Академический Документы

Профессиональный Документы

Культура Документы

Gold Standard

Загружено:

Ujjwal Kumar DasИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gold Standard

Загружено:

Ujjwal Kumar DasАвторское право:

Доступные форматы

PRO Gold Standard Gold retains a value that has been recognized across the globe throughout history.

Our paper money is a "fiat" currency that can be printed without limit and has no real value its value is only maintained by the "full faith and credit" of the government. Gold has real value due to its beauty, usefulness, and scarcity. Humanity has recognized the value of gold as a medium of exchange dating back to 550 BC, when the King of Lydia (modern day Turkey) began minting gold coins. [5] Steve Forbes, Editor-in-Chief of Forbes magazine, says gold "retains an intrinsic, stable value better than anything else." [6] A gold standard puts limits on government power by restricting its ability to print money at will. With a fiat currency the government can essentially manufacture money virtually out of thin air. [7] Since leaving the gold standard in 1971 US currency in circulation (M1) increased from $48.6 billion to over $1 trillion dollars in 2012. [4] Between 1971 and 2003 the entire supply of money (M3) in the United States has increased by 1,100%. [29] Under a gold standard, new money could only be printed if a corresponding amount of gold were availabe to back the currency. This restriction is an existential check on government power. According to Supreme Court Justice Stephen Field (1863-1897)," arguments in favor of the constitutionality of legal tender paper currency tend directly to break down the barriers which separate a government of limited powers from a government resting in the unrestrained will of Congress. Those limitations must be preserved, or our government will inevitably drift from the system established by our Fathers into a vast, centralized, and consolidated government." [35] Our current fiat monetary system is inherently undemocratic. Our current fiat monetary system empowers an unelected central banking committee (the Federal Reserve) to determine whether the supply of money grows or is reduced rather than allowing market forces to determine the supply of money as they would under a gold standard. Fiat dollars allow government to spend money without raising taxes, which shields them from democratic accountability. Instead, they impose the hidden tax of inflation. [34] Returning to a gold standard would lower inflation rates and slow the rise in consumer prices. Historically, the United States has had lower levels of inflation when on a gold standard. From 1880-1913, under a gold standard, average inflation was 1.6% per year. [8] In 1971, when Nixon took the United States off the gold standard, inflation was at 3.3%. By 1979 it had risen to 13.3%.[10] In a study of 15 countries

CON Gold Standard The value of gold fluctuates widely and would not provide the price stability necessary for a healthy economy. Between 1879 and 1933, when the United States was on a full gold standard, the inflation adjusted market price of gold fluctuated from the $700 range (1890s) to the $200 range (1920s). From 1934-1970, when the US was on a partial gold standard, the inflation adjusted price of gold went from $563 to $201. [36] In 1980, the inflation adjusted price of gold was $2,337, much higher than than today's price of $1,672 per ounce (Dec. 19, 2012). [37] Fluctuations like these would be damaging to a gold standard economy, since the value of a dollar would be attached to the value of gold. For example, a 10% increase or decrease in the value of gold would eventually result in a 10% rise or fall in the overall price level of goods across the country - such fluctuations would destabilize the economy. [38] A well-managed fiat monetary system is the best way to keep inflation down, not returning to a gold standard. In 1981, when annual inflation was at 10.3%, [10] Congress authorized a US Gold Commission to study returning to the gold standard as a way to bring down the inflation. The commission concluded that "restoring a gold standard does not appear to be a fruitful method for dealing with the continuing problem of inflation." [39] By 1982, the monetary policy decisions of Federal Reserve Chairman Paul Volker had already stopped the inflation. [40] By 1983 growth in consumer prices was down to 3.2% from a high of 13.5% in 1980. [10] Gold standards create periodic deflations and economic contractions which destabalize the economy. Under a gold standard, economic growth can outpace growth in the money supply since more money cannot be created and circulated until more gold is first obtained to back it. When this happens deflation and economic contraction occurs. Between 1913 and 1971, when the United States was on some form of a gold standard, there were 12 years when deflation occurred the highest levels were in 1921 (-10.5%), 1931 (-9.0%), and 1932 (-9.9%). [10] According to Federal Reserve Chairman Ben Bernanke, "the length and depth of the deflation during the late 1920s and early 1930s strongly suggest a monetary origin, and the close correspondence... between deflation and nations' adherence to the gold standard." [41] Since leaving the gold standard in 1971 there has only been one year (2009) in which any deflation occurred (-0.4%). [10] The gold standard caused many financial panics, bank

covering the years 1820-1994, Federal Reserve economists found the average annual inflation rate under a gold standard was 1.75%, versus 9.17% when not on a gold standard. [11] From 1971 to 2003 the dollar lost nearly 80% of its purchasing power due to inflation. [29] Between 1971 and 1980 the inflation rate rose from 4.4% to 13.5%.[10] By 2011, the dollar's purchasing power had been reduced to the point that it has the same purchasing power as 19 cents did in 1971. [30] Returning to a gold standard would reduce the US trade deficit. Our current fiat money system allows the Fed to finance large trade deficits by printing money, allowing Americans to purchase imported goods "without really paying" for them. [22] Since abandoning the gold standard in 1971, the United States has had the highest trade deficits the world has ever seen reaching a high of $378.6 billion in 2009. [32] Since 1995, foreign nations have taken the fiat dollars received in payment for exports, and used them to invest in United States debt (Treasury Bonds). In this way, foreign creditors have financed 50% of the US national debt since 1995. [33] According to US Representative Ron Paul (R-TX), this "free lunch cannot last. Printing money, buying foreign products, and selling foreign holders of dollars our debt ends when the foreign holders of this debt become concerned with the dollar's future value." [12] A gold standard would restrict the ability of the federal government to increase the national debt. Under the fiat money system used by the United States the government can raise money by issuing treasury bonds which the Federal Reserve can purchase with newly printed money. These bonds count toward the national debt. Between 1971 and 2003, the national debt went from $406 billion to $6.8 trillion - an increase of 1,600%. This increase in debt corresponded with an 1,100% increase in the money supply (M3) between 1971 ($776 billion) and 2003 ($8.9 trillion). [29] As of Dec. 26, 2012 the national debt stood at $16.3 trillion. [31] As a percentage of the GDP (gross domesic product) the national debt has more than doubled since leaving the gold standard in 1971 - going from from slightly under 30% to 67.7% in 2011.[106] A gold standard would force the United States to reduce its military and defense spending and could prevent unnecessary wars. According to US Representative Ron Paul (R-TX) "fiat money enable[s] government to maintain an easy war policy... To be truly opposed to preemptive and unnecessary wars one must advocate sound money to prevent the promoters of war from financing their imperialism." [12] The government's ability to limitlessly print fiat paper money

failures, and prolonged the Great Depression. Between 1879 and 1933 the United States had financial panics in 1884, 1890, 1893, 1907, 1930, 1931, 1932, and 1933. [45] During the panic of 1933 alone 4,000 banks suspended operations. [48] Many of these panics were exacerbated by contraction in the money supply caused by the gold standard (more money could not be printed without first acquiring additional gold to back it).[41] Many economists contend that the gold standard played a role in preventing the United States from stabilizing the economy after the stock market crash of 1929, and prolonged the Great Depression. In 1933, when the United States went off the full domestic gold standard, the economy began to recover. [49] [44] [50] A gold standard would limit the ability of the Federal Reserve to help the economy out of recessions and depressions. Under the current fiat money system the Federal Reserve can use monetary policy to respond to financial crises by lowering interest rates during a recession, raising them during a period of inflation, and injecting money into the economy when necessary. A gold standard would severly hamper it from performing these functions. [44]After the 2008 financial crash, the Feds TARP (troubled assest relief program) created $700 billion to bail out financial institutions and stabilize the economy.[46] According to Nobel Prize-winning economist Paul Krugman, without the Fed's intervention a "powerful deflationary forc[e]" [45] would have been created. Without the intervention of the Fed it is possible the 2008 crash could have led to another Great Depression. [47] Returning to a gold standard would limit governments ability to address unemployment. According to Federal Reserve Chairman Ben Bernanke a gold standard "means swearing that no matter how bad unemployment gets you are not going to do anything about it using monetary policy. [44] Under our current fiat money system, the Fed can expand the US money supply by purchasing treasury bonds and the government can use this money to help put the unemployed to work through public spending [51] as the Obama administration did with the $787 billion fiscal stimulus.[110] It is estimated that the 2009 Obama stimulus prevented the loss of about three million jobs. [111]Under a gold standard the stimulus could not have occured. Returning to a gold standard could destabilize and crash the already fragile United States economy. The last time the United States moved from a fiat monetary system to a gold standard was in 1879, when the United States returned to a gold standard after the Civil War. The shift caused a massive deflation. [47] Given the current fragility of the United States

allows it to fund a massive global defense establishment, including 662 military bases in 38 countries [14] and costly foreign military interventions. [15] The United States spent $711 billion on defense spending in 2011, more than the other top 13 countries combined. [70] This level of spending would not be possible if the United States returned to a full gold standard. Returning to a gold standard would stabilize the price of oil and help slow the rise in gasoline prices. Since leaving the gold standard in 1971, inflation has reduced the value of the dollar, and inflated the price of oil about 32 fold. [17] In 1973, Saudi Arabia (and in 1975 all OPEC nations) agreed to trade oil only in dollars. [16] This created a new international demand for the fiat dollars the Fed was now printing and as more dollars flooded the world, general inflation (as well as spikes and collapses) in oil prices followed. [18] When on a partial gold standard in the 1950s and 1960s the nominal price of oil was stable, averaging $2.90 a barrel. By June 2008 the nominal price of oil hit $126.33 per barrel. Adjusted for inflation, a barrel of oil cost $20 in 1971 it now costs close to $100. [19] According to Charles Kadlec, founder of Community of Liberty and Forbescontributor, if the gold standard had been maintained the price of gasoline today would likely be about $1.00 a gallon. [20] A gold standard would reduce the risk of economic crises and recessions such as the housing bubble and financial crisis of 2008-2009. The ability of the Federal Reserve to print fiat money and maintain easy credit by keeping interest rates too low from 2001 to 2006 [23] was a significant cause of the real estate bubble which led to the Great Recession. [21][22] The response to the recession has been more of what caused it in the first place printing money. Over $2 trillion in bailouts for failed financial institutions was paid for with Federal Reserve money, [24] setting the stage for another possible bubble and collapse. [25] The Fed's history of providing economic stablility with fiat money has not been a good one. Since the United States abandoned the gold standard there have been 12 financial crises, including the financial crisis of 2008-2009. [20] A gold standard self-regulates to match the supply of money to the need for it.Since gold is a finite natural material, and must be mined and processed at a significant cost, it tends to be produced at levels consistent with demand. Under a gold standard, creating more currency requires obtaining more gold, which raises golds market price and stimulates increased mining. More gold is then used to back more money until a point when currency levels are adequate, the price of gold levels out, and mining gets scaled back. [26] It

and global economy, the deflation caused by moving from a fiat money system to a gold standard would severly harm, if not crash, the economy. According to economist Barry Eichengreen, it would be a "recipe for disaster." [47] A gold standard would increase the environmental and cultural harms created by gold mining. Returning to a gold standard would create increased demand for gold and mining activity would increase. Many gold mines use a process called cyanide leach mining that creates large scale water pollution [55] and massive open-pit scars on the land. Producing one ounce of gold creates 70 tons of mine waste. In addition nearly 50% of global gold mining occurs on indigenous lands, [56] where the communities' land rights are often violated. [57] [58] For example, in Nevada, Barrick Gold is currently engaged in a legal fight to dig out a 2,000 foot open-pit gold mine on Mt. Tenabo, a sacred mountain of the Western Shoshone. [59] Returning to a gold standard would be a large waste of time, money, and resources. Gold mining and refining is expensive and time consuming. According to Barrick Gold (the worlds largest producer), an ounce of gold costs $560 to produce in 2012. [52] All the human labor used for mining, refining, and storing gold is time and energy diverted from the real economy. The direct costs associated with a fiat paper money system (paper and printing costs) are much lower (a paper federal reserve note only costs $0.087 to produce). [53] Economist Milton Friedman estimated that for the United States to maintain the gold reserves necessary to back its currency, it would cost 1.5% of the national income.[54] A gold standard makes the supply of money vulnerable to the ups and downs of gold production. Under a gold standard the supply of money would be dependent on how much gold is produced. Inflation would occur when large gold discoveries were made and deflation would occur during periods of gold scarcity. [60] For example, in 1848, when large gold finds were made in California, the United States suffered a monetary shock as large quantities of gold created inflation. This rise in US prices caused a trade deficit as US exports became over priced in the international marketplace. [9] A gold backed currency could not expand fast enough to maintain a healthy rate of international trade and economic growth.At current mining rates, the total world gold supply increases about 1.5% to 2% per year [61], which is not enough to maintain a healthy rate of global economic growth. According to United Bank of Switzerland economist

is a self-regulating system. [22] Under a fiat money system the production of money has no natural self-regulation mechanism. Under a gold standard the United States had stronger economic growth over its history. Over the 179 years the United States was on some form of a gold or metallic standard (1792-1971), the economy grew an average of 3.9% each year. Since 1971, under a fiat money standard not backed by gold in any way, economic growth has averaged 2.8% per year. [20] This lower growth rate translates into an economy that is about $8 trillion dollars smaller than it would have been had the gold standard not been abandoned in 1971. [27] A gold standard would prevent government from overprinting money to bail out financial corporations. To fund the past bailouts of financial corporations like Bear Stearns ($29 billion) and AIG ($180 billion), [23] the Fed created massive amounts of new fiat money. In Apr. 2008, the yearly growth rate of the money supply was 1.5%. By Aug. 2009 it was at 14.3%. [24] Between Dec. 2007 and Dec. 2008 the Fed's balance sheet (assets held such as government bonds) had gone from a yearly growth rate of 2.6% to 152.8%. [24] This massive expansion of the money supply put the country at risk of significant future inflation. Under the gold standard, income levels in the United States were rising much faster and unemployment levels were lower. In the decades prior to the United States abandoning the gold standard (1950-1968), the real median income for males rose 2.7% per year. Since leaving the gold standard in 1971, the average median income has only increased 0.2% per year. [28] If the gold standard had not been abandoned in 1971, and income levels had continued to grow at the prior rates, the average median family income today would be about 50% higher. [27] In addition, unemployment levels were lower in the decades leading up to the United States abandoning the gold standard. Between 1944 and 1971, while on a partial gold standard, unemployment averaged 5%. From 1971 to present, unemployment levels have averaged 6% under the fiat money standard. [20] Many politicians, businessmen, and organizations support the return to a gold standard. United States Representative Ron Paul (R-TX) has made the return to a gold standard a central focus of his political career, arguing that government creation of fiat money is "morally identical to the counterfeiter who illegally prints currency." [66] Steve Forbes, Editor-in-Chief of Forbes magazine, argues that a "new gold standard is

Paul Donovan, the nominal rate of growth in world trade should be around 6% to 6.5%. If an international gold standard were to be re-introduced this growth rate could not be maintained. [62] Returning to a gold standard could harm national security by restricting the countrys ability to finance national defense. In times of war, a quick expansion of currency to finance war buildup is sometimes necessary and a gold standard would prevent this from occurring. In order to help finance the Civil War, President Lincoln authorized the printing $450 million in fiat currency known as "greenbacks." [63] The United States financed its involvement in WWII in large part by having the Fed print money (which was not convertible to gold by the public since 1933), selling war bonds, and running large deficits. According to Congressional Research Service (CRS) researchers, "the means by which the increase in the money supply came about was through the Federal Reserves purchase of government bonds. In effect, the Federal Reserve made a loan to the government of newly printed money." By 1946, publicly held debt was 108.6% of GDP. [64] Returning to a gold standard would be extremely difficult, if not impossible, given the scarcity of gold and the vast amount of money already in circulation in the United States. As of 2012 the US treasury holds about 260 million troy ounces of gold reserves. At the market price of gold, about $1,662 an ounce (as of Dec. 27, 2012), that would equal about $434.6 billion in gold. However, the current United States money supply, including cash in circulation and bank deposits, is about $2.6 trillion. In order to peg the dollar to gold, the United States would either have to vastly increase its gold holdings, set the dollar price of gold at $10,000 an ounce, or suffer a massive deflation and contraction in the money supply (or some combination of the three). [65] All the gold that currently exists in the world about 5.5 billion troy ounces - would be worth about $9.1 trillion dollars at current market prices. [1] Even that is not enough to cover the $16.3 trillion national debt of the United States. [31] Many prominent economists oppose returning to a gold standard. Nobel Prize-winning economist Paul Krugman has called returning to a gold standard "an almost comically (and cosmically) bad idea," [45] and the Chairman of the Federal Reserve, Ben Bernanke, has said "the gold standard would not be feasible for both practical reasons and policy reasons." [44] In one survey of 50 economic experts, all senior faculty members at "elite research universities," not a single one believed returning to a gold standard would be

crucial," [67] to save the country from a "crisis that would be even worse than 2008." [68] Many organizations support a return to a gold standard including the American Principles Project, [107] the Lehrman Institute, [108] and several economists of the Austrian school affiliated with the Ludwig von Mises Institute. [109]

"better for the average American" in terms of price stability or employment outcomes. According to one economic advisor to the Congressional Budget Office, "Love of the G.S. [gold standard] implies macroeconomic illiteracy." [43]

Вам также может понравиться

- A New Empirical Approach To Catching Up or Falling Behind: ArticleДокумент23 страницыA New Empirical Approach To Catching Up or Falling Behind: ArticleUjjwal Kumar DasОценок пока нет

- Understanding Financial Crises: A Developing Country PerspectiveДокумент57 страницUnderstanding Financial Crises: A Developing Country PerspectiveUjjwal Kumar DasОценок пока нет

- Imes Discussion Paper Series: Financial Stability in Open EconomiesДокумент41 страницаImes Discussion Paper Series: Financial Stability in Open EconomiesUjjwal Kumar DasОценок пока нет

- Financial Capability, Income and Psychological Wellbeing: Mark TaylorДокумент31 страницаFinancial Capability, Income and Psychological Wellbeing: Mark TaylorUjjwal Kumar DasОценок пока нет

- The Economics of Globalisation Lecture 3: Trade Policy: Annina Kaltenbrunner G.19Документ31 страницаThe Economics of Globalisation Lecture 3: Trade Policy: Annina Kaltenbrunner G.19Ujjwal Kumar DasОценок пока нет

- Committee On Payment and Settlement Systems: Policy Issues For Central Banks in Retail PaymentsДокумент54 страницыCommittee On Payment and Settlement Systems: Policy Issues For Central Banks in Retail PaymentsUjjwal Kumar DasОценок пока нет

- Lagrange EconДокумент6 страницLagrange EconUjjwal Kumar DasОценок пока нет

- Globalization and The Least Developed Countries: Issues in TechnologyДокумент12 страницGlobalization and The Least Developed Countries: Issues in TechnologyUjjwal Kumar DasОценок пока нет

- Op Tim IzationДокумент96 страницOp Tim IzationUjjwal Kumar DasОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Capital Market Theory: Amit SinglaДокумент9 страницCapital Market Theory: Amit Singlaamitsingla19Оценок пока нет

- Xi Akl 3 - Lembar Kerja Memproses Entry JurnalДокумент25 страницXi Akl 3 - Lembar Kerja Memproses Entry JurnalKeshya MantovanniОценок пока нет

- Foreign Exchange MarketДокумент3 страницыForeign Exchange MarketVasim ShaikhОценок пока нет

- Soal FinancialДокумент4 страницыSoal Financialnoviakus38% (8)

- Tax Calculator by Tax GurujiДокумент4 страницыTax Calculator by Tax GurujiSunitKumarChauhanОценок пока нет

- Exercise 2Документ3 страницыExercise 2Gilang PurwoОценок пока нет

- Chapter 3 National Income Test BankДокумент45 страницChapter 3 National Income Test BankmchlbahaaОценок пока нет

- AssignmentДокумент7 страницAssignmentMona VimlaОценок пока нет

- The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoДокумент5 страницThe Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy - Federal Reserve Bank of ChicagoAlvaroОценок пока нет

- Your Business Fundamentals Checking: Account SummaryДокумент14 страницYour Business Fundamentals Checking: Account Summaryabal67% (3)

- Cash Management Techniques of Selected AДокумент50 страницCash Management Techniques of Selected AivyОценок пока нет

- Beneficiary's (Bailor) Deposit Disbursement Payment Discharge of Contract CloseДокумент5 страницBeneficiary's (Bailor) Deposit Disbursement Payment Discharge of Contract Closein1or93% (14)

- Risk Bearing Documents in International TradeДокумент8 страницRisk Bearing Documents in International TradeSukrut BoradeОценок пока нет

- MNC Valuation MefДокумент9 страницMNC Valuation MefKabulОценок пока нет

- Valuation of Securities-3Документ54 страницыValuation of Securities-3anupan92Оценок пока нет

- A Study On The Financial Performance of Canara BankДокумент7 страницA Study On The Financial Performance of Canara BankAruna AОценок пока нет

- Pretest - Cash and ReceivablesДокумент5 страницPretest - Cash and ReceivablesMycah AliahОценок пока нет

- Rubi Verma Mutual Fund and Ulip ReportДокумент92 страницыRubi Verma Mutual Fund and Ulip ReportSadhanaОценок пока нет

- Assignment 2 MBA 502 Econ Analysis - 2014Документ4 страницыAssignment 2 MBA 502 Econ Analysis - 2014Thushan AmarasenaОценок пока нет

- Test Unit Two IntermediateДокумент6 страницTest Unit Two IntermediateBernát GulyásОценок пока нет

- Dissertation Report On Cash Management of Standard Chartered BankДокумент92 страницыDissertation Report On Cash Management of Standard Chartered BankSunil Kumar100% (15)

- Coffee Table Booklet 19012024Документ244 страницыCoffee Table Booklet 19012024Antony AОценок пока нет

- Payback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsДокумент2 страницыPayback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsIzhiel Mai PadillaОценок пока нет

- Contoh Soal SAP 010 - Financial Accounting (Batch 1&2)Документ19 страницContoh Soal SAP 010 - Financial Accounting (Batch 1&2)Jhoni100% (3)

- MGT201 Finalterm GoldenFileДокумент230 страницMGT201 Finalterm GoldenFilemaryamОценок пока нет

- Introduction To AccountingДокумент14 страницIntroduction To AccountingJunaid IslamОценок пока нет

- Control Accounts Questions PDFДокумент19 страницControl Accounts Questions PDFDi-Shanae BurnettОценок пока нет

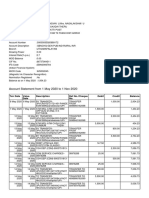

- Account Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент9 страницAccount Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChellapandiОценок пока нет

- Bop in IndiaДокумент54 страницыBop in IndiaChintakunta PreethiОценок пока нет

- Analyzing The Impact of Negative Cash Flow On Construction Performance inДокумент28 страницAnalyzing The Impact of Negative Cash Flow On Construction Performance intieuthuhangОценок пока нет