Академический Документы

Профессиональный Документы

Культура Документы

Laconia Daily Sun - JUA 07-30-09

Загружено:

Grant Bosse100%(2)100% нашли этот документ полезным (2 голоса)

229 просмотров2 страницыLaconia Daily Sun reporter Michael Kitch writes up Judge Kathleen McGuire's ruling blocking the State of New Hampshire from seizing $110 million in surplus premiums owned by the Joint Underwriting Association.

Оригинальное название

Laconia Daily Sun- JUA 07-30-09

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документLaconia Daily Sun reporter Michael Kitch writes up Judge Kathleen McGuire's ruling blocking the State of New Hampshire from seizing $110 million in surplus premiums owned by the Joint Underwriting Association.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

100%(2)100% нашли этот документ полезным (2 голоса)

229 просмотров2 страницыLaconia Daily Sun - JUA 07-30-09

Загружено:

Grant BosseLaconia Daily Sun reporter Michael Kitch writes up Judge Kathleen McGuire's ruling blocking the State of New Hampshire from seizing $110 million in surplus premiums owned by the Joint Underwriting Association.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Thursday, July 30, 2009

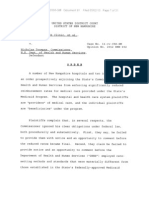

Judge sides with LRGH in battle with Lynch

Rules state cannot confiscate $110M ‘surplus’ in special medical malpractice fund to balance budget

by Michael Kitch

LACONIA — In a decision that immediately million in annual premiums — brought suit,

put the state in the red, Justice Kathleen disputing the state’s claim to the funds and

McGuire of Belknap County Superior Court staking a claim of their own.

ruled yesterday that the state cannot drain In a lucid 27-page order, McGuire rejected all

$110-million from a medical malpractice the major arguments advanced by the state and

insurance fund to balance its budget. upheld those of the policyholders in declaring

The budget applies $65-million to a projected HB-2 unconstitutional and ordering that it not

deficit in the fiscal year that ended on June 30 be enforced.

this year and divides the balance evenly Although the decision forestalls the transfer of

between the next two fiscal years. the funds to the state, it stops far short of

In a prepared statement issued soon after the requiring that any funds be distributed to the

decision, Governor John Lynch said that the policyholders.

state would appeal the decision to the New Nevertheless, Henry Lipman, senior vice-

Hampshire Supreme Court. president and chief financial officer of

In remarks echoed by Democratic Speaker of LRGHealthcare, who played a key role in the

the House Terry Norelli, the governor insisted class action suit, heralded the decision as a

that the JUA “was established — and given victory for the policyholders. “As a charitable

tax-free status as a state entity — in order to trust, we believed that we had compelling

provide a service, not a windfall, to doctors.” interest and fiduciary responsibility to advocate

The funds, he declared, “belong to the citizens for these assets,” he said. “When we first

of New Hampshire.” learned that the state planned to transfer the

Clearly relishing the setback to the funds,” he explained, “our concern was not

Democratic administration, former governor about getting a dividend or windfall, but about

John H. Sununu, who chairs the Republican whether the JUA would have sufficient capital

State Committee applauded the court for to sustain its operations without increasing

thwarting the “attempted theft” and confirming premiums or levying assessments. The decision

that the budget is a “real disaster” for the state. provides the JUA with a clear path to operate in

House Bill 2, the so-called companion bill to the best interests of the policyholders.”

the 2010-2011 state budget, stipulates that the The JUA was established in 1975 under a

surplus of the New Hampshire Medical statute (RSA 404-C) authorizing the insurance

Malpractice Joint Underwriting Association or commissioner to create so-called “mandatory

JUA must be transferred by Friday, July 31. risk sharing plans” to provide any form of

However, shortly before the Legislature liability insurance for which there is no private

adopted the budget nearly a third of the 900 or voluntary market. It is managed by a board

policyholders of the JUA — including of directors according to rules written by the

LRGHeathcare, which pays more than $1- Insurance Department and approved by the

Joint Legislative Committee on Administrative with private parties — the liability carriers and

Rules. The JUA meets its losses and pays its policyholders. Likewise, she rejected the state’s

expenses from the premiums paid by contention that it is entitled to the funds

policyholders. Moreover, all liability insurers because they will serve an important public

writing policies in the state are “members” of purpose. Noting that the state claimed the

the JUA and in the event it suffers a deficiency money to balance its budget, she cited an

can be assessed to overcome the shortfall. The opinion of the New Hampshire Supreme Court

state neither funds nor guarantees its liabilities where the justices held that “financial

or expenses. necessity, though superficially compelling, has

The operating rules provide if there is a never been sufficient of itself to permit states to

surplus, that is if premiums “exceed the amount abrogate contracts.”

necessary to pay losses and expenses,” the rules Taking the argument a step further, McGuire

provide either that assessments will be noted that if the JUA ran short of funds, the

refunded to members or that “the board shall . . policyholders would be assessed to make up

. distribute such excess to those health care the shortfall and said that transferring the funds

providers covered by the association, in such a would diminish earnings on investments, which

manner as is just and equitable.” in turn would increase the risk of assessing or

The rule is mirrored in the so-called surcharging policyholders. Since the state bears

“assessable and participating” policies between no responsibility to shore up the finances of the

the JUA and its policyholders. The policies JUA, she concluded that “not only is the

provide that if the JUA is in deficit, it can likelihood that the policyholders will receive a

assess the policyholders for additional dividend decreased, but the likelihood that

premiums while if it posts earnings “the named members and policyholders may be assessed to

insured shall participate in the earnings of the cover future liabilities is increased.”

company, to such extent and upon such Turning to the claims of the policyholders,

conditions as shall be determined by the board McGuire found that “the policy language is

of directors in accordance with law.” clear and unambiguous. They have a vested

The policyholders insisted that the plain right,” she continued, “based on contractual

language of the operating rules of the JUA and language, regulatory requirements, and the

their insurance policies with it entitled them to nature and history of the JUA, including that

funds in excess of monies required to defray dividends were paid and surcharges assessed in

pending and projected claims and to pay the past.” Consequently, McGuire ruled that

expenses. The state countered that because it HB-2 represented an unlawful taking of private

created the JUA to serve a public purpose, property without just compensation and

prescribed its operating rules, and exempts it impairment of a contractual relationship, both

from state and federal taxation, the association in violation of the state and federal

is a state agency whose surplus funds belong to constitutions.

the state. However, McGuire repeated that the court had

However, McGuire pulled the rug from under no authority to order the JUA to distribute any

the state by ruling that the JUA “is not a part of portion of surplus funds. “The upshot of the

state government,” and concluding “the state court’s order will be that the purported JUA

cannot own JUA funds under that theory.” In surplus will stay put,” she explained, “unless

particular, she found that the tax-exempt status distributed through means established in the

of the JUA did not compromise its status as an regulations governing the JUA.”

independent entity, whose financial risk rests

Вам также может понравиться

- Laconia Daily Sun - JUA 06-26-09Документ1 страницаLaconia Daily Sun - JUA 06-26-09Grant BosseОценок пока нет

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemОт EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemОценок пока нет

- Laconia Daily Sun - JUA 06-18-09Документ1 страницаLaconia Daily Sun - JUA 06-18-09Grant BosseОценок пока нет

- Legal Authority To Adjust State Pension Plans: by Ralph Benko July, 2011Документ4 страницыLegal Authority To Adjust State Pension Plans: by Ralph Benko July, 2011Paresh DaveОценок пока нет

- Justices Seem Skeptical of State's Position in $110M JUA CaseДокумент2 страницыJustices Seem Skeptical of State's Position in $110M JUA CaseGrant BosseОценок пока нет

- Laconia Daily Sun - JUA 06-24-09Документ1 страницаLaconia Daily Sun - JUA 06-24-09Grant BosseОценок пока нет

- Policy Brief: What Flexibility?Документ6 страницPolicy Brief: What Flexibility?Steve CouncilОценок пока нет

- Borrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashДокумент7 страницBorrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashSimply Debt SolutionsОценок пока нет

- What The Debt Ceiling Means For Social Security and More - The New York TimesДокумент3 страницыWhat The Debt Ceiling Means For Social Security and More - The New York TimesCesar Augusto CarmenОценок пока нет

- New Brunswick Trust Co. v. Commissioner of Internal Revenue, 180 F.2d 959, 3rd Cir. (1950)Документ4 страницыNew Brunswick Trust Co. v. Commissioner of Internal Revenue, 180 F.2d 959, 3rd Cir. (1950)Scribd Government DocsОценок пока нет

- Laconia Daily Sun - JUA 04-29-10Документ2 страницыLaconia Daily Sun - JUA 04-29-10Grant BosseОценок пока нет

- 1012 FM Health MythДокумент5 страниц1012 FM Health MythSteve CouncilОценок пока нет

- Midwest Edition: Clock Is Ticking On ExchangesДокумент6 страницMidwest Edition: Clock Is Ticking On ExchangesPayersandProvidersОценок пока нет

- Settlement USDOJ FILING News Release1Документ3 страницыSettlement USDOJ FILING News Release1Razmik BoghossianОценок пока нет

- Brannon v. McMaster - SC Supreme Court OpinionДокумент4 страницыBrannon v. McMaster - SC Supreme Court OpinionWMBF NewsОценок пока нет

- Simplifying Medicare ComplianceДокумент4 страницыSimplifying Medicare ComplianceForge ConsultingОценок пока нет

- A State-Based Health Exchange:: Fast-Tracking Government Controlled Health Care in South CarolinaДокумент5 страницA State-Based Health Exchange:: Fast-Tracking Government Controlled Health Care in South CarolinaSteve CouncilОценок пока нет

- PPACA ComplaintДокумент15 страницPPACA ComplaintCompetitive Enterprise InstituteОценок пока нет

- Cato Handbook Congress: Washington, D.CДокумент13 страницCato Handbook Congress: Washington, D.CMahmood BeasyОценок пока нет

- Republican Regulatory PlanДокумент6 страницRepublican Regulatory PlanZerohedgeОценок пока нет

- MD544971Документ90 страницMD544971s88831139Оценок пока нет

- Noticias Analisis Financiero 2Документ3 страницыNoticias Analisis Financiero 2G.A. Juan Sebastian Bermúdez VélezОценок пока нет

- Comunicado Del Senado de EEUUДокумент2 страницыComunicado Del Senado de EEUUTodo NoticiasОценок пока нет

- Key States On The Front Line of Stopping ObamaCareДокумент5 страницKey States On The Front Line of Stopping ObamaCareIllinois PolicyОценок пока нет

- McKenna, WA AG & Feds Obtain $25 Billion in Mortgage Relief From BanksДокумент6 страницMcKenna, WA AG & Feds Obtain $25 Billion in Mortgage Relief From BanksnadiahopeОценок пока нет

- United States Court of Appeals, Third CircuitДокумент9 страницUnited States Court of Appeals, Third CircuitScribd Government DocsОценок пока нет

- Indian Economy and Issues Relating To Planning, Mobilization of Resources, Growth, Development and EmploymentДокумент33 страницыIndian Economy and Issues Relating To Planning, Mobilization of Resources, Growth, Development and EmploymentShridhar RaskarОценок пока нет

- United States Court of Appeals, Fifth CircuitДокумент12 страницUnited States Court of Appeals, Fifth CircuitScribd Government DocsОценок пока нет

- United States v. Anthony J. Pisani, M.D., 646 F.2d 83, 3rd Cir. (1981)Документ10 страницUnited States v. Anthony J. Pisani, M.D., 646 F.2d 83, 3rd Cir. (1981)Scribd Government DocsОценок пока нет

- Outrageous - Federal Reserve Blocks The New Foreclosure Regulations - Throwing Homeowners Under The BusДокумент3 страницыOutrageous - Federal Reserve Blocks The New Foreclosure Regulations - Throwing Homeowners Under The Bus83jjmackОценок пока нет

- How The Consumer Financial Protection AgДокумент57 страницHow The Consumer Financial Protection AgtoledogotorisabelОценок пока нет

- OCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - ForeclolsuresДокумент6 страницOCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - Foreclolsures83jjmackОценок пока нет

- 1.2.1. Yap V COA2Документ23 страницы1.2.1. Yap V COA2Jennilyn TugelidaОценок пока нет

- Health Care ExchangesДокумент2 страницыHealth Care Exchangesjames_valvoОценок пока нет

- Conway Release Aug 21Документ4 страницыConway Release Aug 21mgreenОценок пока нет

- Desk and The ConsumerДокумент8 страницDesk and The ConsumerdonОценок пока нет

- Government-Sponsored Enterprises (Gses) : An Institutional OverviewДокумент6 страницGovernment-Sponsored Enterprises (Gses) : An Institutional OverviewLarry J KingОценок пока нет

- Commissioner of Internal Revenue v. Union Mutual Insurance Company of Providence, 386 F.2d 974, 1st Cir. (1967)Документ7 страницCommissioner of Internal Revenue v. Union Mutual Insurance Company of Providence, 386 F.2d 974, 1st Cir. (1967)Scribd Government DocsОценок пока нет

- Chapter 2Документ33 страницыChapter 2N KhОценок пока нет

- Week 5 Case AnalysisДокумент11 страницWeek 5 Case AnalysisPatrickОценок пока нет

- United Coconut Planters Banks VsДокумент4 страницыUnited Coconut Planters Banks VsVance CeballosОценок пока нет

- Hospital Authority of Floyd County, Georgia v. Margaret M. Heckler, Secretary, U.S. Department of Health & Human Services, 707 F.2d 456, 11th Cir. (1983)Документ7 страницHospital Authority of Floyd County, Georgia v. Margaret M. Heckler, Secretary, U.S. Department of Health & Human Services, 707 F.2d 456, 11th Cir. (1983)Scribd Government DocsОценок пока нет

- Laconia Daily Sun - JUA 06-30-09Документ1 страницаLaconia Daily Sun - JUA 06-30-09Grant BosseОценок пока нет

- 2015-12-15 GSE PAPER Something Old, Somethng New, Something BorrowedДокумент78 страниц2015-12-15 GSE PAPER Something Old, Somethng New, Something BorrowedJoshua RosnerОценок пока нет

- The Cost of Government Financial Interventions, Past and PresentДокумент6 страницThe Cost of Government Financial Interventions, Past and Presentalex1521dfОценок пока нет

- United States Court of Appeals, Fifth CircuitДокумент9 страницUnited States Court of Appeals, Fifth CircuitScribd Government DocsОценок пока нет

- RealitiesДокумент2 страницыRealitiesNick ReismanОценок пока нет

- Payers & Providers Midwest Edition - Issue of October 4, 2011Документ6 страницPayers & Providers Midwest Edition - Issue of October 4, 2011PayersandProvidersОценок пока нет

- Scooping and Tossing Puerto Rico's FutureДокумент8 страницScooping and Tossing Puerto Rico's FutureRoosevelt Institute100% (2)

- Enrique Velazco v. Steven A. Minter, Etc., 481 F.2d 573, 1st Cir. (1973)Документ12 страницEnrique Velazco v. Steven A. Minter, Etc., 481 F.2d 573, 1st Cir. (1973)Scribd Government DocsОценок пока нет

- The People United Will Leave The Banks DividedДокумент4 страницыThe People United Will Leave The Banks DividedRicharnellia-RichieRichBattiest-CollinsОценок пока нет

- Boston Regional v. Mass. Div. Health, 365 F.3d 51, 1st Cir. (2004)Документ17 страницBoston Regional v. Mass. Div. Health, 365 F.3d 51, 1st Cir. (2004)Scribd Government DocsОценок пока нет

- 1 CSC Vs DBMДокумент6 страниц1 CSC Vs DBMkimmyОценок пока нет

- State Insurance Regulation: History, Purpose and StructureДокумент5 страницState Insurance Regulation: History, Purpose and StructuremehdontcareОценок пока нет

- AMA and AHA - Complaint 12 9 2021 Embargoed VersionДокумент29 страницAMA and AHA - Complaint 12 9 2021 Embargoed VersionPeter SullivanОценок пока нет

- Obamacare OrderДокумент29 страницObamacare OrderRoger DuPuisОценок пока нет

- BPCLC Public Comment Letter in Response To The Patient Protection and Affordable Care Act Exchange Program Integrity Proposed RuleДокумент5 страницBPCLC Public Comment Letter in Response To The Patient Protection and Affordable Care Act Exchange Program Integrity Proposed RuleState Senator Liz KruegerОценок пока нет

- Medicaid RulingДокумент48 страницMedicaid RulingWKYTОценок пока нет

- Philippine Health Care Providers VS CirДокумент3 страницыPhilippine Health Care Providers VS CirClaudine Christine A. VicenteОценок пока нет

- Balboni Letter - Charter Schools 10-10-12Документ3 страницыBalboni Letter - Charter Schools 10-10-12Grant BosseОценок пока нет

- NH DHHS Letter To CMS - June 22 2012Документ2 страницыNH DHHS Letter To CMS - June 22 2012Grant BosseОценок пока нет

- Wallner V Gardner PetitionДокумент16 страницWallner V Gardner PetitionGrant BosseОценок пока нет

- Medicaid Access Monitoring - June 2012 - FinalДокумент81 страницаMedicaid Access Monitoring - June 2012 - FinalGrant BosseОценок пока нет

- NH DHHS Response To CMS 06-04-12Документ3 страницыNH DHHS Response To CMS 06-04-12Grant BosseОценок пока нет

- McAuliffe Medicaid Order 09-27-12Документ14 страницMcAuliffe Medicaid Order 09-27-12Grant BosseОценок пока нет

- Impact On The State of New Hampshire of Implementing The Medicaid Expansion Under The ACAДокумент29 страницImpact On The State of New Hampshire of Implementing The Medicaid Expansion Under The ACAGrant BosseОценок пока нет

- Wallner V Gardner ExhibitsДокумент121 страницаWallner V Gardner ExhibitsGrant BosseОценок пока нет

- Manchester V Gardner Order of NoticeДокумент1 страницаManchester V Gardner Order of NoticeGrant BosseОценок пока нет

- Concord V Gardner ExhibitsДокумент16 страницConcord V Gardner ExhibitsGrant BosseОценок пока нет

- Wallner V Gardner Cover LetterДокумент2 страницыWallner V Gardner Cover LetterGrant BosseОценок пока нет

- Concord V Gardner PetitionДокумент76 страницConcord V Gardner PetitionGrant BosseОценок пока нет

- Manchester V Gardner PetitionДокумент9 страницManchester V Gardner PetitionGrant BosseОценок пока нет

- McAuliffe Order - Dartmouth-Hitchcock V ToumpasДокумент3 страницыMcAuliffe Order - Dartmouth-Hitchcock V ToumpasGrant BosseОценок пока нет

- Dred - Bald Mileage EstimateДокумент1 страницаDred - Bald Mileage EstimateGrant BosseОценок пока нет

- Dartmouth-Hitchcock V Toumpas 03-02-12 OrderДокумент31 страницаDartmouth-Hitchcock V Toumpas 03-02-12 OrderGrant BosseОценок пока нет

- Scholarship Tax Credit Programs AnalysisДокумент28 страницScholarship Tax Credit Programs AnalysisGrant BosseОценок пока нет

- Fish and Game State VehiclesДокумент1 страницаFish and Game State VehiclesGrant BosseОценок пока нет

- Plaintiff's Reply in Support of Motion For Preliminary InjunctionДокумент20 страницPlaintiff's Reply in Support of Motion For Preliminary InjunctionGrant BosseОценок пока нет

- Irrational-Do Certificate of Need Laws Reduce Costs or Hurt Patients?Документ8 страницIrrational-Do Certificate of Need Laws Reduce Costs or Hurt Patients?Grant BosseОценок пока нет

- Health and Human Services State VehiclesДокумент1 страницаHealth and Human Services State VehiclesGrant BosseОценок пока нет

- NH DRED State Vehicle RequestsДокумент7 страницNH DRED State Vehicle RequestsGrant BosseОценок пока нет

- Corrections State Vehicle RequestsДокумент2 страницыCorrections State Vehicle RequestsGrant BosseОценок пока нет

- NH Liquor Commission State Vehicles RequestsДокумент4 страницыNH Liquor Commission State Vehicles RequestsGrant BosseОценок пока нет

- S&P Bond Statement On NH GO Bonds 10-19-11Документ8 страницS&P Bond Statement On NH GO Bonds 10-19-11Grant BosseОценок пока нет

- Fitch Bond Statement On NH GO Bond Sale 10-18-2011Документ3 страницыFitch Bond Statement On NH GO Bond Sale 10-18-2011Grant BosseОценок пока нет

- Defendant's Reply To Plaintiff's Objection To MTDДокумент10 страницDefendant's Reply To Plaintiff's Objection To MTDGrant BosseОценок пока нет

- Plaintiff's Objection To Defendant's Motion To DismissДокумент23 страницыPlaintiff's Objection To Defendant's Motion To DismissGrant BosseОценок пока нет

- State of NH General Obligation Capital Improvement Bonds 2011Документ106 страницState of NH General Obligation Capital Improvement Bonds 2011Grant BosseОценок пока нет

- Smith Affidavit in Support of ObjectionДокумент3 страницыSmith Affidavit in Support of ObjectionGrant BosseОценок пока нет

- MASДокумент11 страницMASgray downeyОценок пока нет

- Chapter One Basics of Public FinanceДокумент30 страницChapter One Basics of Public FinanceAhmedОценок пока нет

- Sap HR HCMДокумент8 страницSap HR HCMRavi DingariОценок пока нет

- Personal Expense Tracker 1Документ32 страницыPersonal Expense Tracker 1Ashok Kumar ReddyОценок пока нет

- (DRAFT) JMC 2 ADM Implementation GuidelinesДокумент12 страниц(DRAFT) JMC 2 ADM Implementation Guidelinesruss8dikoОценок пока нет

- FOAT Manual For 2010 Assessment (4th Cycle)Документ57 страницFOAT Manual For 2010 Assessment (4th Cycle)David Adeabah OsafoОценок пока нет

- Culminating Activity Project Proposal FormДокумент4 страницыCulminating Activity Project Proposal FormDarwin Mateo SantosОценок пока нет

- 7 Sales Budget FinalДокумент18 страниц7 Sales Budget FinalanashussainОценок пока нет

- Student Organization Officer RolesДокумент2 страницыStudent Organization Officer RolesAli khan7Оценок пока нет

- C. Decentralization and Devolution, DistinguishedДокумент2 страницыC. Decentralization and Devolution, DistinguishedGRОценок пока нет

- How The European Union WorksДокумент44 страницыHow The European Union WorksAncuta AbrudanОценок пока нет

- Blue Jay Private LimitedДокумент2 страницыBlue Jay Private LimitedanuОценок пока нет

- SB Appropriation Ordinance 2022-104 (SB 1)Документ3 страницыSB Appropriation Ordinance 2022-104 (SB 1)Frianca Rhoqueza AbsaralОценок пока нет

- ASG 3 Soloist PDFДокумент4 страницыASG 3 Soloist PDFJohnsen PratamaОценок пока нет

- Chap14 Test BankДокумент31 страницаChap14 Test BankJacob MullerОценок пока нет

- Implementing IPSAS at UNHCR PDFДокумент43 страницыImplementing IPSAS at UNHCR PDFrafimaneОценок пока нет

- Theories and Principles of Educational ManagementДокумент17 страницTheories and Principles of Educational ManagementPatrizzia Ann Rose OcbinaОценок пока нет

- Saginaw Mayor - 2023 State of The City AddressДокумент15 страницSaginaw Mayor - 2023 State of The City AddressCaleb HollowayОценок пока нет

- 2016advocacyhandbook OnlineДокумент220 страниц2016advocacyhandbook OnlineJHОценок пока нет

- Cash BudgetsДокумент23 страницыCash Budgetsarjun sachdevОценок пока нет

- Blocher8e EOC SM Ch10 FinalДокумент99 страницBlocher8e EOC SM Ch10 FinalPhiranat NANGSIKHUNОценок пока нет

- Myanmar Agriculture Sector ReviewДокумент19 страницMyanmar Agriculture Sector Reviewpoppytrang100% (1)

- Raus IAS Prelims Compass 2020 Budget and Economic Survey PDFДокумент98 страницRaus IAS Prelims Compass 2020 Budget and Economic Survey PDFSoft CrazeОценок пока нет

- M3 Shifa 2021-23 PracticeДокумент5 страницM3 Shifa 2021-23 PracticeSetul ShethОценок пока нет

- B. Sales Less Variable: Absorption CostingДокумент3 страницыB. Sales Less Variable: Absorption CostingLaraОценок пока нет

- Pto BylawsДокумент4 страницыPto Bylawsapi-233396695Оценок пока нет

- Minutes of MDC Meeting February 2 2012 PDFДокумент3 страницыMinutes of MDC Meeting February 2 2012 PDFPearly ShellОценок пока нет

- Criteria For Advance paraДокумент29 страницCriteria For Advance paraFayaz KhanОценок пока нет

- Chapter 3. The Optimal Capital Budget: The Investment Opportunity Schedule (IOS)Документ14 страницChapter 3. The Optimal Capital Budget: The Investment Opportunity Schedule (IOS)shiprabansal_123Оценок пока нет

- Chapter 8 - Master Budgeting Flashcards - QuizletДокумент3 страницыChapter 8 - Master Budgeting Flashcards - QuizletBisag AsaОценок пока нет

- The Courage to Be Free: Florida's Blueprint for America's RevivalОт EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalОценок пока нет

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesОт EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesОценок пока нет

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonОт EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonРейтинг: 4.5 из 5 звезд4.5/5 (21)

- Modern Warriors: Real Stories from Real HeroesОт EverandModern Warriors: Real Stories from Real HeroesРейтинг: 3.5 из 5 звезд3.5/5 (3)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpОт EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpРейтинг: 4.5 из 5 звезд4.5/5 (11)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteОт EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteРейтинг: 4.5 из 5 звезд4.5/5 (16)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldОт EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldРейтинг: 3.5 из 5 звезд3.5/5 (9)

- The Red and the Blue: The 1990s and the Birth of Political TribalismОт EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismРейтинг: 4 из 5 звезд4/5 (29)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaОт EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaРейтинг: 4.5 из 5 звезд4.5/5 (12)

- The Quiet Man: The Indispensable Presidency of George H.W. BushОт EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushРейтинг: 4 из 5 звезд4/5 (1)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicОт EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicОценок пока нет

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityОт EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityОценок пока нет

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeОт EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeРейтинг: 4 из 5 звезд4/5 (572)

- Commander In Chief: FDR's Battle with Churchill, 1943От EverandCommander In Chief: FDR's Battle with Churchill, 1943Рейтинг: 4 из 5 звезд4/5 (16)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentОт EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentРейтинг: 3.5 из 5 звезд3.5/5 (52)

- The Next Civil War: Dispatches from the American FutureОт EverandThe Next Civil War: Dispatches from the American FutureРейтинг: 3.5 из 5 звезд3.5/5 (47)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaОт EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Crimes and Cover-ups in American Politics: 1776-1963От EverandCrimes and Cover-ups in American Politics: 1776-1963Рейтинг: 4.5 из 5 звезд4.5/5 (26)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismОт EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismРейтинг: 4.5 из 5 звезд4.5/5 (42)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismОт EverandReading the Constitution: Why I Chose Pragmatism, not TextualismОценок пока нет

- Hatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaОт EverandHatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaРейтинг: 4 из 5 звезд4/5 (5)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryОт EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryРейтинг: 4 из 5 звезд4/5 (6)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorОт EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorОценок пока нет

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordОт EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordРейтинг: 4 из 5 звезд4/5 (5)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushОт EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushРейтинг: 4 из 5 звезд4/5 (6)

- 1960: LBJ vs. JFK vs. Nixon--The Epic Campaign That Forged Three PresidenciesОт Everand1960: LBJ vs. JFK vs. Nixon--The Epic Campaign That Forged Three PresidenciesРейтинг: 4.5 из 5 звезд4.5/5 (50)