that global inflation was at historic levels, and that domestic inflation was at 10-20 year highs for many nations. "Excess money supply around the globe, monetary easing by the Fed to tame financial crisis, growth surge supported by easy monetary policy in Asia, speculation in commodities, agricultural failure, rising cost of imports from China and rising demand of food and commodities in the fast growing emerging markets," have been named as possible reasons for the inflation. In mid-2007, IMF data indicated that inflation was highest in the oil-exporting countries, largely due to the unsterilized growth of foreign exchange reserves, the term unsterilized referring to a lack of monetary policy operations that could offset such a foreign exchange intervention in order to maintain a countrys monetary policy target. However, inflation was also growing in countries classified by the IMF as "non-oil-exporting LDCs" (Least Developed Countries) and "Developing Asia", on account of the rise in oil and food prices. Inflation was also increasing in the developed countries, but remained low compared to the developing world.

=Seminar in Economic Policy= =Economic and Financial Recession=

Overproduction

It has also been debated that the root cause of the crisis is overproduction of goods caused by globalization (and especially vast investments in countries such as China and India by western multinational companies over the past 1520 years, which greatly increased global industrial output at a reduced cost). Overproduction tends to cause deflation and signs of deflation were evident in October and November 2008, as commodity prices tumbled and the Federal Reserve was lowering its target rate to an all-time-low 0.25%. On the other hand, Professor Herman Daly suggests that it is not actually an economic crisis, but rather a crisis of overgrowth beyond sustainable ecological limits.

War

The recent wars in Afghanistanand Iraq have had a significant role to play in the causes of the current economic recession. A current estimate of the total cost of the war is $1.6 trillion by the end of 2009. This money was generated by massive U.S governemnt borrowing that contributed heavily to the debt burden of the government and reduced money supply. At the same time it also added an aura of uncertainity to the Middle East causing fears of disruption to the oil supply and increasing price levels.

Effects of Recession

Bankruptcy

Bankruptcy is a legally declared inability or impairment of ability of an individual or organization to pay its creditors. Creditors may file a bankruptcy petition against a debtor ("involuntary bankruptcy") in an effort to recoup a portion of what they are owed or initiate a restructuring. In the majority of cases, however, bankruptcy is initiated by the debtor (a "voluntary bankruptcy" that is filed by the insolvent individual or organization).

Credit Crunch

A credit crunch (also known as a credit squeeze or credit crisis) is a reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from the banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates has implicitly changed, such that either credit becomes less available at any given official interest rate, or

=Seminar in Economic Policy= =Economic and Financial Recession=

there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises).

Foreclosure

Foreclosure is the legal and professional proceeding in which a mortgagee, or other lien holder, usually a lender, obtains a court ordered termination of a mortgagors equitable right of redemption Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender try to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, the lender cannot be sure that it can successfully repossess the property, thus the lender seeks to foreclose the equitable right of redemption. Other lien holders can also foreclose the owner's right of redemption for other debts, such as for overdue taxes, unpaid contractors' bills etc.

The foreclosure process as applied to residential mortgage loans is a bank or other secured creditor selling or repossessing a parcel of real property after the owner has failed to comply with an agreement between the lender and borrower called a "mortgage or "deed of trust. Commonly, the violation of the mortgage is a default in payment of a promissory note , secured by a lien on a property. When the process is complete, the lender can sell the property and keep the proceeds to pay off its mortgage and any legal costs, and it is typically said that "the lender has foreclosed its mortgage or lien

Unemployment

Unemployment occurs when a person is available to work and currently seeking work, but the person is without work. The prevalence of unemployment is usually measured using the unemployment rate, which is defined as the percentage of those in the labor force who are unemployed. The unemployment rate is also used in economic studies and economic indexes such as the United States ' Conference Board's Index of Leading Indicators as a measure of the state of the macroeconomics

=Seminar in Economic Policy= =Economic and Financial Recession=

Effect on Nations

Developing Nations

The economic downturn in developed countries may also have significant impact on developing countries. The channels of impact on developing countries include:

Trade and trade prices

Growth in China and India has increased imports and pushed up the demand for copper, oil and other natural resources, which has led to greater exports and higher prices, including from African countries. Eventually, growth in China and India is likely to slow down, which will have knock on effects on other poorer countries.

Remittances

Remittances to developing countries will decline. There will be fewer economic migrants coming to developed countries when they are in a recession, so fewer remittances and also probably lower volumes of remittances per migrant.

Foreign direct investment (FDI) and equity investment

These will come under pressure. While 2007 was a record year for FDI to developing countries, equity finance is under pressure and corporate and project finance is already weakening. The proposed Xstrata takeover of a South African mining conglomerate was put on hold as the financing was harder due to the credit crunch. There are several other examples e.g. in India.

Commercial lending

Banks under pressure in developed countries may not be able to lend as much as they have done in the past. Investors are, increasingly, factoring in the risk of some emerging market

=Seminar in Economic Policy= =Economic and Financial Recession=

countries defaulting on their debt, following the financial collapse of Iceland. This would limit investment in such countries as Argentina, Iceland, Pakistan and Ukraine.

Aid

Aid budgets are under pressure because of debt problems and weak fiscal positions, e.g. in the UK and other European countries and in the USA. While the promises of increased aid at the Gleneagles summit in 2005 were already off track just three years later, aid budgets are now likely to be under increased pressure.

Developed Nations Increased Unemployment

Presently due to the recession even the developed countries are facing unemployment. Developing economies have always faced unemployment due to their overpopulation and lack of proper technology to tap the natural resources to their maximum. The International Labour Organization (ILO) predicted that at least 20 million jobs will have been lost by the end of 2009 due to the crisis mostly in "construction, real estate, financial services, and the auto sector" bringing world unemployment above 200 million for the first time. The number of unemployed people worldwide could increase by more than 50 million in 2009 as the global recession intensifies, the ILO has forecast

Stagflation

Stagflation refers to a condition whereby inflation coexists with economic stagnation. There are less growth opportunities. Prices continue to increase with less supply of commodities. The present era, according to economists is a stagflation era.

Consumer Confidence

Consumer confidence has dropped due to a negative wealth affect leading to a drop in consumption levels leading in turn to a decrease in overall consumption that has another negative effect on the economy already hurting from other economic shocks.

=Seminar in Economic Policy= =Economic and Financial Recession=

Trade and industrial production

In middle-October 2008, the Baltic Dry Index, a measure of shipping volume, fell by 50% in one week, as the credit crunch made it difficult for exporters to obtain letters of credit. In February 2009, The Economist claimed that the financial crisis had produced a "manufacturing crisis", with the strongest declines in industrial production occurring in exportbased economies. In March 2009, Britain's Daily Telegraph reported the following declines in industrial output, from January 2008 to January 2009: Japan -31%, Korea -26%, Russia -16%, Brazil -15%, Italy 14%, Germany -12%. Some analysts even say the world is going through a period of deglobalization and protectionism after years of increasing economic integration.

Response to Recession

United States policy responses Loans to banks for asset-backed commercial paper

During the week ending September 19, 2008, money market mutual funds had begun to experience significant withdrawals of funds by investors. This created a significant risk because money market funds are integral to the ongoing financing of corporations of all types. Individual investors lend money to money market funds, which then provide the funds to corporations in exchange for corporate short-term securities called asset-backed commercial paper (ABCP). However, a potential bank run had begun on certain money market funds. If this situation had worsened, the ability of major corporations to secure needed short-term financing through ABCP issuance would have been significantly affected. To assist with liquidity throughout the system, the US Treasury and Federal Reserve Bank announced that banks could obtain funds via the Federal Reserve's Discount Window using ABCP as collateral.

Legislation

The Secretary of the United States Treasury, Henry Paulson and President George W. Bush proposed legislation for the government to purchase up to US$700 billion of "troubled mortgage-related assets" from financial firms in hopes of improving confidence in the mortgage-backed securities markets and the financial firms participating in it. Discussion, hearings and meetings among legislative leaders and the administration later made clear that the proposal would undergo significant change before it could be approved by Congress. On

=Seminar in Economic Policy= =Economic and Financial Recession=

October 1, a revised compromise version was approved by the Senate with a 74-25 vote. The bill, HR1424 was passed by the House on October 3, 2008 and signed into law. The first half of the bailout money was primarily used to buy preferred stock in banks instead of troubled mortgage assets. In January 2009, the Obama administration announced a stimulus plan to revive the economy with the intention to create or save more than 3.6 million jobs in two years. The cost of this initial recovery plan was estimated at 825 billion dollars (5.8% of GDP). The plan included 365.5 billion dollars to be spent on major policy and reform of the health system, 275 billion (through tax rebates) to be redistributed to households and firms, notably those investing in renewable energy, 94 billion to be dedicated to social assistance for the unemployed and families, 87 billion of direct assistance to states to help them finance health expenditures of Medicaid, and finally 13 billion spent to improve access to digital technologies.

Asia-Pacific policy responses

On September 15, 2008 China cut its interest rate for the first time since 2002. Indonesia reduced its overnight repo rate, at which commercial banks can borrow overnight funds from the central bank, by two percentage points to 10.25 percent. The Reserve Bank of Australia injected nearly $1.5 billion into the banking system, nearly three times as much as the market's estimated requirement. The Reserve Bank of India added almost $1.32 billion, through a refinance operation, its biggest in at least a month. On November 9, 2008 the 2008 Chinese economic stimulus plan is a RMB 4 trillion ($586 billion) stimulus package announced by the central government of the People's Republic of China in its biggest move to stop the global financial crisis from hitting the world's second largest economy. A statement on the government's website said the State Council had approved a plan to invest 4 trillion yuan ($586 billion) in infrastructure and social welfare by the end of 2010. The stimulus package will be invested in key areas such as housing, rural infrastructure, transportation, health and education, environment, industry, disaster rebuilding, income-building, tax cuts, and finance. In Taiwan, the central bank on September 16, 2008 said it would cut its required reserve ratios for the first time in eight years. The central bank added $3.59 billion into the foreign-currency interbank market the same day. Bank of Japan pumped $29.3 billion into the financial system on September 17, 2008 and the Reserve Bank of Australia added $3.45 billion the same day. In developing and emerging economies, responses to the global crisis mainly consisted in low-rates monetary policy (Asia and the Middle East mainly) coupled with the depreciation of the currency against the dollar. There were also stimulus plans in some Asian countries, in the Middle East and in Argentina. In Asia, plans generally amounted to 1 to 3% of GDP, with the notable exception of China, which announced a plan accounting for 16% of GDP (6% of GDP per year).

=Seminar in Economic Policy= =Economic and Financial Recession=

European policy responses

Until September 2008, European policy measures were limited to a small number of countries (Spain and Italy). In both countries, the measures were dedicated to households (tax rebates) reform of the taxation system to support specific sectors such as housing. From September, as the financial crisis began to seriously affect the economy, many countries announced specific measures: Germany, Spain, Italy, Netherlands, United Kingdom, and Sweden. The European Commission proposed a 200 billion stimulus plan to be implemented at the European level by the countries. At the beginning of 2009, the UK and Spain completed their initial plans, while Germany announced a new plan. The European Central Bank injected $99.8 billion in a one-day money-market auction. The Bank of England pumped in $36 billion. Altogether, central banks throughout the world added more than $200 billion from the beginning of the week to September 17. On 8 October 2008 the British Government announced a bank rescue package of around 500 billion ($850 billion at the time). The plan comprises three parts. First, 200 billion will be made available to the banks in the Bank of England's Special Liquidity scheme. Second, the Government will increase the banks' market capitalization, through the Bank Recapitalization Fund, with an initial 25 billion and another 25 billion to be provided if needed. Third, the Government will temporarily underwrite any eligible lending between British banks up to around 250 billion. In February 2009 Sir David Walker was appointed to lead a government inquiry into the corporate governance of banks. In early December German Finance Minister Peer Steinbrck indicated that he does not believe in a "Great Rescue Plan" and indicated reluctance to spend more money addressing the crisis. In March 2009, The European Union Presidency confirms that the EU is strongly resisting the US pressure to increase European budget deficits.

=Seminar in Economic Policy= =Economic and Financial Recession=

Conclusion

The recession of 2007-09 was considered to be severe but was not catastrophic, however, all this showed us was the need for strong governemnt regulation and oversight of the market in comparison to a completely free market scenario. Also, the need for fiscal rather than monetary tools to control the market was underlined and also the need for being prepared for the future was underlined with the need for future stockpiles and preperation underlined. There is also the need to focus on natioanl development and independence rather than relying on interdepence with other nations. Risks are an integral part of the economic scenario but there is a need to focus on the having calculated the risk that is inherent and focusing on longterm benefits rather than short-term returns. No point for guessing that poor planning led to the dilapidated financial conditions of many in the recession. With proper planning such situations can be avoided in future. However, this too like everything else will pass but we need to be prepared for the future and accept what has occurred.

Вам также может понравиться

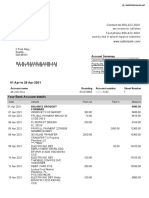

- Sutton Bank StatementДокумент2 страницыSutton Bank StatementNadiia AvetisianОценок пока нет

- Learning From Michael BurryДокумент20 страницLearning From Michael Burrymchallis100% (7)

- IRS Document 6209 Manual (2003 Ed.)Документ0 страницIRS Document 6209 Manual (2003 Ed.)iamnumber8Оценок пока нет

- A Study On Economic CrisisДокумент12 страницA Study On Economic CrisisShelby ShajahanОценок пока нет

- Executive Summary: The Global OutlookДокумент34 страницыExecutive Summary: The Global OutlookmarrykhiОценок пока нет

- Guidance Note On GSTДокумент50 страницGuidance Note On GSTkjs gurnaОценок пока нет

- Strategy Management For HotelДокумент14 страницStrategy Management For HotelkamleshmistriОценок пока нет

- Four Phases of Business CycleДокумент10 страницFour Phases of Business CycleSiddharth SamantakurthiОценок пока нет

- Students Perceptions Case StudyДокумент19 страницStudents Perceptions Case Studyapi-286737609Оценок пока нет

- Heirs of Extremadura v. Extremadura G.R. No. 211065 - June 15, 2016 FACTS: Jose, Now Deceased, Filed A Case For Quieting of Title With Recovery ofДокумент1 страницаHeirs of Extremadura v. Extremadura G.R. No. 211065 - June 15, 2016 FACTS: Jose, Now Deceased, Filed A Case For Quieting of Title With Recovery ofJed MacaibayОценок пока нет

- SaleДокумент1 страницаSaleMegan HerreraОценок пока нет

- ChE Calc Recyle Bypass and Purge - 003Документ32 страницыChE Calc Recyle Bypass and Purge - 003Julaiza SalazarОценок пока нет

- Suture ManufacturerДокумент7 страницSuture ManufacturerVishal ThakkarОценок пока нет

- Study of Financial CrisisДокумент71 страницаStudy of Financial CrisisAmar Rajput100% (1)

- Causes of Business CycleДокумент17 страницCauses of Business CycletawandaОценок пока нет

- Financial Crisis in 2007-2008 & It's Impact in BangladeshДокумент34 страницыFinancial Crisis in 2007-2008 & It's Impact in Bangladeshjahid.coolОценок пока нет

- Current Events 2009Документ45 страницCurrent Events 2009Doynitza LecaОценок пока нет

- The Causes, Consequences and Policy Responses of The 2008-2009 RecessionДокумент12 страницThe Causes, Consequences and Policy Responses of The 2008-2009 Recessiontim kimОценок пока нет

- Causes, Effects and The Solutions of The Global Financial Crisis and BIS Reaction.Документ27 страницCauses, Effects and The Solutions of The Global Financial Crisis and BIS Reaction.TALENT GOSHO100% (1)

- Symptomatic to Systemic: Understanding Postwar Cycles and Financial DebaclesОт EverandSymptomatic to Systemic: Understanding Postwar Cycles and Financial DebaclesОценок пока нет

- Deflation and Its Economics SignificanceДокумент19 страницDeflation and Its Economics SignificanceAkshayОценок пока нет

- RecessionДокумент55 страницRecessionsinhasaumya100% (1)

- Deflation Making Sure It Doesn't Happen HereДокумент13 страницDeflation Making Sure It Doesn't Happen Herefangliyuan123Оценок пока нет

- The Great Recession: A Macroeconomic EarthquakeДокумент8 страницThe Great Recession: A Macroeconomic Earthquakelucifer morningstarОценок пока нет

- The Impact of Recent Global Economic Slump On Indian Capital MarketДокумент25 страницThe Impact of Recent Global Economic Slump On Indian Capital MarketKalpeshjini50% (2)

- Economic Enironment For Business ReportДокумент47 страницEconomic Enironment For Business Reportutpala123456Оценок пока нет

- Global Financial CrisisДокумент5 страницGlobal Financial CrisisClaudia Carrera CalvoОценок пока нет

- Svensson, L. (2003) - Escaping From A Liquidity Trap and DeflationДокумент26 страницSvensson, L. (2003) - Escaping From A Liquidity Trap and DeflationAnonymous WFjMFHQОценок пока нет

- Money Banking Group AssignmentДокумент33 страницыMoney Banking Group AssignmentnanaОценок пока нет

- Economic CrisisДокумент1 страницаEconomic CrisisHITОценок пока нет

- Global Economic Crisis Part 1Документ8 страницGlobal Economic Crisis Part 1Phine TanayОценок пока нет

- Project Report On Multinational Business Finance Submitted To: Prof. K P Ramakrishnan Submitted By: Arash Fruzi (8) Section: SF1Документ16 страницProject Report On Multinational Business Finance Submitted To: Prof. K P Ramakrishnan Submitted By: Arash Fruzi (8) Section: SF1Nasim JanОценок пока нет

- The Global Financial Crisis 2007-2009Документ6 страницThe Global Financial Crisis 2007-2009Jacques OwokelОценок пока нет

- Criza Economica Si Financiara in RomaniaДокумент5 страницCriza Economica Si Financiara in RomaniaDana NiculescuОценок пока нет

- The Global Financial Crisis: Overview: A Supplement To Macroeconomics (W.W. Norton, 2008)Документ26 страницThe Global Financial Crisis: Overview: A Supplement To Macroeconomics (W.W. Norton, 2008)Zer Nathan Gonzales RubiaОценок пока нет

- Sustanability of Manufacturing Companies During Recession Period Orignal VersionДокумент27 страницSustanability of Manufacturing Companies During Recession Period Orignal VersionSuez GaekwadОценок пока нет

- Deflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)Документ8 страницDeflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)João Henrique F. VieiraОценок пока нет

- The Financial Crisis and Its Impact To The US Economy-FinalVДокумент19 страницThe Financial Crisis and Its Impact To The US Economy-FinalVGlenn MöllerОценок пока нет

- Financial Melt Down and Its Impact On Indian EconomyДокумент56 страницFinancial Melt Down and Its Impact On Indian EconomyZarna SolankiОценок пока нет

- Diffrence Between Reccession and DepressionДокумент6 страницDiffrence Between Reccession and DepressionHanya ElshehryОценок пока нет

- Economic Recession in India: A Net Based Commentary: What The Issue Is All About?Документ9 страницEconomic Recession in India: A Net Based Commentary: What The Issue Is All About?Anshu ManzОценок пока нет

- Bernanke On Deflation - November 21, 2002Документ12 страницBernanke On Deflation - November 21, 2002Shyam SunderОценок пока нет

- Iilm Institute For Higher Education 2009-11Документ24 страницыIilm Institute For Higher Education 2009-11rathore31Оценок пока нет

- AssignmentДокумент7 страницAssignmentTabish KhanОценок пока нет

- What Is A RecessionДокумент2 страницыWhat Is A Recessionbiks007Оценок пока нет

- The Small Business Sector in Recent RecoveriesДокумент29 страницThe Small Business Sector in Recent RecoveriesOlaru LorenaОценок пока нет

- Financial Crises: Why Do Occur and Why Are They So Damaging To The EconomyДокумент78 страницFinancial Crises: Why Do Occur and Why Are They So Damaging To The Economy06162kОценок пока нет

- Technical University of Mombasa School of Business Bachelor of Commerce (Finance Option)Документ11 страницTechnical University of Mombasa School of Business Bachelor of Commerce (Finance Option)George OtienoОценок пока нет

- Financial Melt Down N Its Impact On Indian EconomyДокумент54 страницыFinancial Melt Down N Its Impact On Indian EconomyZarna SolankiОценок пока нет

- Bernanke 20121120 AДокумент16 страницBernanke 20121120 Atax9654Оценок пока нет

- International Finance Report: Topic - Financial Business CycleДокумент37 страницInternational Finance Report: Topic - Financial Business CycleAdish JainОценок пока нет

- 1456892183BSE P5 M34 E-Text PDFДокумент9 страниц1456892183BSE P5 M34 E-Text PDFsahil sharmaОценок пока нет

- Global Financial Crisis - Dr. Ayubur Rahman BhuyanДокумент17 страницGlobal Financial Crisis - Dr. Ayubur Rahman Bhuyanekab88Оценок пока нет

- Ec1013a CourseworkДокумент16 страницEc1013a CourseworkAbolanle OkunlayaОценок пока нет

- UAS Macroeconomy CaseДокумент10 страницUAS Macroeconomy Caserichiealdo7Оценок пока нет

- Rajiv Gandhi National University of Law, PunjabДокумент15 страницRajiv Gandhi National University of Law, PunjabAnish SinghОценок пока нет

- Global Financial Crisis: AnalysisДокумент21 страницаGlobal Financial Crisis: Analysischinmaydeshmukh1Оценок пока нет

- API AssignmentДокумент19 страницAPI AssignmentAreej IftikharОценок пока нет

- Financial ManagementДокумент6 страницFinancial ManagementMuhammad HassanОценок пока нет

- The Hayek Rule - Federal - Reserve - Monetary - Policy - Hayek - RuleДокумент56 страницThe Hayek Rule - Federal - Reserve - Monetary - Policy - Hayek - RuleDavid BayoОценок пока нет

- Global Financial CrisesДокумент11 страницGlobal Financial CrisesokashaОценок пока нет

- Recession Full Data Report and Financial and Market Analysis DoneДокумент46 страницRecession Full Data Report and Financial and Market Analysis Doneamitsaini03Оценок пока нет

- Impact of Global Recession On Indian Corporate Sector: GET Better GradesДокумент28 страницImpact of Global Recession On Indian Corporate Sector: GET Better GradesPradeep Singh100% (1)

- Charts and DescriptionsДокумент4 страницыCharts and Descriptionsemirav2Оценок пока нет

- RecessionДокумент6 страницRecessionWilly RaoulОценок пока нет

- Basics Recession PDFДокумент2 страницыBasics Recession PDFaila jasmin malabananОценок пока нет

- Financial Crisis - KGPДокумент17 страницFinancial Crisis - KGPKIRAN GOPALОценок пока нет

- Global Recession & It'S Impact On Indian Economy: Mrs. R.SRIPRADHA M.I.B.A., Mrs. V.SARANYA B.SC.Документ9 страницGlobal Recession & It'S Impact On Indian Economy: Mrs. R.SRIPRADHA M.I.B.A., Mrs. V.SARANYA B.SC.srisudhaaОценок пока нет

- EconДокумент7 страницEconRainidah Mangotara Ismael-DericoОценок пока нет

- Phontices TranciptionДокумент1 страницаPhontices TranciptionApplecart23Оценок пока нет

- Getting The Most From Textbook Listening ActivitiesДокумент29 страницGetting The Most From Textbook Listening ActivitiesApplecart23Оценок пока нет

- Past Simple ActivityДокумент1 страницаPast Simple ActivityApplecart23Оценок пока нет

- Instructions: Read The Lyrics of The Song You Heard and Mark The Mistakes. Write Down The Correct Word in Place of The Wrong WordДокумент1 страницаInstructions: Read The Lyrics of The Song You Heard and Mark The Mistakes. Write Down The Correct Word in Place of The Wrong WordApplecart23Оценок пока нет

- Joyce's Use of Imagery in "The Portrait of An Artist As A Young Man."Документ1 страницаJoyce's Use of Imagery in "The Portrait of An Artist As A Young Man."Applecart23Оценок пока нет

- Novel B MorДокумент1 страницаNovel B MorApplecart23Оценок пока нет

- Annual Budget PDFДокумент1 страницаAnnual Budget PDFApplecart23Оценок пока нет

- Learning Strategies: Strategies Related To ReadingДокумент8 страницLearning Strategies: Strategies Related To Readingshiny2012Оценок пока нет

- 1st Level Editing ChecklistДокумент1 страница1st Level Editing ChecklistApplecart23Оценок пока нет

- Sample 601 Annual Report Yr05Документ1 страницаSample 601 Annual Report Yr05Applecart23Оценок пока нет

- Agm Common Proposal Form Project & Organization Budget SummaryДокумент1 страницаAgm Common Proposal Form Project & Organization Budget SummaryApplecart23Оценок пока нет

- ActivelearningДокумент28 страницActivelearningApplecart23Оценок пока нет

- Academic Referee Report Form 2012 07Документ5 страницAcademic Referee Report Form 2012 07Applecart23Оценок пока нет

- Group TasksДокумент2 страницыGroup TasksApplecart23Оценок пока нет

- Getting The Most From Textbook Listening ActivitiesДокумент29 страницGetting The Most From Textbook Listening ActivitiesApplecart23Оценок пока нет

- Your Attitude Is Your Window To The World: WorksheetДокумент1 страницаYour Attitude Is Your Window To The World: WorksheetApplecart23Оценок пока нет

- Role Profile: A. Job DescriptionДокумент3 страницыRole Profile: A. Job DescriptionApplecart23Оценок пока нет

- Online Application ReceivedДокумент3 страницыOnline Application ReceivedApplecart23Оценок пока нет

- Comparative EssayДокумент2 страницыComparative EssayApplecart23100% (1)

- Brian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Документ3 страницыBrian Ghilliotti: BES 218: Entrepreneurial Studies: Week 3Brian GhilliottiОценок пока нет

- What Are The Difference Between Governme PDFДокумент2 страницыWhat Are The Difference Between Governme PDFIndira IndiraОценок пока нет

- Economy of Pakistan Course OutlineДокумент2 страницыEconomy of Pakistan Course OutlineFarhan Sarwar100% (1)

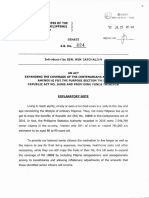

- S.B. No. 824: First Regular SessionДокумент5 страницS.B. No. 824: First Regular SessionKevin TayagОценок пока нет

- Grant of IR17JulДокумент2 страницыGrant of IR17JulAshwani BhallaОценок пока нет

- DELIVERY Transfer of Risk and Transfer of TitleДокумент2 страницыDELIVERY Transfer of Risk and Transfer of TitleLesterОценок пока нет

- Awnser KeyДокумент3 страницыAwnser KeyChristopher FulbrightОценок пока нет

- (Resa2016) Afar (Quiz 1)Документ6 страниц(Resa2016) Afar (Quiz 1)PCОценок пока нет

- TYS 2007 To 2019 AnswersДокумент380 страницTYS 2007 To 2019 Answersshakthee sivakumarОценок пока нет

- Tanzania Mortgage Market Update 2014Документ7 страницTanzania Mortgage Market Update 2014Anonymous FnM14a0Оценок пока нет

- Apollo Tyre Company: A Project Report ONДокумент55 страницApollo Tyre Company: A Project Report ONMOHITKOLLI100% (1)

- Application of Memebership Namrata DubeyДокумент2 страницыApplication of Memebership Namrata DubeyBHOOMI REALTY AND CONSULTANCY - ADMINОценок пока нет

- AssignmentДокумент13 страницAssignmentabdur RahmanОценок пока нет

- 2013-09-23 Rudin Management Company - James Capalino NYC Lobbyist & Client Search ResultДокумент4 страницы2013-09-23 Rudin Management Company - James Capalino NYC Lobbyist & Client Search ResultConnaissableОценок пока нет

- Intel 5 ForcesДокумент2 страницыIntel 5 ForcesNik100% (1)

- Assignment - Engro CorpДокумент18 страницAssignment - Engro CorpUmar ButtОценок пока нет

- Latest Berthing-Report MundraДокумент2 страницыLatest Berthing-Report MundraphilmikantОценок пока нет

- UAS MS NathanaelCahya 115190307Документ2 страницыUAS MS NathanaelCahya 115190307Nathanael CahyaОценок пока нет

- ToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...Документ14 страницToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...PalawanBaliОценок пока нет

- Introduction To GlobalizationДокумент6 страницIntroduction To GlobalizationcharmaineОценок пока нет

- Registration of PropertyДокумент13 страницRegistration of PropertyambonulanОценок пока нет