Академический Документы

Профессиональный Документы

Культура Документы

M4 Drve

Загружено:

Manisha LambaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

M4 Drve

Загружено:

Manisha LambaАвторское право:

Доступные форматы

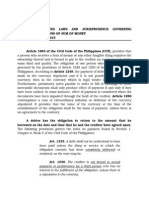

FINANCIAL ANALYSIS

Money 4 drive advertising pvt .ltd (''the Company'') as at March 31, 2011 and also the Profit and loss account and the Cash flow statement for the year ended on that date annexed thereto. These financial statements are the responsibility of the Company''s management. our responsibility is to express an opinion on these financial statements based on our audit. 2. We conducted our audit in accordance with auditing standards generally accepted in india. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. an audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. an audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. 3. as required by the Companies (auditor''s report) order, 2003, as amended by the Companies (auditor''s report) (amendment) order, 2004, issued by the Central Government of india in terms of sub-section (4a) of section 227 of the Companies act, 1956 and on the basis of such checks of the books and records of the company as we considered appropriate and according to the information and explanations given to us, we give in the annexure a statement on the matters specified in paragraphs 4 and 5 of the said order. 4. further to our comments in the paragraph 3 above, we report that: i. We have obtained all the information and explanations, which to the best of our knowledge and belief were necessary for the purpose of our audit; ii. in our opinion, proper books of account as required by law have been kept by the Company so far as appears from our examination of those books; iii. The balance sheet, Profit and loss account and the Cash flow statement dealt with by this report are in agreement with the books of account; iv. in our opinion, the balance sheet, the Profit and loss account and the Cash flow statement dealt with by this report comply with the accounting standards referred to in sub-section (3C) of section 211 of the Companies act, 1956.

v. on the basis of the written representations received from the directors, as on March 31, 2011, and taken on record by the board of directors, we report that none of the directors is disqualified as on March 31, 2011 from being appointed as a director in terms of clause (g) of sub-section (1) of section 274 of the Companies act, 1956. vi. in our opinion and to the best of our information and according to the explanations given to us, the said accounts give the information required by the Companies act, 1956, in the manner so required, subject to note no. 7 of schedule 16 (ii) relating to pending confirmations and reconciliations of balances of loans & advances and consequential adjustments, if any, give a true and fair view in conformity with the accounting principles generally accepted in india; a) in the case of the balance sheet, of the state of affairs of the Company as at March 31, 2011; b) in the case of the Profit and loss account, of the profit of the Company for the year ended on that date; and c) in the case of Cash flow statement, of the cash flows of the Company for the year ended on that date. ANNEXURE TO AUDITORS'' REPORT [referred to in paragraph 3 of the auditors'' report of even date to the members of brandhouse retails limited on the financial statements for the year ended 31.3.2011] (i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets. (b) all the fixed assets have not been physically verified by the management during the year, but there is a regular programme of verification which, in our opinion, is reasonable having regard to the size of the Company and the nature of its assets. as informed, no material discrepancies were noticed on such verification. (c) in our opinion and according to the information and explanations given to us, a substantial part of fixed assets has not been disposed off by the Company during the year.

(ii) (a) as explained to us, the management has physically verified the

inventory at all the showrooms as per a phased program, in which, all the showrooms are covered at least once in a year. in our opinion, the frequency of such verification is reasonable. . (b) The procedures of physical verification of inventory followed by the management are reasonable and adequate in relation to the size of the Company and the nature of its business. (c) on the basis of our examination of records of Company, we are of the opinion that the Company is maintaining proper records of inventory. The discrepancies noticed on verification between physical stocks and book stocks were not material and same have been properly dealt with in the books of accounts. (iii) (a) as informed, the Company has not granted any loans, secured or unsecured to companies, firms or other parties covered in the register maintained under section 301 of the Companies act, 1956 and hence, clauses (iii)(b), (iii) (c) and (iii)(d) of paragraph 4 of the Companies (auditor''s report) order, 2003, as amended by the Companies (auditor''s report) (amendment) order, 2004, are not applicable to the Company. (b) as informed, the Company has not taken any loans, secured or unsecured from companies, firms or other parties covered in the register maintained under section 301 of the Companies act, 1956 and hence clauses (iii)(f) and (iii)(g) of paragraph 4 of the Companies (auditor''s report) order, 2003, as amended by the Companies (auditor''s report) (amendment) order, 2004, are not applicable to the Company. (iv) in our opinion and according to the information and explanations provided to us, there exists an adequate internal control system commensurate with the size of the Company and nature of its business with regards to purchase of inventories, fixed assets and sale of goods and services. during the course of our audit, we have not observed nor have been informed of any continuing failure to correct major weaknesses in internal control systems of the Company. (v) (a) according to the information and explanations given to us, we are of the opinion that the particulars of contracts or arrangements referred to in section 301 of the Companies act, 1956 that need to be entered into the register maintained under section 301 have been so entered. (b) in our opinion and according to the information and explanations given to us, the transactions made in pursuance of such contracts or arrangements exceeding value of rupees five lacs have been entered into

during the financial year at prices which are reasonable having regard to the prevailing market prices at the relevant time. (vi) The Company has not accepted any deposits from the public within the meaning of sections 58a and 58aa of the Companies act, 1956 and the rules framed there under. (vii) in our opinion, the Company has an internal audit system commensurate with the size and nature of its business. (viii) The Central Government of india has not prescribed the maintenance of cost records under clause (d) of sub-section (1) of section 209 of the act for any of the products dealt with by the Company. (ix) (a) undisputed statutory dues including provident fund, investor education and Protection fund, or employees'' state insurance, sales-tax, Wealth tax, service tax, Customs duty, excise duty, Cess etc. have generally been regularly deposited with the appropriate authorities. further, since the Central Government has till date not prescribed the amount of cess payable under section 441 a of the Companies act,1956, we are not in a position to comment upon the regularity or otherwise of the Company in depositing the same. (b) according to the information and explanations given to us, undisputed dues in respect of advance income-tax amounting to rs. 298.76 lacs (excluding interest) for f.Y. 2010-11 was outstanding, as at the year end for a period of more than six months from the date they became payable. (c) according to the information and explanations given to us, there are no dues of income tax, sales-tax, Wealth tax, service tax, Customs duty, excise duty and Cess which have not been deposited on account of any dispute except for the following:

Period From 2011 2010 2009 To 2012 2011 2010

Instrument

Authorized Capital

(Rs. cr)

Issued Capital

(Rs. cr)

-PAIDUPShares (nos) 53602767 53602767 53602767 Face Value 10 10 10

Equity Share Equity Share Equity Share

60 60 60

53.6 53.6 53.6

2008 2007 2006

2009 2008 2007

Equity Share Equity Share Equity Share

60 25 25

53.6 6.3 6.3

53602767 6300000 6300000

10 10 10

Вам также может понравиться

- A New Mandate For Human ResourcesДокумент13 страницA New Mandate For Human ResourcesManisha LambaОценок пока нет

- ITC Hotels internship report on effectiveness of performance appraisalДокумент71 страницаITC Hotels internship report on effectiveness of performance appraisalManisha LambaОценок пока нет

- Group 4 - InfosysДокумент26 страницGroup 4 - InfosysManisha Lamba0% (1)

- CSE Session 2 & 3 ExamplesДокумент13 страницCSE Session 2 & 3 ExamplesManisha LambaОценок пока нет

- Performance Appraisal Project ReportДокумент36 страницPerformance Appraisal Project Reportkamdica90% (88)

- Introduction AirtelДокумент1 страницаIntroduction AirtelManisha LambaОценок пока нет

- Industry Analysis: Competition Analysis Financial StatementsДокумент1 страницаIndustry Analysis: Competition Analysis Financial StatementsManisha LambaОценок пока нет

- Ritz Carlton Critz Carltonase StudyДокумент30 страницRitz Carlton Critz Carltonase StudyManisha LambaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Using Options To Buy Stocks - Build Wealth With Little Risk and No CapitalДокумент534 страницыUsing Options To Buy Stocks - Build Wealth With Little Risk and No CapitalpetefaderОценок пока нет

- 11Документ16 страниц11Dennis AleaОценок пока нет

- Rural bank certification documentsДокумент3 страницыRural bank certification documentsDarwin Solanoy100% (1)

- 1396581735517Документ2 страницы1396581735517pendleesunilОценок пока нет

- Lal Project...Документ80 страницLal Project...Mamta KhowalОценок пока нет

- Entrepreneur Management Questions and AnswersДокумент24 страницыEntrepreneur Management Questions and AnswersArun DassiОценок пока нет

- Kumarmangalam Report On Corporate GovernanceДокумент22 страницыKumarmangalam Report On Corporate Governancepritikopade020% (1)

- Contracts Course Outline Revised BQS 112Документ7 страницContracts Course Outline Revised BQS 112MichaelKipronoОценок пока нет

- Synopsis-Un Paid SellerДокумент2 страницыSynopsis-Un Paid SellerVivek RanjanОценок пока нет

- Indian Banking System OverviewДокумент67 страницIndian Banking System Overviewvandana_daki3941Оценок пока нет

- Wealth DynamicsДокумент32 страницыWealth Dynamicsmauve08Оценок пока нет

- Done - 11. Guingona, Jr. v. City Fiscal of Manila - 1984Документ2 страницыDone - 11. Guingona, Jr. v. City Fiscal of Manila - 1984sophiaОценок пока нет

- A Project Report On HDFC BankДокумент47 страницA Project Report On HDFC BankMukesh Lal100% (1)

- Lighthouse Point News July IssueДокумент76 страницLighthouse Point News July IssueJon FrangipaneОценок пока нет

- A Comparison of NEC and FIDIC by Rob GerrardДокумент4 страницыA Comparison of NEC and FIDIC by Rob GerrardbappanaduОценок пока нет

- Business Law TeacherДокумент3 страницыBusiness Law TeacherAMIN BUHARI ABDUL KHADER100% (1)

- Kohat Cement Company, Presentation Slides Mc100205161Документ31 страницаKohat Cement Company, Presentation Slides Mc100205161aftab33% (3)

- Trade Credit Insurance: Peter M. JonesДокумент33 страницыTrade Credit Insurance: Peter M. JonessergioОценок пока нет

- Legal Memo - Collection of Sum of MoneyДокумент9 страницLegal Memo - Collection of Sum of MoneyArnold Cavalida Bucoy100% (3)

- Executive Summary Tripplesea Soya ProjectДокумент3 страницыExecutive Summary Tripplesea Soya ProjectebubecОценок пока нет

- Time Value of Money:: "Money Is An Arm or Leg. You Either Use It or Lose It." - Henry FordДокумент33 страницыTime Value of Money:: "Money Is An Arm or Leg. You Either Use It or Lose It." - Henry FordramunagatiОценок пока нет

- Setting up an Architectural PracticeДокумент19 страницSetting up an Architectural PracticeAditi100% (1)

- Monetary Policies by Rbi in RecessionДокумент21 страницаMonetary Policies by Rbi in Recessionsamruddhi_khaleОценок пока нет

- Garcia vs. Court of AppealsДокумент12 страницGarcia vs. Court of AppealsJoannah SalamatОценок пока нет

- Bernardo V MejiaДокумент2 страницыBernardo V MejiaPaul VillarosaОценок пока нет

- Revised SWORN Statement of Assets, Liabilities and Net WorthДокумент10 страницRevised SWORN Statement of Assets, Liabilities and Net WorthJeanrichel Quillo LlenaresОценок пока нет

- Guide To: Credit Rating EssentialsДокумент19 страницGuide To: Credit Rating EssentialseduardohfariasОценок пока нет

- Adopt-A-Family: of The Palm Beaches, IncДокумент4 страницыAdopt-A-Family: of The Palm Beaches, Incm_constantine8807Оценок пока нет

- Financial Planning and BudgetingДокумент3 страницыFinancial Planning and BudgetingMuhammad RamzanОценок пока нет

- Property Case DigestsДокумент19 страницProperty Case DigestsZie Bea0% (1)