Академический Документы

Профессиональный Документы

Культура Документы

What Is A Bond

Загружено:

Kau MilikkuИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What Is A Bond

Загружено:

Kau MilikkuАвторское право:

Доступные форматы

What is a bond?

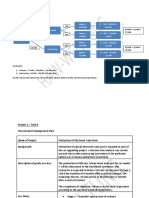

Contract Surety Bonds Defined A bond issued by a surety bond company on behalf of a contractor, guaranteeing that thecontractor will complete a contract as per the specifications - to a third party. Three Parties to a Contract Surety Bond Principal This is your company. The company who will be expected to complete the contract theyenter into with the Obligee. It is the principals obligation that is being guaranteed by the Surety Company. Obligee The party to whom the bond is payable and with whom the principal has a contract. Often called the owner or the contractors client. Surety The entity giving the bond (the party that issues the bond). The Surety guarantees the performance of the obligations of the Principal under a contract

Who benefits from a Contract Surety Bond? If the Principal cannot or will not perform, the Surety Company steps in and makesgood on the Principal's obligation to the Obligee How are bonds different from insurance? An insurance policy assumes that there will be a loss and the premium reflects this. Abond, on the other hand, is an extension of credit with the assumption there will beno loss. The bond premium covers only the underwriting expenses of the suretycompany.

3 Stages of Construction Bidding

1. PREQUALIFICATION STAGE Often contractors are required to submit a prequalification package prior to a job beinglet for tender which may include a letter from their bonding company. At this stagethere is no spec available to underwrite so the bonding company cannot commit tobonding. We have done our best to education the public buying community but theycontinue to ask for a commitment. We do have a standardized form of such a letterand this can be ordered through the website at a cost of $150. 2.TENDER STAGE The job is now out of tender and you are able to bid on it. You get the spec and one

of the first things you should do is look for bond requirements. They hide this in a variety of places and you will get used to finding it.

Tender Stage Continued

There are 2 contract surety bonds which could potentially be required at this stage 1. Agreement to Bond (Suretys Consent) A guarantee by the surety that it will provide the Performance and/or Labour andMaterial Payment Bond if you as the principal are the successful bidder. 2. Bid Bond A guarantee from the Surety (bonding company) to the Obligee, the good faith of thePrincipal (you the contractor) when tendering. If the principal fails to enter into aformal contract after the bid has been accepted, the Principal is obliged to pay theObligee either a fixed amount or the difference in money between his tender and thecontract price the Obligee eventually enters into with someone else. In other words if you make a mistake in your tender and dont want to take the job afterall; thebonding company will have to pay the obligee the difference between your price andthe price of the next qualified tender. Remember that with bonds; you will be heldpersonally and corporately to REPAY the bonding company that amount plus theirexpenses

3.CONTRACT STAGE So you got the job!! Now you need to provide the final bonds or contract bondsand that might be just a performance bond or a performance bond and labour andmaterial payment bond. Performance Bond CCDC to guarantee the Principals (your) completion of the contract as per the plans andspecifications. If you fail then the Surety will do so and you will be corporately andpersonally liable to pay the surety back their costs to do so. The Suretys liability is limited to the penal amount of the bond. Obligee must bring suit within one year of date of final payment due CCDC wording preferred

Вам также может понравиться

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryОт EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryОценок пока нет

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnДокумент6 страницInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSОценок пока нет

- Living Beneficiary of The Estate Trust General Post Office Judicial DistrictДокумент2 страницыLiving Beneficiary of The Estate Trust General Post Office Judicial DistrictmragsilvermanОценок пока нет

- AFFIDAVITДокумент1 страницаAFFIDAVITAnonymous LYF2sud6Оценок пока нет

- How Much Should You InvestДокумент3 страницыHow Much Should You InvestKurian PunnooseОценок пока нет

- Bailbond 2Документ5 страницBailbond 2romnickОценок пока нет

- Gordon Hall 2Документ8 страницGordon Hall 2Ricardo VargasОценок пока нет

- AFFIDAVIT For Issue of Duplicate Share CertificateДокумент2 страницыAFFIDAVIT For Issue of Duplicate Share CertificatePiyush AgrawalОценок пока нет

- Non-Citizen Guidance 063011Документ62 страницыNon-Citizen Guidance 063011bwidjaja73Оценок пока нет

- Constellation Energy Group $1 Billion Promissory NoteДокумент19 страницConstellation Energy Group $1 Billion Promissory NoteBilly LeeОценок пока нет

- In Form Pauperis Overview and Sample FormsДокумент7 страницIn Form Pauperis Overview and Sample FormsLula SafritОценок пока нет

- Creditor VerificationДокумент2 страницыCreditor VerificationWen' George BeyОценок пока нет

- Salazar Letter To Judge, CommissionersДокумент2 страницыSalazar Letter To Judge, CommissionersMaritza NunezОценок пока нет

- Form of Protest Which May in Terms of Section Ninety-Eight ofДокумент3 страницыForm of Protest Which May in Terms of Section Ninety-Eight ofJohn KronnickОценок пока нет

- W-8BEN: Do NOT Use This Form IfДокумент1 страницаW-8BEN: Do NOT Use This Form IfdoyokaОценок пока нет

- Bank of Georgia v. Higginbottom, 34 U.S. 48 (1835)Документ13 страницBank of Georgia v. Higginbottom, 34 U.S. 48 (1835)Scribd Government DocsОценок пока нет

- Power of Attorney (General)Документ3 страницыPower of Attorney (General)Banerjee SuvranilОценок пока нет

- Banksters Used The Promossory NoteДокумент2 страницыBanksters Used The Promossory NotecolimatradeОценок пока нет

- Contract SsДокумент20 страницContract SsMir Mahbubur RahmanОценок пока нет

- Secured Transactions Reading Notes and Cases - Week 2Документ3 страницыSecured Transactions Reading Notes and Cases - Week 2BG215Оценок пока нет

- Letter of InstructionДокумент4 страницыLetter of Instructionmptacly9152Оценок пока нет

- Trust ReceiptДокумент3 страницыTrust ReceiptMaFatimaP.LeeОценок пока нет

- LeverageДокумент38 страницLeverageAnant MauryaОценок пока нет

- PRO-ForMA Thru Bank FinancingДокумент3 страницыPRO-ForMA Thru Bank FinancingCloudette BaguiwenОценок пока нет

- Form 8 Assignment For The General Benefit of CreditorsДокумент1 страницаForm 8 Assignment For The General Benefit of CreditorsRisah ahhhОценок пока нет

- SOP For Obtaining Bid BondДокумент3 страницыSOP For Obtaining Bid BondAbdulsamadОценок пока нет

- Statement of Claim PDFДокумент1 страницаStatement of Claim PDFDavid WuisОценок пока нет

- Virginia Quit Claim Deed FormДокумент2 страницыVirginia Quit Claim Deed FormLj PerrierОценок пока нет

- Fixed Interest Rate."Документ6 страницFixed Interest Rate."Michelle T100% (1)

- Trusts OutlineДокумент8 страницTrusts OutlineClint Bell100% (1)

- Keyes - NOTICE of Deficiency Re Proof of Service (#12, June 10, 2009)Документ1 страницаKeyes - NOTICE of Deficiency Re Proof of Service (#12, June 10, 2009)tesibriaОценок пока нет

- Civil Precipe For Subpoena Duces TecumДокумент2 страницыCivil Precipe For Subpoena Duces TecumAnatoly Mazi Moore ElОценок пока нет

- IAM Constitution 2012Документ202 страницыIAM Constitution 2012LaborUnionNews.comОценок пока нет

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsДокумент2 страницыProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionОценок пока нет

- Non Disc Hold HarmДокумент4 страницыNon Disc Hold HarmSylvester MooreОценок пока нет

- Last Will and TestamentДокумент3 страницыLast Will and TestamentLetlhogonolo Molokomme MokhuseОценок пока нет

- Securitization Is Illegal Securitization Is IllegalДокумент55 страницSecuritization Is Illegal Securitization Is IllegalPAtty BarahonaОценок пока нет

- Statutory and Other RestrictionsДокумент15 страницStatutory and Other Restrictionsrgovindan123Оценок пока нет

- Issue of DebenturesДокумент23 страницыIssue of Debenturesramandeep kaurОценок пока нет

- JKSC ClassesДокумент24 страницыJKSC ClassesCA Seshan KrishОценок пока нет

- David Kotolup & Bruce Wong DBA Avenue AutoДокумент5 страницDavid Kotolup & Bruce Wong DBA Avenue AutomoorishnationОценок пока нет

- Company Credit Account ApprobationДокумент1 страницаCompany Credit Account ApprobationkiranrauniyarОценок пока нет

- Trust Account Deposit FormДокумент1 страницаTrust Account Deposit Formchristian09x100% (1)

- Bond Application IndividualДокумент4 страницыBond Application IndividualDaniel Moraleda AsaulaОценок пока нет

- Federal Habeas Corpus Petition 28 U S C 2254Документ19 страницFederal Habeas Corpus Petition 28 U S C 2254Janeth Mejia Bautista AlvarezОценок пока нет

- Funny MoneyДокумент1 страницаFunny MoneytrustkonanОценок пока нет

- Quitclaim Deed AmendedДокумент2 страницыQuitclaim Deed AmendedKonan SnowdenОценок пока нет

- Doctrine of Ultra ViresДокумент3 страницыDoctrine of Ultra ViresTony Davis100% (1)

- N1 Claim Form Against Swansea UniversityДокумент2 страницыN1 Claim Form Against Swansea UniversityJonathan BishopОценок пока нет

- Contract Act 1872: by Mr. Yogesh KumarДокумент19 страницContract Act 1872: by Mr. Yogesh KumarYogesh Palahwat100% (1)

- Company Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Документ17 страницCompany Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Rick SwordsОценок пока нет

- 04 ImmunityДокумент78 страниц04 ImmunityPadmini Subramaniam100% (1)

- Affidavit: Fuonsbtstionet Felersl Fiotttl GLRДокумент6 страницAffidavit: Fuonsbtstionet Felersl Fiotttl GLRelio bohechio elОценок пока нет

- Maturity Claim (Form No.3825)Документ3 страницыMaturity Claim (Form No.3825)PrasanthОценок пока нет

- Streamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireДокумент2 страницыStreamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireTuan HoangОценок пока нет

- AECC. CAMARO. OPS. Excavation Progress Report. 2022 AUG 25Документ81 страницаAECC. CAMARO. OPS. Excavation Progress Report. 2022 AUG 25mj macaspacОценок пока нет

- CASE DIGEST - Cargill, Inc. vs. Intra Strata Assurance CorporationДокумент2 страницыCASE DIGEST - Cargill, Inc. vs. Intra Strata Assurance CorporationGladys Cañete100% (4)

- Bab 3 Interim PaymentДокумент23 страницыBab 3 Interim Paymentamyamirulali100% (2)

- SBMA Omnibus Policy On Performance BondДокумент17 страницSBMA Omnibus Policy On Performance BondmysubicbayОценок пока нет

- Construction AgreementДокумент27 страницConstruction AgreementEdna SaldañaОценок пока нет

- 46 Cargill, Inc. v. Intra Strata Assurance Corp. (Case Digest)Документ2 страницы46 Cargill, Inc. v. Intra Strata Assurance Corp. (Case Digest)Patricia GumpalОценок пока нет

- PMP Project 1Документ7 страницPMP Project 1julybaby8679% (14)

- Full Contract PDFДокумент99 страницFull Contract PDFLAYLA •Оценок пока нет

- Phil Export V VP EusebioДокумент4 страницыPhil Export V VP EusebioNerissa BalboaОценок пока нет

- CARGILL vs. Intra Strata Assurance Corporation.Документ2 страницыCARGILL vs. Intra Strata Assurance Corporation.rosemariejoy bayotОценок пока нет

- Variation Order Manual Final Copy - PPTX Rfevised4132015Документ58 страницVariation Order Manual Final Copy - PPTX Rfevised4132015Brian Paul100% (2)

- Guarantee Bond (Retention) & Surety Bond (Down Payment) : Estimated Bonds Premium Validity 1 Year 1Документ6 страницGuarantee Bond (Retention) & Surety Bond (Down Payment) : Estimated Bonds Premium Validity 1 Year 1Jared Eli SorianoОценок пока нет

- What Is A BondДокумент2 страницыWhat Is A BondKau MilikkuОценок пока нет

- Part 10 Rics Retention DWL Black BookДокумент26 страницPart 10 Rics Retention DWL Black BookChris Gonzales100% (1)

- Sell Refined White Cane Sugar Grade "A" Icumsa 45Документ3 страницыSell Refined White Cane Sugar Grade "A" Icumsa 45Carlos MartinezОценок пока нет

- Bid DocumentДокумент39 страницBid Documentdanwilbur23Оценок пока нет

- Lumber DealerДокумент7 страницLumber DealerJika Hatch IIОценок пока нет

- Required Reading 1 UAP Document 301 Part 1Документ63 страницыRequired Reading 1 UAP Document 301 Part 1DenmarynneDomingoОценок пока нет

- Sample Notice of DishonorДокумент4 страницыSample Notice of DishonorDon CorleoneОценок пока нет

- Construction Bonds and Contracts - Part 2Документ18 страницConstruction Bonds and Contracts - Part 2Erza LeeОценок пока нет

- PEM - Types of ContractДокумент117 страницPEM - Types of ContractNimit PorwalОценок пока нет

- Types of BondsДокумент11 страницTypes of BondsAnthony John Santidad100% (1)

- How To Beat Criminal Charges in Admiralty CourtsДокумент9 страницHow To Beat Criminal Charges in Admiralty CourtsJulie Hatcher-Julie Munoz Jackson98% (105)

- Summary PAM Contract 2018 Vs PAM Cpntract 2006 PDFДокумент1 страницаSummary PAM Contract 2018 Vs PAM Cpntract 2006 PDFyqizОценок пока нет

- JRU Lipa BOQ ArchiДокумент37 страницJRU Lipa BOQ ArchiAristeo GarzonОценок пока нет

- Stronghold Vs Stroem Case DigestДокумент3 страницыStronghold Vs Stroem Case DigestJustineОценок пока нет

- Jean Keating BondsДокумент23 страницыJean Keating BondsDele Olora97% (61)

- Typcal Glass Design GEO.a.kelsonДокумент466 страницTypcal Glass Design GEO.a.kelsonDejin KongОценок пока нет

- United States Court of Appeals, Sixth CircuitДокумент5 страницUnited States Court of Appeals, Sixth CircuitScribd Government DocsОценок пока нет

- Tax Notes For Construction Industry in AlbaniaДокумент117 страницTax Notes For Construction Industry in AlbaniaEduart GjokutajОценок пока нет