Академический Документы

Профессиональный Документы

Культура Документы

Shell Puts Small-Scale Technology To Work at Elba Island

Загружено:

1garchИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shell Puts Small-Scale Technology To Work at Elba Island

Загружено:

1garchАвторское право:

Доступные форматы

www.poten.

com

August 21, 2013

Shell Puts Small-Scale Technology To Work At Elba Island

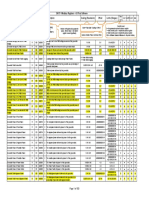

While Chenieres Sabine Pass continues to garner headline after headline touting it as the first liquefaction project to export from the US Lower 48, Shell and Kinder Morgan are positioning themselves to possibly get across the finish line first at their Elba Island project in Georgia. The two energy companies are aiming for the 1.5 MMt/y first phase to be in commercial service by December 2015 and the second 1 MMt/y phase producing LNG the same time the following year. The ambitious timeline hinges on the projects decision to sidestep the US Department of Energys non-free trade agreement license process, meaning all production would be sent to destinations that have trade agreements in place with the US. Shell will take all of the liquefaction capacity in the project, as well as a 49% equity stake, while the US pipeline giant will retain a controlling interest and operate the facility located outside of Savannah. Kinder Morgan Elba Island Goes Small-Scale inherited Elba Island after its acquisition of fellow midstream firm El Paso in 2012. Elba Islands time advantage also rests in its plans to deploy Shells small-scale LNG technology at the Georgia location. Shells Moveable Modular Liquefaction System is a liquefaction, gas processing and treating unit that can produce up to 0.25 MMt/y. Modules can also be easily

Source: Poten & Partners

Email: lng@poten.com

NEW YORK

LONDON PERTH ATHENS HONG KONG SINGAPORE

GUANGZHOU

disassembled and deployed to multiple locations. The MMLS units are at the heart of Shells continental strategy to fill North American highways with gas-burning vehicles and waterways with LNGpowered vessels. However, Elba Island would represent the largest deployment of the MMLS design. Shell plans to string together six MMLS units for the first phase of the project and another four modules in the second phase for a cumulative 2.5 MMt/y plant. The units are scheduled to be built in the US, likely at a site in Texas. CB&I is undertaking front-end engineering and design work, which represents a scaled-down job compared to other US LNG export projects since Shell has the liquefaction units already devised. Before Elbas start up, the first MMLS application in North America is scheduled for Shells Jumping Pound gas complex, which is the epicenter for the companys so-called Green Corridor that will provide LNG fuelling stations throughout the Canadian province of Alberta. Jumping Pound, west of Calgary, is already gathering up to 7.7 MMcm/d of gas production from Shells Alberta acreage for processing. A portion of the methane will used for LNG production, which will be taken by truck to retail filling stations operated by Flying J and sold to vehicles with gas-consuming engines. Shell is expected to start commercial operations in Alberta next year. The company also plans to install 0.25 MMt/y MMLS units at its Sarnia refining and chemical complex in Ontario and its petrochemical plant in Geismar, Louisiana after making a final investment decision on both ventures in March. Liquefaction at the two locations will be primarily used for marine fuel applications. The Gulf Coast Corridor will use LNG from Geismar as a jumping off point for bunkering around the regions busy waterways. The Sarnia location is envisioned to be a hub for LNG marine services throughout the Great Lakes. While Shell awaits the commercial start of its first MMLS, other small-scale firms have pushed ahead with LNG fuelling plans in the US. But most of them are previous peak shaving units, such as Pivotal LNGs Chattanooga, Tennessee and Trussville, Alabama facilities, that are being used as LNG fuel distribution units. Natural gas filling station operators, Blu LNG, which is majority owned by Chinas ENN Energy, has a handful of LNG stations in the US with aspirations for 50 locations by the end of the year. The US company Clean Energy also has about a dozen LNG stations around the

Email: lng@poten.com

NEW YORK

LONDON PERTH ATHENS HONG KONG SINGAPORE

GUANGZHOU

country. The only greenfield liquefier in the US that could match the size of a MMLS is the Floridian Gas Storage project in southwest Florida, which is fully permitted by the Federal Energy Regulatory Commission and is targeting possible ISO-container exports. Shells MMLS units boast a flexible processing technology that can take unconventional, flared, associated and pipeline gas. Feed gas for the Elba Island facility will come from the US pipeline market after Kinder Morgan successfully reverses the 36-inch Elba Express pipeline by installing additional compressor capacity at the Hartwell station. The Express line intersects with the Southern Natural Gas system, which brings gas across the southeast US from Texas, and ends at the massive Transco line where it straddles the pipelines Zone 4 and Zone 5 regions. Elba is also linked to the 167-mile Cypress pipeline that takes gas from the terminal straight south into northeast Florida. BG has the capacity on 0.4 Bcf/d pipeline and still has supply obligations in Florida. This is why deliveries continue to the Savannah receiving terminal, most recently a discharge from the Murwab on March 17. BG shares capacity in Elbas import terminal with Shell. Shell is aiming to take all of its capacity at Elba to free trade countries, allowing the project to move forward without a DOE nonFTA license. The anticipation is that 1.5 MMt/y of offtake in Elbas first phase would displace Shells monthly Q-Flex deliveries into the Altamira terminal in Mexico and allow the Anglo-Dutch giant to send those volumes to higher-priced markets. The company is an import capacity holder in the Gas de Litoral joint venture with Total and Mexico has free trade status with the US. The Hagueheadquartered firm had been keen to take a larger US export position, but backed off since it lost out on the second and third trains at Freeport LNG (see LNGWM, Jan 13). Shells acquisition of Repsols LNG assets in February boosted its supply stake in the Americas with substantial offtake at Trinidads Atlantic LNG and Peru LNG, leaving its export aspirations in North America to its LNG Canada project. Kinder Morgans other US LNG asset, the proposed 10 MMt/y Gulf LNG export venture in Pascagoula, Mississippi has progressed at a measured pace compared to its Elba Island venture. Kinder Morgans notoriously conservative corporate philosophy has kept

Email: lng@poten.com

NEW YORK

LONDON PERTH ATHENS HONG KONG SINGAPORE

GUANGZHOU

the countrys largest pipeline firm from taking on risk that other liquefaction sponsors have been forced to do. Kinder Morgan decided to let the two tanks at the brownfield Pascagoula site warm up as the heating value of the gas in storage elevated above US pipeline quality limits. Gulf LNG has been in discussions with liquefaction off takers and has memorandums of understanding in place. But the company has not initiated pre-FEED yet as it has balked at investing capital that is determinant on an uncertain DOE non-FTA approval process. Gulf LNG is No. 12 on DOEs non-FTA assessment list, one spot behind Elba Island, a position that might not get a serious look from the government for at least another year. Gulf LNGs marketing plan is to have a FTA buyer for at least one 5 MMt/y train to loosen DOEs grip on the projects viability.

This is an issue of Potens monthly LNGOpinion. Please click here to subscribe to this report.

Email: lng@poten.com

NEW YORK

LONDON PERTH ATHENS HONG KONG SINGAPORE

GUANGZHOU

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- L23 Interaction Between AC-DC SystemsДокумент55 страницL23 Interaction Between AC-DC Systemssin_laugh100% (9)

- IJEDRCP1402017Документ4 страницыIJEDRCP1402017anas maraabaОценок пока нет

- Rotary Cam SwitchesДокумент5 страницRotary Cam Switchesasalasv65Оценок пока нет

- Related StudiesДокумент3 страницыRelated StudiesAeron jay ZuelaОценок пока нет

- With Nano Thermo Technology!: TO Heat Transfer AND HydromxДокумент9 страницWith Nano Thermo Technology!: TO Heat Transfer AND HydromxSoundar rajanОценок пока нет

- Eadm - Iv - I Eee PDFДокумент125 страницEadm - Iv - I Eee PDFLakshmangowda Harshith100% (1)

- 0Dnlqjkljktxdolw/Iuhvkzdwhue/ Xwlolvlqjzdvwhkhdwiurpwkhglhvho HQJLQHДокумент2 страницы0Dnlqjkljktxdolw/Iuhvkzdwhue/ Xwlolvlqjzdvwhkhdwiurpwkhglhvho HQJLQHAlexanderОценок пока нет

- An Integer Linear Programming Based Optimization For Home Demand-Side Management in Smart GridДокумент5 страницAn Integer Linear Programming Based Optimization For Home Demand-Side Management in Smart Gridkumar_ranjit6555Оценок пока нет

- GSR April 2022Документ32 страницыGSR April 2022Abhi PasupulatiОценок пока нет

- 0S-ACRP1xx REV01Документ2 страницы0S-ACRP1xx REV01Cidi Com100% (1)

- Motor Starter Coordination Guide To Selection Right Component of Merlin GerinДокумент15 страницMotor Starter Coordination Guide To Selection Right Component of Merlin GerinCu Mi DayОценок пока нет

- Engine Starter Relay: FeaturesДокумент2 страницыEngine Starter Relay: FeaturesBishoy SaadОценок пока нет

- Sanmim Economic SeriesДокумент6 страницSanmim Economic SeriesImran SayeedОценок пока нет

- Induction Motor 4Документ83 страницыInduction Motor 4ankit407Оценок пока нет

- Proudly Launching Our Energy Saving Precision ChillerДокумент13 страницProudly Launching Our Energy Saving Precision ChillerGem OrionОценок пока нет

- 213 Hobart 2300 August 2014Документ2 страницы213 Hobart 2300 August 2014Le SonОценок пока нет

- BillДокумент1 страницаBillM Hassan BashirОценок пока нет

- Kinetic and Potential Energy HW 1 AnswersДокумент3 страницыKinetic and Potential Energy HW 1 AnswersJustine KyleОценок пока нет

- Sarel Sysclad Primary Switchgears 12 175kvДокумент16 страницSarel Sysclad Primary Switchgears 12 175kvtatacpsОценок пока нет

- SFC On Gas Power PlantДокумент9 страницSFC On Gas Power PlantFauzan PhoneОценок пока нет

- Thermal Design Well Head Natural GasДокумент3 страницыThermal Design Well Head Natural GaskodeesОценок пока нет

- Internal Combustion EngineДокумент13 страницInternal Combustion EngineNAITAJIОценок пока нет

- REQUIRED REGISTER LIST - Silverhawk Generating Station (Analog Conversion)Документ2 страницыREQUIRED REGISTER LIST - Silverhawk Generating Station (Analog Conversion)Cedric SINDJUIОценок пока нет

- MPE 371 CH 1 - Air Standard Cycles-1Документ27 страницMPE 371 CH 1 - Air Standard Cycles-1Abraham MugambiОценок пока нет

- Thesis On Zero Energy BuildingДокумент7 страницThesis On Zero Energy BuildingWhitePaperWritingServicesCanada100% (2)

- GF SivaДокумент21 страницаGF SivaMohanRaju VenkatRajuОценок пока нет

- Development of A Hydro-Mechanical Hydraulic Hybrid Drive Train With Independent Wheel Torque Control For An Urban Passenger VehicleДокумент11 страницDevelopment of A Hydro-Mechanical Hydraulic Hybrid Drive Train With Independent Wheel Torque Control For An Urban Passenger Vehicleمحمد جوادОценок пока нет

- Remote Visulisation of Synchroscope Using Synchrophasors CBIP WE Oct 2020Документ5 страницRemote Visulisation of Synchroscope Using Synchrophasors CBIP WE Oct 2020chandan8240000Оценок пока нет

- EEObjective Q4Документ39 страницEEObjective Q4Ven Jay Madriaga TabagoОценок пока нет

- Ds Ylm72cell HSF Smart-36b 40mm Eu en 20171031 v04Документ2 страницыDs Ylm72cell HSF Smart-36b 40mm Eu en 20171031 v04danilohmОценок пока нет