Академический Документы

Профессиональный Документы

Культура Документы

Lian Beng 2013

Загружено:

ventriaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lian Beng 2013

Загружено:

ventriaАвторское право:

Доступные форматы

Singapore | Construction & Engineering

Asia Pacific Equity Research

LIAN BENG GROUP | BUY

MARKET CAP: USD 227M AVG DAILY TURNOVER: USD 1M 11 Oct 2013 Company Update

1QFY14 RESULTS MARRED BY MARKETING EXPENSES

1QFY14 PATMI down 31% YoY Gross margins dip due to revenue mix Increasing uncertainties in resi segment

BUY (maintain)

Fair value add: 12m dividend forecast versus: Current price 12m total return forecast S$0.58 S$0.02 S$0.54 12%

1QFY14 profit down 31% YoY Lian Beng announced 1QFY14 (ended 31 Aug 2013) PATMI of S$7.3m down 30.9% YoY mostly due to increased selling and marketing expenses incurred at launched projects (Spottiswoode Suites, The Midtown, Newest, KAP Residences and Eco-tech@Sunview) and the cessation of tenant leases at Hougang Plaza which was demolished for redevelopment. We also note the relatively new dormitory business contributed an estimated S$1.3m - S$1.4m in attributable net profits over the quarter. Falling gross margins from shifting revenue mix Topline for 1QFY14 came in 44.2% higher YoY at S$163.5m due to higher contributions from the construction and property development businesses as well as the ready-mixed concrete division. Due to a shift in revenue mix with a heavier percentage contribution from the construction segment, however, overall gross margins continue to dip falling from 14.1% in 1QFY13 to 12.2% in 1QFY14. Expect profit recognition from M-space in 2Q-3QFY14 Looking forward to 2Q-3QFY14, we expect profit contributions from the fully sold 55%-owned industrial development, M-space, which can only be recognized upon TOP as stipulated by the accounting standard INT FRS 115. We note that already launched development projects from the group are achieving fairly firm sell-through rates and that the construction order book remains strong at S$1.2b as at end Aug 2013 only marginally down from S$1.3b as at end May 2013. BUY with a FV estimate of S$0.58 We note that Lian Beng continues to enjoy a firm construction book of S$1.2b, which would buttress forward revenues to an extent, and also a strong balance sheet with S$200.7m in cash with a fairly benign net gearing of 25.2%. That said, we see increasing uncertainties in the domestic residential space from recent cooling measures which could result in headwinds for the groups property development business going forward. BUY with a fair value estimate of S$0.58.

Analysts Eli Lee (Lead) +65 6531 9112 Eli Lee@ocbc-research.com Sarah Ong +65 6531 9678 sarahong@ocbc-research.com

Key information Market cap. (m) Avg daily turnover (m) Avg daily vol. (m) 52-wk range (S$) Free float (%) Shares o/s. (m) Exchange BBRG ticker Reuters ticker ISIN code GICS Sector GICS Industry Top shareholder S$283.4 / USD226.8 S$0.9 / USD0.8 18.2 0.3484 - 0.6172 66.3 529.8 SGX LBG SP LIBG.SI L03 Industrials Const & Eng Ong S.C - 26% 1m -3 -5 3m -6 -6 12m 35 27

Relative total return Company (%) STI-adjusted (%) Price performance chart

Share Pr ice ( S$) 0.67 0.61 0.55 0.48 0.42 0.36 Oct - 12 Jan- 13

Fair Value

Index Level 5200 4700 ` 4200 3700 3200 2700 Apr -13

LBG SP

Jul-13

Oct - 13

FSSTI

Sources: Bloomberg, OIR estimates

Key financial highlights Year ended 31 May (S$m) Revenue Cost of sales Gross profit PATMI EPS (S-cents) Cons. EPS (S cts) PER (x) P/NAV (x) ROE (%) Net gearing (%) FY12 445.0 -371.5 73.5 52.1 9.8 na 5.4 1.2 22.5 9.7 FY13 505.6 -440.6 65.0 39.4 7.4 na 7.2 1.1 15.1 76.1 FY14F 682.6 -573.4 109.2 64.7 12.2 12.7 4.4 0.9 20.4 37.7 FY15F 716.7 -623.5 93.2 63.5 12.0 12.5 4.5 0.8 17.0 7.0

Industry-relative metrics

Per centil e 0th Mkt Cap Beta ROE PE PB Company Industr y Aver age 25th 50th 75th 100th

Note: Industry universe defined as companies under identical GICS classification listed in the same exchange. Sources: Bloomberg, OIR estimates

Please refer to important disclosures at the back of this document.

MCI (P) 004/06/2013

OCBC Investment Research Singapore Equities

Exhibit 1: Quarterly financial highlights 1QFY13 Revenue Cost of sales Gross profit Other operating income Distribution expenses Admin expenses Other operating expenses Finance cost Share of assoc./JV profits PBT Income tax PAT MI PATMI Sources: Company financials (S$m) 113.4 -97.5 15.9 2.7 -0.2 -4.3 -1.4 -0.2 0.0 12.6 -2.0 10.6 0.1 10.5 1QFY14 (S$m) 163.5 -143.5 20.0 1.0 -3.0 -4.4 -1.8 -0.5 -1.6 9.7 -1.2 8.5 1.2 7.3 % Chg (YoY) 44% 47% 25% -63% >500% 3% 23% 212% nm -23% -38% -20% nm -31% 4QFY13 (S$m) 154.9 -138.9 16.1 -1.1 -0.8 -3.8 -2.4 -0.4 3.3 10.9 -1.5 9.5 0.2 9.3 % Chg (QoQ) 6% 3% 24% -187% 295% 16% -25% 29% -149% -11% -16% -10% 619% -22%

OCBC Investment Research Singapore Equities

Company financial highlights

Income statement Year ended 31 May (S$m) Revenue Cost of sales Gross profit Other operating income Admin expenses Share of assoc./JV profits Others PBT PAT PATMI

FY12 445.0 -371.5 73.5 14.6 -16.5 0.0 -9.2 62.4 51.8 52.1

FY13 505.6 -440.6 65.0 6.4 -17.4 3.3 -9.7 47.6 40.2 39.4

FY14F 682.6 -573.4 109.2 6.8 -19.1 8.0 -11.3 93.6 77.7 64.7

FY15F 716.7 -623.5 93.2 7.2 -20.1 15.0 -11.5 83.8 69.5 63.5

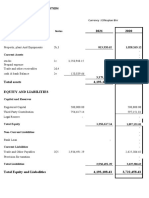

Balance sheet As at 31 May (S$m) Cash and equivalents PPE Development properties Total assets Current financial liabilities Non-current financial liabilities Total liabilities Shareholders equity Total equity Total equity and liabilities

FY12 186.8 50.0 102.9 587.4 103.7 105.5 355.1 231.5 232.2 587.4

FY13 170.9 58.8 167.8 792.7 106.2 263.1 530.6 260.7 262.1 792.7

FY14F 204.4 55.4 137.8 858.1 74.3 249.9 526.2 317.4 331.9 858.1

FY15F 158.4 52.5 97.8 795.2 59.5 125.0 401.7 373.0 393.4 795.2

Cash flow statement Year ended 31 May (S$m) PBT Working capital change Cash tax paid Operating cash flow Investing cash flow Financing cash flow Net change in cash Cash at beginning of the year Other adjustments Cash at end of the year

FY12 62.4 31.2 -8.1 80.7 -8.8 -35.0 36.9 149.9 0.0 186.8

FY13 47.6 -65.5 -9.8 -26.0 -115.3 125.4 -15.9 186.8 0.0 170.9

FY14F 93.6 13.4 -15.9 87.6 0.0 -54.0 33.6 170.9 0.0 204.4

FY15F 83.8 44.3 -14.2 102.5 0.0 -148.5 -46.0 204.4 0.0 158.4

Key rates & ratios EPS (S-cents) NAV per share (S-cents) PER (x) P/NAV (x) Gross profit margin (%) Net profit margin (%) Net gearing (%) Dividend yield (%) ROE (%) ROA (%) Sources: Company, OIR forecasts

FY12 9.8 43.7 5.4 1.2 16.5 11.6 9.7 3.7 22.5 8.9

FY13 7.4 49.2 7.2 1.1 12.9 8.0 76.1 2.3 15.1 5.0

FY14F 12.2 59.9 4.4 0.9 16.0 11.4 37.7 2.8 20.4 7.5

FY15F 12.0 70.4 4.5 0.8 13.0 9.7 7.0 2.8 17.0 8.0

Company financial highlights

OCBC Investment Research Singapore Equities

SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report holds/hold NIL shares in the above security.

DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our written consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS: - OCBC Investment Researchs (OIR) technical comments and recommendations are short-term and trading oriented. - OIRs fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIRs BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total returns less than -5%.

Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd

Published by OCBC Investment Research Pte Ltd

Important disclosures

Вам также может понравиться

- Artificial Intelligence Global Ex UsДокумент28 страницArtificial Intelligence Global Ex UsventriaОценок пока нет

- Memtech International Not Rated: A Visit To China FactoriesДокумент12 страницMemtech International Not Rated: A Visit To China FactoriesventriaОценок пока нет

- SPH Reit - Hold: Upholding Its StrengthДокумент5 страницSPH Reit - Hold: Upholding Its StrengthventriaОценок пока нет

- Small Caps: Singapore Small-Cap ConferenceДокумент12 страницSmall Caps: Singapore Small-Cap ConferenceventriaОценок пока нет

- Insas BerhadДокумент3 страницыInsas BerhadventriaОценок пока нет

- Hang Seng Index FuturesДокумент3 страницыHang Seng Index FuturesventriaОценок пока нет

- 23 May 14 Market OpnionДокумент1 страница23 May 14 Market OpnionventriaОценок пока нет

- Daily Market Commentary: FBMKLCI Futures: Technical AnalysisДокумент1 страницаDaily Market Commentary: FBMKLCI Futures: Technical AnalysisventriaОценок пока нет

- 23 May 14 CPO FuturesДокумент1 страница23 May 14 CPO FuturesventriaОценок пока нет

- 21 May Technical FocusДокумент1 страница21 May Technical FocusventriaОценок пока нет

- Market Pulse 130619Документ5 страницMarket Pulse 130619ventriaОценок пока нет

- Frasers Commercial Trust: Charted TerritoryДокумент2 страницыFrasers Commercial Trust: Charted TerritoryventriaОценок пока нет

- Starhill Global REIT Ending 1Q14 On High NoteДокумент6 страницStarhill Global REIT Ending 1Q14 On High NoteventriaОценок пока нет

- Goodpack LTDДокумент3 страницыGoodpack LTDventriaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Statement of Cash Flow - OnlineДокумент36 страницStatement of Cash Flow - OnlineEvans Galista AHОценок пока нет

- Fabm 1 q2 Week 6 PDFДокумент4 страницыFabm 1 q2 Week 6 PDFA.Оценок пока нет

- Xy95lywmi - Midterm Exam FarДокумент12 страницXy95lywmi - Midterm Exam FarLyra Mae De BotonОценок пока нет

- Chapter 8 VДокумент28 страницChapter 8 VAdd AllОценок пока нет

- Liyu - 2021 G.CДокумент8 страницLiyu - 2021 G.CElias Abubeker AhmedОценок пока нет

- Financial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Документ70 страницFinancial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Tấn Lộc LouisОценок пока нет

- ECC6 Report ListsДокумент12 страницECC6 Report Listsdienda1Оценок пока нет

- Salasar Sales 2023Документ20 страницSalasar Sales 2023tryabhi1234Оценок пока нет

- Audit of Intangible AssetsДокумент8 страницAudit of Intangible AssetsHira IdaceiОценок пока нет

- 2440120041-Raynerd Cornelius Week 3Документ8 страниц2440120041-Raynerd Cornelius Week 3Drenyar ScoutОценок пока нет

- Final ReviewДокумент53 страницыFinal ReviewLalalaОценок пока нет

- VIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingДокумент11 страницVIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingZeeОценок пока нет

- Discontinued Operation, Segment and Interim ReportingДокумент22 страницыDiscontinued Operation, Segment and Interim Reportinghis dimples appear, the great lee seo jinОценок пока нет

- Seminar Solutions - Term 2Документ36 страницSeminar Solutions - Term 2bontom333Оценок пока нет

- BusinessAcumen SafrinHeruwanto HelmiДокумент181 страницаBusinessAcumen SafrinHeruwanto HelmiTrisni Kencana DewiОценок пока нет

- Accounts Question Paper Omtex ClassesДокумент8 страницAccounts Question Paper Omtex ClassesAmin Buhari Abdul KhaderОценок пока нет

- 8e Ch4 Mini Case Und EntityДокумент8 страниц8e Ch4 Mini Case Und Entityspatel9167% (3)

- Government GrantsДокумент9 страницGovernment Grantssorin8488100% (1)

- 101 - 255 - 93 - 94-Annual Report 2017 PT Panca Budi Idaman Tbk.Документ236 страниц101 - 255 - 93 - 94-Annual Report 2017 PT Panca Budi Idaman Tbk.RianSastianAndrianaОценок пока нет

- Distinguish Between Capital Expenditure and Revenue ExpenditureДокумент11 страницDistinguish Between Capital Expenditure and Revenue ExpenditureGopika GopalakrishnanОценок пока нет

- 2.5.8 - Assignment - Journal and The LedgerДокумент2 страницы2.5.8 - Assignment - Journal and The Ledgerfatimaafzal072007Оценок пока нет

- AF1401 2020 Autumn Lecture 2Документ38 страницAF1401 2020 Autumn Lecture 2Dhan AnugrahОценок пока нет

- ch07 SM Carlon 5eДокумент39 страницch07 SM Carlon 5eKyle100% (1)

- TutorialДокумент2 страницыTutorialDanialОценок пока нет

- Answer Keys Assignment IДокумент3 страницыAnswer Keys Assignment IAshutosh SinghОценок пока нет

- AC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With CommentsДокумент74 страницыAC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With Comments전민건Оценок пока нет

- Asset Utilization AnalysisДокумент41 страницаAsset Utilization AnalysisMohamedHibahMhibahОценок пока нет

- MS7SL800 - Assignment - 1 - McBrideДокумент36 страницMS7SL800 - Assignment - 1 - McBrideDaniel AjanthanОценок пока нет

- Chapter 7 - Finance CycleДокумент15 страницChapter 7 - Finance Cyclecarmel andreОценок пока нет

- The Role of Accountants and Accounting InformationДокумент28 страницThe Role of Accountants and Accounting InformationSamuel KohОценок пока нет