Академический Документы

Профессиональный Документы

Культура Документы

OH02002 Cuyahoga County PDF

Загружено:

Matt ChaseИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

OH02002 Cuyahoga County PDF

Загружено:

Matt ChaseАвторское право:

Доступные форматы

REAL ESTATE MARKET REPORT

CUYAHOGA COUNTY

Su

Tu

Th

Sa

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

Sunday, November 3

2013

TABLE OF CONTENTS

Market Summary Table

..

Glossary

...

Chase Group Real Estate

Keller Williams Greater Cleveland West

5061 N. Abbe Rd. STE 1

Sheffield Village, OH 44035

www.chasegrouprealestate.com

matt@chasegrouprealestate.com

440.328.4804

chasegrouprealestate

chasematt

chasegroupre

chasegrouprealestate

Real Market Reports

www.RealMarketReports.com

Page 1

Page 2

REAL ESTATE MARKET REPORT

CUYAHOGA COUNTY

Sunday, November 3, 2013

Chase Group Real Estate

Keller Williams Greater Cleveland West

matt@chasegrouprealestate.com

440.328.4804

219

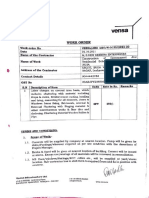

MARKET SUMMARY TABLE

A = Average Value

M = Median Value

N/A = Not Available

Price Range

506

Low

High

Num

#

$0

$49,999

24

$50,000

$99,999

37

$100,000

$149,999

135

$150,000

$199,999

107

$200,000

$249,999

39

$250,000

$299,999

34

$300,000

$349,999

16

$350,000

$399,999

16

$400,000

$449,999

19

$450,000

$499,999

$500,000

$549,999

$550,000

$599,999

14

$600,000

$649,999

$650,000

$699,999

$700,000

42

Market Totals

506

335

PENDING [2]

1018

ACTIVE [1]

Days

on

Market

Current

List

Price

96

24,463

61

28,950

110

84,246

69

89,900

124

$ 127,817

93

$ 129,000

104

$ 173,689

69

$ 171,000

93

$ 226,905

72

$ 228,500

118

$ 278,518

66

$ 279,250

101

$ 333,017

58

$ 332,450

158

$ 380,606

84

$ 383,750

187

$ 430,242

79

$ 429,900

164

$ 481,038

98

$ 482,450

149

$ 525,350

96

$ 524,950

175

$ 580,821

173

$ 577,450

161

$ 642,269

164

$ 649,700

273

$ 688,957

192

$ 695,000

215

$ 1,295,669

137

$ 1,097,500

OFF-MARKET (last 6 mos) [3]

Num

#

Pend

Ratio

Num

#

Num

#

14%

14

41

31

46%

22

89

67

33%

103

274

42

28%

75

225

22

36%

32

126

20

37%

17

101

36%

13

47

27%

10

26

24%

21

11%

15

33%

11

19

19

335

1018

0

1

20%

30%

11%

219

30%

ABSORPTION RATE

(months of inventory)

SOLD/CLOSED (last 6 months) [4]

Days

on

Market

Original

List

Price

Final

List

Price

Sold/

Closed

Price

ListSale

Ratio

82

31,027

27,498

89%

70

32,000

26,800

84%

70

85,870

79,221

92%

51

89,900

82,250

91%

70

$ 132,364

$ 127,526

96%

47

$ 133,625

$ 128,250

96%

74

$ 177,081

$ 172,427

97%

41

$ 175,000

$ 170,000

97%

67

$ 232,697

$ 224,481

96%

33

$ 234,243

$ 224,000

96%

86

$ 279,755

$ 274,973

98%

35

$ 280,000

$ 275,000

98%

59

$ 334,251

$ 322,234

96%

43

$ 334,900

$ 320,000

96%

46

$ 389,504

$ 379,055

97%

15

$ 391,250

$ 383,367

98%

113

$ 439,622

$ 422,319

96%

62

$ 439,900

$ 420,000

95%

53

$ 483,313

$ 467,600

97%

37

$ 484,900

$ 460,000

95%

45

$ 548,771

$ 521,786

95%

17

$ 535,000

$ 525,000

98%

79

$ 598,938

$ 568,875

95%

30

$ 599,000

$ 565,550

94%

89

$ 670,609

$ 633,091

94%

49

$ 664,900

$ 640,000

96%

69

$ 706,550

$ 670,625

95%

45

$ 697,250

$ 669,500

96%

87

$ 1,160,979

$ 1,049,553

90%

58

$ 845,000

$ 790,000

93%

3.5

2.5

3

2.9

1.9

2

2

3.7

5.4

3.2

3.4

10.5

2.2

5.3

13.3

3

Market Averages

130

$ 303,057

73

$ 224,597

$ 215,452 96%

Market Medians

81

$ 174,900

43

$ 174,900

$ 170,000 97%

Date Range (Off-Market & Sold) = 05/05/2013 to 11/03/2013

Data believed to be accurate but not guaranteed.

Est.

Mos.

Favors Sellers

Favors Buyers

Status = [1] A; [2] C, P; [3] X, W; [4] S

Area = 201, 202, 203, 204, 205, 305

Property Subtype 1 = SING

Real Market Reports

www.RealMarketReports.com

Market Summary Table

REAL ESTATE MARKET REPORT

CUYAHOGA COUNTY

Sunday, November 3, 2013

Chase Group Real Estate

Keller Williams Greater Cleveland West

matt@chasegrouprealestate.com

440.328.4804

1. PROPERTIES FOR SALE (ACTIVE)

a. Number Active: The number of listings for sale which are currently being marketed but do not yet have a purchase

agreement.

b. Days on Market (DOM): The marketing period of currently active listings. This does not account for some listings

which have had a previous listing period, but were re-entered as a new listing.

c. Current List Price: The price that a property seller is currently asking.

2. CONTRACTS PENDING

a. Number Pending: The number of current listings for which a contract has been signed but has not yet closed.

b. Pending Ratio: Sometimes called a list-to-pending ratio. This is a measure of how fast properties are going under

contract vs. how fast they are being listed.

Pending Ratio =

P (Number of Pending Listings)

A+P (Number of Active + Pending)

(P) represents properties that buyers have chosen

(A+P) represents the entire pool from which they have chosen

3. OFF-MARKET

a. Number Off-Market: The number of listing agreements that have failed to close in the last 6 months. Some

owners may choose to re-offer their property for sale.

4. PROPERTIES SOLD (CLOSED CONTRACT)

a. Number Sold: The number of properties that have gone to a closing in the last 6 months.

b. Days on Market (DOM): The marketing time it has taken properties to sell in the last 6 months.

c. Original List Price: The price at which a sold property was originally marketed.

d. Final List Price: The price at which a sold property was marketed just prior to selling.

e. Sold/Closed Price: The price for which a property sold.

f.

List to Sales Ratio: The percentage of the list price that the buyer ultimately paid for the property.

List to Sales Ratio =

Sold Price

Final List Price

5. ABSORPTION RATE / MONTHS OF INVENTORY

a. Absorption Rate / Months of Inventory: An estimate of how fast listings are currently selling measured in months.

For example, if 100 properties sell per month and there are 800 properties for sale - there is an 8 month supply of

inventory before counting the additional properties that will come on the market.

Real Market Reports

www.RealMarketReports.com

Glossary

Вам также может понравиться

- Bullet Proof InvestingДокумент25 страницBullet Proof InvestingNiru0% (1)

- Access To Finance For Women Entrepreneurs in South Africa (November 2006)Документ98 страницAccess To Finance For Women Entrepreneurs in South Africa (November 2006)IFC SustainabilityОценок пока нет

- Finance Demo Script - ConsolidationsДокумент46 страницFinance Demo Script - ConsolidationshnoamanОценок пока нет

- How to Sell a House Fast in a Slow Real Estate Market: A 30-Day Plan for Motivated SellersОт EverandHow to Sell a House Fast in a Slow Real Estate Market: A 30-Day Plan for Motivated SellersОценок пока нет

- Developing Marketing Strategies and PlansДокумент43 страницыDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- Business Strategy of SbiДокумент23 страницыBusiness Strategy of Sbichitra_sweetgirl100% (1)

- OH02002 Lorain County PDFДокумент3 страницыOH02002 Lorain County PDFMatt ChaseОценок пока нет

- OH02002 Lorain CountyДокумент3 страницыOH02002 Lorain CountyMatt ChaseОценок пока нет

- OH02002 Cuyahoga CountyДокумент3 страницыOH02002 Cuyahoga CountyMatt ChaseОценок пока нет

- August Cuyahoga County Market ReportДокумент3 страницыAugust Cuyahoga County Market ReportMatt ChaseОценок пока нет

- OH02002 Lorain CountyДокумент3 страницыOH02002 Lorain CountyMatt ChaseОценок пока нет

- July 2014 Cuyahoga CountyДокумент3 страницыJuly 2014 Cuyahoga CountyMatt ChaseОценок пока нет

- College Park Real Estate Market Report Nov 3 2013Документ5 страницCollege Park Real Estate Market Report Nov 3 2013Marc CormierОценок пока нет

- Greenville Market Update 2012Документ5 страницGreenville Market Update 2012John McMillanОценок пока нет

- 04 30 12 Market Update (SF) Az Cave Creek-2Документ6 страниц04 30 12 Market Update (SF) Az Cave Creek-2Kelli J GrantОценок пока нет

- Prepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626Документ33 страницыPrepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626eNeighborhoodsОценок пока нет

- Cynthia's Weekly Redwood City Market Update - 6/30/15Документ5 страницCynthia's Weekly Redwood City Market Update - 6/30/15Jeffery AbbottОценок пока нет

- The Wright Report:: Sacramento's Residential Investment AnalysisДокумент26 страницThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateОценок пока нет

- Union City Full Market Report (Week of Nov 4, 2013)Документ6 страницUnion City Full Market Report (Week of Nov 4, 2013)Harry KharaОценок пока нет

- 04 30 12 Market Update (SF) Az ScottsdaleДокумент6 страниц04 30 12 Market Update (SF) Az ScottsdaleKelli J GrantОценок пока нет

- Fremont Full Market Report (Week of October 28, 2013)Документ6 страницFremont Full Market Report (Week of October 28, 2013)Harry KharaОценок пока нет

- Prepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626Документ33 страницыPrepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626eNeighborhoodsОценок пока нет

- 171 Stanford Ave PDFДокумент8 страниц171 Stanford Ave PDFJonathan MarksОценок пока нет

- Hayward Full Report Market (Week of November 18, 2013)Документ6 страницHayward Full Report Market (Week of November 18, 2013)Harry KharaОценок пока нет

- KW St. Louis Luxury Residential Real Estate Total Market Overview - April 23, 2012Документ1 страницаKW St. Louis Luxury Residential Real Estate Total Market Overview - April 23, 2012Russell NoltingОценок пока нет

- Fremont Full Market Report (Week of November 18, 2013)Документ6 страницFremont Full Market Report (Week of November 18, 2013)Harry KharaОценок пока нет

- Cynthia's Weekly Redwood City Market Update For The Week of 12.1.15Документ5 страницCynthia's Weekly Redwood City Market Update For The Week of 12.1.15CynthiaОценок пока нет

- Hayward Full Market Report (Week of October 28, 2013)Документ6 страницHayward Full Market Report (Week of October 28, 2013)Harry KharaОценок пока нет

- Dana Point Listing Presentation: Prepared Especially ForДокумент15 страницDana Point Listing Presentation: Prepared Especially ForeNeighborhoodsОценок пока нет

- Fremont-Full Market Report (Week of Sep 23, 2013)Документ6 страницFremont-Full Market Report (Week of Sep 23, 2013)Harry KharaОценок пока нет

- Dec 2013 Lincoln SquareДокумент1 страницаDec 2013 Lincoln SquareHillary Dunn DeckОценок пока нет

- 04 02 12 (SF) Az Cave CreekДокумент6 страниц04 02 12 (SF) Az Cave CreekKelli J GrantОценок пока нет

- Fremont Full Market Report (Week of Sep 30, 2013)Документ6 страницFremont Full Market Report (Week of Sep 30, 2013)Harry KharaОценок пока нет

- KW St. Louis Residential Real Estate Total Market Overview - April 23, 2012Документ1 страницаKW St. Louis Residential Real Estate Total Market Overview - April 23, 2012Russell NoltingОценок пока нет

- Cynthia's Weekly Redwood City Market Update - 6/16/15Документ5 страницCynthia's Weekly Redwood City Market Update - 6/16/15Lindsey ArnoldОценок пока нет

- Local Real Estate Market Update: This WeekДокумент5 страницLocal Real Estate Market Update: This WeekCynthiaОценок пока нет

- Prepared Especially ForДокумент15 страницPrepared Especially ForeNeighborhoodsОценок пока нет

- Union City Full Market Report (Week of Sep 30, 2013)Документ6 страницUnion City Full Market Report (Week of Sep 30, 2013)Harry KharaОценок пока нет

- 03 12 12 Market Update (Condo) 85085Документ11 страниц03 12 12 Market Update (Condo) 85085Kelli J GrantОценок пока нет

- 03 12 Market Update (Condo) AZ PHOENIX 85086Документ11 страниц03 12 Market Update (Condo) AZ PHOENIX 85086Kelli J GrantОценок пока нет

- Prepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626Документ24 страницыPrepared Especially For:: 2712 Skylark Circle Costa Mesa Ca 92626eNeighborhoodsОценок пока нет

- Cynthia's Weekly Redwood City Market Update - 8/5/15Документ5 страницCynthia's Weekly Redwood City Market Update - 8/5/15Anonymous VNEUly9Оценок пока нет

- May 2015 Market UpdateДокумент4 страницыMay 2015 Market UpdateDan DunlapОценок пока нет

- Residential Closings - Entire MLS: The Monthly Market SnapshotДокумент4 страницыResidential Closings - Entire MLS: The Monthly Market SnapshotpmurphyassistОценок пока нет

- Prepared Especially ForДокумент17 страницPrepared Especially ForeNeighborhoodsОценок пока нет

- Cynthia's Weekly Redwood City Market Update 9/28/15Документ5 страницCynthia's Weekly Redwood City Market Update 9/28/15CynthiaОценок пока нет

- Dms Sawfish: Prepared Especially ForДокумент15 страницDms Sawfish: Prepared Especially ForeNeighborhoodsОценок пока нет

- Ekaterina Bazyka, Miami Realtor Market Update (Condo) FORT Lauderdale 33301 Week of September 5th 20011Документ11 страницEkaterina Bazyka, Miami Realtor Market Update (Condo) FORT Lauderdale 33301 Week of September 5th 20011Ekaterina Bazyka, Realtor MiamiОценок пока нет

- Fremont-Full Market ReportДокумент6 страницFremont-Full Market ReportHarry KharaОценок пока нет

- Manhattan Beach Real Estate Market Conditions - December 2013Документ15 страницManhattan Beach Real Estate Market Conditions - December 2013Mother & Son South Bay Real Estate AgentsОценок пока нет

- MIAMI Homes Market Update Sept 5th2011Документ246 страницMIAMI Homes Market Update Sept 5th2011Ekaterina Bazyka, Realtor MiamiОценок пока нет

- Monterey Real Estate Sales Market Report For December 2015Документ4 страницыMonterey Real Estate Sales Market Report For December 2015Nicole TruszkowskiОценок пока нет

- Pleasanton Full Market Report (Week of January 27th, 2014)Документ6 страницPleasanton Full Market Report (Week of January 27th, 2014)Harry KharaОценок пока нет

- Carmel Valley Homes Market Action Report Real Estate Sales For February 2015Документ4 страницыCarmel Valley Homes Market Action Report Real Estate Sales For February 2015Nicole TruszkowskiОценок пока нет

- Cynthia's Weekly Redwood City Market Update - 6/23/15Документ5 страницCynthia's Weekly Redwood City Market Update - 6/23/15Steven WrightОценок пока нет

- Cynthia's Weekly Redwood City Market Update For The Week of 1.18.16Документ5 страницCynthia's Weekly Redwood City Market Update For The Week of 1.18.16CynthiaОценок пока нет

- 04 02 12 Market Update SFD Az PhoenixДокумент6 страниц04 02 12 Market Update SFD Az PhoenixKelli J GrantОценок пока нет

- March 2015 Market UpdateДокумент4 страницыMarch 2015 Market UpdateDan DunlapОценок пока нет

- Carmel Valley Real Estate Sales Market Action Report For August 2015Документ4 страницыCarmel Valley Real Estate Sales Market Action Report For August 2015Nicole TruszkowskiОценок пока нет

- 03 12 Market Update (SF) Az PhoenixДокумент6 страниц03 12 Market Update (SF) Az PhoenixKelli J GrantОценок пока нет

- Cynthia's Weekly Redwood City Market Update - 7/6/15Документ5 страницCynthia's Weekly Redwood City Market Update - 7/6/15Hollie JohnsonОценок пока нет

- Economic and Market Watch ReportДокумент14 страницEconomic and Market Watch ReportNevadaHomesОценок пока нет

- Northern Nevada Third Quarter 2008 Economic and Market Watch ReportДокумент15 страницNorthern Nevada Third Quarter 2008 Economic and Market Watch ReportNevadaHomesОценок пока нет

- Prepared Especially For:: Philip SeymourДокумент14 страницPrepared Especially For:: Philip SeymoureNeighborhoodsОценок пока нет

- RIFD at The Metro GroupДокумент8 страницRIFD at The Metro GroupSoumya BarmanОценок пока нет

- Non Current Assets 2019AДокумент4 страницыNon Current Assets 2019AKezy Mae GabatОценок пока нет

- Big Picture A in Focus: Uloa.: Let'S CheckДокумент6 страницBig Picture A in Focus: Uloa.: Let'S CheckNatsu PolsjaОценок пока нет

- Accounting For Joint Product and by ProductsДокумент23 страницыAccounting For Joint Product and by ProductsQwerty UiopОценок пока нет

- International TaxationДокумент46 страницInternational TaxationsridhartksОценок пока нет

- Introduction To DerivativesДокумент6 страницIntroduction To DerivativesXiaoxi NiОценок пока нет

- IA RoqueДокумент52 страницыIA RoqueTrisha RafalloОценок пока нет

- Chapter 5 - Asset ValuationДокумент4 страницыChapter 5 - Asset ValuationSteffany RoqueОценок пока нет

- JVJ Grocery Products Distribution BodyДокумент11 страницJVJ Grocery Products Distribution BodyOscar Bocayes Jr.Оценок пока нет

- Equity Research AssignmentДокумент3 страницыEquity Research Assignment201812099 imtnagОценок пока нет

- Distribution Channel of United BiscuitsДокумент5 страницDistribution Channel of United BiscuitsPawan SharmaОценок пока нет

- WmsДокумент43 страницыWmssanthosh kumarОценок пока нет

- Global Study On Interactions Between Social Processes and Participatory Guarantee SystemsДокумент90 страницGlobal Study On Interactions Between Social Processes and Participatory Guarantee SystemsedgoitesОценок пока нет

- International Marketing Channels: Mcgraw-Hill/IrwinДокумент35 страницInternational Marketing Channels: Mcgraw-Hill/IrwinIzatti AyuniОценок пока нет

- Contact Information Focus Areas Geological Survey of FinlandДокумент2 страницыContact Information Focus Areas Geological Survey of Finlandhabibi1328Оценок пока нет

- Solutions For GST Question BankДокумент73 страницыSolutions For GST Question BankSuprajaОценок пока нет

- MBM 207 QB - DistanceДокумент2 страницыMBM 207 QB - Distancemunish2030Оценок пока нет

- Work ImmersionДокумент10 страницWork ImmersionKathy Sarmiento100% (1)

- CPALE Syllabi 2018 PDFДокумент32 страницыCPALE Syllabi 2018 PDFLorraine TomasОценок пока нет

- Vensa WorkorderДокумент9 страницVensa WorkorderAshutosh Kumar DwivediОценок пока нет

- Finweek English Edition - March 7 2019Документ48 страницFinweek English Edition - March 7 2019fun timeОценок пока нет

- Contemporary Issues in Sustainable Finance Exploring Performance Impact Measurement and Financial Inclusion Mario La Torre Full ChapterДокумент68 страницContemporary Issues in Sustainable Finance Exploring Performance Impact Measurement and Financial Inclusion Mario La Torre Full Chapterterrance.acevedo969100% (5)

- Macroeconomics, Lecture 12. The ShortRun Tradeoff Between Inflation and UnemploymentДокумент26 страницMacroeconomics, Lecture 12. The ShortRun Tradeoff Between Inflation and UnemploymentTemo GiorgadzeОценок пока нет

- Call Front Spread - Call Ratio Vertical Spread - The Options PlaybookДокумент3 страницыCall Front Spread - Call Ratio Vertical Spread - The Options PlaybookdanОценок пока нет

- 2015aptransco Ms 9Документ14 страниц2015aptransco Ms 9vijaybunny141Оценок пока нет