Академический Документы

Профессиональный Документы

Культура Документы

A Report On Investment

Загружено:

JHmonirИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

A Report On Investment

Загружено:

JHmonirАвторское право:

Доступные форматы

Page |1

CHAPTER- ONE Introduction

Page |2

1.1 Introduction

Insurance industry consists of such financial institutions which help us to be protected from a variety of perils. Not only in Bangladesh rather throughout the world, insurance industry has evolved as an important sector of the financial system side by side the banking industry. This industry helps the business sector as well as individuals more extensively than the banks. Because if one takes a loan at necessity of fund from a bank, in exchange one will have to pay a higher value for that including interest. On the other hand, in case of an insurance company, the policyholder gets a larger amount as claim against any loss covered at the time of real trouble in exchange of a small payment in the form of premium. Feyen & Rocha (2011) states that the insurance sector helps pool risk and reduces the impact of large losses on firms and householdswith a beneficial impact on output, investment, innovation, and competition. The authors further indicates the insurance sectors role in the improvement of the efficiency of other segments of the financial sector, such as banking and bond markets, by enhancing the value of collateral through property insurance and reducing losses at default through credit guarantees and enhancements. Arkell (2011) states that

insurance industry plays a more fundamental role in underpinning the working of a modern society, being a necessary precondition for many activities.

The premium collected by the general insurance companies is mainly used to settle down the claims for different incidents covered under the insurance policies. This part of the premium usually insurance companies keep in their bank accounts in the form of FDR as well as STD account. A part of premium income the companies use for making payment of reinsurance premium. And a part companies use for investment purpose. So among the various uses of premium, investment is the only utilization which provides positive income in future for the company. Different insurance companies have investment in different sectors to get income from their investment. Chatterji (2012) focuses on economic significance of insurance as insurance business contributes to formation of national income by creating value added role in providing indemnification and role as institutional investor. In Bangladesh general insurance companies have achieved a good growth inspite huge competition in the sector and there is huge scope for the insurance companies in the country.

Page |3 However with the expansion of general insurance industry, companies in this industry are involving themselves in several investment activities. This article discusses about the general insurance industry in Bangladesh concentrating and analyzes the investment

activities of these companies. The rest of the paper follows as part 2 literature review, part 3 methodology, part 4 discusses techniques and strategies of investment in the industry, and lastly part 5 conclusion.

Page |4

1.2Insurance Industry in Bangladesh

Bangladesh has a history of insurance industry aging about a century. Before liberation about 75 insurance companies including 10 locally incorporated ones had insurance business in East Pakistan. After liberation, all the insurance companies of this area were nationalized under the control of five insurance companies through Bangladesh Insurance Order 1972. In 1973 government decided to separate the two major sectors of insurancelife insurance & general insurance. So at that time government formed Jiban Bima Corporation to take over the undertakings of life insurance activities & Shadharan Bima Corporation to deal with general insurance activities. As the single state-owned institution to handle all types of general insurance business in Bangladesh, Sadharan Bima Corporation did 100% of the business until 1984. Through the Insurance (Amendment) Ordinance 1984 and Insurance Corporations (Amendment) Ordinance 1984, the government allowed operation of insurance companies in the private sector. In 1990, the government further allowed private sector insurance companies to

underwrite 50% of public sector business and the remaining 50% was kept reserved for Sadharan Bima Corporation. Private insurance companies were also given option to insure 50% of their re-insurable business with any local or foreign insurance companies. SBC distributes 50% of all public sector insurance businesses to private general insurance companies on an equal basis. Recently some more changes have been incurred in the insurance industry of Bangladesh. The circular (No: 21/21/98-376 dated March 12, 2007) of the Chief Controller of Insurance regarding mandatory credit rating for the insurance companies is considered to be the most effective breakthrough in the sector. According to the direction, all insurance companies were instructed to get credit rating with effect from 2007. Although the rating of insurance companies is a new phenomenon in the rating industry in Bangladesh, it experienced tremendous response from the market participants including the insurers themselves. Many of the good rated insurance companies, particularly upper investment grade entities, started using the rating as a marketing tool. They are also trying to improve their position based on report of the rating agencies. (Khaled Mahmud Raihan).

Page |5 The age old insurance laws have been replaced with Insurance Regulatory Authority (IRA) Ordinance 2008 and Insurance Ordinance (IO) 2008. The Department of Insurance will be abolished by the five member Insurance Regulatory Authority headed by the Chairman not below the rank of Government Secretary. To improve the solvency position of this industry, the paid up capital for general and life insurance companies have been raised to TK. 400 million and TK. 300 million respectively. According to the new law the insurance companies will have to ensure international accounting standard, have to separate Islamic insurance from conventional ones and need to put a limit on commission expenses. With the promulgation of the ordinances, the insurance industry will be under the Ministry of Finance from the Ministry of Commerce. Hopefully all these steps taken by the regulatory authority will make the industry more stronger and the companies sustainable in the long run.At the recent time some changes have been made in the insurance industry of Bangladesh to accelerate the development and efficiency of this sector.

1.3Development of Insurance in Bangladesh

Insurance is not a new business in Bangladesh. Almost a century back, during British rule in India, some insurance companies started transacting business, both life and general, in Bengal. Insurance business gained momentum in East Pakistan during 1947-1971, when 49 insurance companies transacted both life and general insurance schemes. These companies were of various origins British, Australian, Indian, West Pakistani and local. Ten insurance companies had their head offices in East Pakistan, 27 in West Pakistan, and the rest elsewhere in the world. These were mostly limited liability companies. Some of these companies were specialized in dealing in a particular class of business, while others were composite companies that dealt in more than one class of business.

The government of Bangladesh nationalized insurance industry in 1972 by the Bangladesh Insurance (Nationalization) Order 1972. By virtue of this order, save and except postal life insurance and foreign life insurance companies, all 49 insurance companies and organizations transacting insurance business in the country were placed in the public sector under five

Page |6 corporations. These corporations were: the Jatiya Bima Corporation, Tista Bima Corporation, Karnafuli Bima Corporation, Rupsa Jiban Bima Corporation, and Surma Jiban Bima Corporation. The Jatiya Bima Corporation was an apex corporation only to supervise and control the activities of the other insurance corporations, which were responsible for underwriting. Tista and Karnafuli Bima Corporations were for general insurance and Rupsa and Surma for life insurance. The specialist life companies or the life portion of a composite company joined the Rupsa and Surma corporations while specialist general insurance companies or the general portion of a composite company joined the Tista and Karnafuli corporations.

The basic idea behind the formation of four underwriting corporations, two in each main branch of life and general, was to encourage competition even under a nationalized system. But the burden of administrative expenses incurred in maintaining two corporations in each front of life and general and an apex institution at the top outweighed the advantages of limited competition. Consequently, on 14 May 1973, a restructuring was made under the Insurance Corporations Act 1973. Following the Act, in place of five corporations the government formed two: the Sadharan Bima Corporation for general business, and Jiban Bima Corporation for life business.

The postal life insurance business and the life insurance business by foreign companies were still allowed to continue as before. In reality, however, only the american life insurance company. continued to operate in the life sector for both new business and servicing, while three other foreign life insurance continued to operate only for servicing their old policies issued during Pakistan days. Postal life maintained its business as before. After 1973, general insurance business became the sole responsibility of the Sadharan Bima Corporation. Life insurance business was carried out by the Jiban Bima Corporation, the American Life insurance Company, and the Postal Life Insurance Department until 1994, when a change was made in the structural arrangement to keep pace with the new economic trend of liberalization. The Insurance Corporations Act 1973 was amended in 1984 to allow insurance companies in the private sector to operate side by side with Sadharan Bima Corporation and Jiban Bima Corporation. The Insurance Corporations Amendment Act 1984 allowed floating of insurance

Page |7 companies, both life and general, in the private sector subject to certain restrictions regarding business operations and reinsurance. Under the new act, all general insurance businesses emanating from the public sector were reserved for the state owned Sadharan Bima Corporation, which could also underwrite insurance business emanating from the private sector. The Act of 1984 made it a requirement for the private sector insurance companies to obtain 100% reinsurance protection from the Sadharan Bima Corporation. This virtually turned Sadharan Bima Corporation into a reinsurance organisation, in addition to its usual activities as direct insurer. Sadharan Bima Corporation itself had the right to reinsure its surplus elsewhere outside the country but only after exhausting the retention capacity of the domestic market. Such restrictions aimed at preventing outflow of foreign exchange in the shape of reinsurance premium and developing a reinsurance market within Bangladesh. The restriction regarding business placement affected the interests of the private insurance companies in many ways. The restrictions were considered not congenial to the development of private sector business in insurance. Two strong arguments were put forward to articulate feelings: (a) Since the public sector accounted for about 80% of the total premium volume of the country, there was little premium left for the insurance companies in the private sector to survive. In this context, Sadharan Bima Corporation should not have been allowed to compete with the private sector insurance companies for the meagre premium (20%) emanating from the private sector; (b) Being a competitor in the insurance market, Sadharan Bima Corporation was hardly acceptable as an agency to protect the interests of the private sector insurance companies and should not have retained the exclusive right to reinsure policies of these companies. The arrangement was in fact, against the principle of laissez faire.

Private sector insurance companies demanded withdrawal of the above restrictions so that they could: (a) Underwrite both public and private sector insurance business in competition with the Sadharan Bima Corporation, and

Page |8 (b) Effect reinsurance to the choice of reinsurers. The government modified the system through promulgation of the Insurance Corporations (Amendment) Act 1990. The changes allowed private sector insurance companies to underwrite 50% of the insurance business emanating from the public sector and to place up to 50% of their reinsurance with any reinsurer of their choice, at home or abroad, keeping the remaining for placement with the Sadharan Bima Corporation.

According to the new rules the capital and deposit requirements for formation of an insurance company are as follows:

Capital requirements: for life insurance company - Tk 75 million, of which 40% shall be subscribed by the sponsors; for mutual life insurance company - Tk 10 million; for general insurance company - Tk 150 million, of which 40% shall be subscribed by the sponsors; and for cooperative insurance society - Tk 10 million for life and Tk 20 million for general. Deposit requirements (in cash or in approved securities): For life insurance - Tk 4 million; for fire insurance - Tk 3 million; for marine insurance - Tk 3 million; for miscellaneous insurance - Tk 3 million; for mutual insurance company - Tk 1.4 million; and for cooperative insurance society, in case of life insurance - Tk 1.4 million, and in case of general insurance - Tk 1 million for each class.

The government guidelines for formation of an insurance company are:

(1) The intending sponsors must first submit an application in prescribed form to the Chief Controller of Insurance for prior permission. (2) After necessary scrutiny the Chief Controller shall forward the application with his recommendation to the Ministry of Commerce. (3) After further scrutiny, the Ministry of Commerce shall submit its views to the Cabinet Committee constituted for this purpose.

Page |9 (4) The decision of the Committee, if affirmative, should be sent back to the Ministry of Commerce which in turn should send it back to the Chief Controller of Insurance for communicating the same to the sponsors. (5) The sponsors would then be required to apply in a prescribed form to the Registrar of Joint Stock Companies to get registration as a public liability company under the Companies Act. Memorandum and Articles of Association duly approved by the Controller of Insurance would have to be submitted with the application. (6) Once the registration process was completed the sponsors would have to obtain permission of the securities and exchange commission to issue share capital. (7) Reinsurance arrangements would have to be made at this stage. (8) After all the above requirements were fulfilled the license to commence business under the Insurance Act 1938 is to be obtained from the Chief Controller of Insurance. Application can only be made subject to government announcements in this regard.

The control over insurance companies, including their functions relating to investments, taxation, and reporting, are regulated mainly by the Insurance Act 1938 and the Finance Acts.

The privatization policy adopted in the 1980s paved the way for a number of insurers to emerge in the private sector. This resulted in a substantial growth of premium incomes, competition, improvement in services, and introduction of newer types of business in wider fields hitherto untapped. Prior to privatization, the yearly gross premium volume of the country was approximately Tk 900 million in general insurance business and approximately Tk 800 million in life insurance business. In 2000, premium incomes rose to Tk 4,000 million in general insurance business and Tk 5,000 million in life insurance business. Up to 2000, the government has given permission to 19 general insurance companies and 10 life insurance companies in the private sector. Insurers of the country now conduct almost all types of general and life insurance, except crop insurance and export credit guarantee insurance, which are available only with the Sadharan Bima Corporation.

P a g e | 10 Numerous institutions, associations and professional groups work to promote the development of insurance business in Bangladesh. Prominent among them are the Bangladesh Insurance Association and Bangladesh insurance academy. Bangladesh Insurance Association was formed on 25 May 1988 under the Companies Act 1913. It is registered with the Registrar of Joint Stock Companies and has 30 members. It aims at promoting, supporting and protecting the interests and welfare of the member companies. Surveyors and insurance agents occupy a prominent position in the insurance market of Bangladesh. The surveyors are mainly responsible for surveying and assessing general insurance losses and occasionally, for valuation of insurance properties, while the agents work to procure both life and general insurance business against commission. The system of professional brokers has not yet developed in Bangladesh. However, it is a common practice of the insurers to engage salaried development officers for promotion of their insurance business.

1.4Role of Insurance Industry in Economic Growth

With the growth of a countrys economy, there is in increase in the facilitating role played by the financial services sector. Financial Services play a supportive role in the basic activity of production. Insurance frees industries from the worries of losses and uncertainties. Insurance helps process of the countrys growth in various ways: Insurance covers many economic risks. It protects entrepreneurs against the risk of damage to or losses of the goods and other assets, which they employ in manufacturing, marketing, transport and other related activities. This protection offers a kind of stability to business. With the cover of insurance on their assets, businessmen and industries are able to take bold decisions in enlarging their field of activity, and take financial risks which they cannot otherwise take. Hence, insurance plays a promotional role in nation-building and also increasing the number of jobs for the people. Again, there is life insurance, which plays the most useful role in the lives of individuals. Life insurance offers economic safety at reasonable cost to millions of families in the country. In a way, this helps the government also as it lightens the governments burden of providing social welfare to affected families.

P a g e | 11 Insurance companies collect premium from policyholders and invest this money in government bonds, corporate securities and other approved channels of investment. In this way, insuranceCompanies are helpful in providing capital for new ventures or expansion of old units. These funds are also used for financing the infrastructure projects with long gestation period. This lending of funds for infrastructure and other development influences the decision-making process in the government. Insurance in Bangladesh today covering a broad range of topics, the booklet shows the diversity of Bangladesh insurance, its development and its Prospects. It also provides a lot of international comparisons which put developments in Bangladesh into perspective. Bangladesh by nationality has pursued a lot of his professional career overseas. Since, the time when businesses were tightly regulated and concentrated in the hands of a few public sector insurers. Following the passage of the Insurance Regulatory and Development Authority Act in 1999,,Bangladesh abandoned public sector Exclusivity in the insurance industry in favors of market-driven competition. This shift has brought about major changes to the industry. The inauguration of a new era of insurance development has seen the entry of international insurers, the proliferation of innovative products and distribution channels, and the raising of supervisory standards. There are good reasons to expect that the growth momentum can be sustained. In particular, there is huge untapped potential in various segments of the market. While the nation is heavily exposed to natural catastrophes, insurance to mitigate the negative financial consequences of these adverse events is underdeveloped. The same is true for both pension and health insurance, where insurers can play a critical role in bridging demand and supply gaps. Major changes in both national economic policies and insurance regulations will highlight the prospects of these segments going forward.

P a g e | 12

CHAPTER- TWO Literature Review

P a g e | 13

2.1 Literature Review

An extensive literature has been developed regarding the investment portfolio of property insurance companies. Janowicz-Lomott (2011) describe the role of insurance investment management as to manage the funds generated by the insurance business,

maximizing risk adjusted returns while meeting regulatory requirements on its assets and other financial constraints. The author further states that insurance investment management must ensure that investment returns preserve the solvency, both regulatory and the insurance company, earn the economic, of

return commensurate with the use of its capital

and enable it to continue to underwrite profitable insurance business.

Oyatoye & Arileserre (2012) states that as it is crucial for insurance industry to survive and develop, the insurance investment enables insurance companies to offset their possible underwriting losses and make a considerable profit. Mukati (2012) states that the risk faced by an insurance fund manager differs from what the typical fund manager faces because of the fact that the risk in insurance investment management must factor in the liability side of its balance sheet that includes benefit amounts for shareholder capital as well as the reserves that are necessary for the insurer future claims.

Lambert & Hofflander (1967) argued that the most important single factor affecting the investment portfolio decision of property liability insurance companies is liquidity i.e. the readily available fund to make payment of the claims of the policyholders. They also identified that income from investment is a requirement by the stockholders as they get dividend from it. Cummins & Nye (1981) presents a model to assist property liability insurance companies in making product and investment mix decision. Steinle& Eggers (1994) shows how strategic planning can benefit an insurance companies decision. insurance companies investment

Hobbs et. Al. (2010) examine strategies to protect

portfolios against potential inflation scenarios. Oyatoye & Arileserre (2012) offer alternative solution to portfolio investment management by implementing best processes for

P a g e | 14 minimizing the risk for a given expected return, which is generally a non-linear function considering the scenario of Nigeria. Worzala et. Al. (1996) explores the use of real estate in investment portfolios of large property/casualty and life insurance companies in the U.S.

In Bangladesh different authors have analyzed different aspects of insurance industry of the country. Raihan (a financial analyst) has measured the performance of insurance industry both for life insurance and general insurance in terms of corporate governance, business profile, risk management, performance level, solvency and liquidity. Raihan states that The significant portion of the investment portfolio of insurance industry is usually kept with different banks as FDR under different maturity bucket which serves the purpose of liquidity.

Tamjid, Rahman and Afza (2007) put light regarding the reasons behind non-popularity of insurance service in Bangladesh. Nurul Haq (2008) describes how the trend of

globalization may create new dimension of challenges for insurance industry. But the structure of investment portfolio of these insurance companies was not discussed under those studies. So this paper focuses on this area of investment portfolio structure of general insurance companies in Bangladesh as the investment portfolio of insurance industry has been given emphasized in different studies.

P a g e | 15

CHAPTER- THREE Methodology

P a g e | 16

3.1 Origin Of The Report

The report has been assigned by Md. Sueabur Rahman (Lecturer), Department of Accounting Madan Mohan College, Sylhet for the purpose of fulfillment of BBA (Honours) 2nd Year under National University, Bangladesh. The program started from 9th July, 2013 and continued until 30th September. The term paper on Investment Scheme of Insurance Company in Bangladesh is prepared for National University, Bangladesh and submitted to my supervisor Md. Sueabur Rahman (Lecturer), Department of Accounting ,Madan Mohan College, Sylhet

3.2Objective

To know investment scheme of the Insurance Company in Bangladesh.

Specific objectives 1. 2. 3. 4. 5. To know the practical environment of insurance industry. To know the investment pattern of investors in various insurance company To understand the situation of insurance industry after the privatization To identify the purpose of investment in insurance sector. To find out the structure of investment portfolio of selected insurance companies in Bangladesh. 6. To find out the determinant factors of investment portfolio.

3.3 Sources of the data collection

Both primary and secondary data have been collected to make this term paper.Primary data have been collected from personal interviews of insurance firms personnels and personal observations. External secondary data have been gathered from different libraries, magazines and web sites to come up with relatively accurate information and solutions. Information regarding the investment scheme of insurance companies has been collected from the annual report of the concerned companies. Besides that the Insurance Year Book

P a g e | 17 published by Bangladesh Insurance Association was also utilized to get required information. So it can be said that the paper is based on secondary data source.

3.4 Scope of The Report

To achieve my report objectives, some insurance companies were visited. The study is mainly concentrated In Sylhet City. Now a day its market is expanding in other district City areas especially in the Dhaka and Chittagong City, Due to time limitation and area concentration the scope of the study has been limited in Sylhet City only.

3.5 Limitations Of The Report

In doing this report I have faced some unwanted limitations:

The research has some errors as the time, budget and experience in choosing the sample are deemed to be inadequate.

Time: Time is an important issue in report writing. As a specific deadline has been given for submission so could not perform all the researches. And I hardly found time to sit and do more libraries works and to explore more new things, as I had to do a regular office job beside this project.

Lack of experience: A comprehensive result of practice of marketing study could not be found, as had some pivotal limitations like inexperience. Sometimes it is necessary to evaluate the primary data through investigations, which, if I could have done, certainly made my report a better one.

P a g e | 18

CHAPTER- FOUR Investment Schemes of Insurance Company in Bangladesh

P a g e | 19

4.1Investment Scheme of Insurance Company in Bangladesh

Based on the annual report of the sample general insurance companies, we observed the financial asset items in which these insurance companies have invested. In this case one thing to be noted that this paper focuses only towards the general insurance companies and in general insurance companies the policy is made for one year tenure, so these companies invest their fund mainly in short term instruments or instruments which are marketable means easily sellable in market. After analyzing the annual reports, we found the following instruments in which the sample companies invest more or less: 1. Govt. Securities: As government securities general insurance companies mainly invest in National Investment Bonds. This is a risk free investment for them as well as this instrument is very liquid. Moreover insurance companies get involved in these instruments as a part of fulfillment of govt. statutory requirements. 2. Corporate Debt Instruments: Besides the govt. securities, general insurance companies do involve in investment in corporate debt instruments. They invest in debentures, corporate bonds etc. 3. Minority Ownership: Insurance companies which are under a holding company, sometimes invest in other subsidiary companies. But such ownership has a minor proportion. 4. Share: Like govt. securities, most of the sample general insurance companies invest in shares of different companies. Most of this share investment is done through private placement. A very less percentage of the total share investment is done through stock exchange. 5. ICB Debenture: Some general insurance companies invest in the debenture issued by the Investment Corporation of Bangladesh.

All non-life (general) insurance companies will have to mandatorily invest in the government securities, such as treasury bills and long-term bonds, as a move to develop and

P a g e | 20 expand the country's bond market, sources said. Under the proposed regulation, the general insurance companies will be required to make investment of at least 5 per cent to 20 per cent of their investable funds. According to the Insurance Act-2010, the country's existing life insurance companies have a provision for investing 30 per cent of their funds in the minimum. But there is no such provision for non-life insurance companies. "Most of the insurance companies are not complying properly with the provision. In most cases they have deposited funds in commercial banks in the form of fixed deposit. So we want to take steps to stop such practice by life insurance companies and to ensure minimum 30 per cent investment of their funds, the sources said. The Bangladesh Bank (BB) is requesting the Insurance Development and Regulatory Authority (IDRA) again and again to ensure 30 per cent investment of the life fund in the government securities as many insurance companies are not fulfilling the requirement, they said. The Ministry of Finance, in association with the central bank and IDRA, is preparing a prudential regulation in this connection that will be finalized within next two months, a source concerned said. A meeting was arranged in the finance ministry on January 07 last in this connection. The next meeting would be held in February which would decide finally about investment of insurance companies in securities market. Representatives of the finance ministry, the BB and IDRA will be present at the meeting, the central bank sources concerned said. A Bangladesh Insurance Association (BIA) source said as of June 2012, the amounts of life and non-life funds of insurance companies available for investment were about Tk 140 billion and nearly Tk 30 billion respectively. A BB high official said that investing the funds in these bills/bonds would help expand the country's bond market and also to facilitate more government borrowings.

P a g e | 21

4.1.1 Investment Assets

Investments in securities constitute the majority of invested assets, especially for PC insurers. Loans are significant for LH insurers, but not for PC insurers. The differential investment compositions of PC(property & casualty) and LH(life & health) insurers reflect differences in focusliquidity for PC insurers versus yield and asset-liability match for LH insurers. Investments in securities and loans are discussed separately below. The other categories are reviewed next. Most insurers do not report a separate category of short-term investments but instead include them in cash or investment in securities. Short-term investments include primarily shortterm fixed income instruments such as commercial paper and T-bills. These investments are reported at either fair value or amortized historical cost which, due to the short-term nature of the instruments, approximates fair value. Interest income is calculated using the effective interest rate method, which is described below. Real estate and related improvements held for investment are stated at cost less accumulated depreciation, possibly adjusted downward for impairment. Properties are tested for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Properties whose carrying values are greater than the corresponding undiscounted expected cash flows are written down to their fair value, with the impairment loss included in net investment gains (losses). Fair value is typically estimated using the present value of the expected cash flows, discounted at a rate commensurate with the underlying risks. Rental income is recognized on a straight-line basis over the term of the respective leases and is included in investment income. Depreciation charges on real estate held for investment are netted against investment income. Real estate held-for-sale is reported on the balance sheet at the lower of the carrying amount or fair value less expected disposition costs. For real estate acquired upon foreclosure, the initial carrying amount is the carrying value of the mortgage loan at the date of foreclosure. Real estate is not depreciated while it is classified as held-for-sale. Losses due to a decline in fair value are included in net investment gains (losses). Other investments may include short term investments or investments in loans or real estate that are not material enough to be disclosed separately. For some insurers, other investments include investments in private equity limited partnerships or hedge funds. These investments are generally reported at fair value, but for private equity and some hedge funds fairvalue estimates

P a g e | 22 involve significant discretion and are often delayed. In some cases, other investments includes the estimated fair value of derivatives at net gain positions.

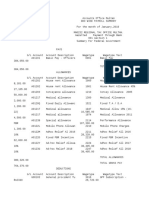

4.1.2Investments in Securities This category includes all investments in fixed income securities, passive investments in equity securities (i.e., other than control or significant influence investments), and investments in other securities. Table 1provides the composition. As shown, investments in debt securities constitute the majority of securities holdings and, for many insurers, the majority of reported assets. Investments in equity securities are a distant second. PC insurers have significant investments in equity securities, which are generally very liquid. LH insurers invest almost exclusively in fixed income instruments. The following table is showing the accounting investing in Assets: Table 1

For all four classifications, interest income is measured using the effective interest rate method. Under this method, interest income each period is equal to the product of the at-purchase yield (referred to as the effective interest rate) and the securities amortized cost at the beginning of the period. Amortized cost is historical cost adjusted for the cumulative amortization of any atpurchase discount or premium, where the periodic amortization is calculated as the difference between interest income and interest receipts. Interest income is reported in the income statement as part of net investment income.

P a g e | 23

The following table is showing the accounting investing in Securities: Table: 2

Unlike other companies, insurers are required to report all passive investments in equity securitiesincluding unlisted securitiesat estimated fair value. Similar to investments in debt securities, realized gains and losses and other-than-temporary impairments are reported in the income statement as part of net investment gains (losses). Unlike investments in debt securities, the following factors are considered in evaluating whether an impairment is other-thantemporary: (a) The length of the time and extent to which fair value has been less than cost, (b) The financial condition and near-term prospects of the issuer, (c) The intent and ability of the holder to retain the investment for a period of time sufficient to allow for anticipated recovery in value, (d) The cause of the price decline, and (e) Other factors relevant for the determination of whether the price decline is other-thantemporary.

P a g e | 24

4.2Factors Determining the Investment Strategies

Investment departments have traditionally been set apart in our industry to protect the assets built up in the business and to earn a return both on these funds and on the additions generated by volume growth and retained earnings. The separate character of the department has developed for a number of reasons. The nature of the insurance side of the business is such that practically all outlays are viewed as expenses to be controlled, and the nature of the in-vestment side is such that practically all outlays are considered as investments to be encouraged. Thus there is a minimum of competition for the privilege of spending the company's money. The legitimate desire to keep investment results out of insurance rates has also contributed to the isolation of the investment function.

From what has been said thus far, it might be concluded that the investment manager has the best of all possible worlds-he is set apart from the problems of the insurance business, his fellow executives make every effort to maximize the money he has to spend, and no one seems to measure the result of his efforts! For any investment man whose view of his responsibilities is this comfortable, need hardly advise that he should never sell a bond at a loss if it is amortizable, and should always add to common stock carried at a low cost. Neither precept is guaranteed to produce a good result, but will, nonetheless, present a favorable appearance.

Before the portfolio manager can make useful decisions, there are several major factors he must take into account in pursuing his investment polices. These would be: (I) State insurance laws (2) Tax laws (3) Financial position (4) Liquidity requirements, and (5) Market conditions

P a g e | 25 The first of these-state insurance laws-has a negligible influence the day-to-day investment activities of responsible companies in the business. Typically, such laws prevent investments which common sense would discourage and require investments that prudence would suggest. For instance, we are required to invest an amount at least equal to the par value of the common stock of our company. On the other hand we are prevented from lending money to individuals or investing in insolvent corporations. Investment in real state must be limited to those properties necessary for the conduct of the insurance business. One state in which we do business influences our investment decisions indirectly by permitting us to avoid certain premium taxes, provided we deposit with it general obligations of that state in an amount related to the premium volume generated within that state. Another state over-reaches in this same effort to encourage investment in its debt by relating the share of premium taxes it will forgive to the share of the company's investments represented by tax-exempts issued from within that state. As you might expect, the encouragement is disregarded in a national company, or, if business in that state is large enough, a separate subsidiary is established there.

One aspect of state regulation of investments which individual companies have examined carefully in recent years has been general discouragement of controlled and managed investments in other businesses. When companies have considered major moves into investments in other financial services, they have frequently found that it would be desirable to establish a holding company that would separate the stock of the insurance company from the other operations. If capital supporting the stronger insurance companies is drained away into these other activities, it should have a profound effect on the business. From time to time there are suggestions that state laws should be more restrictive on investments, and there is always available to frighten small children the mythical company that is recklessly gathering in premiums so it can speculate in the stock market and parlay its inadequate capital funds. Capital is leaving the business, by liquidation, common stock repurchase, and diversification. A tightening of state laws

P a g e | 26 governing the investments of the business would accelerate the withdrawal of responsible capital, weakening the strong and providing a useless remedy for the weak.

Turning now to the impact of tax laws on investment decisions, it is worth noting that neither the stock companies nor the mutual companies benefit from any significant tax concessions, nor do they suffer from any peculiar tax burdens. One curious effect of institutional buying patterns is that the preferred stocks of many companies yield less than the bonds that are senior to them. Some insurance companies do not make great use of preferred stocks in their portfolio, partly because they must be priced at market, but if this is not a consideration, they usually provide more yield after tax than municipals of equivalent quality. Turning now to the influences of the financial position of a company on its investment policies, it could be summarized by citing a recent article by Allan Comrie, of Great American Insurance Company, in which he remarked that "Insurance exposure and investment exposure should vary inversely." You may be familiar with a rule of thumb that says that assets equal to the sum of the loss reserve and the unearned premium reserve should be in cash, agents' balances and fixed income securities. There are a number of variations to this which consider the equity in the un- earned premium reserves and redundancy in the loss reserve, or which exclude preferred or non-rated bonds from the offsetting assets. In other words, the measure is adaptable to management's desires. As the ratio of net worth to liabilities increases, and as the profitability of the business improves, investment judgment should take over and asset allocation should be disregarded. If the company is not financially strong, has poor operating results, and is not generating funds, then a more conservative attitude than that embodied in the rule of thumb may be called for, since capital adequacy is in doubt and liquidity needs become a factor. If fixed income seems called for very heavily, it is interesting that the investment manager will often accept a lower credit portfolio to reach for results ordinarily denied him by the category. Where the manager has a number of options, the temptation to speculate in the bond account is minimal.

P a g e | 27 Capital adequacy is perhaps the single most important influence on investment policy. Reviewing the record of the past 10 years, it can be shown that most additional capital was raised (either in the market or through acquisition of an overcapitalized or liquidating company) when a company's net worth was between 40 and 45% of its liabilities. This is probably the best measure of minimum capital. If a company in this position were to invest its capital funds in common stocks, and were to suffer simultaneously a sharp market decline and a bad underwriting year, the potential of the company would be severely damaged. Companies with a more substantial capital position can afford the risk associated with full investment of their capital funds in common stock, and as we move toward the over-capitalized companies, it is not uncommon to find the value of equities in the portfolio exceeding the capital funds.

Liquidity is the next factor which was listed at the outset of this discussion. Insurance companies may need money fast for a number of reasons. They may be concerned about the ability to pay off a catastrophe loss quickly. They may want to buy in some of their own stock. They may want flexibility in shifting between taxables and tax-exempts. They may work their cash so hard that there is a frequent call on invested funds. Or, they may simply be losing cash in poor underwriting results without volume growth. Government bonds of any maturity are highly liquid, and an excellent vehicle for any of these requirements. A maturity schedule for all bonds may be established to augment the cash flow. A line of credit may be established for quick access to funds. Now that banks are active borrowers for capital needs, there is every reason to expect that insurance companies will change their attitude about debt. The healthier the com- pany, the less it must consider liquidity, for a strongly positive cash flow should take care of the needs of the business. A maturity schedule in such a case is unnecessary, and only provides the manager with an excuse for hiding behind a formula.

From what has been discussed so far, perhaps some insight has been gained into why there is such a variety of ways in which different companies' investments are distributed. Circumstances change enough that from decade to decade, the portfolio pattern will vary

P a g e | 28 considerably, so that what you have learned today will be obsolete not many years from now. One lesson that may last longer is one we all knew anyway: the rich get richer. More particularly, the weak companies with poor underwriting results must maintain relatively conservative portfolios, and their opposites can be just as aggressive as they please. Whether this advantage is real or imaginary depends on the relative qualities of the managers.

P a g e | 29

CHAPTER- FIVE Conclusion

P a g e | 30

Conclusions

Insurance Company serves a very important role in the economy by extending helping hands towards the distress people at the time of their necessity. For this reason besides commercial banks, insurance companies have become an essential ingredient of the financial system. There are two wings of insurance companies among which one category is the general insurance companies. These companies help people against different perils like fire incident, incident in the marine way, motor accident, aviation incident, natural calamity etc. However besides the regular dealings of general insurance companies, they occupy in investment with a part of their premium collection. Different general insurance companies invest in different sectors. This paper focusedon the scenario of Bangladesh general insurance industry. After liberation in 1971, theindustry passed through certain phases and has achieved a good growth though thecontribution of this industry to economic development is not that much remarkable. The number of companies has grown rapidly which has created a huge competition in the industry for which the companies have found investment as one of their incomesource. After analyzing the investment portfolio of general insurance companies inBangladesh, it is found that the sample companies mainly invest in two financial instruments, i.e. government securities and shares. Besides, they also invest incorporate debt instruments, minority ownership and ICB debenture to some extent.However the proportion of investment by the general insurance companies inBangladesh has increased substantially which may induce the companies to move forsome more diversified portfolio.

P a g e | 31

References

1. Haq Nurul, 2008, Globalization and its impact on insurance industry of Bangladesh, Financial express, <http://www.thefinancialexpress-bd.com/> 2. Malik Hifza, 2011, Determinants Of Insurance Companies Profitability: An analysis of insurance sector of Pakistan, Academic Research International, ISSN: 2223-9553, Volume 1, Issue 3, November 2011 3. Raihan Khaled, 2008, Insurance industry in Bangladesh: a raters perspective, Financial Express, 2008, <http://www.thefinancialexpress bd.com/> 4. Rejda GE, Principles of Risk Management and Insurance, Adison-Wesley, 1998 5. Tamzid, Masud & Rownak, 2007, Perceptions Of The Customers Towards Insurance Companies In Bangladesh-A Study Based On The Survqual Model, BRAC University Journal, Vol. IV, No. 2, 2007, pp. 55-66 6. Oppenheimer, HR & Schlarbaum, GG 1983, liability insurers and pension plans: Investment policies of propertyfrom Ben Graham, The A lesson

Journal of Risk and Insurance, vol. 50, no. 4, December, pp. 611630.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Audit of PpeДокумент2 страницыAudit of PpeWawex DavisОценок пока нет

- Notes On The Overview of Money Market SecuritiesДокумент2 страницыNotes On The Overview of Money Market SecuritiesjeanneОценок пока нет

- Account Statement As of 23-10-2020 09:17:02 GMT +0530Документ19 страницAccount Statement As of 23-10-2020 09:17:02 GMT +0530padma princessОценок пока нет

- Enclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessДокумент7 страницEnclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessKim FloresОценок пока нет

- Accounting Policies and Procedures Manual (Draft)Документ30 страницAccounting Policies and Procedures Manual (Draft)Malaking Pulo Multi-Purpose CooperativeОценок пока нет

- Chapter 20 - AnswerДокумент12 страницChapter 20 - Answerwynellamae100% (3)

- Hedge Fund Wisdom: Free Sample IssueДокумент85 страницHedge Fund Wisdom: Free Sample Issuemarketfolly.comОценок пока нет

- GovAcc HO No. 3 - The Government Accounting ProcessДокумент9 страницGovAcc HO No. 3 - The Government Accounting Processbobo kaОценок пока нет

- Profile 3 - Dr. Rana SinghДокумент3 страницыProfile 3 - Dr. Rana SinghAmit JainОценок пока нет

- Aug 2022 Final Exam Far 160Документ9 страницAug 2022 Final Exam Far 160adreanamarsyaОценок пока нет

- Grant Thornton DRAFT Audit Findings - Slough Council 2021Документ50 страницGrant Thornton DRAFT Audit Findings - Slough Council 2021hyenadogОценок пока нет

- Module 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Документ6 страницModule 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Cale Robert RascoОценок пока нет

- Digital Banking & Sales Distribution: Program Kerja 2021Документ8 страницDigital Banking & Sales Distribution: Program Kerja 2021Muhammad Nur Alim Labalo100% (1)

- "Study On Loan and Credit Facility at SDCC Bank, Rourkela ": Summer Internship Project Report OnДокумент81 страница"Study On Loan and Credit Facility at SDCC Bank, Rourkela ": Summer Internship Project Report OnASIT EKKAОценок пока нет

- Icpu Registration FormДокумент1 страницаIcpu Registration FormGhulam AbbasОценок пока нет

- S 0232 01Документ50 страницS 0232 01Shahaan ZulfiqarОценок пока нет

- Assignment 6 SolutionsДокумент4 страницыAssignment 6 SolutionsjoanОценок пока нет

- SAP-Shortcut KeysДокумент56 страницSAP-Shortcut KeysAnandОценок пока нет

- Imports With Letter of Credit in SAP ERPДокумент8 страницImports With Letter of Credit in SAP ERPMohamed QamarОценок пока нет

- 2015 Security Breach Information 7-6-2015Документ9 страниц2015 Security Breach Information 7-6-2015Anonymous EHPq5kОценок пока нет

- Chapter 17 - Control AccountsДокумент17 страницChapter 17 - Control Accountsshemida75% (4)

- Exclusive Current Affairs Tonic For NABARD & HARYANA Co-Operative Bank (Part I)Документ64 страницыExclusive Current Affairs Tonic For NABARD & HARYANA Co-Operative Bank (Part I)Manu Mallikarjun NelagaliОценок пока нет

- Raizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1Документ4 страницыRaizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1RAIZA CANILLASОценок пока нет

- COURSE GUIDE FOR (Insurance) : I. Grading SystemДокумент4 страницыCOURSE GUIDE FOR (Insurance) : I. Grading SystemArbie ChuaОценок пока нет

- Credit Card Debt AssignmentДокумент5 страницCredit Card Debt Assignmentapi-581454156Оценок пока нет

- Falin-Math of Finance and Investment 3 PDFДокумент97 страницFalin-Math of Finance and Investment 3 PDFAlfred alegadoОценок пока нет

- SUBJECT MATTER 6 - QuizДокумент4 страницыSUBJECT MATTER 6 - QuizKingChryshAnneОценок пока нет

- Mind Mapping Chap2 Money Market - Nur Shahira ParjoДокумент6 страницMind Mapping Chap2 Money Market - Nur Shahira ParjoNur ShahiraОценок пока нет

- IAS 12 - Income Tax: Prepared By: Sir Hamza Abdul HaqДокумент33 страницыIAS 12 - Income Tax: Prepared By: Sir Hamza Abdul HaqSrabon BaruaОценок пока нет

- Ethiopian Government AccountingДокумент120 страницEthiopian Government Accountingewnetu100% (6)