Академический Документы

Профессиональный Документы

Культура Документы

Manufacturing Accounting

Загружено:

Kanika BakhaiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Manufacturing Accounting

Загружено:

Kanika BakhaiАвторское право:

Доступные форматы

Advanced Level

Manufacturing Account (With answers)

A) Modified Trading and Profit and Loss Account A company imported transistor radios from Britain, however, the radios must be modified to meet Hong Kong specifications with the help of some equipment. The trial balance at year end 31st December, 1993 is as follows: $ $ Sales 12000 Purchases 4500 Radios 3000 Carriage inwards 200 Carriage outwards 300 Returns inwards 600 Returns outwards 500 Wages for modifications 400 Motor vans 10 000 Equipment 2 000 Selling expenses 500 Capital _ 9 000 21 500 21 500 It is the company's policy to depreciate fixed assets at 10% p.a. and increase the stock held by 10% each year. Prepare the Trading and Profit and Loss Account for the year ended 31st December 1993. Trading and profit and loss account for the year ended 31-12-1993 Sales Less: Returns Inwards Net Sales Less: Cost of goods sold Opening stock Less: Purchases Less: Returns Outwards Net Purchases Add: Carriage inwards Less: Closing stock Add: Wages for modifications Depreciation expense on equipment Gross Profit 400 200 600 4500 6900

1

12000 600 11400 3000 4500 500 4000 200 4200 7200 3300 3900

Advanced Level

Less: Expenses Carriage outwards Selling expenses Depreciation expense on motor van Net Profit 300 500 1000 1800 5100

B)

Elements of manufacturing cost In general four elements of manufacturing cost are usually recognised in a manufacturing account. These are: 1. Direct materials / Raw materials 2. Direct labour / Direct wages / Factory wages 3. Other direct expenses Prime cost (total of 1, 2 and 3) 4. Factory overhead expenses Manufacturing or factory cost (total of 1, 2, 3 and 4) The word 'direct' indicates the relationship of the cost element to the actual goods being produced. Direct materials are materials which become a physical part of the goods produced. Direct labour is the cost of labour actually working on the goods produced and excludes costs of supervision and other labour costs which cannot be associated with actual work on the product. There are rarely any other direct expenses which can be related directly to the goods produced, though a royalty calculated per unit of goods produced would be an example of this type of expense. Factory overhead includes all factory costs which are not direct. These include indirect labour costs such as the wages of foremen, cleaners, maintenance men, indirect materials such as factory cleaning materials, lubricants, and general factory overheads such as depreciation, rent, rates, electricity, etc. In a manufacturing account, the direct costs are largely variable while the factory overhead expenses will tend to be either fixed or semi-variable.

Advanced Level

C. Special points to be noted 1) Work in progress If the 'work in progress' is valued at 'prime cost', the adjustment for the different value of the work in progress at the beginning and at the end of the accounting period should be shown after all the direct expenses have been totalled, and before factory overhead expenses are added. Manufacturing Accounts (Extract) Prime Cost 100 Add: work in progress at 50 begin (valued at prime cost) 150 Less: work in progress at end 20 (valued at prime cost) 130 2) Manufacturing profit In order to assess the efficiency and performance of the production process in the factory, a manufacturing profit is calculated either by: i) Market value of goods produced - Manufacturing cost of goods produced OR ii) applying a fixed mark-up on manufacturing cost of goods produced Example one The information extracted from the books of the company is: Raw materials consumed $1000 Direct labour 1000 Factory overhead 700 Work in progress, at prime cost: At the beginning 500 At the end 200 Selling expenses 300 Show the Manufacturing and Trading and Profit and Loss Account under different assumptions. Assumption One All the goods manufactured are transferred at cost to the selling office. i.e. no manufacturing profit, and all of them are sold at $3 200.

3

Advanced Level

Manufacturing and trading and profit and loss account $ Raw material consumed Direct labour Prime cost Add: work-in-progress at beg Less: work-in-progress at end Factory overhead Cost of finished goods manufactured Production cost Gross profit c/d 1000 Cost of goods manufactured 1000 transferred to trading 2000 500 2500 200 2300 700 3000 3000 Sales 200 3200 Selling expenses 300 Gross Profit b/d Net Loss 300 3200 200 100 300 3000 3200 3000 $

Assumption Two All the goods manufactured are transferred at market price of $3 300 to the selling office and all of them are sold at $3 200. Manufacturing and trading and profit and loss account $ Raw material consumed Direct labour Prime cost 1000 Goods transferred at market value 1000 2000

4

$ 3300

Advanced Level

Add: work-in-progress at beg Less: work-in-progress at end Factory overhead Cost of finished goods manufactured Manufacturing profit

500 2500 200 2300 700 3000 300 3300 3300

Goods manufactured at market value

3300 Sales Gross loss 3300

3200 100 3300 300 100 400

Gross loss Selling expenses

100 Manufacturing profit 300 Net Loss 400

Double entry Dr. Manufacturing a/c- Manufacturing profit Cr. Profit and Loss Manufacturing profit 300 300

Assumption Three All the goods manufactured are transferred at market price of $3 300 but none or them are sold at year end. No selling expenses incurred. Manufacturing and trading and profit and loss account $ Raw material consumed Direct labour Prime cost Add: work-in-progress at beg 1000 Goods transferred at market value 1000 2000 500 2500

5

$ 3300

Advanced Level

Less: work-in-progress at end Factory overhead Cost of finished goods manufactured Manufacturing profit

200 2300 700 3000 300 3300 3300

Goods manufactured at market value Less: closing stock Cost of goods sold Gross profit

3300 3300 0 0 0 0 0 300

Provision for unrealised profit Stock (Year One) Trading- closing 3000

300 Manufacturing profit Stock (Year One) Trading- Closing 3300

Provision for unrealised profits (Year One) Trading (Year Two) Stock Gross profit 3000 Sales 200 Stock 3200 Trading (Year Two) 3300 Sales Gross Loss Gross Loss Selling expenses Example Two Cost of production for the year $10 000 Finished goods, at cost: At the beginning of year 6 000 At the end of year 2 000 The goods are transferred from factory to sales office at 10% mark up. Show the balance sheet (extract) at the beginning and the end of the year and also the provision for unrealized profit on stock account. Balance Sheet (Extract) Beginning Finished goods Less: Provision for unrealised profit 6600 600 Ending 2200 200

6

P&L

300

3200 100 300 100

100 Dec in prov 300 Net Loss

Advanced Level

6000

2000

Provision for unrealised profit Profit and Loss Balance c/d 400 Balance b/d 200 600

3) Abnormal and normal stock loss Example One Beginning stock $10 000 Purchases 5 000 Ending stock (after stock loss) 7 000 Sales 12 000 Prepare the trading account if: i) There was a normal loss of damaged stock of $10, and ii) There was a fire during the year and the loss amounted to $2 000. (i) Beginning stock Add: Purchases Less: Ending stock Cost of goods sold Gross profit Trading 10000 Sales 5000 15000 7000 8000 4000 12000 Beginning stock + Purchases = Ending Stock + Cost of goods sold + Stock Loss 10000 (ii) 5000 7000 Trading

7

12000

12000

7990

10

Advanced Level

Beginning stock Add: Purchases Less: Ending stock Stock loss Cost of goods sold Gross profit

10000 Sales 5000 15000 7000 2000 6000 6000 12000

12000

12000 6000

Stock loss due to fire

2000 Gross profit

Beginning stock + Purchases = Ending Stock + Cost of goods sold + Stock Loss 10000 5000 7000 6000 2000 2000

Dr. Profit and Loss: stock loss due to fire Cr. Trading account: Stock loss

2000

Example Two Beginning raw material $ 10 000 Purchases of raw material 10 000 Ending raw material 5 000 Raw materials stolen 6 000 Prepare the extract of the manufacturing account and the journal entry for the stock stolen. Manufacturing account Beginning raw material Add: Purchases Less: Ending raw material Raw materials stolen Cost of raw material consumed Dr. Profit and Loss ~ Loss due to theft Cr. Manufacturing ~ Loss due to theft 10000 Transferred to trading 10000 20000 5000 6000 9000 6000 6000 9000 9000

Advanced Level

Manufacturing account Beginning raw material Add: Purchases Less: Ending raw material Cost of raw material consumed 10000 Transferred to trading 10000 20000 5000 15000 15000 15000

Not true and fair view

Exercise One From the following information prepare the manufacturing, trading and profit and loss accounts for the year ending 31 December 19X6 and the balance sheet as at 31 December 19X6 for the firm of J. Jones. Purchase of raw materials Fuel and light Administration salaries Factory wages Carriage outwards Rent and rates Sales Returns inward General office expenses Repairs to plant and machinery Stock at 1 January 19X6 Raw materials Work in progress Finished goods Sundry creditors 258,000 21,000 17,000 59,000 4,000 21,000 7,000 9,000 9,000 21,000 14,000 23,000 37,000 457,000

9

482,000

Advanced Level

Capital account Freehold premises Plant and machinery Debtors Provision for depreciation on plant and Machinery at 1 January 19X6 Cash in hand

410,000 80,000 20,000 8,000 11,000 984,000 984,000

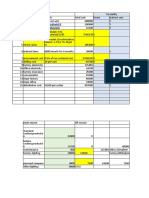

Make provision for the following: (a) Stock in hand at 31 December 19X6 Raw materials 25,000 Work in progress 11,000 Finished goods 26,000 (b) Depreciation of 10% on plant and machinery straight line method (c) 80% of fuel and light and 75% of rent and rates to be charged to manufacturing (d) Doubtful debts provision 5% of sundry debtors (e) 4,000 outstanding for fuel and light (f) Rent and rates paid in advance - 5,000 (g) Market value of finished goods - 382,000 Manufacturing A/C for the yr. Ended 31-12-19-6 $ Beginning stock Add: Purchases Less: ending stock Cost of materials consumed Factory Overhead Prime cost Fuel & light Rent & Rates Repairs to plant Depreciation Add: Work-in-progress Less: Work-in-progress Manufacturing profit Market value of goods 20,000 12,000 9,000 8,000 49000 362,000 14,000 376,000 11,000 365,000 17,000 382,000 382,000

10

$ 382,000

21,000 Goods transferred at market value 258,000 279,000 25,000 254,000 59,000 313,000

Advanced Level

manufactured Trading & Profit & Loss A/C for the year Ended 31-12-19-6 Beginning stock Add: Production cost Less: ending stock Cost of sales Gross profit Fuel and light Rent & Rates Administration salaries Carriage outwards General office expenses Provision for Bad Debts Net Profit 23,000 Sales 382,000 Less: Sales Returns 405,000 Net Sales 26,000 379,000 9,6000 475,000 5,000 Gross profit 4,000 Manufacturing profit 17,000 4,000 9,000 1,000 73,000 113,000 Balance Sheet as at 31-12-19-6 Fixed Assets Freehold premises Plant & Machinery Less: Depreciation Current Assets Stock- raw materials - Work-in-progress - Finished goods Debtors Less:Provision for B.D. Prepayment Cash in hand 20,000 1,000 19000 5,000 11,000 97,000 571,000 571,000 25,000 11,000 26,000 80,000 16,000 64,000 474,000 Current liabilities Creditors Accruals 37,000 4,000 41,000 410,000 Capital Add: Net Profit 457,000 73,000 530,000 113000 475,000 96,000 17,000 482,000 7,000 475,000

11

Advanced Level

M-anufacturing Profit a) The double entry for the factory profit is Dr. Manufacturing Accounts Cr. Profit and Loss Accounts b) Provision for unrealised profit on stock is calculated: Cost of production $10000 Finished good, at cost At the beginning of the year 6000 At the end of the year 2000 Sales 27000 The goods are transferred from factory to sales department at 10% mark-up. i) Extract of Balance Sheet at the beginning of the year Finished goods at make-up price 6600 Less: Provision for unrealised profit on stock 600 Finished goods at cost 6000 ii) Extract of Balance Sheet at the end of the year Finished goods at make-up price 2200 Less: Provision for unrealised profit on stock 200 Finished goods at cost 2000

12

Advanced Level

iii) Provision for unrealised profit on stock Profit and Loss a/c Balance c/d 400 200 600 Provision for unrealised profit on stock Opening stock Add: Manufactured at transfer price Less: Closing stock Cost of goods sold Gross profit 6600 11000 17600 2200 15400 11600 27000 Gross profit Manufacturing profit Decrease in provision 27000 11600 1000 400 Sales 27000 600 Balance b/d 600

Exercise Five John Cormack started in business on 1 st January 1980 as a manufacturer of gaming machines. The following figures are extracted from his records on 31st December 1980. Sales (30,000 machines at 30 each) Plant and machinery (bought 1st January 1980) Motor vans (bought 1st January 1980) Administrative wages Loose tools bought Light and power Building repairs Raw materials bought Salesmens salaries Drivers wages Motor van expenses Direct wages General administration expenses Indirect wages Repairs to machinery Rates and insurance 900,000 80,000 10,000 18,000 6,400 40,000 20,000 273,400 29,000 24,000 5,000 302,000 6,000 54,000 11,000 10,000

13

Advanced Level

The following information is also made available to you: (a) The work in progress on 31st December 1980, valued at production cost was 55,000. (b) The closing stocks on 31st December 1980 were: Raw materials 13,400, Loose tools 2,400. (c) Depreciate motor vans 20%, plant and machinery 10%. (d) Allocate expenses as follows: Factory Administration Light and power 9/10 1/10 Building repairs 3/5 2/5 Rates and insurance 4/5 1/5 (e) A manufacturing profit of 25% on production cost was added for the purpose of transferring finished goods to the trading account. (f) During the year 40,000 machines were completed. Value the 10,000 machines in stock at the average cost of production (subject to provision for unrealized profit). You are required to draw up the manufacturing, trading and profit and loss account for the year ended 31st December 1980. Show clearly the figures of prime cost and production cost of goods completed. Manufacturing & Trading & Profit & Loss account for the year ended 31-12-80 Purchases Less: ending stock Cost of materials consumed Direct wages Prime cost Factory Overhead Depreciation Loose tools (6400-2400) Light & power Building repairs Rates & Insurance Indirect wages Repairs to machinery 8,000 4,000 36,000 12,000 8,000 54,000 11,000 133,00 0 695,00

14

273,40 Goods transferred at market value 0 13,400 260,00 0 302,00 0 562,00 0

800,000

Advanced Level

0 Less: work-in-progress 55,000 640,00 0 Manufacturing profit Market value of goods manufactured 160,00 0 800,00 0 800,00 Sales 0 200,00 0 600,00 0 300,00 0 900,00 0 Depreciation Administrative wages Light & power Building repairs Rates & Insurance Salaries Drivers wages Motor van expenses General expenses Provision for unrealized profit Net profit 2,000 Gross profit 18,000 Manufacturing profit 4,000 8,000 2,000 29,000 24,000 5,000 6,000 40,000 322,00 0 460,00 0 460,000 900,000 300,000 160,000 800,000

Market value of goods manufactured Less: closing stock Cost of sales Gross profit

900,000

15

Вам также может понравиться

- (Syndicate 5) Becton Dickinson Division - Marketing OrganizationДокумент23 страницы(Syndicate 5) Becton Dickinson Division - Marketing OrganizationJonathan FebrianОценок пока нет

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОт EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОценок пока нет

- Diagram of Accounting EquationДокумент1 страницаDiagram of Accounting EquationMary100% (3)

- Manufacturing Accounts GuideДокумент9 страницManufacturing Accounts GuideFarrukhsg100% (5)

- Accounting For Manufacturing BusinessДокумент56 страницAccounting For Manufacturing Businessrajahmati_2890% (20)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Manufacturing Accounts FormatДокумент6 страницManufacturing Accounts Formatkerwinm6894% (16)

- IAS 16 Property, Plant and Equipment Accounting DisclosureДокумент2 страницыIAS 16 Property, Plant and Equipment Accounting Disclosurefurqan0% (1)

- Financial Reporting and Analysis: Assignment - 1Документ8 страницFinancial Reporting and Analysis: Assignment - 1Sai Chandan Duggirala100% (1)

- Activity Based Costing and Just in TimeДокумент120 страницActivity Based Costing and Just in TimePaulo M.P. Harianja100% (2)

- Introduction to Accounting and Business Chapter 1Документ51 страницаIntroduction to Accounting and Business Chapter 1Gelyn Cruz50% (2)

- Journal - Problems & SolutionsДокумент5 страницJournal - Problems & SolutionsSreenivasa Murthy Kota83% (6)

- Accounting CycleДокумент13 страницAccounting CycleMylene SalvadorОценок пока нет

- Manufacturing AccountДокумент26 страницManufacturing AccountwilbertОценок пока нет

- Cost Accounting Practice Set (L. Payongayong)Документ60 страницCost Accounting Practice Set (L. Payongayong)rocketkaye100% (2)

- Management Accounting in Enterprise Resource Planning SystemsОт EverandManagement Accounting in Enterprise Resource Planning SystemsРейтинг: 4 из 5 звезд4/5 (1)

- Percentages Questions For CATДокумент6 страницPercentages Questions For CATSreekanth PenugondaОценок пока нет

- Arun Ice Cream, Case StudyДокумент17 страницArun Ice Cream, Case StudyApurbh Singh Kashyap100% (2)

- Minutes of service report for AST 70 model telescopic jibbed BMUДокумент2 страницыMinutes of service report for AST 70 model telescopic jibbed BMUhabibullaОценок пока нет

- Manufacturing AccountДокумент36 страницManufacturing AccountSaksham RainaОценок пока нет

- AccountingДокумент14 страницAccountingHelpline100% (1)

- Manufacturing AccountsДокумент11 страницManufacturing Accountslukamasia100% (1)

- IAS 40 ICAB QuestionsДокумент5 страницIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- Revaluating partnership assets upon dissolutionДокумент32 страницыRevaluating partnership assets upon dissolutionERICK MLINGWAОценок пока нет

- Financial Accounting and Reporting Retained EarningsДокумент68 страницFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- Accounting RatiosДокумент5 страницAccounting RatiosNaga NikhilОценок пока нет

- Financial Accounting and Accounting StandardsДокумент31 страницаFinancial Accounting and Accounting StandardsIrwan JanuarОценок пока нет

- Absorption Costing, Activity Based Costing & Standard CostingДокумент34 страницыAbsorption Costing, Activity Based Costing & Standard CostingMuhammad Sajid SaeedОценок пока нет

- Absorption vs Marginal Costing: Worked ExamplesДокумент5 страницAbsorption vs Marginal Costing: Worked ExamplesSUHRIT BISWASОценок пока нет

- Accounting Equation and Financial Statements ExplainedДокумент12 страницAccounting Equation and Financial Statements ExplainedAishah Rafat Abdussattar100% (1)

- Chapter 18 Policies Estimates and ErrorsДокумент28 страницChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Cash Flow Statement InterpertationsДокумент6 страницCash Flow Statement InterpertationsMansoor FayyazОценок пока нет

- Consolidation IIIДокумент36 страницConsolidation IIIMuhammad Asad100% (1)

- FA Chapter 11 Group Accounts Consolidated Balance SheetДокумент50 страницFA Chapter 11 Group Accounts Consolidated Balance Sheetabhinand67% (3)

- Cost Accounting Fundamentals for Manufacturing BusinessesДокумент21 страницаCost Accounting Fundamentals for Manufacturing Businessesabdullah_0o0Оценок пока нет

- Branch Accounting PDFДокумент18 страницBranch Accounting PDFSivasruthi DhandapaniОценок пока нет

- Internal Control Reviewer3Документ12 страницInternal Control Reviewer3Lon DiazОценок пока нет

- Acco 420 Final Coursepack CoursepacAplusДокумент51 страницаAcco 420 Final Coursepack CoursepacAplusApril MayОценок пока нет

- Manufacturing AccountsДокумент6 страницManufacturing Accountsdhanyasugukumar100% (2)

- Stockholders' Equity Accounts With Normal BalancesДокумент3 страницыStockholders' Equity Accounts With Normal BalancesMary67% (3)

- Accounting for Manufacturing CostsДокумент81 страницаAccounting for Manufacturing CostsAdrian Faminiano100% (1)

- Profitability of Products and Relative ProfitabilityДокумент5 страницProfitability of Products and Relative Profitabilityshaun3187Оценок пока нет

- Advanced Cost Accounting-FinalДокумент154 страницыAdvanced Cost Accounting-FinalThilaga SenthilmuruganОценок пока нет

- Manufacturing AccountsДокумент9 страницManufacturing AccountsCrystal Johnson100% (1)

- PROCESS COSTING - Practice QuestionsДокумент5 страницPROCESS COSTING - Practice QuestionsabbasОценок пока нет

- "Accounting Principles: Managerial Accounting" (2011)Документ316 страниц"Accounting Principles: Managerial Accounting" (2011)textbookequity100% (2)

- Top 14 Cost Accounting Problems With SolutionsДокумент47 страницTop 14 Cost Accounting Problems With SolutionsAmit100% (1)

- Report On Cost AuditДокумент15 страницReport On Cost AuditMH (Mahmudul Hasan)100% (1)

- Uniform CPA Examination. Questions and Unofficial Answers 1989 N PDFДокумент97 страницUniform CPA Examination. Questions and Unofficial Answers 1989 N PDFJeremie RealinoОценок пока нет

- Cost Accounting FinalsДокумент4 страницыCost Accounting FinalsJerico Mamaradlo100% (1)

- Difference Between GAAP and IFRSДокумент3 страницыDifference Between GAAP and IFRSGoutam SoniОценок пока нет

- Accounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFДокумент7 страницAccounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFshevon mhlangaОценок пока нет

- Harsh ElectricalsДокумент7 страницHarsh ElectricalsR GОценок пока нет

- Introduction To Management AccountingДокумент55 страницIntroduction To Management AccountingUsama250100% (1)

- CVP - WWW - Ffqacca.co - CCДокумент7 страницCVP - WWW - Ffqacca.co - CCxxxfarahxxx100% (1)

- Review QsДокумент92 страницыReview Qsfaiztheme67% (3)

- Chapter 5 - Cost EstimationДокумент36 страницChapter 5 - Cost Estimationalleyezonmii0% (2)

- Accounting For Single Entry and Incomplete RecordsДокумент18 страницAccounting For Single Entry and Incomplete RecordsCA Deepak Ehn77% (13)

- AkaunДокумент4 страницыAkaunaisyah100% (1)

- IFRS 15 For Transport and LogisticsДокумент8 страницIFRS 15 For Transport and Logisticsarianne chiuОценок пока нет

- IAS 1 Presentation of Financial Statements & Accounting PrinciplesДокумент31 страницаIAS 1 Presentation of Financial Statements & Accounting Principlesisrael adesanya0% (1)

- The Petty Cash FundДокумент10 страницThe Petty Cash FundLilian TaiОценок пока нет

- Journalising Transactions and Ledger PostingДокумент63 страницыJournalising Transactions and Ledger PostingTwinkle Kashyap100% (1)

- 10 Years Sugar ProductДокумент1 страница10 Years Sugar ProductKanika BakhaiОценок пока нет

- Current Affairs June 2012: Current Affairs Questions June 2012Документ5 страницCurrent Affairs June 2012: Current Affairs Questions June 2012Kanika BakhaiОценок пока нет

- MRP & MPSДокумент2 страницыMRP & MPSKanika Bakhai100% (2)

- Manufacturing AccountДокумент50 страницManufacturing AccountfarissaharОценок пока нет

- Attitudes and Preferences in Relation To Internet Banking in The CaribbeanДокумент41 страницаAttitudes and Preferences in Relation To Internet Banking in The CaribbeanKanika BakhaiОценок пока нет

- Current Affairs October 2012 QuestionsДокумент7 страницCurrent Affairs October 2012 QuestionsKanika BakhaiОценок пока нет

- BankingДокумент30 страницBankingKanika BakhaiОценок пока нет

- Executive Summar1Документ6 страницExecutive Summar1Kanika BakhaiОценок пока нет

- Current Affairs September 2012: Current Affairs Questions September 2012Документ6 страницCurrent Affairs September 2012: Current Affairs Questions September 2012Kanika BakhaiОценок пока нет

- Core Courses Credits: Elective Courses (6 Credits) Each Course Has 3 Credits Any 2 Courses To Be ChosenДокумент4 страницыCore Courses Credits: Elective Courses (6 Credits) Each Course Has 3 Credits Any 2 Courses To Be ChosenKanika BakhaiОценок пока нет

- Current Affairs August 2012: Current Affairs Questions August 2012Документ6 страницCurrent Affairs August 2012: Current Affairs Questions August 2012Kanika BakhaiОценок пока нет

- IUPAC Nomenclature of Organic ChemistryДокумент21 страницаIUPAC Nomenclature of Organic ChemistryKanika BakhaiОценок пока нет

- "Career Planning": U T R SДокумент45 страниц"Career Planning": U T R SsivapathasekaranОценок пока нет

- EconomicsДокумент2 страницыEconomicsKanika BakhaiОценок пока нет

- Manufacturing AccountДокумент50 страницManufacturing AccountfarissaharОценок пока нет

- Chemistry Project On Determination of Contents of Cold DrinksДокумент8 страницChemistry Project On Determination of Contents of Cold DrinksKanika BakhaiОценок пока нет

- Hahn V CAДокумент2 страницыHahn V CASocОценок пока нет

- NucorДокумент9 страницNucorMisaki UsuiОценок пока нет

- Case STUDYДокумент3 страницыCase STUDYrohitbatra0% (1)

- Pillsbury Cookie ChallengeДокумент7 страницPillsbury Cookie ChallengeDeepta Guha100% (1)

- Final Order FormДокумент2 страницыFinal Order FormhiteshcparmarОценок пока нет

- Mankind ProjectДокумент66 страницMankind ProjectRam Mandhan0% (2)

- FactoringДокумент4 страницыFactoringjeganrajrajОценок пока нет

- HDB Press ReleaseДокумент9 страницHDB Press ReleasejuronglakesideОценок пока нет

- Inside The Minds - Leading ConsultantsДокумент281 страницаInside The Minds - Leading ConsultantsYan Kwok100% (2)

- 15 - Chapter 5 PDFДокумент55 страниц15 - Chapter 5 PDFNitika SharmaОценок пока нет

- Cognitix Running Event TicketДокумент1 страницаCognitix Running Event TicketKanzul AufaОценок пока нет

- Pertanyaan CASE 6-17Документ2 страницыPertanyaan CASE 6-17unoliviableОценок пока нет

- Master Coal AgreementДокумент32 страницыMaster Coal Agreementahong100Оценок пока нет

- Jolly's Java and Bakery Bakery Business Plan Executive SummaryДокумент28 страницJolly's Java and Bakery Bakery Business Plan Executive SummaryAtlasLiuОценок пока нет

- B2B Marketing - Assignment SolutionДокумент12 страницB2B Marketing - Assignment SolutionArati NaudiyalОценок пока нет

- AEXQ1283 AcrossTheTableДокумент112 страницAEXQ1283 AcrossTheTableRoque Bueno ArchboldОценок пока нет

- Café Mocha's positioning through evidence of serviceДокумент32 страницыCafé Mocha's positioning through evidence of serviceAkanksha BakshiОценок пока нет

- Case Study 2Документ3 страницыCase Study 2api-388950428Оценок пока нет

- Express and Implied ContractsДокумент75 страницExpress and Implied ContractsRiya GujralОценок пока нет

- Maths Work SheetДокумент2 страницыMaths Work SheetAbrha636Оценок пока нет

- Rmo 19-2007Документ14 страницRmo 19-2007Em CaparrosОценок пока нет

- Introduction to Marginal Costing TechniqueДокумент8 страницIntroduction to Marginal Costing TechniqueSaurabh Bansal100% (1)

- DepartmentalizationДокумент2 страницыDepartmentalizationAreissa JamesОценок пока нет

- Irfan YounasДокумент3 страницыIrfan YounasMuhammad AhsanОценок пока нет

- Kurt GeigerДокумент5 страницKurt GeigerKhepo Pang100% (1)

- Strategic ManagementДокумент9 страницStrategic ManagementSree Raja Sekhar KatamОценок пока нет