Академический Документы

Профессиональный Документы

Культура Документы

Financial Statement Analysis A Look at The Income Sheet

Загружено:

Najmalinda ZenithaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statement Analysis A Look at The Income Sheet

Загружено:

Najmalinda ZenithaАвторское право:

Доступные форматы

FUNDAMENTALS

FINANCIAL STATEMENT ANALYSIS: A LOOK AT THE INCOME SHEET

By John Bajkowski

The goal of the income statement is to determine revenue for the period covered and then match the corresponding expenses to the revenue. It presents a picture of a companys profitability over the entire period of time covered.

The income statement reports on one of the most critical company figures its earnings per share. Over the long run, a stocks value is dependent upon its earnings potential. Investors closely monitor earnings announcements. Stock price can nose dive when earnings expectations are missed by even a few pennies. Therfore, it is important to be able to read and understand an income statement and identify trends of key items that impact earnings. This fundamentals article is the second in a series on financial statements how to read them and use them for stock analysis. The balance sheet was introduced in the January 1999 AAII Journal. This fundamentals article will examine the income statement. Every other issue of the AAII Journal this year will carry an article exploring the use and interpretation of financial statements. We are collecting and organizing these articles under the heading Focus on Financial Statements within the stocks area on our Web site (www.aaii.com/stocks/). We are also publishing member questions and answers related to financial statements. If you have any questions or comments, please E-mail them to financials@aaii.com. THE INCOME STATEMENT The goal of the income statement is to determine revenue for the period that it covers and then match the corresponding expenses to the revenue. The income statement, sometimes referred to as the statement of earnings or statement of operations, presents a picture of a companys profitability over the entire period of time covered. This is in contrast to the balance sheet, which presents a snapshot of a companys financial condition at a specific point in time. The income statement cumulates revenues and expenses and presents the results in a statement that is designed to be read from top to bottom. Like the balance sheet, the income statement reflects managements decisions, estimates, and accounting choices. Just looking at the bottom-line profits may mislead investors. A careful, step-by-step review of the income statement is useful in order to judge the quality and content of the bottom-line earnings figure. The income statement outline presented in Table 1 has five income steps: (1) gross income, (2) operating income, (3) income before taxes, (4) income after taxes and (5) net income. There is a wide latitude of income statement formats used by firms, but the five-step format is useful in explaining the information provided by the statement. ACCRUAL ACCOUNTING Before the income statement can be analyzed correctly, it is important to understand that most companies report their financials using the accrual principle of accounting. Sales revenues and expenses are recorded when they are earned and incurred whether or not cash has been received or paid. Sales should only be recorded once the exchange of goods or services has been

John Bajkowski is AAIIs senior financial analyst and editor of Computerized Investing.

AAII Journal/April 1999

23

FUNDAMENTALS

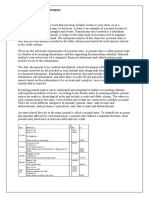

TABLE 1. INCOME STATEMENT STRUCTURE

Net Sales Revenue .................................................. $8,500 Less Cost of Goods Sold .......................................... 5,600 Gross Income ........................................................... 2,900 Operating Expenses Selling, Administrative and General .................... 1,600 Research and Development ...................................... 450 Depreciation .................................................................. 80 Amortization of Intangibles ........................................ 20 Total Operating Expenses ................................ 2,150 Operating Income ........................................................ 750

Other Income (Expense) Interest Income (Expense) ..................................... (120) Non-Operating Income (Expense) ............................. 50 Gain (Loss) on Sale of Assets .................................. (10) Total Other Income (Expense) ................................. (80) Income Before Taxes ................................................... 670 Income Taxes .............................................................. 240 Income After Taxes ...................................................... 430 Extraordinary Gain (Loss) .............................................. 15 Gain (Loss) on Discontinued Operations ..................... (60) Cumulative Effect of Change in Accounting .................. (5) Net Income .................................................................. 380 Less Preferred Dividends ............................................... 10 Net Earnings Available for Common ........................... 370 Common Dividends ..................................................... 100 Earnings Per ShareBasic ........................................... 3.70 Earnings Per ShareDiluted ........................................ 3.66 Dividends per Share ................................................... 1.00

completed and the sale has been completed. Expenses are recorded when the goods and services that generate expenses are used. Accrual accounting includes credit sales in the sales line and records them as accounts receivable on the asset side of the balance sheet. Likewise, unpaid (accrued) expenses are presented as expenses on the income statement, but recorded as liabilities on the balance sheet. The cash flow statement, which will be covered in the June 1999 AAII Journal, looks directly at generation and use of cash within the company. SALES Sales revenue is the total of sales for the period. Sales should not be booked unless there is a high probability that the goods will not be returned and the customer will pay for them. Risk and benefit of ownership of the goods should have been transferred to the buyer in order to be considered a finished sale. For example, it is common for publishers to sell books to bookstores under the provision that the bookstore may return unsold books. Under this circumstance it would not be proper to record all of the revenue from this type

Consolidated Statement of Retained Earnings

Balance, Beginning of Year ............................................ 30 Net Income .................................................................. 370 Cash Dividend Declared on Common ................. (100) Retained Earnings Balance, End of Year ...................... 300

of sale. Companies are required to estimate an allowance for future returns on sales made during the reporting period. Most companies report net sales within the income statement, which is sales less this allowance and other sales discounts. The notes to the financial statements would typically have to be studied to see the estimated annual allowance. Accounts receivable, a balance sheet item, should roughly move in tandem with sales. Accounts receivable is the credit extended to customers to purchase goods. Accounts receivable increasing at a faster rate than sales may point to more lenient change in a firms credit policy toward customers, or a firm pushing unwanted products out to customers to boost short-term sales. The quarter-end period is a noteworthy time for companies to push this sales recognition frontier. Some firms have gone so far as to send unfinished, returned, and defective goods just to meet a sales growth objective. While outright fraud is difficult for an outsider to detect, a sudden increase in accounts receivable relative to sales is a warning flag that merits further investigation. Not all cash received in connection with a sale can be booked as sales for a given reporting period. Firms must match up the sales revenue to the period in which the good or service is delivered. A magazine publisher that receives cash for a multi-year subscription should only count that portion of the subscription delivered during the current reporting period as sales, and establish a balance sheet liability titled unearned revenue for the remainder of the subscription. In subsequent periods, the appropriate portion of unearned revenue account can be converted into sales. Trends in sales are extremely important in judging the current health and prospects of the firm. COST OF GOODS SOLD The cost of goods sold item

24

AAII Journal/April 1999

FUNDAMENTALS

indicates the cost to produce the goods sold and includes the raw materials and labor costs to create the finished product. The cost of goods sold is often a substantial line item for traditional manufacturers, wholesalers, and retailers so the method used to determine this expense can have a dramatic effect on the companys bottom line. Switching from a LIFO (last-in, firstout) to a FIFO (first-in, first-out) inventory valuation system in an inflationary period can boost earnings temporarily as inventory tagged with older, lower prices is matched up with sales. Companies have some discretion on the accounting method used to determine the cost of inventory sold, and any changes to the methods must be disclosed in the notes accompanying the financial statements. Subtracting the cost of goods sold from the net sales revenue produces gross income (or gross profit). This is the first income step and indicates the profitability before operating, financial, and tax expenses are considered. The nature and efficiency of the products manufacturing cycle will greatly affect the gross income. OPERATING EXPENSES Operating expenses are diverse and may include advertising, selling and administrative expenses, depreciation, research and development, maintenance and repairs, and even lease payments. Items such as research and development are only required to be listed as separate line items if they represent a significant and material value. Only about a third of the 9,000 companies covered by AAIIs Stock Investor stock screening program disclose their research and development expenses. The vast majority of these firms operate in the technology and health care sectors. Depreciation expense is the allocation to this years revenue of a portion of the cost of long-lived

assets such as buildings, machinery, trucks, and autos. Depreciation charges reflect the useful lives of the assets, their original cost, and estimated salvage value. Depreciation expense is a non-cash expense. The cash for the asset depreciating in value was spent when the asset was purchased. Depreciation attempts to capture the use and depletion of the asset over the course of the reporting periods. It reduces reported taxable income, although it does not actually represent the use of cash. By lowering the pretax income and thereby the firms tax liability, it may actually help to decrease cash outflow from the company. Various depreciation methods are available to the firm such as straight-line and accelerated. The choice of depreciation methods will affect earnings over the depreciation schedule of the asset. For example, an accelerated depreciation schedule will reduce the value of an asset at a faster pace early in the assets life, but more slowly at the end of the assets life. Under an accelerated depreciation schedule, depreciation will be higher early in the assets life accompanied with a higher operating expense, lower pretax income, lower tax liability, and lower reported earnings. The firm must also estimate the useful life of the asset. A longer life will result in a lower annual expense at the cost of stretching out the expenses over a longer period. While guidance is provided for common assets such as cars (five years) and buildings (31.5 years), companies still have some discretion. For example, two airlines may estimate different useful lives for the same type of airplane. Subtracting operating expenses from gross income provides the next income stepoperating income. Operating income or earnings before interest and taxes (EBIT) represents income generated for the period after all costs except interest, taxes, nonoperating costs, and extraordinary charges. Operating income reflects the organizational and productive

efficiency of the firm before considering how the firm was financed or the contribution (or drag) of nonbusiness activities. NON-OPERATING EXPENSES Interest expense includes interest paid by the firm on all outstanding debt and may also include loan fees and other related financing costs. The special nature of interest leads to separate reporting. Interest is a financial cost, not an operating cost. Interest cost is dependant upon the financial policies of the firm without regard to nature or efficiency of the firms operation. If the company had additional non-operating expenses or profits, they would also be listed after the operating expenses, but before the tax liabilities. Common elements include interest income from investments and gain or loss from the sale of assets. These are items not related to the sales revenue activity of the firm and need to be tracked separately to measure their impact on bottom line income. Subtracting non-operating expense from operating income leaves income or earnings before taxes (EBT). This is the third income step and a step that cumulates all revenue and expenses with the exception of a potential tax liability. INCOME TAX The income tax expense lists the federal and state tax liability incurred by the firm. Other types of taxes, such as property and Social Security, appear under operating expenses. Note that companies usually maintain separate accounting books for tax reporting purposes. Taxes are paid on income, so companies try keep profits as low as possible to minimize their tax liability when reporting to the IRS. While generally accepted accounting principles must be followed for both sets of books, differences can arise in the calculaAAII Journal/April 1999

25

FUNDAMENTALS

tion of tax liabilities between the accounting statements prepared for the IRS and those presented to investors. For example, a firm may use an accelerated depreciation schedule when reporting income to the IRS, but a straight-line method for reporting income to investors. Since more depreciation and lower income would be recorded in the early years of the asset for tax purposes, the tax liability would be smaller for the IRS-prepared statements. The difference would be considered deferred income taxes and would show up as a liability on the balance sheet. This temporary difference would reverse itself in the later years of the asset life when the annual straight-line depreciation amounts exceed the annual accelerated depreciation expense. ADJUSTMENTS TO INCOME Subtracting income tax expense from income before taxes produces aftertax income. For most firms this figure will also be the net income, however there are three notable items that may be listed after taxesextraordinary items, discontinued operations, and cumulative effect of change in accounting. Extraordinary items are distinguished by their unusual nature and by the infrequency of their occurrence. An uninsured loss from an earthquake would qualify as an extraordinary item. The event should not be related to the firms normal course of business. The discontinued operations line can detail the gain or loss from the disposing a segment of a firms business or closing down a line of business. As companies adapt new accounting policies or make corrections to past financial statements, there may

be the need take a special one-time, non-cash charge. This charge would be reflected in the line item cumulative effect of change in accounting and described in the footnotes. Investors need to be aware of managements propensity to determine these types of adjustments. Management has control over factors such as the timing of selling a business or closing down a line. Some firms have shown a tendency to bunch up adjustments to clear the slate for future profits. When earnings are expected to be weak during a particular period, there may be a push to take a big bath. When new management takes over a company, there is also a strong temptation to write-off old projects and assets to show strong improvements during future periods. Recently the Securities and Exchange Commission warned companies reporting charges that it will examine the charges closely and reiterated the disclosure requirements for justifying and explaining the determination of each charge. NET INCOME Net income or earnings is the bottom line figure that attracts the most attention. Usually, however, it is reported in a different format, as earnings per share. The earnings per share figure (basic earnings per share) is simply the net income of the firm, less any preferred dividend payments, divided by the average number of common shares outstanding during the period. If a company had convertible bonds or stocks, stock options, and warrants, it must also calculate a diluted earnings per share, which measures the impact on earnings per share created by the conversion and exercising of all of these securities into common stock.

Both the basic and fully diluted earnings per share must be reported in the income statement. The same line item may be labeled basic and diluted if the company has no convertible securities. The notes to financial statements should include a table describing the calculation of basic and diluted earnings per share. The statement of retained earnings section details how the retained earnings figure on the balance sheet is affected by the current period earnings and dividend decisions. The retained earnings are not necessarily available cash, but instead may be invested in other current and longterm assets of the firm. CONCLUSION The income statement provides insights on how well management can translate sales revenues into earnings. There are many management judgments, estimates, and choice of accounting methods that affect the bottom line, so it is important to be aware and alert to these issues when judging the quality of the firms earnings. No single year will capture the dynamics of the firm. A careful comparison of changes and an identification of trends can aid in judging the attractiveness of the stock. The income statement provides valuable guidance on the sales and earnings trend of a firm. But it does a poor job of identifying whether the company is producing cash flow. In our next article, we will go directly to the source and examine the cash flow statement. If you have any questions regarding the income statement, please Email them to financials@aaii.com. In May we will post weekly questions and answers on our Web site at www.aaii.com.

26

AAII Journal/April 1999

Вам также может понравиться

- Understanding Financial Statements (Review and Analysis of Straub's Book)От EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Рейтинг: 5 из 5 звезд5/5 (5)

- Module 3 Fundamental Analysis 1Документ27 страницModule 3 Fundamental Analysis 1wijayaarieОценок пока нет

- s04 Financial Statements and RatioДокумент34 страницыs04 Financial Statements and RatioKranti PrajapatiОценок пока нет

- Lana Taher (Second Stage) - Profit and Loss AccountДокумент8 страницLana Taher (Second Stage) - Profit and Loss AccountTana AzeezОценок пока нет

- Trading P&L Balance SheetДокумент15 страницTrading P&L Balance Sheetmdhanjalah08Оценок пока нет

- Principles of Finance Chapter07 BlackДокумент115 страницPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Unit - 4 Final AccountДокумент39 страницUnit - 4 Final AccountHusain BohraОценок пока нет

- Profit and Loss (P&L) : Definition - What Does Mean?Документ2 страницыProfit and Loss (P&L) : Definition - What Does Mean?Divyang BhattОценок пока нет

- Income StatementДокумент3 страницыIncome StatementMamta LallОценок пока нет

- Contabilitate COURSE 4Документ47 страницContabilitate COURSE 4Raluca ToneОценок пока нет

- Business Finance A1 AqibДокумент4 страницыBusiness Finance A1 AqibJunior RajpuatОценок пока нет

- Proforma Fin Statement AssignmentДокумент11 страницProforma Fin Statement Assignmentashoo khoslaОценок пока нет

- Understanding The Income StatementДокумент4 страницыUnderstanding The Income Statementluvujaya100% (1)

- Financial Statement Analysis A Look at The Balance Sheet PDFДокумент4 страницыFinancial Statement Analysis A Look at The Balance Sheet PDFnixonjl03Оценок пока нет

- Financial Statements of Sole ProprietorshipДокумент39 страницFinancial Statements of Sole ProprietorshipVishal Tanwar100% (1)

- Chapter 2Документ50 страницChapter 2najmulОценок пока нет

- Alk Bab 4Документ5 страницAlk Bab 4RAFLI RIFALDI -Оценок пока нет

- Stock Analysis Week 4: Quantitative Analysis: Balance SheetДокумент7 страницStock Analysis Week 4: Quantitative Analysis: Balance SheetSushil1998Оценок пока нет

- Financial Accounting & AnalysisДокумент5 страницFinancial Accounting & AnalysisSourav SaraswatОценок пока нет

- How To Read A Financial Report by Merrill LynchДокумент0 страницHow To Read A Financial Report by Merrill Lynchjunaid_256Оценок пока нет

- CH2 Fabm2Документ27 страницCH2 Fabm2Crisson FermalinoОценок пока нет

- Trading AccountДокумент3 страницыTrading AccountRirin GhariniОценок пока нет

- Describe Merchandising Operations and Inventory SystemsДокумент4 страницыDescribe Merchandising Operations and Inventory SystemsSadia RahmanОценок пока нет

- How To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterДокумент16 страницHow To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterSiti Asma MohamadОценок пока нет

- Understanding Financial Statements - Making More Authoritative BCДокумент6 страницUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyОценок пока нет

- What Is The Statement of Comprehensive Income?: EquityДокумент4 страницыWhat Is The Statement of Comprehensive Income?: EquityKatherine Canisguin AlvarecoОценок пока нет

- Financial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIДокумент3 страницыFinancial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIMeyannaОценок пока нет

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoДокумент6 страницLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithОценок пока нет

- Fsa 9NДокумент4 страницыFsa 9Npriyanshu.goel1710Оценок пока нет

- CHAPTER 2-Statement of Comprehensive IncomeДокумент4 страницыCHAPTER 2-Statement of Comprehensive IncomeDan GalvezОценок пока нет

- Tutorial FAДокумент22 страницыTutorial FARicky HoОценок пока нет

- Act 202 SS4Документ21 страницаAct 202 SS4estherОценок пока нет

- Current Assets Current LiabilitiesДокумент7 страницCurrent Assets Current LiabilitiesShubham GuptaОценок пока нет

- Understanding Income StatementsДокумент39 страницUnderstanding Income StatementsMarsh100% (1)

- 15 1312MH CH09 PDFДокумент17 страниц15 1312MH CH09 PDFAntora HoqueОценок пока нет

- Zooming in On NOIДокумент8 страницZooming in On NOIandrewpereiraОценок пока нет

- 28898cpt Fa SM cp6Документ0 страниц28898cpt Fa SM cp6వెంకటరమణయ్య మాలెపాటిОценок пока нет

- Act2 TablazonДокумент3 страницыAct2 Tablazon0044 TABLAZON, ABBY NICOLE B.EОценок пока нет

- 33 - Financial Statements: 33.1 Statement of Profit or LossДокумент14 страниц33 - Financial Statements: 33.1 Statement of Profit or LossRokaia MortadaОценок пока нет

- Financial Health in Terms of Profitabilty and LiquidityДокумент49 страницFinancial Health in Terms of Profitabilty and Liquiditymilind_iiseОценок пока нет

- Materi Meet 10 Evaluating, Recording MethodsДокумент12 страницMateri Meet 10 Evaluating, Recording MethodsSiti Nuranisa AziarОценок пока нет

- Understanding Financial Statement FM 1Документ5 страницUnderstanding Financial Statement FM 1ashleyОценок пока нет

- Econ 303Документ5 страницEcon 303ali abou aliОценок пока нет

- FABM 2 Module 3 Statement of Comprehensive IncomeДокумент10 страницFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskieОценок пока нет

- Basic Accountin Written Assignment SubmissionДокумент2 страницыBasic Accountin Written Assignment SubmissionMailu ShirlОценок пока нет

- AccounitingДокумент0 страницAccounitingDrRam Singh KambojОценок пока нет

- CH 2 CF (EMBF 10th Batch)Документ41 страницаCH 2 CF (EMBF 10th Batch)thar tharОценок пока нет

- Key Takeaways: DirectДокумент13 страницKey Takeaways: DirectSB CorporationОценок пока нет

- 3.1 The Construction of An Income Statement: Learning ObjectivesДокумент6 страниц3.1 The Construction of An Income Statement: Learning ObjectivesShiv NarayanОценок пока нет

- 8 Financial StatementДокумент11 страниц8 Financial StatementLin Latt Wai AlexaОценок пока нет

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetДокумент36 страницLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamОценок пока нет

- CashflowДокумент6 страницCashflowAizia Sarceda Guzman71% (7)

- Corporate AccountingДокумент11 страницCorporate AccountingDhruv GargОценок пока нет

- Meaning of Financial StatementsДокумент44 страницыMeaning of Financial Statementsparth100% (1)

- Basics of Indeterminate AccountingДокумент19 страницBasics of Indeterminate AccountinghummankhanОценок пока нет

- Assesment TwoДокумент17 страницAssesment TwoDhanushka Arsakulasooriya De SilvaОценок пока нет

- Financial StatementsДокумент12 страницFinancial StatementsNitesh KumarОценок пока нет

- Balance Sheet Income StatementДокумент50 страницBalance Sheet Income Statementgurbaxeesh0% (1)

- Financial Accounting Ch03Документ32 страницыFinancial Accounting Ch03Diana FuОценок пока нет

- Childhood Emotional Abuse and The Attachment System Across The Life Cycle What Theory and Research Tell UsДокумент48 страницChildhood Emotional Abuse and The Attachment System Across The Life Cycle What Theory and Research Tell UsNajmalinda ZenithaОценок пока нет

- The Impact of Giftedness On Psychological Well-BeingДокумент14 страницThe Impact of Giftedness On Psychological Well-BeingNajmalinda ZenithaОценок пока нет

- TeoriAkun2 NajmalindaДокумент15 страницTeoriAkun2 NajmalindaNajmalinda ZenithaОценок пока нет

- Fomc Minutes 20081029Документ20 страницFomc Minutes 20081029Najmalinda ZenithaОценок пока нет

- Mcs Week3 Najmalinda ZenithaДокумент2 страницыMcs Week3 Najmalinda ZenithaNajmalinda ZenithaОценок пока нет

- Tugas MCS Case2-1 SD 3 NajmalindaZenithaДокумент4 страницыTugas MCS Case2-1 SD 3 NajmalindaZenithaNajmalinda ZenithaОценок пока нет

- Primary and Diluted EPSДокумент11 страницPrimary and Diluted EPSNajmalinda ZenithaОценок пока нет

- Art1 Mb201001en Pp63-71enДокумент9 страницArt1 Mb201001en Pp63-71enjulia13anaderolОценок пока нет

- I. Choose The Best Answer As Per The Box Provided: Pagsanahan National High School Division of Ilocos NorteДокумент1 страницаI. Choose The Best Answer As Per The Box Provided: Pagsanahan National High School Division of Ilocos NorteMark JosephОценок пока нет

- Larsons MCH 3Документ52 страницыLarsons MCH 3Christopher John NatividadОценок пока нет

- Wipro Case StudyДокумент10 страницWipro Case StudyNisha Bhagat0% (1)

- Nyu Stern 2011 811191422Документ137 страницNyu Stern 2011 811191422Chika OfiliОценок пока нет

- Marketing ConceptsДокумент11 страницMarketing Conceptschatura_gunawardanaОценок пока нет

- Tally ProblemsДокумент10 страницTally ProblemsGudapati PrasadОценок пока нет

- TX Fusion Cloud Service Price List 5041780Документ24 страницыTX Fusion Cloud Service Price List 5041780fahadcaderОценок пока нет

- Writing A Business Plan: Executive SummaryДокумент14 страницWriting A Business Plan: Executive SummaryarnoldОценок пока нет

- All About DHL Logistics - Live ProjectДокумент39 страницAll About DHL Logistics - Live ProjectMihir Thakkar85% (26)

- Vadilal Ice CreamДокумент84 страницыVadilal Ice CreamRaj100% (1)

- Rank (By March Manufacturer Model Sales (March 2011) Sales (March 2010) Percent Change in 2011 Sales) Sales From 2010Документ1 страницаRank (By March Manufacturer Model Sales (March 2011) Sales (March 2010) Percent Change in 2011 Sales) Sales From 2010Jhonalyn Montimor GaldonesОценок пока нет

- Questionnaire FinalДокумент5 страницQuestionnaire Finalcrispyy turonОценок пока нет

- Beyond ERP: Dept. of Information Systems SVKM's NMIMS University 1Документ21 страницаBeyond ERP: Dept. of Information Systems SVKM's NMIMS University 1devesh_mendiratta_61Оценок пока нет

- Short Problems in MerchandisingДокумент2 страницыShort Problems in MerchandisingEve Rose Tacadao IIОценок пока нет

- General Ability Slides For CSS PreparationДокумент161 страницаGeneral Ability Slides For CSS PreparationSa Na100% (1)

- Research Report On Indian Two Wheeler IndustryДокумент7 страницResearch Report On Indian Two Wheeler IndustryTapas DashОценок пока нет

- Overview of The Amendments-Train LawДокумент23 страницыOverview of The Amendments-Train LawCha GalangОценок пока нет

- Challenges and Opportunity Faced by Various BrandДокумент5 страницChallenges and Opportunity Faced by Various BrandGovind ChowdharyОценок пока нет

- FDA Most Used LawsДокумент10 страницFDA Most Used LawsRodolfo Lastimoso Diaz Jr.Оценок пока нет

- MaggiДокумент8 страницMaggiManisha SharmaОценок пока нет

- HOW TO-Get Paid Flipping Houses You Never Even Own PDFДокумент158 страницHOW TO-Get Paid Flipping Houses You Never Even Own PDFDimitrije Mijatovic100% (2)

- Monster EnergyДокумент4 страницыMonster EnergyJose Luis Isaza VОценок пока нет

- Intermacc Inventories and Bio Assets Postlec WaДокумент2 страницыIntermacc Inventories and Bio Assets Postlec WaClarice Awa-ao100% (1)

- Royale Business ClubДокумент13 страницRoyale Business Clubkyeneshi3056356Оценок пока нет

- A87ffmercedes Benz - Competitive Forces and Competitive StrategyДокумент2 страницыA87ffmercedes Benz - Competitive Forces and Competitive Strategythuyanhvirgo0809100% (1)

- HRM587 Communication Grid, M. PurdyДокумент11 страницHRM587 Communication Grid, M. PurdyMegan PurdyОценок пока нет

- Springtek Mattress InvoiceДокумент1 страницаSpringtek Mattress InvoiceRavi kumar BhukyaОценок пока нет

- 2011 - 09 - 01 Mercator Business ReportДокумент56 страниц2011 - 09 - 01 Mercator Business ReportSandi KodričОценок пока нет

- Case 15 1and15 5Документ13 страницCase 15 1and15 5hellojsanОценок пока нет

- Internship Report On Bajaj Allianz - 151904489Документ60 страницInternship Report On Bajaj Allianz - 151904489Prakhar100% (1)