Академический Документы

Профессиональный Документы

Культура Документы

July August 2013

Загружено:

awhk2006Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

July August 2013

Загружено:

awhk2006Авторское право:

Доступные форматы

July/August 2013

Pumping and Related Technology for Oil & Gas

I-IV Cover.indd I 7/22/13 2:38 PM

Excellent

Oil & Gas

Solutions

MAXIMIZE LIFE.

REDUCE COST.

WITH SPM

DURALAST

TECHNOLOGY.

CUSTOMER FOCUS PRESSURE PUMPING

WeirInAction.com weiroilandgas.com 1.800.342.7458

* When compared to conventional SPM

uid ends

that do not feature Duralast

Fluid End Technology.

Now Available for All SPM

Frac Pump Models

Weir Oil & Gas brings you more long-lasting performance and less downtime for all uid ends with

the SPM

Duralast

Fluid End Technology.

Engineered to double the life of conventional uid ends, the patent-pending technology of SPM

Duralast

lets you frac longer and in harsher environments. It lowers operational costs and increases productivity

through an advanced design that improves fatigue life by more than 50 percent and reduces stress

concentrations by more than 30 percent. *

SPM

Duralast

Technology Design Features and Benets

Reduces cost of ownership over pump life

Reduces capital outlay

Increases frac pump efciency

When used with proprietary stainless steel,

delivers up to 5x the life of conventional

SPM

uid ends

Standardized uid end components across

SPM

pump product range to reduce inventory

circle 100 on card or go to upsfreeinfo.com

2 Upstream Pumping Solutions July/August 2013

FROM THE EDITOR

E

ven with declining natural gas

prices, production continues

in the Marcellus Shale. Penn-

sylvania and West Virginia now pro-

duce 7 billion cubic feet of gas per day,

which is 25 percent of the nationwide

production and nearly double 2011s

rate. In 2012, the Marcellus Shale was

the most productive gas feld in the

nation. Te play that ushered in the

shale gas boom is still the dominant

production feld today.

Hydraulic fracturing has been

used for decades and is safe when

conducted correctly. However, en-

vironmental concerns continue to

be at the forefront of production in

the Marcellus region. Doug Walsers

Report from the Field on page 32 dis-

cusses the need for and steps to take

for responsible production in the area.

In addition to responsible pro-

duction, the reuse of drilling mud is

common practice among operators. A

pump technology that helps improve

the removal of solids from drilling

mud is detailed on page 10.

In hydraulic fracturing, the need

to decrease the timeframe required to

complete a well is an industry issue.

Te frst part of a two-part series on

page 14 examines a new but well-test-

ed technique that decreases comple-

tion time.

Subsea equipment must survive

extreme cold and heat. For these

conditions, specialized insulation

must be used to protect pipelines and

other architecture. One such insula-

tion is detailed on page 24.

As in all operations in the oilfeld,

pumps in production must be special-

ized for individual applications. API

682 seals used in many areas of the oil

patch and in refneries are discussed

on page 36.

Look for this issue at the Oil

Sands Trade Show & Conference in

Fort McMurray, Alberta, and read

the article on oil sands production on

page 40. Also, look for the Upstream

Pumping Solutions team at SPE

ATCE. We hope to see you there!

Best Regards,

Lori Ditoro

Editor

Editors Note: In Horizontal

Multistage Pumping System for

Natural Gas Liquids, in the May/

June 2013 issue, the phrase bearings

made of metal-impregnated graphite

should have read bearings made of

GRAPHALLOY. We apologize for

any confusion or inconvenience this

may have caused.

Editorial Advisory Board

Cleon Dunham, President, Oileld Automation Consulting, &

President, Articial Lift R&D Council

David Jones, Business Development Manager, Siemens Industry Inc.

Chad Joost, Sales Manager, Well Stimulation Products, Stewart & Stevenson

Daniel Lakovic, Progressing Cavity Pump Technical Expert, seepex, Inc.

Santosh Mathilakath, Vice President - Mono Group, National Oilwell Varco

Gord Rasmuson, Sales Manager, Oil Lift Technology

Bill Tipton, Division Vice President - Business Development, Weir Oil & Gas

Doug Walser, Technology Manager, Pinnacle, a Halliburton Business Line

Shaun White, Mud Pump Designer, White Star Pump Company

Publisher

Walter B. Evans, Jr.

VP of Sales

George Lake

glake@pump-zone.com 205-345-0477

VP of Editorial

Michelle Segrest

msegrest@pump-zone.com 205-314-8279

Creative Director

Terri Jackson

tjackson@cahabamedia.com

EDITORIAL

Editor

Lori K. Ditoro

lditoro@cahabamedia.com 205-314-8269

Associate Editor

Amanda Perry

aperry@cahabamedia.com 205-314-8274

Contributing Editor

Doug Walser

CREATIVE SERVICES

Creative Director

Terri Jackson

Senior Art Director

Greg Ragsdale

Art Director

Jaime DeArman

PRODUCTION

Print Advertising Trafc

Lisa Freeman

lfreeman@pump-zone.com 205-212-9402

Web Advertising Trafc

Ashley Morris

amorris@pump-zone.com 205-561-2600

CIRCULATION

Jeff Heine

jheine@cds1976.com 630-739-0900

ADVERTISING

Associate Publisher

Vince Marino

vince@pump-zone.com 205-310-2491

Addison Perkins

aperkins@pump-zone.com 205-561-2603

Derrell Moody

dmoody@pump-zone.com 205-345-0784

Mary-Kathryn Baker

mkbaker@pump-zone.com 205-345-6036

Mark Goins

mgoins@pump-zone.com 205-345-6414

from the publishers of

P.O. Box 530067, Birmingham, AL 35253

Editorial, Circulation and Production Ofces

1900 28th Avenue South, Suite 110

Birmingham, AL 35209, Phone: 205-212-9402

Advertising Sales Ofces

2126 McFarland Blvd. East, Suite A

Tuscaloosa, AL 35404, Phone: 205-345-0477

UPSTREAM PUMPING SOLUTIONS (ISSN# 2159-3035) is published bimonthly by Cahaba Media Group, 1900 28th Avenue So., Suite 110, Birmingham, AL 35209. Standard A postage paid at

Birmingham, AL, and additional mailing ofces. Subscriptions: Free of charge to qualied industrial pump users. Publisher reserves the right to determine qualications. Annual subscriptions: US

and possessions $48, all other countries $125 US funds (via air mail). Single copies: US and possessions $5, all other countries $15 US funds (via air mail). Call (205) 212-9402 inside or outside the

U.S. POSTMASTER: Send changes of address and form 3579 to Upstream Pumping Solutions, Subscription Dept., 440 Quadrangle Drive, Suite E, Bolingbrook, IL 60440. 2013 Cahaba Media

Group, Inc. No part of this publication may be reproduced without the written consent of the publisher. The publisher does not warrant, either expressly or by implication, the factual accuracy of

any advertisements, articles or descriptions herein, nor does the publisher warrant the validity of any views or opinions offered by the authors of said articles or descriptions. The opinions expressed

are those of the individual authors, and do not necessarily represent the opinions of Cahaba Media Group. Cahaba Media Group makes no representation or warranties regarding the accuracy or

appropriateness of the advice or any advertisements contained in this magazine. SUBMISSIONS: We welcome submissions. Unless otherwise negotiated in writing by the editors, by sending us

your submission, you grant Cahaba Media Group, Inc. permission by an irrevocable license to edit, reproduce, distribute, publish and adapt your submission in any medium on multiple occasions.

You are free to publish your submission yourself or to allow others to republish your submission. Submissions will not be returned. Volume 4 Number 4

Centrifugal Priming-Assisted Submersible Rotary Gear

When its performance you need...

Whether your pumping application involves clean water, large solids,

extreme pressure or high ow - Gorman-Rupp has you covered.

Designed and engineered to exacting standards, Gorman-Rupp has

over 3,000 pump models to meet all of your uid-handling needs. We

will also assist you in keeping your pumps working as hard as you do

with the help of the best distributor network in the business.

Visit GRpumps.com to learn more about the pumps that help fuel the

gas and oil exploration industry.

Gorman-Rupp has the right pump for the job.

THE GORMAN-RUPP COMPANY, 4HUZLSK+P]PZPVU

P.O. BOX 1217 QMANSFIELD, OHIO 44901 QPH: 419.755.1011 QFX: 419.755.1251

480 Copyright, The Gorman-Rupp Company, 2013 Gorman-Rupp Mansfield Division is an ISO 9001:2008 and an ISO 14001:2004 Registered Company

Self-Priming

GRpumps.com

c

i

r

c

l

e

1

0

3

o

n

c

a

r

d

o

r

g

o

t

o

u

p

s

f

r

e

e

i

n

f

o

.

c

o

m

4 Upstream Pumping Solutions July/August 2013

TABLE OF CONTENTS

27

DEPARTMENTS

Drilling

10 Rotary Lobe Pumps &

Decanter Centrifuge

Increase Solids Removal

By Bill Blodgett, LobePro Rotary Pumps

Operators can experience ease of use, cost savings and

improved efciency.

Well Completion

14 Remedial Efforts for Fracture

Treatment in Horizontal Laterals

By Robert Reyes, Halliburton

A design stimulation program using a diversion frac

for proppant distribution can effectively stimulate

troubled wells.

20 Fluid End Life

By Gary Pendleton and Rob McPheron,

AXON Energy Products

Fluid end developments and modular design prolong

uid end life while maintaining higher pressures.

Production

36 The Revised API 682 Mechanical

Seal Standard

By Thomas Bhm and Markus Fries, EagleBurgmann

The 4th Edition includes details on the revised product

coding system, the seal system selection process and

seal supply systems.

40 Testing Center Helps Ultra-

Temperature ESP Systems

Improve Operations

By Lawrence Burleigh, Baker Hughes

Because of the harsh nature of SAGD operations,

specialized articial lift systems are required.

A eld engineer prepares a packer to complete

a horizontal well in the Marcellus Shale.

Image courtesy of Baker Hughes Incorporated

July/August 2013

Pumping and Related Technology for Oil & Gas

July/August 2013

Volume 4 Number 4

31

Subsea Equipment

24 Pipeline Protection During

Deepwater Production

By Alexander Lane, The Dow Chemical Company

Wet insulation systems for subsea ow assurance provide reliable

performance in extreme environments.

27 Low-Vibration Compressor Motors

By Sumit Singhal, Siemens

Motor Structural Design

The Marcellus Shale

31 Still a Production Giant

By Lori K. Ditoro

With nearly doubled rates in 2012, the Marcellus Shale continues its

dominance in U.S. natural gas production.

32 A New Focus on Responsible Development

By Doug Walser, Pinnacle, a Halliburton Service Line

A revolution concentrating on responsibility is taking place in North

American unconventional oil and gas extractionparticularly in the

Marcellus Shale.

20

IN EACH ISSUE

2 From the Editor

6 Industry News

42 Trade Show Coverage

43 Oileld Resources

45 Classied Ads & Index of Advertisers

48 Upstream Oil & Gas Market

SPECIAL

s e c t i o n

COVER

SERIES

Frac water storage?

Weve got you covered.

Every type, every size, every situation.

There are many different challenges that you

may face in frac water storage, but one thing is

always constant Dragon has the right solution.

With the addition of Water Corral, our fast-deploy

soft storage offering, we now carry the full

range of water storage systems. Every Dragon

product is severe-duty engineered to perform in

harsh production environments. Plus, with 12

manufacturing facilities near the major U.S. shale

plays, we have the units you need available now.

Dragon knows frac water storage and handling like

no other company. Our engineers design solutions

specic to each job site, including custom packages

if needed, and we offer onsite service as well.

Want to be covered no matter what you need?

Make it happen.

www.dragonproductsltd.com 1-877-231-8198

Copyright 2013 Modern Group Inc. All rights reserved.

U.S. owned and operated for over 50 years.

Make it happen.

circle 102 on card or go to upsfreeinfo.com

6 Upstream Pumping Solutions July/August 2013

INDUSTRY NEWS

NEW HIRES,

PROMOTIONS &

RECOGNITIONS

MARK J. SULLIVAN, Pump

Systems Matter

PARSIPPANY, N.J. ( July 9, 2013)

Te Hydraulic Institute appointed

Mark J. Sullivan as its new director

of education and training. Sullivan

will lead all strategic development,

marketing and Pump Systems Matter

educational programs.

Pump Systems Matter is a

501(c)3 education/training organi-

zation af liated with the Hydraulic

Institute, www.pumpsystemsmatter.

org. Te Hydraulic Institute is North

Americas largest pump association,

www.pumps.org.

BEN VAN BEURDEN, Royal

Dutch Shell

THE HAGUE, Te Netherlands

( July 9, 2013) Te Board of Royal

Dutch Shell plc announced that Ben

van Beurden will succeed Peter Voser

as CEO. Voser will leave Shell at the

end of March 2014.

Royal Dutch Shell is a global

group of energy and petrochemicals

companies. www.shell.com

MICHAEL BROWN, Chet

Morrison Contractors

HOUMA, La. ( July

1, 2013) Chet

Morrison Contractors

hired industry veteran

Michael Brown as

general manager of

Marine Construction.

Brown has 35 years of

experience in the commercial diving

industry.

Chet Morrison Contractors pro-

vides construction, maintenance and

abandonment services to the oil and

gas industry. www.chetmorrison.com

TOM GEISSLER & DAVID

SMITH, SOR Inc.

LENEXA, Kan. ( June 28, 2013)

SOR Inc. announced the new

Western regional sales manager, Tom

Geissler. Geissler has worked across a

broad spectrum of industries includ-

ing oil and gas, chemical, water and

wastewater, bio-tech and pharmaceu-

tical.

David Smith was named Gulf

Coast regional sales manager. With

more than 30 years experience in

sales and service in the oil and gas

industry, Smith will manage strategic

accounts.

SOR Inc. provides level, pressure,

temperature and fow instrumenta-

tion. www.sorinc.com

NICOLS M. DEPETRIS

CHAUVIN, WEC

LONDON ( June 11, 2013) Te

World Energy Council (WEC)

appointed Dr. Nicols M. Depetris

Chauvin as its regional manager for

the Latin America and Caribbean

(LAC) region. Depetris Chauvin will

support the WEC in strengthening

its network in this region.

WEC is the principal impartial

network of leaders and practitioners

promoting an afordable, stable and

environmentally sensitive energy

system for the greatest beneft of all.

www.worldenergy.org

GUNTER CONNERT, Colfax

Fluid Handling

RADOLFZELL, Germany ( June

6, 2013) Colfax Fluid Handling

announced Gunter Connert as

direct sales manager at Colfax Fluid

Handling. Connert is responsible for

serving the Power & Industry busi-

ness segment in Germany, Benelux,

Great Britain and Finland.

Colfax Fluid Handling, a business

of Colfax Corporation, is a provider

in critical fuid-handling and transfer

solutions. www.colfaxcorp.com

JEFF SHELLEBARGER,

Chevron

SAN RAMON, Calif. ( June 5,

2013) Chevron Corporation

named Jef Shellebarger president of

Chevron North America Exploration

and Production Company.

Shellebarger succeeds Gary Luquette,

who will retire afer 35 years. He

will be responsible for overseeing

Chevrons exploration and produc-

tion activities.

Chevron is an integrated energy

company. www.chevron.com

NICHOLAS DALE & GERRY

MILLER, Claxton Engineering

Services Ltd.

GREAT YARMOUTH, U.K. ( June

5, 2013) Claxton Engineering

Michael

Brown

ACTEON

completes acquisition of J2 Engineering Services Ltd. July 11, 2013

GE

completes acquisition of Lufin Industries July 1, 2013

ACCELERATED COMPANIES

acquires DynaFlo Artifcial Lif Systems and

Five Star Equipment June 27, 2013

ROSNEFT

and ExxonMobil advance strategic cooperation June 21, 2013

MERGERS & ACQUISITIONS

www.upstreampumping.com 7

Services Ltd., an

Acteon company,

named Nicholas Dale

business develop-

ment manager for

Southeast Asia. Based

in Singapore, he will

focus on increasing the

companys penetration

into the areas market.

Claxton also appoint-

ed Gerry Miller as

vice president of sales,

marketing and com-

mercial. Millers base

will be at Claxtons headquarters in

Great Yarmouth, U.K.

Claxton, an Acteon company,

supplies engineering and services,

www.claxtonengineering.com.

Acteon companies provide mooring,

foundation, riser, conductor, fowline

and marine electronics products and

services, www.acteon.com.

VISTAVU Among Canadas

Fastest-Growing Companies

CALGARY, Canada ( June 3, 2013)

VistaVu made its frst appearance

on the defnitive listing of Canadas

Fastest-Growing Companies. It was

ranked 385 in the 2013 PROFIT 500

list.

VistaVu Solutions is an ERP

sofware solution provider. www.

vistavusolutions.com

MIKE SUMRULD,

Baker Hughes

HOUSTON (May 28, 2013)

Baker Hughes Incorporated named

Mike Sumruld as vice president and

treasurer.

Baker Hughes supplies oilfeld

services, products, technology and

systems to the oil and natural gas

industry. www.bakerhughes.com

IN THE FIELD

Weir Minerals Canada Opens

New Facility

MISSISSAUGA, Ontario ( July

24, 2013) Weir Minerals Canada

announced that its Fort McMurray

service and distribution operation

has been relocated to a new facility

in the MacKenzie Industrial Park.

Tis 19,000-square-foot facility will

support customers in the Athabasca

Oil Sands. Weir Minerals delivers

end-to-end solutions for mining,

dewatering, transportation, milling,

processing and waste management

activities. www.weir.co.uk

Gerry Miller

Nicholas

Dale

Scalewatcher

The simple solution to hard water problems

Dont

Let This

Happen

To Your

Pipes!

Saves you money

Prevents scale formation

Removes existing scale

Maintenance free

Treats any size of pipe

Environmentally friendly

Over half a million

satisfed customers

Money back guarantee

Scalewatcher

345 Lincoln St.

Oxford, PA 19363

800-504-8577

610-932-6888

Fax: 610-932-7559

scalewatcher.com

circle 123 on card or go to upsfreeinfo.com

8 Upstream Pumping Solutions July/August 2013

INDUSTRY NEWS

SCHLUMBERGER Opens

Reservoir Laboratory in China

CHENGDU, China ( July 3, 2013)

Schlumberger announced the of-

fcial opening of the Schlumberger

Reservoir Laboratory in Chengdu,

China.

Te company also contributed

fve scholarships to the American

Association of Petroleum Geologists

(AAPG) Outstanding Student

Chapter Awards. Schlumberger is a

supplier of technology, integrated

project management and informa-

tion solutions. www.slb.com

GE Measurement & Control

Unveils New Customer

Application Center

MOSCOW ( June 26, 2013) GE

announced the grand opening of its

new Customer Application Center

in Moscow. Te company also

announced the grand opening of its

Customer Solutions Center at GE

Measurement & Controls Inspection

Technologies site in Lewistown,

Pa. GE Measurement & Control

provides advanced, sensor-based

measurement; non-destructive test-

ing and inspection; fow and process

control; turbine, generator, and plant

controls; and condition monitoring.

www.ge-mcs.com

HOLT CAT Breaks Ground for

New Facilities

EDINBURG, Texas ( June 25, 2013)

HOLT CAT held groundbreak-

ing ceremonies for its facilities in

Edinburg, Texas, and Little Elm,

Texas.

HOLT CAT sells, rents and ser-

vices Caterpillar machines, engines,

generator sets and trucks. www.

holtcat.com

EVENTS

Eastern Oil & Gas Conference

Aug. 27 28

Monroeville, Pa.

www.pioga.org

Oil Sands Conference

Sept. 9 11

Fort McMurray, Canada

www.oilsandstradeshow.com

NEVA

Sept. 24 27

St. Petersburg, Russia

+44 1449 741801

www.transtecneva.com

SPE ATCE

Sept. 30 Oct. 2

Ernest N. Morial Convention Center

New Orleans, La.

800-456-6863

www.spe.org/atce/2013

Its Your Play...

Black!

Go For

1809 Century Avenue SW

Grand Rapids, MI 49503-1530

USA

+1 (616) 241-1611

www.blackmer.com

Blackmer sliding vane pumps and reciprocating gas compressors

are the best bet to boost productivity in Oil & Gas applications.

Contact your authorized Blackmer distributor today.

W

h

e

r

e

I

n

n

o

v

a

t

i

o

n

F

l

o

w

s

.

W

h

e

r

e

I

n

n

o

v

a

t

i

o

n

F

l

o

w

s

Sliding vane pumps provide sustained performance and trouble-free operation

Reciprocating gas compressors with advanced design technology for maximum performance

Wide range of materials, models, and designs available for product compatibility

SUPPLIER

HD Series

HXL Series

circle 122 on card or go to upsfreeinfo.com

BECAUSE DOWNTIME

IS UNACCEPTABLE

Whether youre 30 miles offshore or drilling 10,000 feet in the middle of Oklahoma,

you cant afford downtime. If the drill stops, youre losing money. Thats unacceptable.

With 16,000 units representing 10 million horsepower in oilelds worldwide, Yaskawa

AC drives offer a combination of proven performance, consistent reliability and a

personal commitment to your success.

Need to complete your drilling project on time and without costly downtime?

Trust Yaskawa.

YAS KAWA AMERI CA, I NC.

DRI VES & MOT I ON DI VI S I ON

1 - 8 00-YAS KAWA | YAS KAWA. COM

For more info:

http://Ez.com/yai493

Get personal with Yaskawa.

Call Jonathan Johnson today.

1-847-887-7145

2013 Yaskawa America Inc.

c

i

r

c

l

e

1

0

9

o

n

c

a

r

d

o

r

g

o

t

o

u

p

s

f

r

e

e

i

n

f

o

.

c

o

m

10 Upstream Pumping Solutions July/August 2013

DRILLING

D

ilute drilling fuid required

to return the drilling fuid

to within the original speci-

fcation is a major drilling expense.

Typically, 20 or more barrels of dilute

drilling fuid are required to ofset

one barrel of drilled solids that is not

removed from the drilling fuid. As a

result, many operators now use a de-

canter centrifuge, in addition to the

standard shaker and desander, to im-

prove their solids removal ef ciency

(SRE).

Te improvement in SRE comes

from a decanter centrifuges abil-

ity to remove drilled solids that are

too small for a shaker, desander and

desilter to separate. Tis article dis-

cusses how a centrifuge fed by a ro-

tary lobe pump can improve solids

removal. It also details an example

of a savings calculation from a dilute

drilling fuid calculator that shows

the possible savings from using a de-

canter centrifuge with a rotary lobe

pump.

Feeding with a Rotary

Lobe Pump

A centrifuge can help remove solids

that are too small to be eliminated by

the standard shakers, desanders and

desilters. Te D50 cut-point for the

shaker, desilter and desander combi-

nation is typically 70 microns. Te

D50 cut-point for a decanter centri-

fuge is typically 6 microns. A D50

cut-point of 6 microns means that

the centrifuge will remove 50 percent

of the 6 micron solids in the drilling

fuid.

To obtain the maximum beneft,

decanter centrifuges should be fed

by a low-shear, positive displacement

pump. Te solids removal is improved

with a rotary lobe pump because a

centrifugal pumps shearing action re-

sults in a higher percentage of drilled

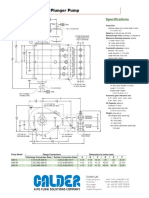

Rotary Lobe Pumps &

Decanter Centrifuge Increase

Solids Removal

By Bill Blodgett, LobePro Rotary Pumps

Operators can experience ease of use, cost savings and improved efciency.

A drilling rig in the Marcellus Shale, image courtesy of Baker Hughes Inc.

www.upstreampumping.com 11

solids that are less than 6 microns and,

therefore, unable to be removed by

the centrifuge. Te fow from a rotary

lobe pump is not afected as much as

a centrifugal pump by changes in vis-

cosity, pressure and specifc gravity.

Terefore, a rotary lobe pump can be

much more readily managed to feed

enough drilling fuid to take full ad-

vantage of the centrifuges capacity

without overfeeding it.

Drilling rig personnel are gener-

ally occupied with other tasks and

cannot constantly adjust a centrifugal

pump or change impellers as required.

As a result, many more barrels of drill-

ing fuid will typically be processed by

the centrifuge when fed by a rotary

lobe pump.

Tis is also important because it

is generally accepted that drilling sol-

ids not removed on the frst pass will

never be removed and will have to be

controlled by dilution.

Rotary Lobe Pump

Improvements

Measured

Table 1 shows a substantial reduction

in dilution drilling fuid required for a

7,000-foot hole that results from the

addition of a decanter centrifuge to

other solids separation equipment. In

this example, the savings in dilution

drilling fuid preparation and disposal

net of the centrifuge rental expense

is $70,548 for the one 10-day job.

Te example in Table 1 is taken from

Chapter 13 of the Drilling Fluids

Processing Handbook published by

ASME Shale Shaker Committee.

Te drilling fuid in this example

was separated using a shaker, desilter

and desander in combination, which

removed 60 percent of the drilled sol-

ids. Ten a centrifuge removed of

the 40 percent of drilled solids that re-

mained. Te improvement in SRE re-

sulted from the decanter centrifuges

ability to remove particles between 6

to 70 microns that were not removed

by the other solids separation equip-

ment.

In the example, a well bore of

13.5 inches in diameter that is 7,000

feet deep will result in 1,237 barrels of

drilled solids. Te shaker, desilter and

desander combination leaves 495 bar-

rels (40 percent of 1,237) of drilled

solids in the drilling fuid. Using

Section 4 in Table 1, 32.1 barrels of

dilute drilling fuid are required for

each barrel of drilled solids to restore

the drilling mud to specifcation. Tis

equals 15,868 barrels of dilute drilling

fuid (495 x 32.1) with a total cost of

$238,025 ($15 x 15,868) for dilute

drilling fuid if a decanter centrifuge

is not used.

By using a decanter centrifuge

fed by a rotary lobe pump to remove

of the 495 barrels of drilled solids

remaining in the drilling fuid afer

processing by the shaker, desander

and desilter combination, the cost of

dilute drilling fuid can be reduced by

$78,548 ($238,025 x ).

Some drilled solids, primarily

those less than 6 microns, remain afer

centrifuge treatment. Unfortunately,

the solids that contribute most to

poor hole conditions are colloids and

ultra-fne solids under 6 microns. As

a result, many experienced operators

have switched to low-shear, positive

displacement pumps to feed the de-

canter centrifuge in an efort to mini-

mize colloids and ultra-fne drilled

solids.

Te dilute drilling fuid calcu-

lator, which was used to obtain the

numbers in Table 1, helps determine

the reduction in dilution drilling fuid

required if the centrifuge is fed with

a low-shear rotary lobe pump versus a

centrifugal pump. (Email the author

for a copy of the calculator.)

Using a centrifugal pump instead

will reduce the percentage of drilled

Table 1. Dilute drilling uid calculator

12 Upstream Pumping Solutions July/August 2013

DRILLING

solids removed from 33 percent to

25 percent. Tis reduces the savings

from using a decanter centrifuge

by $19,042 on just one 10-day job.

Additional benefts of a rotary lobe

pump are:

Eliminating the annual overhaul

cost for the centrifuge that can

result from overfeeding of the

centrifuge by a centrifugal pump,

typically about $12,000 per year

Avoiding priming problems at the

drill sitea nuisance for opera-

torsbecause rotary lobe pumps

are self-priming and have strong

vacuums

Case Study

In 2009, a pumping solution com-

pany was selected by a manufacturer

of decanter centrifuges as a partner.

Most operators using low-shear, posi-

tive displacement pumps selected

progressive cavity pumps (PCPs). Te

decanter centrifuge manufacturers

management knew that several key

operators were unhappy with the

PCPs because of feld failures caused

by dry running for as little as 30 sec-

onds, the time and dif culty to re-

place parts in the feld, and the cost of

repair parts.

Afer extensive testing by its en-

gineering staf, one of these users se-

lected the decanter centrifuge manu-

facturers package featuring the rotary

lobe pumps to feed their centrifuges

and have replaced many of their

PCPs with the pump solution com-

panys low-shear, positive displace-

ment pump. Tese rotary lobe pumps

are well-suited for their drilling mud

tasks because they can run dry, pro-

vide low shear, have a strong vacuum

and are self-priming. An additional

bonus to these pumps is the ability to

perform pump maintenance in-place

quickly and easily. One person can

handle the maintenance on the com-

panys average size pump in half the

time of a comparable PCP.

Bill Blodgett is presi-

dent of LobePro Rotary

Pumps. He holds degrees

in economics and fnance

fom the University

of Pennsylvania and

the University of Chicago. He can be

reached at billb@lobepro.com.

LobePro Rotary Pumps provides engi-

neered pumping solutions in applica-

tions such as drilling mud, oil refning,

corrosives and waste oil. To learn more

about LobePro Rotary Pumps, please

visit www.lobepro.com.

H b

2570 Beverly Dr. #128, Aurora, IL 60502 T 630.236.3500

circle 120 on card or go to upsfreeinfo.com

circle 104 on card or go to upsfreeinfo.com

14 Upstream Pumping Solutions July/August 2013

WELL COMPLETION

A

s oil and gas well fracture

stimulation has progressed,

multiple novel technologies

have been developed to keep pace.

With the onset of horizontal lateral

drilling and completion work, this

trend has been magnifed even more.

It has been reported that 500 to 1,000

trillion cubic feet of recoverable gas

reserves have been added by North

American shale plays alone. In 19 geo-

graphical basins, an estimated 35,000

horizontal wells have been drilled and

completed using multistage fractur-

ing techniques.

Proved reserves of U.S. oil and

natural gas in 2010 rose by the highest

amounts ever recorded since the U.S.

Energy Information Administration

(EIA) began publishing proved re-

serves estimates in 1977. An impor-

tant factor for both oil and gas was

the expanding application of horizon-

tal drilling and hydraulic fracturing in

resource shales and other tight (very

low permeability) formations. Te

same technologies that frst spurred

substantial gains in natural gas proved

reserves have more recently expanded

into similar oil producing formations.

Helping drive proved reserves increas-

es in 2010 were higher prices used to

assess economic viability relative to

the prices used for the 2009 reporting

year, particularly for oil.

1

Remedial Eorts for

Fracture Treatment in

Horizontal Laterals

By Robert Reyes, Halliburton

A design stimulation program using a diversion frac for proppant distribution can

effectively stimulate troubled wells.

First of Two Parts

www.upstreampumping.com 15

Stimulation Evolution

Fracture stimulation methods have

evolved signifcantly from the high

rate100 to more than 180 barrels

per minutetrue limited entry de-

sign that used perforation techniques

in an attempt to fracture treat from

the heel to toe with a one-time pump-

in stage. Many of these applications

treated as much as a mile of lateral in

one or two hours in a single opera-

tion. On most of these jobs, when a

post-frac survey was performed, a

large percentage of the lateral would

show little or no stimulation, with the

toe section most ofen untreated. Tis

led well operators to seek better com-

pletion plans, and new completion

and stimulation tools were designed

to implement such changes.

Te frst major change was to

subdivide the wellbore and use the

same limited entry perforating tech-

nique on shorter sections, with the in-

dustry designing new staging plug de-

signs that allowed them to be pumped

down the lateral to the desired posi-

tion and wireline set. Soon, this type

of plug would also drag down a multi-

shot perf gun in the same operation,

and by about 2002 or 2003, the perf

and plug process was in use. New

completion designs emerged that re-

quired lower injection rates, typically

50 to 90 barrels per minute, depend-

ing on the number of dividing stages

that were selected or the number of

perforated intervals per stage. For this

reason, staged fracturing completions

began to be the dominant method as

resource shale completions became

more common.

Tis perf and plug method re-

duced horsepower costs while pro-

viding each fractured compartment a

better chance to be efectively treated.

Te savings in horsepower was ini-

tially a trade of with the amount of

increased time spent performing the

stage frac treatment, but going back

to non-staged completions was not

considered a viable economic option.

With decreased total completion time

becoming a critical issue for improv-

ing economics further, pumping ser-

vice companies began to address how

the stage fracture treatment could

be as ef cient as the compartmental

lower rate plug and perf method, yet

signifcantly reduce the time required

for stimulation. Te next major solu-

tion was sliding sleeves activated by

ball drop mechanics. Tis approach

increased the hardware costs of com-

pletion, but ofered the economic

benefts of reduced stimulation times.

By installing the lateral slid-

ing sleeves with a baf e (increasing

in opening size as the position ap-

proached the heel) each stage would

end by dropping a specifcally sized

ball from the surface to land on the

baf e and slide the sleeve into an

open position. With this technol-

ogy, instead of shutting down to

pump a plug and perforate, the time

between stages was reduced signif-

cantly. Operators were again able to

fracture an entire wellbore lateral

(10 to 20 stages) in one day, possibly

even allowing for fowback. However,

just as plug and perf operations of-

ten encounter malfunctions that add

costs, so might the ball activated slid-

ing sleeve completion. Tey may be

caused by human error of action or

judgment, mechanical failure, or by

unforeseen quirks of nature.

With respect to the premature

sticking of plugs or failed perf guns,

recovering from these failures is usu-

ally possible, with added time and

costs for the recovery operations, but

seldom with very much loss of pro-

ducing zones. However, when a fail-

ure occurs with a ball activated sliding

sleeve assembly in place, the degree of

problem may be as small as losing a

single pay interval to an issuesuch

as 10 or more completion stages with

sliding sleeves in the lateral and be-

ing unable to open any of the sliding

sleeve ports. Such a case could pos-

sibly be solved by milling out all the

ball seats and then attempting to re-

vert back to the application of plug

and perf technique, requiring pos-

sibly a week or longer to recover the

wellbore and to pump a perf and plug

stimulation.

Tis two-part series discusses

a novel technique detailing a west

Texas case history in which a service

company was asked to recover a well

in which all the sliding sleeve comple-

tion tools were in failure mode. It was

decided to open all the zones and use

a new product to efectively treat all

stages in one pumping treatment. Tis

technique is called diversion frac for

proppant distribution.

Diversion Frac for

Proppant Distribution

Te diversion frac method is engi-

neered to improve the ef ciency of

completion techniques. As a result,

production increases should be ob-

served. Te procedure involves pro-

viding all reservoir access points an

opportunity to receive fracture stimu-

lation treatment. Te access points

include the perforations, comple-

tion sliding sleeve tools, hydraulic

sleeves, hydrojetted holes, and open

hole, which are the fracture initiation

points. With the staged dropping of

a biodegradable material, which exists

in a range of mesh sizes, a previously

treated zone is bridged and diverted,

sending the trailing fracture treat-

ment stage into the next access point,

which should be the next untreated

zone that is least resistant to taking

fuid. Time is saved when the drop is

made, and the previously treated zone

is diverted, redirecting the treatment

16 Upstream Pumping Solutions July/August 2013

WELL COMPLETION

fuid that follows to break down

the next zone. Tis process occurs in

the same timeframe in which crews

operating the old plug and perforate

method would be shutting down

to get ready for wireline runs to set

a plug and perforate the next zone,

which could take two hours per stage

on an average well.

Background: Plug and

Perforate Method

Te plug and perforate completion

technique has been the primary pro-

cess for stage frac completions for

most of the past decade. Te well com-

pletion type most commonly applied

has been be a cemented liner or casing

or, less ofen, an openhole liner using

casing external packers to partition

the annulus into zones and includes

pumping down plugs and perforat-

ing guns in horizontal applications.

Te application consists of gaining

entry to the formation by perforating

the farthest interval or the toe section

and then breaking down the forma-

tion and pumping the frst fracture

treatment into this zone. Afer a large

fush stage to wash residual proppant

from the wellbore and then shutting

down, isolation is achieved from the

just-treated zone by placing a pump-

down mechanical plug above it. Ten

the process repeats as the next zone to

be treated is perforated (typically two

to seven perf clusters). Te gun is re-

trieved and then the interval is broken

down and fracture stimulated. Tis

procedure continues until the last

planned zone is treated and fushed.

In North America, the plug and

perforate process is being used in

about 85 percent of todays horizon-

tal well completions.

2

Ef ciencies can

be improved by combining multiple

perforating runs (i.e., multiple stages)

into one and a signifcant amount of

time can be saved by using diversion

frac for proppant distribution in be-

tween these sub-stages. With an hour

or two as a baseline to perform wire-

line runs, running three sub-stages in

one run saves two to four hours per

treatment.

Applications of

Diversion Frac for

Proppant Distribution

Te service operators special biode-

gradable diverting agents provide tem-

porary temperature- or time-based

fuid-loss control (temporary perf

sealing) in the near-wellbore region

(NWB) of the perforations and the

fracture of new zones accepting fuid

afer the diverter arrives. Diverting

agents of this type have been used to

divert in perforation tunnels, near-

feld fractures, slotted liners and open

hole zones to redirect the fracturing

treatment fuid to non-treated zones

(zones that accepted little or no fuid

before diverter placement).

Treatment fuids used include

frac gel, acid, scale treatment and well-

control treatments. Te treatment can

be placed in aqueous fuid between

applications or bullheaded before an

application, such as with split casing

in which one is attempting to divert

away from a trouble zone. Volumes

required depend on the geometry of

where diversion is desired. Reservoir

or treating pressure will not afect bio-

degradable diverters.

Te advantages of biodegradable

diversion material include:

Treatment time is reduced.

Treatment fuid is distributed more

ef ciently.

Te need to drill out plugs is

eliminated.

Figure 1. Material A (1 pound per gallon) degradation testing at 160 F

Figure 2. Material B degradation at 100 F

www.upstreampumping.com 17

Te material is compatible with

many fracturing fuids.

Te material degrades over time.

Care must be taken to isolate the

pumps that are engaged with the ma-

terial because special valve seats are

required for proper pumping.

2

Diverter Delivery

and Diversion

Using a method to alter fow distribu-

tion is called diversion. Its purpose is

to divert the fow of fuid from one

portion of an interval to another.

Te diversion method best suited

for a particular situation depends on

many factors, including but not lim-

ited to the type of well completion,

perforation density, the type of fuid

that is produced or injected afer the

diversion treatment, casing and ce-

ment sheath integrity, bottomhole

temperature, and bottomhole pres-

sure available as fow-back energy.

3

Particle bridging is achieved with

a product that is multi-sized, biode-

gradable and temporary. Two specifc

size distributions are:

Material A particle size distribu-

tion: 20 to 25 percent is in the

4- to 10-mesh size range and 40

to 50 percent is in the 20- to 40-

mesh size range. Te remainder is

smaller.

Material B particle size distribu-

tion: 8 to 10 percent is larger than

8 mesh, 40 to 50 percent is in the

20- to 40-mesh range, and 30 to 45

percent is smaller than 40 mesh.

Te action of the smaller particles

will nest in the pore throats of the

coarse-sized particles and create a seal

to fuid fow. A characteristic of par-

ticle bridging is that it is independent

of the size or geometry of the perfo-

ration or void space. Te variable

mesh will accumulate and divert fuid

fow. At the designed temperature, the

material will sofen, helping achieve a

seal that is more restrictive to fow,

which creates back-pressure against

any fuid that attempts to fow into a

diverted channel. Tis allows higher

pressure in the wellbore that may be

needed to initiate fow in a new zone.

Once the material is pumped into

the perforation or fracture, it will later

degrade based on temperature and/

or time. Te Material A form of this

agent is efective in wells with a bot-

tomhole static temperature (BHST)

of 160 to 320 F (see Figure 1). For

wells with lower BHSTs, Material B is

efective in temperatures as low as 140

F and up to 450 F (see Figure 2).

For cooler wells, because the deg-

radation occurs over time, depend-

ing on the pumping time, it can be

acceptable to use diversion frac for

proppant distribution, but laboratory

testing must confrm the candidate

well. Case History A (discussed later

in this article) was such a well, with

BHST of only 127 F.

Degradation of these materials is

based on the dissolution of the mate-

rials in water or other brine solutions.

For typical well fowback, 100 percent

dissolution is not required. Field ex-

perience has indicated that as little as

20 percent degradation would result

in non-restrictive fowback and clean

up times would not be impacted.

Case History A

Te case history discussed in this sec-

tion describes a horizontal west Texas

well in Ward County. Te well was

cased with 7-inch, 26-pound-per-foot

Name

Measured

Depth (feet)

Outer

Diameter

(inches)

Inner

Diameter

(inches)

Linear

Weight

(ppf)

Grade

Production

Casing

0 to 8,610 7 6.276 26 P-110

Open Hole 7,651 to 9,718 6.125

Production Liner 7,651 to 12,353 4.5 4.000 11.6 P-110

Table 1. Tubulars

Interval Name/ Depth (feet) No. of Perfs TVD (feet)

Stg 1 perforation interval: 12,213 to 12,214 12 8,083

Stg 2 perforation interval: 11,900 to 11,901 12 8,081

Stg 3 perforation interval: 11,546 to 11,547 12 8,078

Stg 4 perforation interval: 11,145 to 11,146 12 8,084

Stg 5 perforation interval: 10,703 to 10,704 12 8,099

Stg 6 perforation interval: 10,253 to 10,254 12 8,114

Stg 7 perforation interval: 9,989 to 9,990 12 8,119

Stg 8 perforation interval: 9,633 to 9,634 12 8,125

Stg 9 perforation interval: 9,366 to 9,367 12 8,130

Stg 10 perforation interval: 8,967 to 8,968 12 8,136

Stg 11 perforation interval: 8,655 to 8,656 12 8,144

Stg 12 perforation interval: 8,344 to 8,345 12 8,146

Table 2. Perforations

Treatment/Depth (ft.) Pore Press. (psig) BHST (F) Frac. Grad. (psi/ft.)

Devonian: 8,344 to 12,214 3,092 127 0.75

Table 3. Lithology

18 Upstream Pumping Solutions July/August 2013

WELL COMPLETION

(ppf ) casing to 8,610 feet, then a 4.5-

inch liner 11.6 ppf is hung at 7,651

to 12,353 feet. True vertical depth

(TVD) was 8,144 feet. Drilled in

the Devonian formation, perfora-

tions were at 12,213; 11,900; 11,546;

11,145; 10,703; 10,253; 9,989; 9,633;

9,366; 8,967; 8,655; and 8,344 feet

shot with 12 shots per foot. Pore pres-

sure was 3,092 psi with 127 F BHST.

A previous service company ran

sliding sleeves as part of the liner,

and the sleeves would not open, caus-

ing a job failure. Te ball-seat baf es

had to be drilled out to allow perfo-

rating. Using the diversion frac for

proppant distribution material, it was

decided to perforate the above depths

and have the horizontal lateral 100

percent open in all zones planned to

frac. Te fracture treatment design

would incorporate diversion to place

the proppant treatment into all zones

in one large pump-in stage. Tables 1

through 3 present the details for the

tubulars, perforations and lithology

of the Ward County well.

Design

Te team decided to pump a guar-

based crosslinked fuid (prepared

from 15 centipoise [cp] base gel) car-

rying 1, 2, 3 and 4 pounds mass per

gallon (lbm/gal) brown 20/40-mesh

sand in fve separate stages. Afer each

fush, the plan was to drop 240 lbm of

100-mesh sand with 240 lbm of the

diversion frac for proppant distribu-

tion material such that it equates to 2

lbm/gal concentration for the diverter

combinations based on the volume in

which they were mixed. Because fve

proppant frac stages were planned,

diversion material was dropped afer

Stages 1 through 4. Afer Stage 5, only

a fush was to be used.

Actual

Te fracture treatment used the

following volumes (Note: All cross-

linked gel was prepared using the 15-

cp linear gel):

74,848 gallons of linear 15-cp fuid

used for fushes and to place divert-

ing material downhole

75,663 gallons of crosslinked gel

used in pad stages

209,464 gallons of crosslinked

gel used to carry 319,848 lbm of

20/40-mesh brown sand at 1, 2, 3

and 4-lbm/gal concentrations

5,964 gallons of crosslinked gel to

carry the diverters at a 2-lbm/gal

concentration

Figures 3 through 6 illustrate the

diversion efects. Stage 1 (not shown)

pumped 47,833 lbm of proppant,

and Stage 2 was commenced (Figure

3). Stage 2 frst dropped a diverter at

11:23 minute on the surface, and it ar-

rived at the calculated bottom interval

at 11:43 minute, which corresponds

to a 200-psi increase in pressure be-

tween these two times as the diverter

approached an uphole, open perfo-

ration. Te operations proceeded to

frac, as designed. A total of 123,203

lbm of proppant was pumped during

Stage 2.

In front of Stage 3 was the sec-

ond diverter drop (Figure 4). Te

diverter was dropped at 13:46 on the

surface, and at 14:11 it reached the

calculated bottom interval, with a

400-psi increase in pressure at 13:56.

Operations proceeded to frac Stage 3.

Figure 3. Pumping of diverter following Stage 1 and the pumping of Stage 2

Figure 4. Diverter after Stage 2 and the pumping of Stage 3

www.upstreampumping.com 19

Sand-laden fuid was pumped (not as

designed, due to high pressures) at 0.5

and 1 lbm/gal. A total of 32,891 lbm

of proppant was pumped.

Prior to Stage 4 was the third di-

verter drop (Figure 5). Te diverter

was dropped at 15:54 on the surface,

and at 16:18, it reached the calculated

bottom interval, with a 300-psi in-

crease in pressure at 16:16. Operations

proceeded to frac Stage 4. Sand-laden

fuid was pumped (not as designed

because of pressure rise) from 0.5, 1,

2 and 3 lbm/gal. Te operator did not

attempt to pump the 4-lbm/gal con-

centration. A total of 115,921 lbm of

proppant was pumped during Stage 4.

Preceding Stage 5 was the fourth

diverter drop (Figure 6). Te diverter

was dropped at 17:45 on the surface

and reached the calculated bottom

interval at 18:17, with elevated pres-

sures. Pumping sand-laden fuid was

not attempted because of maximum

pressure, and the job proceeded to the

fush stage.

Conclusions

Tis work discusses a case history

from a horizontal west Texas well in

Ward County involving diversion frac

for proppant distribution. Te project

was initiated with a troubled horizon-

tal wellbore, which was an economic

burden. Having not been stimulated,

any treatment seemed costly, because

completion tools that had previously

failed had to be altered before the

operator believed a fracture treatment

could be attempted.

A pumping service company

engineered a remedial design stimu-

lation program involving the pre-

perforating of 12 zones and using a

diversion frac for proppant distribu-

tion, which was pumped with excel-

lent results. Both the service company

and the operator were satisfed with

the results, but production numbers

have not yet been released at the re-

quest of the well operator.

Te 4,000-foot lateral and 144

perforations encompassing many

stages of shale pay were efectively

stage fracture treated in approximate-

ly 10 hours. Tis pump-in included

319,848 lbm of 20/40-mesh brown

proppant and 365,939 gallons of frac-

turing fuid with additives and break-

ers set to create a signifcant stimu-

lated reservoir volume, providing the

well a very good chance for economic

production.

Part Two (September/October

2013) will include two other case his-

tories using the diversion frac method.

References

1. EIA U.S. Energy Information

Administration, August 2012.

2. Halliburton. 2012. AccessFrac PD.

Technology Bulletin SMA-1-000-X,

8/23/2012.

3. Reyes, R., Glasbergen, G., Yeager, V.,

and Parrish, J. 2011. DTS Sensing: An

Emerging Technology Ofers Fluid

Placement for Acid. Paper SPE 145055

presented at the SPE Annual Technical

Conference and Exhibition, Denver,

Colorado, USA, 30 October 2

November.

Robert Reyes is on the

Technology Team for

Halliburton Energy

Services in the Permian

Basin and has 18 years

of experience in the oil

and gas industry.

Figure 5. Diverter after Stage 3 and the pumping of Stage 4

Figure 6. The diverter after Stage 4 did not allow pumping of Stage 5

20 Upstream Pumping Solutions July/August 2013

WELL COMPLETION

A

s the hydraulic fracturing

industry has grown and

developed in recent years,

greater demands are placed on hy-

draulic fracturing (frac) and well ser-

vice pump equipment. Specifcally,

because of the necessity of well ser-

vice capabilities at increasing depths,

these pumps face higher pressures

and greater power requirements.

Short Life in

Harsh Conditions

As one of the main consumables of

the pump, the fuid end is greatly

afected by these rising demands.

Depending on the power rating of

the pump, the fuid end must survive

harsh operating environmental con-

ditions while performing at increas-

ingly high pressures and high fow

rates. For example, operating pres-

sures up to 15,000 psi and speeds of

up to 300 strokes per minute are not

uncommon. Te life of the fuid end

is also greatly afected by the pumped

proppant, which can cause erosion

of the pumps internal surfaces and

valves. Ultimately, this reduces the

pressure and fow rate capacity of the

pump.

Pumps are generally confgured

as triplex (three pressure plungers)

or quintuplex (fve pressure plung-

ers) units. During the operational

cycle (one complete revolution of the

pump crank), each pressure plunger

is incorporated into operation. In

particular, the triplex and quintuplex

pumps operate at 120-degree and

72-degree intervals, respectively.

For instance, the correspond-

ing oscillating pressure cycles within

a quintuplex fuid end range from a

negative pressure (suction) to dis-

charge (up to 15,000 psi), occurring

every ffh of a second for a pump

operating at 300 strokes per minute.

Te eventual result of these demand-

ing conditions is fatigue cracking.

Searching for Solutions

During the last decade, the industry

has developed and refned its fuid

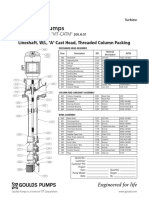

Fluid End Life

By Gary Pendleton and Rob McPheron, AXON Energy Products

Fluid end developments and modular design prolong uid end life while maintaining

higher pressures.

Confgurable quintuplex pump with modular fuid end assembly

Examples of varied fuid end replacement types

www.upstreampumping.com 21

ends to provide operators with solu-

tions to prolong fuid end life while

maintaining high pressures. For ex-

ample, tougher carbon steels and/or

stainless steels have been developed

to provide increased durability of the

internal surfaces to reduce the erosive

efects and resist fatigue cracking.

Tese properties must be balanced

with the increased dif culty of ma-

chining tougher steels and the chemi-

cal efects of the proppants used.

Techniques have been specif-

cally developed to reduce fatigue

efects, including autofrettage and

shot peening. Autofrettage is a metal

processing technique that exposes the

fuid end to massive pressure, causing

its internal portions to yield. Shot

peening is achieved by accelerating

spherical media against the fuid ends

surface to form small dents. Both

methods provide localized, com-

pressed surfaces within the internal

structure of the fuid end. For crack-

ing to occur, the compressive stresses

must be overcome before a tensile

stress can be developed. Once in the

tensile region and subject to material

and geometric properties of the fuid

end, cracking may begin.

Additional benefts can be

achieved with modular fuid ends

if the pressure containment can be

isolated from imposing stresses to

adjacent fuid end cylinders. Because

of its design, stress transfer typically

occurs between cylinders in mono-

block assemblies. In contrast, single

fuid ends (in a triplex or quintuplex

model) provide a natural break in the

stress transfer, reducing the fexing

stress amplitude within the fuid end.

Tis improves pressure cycles and

reduces cylinder stress during opera-

tion, thereby diminishing the poten-

tial for fatigue stress.

All fuid ends could ultimately

fail because of fatigue cracking or a

reaction to chemicals, erosion or a

combination of these. When operat-

ing at high pressures, fuid ends are

prone to fnite lifespans. Using mod-

ular fuid end assemblies instead of

a monoblock design results in easier

maintenance and reduced downtime.

In particular, the modular de-

sign allows for reduced maintenance

cost and time required for service.

Inventory options are also more vi-

able with the modular design, further

decreasing downtime.

For example, it is more viable to

have single fuid end assemblies in

Study conducted for modular fuid end

Depending on the power rating of the pump, the

uid end must survive harsh operating environmen-

tal conditions while performing at increasingly high

pressures and high ow rates.

circle 126 on card or go to upsfreeinfo.com

Reduce your operating costs and

increase your productivity!

PENTICTON FOUNDRY LTD

Penticton, BC, Canada

Phone: 1-250-492-7043 Toll Free: 1-877-288-1204

E-mail: sales@pentictonfoundry.com

Web Site: www.pentictonfoundry.com

Fully Machined castings, poured in our

engineered alloys, will increase the life of

your Frac Pump components.

Convert your fabrications to

CWI castings and achieve as much

as 10x the wear.

Penticton Foundry specializes in

machined Chrome White Iron castings

used in slurry pump components.

sss to to

Contact us today, to learn how we can help you reduce

your operating costs and increase your productivity.

22 Upstream Pumping Solutions July/August 2013

WELL COMPLETION

inventoryready for replacement

in the frac pump when needed

rather than enduring downtime as

the monoblock assembly is manufac-

tured.

Moreover, converting from

monoblock to modular does not re-

quire special tools, training or parts.

Regardless of the design, fuid

end life can be extended with a main-

tenance program that includes:

Inspecting fuid end internals for

damaged or worn parts afer each

job

Washing fuid ends to remove

any stagnant sediment

Inspecting stay rods and tie bars

for proper torque compressions

Maintaining accurate data for

the total rate pumped

Rather than mitigating pump is-

sues as they occur, a thorough main-

tenance schedule is ideal to ensure

the longest fuid end life possible.

Gary Pendleton is the

chief technology of-

fcer at AXON Energy

Products. He has been

involved in product

development in an

extensive range of industries and has

a track record of leading-edge technol-

ogy development and innovation. He

holds an engineering degree fom the

University of Sunderland and patent

registrations in a variety of industries.

Rob McPheron is

the account man-

ager for AXON Well

Intervention Products

with an expertise in

well service pumps and

equipment. Afer attending Middle

Tennessee State University and run-

ning his own business for seven years,

he joined AXON in 2009. He is a

member of SPE, AESC and ICoTA.

He can be reached at robmcpheron@

axonep.com or 832-655-9437.

Modular fuid end assembly compared with monoblock fuid end assembly

i d h

Middl

c

i

r

c

l

e

1

2

5

o

n

c

a

r

d

o

r

g

o

t

o

u

p

s

f

r

e

e

i

n

f

o

.

c

o

m

Everywhere

you are we

are right there

with you.

Email: mission@nov.com

2

0

1

2

N

a

t

i

o

n

a

l

O

i

l

w

e

l

l

V

a

r

c

o

A

l

l

r

i

g

h

t

s

r

e

s

e

r

v

e

d

D

3

9

2

0

0

4

9

2

0

-

M

K

T

-

0

0

1

R

e

v

0

2

O n e C o m p a n y . . . U n l i m i t e d S o l u t i o n s

National Oilwell Varco Mission offers equipment and services for

all of your well service needs. Along with an extensive product

offering of proven brands, Mission has a sales and after-market

network that spans six continents equipped for in-house and

on-site operations. All Mission well service equipment can be

VHUYLFHGUHSDLUHGDQGUHFHUWLHGHYHU\ZKHUH\RXDUH

For more information visit: www.nov.com/mission

MISSION

TM

Well Service Solutions

circle 105 on card or go to upsfreeinfo.com

24 Upstream Pumping Solutions July/August 2013

SPECIAL

s e c t i o n

A

s global energy demand con-

tinues to rise, operators are

pursuing new frontiers in oil

and gas exploration. Following several

years of steady gains, deepwater has

emerged as a leader in unconventional

oil and gas production. According to

an Information Handling Services

report, deepwater reserves accounted

for more than 75 percent of new dis-

coveries last year, exceeding onshore

and shallow water discoveries in num-

ber and size. Deepwater reservoirs are

typically located on the outer edge of

continental shelves and may be found

within the frigid confnes of the Arc-

tic Circle. Both situations pose special

challenges to nearly every aspect of

oil and gas exploration and produc-

tion, including the installation and

operation of pipeline fow assurance

systems.

In subsea oil and gas production,

fow assurance insulation technolo-

gies used to prevent hydrate and wax

formation typically rely on external

coatings, known as wet insulation,

Pipeline Protection During

Deepwater Production

By Alexander Lane, Te Dow Chemical Company

Wet insulation systems for subsea ow assurance provide reliable performance in

extreme environments.

SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEECCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAALLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLLL

ssssssss eeeeeeeeeeeeee ccccccccccccccccccccccccccccccccccccccccccccccccccccccccc tttttttttttttttttttt iiiiiiiiiiiiiiiiiiii oooooooooooooooooooo nnnnnnnnnnnnnnnnnnnnnnnnnnnnnnn sssssssssssssssssssssssssssss eeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee

SPECIAL

s e c t i o n

Performance of the system on line

pipe during reeling and installation

was tested via bend testing.

www.upstreampumping.com 25

SUBSEA EQUIPMENT

that provide thermal protection and

corrosion control from the wellhead

to the delivery point. Polypropylene

and polyurethanes have long been

preferred materials for fow assurance

insulation, primarily because they

satisfy performance needs in a repeat-

able, cost-efective manner.

In deepwater environments, fow

assurance becomes more challeng-

ing because oil fowing from the res-

ervoirs is ofen much hotter than oil

from shallow water or onshore wells.

At the other temperature extreme,

subsea Arctic wells face fow assur-

ance challenges because of extremely

cold ambient temperatures, which

can restrict the fexibility of insula-

tion material and complicate pipe

reeling and installation. In both cases,

these conditions stretch or exceed the

thermal and mechanical capabilities

of current wet insulation oferings for

subsea fow assurance.

Flow Assurance

Solution

To bridge the performance gap, a

chemical company initiated a multi-

year research project to develop a

pipeline fow assurance insulation so-

lution that would reliably perform at

higher service temperatures and lower

installation temperatures. Joining

forces with insulation system applica-

tors worldwide, this initiative resulted

in the development of a subsea fow

assurance wet insulation system.

Te subsea fow assurance wet

insulation system is based on a special

insulation material that ofers uni-

form performance from the wellhead

to the delivery point with a wide in-

stallation and operating temperature

range. Ongoing test data demonstrate

that the system has the ability to with-

stand pressures found at water depths

of at least 4,000 meters and main-

tain stable thermal conductivity at

in-service temperatures as high as 160

C (320 F). Testing also demonstrates

the systems ability to retain fexibility

and toughness in temperatures as low

as -40 C (-40 F).

Te insulation system features a

hybrid polyether thermoset insula-

tion coating for thermal protection

and a fusion-bonded epoxy (FBE)

underlay for corrosion resistance.

Te special FBE anti-corrosion coat-

ing is based on a specifc epoxy resin

technology and is used for line pipe

and feld applications. Te insulation

system maintains a consistent, low

K-factor across components and de-

livers thermal and corrosion protec-

tion using a single technology that

works from the wellhead to the deliv-

ery point. Tis feature helps improve

reliability at any foreseeable subsea

depth by reducing the potential risks

associated with bonding dissimilar

and potentially incompatible materi-

als used on line pipe, subsea architec-

ture and feld joints.

Testing System

Performance

Several tests were conducted in lab

and small-scale to ensure the insula-

tion systems viability for component

coating, pipeline installation and long-

term service performance prior to

commercial-scale testing. In ring shear

testing, a coated pipe without a joint

was cut, and a section was evaluated

for system adhesion by quantifying

the force required to separate the dual-

layer system from the pipe.

During fexural fatigue testing,

system fexibility was tested by cy-

cling a coated pipe with a coated joint

100,000 times to imitate the vibra-

tion that may be experienced during

production. In thermal shock testing,

a coated pipe with a coated joint was

subjected to sudden changes in tem-

perature, cycling between 4 C (39.2

F) and 160 C (320 F) to simulate

sub-zero installation temperatures

and hot oil fowing through a cold

pipe. Tese extreme temperature fuc-

tuations tested joint adhesion and the

overall mechanical integrity of the

system. In all cases, third-party testing

confrmed that the mechanical prop-

erties demonstrated by the system in

lab and small-scale testing were fully

reproducible at full commercial scale.

Optimizing the

Application Process

In addition to extensive performance

testing, commercial-scale coating

trials were conducted to establish

simple, repeatable commercial ap-

plication processes. Across all three

application areas, the coating trials in-

dicated that the application processes

for the components of the insulation

system were complete and that the

system can be applied at full-scale.

Insulation for Line Pipe

Insulation for line pipe was success-

fully applied by a member of the glob-

al qualifed coater network at a new

pipe-coating facility near the Gulf

of Mexico. Te chemical company

collaborated with this coater on the

full-scale qualifcation of the special

line pipe insulation and worked to

optimize the insulation application

capability of the plant.

While full-scale pipe trials con-

tinued, a bending/straightening trial

The fexural fatigue test demonstrated the

fexibility of the system and its resilience

to vibrations that may be experienced

during production.

26 Upstream Pumping Solutions July/August 2013

SPECIAL

s e c t i o n

of jointed pipe coated with special line

pipe and feld joints insulation materi-

als was conducted in 2012 to test the

performance of the insulation system

on line pipe during reeling and instal-

lation. Te pipe was subjected to fve

bending and straightening cycles on

a 7.5-meter radius bending former

and a 30-meter radius straightening

former, respectively, at 8.7 C (47.6

F) ambient test conditions. Te pipe

passed with no audible or visual signs

of disbondment or cracking. Te pipe

was subsequently exposed to simu-

lated service test conditions and post-

testing as well, without any issues.

Afer large-scale testing, specimens

from the pipe were machined to con-

frm property retention.

Insulation for

Field Joints

Te coater for the special feld joints

insulation had advanced equipment

installed at its new research and de-

velopment facilities to support the

new technology ofering. Tis coating

application specialist demonstrated

a simple and robust feld joint coat-

ing process for special feld joint in-

sulation at full production scale on

8-inch line pipe coated with the spe-

cial line pipe insulation. Te robust,

reproducible process resulted in high-

quality feld joints with a competitive

15-minute cycle time, high mobility

and a compact equipment footprint.

Complex Geometry

Insulation for Subsea

Architecture

Another important step in the on-

going qualifcation of the insulation

system as an end-to-end subsea fow

assurance solution was the successful

coating of subsea architecture with a

complex geometry. Since the intro-

duction of the insulation for subsea

architecture with a complex geom-

etry, a member of the global qualifed

coater network has refned its coating

application process to verify its ability

to custom coat complex subsea archi-

tecture and successfully applied the

special complex geometry insulation

to an experimental piece of subsea

architecture designed with intention-

ally complex geometry.

In preparation for the complex

geometry trial, the chemical company

conducted extensive fnite element

analysis modeling and worked closely

with the coater to design a rigor-

ous test piece that would exceed the

level of complexity typically found in

subsea architecture. Modeling results

informed the fnal shape of the mold

design and some of the internal coat-

ing processes. Afer prototype testing

and scale-up, the coating demonstra-

tion was successfully conducted and

replicated with multiple pours and

witnessed by members of a joint oil

and gas industry group.

Conclusion

Te chemical company continues to

pursue a high level of fow assurance

qualifcation for the wet insulation

system to decrease risk, especially in

extreme environments. Te new tech-

nology has been indicated for use in

subsea insulation applications.

Alexander Lane is the

global business leader

for the Transmission

segment of Dow Oil,

Gas & Mining, a

market-facing business