Академический Документы

Профессиональный Документы

Культура Документы

Cotton Fibre

Загружено:

ankit161019893980Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cotton Fibre

Загружено:

ankit161019893980Авторское право:

Доступные форматы

COTTON FIBRE

The sub-group on Cotton, which was constituted under the National Fibre Policy, has enunciated policy recommendations for development of the fibre. Cotton is one of the most important and widely cultivated cash crops across the world. It is also one of the most important commercial crops cultivated in India. Cotton has around 59% share in the raw material consumption basket of the Indian textile industry. Thus, it plays a major role in sustaining the livelihood of an estimated 5.8 mn cotton farmers and about 40-50 mn people engaged in related activities such as cotton processing and trade. The world cotton yield increased from 613 kg/ha in 2000-01 (season beginning August 1) to 797 kg/ha in 2012-13 (season beginning August 1). India has the largest cotton cultivated area that constitutes around 30% of the global cotton area. Domestic cotton production has increased substantially to 290.01 lakh bales in 2008-092 from 30.6 lakh bales in 1950-51. Cotton yield in India improved remarkably to around 524 kg/ha in 2008-09 from 278 kg lint/ha during 2000-01. However, cotton productivity is still lower in India when compared with the world average yield of 767 kg/ha.

COTTON FIBRE SCENARIO: WORLD

World cotton production declined for the second consecutive year in 2008-09 by 10%. In 2007/083, the production levels had dropped by around 2%. In fact, the world cotton production at 23.5 mn tonnes during 2008-09 is the lowest since 2004-05. The reduction in world cotton area for the second consecutive season was one of the reasons for the fall in production; a significant area under cotton cultivation was shifted to grains and oilseed production because these earned more attractive prices than cotton. In the last few years world cotton harvested area declined at a sustained rate. According to the ICAC data, area under cotton cultivation shrank to 30.66 mn ha (estimated) in 2008-09 from 32.84 million ha (estimated) in 2007-08. During 2008-09, cotton yield also registered a decline compared to the previous year primarily on account of unfavourable weather conditions across the world. After witnessing sustained improvement since 2000-01, the world cotton yield is forecasted to have moderated to 767 kg/ha in 2008-09 from a peak of 797 kg/ha in 2007-08. World cotton yield has increased by around 17.8% between 2003-04 and 2008-09 mainly due to extensive use of BT cotton varieties across the globe. Genetically modified (GM) seeds constituted around 48% of the total harvested area globally in 2008-09. During 2008-09, almost all the major cotton producing countries witnessed a decline (y-o-y) in cotton production, except Pakistan and Australia. China, India, USA, Pakistan, Brazil and Uzbekistan accounted for almost 85% of the world cotton production in 2008-09.

Even world cotton imports and exports declined during 2008-09. Exports from major exporting countries such as the US, India and Uzbekistan fell and caused world exports to decline by almost 25.36% in 2008-09. Imports from some of the major importing countries such as China, Turkey and Pakistan also declined.

COTTON FIBRE SCENARIO: INDIA

Cotton production in India has more than doubled in a span of 7 years. Cotton production reached a peak of 307.0 lakh bales during 2007-08 from 140.0 lakh bales in 2000-01 but it fell to 290.0 lakh bales in 2008-09. The gradual increase in cotton production over the years can largely be attributed to the phenomenal increase in the yield of cotton. The introduction of BT cotton seeds has played a catalytic role in enhancing cotton production in India. The consumption of cotton by the textile mills and small-scale spinning units has witnessed sustained increase since 2001-02, except in 2002-03 when the total domestic consumption declined. Domestic consumption of cotton fibre increased at a CAGR of 7.0% rising from 168.8 lakh bales in 2002-03 to 236.9 lakh bales during 2007-08, and fell to 229 lakh bales in 2008-09. Cotton consumption has witnessed a sustained increase since 2003-04 onwards due to growing demand for Indian textiles and subsequently, there has been considerable expansion and modernisation of the textile mills. Even though the Indian cotton consumption has increased at a rapid pace in the last few years, it has not kept pace with the growth in domestic cotton production, which has led to a surplus of production since 2003-2004. As a result, India has emerged as one of the top exporters of raw cotton in the world. Currently, India is the second-largest exporter of cotton after the US. In order to boost cotton exports, the Indian government liberalised raw cotton exports since July 2001, doing away with the system of allocation of cotton export quota in favour of different agencies and traders. Over the years, Indias cotton export has been growing at an impressive rate, except for FY05, when exports dipped. In FY08, India exported 88.5 lakh bales of cotton. Indias exports during 2008-09 have been estimated to have declined to 35 lakh bales.

FUTURE OUTLOOK OF INDIAS COTTON PRODUCTION AND CONSUMPTION

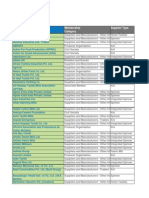

Three different scenarios were examined to arrive at the future projection of the demand-supply scenario for cotton fibre. Cotton production largely depends on the area under cotton production and productivity. Considering the issues pertaining to food security and land pressures, the area under cotton production is assumed to be largely constant at the current level. Thus, the future production is expected to be driven by improvement in cotton yield. Yield is assumed to grow at alternate rates of 4.0% and 4.7%. Additionally, the Directorate of Cotton Development, Mumbai, has also made projections for cotton fibre production. The estimates made by the directorate are closer to our estimate that is based on an assumption of 4.7% increase in yield per hectare till the terminal year, 2020. The projections for consumption of cotton fibre have been arrived at through projections for

cotton fabric consumption and through use of conversion ratios. The final scenario for 2020 is encapsulated in the table below.

Yield growth assumed at 4.7% (in lakh bales)

Year

Production

Consumption

Surplus

2019-20

483

413

70

MAJOR IMPLICATIONS

In the years to come, the robust increase in domestic consumption is likely to drive down the surplus in cotton. Therefore, it is essential that there is greater focus on enhancing domestic production of cotton significantly to cater to the expected increase in domestic demand.

Focus on Enhancing Production:

Given that the area under cotton cultivation in some of the major cotton producing countries such as the US has declined in the last few years, India has an opportunity to emerge as a leading exporter of raw cotton. Moreover, cotton remains Indias strength in the global T&C markets. In the coming years, this strength is expected to accelerate as the area and production of cotton has been declining in China and the US. Over the past few years, the textile processing base has been increasingly shifting to emerging countries. Thus, by increasing cotton production and strengthening the textile value chain India will be able to capture the rapidly-evolving growth opportunities in the cotton industry.

Focus on higher investments in textile value chain

Given that the production of cotton fibre, as well as MMF fibre and filament yarn is expected to witness a substantial increase in the next 10 years, the installed capacity for value addition under the textile value chain also needs to witness substantial improvement to absorb the expected increase in fibre production. It is estimated that investments worth Rs 176,510 crore will be needed during FY10FY20 for creating the required capacity along the textile value chain on the basis of estimate of the

increased fibre production4. The underlying assumptions to arrive at investment estimates are based on CITIs Vision for Indian Textile and Clothing Industry 2007 -2012, Report of working group on Textiles & Jute industry for the eleventh five year plan (Ministry of textile) and inputs from major industry stake-holders, who are members of the sub-group.

Exhibit II: Investment requirement till 2020 (Rs cr) Spinning Weaving Knitting Processing Garmenting Grand total 63,525 38,485 12,499 26,695 35,305 1,76,510

INDIAN COTTON FIBRE SCENARIO

Cotton is one of the most important and widely cultivated cash crops across the world. Cotton accounts for around 40% of the total global fibre production, making it one of the most important fibres of the world. Cotton is also one of the most important commercial crops cultivated in India. In the raw material consumption basket of the Indian textile industry, the proportion of cotton is around 59%. Thus, it plays a major role in sustaining the livelihood of an estimated 5.8 mn cotton farmers and 4050 mn people engaged in related activities such as cotton processing and trade.

In the last few years, the area under cotton cultivation across the world has remained more or less stagnant. However, the world cotton production has witnessed substantial increase on account of sharp rise in cotton yield. World cotton yield increased from 613 kg/ha in 2000-01 (season beginning August 1) to 797 kg/ha in 2007-08 (season beginning August 1). Nonetheless, the cotton yield reduced to 767 kg/ha in 2008-09 (season beginning August 1).

According to ICAC data, India has the largest cotton cultivated area, which forms around 30% of the global cotton area. Domestic cotton production increased substantially to 290.0 5 lakh bales in 2008096 from 30.6 lakh bales in 1950-51. Currently, India is the second-largest cotton producing country in the world, after China and contributes about 21% to global cotton production. Cotton yield in India has improved remarkably to around 524 kg/ha in 2008-09 from 278 kg lint/ha during 2000-01. However, cotton productivity in India is still lower as compared with the world average yield of 767 kg/ha.

COTTON CULTIVATION IN INDIA

Though cotton is inherently a semi Xerophytes perennial crop, it is cultivated as an annual/ seasonal crop. In India cotton is cultivated in three diverse agro-ecological zones, Northern zone, Central zone and Southern zone. Northern zone comprises Punjab, Haryana and Rajasthan, the Central zone includes Maharashtra, Madhya Pradesh and Gujarat and the Southern zone consists of Andhra Pradesh, Karnataka and Tamil Nadu. Besides these nine states, cotton cultivation has gained momentum in Orissa as well. Cotton is also cultivated in small areas of non-traditional states such as Uttar Pradesh, West Bengal and Tripura.

India is the only country that produces all four varieties of cultivated cotton, namely, Gossypium arboreum and herbaceum (Asian cotton), G.barbadense (Egyptian cotton) and G.hirsutum (American Upland cotton). India produces many cotton varieties and hybrids. Though the number of varieties in cultivation exceeds 75, 98% of the production is contributed by about 25 varieties only. Gossypium, hirsutum represents 90% of the hybrid cotton production in India and all the current BT cotton hybrids are G.hirsutum. Currently, India produces the widest range of cotton capable of spinning for 6s to 120s counts of yarn. Around 35% of the total area under cotton is irrigated and the remaining 65% is rain-fed

Cotton Acreage in India

Currently, India has the largest cotton cultivated area in the world. India accounts for around 30% of the 30.66 million hectares (ha) global cotton harvested area. The area under cotton cultivation in India grew from around 56.5 lakh ha in 1950-51 to 94.14 lakh ha in 2007-08 and witnessed a marginal decline at 94.06 lakh ha in 2008-09.

Cotton Acreage in India

However, the rise in area under cotton cultivation over the years has not been on a sustained basis. Various factors such as variability in monsoon, returns from competitive crops, have played a significant role in influencing the cotton planting decision of farmers. For instance, during 2002-03, the drought conditions experienced in India to certain extent restrained the growers to take up cultivation of cotton; as a result, the area under cotton cultivation went down to 76.7 lakh ha from 87.3 lakh ha in 2001-02. Comparatively, the acreage under cotton increased by 5.4% (y-o-y) in 2006-07, primarily on account of a good monsoon in major cotton growing parts of India and higher prices fetched by farmers.

State-wise cotton acreage (2008-09)

Among the cotton-growing states in India, Maharashtra, Gujarat and Andhra Pradesh together account for around 73% of area under cotton. Maharashtra has the highest area under cotton cultivation followed by Gujarat and Andhra Pradesh. During 2008-09, the area under cotton cultivation has declined compared with that of 2007-08 in almost all states except in Andhra Pradesh, Madhya Pradesh and Tamil Nadu.

Cotton Production

Cotton production in India has more than doubled in a span of 7 years. Cotton production had reached a peak of 307.0 lakh bales during 2007-08 as compared with 140.0 lakh bales in 2000-01, but fell to 290.0 lakh bales in 2008-09. The gradual increase in cotton production over the years can largely be attributed to the phenomenal increase in cotton yield. Introduction of BT cotton seeds has played a catalytic role in enhancing cotton production in India. However, in 2002-03, when BT seeds were introduced, cotton production dipped by 13.9% to 136.0 lakh bales due to the severe drought that hit major cotton producing states such as Gujarat, Andhra Pradesh, and parts of Tamil Nadu. Cotton production in Andhra Pradesh, Maharashtra and Gujarat declined by 26.2%, 24.1% and 6.2% respectively, during 2002-03. However, since then, the commercial cultivation of BT seeds has brought about a breakthrough in cotton production.

Cotton fibre production

With suitable climatic conditions, better farm practices fostered by the government under TMC and spread of hybrid and BT seeds, cotton production witnessed significant year-on-year growth of 31.6% and 35.8% during 2003-04 and 2004-05, respectively. Good yield of cotton during 2006-07 encouraged farmers to take up large-scale sowing of cotton during 2007-08; as a result, the production of cotton during this period increased by 12.5%. The area under BT cotton has also increased remarkably in the past few years given that the variety offered 25-30% net return over other conventional varieties. In 2007-08, area under BT cotton shot up to 63.3 lakh ha as compared with 34.8 lakh ha during 2006-07.

In 2008-09, cotton production declined to 290 lakh bales as compared with 307 lakh bales in 2007-08 because cotton yield fell to 524.13 kg/ha in 2008-09 from 554.39 kg/ha in the previous year. Uneven rainfall coupled with high pest incidence could have affected the cotton productivity in 2008-09. Indias cotton production primarily consists of medium long and long staple varieties, which account for around 77.2% of the total cotton fibre production in India. The production of medium long and long staple varieties surged to 216.0 lakh bales in 2006-07 from 61.0 lakh bales in 2001-02.

Staple-wise cotton production (in lakh bales)

Extra-long staple variety had a marginal share of 2.1% in the total production during 2006-07. Moreover, production of extra-long staple variety has remained almost constant over the time period under consideration. Further, the production of short staple cotton has been witnessing sustained fall in the last few years as its production has declined from around 9.5 lakh bales in 2001-02 to 6.0 lakh bales in 2006-07. Short staple cotton constituted around 1.4% of the total cotton production in 200607.

State-wise share in cotton fibre production (2008-09)

As of 2008-09, the central states of Gujarat, Maharashtra and Madhya Pradesh had the highest contribution of 61% in the domestic cotton production while the southern states such as Andhra Pradesh, Karnataka and Tamil Nadu contributed 24% and the northern states such as Punjab, Haryana and Rajasthan contributed to around 14% of cotton production.

Cotton grown in different states have varying staple length, strength and grade depending on the climate and farm and pest management practices. Although Maharashtra had the highest area under

cotton cultivation in 2008-09 (at around 31.4 lakh ha), Gujarat had the highest contribution in cotton

production (at an estimated 90 lakh bales) followed by Maharashtra (at 62 lakh bales). Increased area under cultivation and greater use of hybrid and genetically-modified seeds has aided the robust growth in Cotton production in Gujarat. In Maharashtra, cotton production recorded robust increase of 38.9% and 24.0% in 2006-07 and 2007-08, respectively. The substantial increase in cotton production in Maharashtra can in part be attributed to the initiatives of CITI-CDRA and the government to extend integrated cotton farming programme and contract farming programme. In 2006 CITI-CDRA planned to extend integrated cotton farming programme in 9,600 acres in Wardha district, Maharashtra, which included better combination of crop, soil and pest management practices to increase and sustain productivity as well as quality of cotton. The programme also included a market-supportive mechanism for farmers to sell their produce. During 2007-08, the government took up contract farming programme in 40,044 ha involving 12,000 farmers as compared with 33,279 ha during 200607.

Productivity of cotton

Cotton productivity in India has witnessed substantial improvement over the years. A confluence of factors such as adoption of BT varieties, accelerated technology transfer to the farmers, efforts taken by the government and other agencies have been instrumental in increasing cotton productivity in India. The average cotton yield increased from 278 kg/ha in 2000-01 to peak at 554.39 kg/ha in 200708 and slipped to 524.13 kg/ha in 2008-09. The drop in cotton yield in 2008-2009 could be attributed to the uneven monsoon which led to a dry spell in some areas and excessive rains in other areas. While significant progress has been made in the terms of improving cotton productivity, it is important to note that the cotton yield in India at around 524 kg/ha is lower as compared with the world average yield of 767 kg/ha.

There are huge variations in the cotton productivity levels of different states in India. The vast difference in productivity levels can be gauged from the difference between the highest yield at 780 kg/ha recorded by Tamil Nadu and the lowest yield at 335 kg/ha recorded by Maharashtra. High yield in Tamil Nadu can be attributed to increased use of better quality hybrid seeds, improved irrigation facilities and integrated pest control processes. The average yield in Gujarat and Andhra Pradesh is higher as compared with the average yield in Punjab and Haryana.

State-wise yield of cotton fibre (kg/ha)

CONSUMPTION OF COTTON IN INDIA

Although the Indian textile industry consumes a diverse range of fibres and yarn, it is predominantly cotton based. The ratio of the use of cotton to man-made fibres and filament yarns by the domestic industry is 59:41 (FY09). Thus, cotton is one of the major raw materials for the Indian textile industry. The proportion of cotton in the raw material consumption basket of the Indian textile industry is around 59%. Cotton consumption has increased significantly over the years given the rapidly expanding domestic textile industry.

The consumption of cotton by the textile mills and small-scale spinning units has witnessed sustained increase since 2001-02, except in 2002-03, when the total domestic consumption declined. Domestic consumption of cotton fibre increased at a CAGR of 7.0% rising from 168.8 lakh bales in 2002-03 to 236.9 lakh bales during 2007-08, but fell to 229 lakh bales in 2008-09.

There has been a phenomenal growth in the Indian textile industry in the last 2 decades in terms of installed spindles and yarn production. The pace of modernisation achieved by the Indian spinning industry received a fillip after the launch of "Technology Up-gradation Fund" by the Indian government in April 1999. The robust growth of spinning industry and its modernisation has led to sustained growth in cotton consumption.

Trend of domestic cotton consumption

Cotton consumption has witnessed sustained increase since 2003-04 onwards as a result of growing demand for Indian textiles, which led to considerable expansion and modernisation of the textile mills. In 2007-08, domestic consumption merely grew by around 2% over that in 2006-07 due to consistently high cotton prices mainly because of speculative funds coming into play, and due to large-scale exports of raw cotton. Exports of cotton stood at around 88.5 lakh bales during 2007-08. Also, appreciation in the rupee for some months during the cotton year 2007-08 led to low textile exports that affected the domestic mill consumption of cotton. In the cotton year 2008-09, domestic consumption of cotton declined by 6.9 lakh bales to an estimated 229 lakh bales. The drop in mill consumption was a result of the global slowdown that affected domestic as well as export demand for textiles. Consumption also declined due to a steep hike in minimum support prices of different varieties of cotton, which resulted in high procurement costs of cotton for the mills.

Segment-wise consumption of cotton

Almost 83% of the cotton is consumed by the non-SSI mills and other 9% by the SSI mills. Non-mill consumption of cotton has remained more or less stable over the last 4 years and accounted for around 8%of the total domestic consumption.

COTTON MARKETING IN INDIA

In India, cotton is primarily sold in the form of kapas (raw cotton or seed cotton). However, in other leading cotton growing countries, kapas is processed wherein the fibre is extracted, and then the lint (cotton fibre extracted from seed cotton) is sold as processed bales. The Agriculture Produce Marketing Committee (APMC) is the primary market infrastructure in the country through which cotton is marketed. The APMCs were set up by the Agricultural Produce Marketing Committee (Regulations) Act in 1963 as a marketing platform for the sale of primary agriculture products to provide a regulated market infrastructure for agriculture goods, which was absent earlier on. The main functions of these markets or mandis is to regulate market practices such as weighing, process of sale, method of grading, payment process etc. APMCs also provide facilities storage, boarding and lodging for buyers, sellers etc. This committee charges 1% of the goods value as fees from the buyers. The marketing committee, which runs the market, consists of both buyers and sellers who have the responsibility of maintaining and developing the market yard for its users. In India, currently there are around 7,062 mandis that are functional.

The three marketing agencies engaged in cotton trade are:

Private sector comprising traders, owners of ginneries operating as individual business proprietors, partnership firms and private limited companies

Public sector agencies like the Cotton Corporation of India (CCI)

Co-operative sector.

It has been estimated that approximately 80% of the marketed surplus of kapas and lint is handled by the private marketing channels and the remaining 20% by the institutional marketing channels including co-operatives and Cotton Corporation of India (CCI).

Sale of cotton (In bales)

Cotton marketing system

COTTON EXPORT & IMPORT

With robust growth in cotton production in the last few years, India has become a net exporter of cotton from being a net importer.

Export scenario

Indian cotton consumption has increased at a rapid pace in the last few years but the growth in consumption has not been commensurate with the growth in domestic cotton production, and therefore, since 2003-04, there has been surplus production in India. As a result, India has emerged as one of the top exporters of raw cotton in the world. Currently, India is the second-largest exporter of cotton after the US. In order to boost cotton exports, the Indian government liberalised raw cotton exports since July 2001, doing away with the system of allocation of cotton export quota in favour of different agencies and traders. Over the years, Indias cotton export has been growing at an impressive rate, except for FY05, when exports dipped. In FY08, India exported 88.5 lakh bales of cotton.

Exports of cotton fibre (in lakh bales)

After emerging as the second largest cotton exporter since 2006-07, Indias exports during 2008-09 are estimated to have declined to 35 lakh bales. The substantial decline in cotton exports in 2008-09 could in part be attributed to the lowered export competitiveness of Indian cotton subsequent to a hike of almost 30% to 50% (depending on quality) in the Minimum Support Price of cotton by the

Government. During 2008-09, the Government raised the minimum support price (MSP) of long staple cotton and medium staple cotton to Rs 3,000 per quintal from Rs 2,030 per quintal to Rs 2,500 per quintal from Rs 1,800 per quintal, respectively.

Despite strong growth over the years, one of the major issues faced by the Indian cotton exports is contamination. In the latest (2007) survey by the International Federation of Textile Manufacturers, the six most contaminated cottons tested were from India. Likely sources of contamination are handpicking, where foreign matter (such as polypropylene strands from picking bags) may be accidentally introduced, and ginning, where seed coats may not be adequately removed, and wire or metal can break off machinery and remain embedded within the fibres

Country-wise share in Indias cotton exports (including waste) (FY08)

Among the most important destinations for Indian cotton exports are China, Pakistan and Bangladesh. In fact almost 76.10% of Indias cotton exported to these three countries. China

commands the highest share of 46.6% of Indias cotton fibre exports to the world. Export to China has increased from 1.0 lakh bales in FY05 to 36.30 lakh bales in FY08.

Imports

Cotton has been imported into India under the Open General License (OGL) since April 1994. Till July 8, 2008, the custom duty of 10% and 4% special countervailing duty were levied on cotton imports. However, from July 8, 2008, the Indian government abolished duty on cotton imports, thus enabling the domestic textile mills to import cotton as per their requirements. Indias current import basket consists of the extra-long staple variety due to meagre domestic production of the same. Previously, the domestic manufacturers used to import sizeable quantity of long staple cotton also, but it has shrunk in the last couple of years. There has been a noticeable decrease in the long staple variety over the years. Domestic cotton production coupled with price differences between the domestic and foreign cotton have been key determinants of cotton imports in India. Import of cotton has reduced gradually from around 25.3 lakh bales in 2001-02 to 6.4 lakh bales in 2007-08, barring a surge in 2004-05, when exports increased to 12.2 lakh bales from 7.2 lakh bales in 2003-04. The imports of cotton increased to 10 lakh bales during 2008-09.

Increasing domestic per capita income and refinement of consumer preference have resulted in an increase of imports of the extra-long variety during the last few years. India generally imports ELS cotton from the US, Egypt, Sudan, West Africa and Commonwealth of Independent States (CIS) countries.

Indias cotton Imports

The US has the highest share of 31% and 39% in Indias cotton fibre imports from the world in volume and value terms, respectively. Almost all imports come from the US and the other countries have a meagre share in Indias imports. Egypt accounts for 20% (volume terms) of Indias cotton fibre imports from the world. Within Africa, Egypt has the highest share in Indias cotton fibre imports followed by Benin and Burkina Faso. Within Asia, Bangladesh has the highest share of 16% in Indias cotton fibre imports in terms of quantity, however, in value terms, it accounts for a miniscule 1% share. This implies that the cotton imported from Bangladesh is of very low quality.

Country-wise share in Indias cotton imports (including waste) (FY08)

Indias dependence on cotton imports from Egypt and the US may be a matter of concern for the former, considering the development in the textile industry of Egypt. In future, there can a rise in domestic consumption of Egyptian cotton, which will imply lesser exports to India.

TREND IN INDIAN COTTON PRICES

Prices of cotton across countries and varieties differ on account of a number of factors. Within a country, cotton prices during a particular year vary depending on the variety grown and the quality of the harvested cotton.

Annual average prices of kapas for important varieties

In line with market dynamics, the market price of cotton has largely varied according to the domestic cotton production; for instance, cotton prices surged in 2003-04 consequent to a drop in production

during this period. In addition to the demand-supply dynamics, cotton-pricing mechanism in India is also influenced by the minimum support price fixed by the government. In the past few years, the MSP of cotton has been raised gradually to ensure minimum returns to the farmers. In fact, in 200809, the government increased the MSP on various varieties of cotton by around 30-40% to provide support to the farmers in the depressed market conditions. A dip in cotton production on account of uneven monsoon coupled with lower demand due to global economic slowdown was expected to adversely affect the cotton farmers.

Trend in prices of H-6 cotton variety

Over the years, the market price of H-6 cotton variety has largely been above the MSP set by the government. Thus, the MSP generally acts as a lower ceiling for cotton prices and prevents the price of raw cotton from falling beyond a certain level.

Cotton prices in India vis-a-vis other countries

It can be observed from the above graph that prices of Indian cotton have been slightly higher as compared with the cot look A Index, which is an indicator of the world cotton prices. Cotton prices in Pakistan have been substantially lower as compared with the Indian cotton prices, primarily due to high contamination level in cotton produced in Pakistan. However, the price of cotton in Brazil is higher as compared with the cotton prices in India.

WORLD SCENARIO FOR COTTON FIBRE

Cotton is mainly native to tropical countries. However, it is planted widely in both the hemispheres. Cotton is critical to economies of many developing countries. Out of the 65 cotton-producing countries, 52 were developing countries in 2007-08. Cotton is also regarded as one of the heavily traded agricultural commodities, given the involvement of over 100 countries in exports or imports of cotton. The world cotton industry has witnessed substantial improvement in terms of both production and consumption of cotton. However, the Cottons share of world fibre use has declined to around 40% from about 60% in the 1960s. Nevertheless, it still is one of the major fibres produced in the world.

WORLD COTTON DEMAND-SUPPLY DYNAMICS

World cotton production has declined for second consecutive years in 2008-09. World cotton production has declined by around 2% and 10% in 2007-0813 and 2008-09, respectively. In fact, world cotton production at 23.5 mn tonnes during 2008-09 is the smallest since 2004-05. World cotton production declined during the year primarily due to a reduction in world cotton area for the second consecutive season.

World cotton Production (Season beginning August 1)

Significant area of cotton was shifted to grains and oilseed production due to more attractive prices than for cotton. World cotton harvested area has experienced sustained decline in the last few years. According to the ICAC data, area under cotton cultivation shrank to 30.66 mn ha (estimated) in 200809 from 32.84 million ha in 2007-08. During 2008-09, cotton yield also registered a decline compared to the previous year primarily on account of unfavourable weather conditions across the world. After witnessing sustained improvement since 2000-01, the world cotton yield has moderated to 767kg/ha in 2008-09 from a peak of 797 kg/ha in 2007-08. World cotton yield has increased by around 17.8% from 2003-04 to 2008-09 mainly due to extensive use of BT cotton varieties across the globe. Genetically modified (GM) seeds occupied around 48% of total harvested area globally in 2008-09.

World Cotton harvest area and production yield (Season beginning August 1)

During 2008-09, almost all the major cotton producing countries witnessed a decline (y-o-y) in production of cotton except Pakistan and Australia. China, India, USA, Pakistan, Brazil and Uzbekistan accounted for almost 85% of the world cotton production in 2008-09.

With the global economy traversing through turbulent times, cotton consumption declined substantially by 12.75% during 2008-09. World cotton mill consumption diminished due to a drop in end-use consumption of cotton products subsequent to a slow-down in world economy, loss of competitiveness of cotton prices against polyester prices, and tightening credit conditions for textile mills. The slump in the world consumption of cotton could be largely attributed to substantial decline in domestic consumption of cotton in China, which is the largest consumer of cotton in the world. In fact, the chinas cotton consumption declined by around 17% in 2008-09. During 2008-09, cotton consumption declined in almost all the major cotton consumers in the world.

World domestic consumption (Season beginning August 1)

Even world cotton imports and exports declined during 2008-09. World exports declined by almost 25.36% in 2008-09 primarily backed by reduction in exports from major exporting countries like US, India and Uzbekistan. With imports from some of the major importing countries like China, Turkey and Pakistan witnessing substantial decline, World cotton imports also declined by around 25.73% during 2008-09.

Trend in World Cotton Export & Import

USA maintained its first position as a largest exporter of cotton in 2008-09 accounting for as much as 44.39% of the world cotton exports. India, however, could not secure its place as second largest exporter after USA in 2008-09 on account of significant decline of 73.86% in cotton exports from India. Uzbekistan has emerged as the second largest cotton exporters in the World during 2008-09.

Country-wise Share in Cotton Exports

China continued to retain its position as the leading importer of cotton in 2008-09, accounting for almost 23% of the worlds cotton export. During 2008-09, Bangladesh was the second largest importer of cotton having a share of 10% in world import.

Country-wise Share in Cotton Imports

A BRIEF REVIEW OF MAJOR COTTON PRODUCING COUNTRIES

United States (US)

The United States (US) is the worlds largest exporter of agricultural products. Any change in US agricultural policy markedly influences the worlds agricultural markets. US is the largest exporter of cotton across the world. US primarily exports US upland and US Pima cotton varieties to countries like China, India, Pakistan, etc. US domestic consumption cotton showed a downward trend since 2004-05 due to increased competition from price-competitive foreign imported textile products, particularly from Asia. The proportion of cotton exports in production also grew from 62.1% in 2004-05 to 99.3% in 2008-09. US is a net exporter of cotton. The following chart depicts the trend of exports proportion in production.

Trend of cotton exports proportion in production

US usually enacts Farm Bill in every 5-6 years including comprehensive legislations on farm policies. The latest farm bill titled Food, Conservation, and Energy Act of 2008 (thereon, Farm Bill 2008) is another bill in the long series of farm bills. This farm bill was structured under the purview of record high farm incomes and very high market prices, by historical standards, for two consecutive years. This was primarily in the case for grains, oilseeds and dairy.

China

China is of particular significance in the world cotton industry given that it is not only the largest cotton producer but also the biggest consumer of cotton. There are five main cotton-planting areas in China: the South China Region, the Yangtze River Region, the Yellow River Region, the North Region, with a Special Early-Maturing Cotton Region and the Northwest Inland Region (China Agricultural Network, 2007). Among them, Xinjiang Autonomous Region (included in Northwest Inland Region) takes a significant position in cotton production in China. According to ICAC data, the Chinas cotton production stood at an estimated 8.02 MMT during MY15 2008-09. Despite being the largest producer of cotton, Chinas cotton production has been unable to meet its cotton consumption, which is estimated at 9.00 MMT for MY 2008-09. Thus, china imports large quantities of cotton and is the largest importer of cotton. Chinas cotton imports in MY 2008 -09 are estimated to have been around 1.42 MMT lower compared to 2.51 MMT in the previous year.

Destination-wise United States is the largest import origin for China followed by India. According to an USDA report Indias share in Chinas cotton import has increased from 23% during MY 2006 -07 to 32% in MY 2007-08. Chinese government has over the years taken many measures such as providing seed subsidy, reforming the classification system etc to support the Chinese cotton as well as textile industry. While the Chinese cotton market has been liberalised to greater extent the Government has been intervening by way of state purchase and sale of cotton with an aim to maintain orderly conditions in the market. Government policies such as adjustment of sliding-scale duties, public acquisition of reserve cotton, adjustment of export rebates for textile products and cotton subsidies for improved species with a definite orientation to protect the farmers interests and enhance Chinas sustainable development capacity for cotton products has provided substantial support to all the stake holders in Chinas cotton economy.

Brazil

In 2008-09, Brazil accounted for around 5.19% of the total world cotton production after increasing to 6.12% in 2007-08 from 4.05% in 2005-06. Brazils cotton production declined by around 23.85% during 2008-09 primarily on account of reduction in planted area, especially in the Mato Grosso region. According to a USDA report, the farmers shifted area under cotton production to soyabean and other commodities mainly due to lack of adequate financing. In the last few years although consumption of cotton in Brazil has witnessed marginal improvement, it has been lower compared to the domestic cotton production. Consumption of cotton has declined by 7.07% during 2008-09. Brazil is emerging as one of the leading exporter of cotton. Brazils cotton exports increased at an annual average rate of 21.41% in the last four years (2006-2009)

Brazilian Government has over the years devised policies to aid agriculture sector in general and some commodities in particular. While certain policies such as the Preferential credit policy are aimed at providing support the entire agriculture sector, other like the income support programs have been introduced to promote certain commodities. Preferential credit policies, which have been in place in Brazil since the 1970s, are primarily aimed at stimulating the expansion of agricultural production. New income support programs were also put in place in Brazil since the agricultural policy reform in the early 1990s

Pakistan

Pakistan announced its first ever Textile Policy 2009-2014 during August, 2009. Policy targets to increase exports from the existing US$ 10 billion to US$ 25 billion by the end of policy period. The following initiatives have been taken to support domestic textile industry by the government. .

Вам также может понравиться

- Managerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketДокумент15 страницManagerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketRahulKumbhareОценок пока нет

- PresentationДокумент19 страницPresentationMahak GuptaОценок пока нет

- Spinning Mill Organizational StudyДокумент37 страницSpinning Mill Organizational Studykarthick1679100% (5)

- Quantitative and Qualitative Requirements of Cotton For IndustryДокумент4 страницыQuantitative and Qualitative Requirements of Cotton For IndustrySabesh MuniaswamiОценок пока нет

- Cotton Fibre Quality ResearchДокумент11 страницCotton Fibre Quality ResearchprabhjotseehraОценок пока нет

- Trade Performance of CottonДокумент35 страницTrade Performance of CottonNitin PandyaОценок пока нет

- Pricing Policy of CottonДокумент8 страницPricing Policy of CottonVarsha BhutraОценок пока нет

- Ban On Cotton Export2Документ4 страницыBan On Cotton Export2Abhijeet GangulyОценок пока нет

- Commodity ReportДокумент8 страницCommodity Reporthamna MalikОценок пока нет

- A Profile of Indian Cotton: at A Glance: Shri M. M. Chockalingam, Director (Marketing) - CciДокумент6 страницA Profile of Indian Cotton: at A Glance: Shri M. M. Chockalingam, Director (Marketing) - CciRushikesh patelОценок пока нет

- Sip of TextileДокумент66 страницSip of TextileSANGHAVI SAURAVОценок пока нет

- Indian Cotton & Needs of Spinning Industry, Cotton Research Journal, Vol. 5 (2), 2013Документ5 страницIndian Cotton & Needs of Spinning Industry, Cotton Research Journal, Vol. 5 (2), 2013abisheck444Оценок пока нет

- Vidya DhoptkarДокумент5 страницVidya DhoptkarHasrat Ali MansooriОценок пока нет

- Thailand Cotton and Products Annual 2019: Date: GAIN Report NumberДокумент16 страницThailand Cotton and Products Annual 2019: Date: GAIN Report NumberAkankshaОценок пока нет

- Elite Fabs Deva - MsДокумент51 страницаElite Fabs Deva - MsDevaragulОценок пока нет

- Ethiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019Документ8 страницEthiopia Cotton Production Annual - Addis Ababa - Ethiopia - 5-29-2019DemelashОценок пока нет

- Cotton ReportДокумент21 страницаCotton Reportprince24100% (1)

- Textile PDFДокумент31 страницаTextile PDFsweetshah2Оценок пока нет

- Pakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiДокумент19 страницPakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiSadia KhawajaОценок пока нет

- Textile Report - EOPДокумент10 страницTextile Report - EOPmrbluefaceОценок пока нет

- Pakistan Textiles Industry Challenges and SolutionsДокумент12 страницPakistan Textiles Industry Challenges and SolutionsMuqadas RehmanОценок пока нет

- Cotton GinningДокумент4 страницыCotton Ginningb4i_i4bОценок пока нет

- Textile IndustryДокумент70 страницTextile Industryalkanm750Оценок пока нет

- Indian Textile Industry Chapter 1Документ6 страницIndian Textile Industry Chapter 1himanshuОценок пока нет

- Assignment 6 - Cotton Cloth Industry in PakistanДокумент4 страницыAssignment 6 - Cotton Cloth Industry in PakistanHaider RazaОценок пока нет

- INDUSTRY PROFILE Senkunthar New EditedДокумент10 страницINDUSTRY PROFILE Senkunthar New EditedMukesh kannan MahiОценок пока нет

- Cotton Spinning Note - ICRAДокумент4 страницыCotton Spinning Note - ICRAblindamОценок пока нет

- Strategy Home Textile Caselet KirtivardhanДокумент11 страницStrategy Home Textile Caselet KirtivardhanKirtivardhan Singh ThakurОценок пока нет

- Article On Cotton & Man Made Fibres 07-08Документ10 страницArticle On Cotton & Man Made Fibres 07-08agra_vikashОценок пока нет

- Indian Cotton Industry: Presented byДокумент14 страницIndian Cotton Industry: Presented byP Chandan Kumar PatroОценок пока нет

- SIP ReportДокумент70 страницSIP ReportMaulik TankОценок пока нет

- An Analysis of Trend and Growth Rate of Textile Industry in IndiaДокумент17 страницAn Analysis of Trend and Growth Rate of Textile Industry in IndiaAASHISH SОценок пока нет

- Textile Industry of PakistanДокумент12 страницTextile Industry of PakistanTayyab Yaqoob QaziОценок пока нет

- A Study On Cost and Cost Techniques at Reid Braids India - HassanДокумент58 страницA Study On Cost and Cost Techniques at Reid Braids India - HassanSuresh100% (1)

- Section A: Basic Description About The Industry Present Scenario of The IndustryДокумент4 страницыSection A: Basic Description About The Industry Present Scenario of The IndustryDipPaulОценок пока нет

- Indian Textile Industry and The Global PerspectiveДокумент6 страницIndian Textile Industry and The Global PerspectiveSoumyajyoti KunduОценок пока нет

- Assignment On JuteДокумент12 страницAssignment On JuteAbid hasan0% (1)

- Vardhman Polytex Limited Bathinda Project For MbaДокумент62 страницыVardhman Polytex Limited Bathinda Project For MbahardeepkumargargОценок пока нет

- Cotton Yarn SectorДокумент6 страницCotton Yarn SectorBala GangadharОценок пока нет

- Research Report On Spinning Sector of Bangladesh-InitiationДокумент24 страницыResearch Report On Spinning Sector of Bangladesh-InitiationjohnsumonОценок пока нет

- Chapter 1Документ67 страницChapter 1satseehraОценок пока нет

- Bangladesh Textile Industry HighlightsДокумент19 страницBangladesh Textile Industry HighlightsTanzina HaqueОценок пока нет

- Cotton and Products Annual Dhaka Bangladesh 4-1-2013Документ12 страницCotton and Products Annual Dhaka Bangladesh 4-1-2013iamnahidОценок пока нет

- Indian Textile IndustryДокумент17 страницIndian Textile IndustryVin BankaОценок пока нет

- Jute Matters WebДокумент60 страницJute Matters WebAsraar AhmedОценок пока нет

- A Project On The Spinning Industry of India: BY Deepak Luniya Roll No: 290Документ45 страницA Project On The Spinning Industry of India: BY Deepak Luniya Roll No: 290deepakluniyaОценок пока нет

- Biscuit Industry ProjectДокумент20 страницBiscuit Industry ProjectVivek PatelОценок пока нет

- Internship Report On Gohar TextileДокумент107 страницInternship Report On Gohar Textilesiaapa60% (5)

- IJNRD2202013Документ19 страницIJNRD2202013adityapatnaik.022Оценок пока нет

- International Cotton Advisory Committee: 1629 K Street NW, Suite 702, Washington, DC 20006 USAДокумент9 страницInternational Cotton Advisory Committee: 1629 K Street NW, Suite 702, Washington, DC 20006 USAShukhrat TuychievОценок пока нет

- Jute The Golden Fibre Present Status and Future of IndianДокумент17 страницJute The Golden Fibre Present Status and Future of IndianAditya PandhareОценок пока нет

- Sahana 123Документ26 страницSahana 123Sahana CОценок пока нет

- Textile Industry in India: Last Updated: November 2013Документ2 страницыTextile Industry in India: Last Updated: November 2013Prachi PawarОценок пока нет

- Indian Textile Overview and Swot AnalysisДокумент20 страницIndian Textile Overview and Swot AnalysisRenu Gupta100% (1)

- Food Outlook: Biannual Report on Global Food Markets July 2018От EverandFood Outlook: Biannual Report on Global Food Markets July 2018Оценок пока нет

- Food Outlook: Biannual Report on Global Food Markets. November 2020От EverandFood Outlook: Biannual Report on Global Food Markets. November 2020Оценок пока нет

- Food Outlook: Biannual Report on Global Food Markets May 2019От EverandFood Outlook: Biannual Report on Global Food Markets May 2019Оценок пока нет

- Cotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingОт EverandCotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingHua WangОценок пока нет

- Food Outlook: Biannual Report on Global Food Markets: November 2019От EverandFood Outlook: Biannual Report on Global Food Markets: November 2019Оценок пока нет

- Food Outlook: Biannual Report on Global Food Markets: November 2021От EverandFood Outlook: Biannual Report on Global Food Markets: November 2021Оценок пока нет

- Module, Module 2 3 PDFДокумент17 страницModule, Module 2 3 PDFkrishnavaibhavaОценок пока нет

- 3 Mock Test - General Studies Prelim 2007Документ76 страниц3 Mock Test - General Studies Prelim 2007ankit161019893980Оценок пока нет

- 8 1-Capital AdequacyДокумент30 страниц8 1-Capital Adequacyankit161019893980Оценок пока нет

- Computer Aided Design (Mce-307)Документ1 страницаComputer Aided Design (Mce-307)ankit161019893980Оценок пока нет

- Retail BankingДокумент13 страницRetail Bankingankit161019893980Оценок пока нет

- Chapter-4 (Research Methodology)Документ48 страницChapter-4 (Research Methodology)ankit161019893980Оценок пока нет

- Void Agreements: Charu Bansal (1211310016) Deepshikha Saraf (1211310017)Документ14 страницVoid Agreements: Charu Bansal (1211310016) Deepshikha Saraf (1211310017)ankit161019893980Оценок пока нет

- SBI Mobile BankingДокумент64 страницыSBI Mobile Bankingankit161019893980Оценок пока нет

- Free ConsentДокумент13 страницFree Consentankit161019893980Оценок пока нет

- Sbi Project ReportДокумент102 страницыSbi Project Reportankit161019893980Оценок пока нет

- New Developments in Cotton Ginning: (1) PrefaceДокумент11 страницNew Developments in Cotton Ginning: (1) Prefaceankit161019893980Оценок пока нет

- Essentials of A Valid Contract: By: Ankit Chawla (1211310007) Alisha (1211310004)Документ27 страницEssentials of A Valid Contract: By: Ankit Chawla (1211310007) Alisha (1211310004)ankit161019893980Оценок пока нет

- Training and DevelopmentДокумент17 страницTraining and Developmentankit161019893980Оценок пока нет

- Executive Development ProgrammeДокумент20 страницExecutive Development ProgrammeMUNESH SHARMAОценок пока нет

- Fdi in Retail Sector: BY: Ankit Chawla (1211310007)Документ30 страницFdi in Retail Sector: BY: Ankit Chawla (1211310007)ankit161019893980Оценок пока нет

- Unit - I Lesson - 1 Learning ObjectivesДокумент204 страницыUnit - I Lesson - 1 Learning Objectivesankit161019893980100% (1)

- Role of Government Inshaping Business EnvironmentДокумент19 страницRole of Government Inshaping Business Environmentankit161019893980100% (1)

- Agro Based Industries PROJECTДокумент15 страницAgro Based Industries PROJECThum_tara1235563Оценок пока нет

- Krishi Anusandhan Bhavan-I, Pusa, New Delhi-110 012Документ7 страницKrishi Anusandhan Bhavan-I, Pusa, New Delhi-110 012asishsharmaОценок пока нет

- Organizational Culture & ClimateДокумент59 страницOrganizational Culture & Climateausmelt2009100% (2)

- Report On Organizational Structure Gul AhmedДокумент13 страницReport On Organizational Structure Gul AhmedR.K.Bavatharini0% (1)

- C Textile Product Processing 2019 PDFДокумент17 страницC Textile Product Processing 2019 PDFTabassum RezaОценок пока нет

- National Textile PolicyДокумент36 страницNational Textile PolicyFrancis NyekoОценок пока нет

- Guide For Textile Industries: Cleaner ProductionДокумент75 страницGuide For Textile Industries: Cleaner ProductionAjmal KhanОценок пока нет

- NFRA List of Companies and Auditors (Provisionsal) - 31032021Документ1 059 страницNFRA List of Companies and Auditors (Provisionsal) - 31032021Satya PrasadОценок пока нет

- Anandhu Internship Final ReporДокумент33 страницыAnandhu Internship Final ReporanandhuОценок пока нет

- Ruby Mills - Priya, Nihaarika, Joushita and AnamikaДокумент136 страницRuby Mills - Priya, Nihaarika, Joushita and AnamikaRosey LОценок пока нет

- Industries at Virudhunagar - Localbody Wise: Orange (Less Polluting)Документ42 страницыIndustries at Virudhunagar - Localbody Wise: Orange (Less Polluting)Ranjani PoobalanОценок пока нет

- Hess 405Документ16 страницHess 405Shriram NarakasseryОценок пока нет

- QMS - F.02 Fabric Inspection Training ModuleДокумент22 страницыQMS - F.02 Fabric Inspection Training ModuleDebashishDolonОценок пока нет

- Backward On Linkages in The Textile and Clothing Sector of BangladeshДокумент13 страницBackward On Linkages in The Textile and Clothing Sector of Bangladeshtdebnath_3Оценок пока нет

- Bharat Vijay Mills DocumentДокумент62 страницыBharat Vijay Mills DocumentShivangi BhargavaОценок пока нет

- BCI Members ListДокумент16 страницBCI Members ListSiba PrasadОценок пока нет

- A Pproach TRIBOLOGY BroellДокумент5 страницA Pproach TRIBOLOGY BroellDavid Lopez OaxacaОценок пока нет

- I A A S TДокумент7 страницI A A S Tlalit kashyapОценок пока нет

- Southeast University: School of Science and Engineering, Department of Textile EngineeringДокумент27 страницSoutheast University: School of Science and Engineering, Department of Textile EngineeringAshraful HimelОценок пока нет

- Solar Energy Application in TextilesДокумент4 страницыSolar Energy Application in TextilesShruti KshirsagarОценок пока нет

- PROJECT PDF - 1Документ36 страницPROJECT PDF - 1ssinfo11.databaseОценок пока нет

- A Study On Recuirment and Selection Process in DSM Textile in KarurДокумент104 страницыA Study On Recuirment and Selection Process in DSM Textile in Karurk eswari50% (2)

- Annual ReportДокумент15 страницAnnual ReportDibakar DasОценок пока нет

- Manufacturing IndustriesДокумент36 страницManufacturing IndustriesRamjeeNagarajanОценок пока нет

- Afis Pro: UsterДокумент6 страницAfis Pro: UstervenkatspinnerОценок пока нет

- Operation Management ReportДокумент14 страницOperation Management ReportClaudia SmithОценок пока нет

- BEXIMCO Project Study PDFДокумент147 страницBEXIMCO Project Study PDFMahtab Uddin100% (2)

- Internship Report On Nishat Textile LTDДокумент44 страницыInternship Report On Nishat Textile LTDbbaahmad8967% (3)

- Caustic Soda AnalysisДокумент11 страницCaustic Soda AnalysisMuhammad Ahmed MirzaОценок пока нет

- Textile Energy Efficiency SuratДокумент104 страницыTextile Energy Efficiency SuratAmardeep Singh HudaОценок пока нет