Академический Документы

Профессиональный Документы

Культура Документы

IGNOU MBA MS-45 Solved Assignments December 2012

Загружено:

Girija Khanna ChavliИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IGNOU MBA MS-45 Solved Assignments December 2012

Загружено:

Girija Khanna ChavliАвторское право:

Доступные форматы

MS-45

Management Programme

ASSIGNMENT SECOND SEMESTER 2012

MS 45: INTERNATIONAL FINANCIAL MANAGEMENTS

School of Management Studies

INDIRA GANDHI NATIONAL OPEN UNIVERSITY MAIDAN GARHI, NEW DELHI 110 068

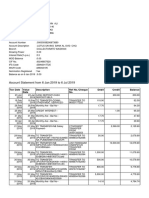

ASSIGNMENT Course Code Course Title Assignment Code Coverage : : : : MS - 45 International Financial Managements MS-45/TMA/SEM - II /2012 All Blocks

Note: Answer all the questions and send them to the Coordinator of the Study Centre you are attached with. 1. How does the International Monetary Fund raise the resources? What are Special Drawing Rights? Briefly explain the funding facilities provided by IMF to its member countries.

The International Monetary Fund (IMF) is an international organization that was created on July 22, 1944 at the Bretton Woods Conference and came into existence on December 27, 1945 when 29 countries signed the Articles of Agreement.[1] It originally had 45 members. The IMF's stated goal was to stabilize exchange rates and assist the reconstruction of the worlds international payment system post-World War II. Countries contribute money to a pool through a quota system from which countries with payment imbalances can borrow funds temporarily.

Fund Raising >> Quota System The IMFs quota system was created to raise funds for loans. Each IMF member country is assigned a quota, or contribution, that reflects the countrys relative size in the global economy. Each members quota also determines its relative voting power. Thus, financial contributions from member governments are linked to voting power in the organization. This system follows the logic of a shareholder-controlled organization: wealthy countries have more say in the making and revision of rules. Since decision making at the IMF reflects each members relative economic position in the world, wealthier countries that provide more money to the fund have more influence in the IMF than poorer members that contribute less; nonetheless, the IMF focuses on redistribution. Definition of 'Special Drawing Rights - SDR'

An international type of monetary reserve currency, created by the International Monetary Fund (IMF) in 1969, which operates as a supplement to the existing reserves of member countries. Created in response to concerns about the limitations of gold and dollars as the sole means of settling international accounts, SDRs are designed to augment international liquidity by supplementing the standard reserve currencies.

IMF's Funding Facilities It has already been mentioned that the member countries borrow from the pool of reserves lying with the IMF. The funding facilities can be grouped as:

1. Permanent facilities for general balance of payments support: a) Reserve tranche facilities b) Credit tranche facilities 2. Permanent facilities for specific purposes: a) Extended fund facility (EFF) b) Compensatory and contingency financing facility c) Buffer stock financing facility (BSFF) d) Supplemental reserve facility (SRF) 3. Special Disbursement Account facility a) Structural adjustment facility (SAF) b) Enhanced structural adjustment facility (ESAF), nowknown as Povertyreduction and growth facility (PRGF)

Reserve tranche drawings indicate unconditional borrowings of a part of the quota held by that particular member. The credit tranche is often known as the IMF's basic financing facility. Such credits are made available in tranches-each tranche being equivalent to 25 per cent of the member's quota. Extended Fund Facility was established in September 1974 for making available long-term resources in larger magnitude than available under credit tranches. It is provided when the balance of payments problem is structural. The compensatory financing facility was established in February 1963. The credit is provided to meet the fluctuation in export earnings due to circumstances beyond the control of the member government. Since 1981,

credit under this facility is also provided to cover the fluctuation in cereal import cost. The main gainers are the primary producing countries. Buffer Stock Financing Facility was set up in June 1969. It assists mainly the primary producing countries in financing their contribution to international buffer stocks under international commodity agreements. Supplementary reserve facility was created in December 1997 to provide assistance to those members that face exceptional balance of payments problem due to large short-term financing vis-a-vis sudden loss of market confidence. Structural Adjustment Facility (SAF) was set up in March 1986 for providing additional balance of payments support in form of loans on concessional terms to low-income developing countries or to IDA-only countries. A member country can get such loans up to 70 per cent of its quota.

Courtesy >> http://www.imf.org/

2.

Explain the structure of balance of payments and discuss what is the impact of various international financial flows on the structure of balance of payments.

Balance of payments (BoP) accounts are an accounting record of all monetary transactions between a country and the rest of the world.[1] These transactions include payments for the country's exports and imports of goods, services, financial capital, and financial transfers. The BoP accounts summarize international transactions for a specific period, usually a year, and are prepared in a single currency, typically the domestic currency for the country concerned. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as negative or deficit items. When all components of the BOP accounts are included they must sum to zero with no overall surplus or deficit. For example, if a country is importing more than it exports, its trade balance will be in deficit, but the shortfall will have to be counterbalanced in other ways such as by funds earned from its foreign investments, by running down central bank reserves or by receiving loans from other countries. While the overall BOP accounts will always balance when all types of payments are included, imbalances are possible on individual elements of the BOP, such as the current account, the capital account excluding the central bank's reserve account, or the sum of the two. Imbalances in the latter sum can result in surplus countries accumulating wealth, while deficit nations become increasingly indebted. The term "balance of payments" often refers to this sum: a country's balance of payments is said to be in surplus (equivalently, the balance of payments is positive) by a certain amount if sources of funds

(such as export goods sold and bonds sold) exceed uses of funds (such as paying for imported goods and paying for foreign bonds purchased) by that amount. There is said to be a balance of payments deficit (the balance of payments is said to be negative) if the former are less than the latter. Under a fixed exchange rate system, the central bank accommodates those flows by buying up any net inflow of funds into the country or by providing foreign currency funds to the foreign exchange market to match any international outflow of funds, thus preventing the funds flows from affecting the exchange rate between the country's currency and other currencies. Then the net change per year in the central bank's foreign exchange reserves is sometimes called the balance of payments surplus or deficit. Alternatives to a fixed exchange rate system include a managed float where some changes of exchange rates are allowed, or at the other extreme a purely floating exchange rate (also known as a purely flexible exchange rate). With a pure float the central bank does not intervene at all to protect or devalue its currency, allowing the rate to be set by the market, and the central bank's foreign exchange reserves do not change. 3. Explain Purchasing Power Parity and reasons for its deviation. Also discuss its applications.

Purchasing power parity (PPP) is an economic theory and a technique used to determine the relative value of currencies, estimating the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to (or on par with) each currency's purchasing power.[1] It asks how much money would be needed to purchase the same goods and services in two countries, and uses that to calculate an implicit foreign exchange rate. Using that PPP rate, an amount of money thus has the same purchasing power in different countries. Deviations from parity imply differences in purchasing power of a "basket of goods" across countries, which means that for the purposes of many international comparisons, countries' GDPs or other national income statistics need to be "PPP-adjusted" and converted into common units. The best-known purchasing power adjustment is the GearyKhamis dollar (the "international dollar"). The real exchange rate is then equal to the nominal exchange rate, adjusted for differences in price levels. If purchasing power parity held exactly, then the real exchange rate would always equal one. However, in practice the real exchange rates exhibit both short run and long run deviations from this value, for example due to reasons illuminated in the BalassaSamuelson theorem. The PPP method is used as an alternative to correct for possible statistical bias. The Penn World Table is a widely cited source of PPP adjustments, and the so-called Penn effect reflects such a systematic bias in using exchange rates to outputs among countries. For example, if the value of the Mexican peso falls by half compared to the US dollar, the Mexican Gross Domestic Product measured in dollars will also halve. However, this exchange rate results from international trade and financial markets. It does not necessarily mean that Mexicans are poorer by a half; if incomes and prices measured in pesos stay the same, they will be no worse off assuming that imported goods are not

essential to the quality of life of individuals. Measuring income in different countries using PPP exchange rates helps to avoid this problem.

4.

Discuss the reasons for the differences in the cost of capital across various counties. How is the cut off rate of foreign projects determined? Discuss.

An understanding of why cost of capital varies across different countries provides an insight into the reasons for competitive superiority of some MNCs in some countries. Knowledge of differences in cost of capital in different countries may enable an MNC to formulate suitable strategy regarding procurement of funds from those countries where they are available at lower cost. An appreciation of cost of capital across the globe can throw light on the differences existing in the pattern of capitalization of different MNCs. Country Differences in the Cost of Debt: Cost of debt to an MNC is the function of two variables, viz; risk-free rate of interest in the currency borrowed and the premium for additional risk required by creditors. Since risk-free interest rate and risk premium differ from country to country, cost of capital will not be the same in different countries. There are various reasons for country differences in the risk-free rate and in the risk premium. Some reasons of these differences: Country Differences in the Risk free Rate Country Differences in the Risk Premium Country Differences in the Cost of Equity DETERMINING CUT OFF RATE FOR FOREIGN PROJECT APPRAISAL Cut-off rate is the minimum rate of return that must be earned on a foreign project if the firm's value has to be maintained. Determining the cut-off rate is therefore, imperative for assessing viability of a foreign project. Although overall cost of capital forms the basis for setting cut-off rate, certain adjustments have to be made in the cost of capital to find the project-specific cut-off rate. These adjustments are made for the exchange risk, political risk, segmentation of capital markets and international diversification effect. Adjusting for the Exchange Risk: The cost of capital of a foreign project may be adjusted by the average rate of appreciation (depreciation) of the host country's currency during the life of the project. Adjusting for the Political Risk: Risk premium to be incorporated in the cost of capital for a project in a country with high political risk will have to be higher than in the case of country with lower political risk. Adjusting for Segmentation of Capital Markets : Segmentation of capital markets, caused by government control on the flow of capital across boundaries and the existence of varying degrees of depth and development of capital markets in different countries and

dearth of accurate information on investment and lending opportunities in different markets, influences the cost of capital of an MNC upward or downward. Cost of capital for a project in a segmented host country capital market has to be adjusted downward because restrictions are clamped on capital outflow resulting in availability of funds in the host country at lower interest rate than the one in the MNC's home country. At times, segmentation of capital markets may lead to higher cost of capital than if such markets were fully integrated. A unique form of segmentation in many countries takes the form of non-availability or limited availability of equity financing. In view of the above, an MNC finance manager has to decide carefully as to what would be suitable cut-off rate for the purpose of evaluation.

5.

What are different types of Exchange Rate Exposures? Describe the techniques used to mange Transaction exposure.

In finance, an exchange rate (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one countrys currency in terms of another currency.[1] For example, an interbank exchange rate of 91 Japanese yen (JPY, ) to the United States dollar (US$) means that 91 will be exchanged for each US$1 or that US$1 will be exchanged for each 91. Exchange rates are determined in the foreign exchange market,[2] which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date. In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a "commission" or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveller's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions is due to the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash. The Present System of Exchange Rate The new/present system provides different options ranging from fixed to floating or even a hybrid of the two. The options are: 1. Fixed exchange rate

a) Pegging to a single currency b) Pegging to a basket of currency c) Pegging to SDRs d) Currency board arrangement 2 Floating exchange rate a) Independent floating b) Managed floating 3 Crawling peg 4 Target-zone arrangement

Вам также может понравиться

- TopstepTrader Path Funded Trader EbookДокумент26 страницTopstepTrader Path Funded Trader EbookfnopulseОценок пока нет

- FMI7e ch15Документ39 страницFMI7e ch15lehoangthuchienОценок пока нет

- Lecture 9 International Financial SystemДокумент30 страницLecture 9 International Financial SystemGina WaelОценок пока нет

- Balance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsДокумент14 страницBalance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsdeanОценок пока нет

- International Monetary FundДокумент5 страницInternational Monetary FundAastha sharmaОценок пока нет

- IMF and WTOДокумент28 страницIMF and WTOFahmiatul JannatОценок пока нет

- Int Mo SystemДокумент5 страницInt Mo Systemdarla85nagarajuОценок пока нет

- International Monetary FundДокумент10 страницInternational Monetary Fund777priyankaОценок пока нет

- Ibe Unitb3 PDFДокумент37 страницIbe Unitb3 PDFMohit BhardwajОценок пока нет

- 4.B IMF Lending and ConditionalityДокумент12 страниц4.B IMF Lending and Conditionalityarian.sajjadi7Оценок пока нет

- Balance of PaymentsДокумент14 страницBalance of PaymentsJutt TheMagicianОценок пока нет

- PGDBA - FIN - SEM III - International FinanceДокумент22 страницыPGDBA - FIN - SEM III - International FinancepoonamsrilkoОценок пока нет

- Imf WBДокумент8 страницImf WBMr. MughalОценок пока нет

- PGDBA - FIN - SEM III - International FinanceДокумент21 страницаPGDBA - FIN - SEM III - International Financeapi-3762419100% (3)

- Access PolicyДокумент20 страницAccess PolicyPankaj SharmaОценок пока нет

- An Introduction To The International Monetary FundДокумент3 страницыAn Introduction To The International Monetary Fundsema mutataОценок пока нет

- International Business Is A Term Used To Collectively Describe All Commercial Transactions (Документ7 страницInternational Business Is A Term Used To Collectively Describe All Commercial Transactions (Moncy Idicula MathaiОценок пока нет

- Skyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Документ8 страницSkyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Rajat SuriОценок пока нет

- Module - 1: OF International Financial ManagementДокумент37 страницModule - 1: OF International Financial Management9832155922Оценок пока нет

- Difference Between IMF and World BankДокумент4 страницыDifference Between IMF and World BankSourabh ShuklaОценок пока нет

- Module Madina ArzybekovaДокумент4 страницыModule Madina ArzybekovaАдэлина АбдыкеримоваОценок пока нет

- Balance of PaymentДокумент16 страницBalance of PaymentHarjas KaurОценок пока нет

- Unit - 1Документ8 страницUnit - 1VaghelaОценок пока нет

- Balance of PaymentsДокумент15 страницBalance of PaymentsrohitlohiyaОценок пока нет

- PSM 204 Role and Functions of IMFДокумент16 страницPSM 204 Role and Functions of IMFZubair JuttОценок пока нет

- International Financial ManagementДокумент16 страницInternational Financial ManagementShaheen MahmudОценок пока нет

- Pan African Enetwork Project Mba Ib: International Institutions and Trade Implications Semester - IiДокумент96 страницPan African Enetwork Project Mba Ib: International Institutions and Trade Implications Semester - IitakangnixonОценок пока нет

- Notes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Документ9 страницNotes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Md Tabish RazaОценок пока нет

- Eco AnswersДокумент22 страницыEco AnswersSapna KawatОценок пока нет

- Macro Economics Project: Balance of PaymentsДокумент16 страницMacro Economics Project: Balance of PaymentsAkash VaigyānikОценок пока нет

- IF Unit 3 Part BДокумент41 страницаIF Unit 3 Part BThanos The titanОценок пока нет

- International InsititutionДокумент23 страницыInternational InsititutionNelsonMoseMОценок пока нет

- Imf Presentation DataДокумент13 страницImf Presentation DataAli SyedОценок пока нет

- Eco International Monetary FundДокумент34 страницыEco International Monetary FundAbbasОценок пока нет

- Trade Barrier: Trade Barriers Are Government-Induced Restrictions OnДокумент5 страницTrade Barrier: Trade Barriers Are Government-Induced Restrictions OnThanasekaran TharumanОценок пока нет

- Role of Financial SystemДокумент2 страницыRole of Financial SystemKunal MidhaОценок пока нет

- In Unit 5Документ16 страницIn Unit 5RoomОценок пока нет

- Bretton Woods InstitutionsДокумент8 страницBretton Woods InstitutionsPradyumn LandgeОценок пока нет

- Opec Oil Crisis 1973Документ59 страницOpec Oil Crisis 1973Anish BanerjeeОценок пока нет

- Terms of International FinanceДокумент3 страницыTerms of International FinanceShahbaz NoorОценок пока нет

- Balance of PaymentsДокумент16 страницBalance of PaymentsVidhi ShahОценок пока нет

- Balance of Payments:: DefinitionДокумент10 страницBalance of Payments:: DefinitionbjhvОценок пока нет

- Open Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFДокумент5 страницOpen Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFganeshОценок пока нет

- Balance of Payment Position of Sri Lanka.Документ32 страницыBalance of Payment Position of Sri Lanka.Dhawal KhandelwalОценок пока нет

- Balance of Payment (BINAY SINGH) 11Документ12 страницBalance of Payment (BINAY SINGH) 11barhpatnaОценок пока нет

- Current AccoCurrent AccountДокумент25 страницCurrent AccoCurrent AccountRajesh NairОценок пока нет

- Forex Reserves - The Need For Optimal LevelДокумент6 страницForex Reserves - The Need For Optimal LevelsmanojvrОценок пока нет

- Balance of Payments WikiДокумент24 страницыBalance of Payments WikiSOURAV MONDALОценок пока нет

- Balance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsДокумент120 страницBalance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsMahesh KumbharОценок пока нет

- International Finance 12Документ9 страницInternational Finance 12moza salimОценок пока нет

- International Economic Integration and Institution WRДокумент10 страницInternational Economic Integration and Institution WRYvonne LlamadaОценок пока нет

- IFM UNIT - 1 - CompressedДокумент36 страницIFM UNIT - 1 - CompressedChirurock TrividhiОценок пока нет

- Foreign Reserve 2Документ6 страницForeign Reserve 2cakartikayОценок пока нет

- Sistem Kewangan Antarabangsa: Halaman 115-128 Bab 9Документ14 страницSistem Kewangan Antarabangsa: Halaman 115-128 Bab 9bennameerОценок пока нет

- Balance of PaymentДокумент35 страницBalance of PaymentRupesh MoreОценок пока нет

- Geopolitics and IMFДокумент50 страницGeopolitics and IMFJeNovaОценок пока нет

- Currency Markets-2Документ24 страницыCurrency Markets-2Nandini JaganОценок пока нет

- The Balance of Payments, Foreign Exchange Rates and IS-LM-BoP ModelДокумент10 страницThe Balance of Payments, Foreign Exchange Rates and IS-LM-BoP Modelmah rukhОценок пока нет

- Financial InnovationsДокумент8 страницFinancial Innovationsganesh_patareОценок пока нет

- CH 6Документ51 страницаCH 6Ella ApeloОценок пока нет

- Powerpoint Slides Financial Institutions, Instruments and Markets Fourth Edition by Christopher VineyДокумент50 страницPowerpoint Slides Financial Institutions, Instruments and Markets Fourth Edition by Christopher Vineyme1434everОценок пока нет

- (Campbell J. Y.) Solution Manual To The Economet PDFДокумент72 страницы(Campbell J. Y.) Solution Manual To The Economet PDFGuillermo Delgado CastilloОценок пока нет

- Interest and EquivalenceДокумент13 страницInterest and EquivalenceKondeti Harsha VardhanОценок пока нет

- Real Estate Agency Practice: ListingДокумент12 страницReal Estate Agency Practice: ListingTe KellyОценок пока нет

- DocДокумент4 страницыDocZulnu Rain AliОценок пока нет

- Banking Banana Skins 2012 ResultsДокумент43 страницыBanking Banana Skins 2012 Resultsankur4042007Оценок пока нет

- Math ProbДокумент2 страницыMath Probadonis bibatОценок пока нет

- Fin Magt Full BookДокумент200 страницFin Magt Full BookSamuel DwumfourОценок пока нет

- FRM SlidesДокумент24 страницыFRM Slidesbhaskar sinhaОценок пока нет

- Concepts of Financial Management 2014Документ9 страницConcepts of Financial Management 2014blokeyesОценок пока нет

- Provisions ReviewerДокумент2 страницыProvisions ReviewerKevin SantiagoОценок пока нет

- Exim PolicyДокумент5 страницExim PolicyRavi_Kumar_Gup_7391Оценок пока нет

- An Overview of Indian Financial SystemДокумент11 страницAn Overview of Indian Financial SystemParul NigamОценок пока нет

- Investment Analysis and Portfolio Management - FinalДокумент2 страницыInvestment Analysis and Portfolio Management - FinalsagsachdevОценок пока нет

- Ex2 19Документ2 страницыEx2 19nehaОценок пока нет

- Morningstar Manager Research - A Global Guide To Strategic Beta Exchange-Traded ProductsДокумент62 страницыMorningstar Manager Research - A Global Guide To Strategic Beta Exchange-Traded ProductsSpartacusTraciaОценок пока нет

- ICO MARKET RESEARChДокумент64 страницыICO MARKET RESEARChGungaa JaltsanОценок пока нет

- Fixed-Income Portfolio Management (1) : Study SessionДокумент2 страницыFixed-Income Portfolio Management (1) : Study SessionflyinzeskyОценок пока нет

- Informe de Riqueza Mundial 2018 de Credit SuisseДокумент60 страницInforme de Riqueza Mundial 2018 de Credit SuisseMarco Antonio MaresОценок пока нет

- Beyond Fintech - A Pragmatic Assessment of Disruptive Potential in Financial ServicesДокумент197 страницBeyond Fintech - A Pragmatic Assessment of Disruptive Potential in Financial ServicesRay Chua100% (1)

- Hedge Fund Survey by FCA, UKДокумент36 страницHedge Fund Survey by FCA, UKEduardo PetazzeОценок пока нет

- Alex Sharp's PortfolioДокумент6 страницAlex Sharp's PortfolioFurqanTariqОценок пока нет

- The Whipping PostДокумент2 страницыThe Whipping PostAdam SussmanОценок пока нет

- Titman Fm13e Im ch07 AKAДокумент3 страницыTitman Fm13e Im ch07 AKAAnup Kumar AgarwalОценок пока нет

- AYALA CORPORATION and Key Economic Indicators (ACADEMIC PURPOSES ONLY)Документ25 страницAYALA CORPORATION and Key Economic Indicators (ACADEMIC PURPOSES ONLY)Danah RoyceОценок пока нет

- Finma Authorized Asset ManagersДокумент10 страницFinma Authorized Asset Managersoctave bodelОценок пока нет