Академический Документы

Профессиональный Документы

Культура Документы

Evolution of e Commerce

Загружено:

pratyush0501Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Evolution of e Commerce

Загружено:

pratyush0501Авторское право:

Доступные форматы

Pratyush Pratap 1220329 M2 Introduction Internet and e-commerce had followed, inevitably, a similar road since these concepts

can not be mutually excluded one from the other one. Innovations in the field of Internet technologies have had instant repercussions in the online business world. From a simple usage having a regional origin located in the United States of America, the phenomenon of electronic commerce has seen a rapid spread globally, according to the innovations related to Internet technologies. The projection of electronic commerce is in perfect accordance with the development stage of the real economy. Due to the low level of development, some states have managed to create and maintain a solid base, especially the one related to IT infrastructure. Thus, due to lack of this essential element, electronic commerce has suffered. The real losers, however, are the consumers, who are deprived of a more convenient way to purchase goods and services, since nowadays almost any product from any corner of the world it may be purchased without further difficulties. E-business and e-commerce The Internet technologies (World Wide Web, intranet, extranet, etc.) and the knowledge on how to implement them in the business area is the starting point for the concept underlying the symbiosis between technology and business, bearing the name of e-business. To be more specifically, what is the definition of e-business? According to IBM, which has defined this concept in 1997,''e-business can be the key in transforming business processes using Internet technologies.'' Analysed from a general perspective, e-business may gather under its umbrella three major components: The human dimension2 that includes processes and activities related to research, development, marketing, manufacturing, logistics, management, etc. The technological-only component, akin to information-related technologies.

Commercial or e-commerce component, taken as a whole and perceived primarily as a phenomenon having a different meaning that the term known e-commerce, basically the purchase of goods and services through Internet technologies. At first, closely linked (the confusion was unavoidable most of the time) to the concept of ebusiness was the notion of e-commerce which later on had differentiated itself, now being seen as an integral part of the first. Most definitions emphasize e-commerce as being the type of transaction in which the parties interact primarily through electronic media. The beginnings and expansion of electronic commerce Electronic commerce has its origins in the implementation of EDI (Electronic Data Interchange) or the exchange of data from one computer to another through networks. During the 70s and the 80s, the subject of transactions were the information exchange or banking transfers. Since 1983, the Internet has become the main medium of transmission of data (at first only in the United States, the country of origin), having a non-commercial character. The implementation of some components later proven to be vital for the later development of the Internet (such as graphical user interface or GUI, HTML and World Wide Web) has basically proven to usher a new era. In 1991, the National Science Foundation (having to perform the management role for NSFNET, the precursor of TCP / IP) removed the prohibition on commercial-type activities on the Internet. The decision triggered within in a few years a major revolution in e-commerce. Analysts mention the period between 1995 and 1999 as a true golden era for the Internet, at this time now being developed and emerging the main browsers and other utilities, as well as the first top brands over the years, veritable symbols of the e-commerce phenomenon - Amazon (established in 1994), Ebay and Yahoo (in 1995), GeoCities (an early model for virtual community, established in 1994). With the momentum of these types of transactions, increasingly more companies began to enter the online market, the growth rate and the results being outstanding. For example, in the United States, in 1996 there were recorded total revenues of 707 million dollars, 2.6 billion the next year, following the record of 5.8 billion dollars in 199815. Again, Amazon distinguished itself by increasing the turnover from 16 million in 1996 to 1.6 billion dollars in 1999. The Dot.com bubble

The peak of the expansion of such companies and other dot.com firms was registered on 10 March 2000, when the NASDAQ Composite Index reached 5133, after a week losing about 9% from the previous value16. Until April 14, the same index has dropped 34.2% while the Dow Jones Internet Composite 53.6%17. After a year, the percentage of NASDAQ fell somewhere below the 2000 points. All companies listed on these exchanges either had very large losses related to the cost shares, regardless of scale and business-size for example, eBay's stock price fell by 27.9% of those from Amazon by 29.9% or 72% for Internet Capital. If these companies have survived the so-called dot.com bubble, many others have bankrupted or at best have been acquired by others. The Dot.com Bubble post-era Getting past the dot.com disaster and trying to regain the pattern of a coherent management, the companies involved in the electronic commerce felt that a more well-planned strategy it needed, which takes into account the improvement of e-commerce platform and last but not least a marketing emphasis on practicality, visual impact and quality of content. As was expected, the dot.com crash sites did not really affect the American industry, the overall percentage of online transactions being very small compared with total retail value. Conclusions E-commerce remains only a small part inside the economic mechanism, representing only a few percent at the macroeconomic level. Considering the current globalization process, this activity will gain more scale in the coming years if it is meaningful to take into account especially the emerging world markets at this moment, some of them still in the early stages of expansion. If evolution can be appreciated globally and according to key indicators, the question remains what will happen to the evolution of individual firms and companies. Some analysts ask themselves if there can rise problem in the future more or less followed by a second Dot.com Bubble, considering the fact that investment in companies such as these exceeds, as percentages, even the events leading up to the famous crash which happened in 2000. The takeovers of companies are now requiring hundreds and even billions of dollars (Google bought DoubleClick for 3.1 billion dollars or Skype, which was acquired by eBay 2.6 billion). The other related issue is about the high market value, either justified or not. Thus, Microsoft paid 240 million dollars for a share of

only 1.6% of the total shares of Facebook or that the same company, Microsoft, wanted to buy Yahoo in 2008 for the sum of approximately $ 45 billion, an amount considered to be too high in comparison with the value of the traded object.

Bibliography Kuechler, D. (n.d.). www.csulb.edu. Retrieved from csulb.edu:

http://www.csulb.edu/journals/jecr/issues/20054/paper1.pdf Mirescu, S. V. (n.d.). http://www.scientificpapers.org. (E. a. Journal of Knowlwdge Management, Producer) Retrieved from scientificpapers.org:

http://www.scientificpapers.org/wpcontent/files/1121_The_premises_and_the_evolution_of_electronic_commerce.pdf

Вам также может понравиться

- E CommerceДокумент8 страницE Commercefaris_baba100% (1)

- Digital Success Blueprint: Unlocking Your Path to Profitable Online VenturesОт EverandDigital Success Blueprint: Unlocking Your Path to Profitable Online VenturesОценок пока нет

- mkt337 Fna1Документ25 страницmkt337 Fna1Master Mojnu MiaОценок пока нет

- E-Comerce Business ModelДокумент16 страницE-Comerce Business ModelMin ZhuОценок пока нет

- MGT 489 Individual ReportДокумент19 страницMGT 489 Individual ReportKawsar Jahan Binti 1511787030Оценок пока нет

- Ecommerce Lesson PlanДокумент5 страницEcommerce Lesson PlanNageswara Rao GottipatiОценок пока нет

- CH 1 1Документ43 страницыCH 1 1aditya bhatiОценок пока нет

- Introduction of Digital MarketingДокумент4 страницыIntroduction of Digital MarketingSahil GroverОценок пока нет

- HR Manager Challenges..Документ10 страницHR Manager Challenges..rahil2112Оценок пока нет

- Kotler Chapter 1Документ30 страницKotler Chapter 1Cindy AbaygarОценок пока нет

- G TodorovaДокумент7 страницG TodorovaOpreaОценок пока нет

- A Framework For Ecommerce Marketing in Bangladesh: A Case ofДокумент13 страницA Framework For Ecommerce Marketing in Bangladesh: A Case ofMd. Moulude HossainОценок пока нет

- E-Commerce Course OutlineДокумент4 страницыE-Commerce Course OutlinePraful DagaОценок пока нет

- A Report On The Strategic Approaches Of: GrameenphoneДокумент20 страницA Report On The Strategic Approaches Of: GrameenphoneFerdows Abid ChowdhuryОценок пока нет

- E-Commerce Assignment For MISДокумент11 страницE-Commerce Assignment For MISIrfan Amin100% (1)

- EcommerceДокумент4 страницыEcommercewalkers hiveОценок пока нет

- Digital Business and E-Commerce, Dave Cheffy, Chapter-1Документ41 страницаDigital Business and E-Commerce, Dave Cheffy, Chapter-1RaihanSharifJewellОценок пока нет

- Module 3 - Building An E-Commerce PresenceДокумент10 страницModule 3 - Building An E-Commerce PresenceAllinie DelgadoОценок пока нет

- E Commerce 6thДокумент10 страницE Commerce 6thMuniza UsmanОценок пока нет

- E-Commerce in The Indian Economy ofДокумент38 страницE-Commerce in The Indian Economy ofArunKumarОценок пока нет

- Bam 570 E-Commerce Management.Документ23 страницыBam 570 E-Commerce Management.Basit Hassan QureshiОценок пока нет

- HRM-Interview With An HR Manager.Документ10 страницHRM-Interview With An HR Manager.faraz_ameemОценок пока нет

- Chapter 1 SlidesДокумент18 страницChapter 1 SlidesMinhaz Hossain OnikОценок пока нет

- Ecommerce NotesДокумент24 страницыEcommerce NotesDhan Singh BoharaОценок пока нет

- Assignment On Financial Aspects of Marketing Break Even AnalysiДокумент8 страницAssignment On Financial Aspects of Marketing Break Even AnalysiAkelectricalsОценок пока нет

- A Synopsis ReportДокумент16 страницA Synopsis Reportsanu singhОценок пока нет

- E-Commerce: Digital Markets, Digital GoodsДокумент39 страницE-Commerce: Digital Markets, Digital GoodsSabahat KhanОценок пока нет

- Amazon E BusinessДокумент12 страницAmazon E BusinessSaadMughalОценок пока нет

- Advertising & Sales Management V4Документ12 страницAdvertising & Sales Management V4solvedcareОценок пока нет

- Multichannel Retailing.-Mftech - Final PPT - PpsДокумент64 страницыMultichannel Retailing.-Mftech - Final PPT - PpsDivyanshJainОценок пока нет

- LGДокумент18 страницLGSachu CyriacОценок пока нет

- Criticisms of The Recent Marketing Definitions by The American Marketing AssociationДокумент4 страницыCriticisms of The Recent Marketing Definitions by The American Marketing AssociationBello Hafis75% (4)

- Digital2021 GlobalReport enДокумент299 страницDigital2021 GlobalReport enCecilia Montessoro100% (2)

- Lecture Notes Business Communication Unit IIДокумент7 страницLecture Notes Business Communication Unit IIAmit Kumar0% (1)

- E - Business PDFДокумент41 страницаE - Business PDFMTОценок пока нет

- Factors Affecting Consumer BehaviourДокумент61 страницаFactors Affecting Consumer BehaviourjointariqaslamОценок пока нет

- Final Research Proposal-Ramandeep ChutaniДокумент16 страницFinal Research Proposal-Ramandeep ChutaniRicky ChutaniОценок пока нет

- 1.0 Consumer-To-Consumer (C2C)Документ7 страниц1.0 Consumer-To-Consumer (C2C)Mariana MahmudОценок пока нет

- A Report On Future International Expansion of FabindiaДокумент23 страницыA Report On Future International Expansion of FabindiaVarun SalgareОценок пока нет

- Fundamentals of Ecommerce: SynopsisДокумент10 страницFundamentals of Ecommerce: SynopsisAskОценок пока нет

- Social Media Marketing: Emarketing Excellence by Dave Chaffey and PR SmithДокумент46 страницSocial Media Marketing: Emarketing Excellence by Dave Chaffey and PR SmithHaris KhanОценок пока нет

- DM Module 2 - Digital Marketing FrameworkДокумент35 страницDM Module 2 - Digital Marketing FrameworkDuc TranAnhОценок пока нет

- Marketing Communications: Adotey Fortune EDML6/022/1020Документ13 страницMarketing Communications: Adotey Fortune EDML6/022/1020Faith AgbemakorОценок пока нет

- E-Commerce AssignmentДокумент39 страницE-Commerce AssignmentMuttant SparrowОценок пока нет

- Legal and Ethical Issues of EcommerceДокумент15 страницLegal and Ethical Issues of EcommerceRavi JindalОценок пока нет

- Laudon-Traver Ec11 PPT Ch01 ReviewedДокумент10 страницLaudon-Traver Ec11 PPT Ch01 ReviewedDinesh NathanОценок пока нет

- Chapter 2 - Group 3 Situation Solution-2Документ5 страницChapter 2 - Group 3 Situation Solution-2PuttyErwinaОценок пока нет

- Unit 1 Fundamental of E-Commerce (Bba-606) - CompleteДокумент56 страницUnit 1 Fundamental of E-Commerce (Bba-606) - CompleteGaurav VikalОценок пока нет

- Extracts From Strategic Brand Management - Kevin LaneДокумент130 страницExtracts From Strategic Brand Management - Kevin Lanedouce.ilona1646Оценок пока нет

- Strategic Marketing - Paragon Ceramics: Summer 2020 Course Code: MKT460 Section: 07Документ59 страницStrategic Marketing - Paragon Ceramics: Summer 2020 Course Code: MKT460 Section: 07Promi GoswamiОценок пока нет

- Syllabus - Introduction To Business AdministrationДокумент15 страницSyllabus - Introduction To Business AdministrationTín Trung Đỗ100% (2)

- E-Commerce: Kenneth C. Laudon Carol Guercio TraverДокумент30 страницE-Commerce: Kenneth C. Laudon Carol Guercio TraversonamrishikapoorОценок пока нет

- Samsung Electronics' Innovation DilemmaДокумент8 страницSamsung Electronics' Innovation DilemmaJames JungОценок пока нет

- Marketing Mix of Samsung Mobile PhonesДокумент6 страницMarketing Mix of Samsung Mobile PhonesSelenaОценок пока нет

- Laudon-Traver Ec10 PPT Ch01Документ29 страницLaudon-Traver Ec10 PPT Ch01Khurram Adeel ShaikhОценок пока нет

- Digital Marketing OverviewДокумент7 страницDigital Marketing OverviewTahsan HasanОценок пока нет

- Business: Economic Issues: An IntroductionДокумент15 страницBusiness: Economic Issues: An Introduction李嘉威Оценок пока нет

- (Aa60) (Homework) (Hoang Trung Kien)Документ1 страница(Aa60) (Homework) (Hoang Trung Kien)Hoàng KiênОценок пока нет

- B2C ECommerce ChapterДокумент38 страницB2C ECommerce ChapterGABRIEL MОценок пока нет

- Implementation of TQM in VodafoneДокумент27 страницImplementation of TQM in Vodafonepratyush0501Оценок пока нет

- GSL Corporate PolicyДокумент1 страницаGSL Corporate Policypratyush0501Оценок пока нет

- Unit 4 - Global Marketing MixДокумент58 страницUnit 4 - Global Marketing Mixpratyush0501Оценок пока нет

- MC 1A Understanding StrategyДокумент2 страницыMC 1A Understanding Strategypratyush0501Оценок пока нет

- A Note On "Trade-Off and Compatibility Between PerformanceДокумент21 страницаA Note On "Trade-Off and Compatibility Between Performancepratyush0501Оценок пока нет

- Newell Company Case StudyДокумент7 страницNewell Company Case StudyRafae Durrani100% (3)

- Important Announcements That Will Impact The Middle Class in BudgetДокумент2 страницыImportant Announcements That Will Impact The Middle Class in Budgetpratyush0501Оценок пока нет

- Directories Are Great Business Marketing ToolsДокумент3 страницыDirectories Are Great Business Marketing Toolspratyush0501Оценок пока нет

- Organisational Structure of V Guard in KeralaДокумент23 страницыOrganisational Structure of V Guard in Keralapratyush0501100% (1)

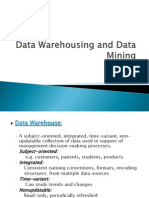

- Data Warehousing and Data MiningДокумент31 страницаData Warehousing and Data Miningpratyush0501Оценок пока нет

- Numbers 15.09Документ28 страницNumbers 15.09pratyush0501Оценок пока нет

- Project Report: Object Tracking in Wireless Sensor NetworksДокумент12 страницProject Report: Object Tracking in Wireless Sensor Networkspratyush0501Оценок пока нет

- Union Budget 2013Документ27 страницUnion Budget 2013Nishanth PillaiОценок пока нет

- Pepsi ProjectДокумент113 страницPepsi Projectsharwan2009Оценок пока нет

- 5 Authority Vs PersuasionДокумент6 страниц5 Authority Vs Persuasionpratyush0501Оценок пока нет

- Presented By: Azeem Rahman K.MДокумент32 страницыPresented By: Azeem Rahman K.Mpratyush05010% (1)

- Try Cargo InternationalДокумент162 страницыTry Cargo Internationalgeorge_zouridis100% (1)

- Project Manager Business Analyst in ST Louis Resume Sharon DelPietroДокумент2 страницыProject Manager Business Analyst in ST Louis Resume Sharon DelPietroSharonDelPietroОценок пока нет

- ch15 Non-Current LiabilitiesДокумент66 страницch15 Non-Current LiabilitiesDesain KPPN KPHОценок пока нет

- 18bba63c U4Документ11 страниц18bba63c U4Thangamani.R ManiОценок пока нет

- Warehouse Management Systems and Logistics ManagementДокумент1 страницаWarehouse Management Systems and Logistics ManagementSanjay RamuОценок пока нет

- Franchise Comprehensive Prob PDF FreeДокумент6 страницFranchise Comprehensive Prob PDF FreetrishaОценок пока нет

- m1 InstДокумент28 страницm1 Instdpoole99Оценок пока нет

- Living in PanamaДокумент106 страницLiving in PanamaMax PlanckОценок пока нет

- Roque Module No.3 PDFДокумент2 страницыRoque Module No.3 PDFElcied RoqueОценок пока нет

- Bio DataДокумент7 страницBio DataPrakash KcОценок пока нет

- IMC Strategy Assignment For StudentsДокумент8 страницIMC Strategy Assignment For StudentsMoin_Khan_5085100% (2)

- Preview of Chapter 16: ACCT2110 Intermediate Accounting II Weeks 6 and 7Документ111 страницPreview of Chapter 16: ACCT2110 Intermediate Accounting II Weeks 6 and 7Chi Iuvianamo100% (1)

- Sahil Kumar Resumef PDFДокумент1 страницаSahil Kumar Resumef PDFSahil KumarОценок пока нет

- Case Study ON Laxmi TransformersДокумент10 страницCase Study ON Laxmi TransformersAjay BorichaОценок пока нет

- Tutorial 3 QuestionsДокумент3 страницыTutorial 3 Questionsguan junyanОценок пока нет

- OPER8340 - Assignment #2 - F20Документ3 страницыOPER8340 - Assignment #2 - F20Suraj Choursia0% (1)

- Sum of The Digits Method - Rule 78Документ1 страницаSum of The Digits Method - Rule 78SeemaОценок пока нет

- Accounting For Trust and ControlДокумент19 страницAccounting For Trust and ControlJuan David Arias SuárezОценок пока нет

- Certified Trade Finance SpecialistДокумент4 страницыCertified Trade Finance SpecialistKeith Parker100% (2)

- Economic CartoonsДокумент39 страницEconomic Cartoonsmartivola100% (1)

- Nov 2018 RTP PDFДокумент21 страницаNov 2018 RTP PDFManasa SureshОценок пока нет

- MBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersДокумент20 страницMBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersAvijit GuinОценок пока нет

- Environmental Impact Assessment (Eia)Документ9 страницEnvironmental Impact Assessment (Eia)kashyap jyoti gohainОценок пока нет

- Business Plan Jan 05Документ18 страницBusiness Plan Jan 05Carolyn TaylorОценок пока нет

- Wall Street Self Defense Manual PreviewДокумент18 страницWall Street Self Defense Manual PreviewCharlene Dabon100% (1)

- Growth of Mutual Funds in India at Reliance Mutual Fund - BBA Finance Summer Training Project ..Документ56 страницGrowth of Mutual Funds in India at Reliance Mutual Fund - BBA Finance Summer Training Project ..Maysera TanveerОценок пока нет

- Final MR Notes (2Документ155 страницFinal MR Notes (2namrocksОценок пока нет

- Toate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreДокумент2 страницыToate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreOliviu ArsenieОценок пока нет

- BSP Interim Org ChartДокумент2 страницыBSP Interim Org ChartJerah Marie PepitoОценок пока нет

- Reaction Paper On MarxДокумент4 страницыReaction Paper On MarxRia LegaspiОценок пока нет

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (88)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryОт EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryРейтинг: 4 из 5 звезд4/5 (26)

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityОт EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityРейтинг: 5 из 5 звезд5/5 (1)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyОт EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (300)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (58)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldОт Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldРейтинг: 5 из 5 звезд5/5 (20)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouОт EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouРейтинг: 4.5 из 5 звезд4.5/5 (87)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- The Master Key System: 28 Parts, Questions and AnswersОт EverandThe Master Key System: 28 Parts, Questions and AnswersРейтинг: 5 из 5 звезд5/5 (62)

- Your Next Five Moves: Master the Art of Business StrategyОт EverandYour Next Five Moves: Master the Art of Business StrategyРейтинг: 5 из 5 звезд5/5 (799)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:От EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Рейтинг: 5 из 5 звезд5/5 (2)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizОт EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizРейтинг: 4.5 из 5 звезд4.5/5 (112)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessОт EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessРейтинг: 4.5 из 5 звезд4.5/5 (24)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeОт EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeРейтинг: 5 из 5 звезд5/5 (22)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayОт EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayРейтинг: 5 из 5 звезд5/5 (42)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyОт EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyРейтинг: 5 из 5 звезд5/5 (22)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursОт EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursРейтинг: 5 из 5 звезд5/5 (24)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsОт EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsРейтинг: 5 из 5 звезд5/5 (2)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleОт EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleРейтинг: 4.5 из 5 звезд4.5/5 (48)

- Faith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateОт EverandFaith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateРейтинг: 5 из 5 звезд5/5 (33)

- Anything You Want: 40 lessons for a new kind of entrepreneurОт EverandAnything You Want: 40 lessons for a new kind of entrepreneurРейтинг: 5 из 5 звезд5/5 (46)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthОт EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthРейтинг: 4.5 из 5 звезд4.5/5 (1026)