Академический Документы

Профессиональный Документы

Культура Документы

Learning Outcome 1

Загружено:

Sanchit AroraАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Learning Outcome 1

Загружено:

Sanchit AroraАвторское право:

Доступные форматы

Learning outcome 1 United Motors Lanka founded a market opportunity in the year 2010 and went to cash on it.

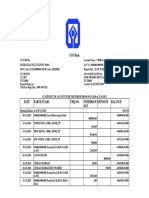

In this section we will analyze the financial statements of the company in order to find out the impact of the opportunity on the financials of the company. For this purpose, ratio analysis will be done. Liquidity Ratios The liquidity aspect will be judged using the current and the liquid ratios. Current ratio is calculated by dividing the current assets by the current liabilities. In order to make comparison we have used financial statements for the year 2011-12 and 2010-11. For 2011-12 Current assets = 4636719 Current Liabilities= 2621668 Current Ratio = Current assets/ Current Liabilities = 4636719/2621668 = 1.76 For 2010-11 Current assets = 1959919 Current Liabilities= 442782 Current Ratio = Current assets/ Current Liabilities = 1959919/442782 = 4.42 Liquid ratio For 2011-12 Liquid assets = 1919190 Liquid Liabilities= 2621668 Liquid Ratio = Liquid assets/ Liquid Liabilities = 1919190/2621668 = 0.73

For 2010-11 Liquid assets = 977882 Liquid Liabilities= 442782 Liquid Ratio = Liquid assets/ Liquid Liabilities = 977882/442782 = 2.20 Going by the liquidity ratios it is clear that the liquidity of the company has been adversely affected after going for the new market opportunity. Efficiency ratios Assets turnover ratio: This ratio will be calculated by dividing the sales by fixed assets. For 2011-12 Sales = 8529451 Fixed assets = 1865562 Assets turnover ratio = 8529451/1865562 = 4.57 For 2010-11 Sales = 4907368 Fixed assets = 1836437 Assets turnover ratio = 4907368/1836437 = 2.67 As the turnover has increased it shows high utilization of assets. Stock turnover ratio: It is calculated by dividing the cost of sales by the average stock For 2011-12 Cost of sales = 6083645 Average stock = 2717529

Stock turnover ratio = 6083645/2717529 = 2.24 For 2010-11 Cost of sales = 3665329 Average stock = 982037 Stock turnover ratio = 3665329/982037 = 3.73 The stock turnover seems to be quite low which shows that the firm is not very efficient in selling stocks. Debtors turnover ratio: this is calculated by dividing the debtors by the credit sales multiplied by 365 days. For 2011-12 Debtors= 15646 Credit sales = 6083645 Debtors turnover ratio = debtors * 365/credit sales = 15646*365/6083645= 0.93 For 2010-11 Debtors= 563629 Credit sales = 3665629 Debtors turnover ratio = debtors * 365/credit sales = 563629*365/3665629= 56.12 The debtors turnover ratio has improved quite a lot which shows that the firm has been able to receive money from its debtors on time. However, going by the actual figures of debtors there has been significant reduction from the year 2010-11 and 2011-12. Profitability ratios: these ratios measure the profit earning capacity of the organization. Gross Profit Margin: It is calculated by dividing the gross profit by the net sales.

For the year 2011-12 Gross Profit= 2445806 Net sales= 8529451 Gross Profit Margin = 2445806/8529451= 28.67% For the year 2010-11 Gross Profit= 1242039 Net sales= 4907368 Gross Profit Margin = 1242039/4907368= 25.30% The gross profit of the organization has improved marginally which is a good sign. Return on equity- it is calculated by dividing the net income by the shareholders equity. For the year 2011-12 Net income= 1341734 Equity = 4641403 Return on equity= 1341734*100/4641403= 28.90% For the year 2010-11 Net income= 518814 Equity = 3720088 Return on equity= 518814*100/3720088= 13.94% The return on equity has improved considerably after taking the opportunity.

Investment ratio Earnings per share: It is calculated by dividing the profit by the number of equity shares. For the year 2011-12 Net profit= 1341734 No. of Equity = 67267 Return on equity= 1341734/67267= 19.95 For the year 2010-11 Net income= 518814 Equity = 67267 Return on equity= 518814/67267= 7.71 With the taking up of this opportunity the earnings per share has also increased. Going by the above analysis, it seems that the liquidity is quite low; thus the company needs to have more liquid assets in order to combat with the difficult times. Further the company has been able to improve its gross profit ratio, return on equity, debtors turnover ratio. However the company is unable to realize its fixed assets to the maximum extent.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Carlyle Model Interview Test - InstructionsДокумент2 страницыCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Finance For Non-Finance People South Asian Ed.Документ2 страницыFinance For Non-Finance People South Asian Ed.Sumit PhougatОценок пока нет

- M&I Merger-Model-GuideДокумент66 страницM&I Merger-Model-GuideSai Allu100% (1)

- Solutions Prada PDFДокумент28 страницSolutions Prada PDFneoss1190% (1)

- Dealing Room, ERM, FX Risk, DerivativesДокумент37 страницDealing Room, ERM, FX Risk, DerivativesSanchit AroraОценок пока нет

- Stock Airtel OfficeДокумент2 страницыStock Airtel OfficeSanchit AroraОценок пока нет

- Performance Appraisal: A Supervision or Leadership Tool?: Rosa Cintrón, Ph.D. (Corresponding Author)Документ9 страницPerformance Appraisal: A Supervision or Leadership Tool?: Rosa Cintrón, Ph.D. (Corresponding Author)Sanchit AroraОценок пока нет

- Jep20121200006 48945057Документ4 страницыJep20121200006 48945057Sanchit AroraОценок пока нет

- Assignment Guidelines 2013Документ2 страницыAssignment Guidelines 2013Sanchit AroraОценок пока нет

- What Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Документ2 страницыWhat Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Sanchit AroraОценок пока нет

- Reasons For Foreign Direct Investment by Alan S. GuttermanДокумент6 страницReasons For Foreign Direct Investment by Alan S. GuttermanSanchit AroraОценок пока нет

- AnalysisДокумент2 страницыAnalysisSanchit AroraОценок пока нет

- HR Recruitment and Select Big Bazaar 1Документ94 страницыHR Recruitment and Select Big Bazaar 1Sanchit Arora100% (1)

- 7MFRP Syllabus May13Документ6 страниц7MFRP Syllabus May13Sanchit AroraОценок пока нет

- BanksДокумент1 страницаBanksSanchit AroraОценок пока нет

- BusinessLaw 2012Документ170 страницBusinessLaw 2012rommel_007100% (1)

- Learning Outcome 1Документ6 страницLearning Outcome 1Sanchit AroraОценок пока нет

- Becoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Документ13 страницBecoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Sanchit AroraОценок пока нет

- Benefits To TataДокумент4 страницыBenefits To TataSanchit AroraОценок пока нет

- FCRA 2010 - Gazette Notification Dtd.27.09Документ24 страницыFCRA 2010 - Gazette Notification Dtd.27.09Prakash KamathОценок пока нет

- AДокумент12 страницASanchit AroraОценок пока нет

- Becoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Документ13 страницBecoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Sanchit AroraОценок пока нет

- GGДокумент2 страницыGGSanchit AroraОценок пока нет

- Ecb - FaqДокумент7 страницEcb - FaqSanchit AroraОценок пока нет

- Exchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesДокумент27 страницExchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesSanchit AroraОценок пока нет

- FD-106 Annexure Service ChargesДокумент11 страницFD-106 Annexure Service ChargesSanchit AroraОценок пока нет

- FD-106 Annexure Service ChargesДокумент11 страницFD-106 Annexure Service ChargesSanchit AroraОценок пока нет

- Abraham Kenneth SДокумент9 страницAbraham Kenneth SSanchit AroraОценок пока нет

- Fabrication ProcessesДокумент4 страницыFabrication ProcessesSanchit AroraОценок пока нет

- Tarrifs & Charges Bajaj FinservДокумент3 страницыTarrifs & Charges Bajaj FinservSanchit AroraОценок пока нет

- Design and Fabrication Part 2Документ3 страницыDesign and Fabrication Part 2Sanchit AroraОценок пока нет

- Casestudy On BMW (A) - Vinay AsopaДокумент13 страницCasestudy On BMW (A) - Vinay AsopaRaji AlamОценок пока нет

- Logistics - Final Project-775Документ38 страницLogistics - Final Project-775Sanchit AroraОценок пока нет

- 06 Intangible AssetsДокумент57 страниц06 Intangible Assets林義哲Оценок пока нет

- Financial Accounting GauriДокумент8 страницFinancial Accounting GauriSanket Santosh RahadeОценок пока нет

- Problem Set 6Документ9 страницProblem Set 6Jade BilisОценок пока нет

- Kieso IFRS TestBank Ch12Документ44 страницыKieso IFRS TestBank Ch12Daniel Hunks100% (1)

- Bulk DealsДокумент63 страницыBulk DealsBhavin SagarОценок пока нет

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Документ12 страницChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavОценок пока нет

- Report 2022Документ338 страницReport 2022Yerrolla MadhuravaniОценок пока нет

- Good GuidesДокумент10 страницGood GuidesDama DamasОценок пока нет

- Audit II Mid ExamДокумент4 страницыAudit II Mid ExamTesfaye SimeОценок пока нет

- SOA of BL 48 LacДокумент5 страницSOA of BL 48 LacParitosh SinghОценок пока нет

- r2010d11421071 Danish Kanojia Assessment2 Uel HR 7003 27850Документ16 страницr2010d11421071 Danish Kanojia Assessment2 Uel HR 7003 27850D bfcpt pОценок пока нет

- ASP Zakat PPT FinalДокумент13 страницASP Zakat PPT FinalDionysius Ivan HertantoОценок пока нет

- Acc426 2020Документ3 страницыAcc426 2020faithОценок пока нет

- Reviewer: Shareholders Equity (SHE)Документ6 страницReviewer: Shareholders Equity (SHE)Jewela NogasОценок пока нет

- Chapter 6 Financial Analysis 2Документ6 страницChapter 6 Financial Analysis 2Syrill CayetanoОценок пока нет

- Deloitte-A Roadmap To Accounting For Income Taxes (Nov2011)Документ505 страницDeloitte-A Roadmap To Accounting For Income Taxes (Nov2011)mistercobalt3511Оценок пока нет

- Intermediate Accounting 13ce KiesoДокумент44 страницыIntermediate Accounting 13ce Kiesofullgradestore2023Оценок пока нет

- Lenders+Deck+Mar'23 IFSДокумент18 страницLenders+Deck+Mar'23 IFSGautam MehtaОценок пока нет

- Term End Examination, 2019: No. of Printed Pages: 6 MCO-007 Master of CommerceДокумент6 страницTerm End Examination, 2019: No. of Printed Pages: 6 MCO-007 Master of CommerceRohit GhuseОценок пока нет

- Comm Law Rev 03.13.18 BeiДокумент7 страницComm Law Rev 03.13.18 Beikristian datinguinooОценок пока нет

- Corporate RestructuringДокумент55 страницCorporate Restructuringrashdi1989100% (2)

- Axis Bluechip Fund - One PagerДокумент3 страницыAxis Bluechip Fund - One PagerjoycoolОценок пока нет

- Prequalifying Exam Level 2 3 Set A AK FSUU AccountingДокумент9 страницPrequalifying Exam Level 2 3 Set A AK FSUU AccountingRobert CastilloОценок пока нет

- ACC1026 Topic 8Документ64 страницыACC1026 Topic 8Ceae SeaОценок пока нет

- Proposal BBS 4th YearДокумент12 страницProposal BBS 4th YearSunita MgrОценок пока нет

- MId Term 440 - Spring 21Документ2 страницыMId Term 440 - Spring 21Ahmed Kabir Akib 1631712630Оценок пока нет