Академический Документы

Профессиональный Документы

Культура Документы

Customer Relationship Management: CRM Entails

Загружено:

Tanoj PandeyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Customer Relationship Management: CRM Entails

Загружено:

Tanoj PandeyАвторское право:

Доступные форматы

Customer Relationship Management

Peter drucker said `the purpose of the business is to create customer. Implied in his words and work is the importance of keeping those same customer and of growing the depth of their relationship with you. Customer relationship is a comprehensive approach for creating, maintaining and expanding customer realtionship.Customer relationship management is a broad approach for creating, maintaining and expanding customer relationships. CRM is the business strategy that aims to understand, anticipate, manage and personalize the needs of an organizations current and potential customers.CRM entails all aspects of interaction that a company has with its customer, whether it is sales or service-related. CRM is often thought of as a business strategy that enables businesses to: Retain customers through better customer experience. Attract new customer. Decrease customer management costs. Understand the customer.

CRM solutions provide you with the customer business data to help you provide services or products that your customers want, provide better customer service, cross-sell and up sell more effectively, close deals, retain current customers and understand who the customer is. Implementing a customer relationship management (CRM) solution might involve considerable time and expense. However, there are many potential benefits. A major benefit can be the development of better relations with your existing customers, which can lead to:

Increased sales through better timing by anticipating needs based on historic trends Identifying needs more effectively by understanding specific customer requirements Cross-selling of other products by highlighting and suggesting alternatives or enhancements Identifying which of your customers are profitable and which are not Technology and the Web has changed the way companies approach CRM strategies because advances in technology have also changed consumer buying behavior and offers new ways for companies to communicate with customers and collect data about them. With each new advance in technology -- especially the

proliferation of self-service channels like the Web and Smartphones -- customer relationships is being managed electronically.

From this structure of Crm we can say it is necessary of every organization to conduct Crm process. Today, many businesses such as banks, insurance companies, and other service providers realize the importance of Customer Relationship Management (CRM) and its potential to help them acquire new customers, retain existing ones and maximize their lifetime value. This structure includes 4 stages Marketing Sales Feedback Support

If we have product A which is newly introduced in market so the 1st step will be making the product popular among the public. So for that purpose we need to do marketing of that product. After doing marketing it will be obvious that product sales will take place, people will tend to buy the product so it is necessary to take feedback about taste, quality of product etc.It can be there will be complain about some defective product so in this step company should make a department who handles the complains and support the customer.

CUSTOMER RELATIONSHIP MANAGEMENT IN BANKING

INTRODUCTION

Today, many businesses such as banks, insurance companies, and other service providers realize the importance of Customer Relationship Management (CRM) and its potential to help them acquire new customers retain existing ones and maximize their lifetime value. At this point, close relationship with customers will require a strong coordination between IT and marketing departments to provide a long-term retention of selected customers. This paper deals with the role of Customer Relationship Management in banking sector and the need for Customer Relationship Management to increase customer value by using some analytical methods in CRM applications. Nowadays, many businesses such as banks, insurance companies, and other service providers realize the importance of Customer Relationship Management (CRM) and its potential to help them acquire new customers retain existing ones and maximize their lifetime value. Competition and globalization of banking services are forcing banks to be productive and profitable. To retain High Net Worth individuals, banks should focus strongly on relationship management with customers. Gone are the days when customers at a bank did not mind the long serpentine queues and waited patiently for their turn with a token in their hand. In todays Internet era, no one has the leisure to wait. In this context, online banking is assuming a great significance. Today, banking is more customer-centric, unlike the yester when it was transaction-centric. Banks are increasingly focusing on the premise that customers choose on the service provider who differentiates through quick and efficient service. Banks are well aware that their success is predominantly dependent on the CRM strategies adopted by them. Service providers have recognized that good CRM bonds customers with the organization for a longer term, resulting in increased revenues. With customers expectations becoming even more competitive, banks are coming up with a wide array of novel products and services every day. The challenge is for the banks to work towards ensuring that customers prefer their products and services over that of competing brands. The key to develop and nurture a close relationship with customers is by appreciating their needs and preferences and catering to their requirements. With the opening up of the economy, a number of private sector banks have joined the fray and are offering an innovative of products and services.

The goal of CRM is to manage all aspects of customer interactions in a manner that enables banks to maximize profitability from every customer. Increasing competition, deregulation, and the internet have all contributed to the increase in customer power. Customers, faced with an increasing array of banking products and services, are expecting more from banks in terms of customized offerings, attractive returns, ease of access, and transparency in dealings. To meet the challenging preferences of the customers and to stay ahead of competitors, bankers are bound to attract customers by providing a spectrum of services. Online banking, ATM banking and telebanking are just a few of them. Banks can enhance customer service by leveraging on technology, maintenance of efficient service delivery standards and business process reengineering. On their part, employees need to demonstrate certain service traits such as, putting on pleasing attire. At the end of the day, bankers should display a flair for cultivating a good relationship with customers through the mechanism of better customer service. Having understood the significance, it is prudent to plan for CRM in retail banks. To a large extent, the success of a CRM plan is dependent on the choice of the software. Towards this end, bankers should identify domain enterprise, credibility in the market, cost implementation and relationship with the vendor as factors on which vendor selection is based. The domains of software systems, multiply product database and tracking require specific CRM focus. Besides understanding the requirements for CRM implementations such as, the setting up of a CRM cell and conducting surveys at a periodic intervals to track their effectiveness, banks need to understand how CRM assists them n customer identification, acquisition and retention. As a part of the planning process, frontline executives in banks should thoroughly understand their organizational structure, infrastructure, as well as the product environment. In this context, the management initiatives for CRM assume importance. A top-down CRM focused approach that starts with the top management, percolating and permeating to all levels of the CRM is a necessity in the present business scenario. Initiatives, such as, introducing CRM audit by independent teams to identify the existing lacunae, and plugging the loopholes in the CRM strategy as per the recommendations of the audit report, are required to be adopted by the banks for reaping benefits. It is observed that banks lose their best clients to competitors due to a variety of reasons. The rationale behind losing their best clients to other service providers such as non-brokerage houses and mutual fund houses needs to be analyzed by banks. Experts opine that inefficient and improper service is one major reason. The remedies suggested by them are that banks should adopt customer relationship building approaches such as responding to complaints instantaneously, analyzing the attrition of the clients in a particular product, and rating of services across the network of branches, and the creation of a suggestion box to elicit the views and suggestion of their employees. Another dimension of the relationship building exercise is to obtain an electronic feedback from customers to understand the level of acceptance of existing products, which will facilitates in developing better products.

Banks can gain a competitive advantage from CRM by becoming low-cost players in the market, achieving operational efficiency and maintaining customer loyalty. The ability to predict the products that customers are likely to purchase over a period of time, increased productivity of managerial executives, sales and customer service staff, and streamlining of business processes are some of the benefits retail banks obtain by taking to successful management of their customer relationships. Implementing the right CRM tools can enhance customer satisfaction leading to business growth. CRM enables organizations to motivate customers to initiate revenuegenerating contacts. Several CRM issues such as, its effectiveness, application and challenges draw attention of the banking industry. Having witnessed the manner in which several global banks have benefited through CRM, the Indian retail banks too need to focus on and continuously invest in the customer relationship activities. The Indian banking scenario, which is still at an embryonic stage as far as the CRM domain is considered, needs to strive towards CRM implementation to meet the emerging demands of universal banking.

CRM & the Banking Industry

Customer Relationship Management (CRM) helps banks to identify, attract and retain the best and most profitable customer relationships. Banks use technology to develop insights as to the types of products and services that customers are most drawn to and the level of satisfaction that they expect. A good CRM system will allow a bank to perform segmentation analysis of its customer base for purposes of understanding its demographics, behavior, attitudes.

Significance

The significance of CRM to a bank is immense because it serves as a plan for future growth.

The CRM system should serve as the method used by a bank to gain insight into their existing and future customer base. It allows the bank to measure the amount of customer business that already exists along with the products and services that need to be offered in order to retain customers. For example, if a current customer maintains his large investment portfolio with a broker dealer, the future value of that customer to the bank is quite great if the customer can be convinced to move his holdings to the bank.

Function

The functions of CRM permit a bank to concentrate marketing efforts upon specific identifiable needs.

The functions contained within the CRM system must allow the bank to formulate its overall marketing and business strategy plan. This function is based upon calculations performed by the CRM platform that produces profitability by asset and liability type

followed by the complete drill down to all basic components such as profitability from deposits and loans. It should also serve as an indicator of the type of business that should be pursued based upon customer needs.

Features

The features of the bank CRM system should be flexible and allow the user the opportunity to explore existing and potential relationships.

The full or partial features of the CRM platform by level of responsibility should be available to all marketing staff, management and any other sales related area of the bank. The monitor screens for these staff members should indicate customers by bank officer, business transactions, total and itemized profitability, contact information and customer profile data, to name a few. The system should also provide "what if" scenarios that allow marketing staff the opportunity to develop personalized business plans for each customer. The CRM system provides transparency within the bank.

Considerations

The development and upkeep of CRM systems must be centralized and monitored for changes.

The CRM system of a bank must be constantly monitored for proper coding, business types, income and cost allocations along with rate analysis. For example, if the bank enters into a new line of business such as insurance, the CRM system must be updated and changed for the inclusion of a new business line along with all of the associated information necessary for functionality. Also, the establishment of new accounts and customers must be properly verified for the coding that is entered into the system. The CRM system is as good as its upkeep.

Potential

The future potential of CRM is geared toward the use of real time on line usage of customer information.

The future potential of CRM systems for banks will be based upon technological advances that allow for the use of real time data. For example, when customers use on line bill paying and charge cards, banks are able to view the life style and spending habits of their customers. This insight will allow banks to predict the future needs of their customers and the types of products that they need.

Present and Future of CRM in banking

Bank merely an organization it accepts deposits and lends money to the needy persons, but banking is the process associated with the activities of banks. It includes issuance of cheque and cards, monthly statements, timely announcement of new services, helping the customers to avail online and mobile banking etc. Huge growth of customer relationship management is predicted in the banking sector over the next few years. Banks are aiming to increase customer profitability with any customer retention. This paper deals with the role of CRM in banking sector and the need for it is to increase customer value by using some analytical methods in CRM applications. It is a sound business strategy to identify the banks most profitable customers and prospects, and devotes time and attention to expanding account relationships with those customers through individualized marketing, pricing, discretionary decision making. In banking sector, relationship management could be defined as having and acting upon deeper knowledge about the customer, ensure that the customer such as how to fund the customer, get to know the customer, keep in tough with the customer, ensure that the customer gets what he wishes from service provider and understand when they are not satisfied and might leave the service provider and act accordingly. CRM in banking industry entirely different from other sectors, because banking industry purely related to financial services, which needs to create the trust among the people. Establishing customer care support during on and off official hours, making timely information about interest payments, maturity of time deposit, issuing credit and debit cum ATM card, creating awareness regarding online and e-banking, adopting mobile request etc are required to keep regular relationship with customers. The present day CRM includes developing customer base. The bank has to pay adequate attention to increase customer base by all means, it is possible if the performance is at satisfactory level, the existing clients can recommend others to have banking connection with the bank he is operating. Hence asking reference from the existing customers can develop their client base. If the base increased, the profitability is also increase. Hence the bank has to implement lot of innovative CRM to capture and retain the customers. There is a shift from bank centric activities to customer centric activities are opted. The private sector banks in India

deployed much innovative strategies to attract new customers and to retain existing customers. Crm in banking sector is still in evolutionary stage, it is the time for taking ideas from customers to enrich its service. The use of CRM in banking has gained importance with the aggressive strategies for customer acquisition and retention being employed by the bank in todays competitive milieu. This has resulted in the adoption of various CRM initiatives by these banks.

The Importance of CRM in the Banking Sector

The banking industry has benefitted as much as any other from CRM.

Customer relationship management (CRM) has been as important to the banking industry at the start of the 21st century as it has been to any other industry. Many banks have used CRM tools to acquire more customers and to improve relationships with them.

Customer Service and Retention

More competition and increased regulation made it more difficult for banks to stand out from the crowd. However, the development of CRM gave proactive banks access to technology that helped them improve customer retention by using customer feedback to offer conveniences like ATMs and online banking. Banks can also use CRM tools to improve customer loyalty by using data collected through customer sign-ups, transactions and feedback processes.

Call Centers

Bank call centers use CRM solutions for various purposes. Cost-driven call centers use CRM to track call transactions and troubleshooting techniques to fine-tune the service resolution process. Metrics like average handle time and customer feedback ratings help bank call centers improve their customer support for retention. Profit-driven call centers also leverage CRM customer account records for add-on selling opportunities.

Sales

Sales have taken on more importance in banks with the evolution of CRM. Bundling of products and premier customer accounts are examples of techniques used by banks to build single-product customer accounts into full product suites including a range of financial services. With CRM software, bankers can easily see what products you currently use, what products you are eligible for and what the benefits are should you add the additional product or service.

Electronic customer relationship management (e-Crm)

Banking refers to mass-market banking where individual customers typically use banks for services such as savings and current accounts, mortgages, loans (e.g. personal, housing, auto, and educational), debit cards, credit cards, depository services, fixed deposits, investment advisory services (for high net worth individuals) etc. Before Internet era, consumers largely selected their banks based on how convenient the location of banks branches was to their homes or offices. With the advent of new technologies in the business of bank, such as Internet banking and ATMs, now customers can freely chose any bank for their transactions. Thus the customer base of banks has increased, and so has the choices of customers for selecting the banks. This is just the beginning of the story. Due to globalization new generations of private sector banks and many foreign banks have also entered the market and they have brought with them several useful and innovative products. Due to forced competition, public sector banks are also becoming more technology savvy and customer oriented. Thus, Non-traditional competition, market consolidation, new technology, and the proliferation of the Internet are changing the competitive landscape of the retail banking industry. Today retail banking sector is characterized by following:]

Multiple products (deposits, credit cards, insurance, investments and securities) Multiple channels of distribution (call center, branch, Internet and kiosk) Multiple customer groups (consumer, small business, and corporate) Today, the customers have many expectations from bank such as (i) Service at reduced cost (ii) Service Anytime Anywhere (iii) Personalized Service With increased number of banks, products and services and practically nil switching costs, customers are easily switching banks whenever they find better services and products. Banks are finding it tough to get new customers and more importantly retain existing customers.

Benefits of (e-Crm) Dyche(2001) described that e-Crm is the combination of software,hardware,application and management commitment.the banks now need to find out what to sell, whom to sell, when to sell, how to sell and how to be different to increase profitability. Banks need to differentiate themselves by adding value-added service, offerings and building long-term relationships with their customers through more customized products, enhanced value offerings, personalized services and increased accessibility. Banks also need to identify customers and products that would be most profitable and target customers with products that are most appropriate to their needs and serve the customers with greater cost efficiency. Banks also need to find out the avenues for increased customer satisfaction, which leads to increased customer loyalty. This may be explained better from two initiatives bank took in the past: Earlier what drove many bankers to invest in ATMs was the promise of reduced branch cost, since customers would use them instead of a branch to transact business. But what was discovered is that the financial impact of ATMs is a marginal increase in fee income substantially offset by the cost of significant increases in the number of customer transactions. The value proposition, however, was a significant increase in that intangible called customer satisfaction. The increase in customer satisfaction has translated to loyalty that resulted in higher customer retention and growing franchise value. Bankers invested in Internet banking, believing that the Internet was a lower-cost delivery channel and a way to increase sales. Studies have now shown, however, that the primary value of offering Internet banking services lies in the increased retention of highly valued customer segments. Again customer satisfaction drives the value proposition. Thus, banks need to retain existing customers with enhanced personalized services and products, which best suits their needs and satisfies them the most.

TECHNOLOGY AND CUSTOMER RELATIONSHIPS MANAGEMENT IN BANKING INDUSTRY.

Introduction

Nowadays, many businesses such as banks, insurance companies, and other service providers realize the importance of Customer Relationship Management (CRM) and its potential to help them acquire new customers retain existing ones and maximize their lifetime value. At this point, close relationship with customers will require a strong coordination between IT and marketing departments to provide a long-term retention of selected customers. This paper deals with the role of CRM in banking sector and the need for Customer Relationship Management to increase customer value. Use of the modern technology in urban areas will also go long way for customer relationships in banking services. Technology based service like credit card, debit card, ATM; anywhere banking, internet banking, and mobile banking are necessary for urban areas. This is because it enables customers to perform banking transactions at their convenience. Business hours of a bank are also an important factor for urban banking. Banking services for long hours, say 12 hours and seven days a week is preferred by urban customers. It is suitable to urban life style.

Read more: The Importance of CRM in the Banking Sector | eHow.com http://www.ehow.com/facts_6883122_importance-crmbanking-sector.html#ixzz1SnmiudB8

Read more: The Importance of CRM in the Banking Sector | eHow.com http://www.ehow.com/facts_6883122_importance-crmbanking-sector.html#ixzz1Snmbs6w7

Read more: CRM & the Banking Industry | eHow.com http://www.ehow.com/about_6636645_crm-banking-industry.html#ixzz1Sng4KkRI

Вам также может понравиться

- 08 Chapter 2Документ72 страницы08 Chapter 2Arshdeep KaurОценок пока нет

- Customer Relationship Management: A powerful tool for attracting and retaining customersОт EverandCustomer Relationship Management: A powerful tool for attracting and retaining customersРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Customer Relationship ManagementДокумент16 страницCustomer Relationship ManagementAjay SahuОценок пока нет

- Project On CRM in Banking SectorДокумент65 страницProject On CRM in Banking SectorMukesh Manwani100% (1)

- Chapter-3 Customer Relationship Management in BanksДокумент21 страницаChapter-3 Customer Relationship Management in BanksAryan SharmaОценок пока нет

- Customer Relationship Marketing: To inspire good customer service behaviour, we must be able to measure customer experiences meaningfully.От EverandCustomer Relationship Marketing: To inspire good customer service behaviour, we must be able to measure customer experiences meaningfully.Оценок пока нет

- Participation of Employees in Customer Relationship Marketing: A Case of Indian Banking SectorДокумент25 страницParticipation of Employees in Customer Relationship Marketing: A Case of Indian Banking SectorNarayana ReddyОценок пока нет

- Index: SR No TopicsДокумент30 страницIndex: SR No Topicsdeepakmaru92Оценок пока нет

- Ere PortДокумент7 страницEre PortPayal SharmaОценок пока нет

- Customer Relationship ManagementДокумент15 страницCustomer Relationship ManagementTanoj PandeyОценок пока нет

- INDUSTRY: Banking Project Title: CRM in Axis BankДокумент7 страницINDUSTRY: Banking Project Title: CRM in Axis BankArup BoseОценок пока нет

- Desing of The StudyДокумент9 страницDesing of The StudyCh TarunОценок пока нет

- CRM:Banking Industry.: Submitted To: Submitted By: Prof. Nivedita Roy Nishant Mendiratta 09BS0001463Документ23 страницыCRM:Banking Industry.: Submitted To: Submitted By: Prof. Nivedita Roy Nishant Mendiratta 09BS0001463nishant_mendiratta_1Оценок пока нет

- CRM in BankingДокумент2 страницыCRM in BankingKaushik SameerОценок пока нет

- Executive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankДокумент56 страницExecutive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankKevin DarrylОценок пока нет

- CRM in Bank With Reference To SbiДокумент45 страницCRM in Bank With Reference To Sbishaikhdilshaad12373% (30)

- "Customer Relationship Management": IntroductionДокумент43 страницы"Customer Relationship Management": IntroductionsudhirОценок пока нет

- Customer Relationship Management in Bhel Company HaridwarДокумент43 страницыCustomer Relationship Management in Bhel Company HaridwarsudhirОценок пока нет

- RM AssignДокумент5 страницRM AssignSanjeev ThakurОценок пока нет

- CRM in Banking Sector.Документ38 страницCRM in Banking Sector.desaikrishna24Оценок пока нет

- CRM Automobile IndustryДокумент8 страницCRM Automobile IndustryKashish MehtaОценок пока нет

- (CRM) in Axis BankДокумент42 страницы(CRM) in Axis Bankkrupamayekar55% (11)

- Nfluence A 360-Degree View of Every Customer: A) Sales Force AutomationДокумент4 страницыNfluence A 360-Degree View of Every Customer: A) Sales Force AutomationAvantika SaxenaОценок пока нет

- CRM in Axis Bank - Stage 2 Mid-Review of The ProjectДокумент7 страницCRM in Axis Bank - Stage 2 Mid-Review of The ProjectShalini MahawarОценок пока нет

- Report On Use of Customer Relationship Management in BangladeshДокумент13 страницReport On Use of Customer Relationship Management in BangladeshSadi AminОценок пока нет

- Industry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaДокумент12 страницIndustry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaBhakti GuravОценок пока нет

- CRM Project: Submitted To: Submitted byДокумент12 страницCRM Project: Submitted To: Submitted byAshishОценок пока нет

- CRM FinalДокумент21 страницаCRM FinalHerleen KalraОценок пока нет

- Customer Relationship Management in Hotel IndustryДокумент66 страницCustomer Relationship Management in Hotel IndustryJas77794% (33)

- Customer Relationship Management (CRM) in Overall Banking Sector of BangladeshДокумент11 страницCustomer Relationship Management (CRM) in Overall Banking Sector of BangladeshAsifHasanОценок пока нет

- Customer Relationship ManagementДокумент66 страницCustomer Relationship Managementrocky gamerОценок пока нет

- Major Project ReportДокумент48 страницMajor Project Reportinderpreet kaurОценок пока нет

- Customer Relationship Management Project ReportДокумент19 страницCustomer Relationship Management Project ReportLokesh Krishnan100% (1)

- Chapter - I: 2010 Customer Relationship ManagementДокумент68 страницChapter - I: 2010 Customer Relationship ManagementShamil VazirОценок пока нет

- (Markenting) CRM SBICAP SECURITIESДокумент73 страницы(Markenting) CRM SBICAP SECURITIESsantoshnagane72Оценок пока нет

- Customer Relationship ManagementДокумент45 страницCustomer Relationship ManagementParag MoreОценок пока нет

- Customer Relationship Management in Hotel IndustryДокумент66 страницCustomer Relationship Management in Hotel IndustryFreddie Kpako JahОценок пока нет

- Customer Relationship Management - STДокумент10 страницCustomer Relationship Management - STDivyansh SinghОценок пока нет

- Business Research Methods Assignment: BY G.Deepthi 2T1-16 TPSДокумент6 страницBusiness Research Methods Assignment: BY G.Deepthi 2T1-16 TPSvinodmeghanaОценок пока нет

- 8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Документ4 страницы8 Yatish Joshi 1936 Research Communication VSRDIJBMR June 2013Rajni TyagiОценок пока нет

- Project 2k19Документ38 страницProject 2k19Abhijit SinghОценок пока нет

- CRM Project, SheratonДокумент16 страницCRM Project, SheratonSonu BansalОценок пока нет

- What Is Customer Relationship Management?Документ41 страницаWhat Is Customer Relationship Management?moregauravОценок пока нет

- Customer Relationship ManagementДокумент11 страницCustomer Relationship Managementdev_dbcОценок пока нет

- Customer Relationship ManagementДокумент58 страницCustomer Relationship ManagementMrinal BankaОценок пока нет

- Customer Relationship Management: Shikha Sehgal Rajesh Punia Tej Inder Singh Yogesh DbeyДокумент44 страницыCustomer Relationship Management: Shikha Sehgal Rajesh Punia Tej Inder Singh Yogesh DbeyyddubeyОценок пока нет

- Promotion Strategies of Customer Relations ManagementДокумент16 страницPromotion Strategies of Customer Relations ManagementRajeev ChinnappaОценок пока нет

- Final Capstone CRM - ReportДокумент39 страницFinal Capstone CRM - ReportakashОценок пока нет

- CRM The Most Valuable Component of Banking: Dr. Sujata Rao, Jinali PatelДокумент7 страницCRM The Most Valuable Component of Banking: Dr. Sujata Rao, Jinali PatelAshish KumarОценок пока нет

- MBA (BI) III Sem CRM in Banks Unit-3Документ28 страницMBA (BI) III Sem CRM in Banks Unit-3maheshgutam8756Оценок пока нет

- CRM in The Automobile Industry: Submitted By: Jatin Patel (75) Dhaval Goriya (29) Neha Shinde (103) Gumansinh RajputДокумент7 страницCRM in The Automobile Industry: Submitted By: Jatin Patel (75) Dhaval Goriya (29) Neha Shinde (103) Gumansinh RajputGumansinh RajputОценок пока нет

- Customer Relationship ManagementДокумент4 страницыCustomer Relationship Managementg peddaiahОценок пока нет

- A Study On Customer Relationship Management Practices in Banking SectorДокумент11 страницA Study On Customer Relationship Management Practices in Banking SectorStuti SrivastavaОценок пока нет

- Customer Relationship ManagementДокумент41 страницаCustomer Relationship Managementgoodwynj100% (1)

- Production Management Kari Session PlanДокумент5 страницProduction Management Kari Session PlanTanoj PandeyОценок пока нет

- CrudeДокумент2 страницыCrudeTanoj PandeyОценок пока нет

- Nelson Mandela LeadershipДокумент1 страницаNelson Mandela LeadershipTanoj PandeyОценок пока нет

- Analytical & Logical ReasoningДокумент8 страницAnalytical & Logical Reasoningkanishqthakur100% (2)

- Challenges Faced by Airlines SectorДокумент2 страницыChallenges Faced by Airlines SectorTanoj PandeyОценок пока нет

- Former Tata Group Chairman Ratan Tata Said The GroupДокумент4 страницыFormer Tata Group Chairman Ratan Tata Said The GroupTanoj PandeyОценок пока нет

- Trading Forex What Investors Need To KnowДокумент24 страницыTrading Forex What Investors Need To KnowTanoj PandeyОценок пока нет

- Hot ItДокумент26 страницHot ItTanoj PandeyОценок пока нет

- Gurgaon: Indiatimes The Economic TimesДокумент6 страницGurgaon: Indiatimes The Economic TimesTanoj PandeyОценок пока нет

- Marketing Strategy of Icici Bank': Tanoj PandeyДокумент5 страницMarketing Strategy of Icici Bank': Tanoj PandeyTanoj PandeyОценок пока нет

- Customer Relationship ManagementДокумент15 страницCustomer Relationship ManagementTanoj PandeyОценок пока нет

- Capital MarketsДокумент7 страницCapital MarketsTanoj PandeyОценок пока нет

- Introduction To Banking Sector: Marketing Strategies of ICICI BankДокумент32 страницыIntroduction To Banking Sector: Marketing Strategies of ICICI BankTanoj PandeyОценок пока нет

- Coffee Industry in IndiaДокумент3 страницыCoffee Industry in IndiaTanoj PandeyОценок пока нет

- Centurion Bank of PunjabДокумент2 страницыCenturion Bank of PunjabTanoj PandeyОценок пока нет

- G 20Документ2 страницыG 20Tanoj PandeyОценок пока нет

- Punjab and Sind Bank Services of Risk ManagementДокумент12 страницPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- ExportДокумент28 страницExportNagarjun AithaОценок пока нет

- Average Daily Traffic On NH - 42 (2011)Документ25 страницAverage Daily Traffic On NH - 42 (2011)Anek AgrawalОценок пока нет

- Answer Legal FormsДокумент10 страницAnswer Legal FormsLean-Klair Jan GamateroОценок пока нет

- Romualdez Vs Civil Service CommissionДокумент1 страницаRomualdez Vs Civil Service CommissionFrancis Gillean OrpillaОценок пока нет

- Trust ReceiptsДокумент23 страницыTrust ReceiptskarenkierОценок пока нет

- FT Business EducationДокумент76 страницFT Business EducationDenis VarlamovОценок пока нет

- JP Morgan Chase Sues To Get Mortgage Loan Files Back From Ben Ezra... Ben Ezra Claims Chase Did Not Pay Its BillДокумент59 страницJP Morgan Chase Sues To Get Mortgage Loan Files Back From Ben Ezra... Ben Ezra Claims Chase Did Not Pay Its Bill83jjmackОценок пока нет

- Hkicl - Disclosure For HKD ChatsДокумент40 страницHkicl - Disclosure For HKD ChatsLawrence TamОценок пока нет

- Fema Add CHДокумент54 страницыFema Add CHMukesh DholakiaОценок пока нет

- Balance SheetДокумент2 страницыBalance SheetAbdul Samad ButtОценок пока нет

- Prepaid Instruments in India Feb 27Документ11 страницPrepaid Instruments in India Feb 27nish21inОценок пока нет

- Matrix Assessment of Pan-European Banks Capital Positions Relating To Basel III: Jan. '11Документ98 страницMatrix Assessment of Pan-European Banks Capital Positions Relating To Basel III: Jan. '11creditplumberОценок пока нет

- Guest Accounting, VTL, Weekly Bill BHM 2Документ4 страницыGuest Accounting, VTL, Weekly Bill BHM 2vickie_sunnie50% (2)

- T03 - Working Capital FinanceДокумент40 страницT03 - Working Capital FinanceJesha JotojotОценок пока нет

- MRAT - Annual Report - 2018 PDFДокумент147 страницMRAT - Annual Report - 2018 PDFdamas anggaОценок пока нет

- RBI Grade B Exam Preparation StrategyДокумент17 страницRBI Grade B Exam Preparation StrategysahilОценок пока нет

- Client AgreementДокумент10 страницClient AgreementAnonymous 4B1M0nwvvОценок пока нет

- Problem 7 - Group 1Документ8 страницProblem 7 - Group 1Francine Torres100% (4)

- Analyze The Roles of International Payment in An Open EconomyДокумент22 страницыAnalyze The Roles of International Payment in An Open EconomyNgô Giang Anh ThưОценок пока нет

- The World Bank: IBRD & IDA: Working For A World Free of PovertyДокумент28 страницThe World Bank: IBRD & IDA: Working For A World Free of PovertyManish TiwariОценок пока нет

- F06084145 PDFДокумент5 страницF06084145 PDFSharath rОценок пока нет

- Visa ReceiptДокумент1 страницаVisa ReceiptAnonymous Dkc838Оценок пока нет

- Guthrie-Jensen - Corporate ProfileДокумент8 страницGuthrie-Jensen - Corporate ProfileRalph GuzmanОценок пока нет

- NIC Account BenefitsДокумент4 страницыNIC Account BenefitsAnkit UpretyОценок пока нет

- IAE Student Prospective Guide San DiegoДокумент15 страницIAE Student Prospective Guide San DiegoNatalia Díaz GarcíaОценок пока нет

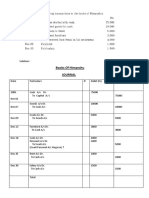

- Books of Himanshu JournalДокумент4 страницыBooks of Himanshu Journalrakesh19865Оценок пока нет

- Assignment No 1 CBLДокумент3 страницыAssignment No 1 CBLsingh rajnishОценок пока нет

- AGENCY, Doctrine of Apparent Authority GR 227990Документ2 страницыAGENCY, Doctrine of Apparent Authority GR 227990Gerard LeeОценок пока нет

- 02 Varun Nagar - Case HandoutДокумент2 страницы02 Varun Nagar - Case Handoutravi007kant100% (1)

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherОт EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherОценок пока нет

- Fascinate: How to Make Your Brand Impossible to ResistОт EverandFascinate: How to Make Your Brand Impossible to ResistРейтинг: 5 из 5 звезд5/5 (1)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoОт Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoРейтинг: 5 из 5 звезд5/5 (25)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItОт EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItРейтинг: 4.5 из 5 звезд4.5/5 (152)

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedРейтинг: 3 из 5 звезд3/5 (6)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffОт Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffРейтинг: 5 из 5 звезд5/5 (19)

- Yes!: 50 Scientifically Proven Ways to Be PersuasiveОт EverandYes!: 50 Scientifically Proven Ways to Be PersuasiveРейтинг: 4 из 5 звезд4/5 (154)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedОт EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedРейтинг: 4.5 из 5 звезд4.5/5 (5)

- Storytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsОт EverandStorytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsРейтинг: 4.5 из 5 звезд4.5/5 (72)

- Summary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedРейтинг: 5 из 5 звезд5/5 (2)

- Understanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationОт EverandUnderstanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationРейтинг: 4 из 5 звезд4/5 (22)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleОт EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleРейтинг: 4.5 из 5 звезд4.5/5 (48)

- How to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorОт EverandHow to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorРейтинг: 4.5 из 5 звезд4.5/5 (33)

- Jab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldОт EverandJab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Pre-Suasion: Channeling Attention for ChangeОт EverandPre-Suasion: Channeling Attention for ChangeРейтинг: 4.5 из 5 звезд4.5/5 (278)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeОт EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeРейтинг: 4 из 5 звезд4/5 (88)

- Summary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisОт EverandSummary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisРейтинг: 5 из 5 звезд5/5 (10)

- Ca$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneОт EverandCa$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneРейтинг: 5 из 5 звезд5/5 (114)

- Visibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessОт EverandVisibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessРейтинг: 4.5 из 5 звезд4.5/5 (7)

- The Importance of Being Earnest: Classic Tales EditionОт EverandThe Importance of Being Earnest: Classic Tales EditionРейтинг: 4.5 из 5 звезд4.5/5 (44)

- Scientific Advertising: "Master of Effective Advertising"От EverandScientific Advertising: "Master of Effective Advertising"Рейтинг: 4.5 из 5 звезд4.5/5 (164)

- Summary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisОт EverandSummary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisРейтинг: 5 из 5 звезд5/5 (4)

- Summary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (6)

![The Inimitable Jeeves [Classic Tales Edition]](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711420909/198x198/ba98be6b93/1712018618?v=1)