Академический Документы

Профессиональный Документы

Культура Документы

Derivative 07 October 2013 by Mansukh Investment and Trading Solution

Загружено:

Mansukh Investment & Trading SolutionsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Derivative 07 October 2013 by Mansukh Investment and Trading Solution

Загружено:

Mansukh Investment & Trading SolutionsАвторское право:

Доступные форматы

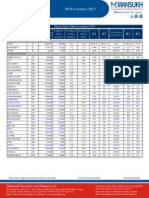

Daily Derivative Report

NIFTY FUTURE : 5907.30 -2.40 -0.04%

07 October 2013

Nifty Sentiment Indicators

Put Call Ratio-Nifty Options Put Call Ratio-Bank Nifty Options 1.31 0.84

NIFTY FUTURE HIGHLITES Nifty October 2013 futures closed at 5957 on Friday at a premium of 50 points over spot closing of 5,907.30, while Nifty November 2013 futures ended at 5990.80 at a premium of 83.50 points over spot closing. Nifty October futures saw an addition of 0.09 million (mn) units taking the total outstanding open interest (OI) to 17.44 mn units. The near month October 2013 derivatives contract will expire on October 31, 2013. From the most active contracts, JP Associates October 2013 futures last traded at a premium of 0.30 points at 38.00 compared with spot closing of 37.70. The number of contracts traded was 11,259. Reliance Communications October 2013 futures last traded at a premium of 1.20 points at 148.35 compared with spot closing of 147.15. The number of contracts traded was 12,966. DLF October 2013 futures were at a premium of 1.30 points at 140.45 compared with spot closing of 139.15. The number of contracts traded was 20,783. Tata Motors October 2013 futures last traded at a premium of 2.05 points at 353.05 compared with spot closing of 351.00. The number of contracts traded was 24,165.

Product

Index Futures Stock Futures Index Options Stock Options Total F&O

03.10.13

419157 541612 2391955 204976 3485700

Volume 04.10.13

419831 527572 2824306 214247 3985956

% Chg

0.16% -2.59% 18.08% 4.52% 14.35%

Index

NIFTY BANK NIFTY CNXIT

Spot

5,907.30 10,197.15 8,396.90

Future

5,957.00 10,267.00 8,352.35

Basis

50 70 (45)

Increase in Open Interest with Increase in price Symbol ARVIND GLENMARK LICHSGFIN ZEEL ADANIPORTS

350000000 300000000 250000000 200000000 150000000 100000000 50000000 0

Increase in Open Interest with Decrease in price Symbol Last price Chg (%) OI ('000')

16.02 14.16 12.23 11.5 10.46

UBL GSKCONS GODREJIND POWERGRID SRTRANSFIN 849.85 4392.55 268.15 98.9 564 -2.25 -0.55 -0.11 -1.79 -2.48 24.5 2.5 730 9524 984

Last price 89.65 560.65 208.05 250.25 144.4

Chg (%) 8.27 2.87 3.69 0.46 1.16

OI ('000') 2636 129 9473 4324 2662

Increase (%)

Increase (%)

11.73 5.63 5.27 1.39 0.46

CP

Industry

AUTO BANKS CONSTRUCTION FINANCE FMCG IT MEDIA & ENT METALS OIL & GAS PHARMACEUTICALS POWER

OI

38627750 147394125 290090000 43241500 23088250 18180000 4953500 69431500 41147500 39422750 77278000

OI Change(%)

2.64 2.05 0.09 -0.83 1.46 3.5 39.89 4.78 3.72 -0.99 1.96

For Our Clients Only

For Private circulation Only

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

AU TO NS BA TR NK UC S TIO FIN N AN CE FM CG M ED IA IT & EN M T ET PH AR OIL ALS M & AC G EU AS TIC A PO LS W ER CO

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

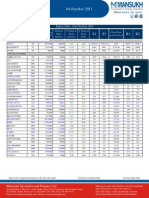

Daily Derivative Report

NIFTY OUTLOOK :The nifty dropped 2.40 points in the last session on the back ofthe strong IT and bank sector. For the upcoming session market seems range bound, however 5948/6010 could be its crucial resistance levels. On the flip side 5862/5804 could be its near term supports levels.

MOST ACTIVE CALLS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY Expiry Date Strike Price 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 6100 6200 6000 6300 6400 5900 6500 6600 6700 Contracts Traded 15505650 14682150 9916350 9743300 5152350 4118800 3255300 1496050 915950 Open Interest 4561150 2459500 3601150 3007500 1361450 2559550 1538200 664250 559250

MOST ACTIVE PUTS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY Expiry Date Strike Price 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 5800 5700 5500 5600 5900 5400 6000 5300 Contracts Traded 11940500 10544450 8543100 8259300 7908500 4076100 3534600 3041600 Open Interest 4047650 4550750 3797850 3717050 2741000 4103650 2142950 2277100

OPTION STRATEGY AS ON 30 SEPTEMBER 2013 UNDERLYING ASSET CMP STRATEGY MAX LOSS MAX PROFIT LOT SIZE NIFTY 5883.2 SELL NIFTY OCTOBER NIFTY OCT. 5700 PA @ 95.00 UNLIMITED 228.2 50 SELL

300 200 100 0 -100 -200 1 2 3

NET INFLOW

For any information or suggestion, please send your query at research@moneysukh.com

For Private circulation Only For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Daily Derivative Report

STRATEGY TRACKER DATE OF STRATEGY UNDERLYING ASSET STRATEGY IN/OUT FLOW NET PROFIT/ LOSS AS ON 30/09/2013 REMARK

30/9/2013

NIFTY

SELL NIFTY OCTOBER. FUTURE SELL NIFTY OCT.5700 PUT@ 95.00 SELL NIFTY AUGUST 5500 PUT@76.10 SELL NIFTY AUGUST 5900 CALL@ 84 SELL NIFTY SEPT. FUTURE SELL NIFTY SEPT. 5300 CALL@ 138.05 BUY NIFTYAUGUST FUTURE SELL NIFTY AUGUST 5300 CALL@ 85.00

95

55.85

BOOK PARTIAL PROFIT

10/8/2013

NIFTY

170.1

75.30

BOOK FULL PROFIT

2/8/2013

NIFTY

138.05

85.20

BOOK PARTIAL PROFIT

21/8/12013

NIFTY

85

43.90

BOOK PARTIAL PROFIT

NAME

Varun Gupta Mohit Taneja Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com mohit.t@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Вам также может понравиться

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Results Tracker 08.11.2013Документ3 страницыResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- Results Tracker 09.11.2013Документ3 страницыResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Results Tracker 07.11.2013Документ3 страницыResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsОценок пока нет

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionДокумент5 страницF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionДокумент3 страницыDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- 5 Anderson V PosadasДокумент8 страниц5 Anderson V PosadasNeil BorjaОценок пока нет

- Assessment Task 2 Group Problem Set: Solution: R 1,000 IДокумент14 страницAssessment Task 2 Group Problem Set: Solution: R 1,000 IEly BОценок пока нет

- Linesight Middle East Handbook 2020 Sept. Update - DigitalДокумент77 страницLinesight Middle East Handbook 2020 Sept. Update - Digital黄磊Оценок пока нет

- Accounting Report (Maan) 3Документ14 страницAccounting Report (Maan) 3Hamid SohailОценок пока нет

- Hospitality BooksДокумент4 страницыHospitality BooksparasОценок пока нет

- Indian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaДокумент14 страницIndian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaAmrit PatnaikОценок пока нет

- Manifest For Rough Diamond 900.12-4Документ8 страницManifest For Rough Diamond 900.12-4nobleconsultants100% (3)

- OEE Calculation Example: Factors Number of Shifts Hours Per Shift TimeДокумент16 страницOEE Calculation Example: Factors Number of Shifts Hours Per Shift TimeMosfet AutomationОценок пока нет

- GENSAN Sep2018-ELEM PDFДокумент124 страницыGENSAN Sep2018-ELEM PDFPhilBoardResultsОценок пока нет

- James R. Lincoln, Michael L. Gerlach-Japan's Network Economy Structure, Persistence, and Change (Structural Analysis in The SoДокумент424 страницыJames R. Lincoln, Michael L. Gerlach-Japan's Network Economy Structure, Persistence, and Change (Structural Analysis in The SoJessica Calderón AlvaradoОценок пока нет

- Management of Transaction ExposureДокумент22 страницыManagement of Transaction ExposurePeter KoprdaОценок пока нет

- Asian Year Ahead 2014Документ562 страницыAsian Year Ahead 2014DivakCT100% (1)

- 1 CNC Rotery Spacial: Terms of DeliveryДокумент3 страницы1 CNC Rotery Spacial: Terms of DeliveryPocket CinemaaОценок пока нет

- Invoice: Exalca Technologies Private LimitedДокумент2 страницыInvoice: Exalca Technologies Private LimitedRajkumar CОценок пока нет

- PWC Ceo 20th Survey Report 2017Документ40 страницPWC Ceo 20th Survey Report 2017Hoanabc123Оценок пока нет

- Challenges of Managing E-Commerce - 64433411Документ7 страницChallenges of Managing E-Commerce - 64433411Pejay_13Оценок пока нет

- Write Equations in Slope-Intercept FormДокумент13 страницWrite Equations in Slope-Intercept FormWenilyn MananganОценок пока нет

- Chapter 2 - Markets and Government in A Modern EconomyДокумент12 страницChapter 2 - Markets and Government in A Modern EconomyStevenRJClarke100% (5)

- Definition of DemocracyДокумент20 страницDefinition of DemocracyAnonymous R1SgvNIОценок пока нет

- Supply and Demand Economics Lesson PlanДокумент4 страницыSupply and Demand Economics Lesson Planapi-319420815Оценок пока нет

- What Is PESTEL Analysis and How It Can Be Used For Salomon and The Treasury Securities Auction Case StudyДокумент4 страницыWhat Is PESTEL Analysis and How It Can Be Used For Salomon and The Treasury Securities Auction Case StudyDivyendu SahooОценок пока нет

- What Are Eco Friendly ProductsДокумент4 страницыWhat Are Eco Friendly Productsmukul1234Оценок пока нет

- The Circular Flow of Economic ActivityДокумент8 страницThe Circular Flow of Economic ActivityHAZEL M. MAGBOOОценок пока нет

- Introduction To Asset-Backed SecuritiesДокумент5 страницIntroduction To Asset-Backed SecuritiesShai RabiОценок пока нет

- HHHДокумент55 страницHHHMarko BarisicОценок пока нет

- Transfer Quote 4 PDFДокумент11 страницTransfer Quote 4 PDFjarraspeedyОценок пока нет

- The Philippines: Human Development Index RankingДокумент21 страницаThe Philippines: Human Development Index RankingRudy QuismorioОценок пока нет

- Procurement Assignment #Документ6 страницProcurement Assignment #Sami Jee Sami Jee100% (1)

- Top Six Characteristics of Imperfect CompetitionДокумент10 страницTop Six Characteristics of Imperfect CompetitionFaiza AbbasОценок пока нет

- Seminar ReportДокумент13 страницSeminar Reportdipti_1312Оценок пока нет