Академический Документы

Профессиональный Документы

Культура Документы

Latihan PAK Pert 5

Загружено:

Yudi HallimОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Latihan PAK Pert 5

Загружено:

Yudi HallimАвторское право:

Доступные форматы

Latihan PAK Pertemuan 5 SOAL 1 Merando Company acquired equipment on January 1, 2009, for 60,000.

Merando elects to value this class of equipment using revaluation accounting. This equipment is being depreciated on a straight-line basis over its 6-year useful life. There is no residual value at the end of the 6-year period. The appraised value of the equipment approximates the carrying amount at December 31, 2009 and 2011. On December 31, 2010, the fair value of the equipment is determined to be 35,000. Instructions (a) Prepare the journal entries for 2009 related to the equipment. (b) Prepare the journal entries for 2010 related to the equipment. (c) Determine the amount of depreciation expense that Merando will record on the equipment in 2011. SOAL 2 On 1 January 2009, Harbour Limited (Harbour) borrowed $180 million to finance the construction of a property, which was expected to take 2 years to build. Construction work of this qualifying asset was commenced on 1 January 2009. Harbour drew down the loan facilities in 3 parts in the amounts of $40 million, $80 million and $60 million on 1 January 2009, 1 May 2009 and 1 September 2009 respectively. Funds used for expenditures on the construction of the property were as follows: $m 1 January 2009 40 1 May 2009 80 1 September 2009 60 Interest of the loan was fixed at 6 % per annum. The unutilized funds were temporarily invested with a return of 3 % per annum. Required: a. Determine the borrowing costs eligible for capitalisation for the year ended 31 December 2009 and consequently the cost of the property as at 31 December 2009. Prepare the journal entry to account for the borrowing costs capitalised in 2009. b. Will your answer in part a) be different if Harbour drew down the loan facilities of $180 million on 1 January 2009 instead of in 3 parts during 2009? Particularly, what will be the borrowing costs eligible for capitalisation for the year ended 31 December 2009 and consequently the cost of the property as at 31 December 2009? Prepare the journal entry to account for the borrowing costs capitalised in 2009.

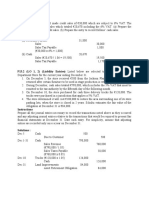

Jawaban Latihan Soal 1 (a) January 1, 2009 Equipment........................................................................ Cash...........................................................................

60,000 60,000

December 31, 2009 Depreciation Expense....................................................... 10,000 Accumulated DepreciationEquipment..................... (b) December 31, 2010 Depreciation Expense........................................................ Accumulated DepreciationEquipment......................

10,000

10,000 10,000

Accumulated DepreciationEquipment............................. 20,000 Loss on Impairment............................................................. 5,000 Equipment (60,000 35,000).................................... (c) Depreciation expense2011: (60,000 25,000) 4 = 8,750 Soal 2 Part a $m Borrowing costs: 1 Jan to 30 April 2009 ($40m x 6% x 4/12) 0.8 1 May to 31 August 2009 ($120m x 6% x 4/12) 2.4 1 September to 31 December 2009 ($180 x 6% x 4/12) 3.6 6.8 Cost of assets: Expenditure incurred 180.0 Borrowing costs capitalised 6.8 Carrying amount as at 31 December 2009 206.8 Journal entry to account for the borrowing costs capitalised in 2009: $m $m Dr. Property under construction 6.8 Cr. Interest expenses 6.8

25,000

Part b

Yes, the borrowing costs eligible for capitalisation for the year ended 31 December 2009 will be $14 million and the cost of the property as at 31 December 2009 will be $214 million, as calculated below:

$m Borrowing costs: 1 Jan to 31 December 2009 ($180m x 6%) Less: investment income 1 Jan to 31 March 2009 ($140m x 3% x 3/12) 1 May to 31 August 2009 ($60m x 3% x 3/12) Cost of assets: Expenditure incurred Borrowing costs capitalised Carrying amount as at 31 December 2009 10.80 (1.05) (0.45) 9.30 180.0 9.3 189.3

Journal entry to account for the borrowing costs capitalised in 2009: $m $m Dr. Property under construction 9.3 Cr. Interest expenses 9.3

Вам также может понравиться

- CH 14Документ2 страницыCH 14tigger5191100% (1)

- RWD 05 CVP AnalysisДокумент58 страницRWD 05 CVP Analysishamba allahОценок пока нет

- CH 14Документ39 страницCH 14Iris MaОценок пока нет

- ACY4001 Individual Assignment 2 SolutionsДокумент7 страницACY4001 Individual Assignment 2 SolutionsMorris LoОценок пока нет

- Working 3Документ6 страницWorking 3Hà Lê DuyОценок пока нет

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldДокумент2 страницыKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Jawaban BE15 - AKMДокумент3 страницыJawaban BE15 - AKMMazz BadruezОценок пока нет

- IygfigДокумент52 страницыIygfigDelfiaОценок пока нет

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesДокумент7 страницCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariОценок пока нет

- Acct 201 3nd AssingnmentДокумент2 страницыAcct 201 3nd Assingnmentapi-280585803Оценок пока нет

- Regression Line of Overhead Costs On LaborДокумент3 страницыRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- CH 21 Answer To in Class Diiscussion ProblemsДокумент20 страницCH 21 Answer To in Class Diiscussion ProblemsJakeChavezОценок пока нет

- Soal Latihan Chapter 16Документ8 страницSoal Latihan Chapter 16Alifia Aprizila0% (2)

- Barbara RichardsonДокумент3 страницыBarbara RichardsonElliot RichardОценок пока нет

- CCFM, CH 02, ProblemДокумент4 страницыCCFM, CH 02, ProblemKhizer SikanderОценок пока нет

- Exercise - Dilutive Securities - AdillaikhsaniДокумент4 страницыExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanОценок пока нет

- Class Participation 9 E7-18: Last Name - First Name - IDДокумент2 страницыClass Participation 9 E7-18: Last Name - First Name - IDaj singhОценок пока нет

- Chapter 14Документ5 страницChapter 14RahimahBawaiОценок пока нет

- Reviewer Mid FinДокумент108 страницReviewer Mid FinIrish Mae DesoyoОценок пока нет

- Solutions To CH 8 A ExercisesДокумент32 страницыSolutions To CH 8 A ExercisesJavier TsangОценок пока нет

- Final Review Jawaban IntermediateДокумент33 страницыFinal Review Jawaban Intermediatelukes12Оценок пока нет

- Kisi2 UAS AKM TerjawabДокумент8 страницKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaОценок пока нет

- Kieso Chapter 13Документ98 страницKieso Chapter 13GraceОценок пока нет

- Ex Ch.15Документ2 страницыEx Ch.15kenny 322016048Оценок пока нет

- 302 CH 14 Class ProblemsДокумент7 страниц302 CH 14 Class ProblemsBettie Sanchez100% (1)

- Chapter 6 and 7 NR and BPДокумент2 страницыChapter 6 and 7 NR and BPCa Ada100% (1)

- Soal Aset TetapДокумент3 страницыSoal Aset TetapNamla Elfa Syariati67% (3)

- Soal Bab 15Документ5 страницSoal Bab 15suci monalia putriОценок пока нет

- ACCT3001 Ch.10 WP SolutionsДокумент14 страницACCT3001 Ch.10 WP SolutionsJoshua Solite0% (1)

- ACCT 611 CHP 22Документ25 страницACCT 611 CHP 22kwame100% (1)

- If A Firm Raises Capital by Selling New BondsДокумент24 страницыIf A Firm Raises Capital by Selling New BondsMary Justine PaquibotОценок пока нет

- Chap 008Документ69 страницChap 008jjseven22100% (1)

- IFA 2 - Group 5 - BE13.7&P13.2Документ1 страницаIFA 2 - Group 5 - BE13.7&P13.2AFIFAH KHAIRUNNISA SUBIYANTORO 1Оценок пока нет

- 5207871Документ87 страниц5207871sfrhОценок пока нет

- CH 15Документ46 страницCH 15Indah SucitraОценок пока нет

- P11Документ7 страницP11Arif RahmanОценок пока нет

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Документ3 страницыMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiОценок пока нет

- PR E2-3, E2-7, E7-1, E7-4Документ5 страницPR E2-3, E2-7, E7-1, E7-4jopi jopОценок пока нет

- Homework1 E3 10Документ4 страницыHomework1 E3 10Jade NguyenОценок пока нет

- Chapter 17 Cornerstone's Cost ManagementДокумент16 страницChapter 17 Cornerstone's Cost ManagementNurul Meutia SalsabilaОценок пока нет

- 1-3-Ulo D ExerciseДокумент5 страниц1-3-Ulo D ExerciseJames Darwin TehОценок пока нет

- Problem Ch.14Документ3 страницыProblem Ch.14kenny 322016048100% (1)

- Chapter 23 HomeworkДокумент10 страницChapter 23 HomeworkTracy LeeОценок пока нет

- Quiz - Inter 2 UTS - Wo AnsДокумент3 страницыQuiz - Inter 2 UTS - Wo AnsNike HannaОценок пока нет

- Pilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Документ9 страницPilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Desi AprilianiОценок пока нет

- CH 14 MCДокумент38 страницCH 14 MCElaine Lingx100% (1)

- Audit of Other Income Statement ComponentsДокумент7 страницAudit of Other Income Statement ComponentsIbratama Sukses PratamaОценок пока нет

- Chapter 2-Bonds Payable Students RevДокумент45 страницChapter 2-Bonds Payable Students RevPriscillia SakuraОценок пока нет

- P2 41 2 42 SolutionsДокумент3 страницыP2 41 2 42 SolutionsMarjorie PalmaОценок пока нет

- Akuntansi KeuanganДокумент11 страницAkuntansi KeuanganDyan NoviaОценок пока нет

- Contoh Latihan SoalДокумент6 страницContoh Latihan SoalfidelaluthfianaОценок пока нет

- Problem 18 - 18 18 - 31 and 18 - 32Документ5 страницProblem 18 - 18 18 - 31 and 18 - 32anon_459698449Оценок пока нет

- Mahusay Acc227 Module 4Документ4 страницыMahusay Acc227 Module 4Jeth MahusayОценок пока нет

- 0 C 58 Cea 5Документ16 страниц0 C 58 Cea 5ayaОценок пока нет

- Sultan Kudarat State University Applied AuditingДокумент4 страницыSultan Kudarat State University Applied Auditingjembot dawatonОценок пока нет

- Exercise Chap 11Документ7 страницExercise Chap 11JF FОценок пока нет

- DipIFR 2009 Dec QДокумент19 страницDipIFR 2009 Dec QSaed AliОценок пока нет

- Print OutДокумент17 страницPrint OutRobin BishwajeetОценок пока нет

- Assignment 2 - Ppe, Wasting AssetДокумент3 страницыAssignment 2 - Ppe, Wasting AssetDianne ArizalaОценок пока нет

- 2009-Financial Reporting Main EQP and CommentariesДокумент46 страниц2009-Financial Reporting Main EQP and CommentariesBryan SingОценок пока нет

- Loan Calculation SampleДокумент60 страницLoan Calculation SampleAnonymous skbHwuОценок пока нет

- Hmi - Ridwan - LHДокумент19 страницHmi - Ridwan - LHYudi HallimОценок пока нет

- Table 1: Bond Description Straight-Line Calculations Other CalculationsДокумент5 страницTable 1: Bond Description Straight-Line Calculations Other CalculationsYudi HallimОценок пока нет

- L 2 - Interpreting FS 2013 Presentation OHNE SolutionДокумент60 страницL 2 - Interpreting FS 2013 Presentation OHNE SolutionYudi HallimОценок пока нет

- Jurnal Hubungan GCG Dan CSRДокумент31 страницаJurnal Hubungan GCG Dan CSRYudi HallimОценок пока нет

- Summary - Economic Reality and The Myth of The BottomlineДокумент2 страницыSummary - Economic Reality and The Myth of The BottomlineYudi HallimОценок пока нет

- Tugas SMB 2 - Mega 15.09.14Документ49 страницTugas SMB 2 - Mega 15.09.14Yudi Hallim100% (1)

- AMB - Unitron CaseДокумент10 страницAMB - Unitron CaseYudi HallimОценок пока нет

- Las Ferreterfas de MexicoДокумент4 страницыLas Ferreterfas de MexicoYudi HallimОценок пока нет

- Company Profile KJPP ASP&R PDFДокумент0 страницCompany Profile KJPP ASP&R PDFYudi HallimОценок пока нет

- Financial Analysis of Tesco PLCДокумент7 страницFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- A Summer Internship Project Report OnДокумент138 страницA Summer Internship Project Report OnVineet Kumar80% (5)

- How Hedge Funds Are StructuredДокумент17 страницHow Hedge Funds Are Structuredvarun khajuriaОценок пока нет

- Secretary's Certificate For Account Opening (Domestic Corporation)Документ3 страницыSecretary's Certificate For Account Opening (Domestic Corporation)JACQUE ARCENALОценок пока нет

- Sample Buyer Presentation - 2Документ13 страницSample Buyer Presentation - 2mauricio0327Оценок пока нет

- Ca Inter (Income Tax) Ca Vijender AggarwalДокумент2 страницыCa Inter (Income Tax) Ca Vijender AggarwalMehul GuptaОценок пока нет

- Finance Quiz 6Документ131 страницаFinance Quiz 6Peak ChindapolОценок пока нет

- Working Capital Project by HILAL AHMADДокумент74 страницыWorking Capital Project by HILAL AHMADLeo SaimОценок пока нет

- FM Project End TermДокумент5 страницFM Project End TermManisha SatpathyОценок пока нет

- BUSS 207 Quiz 4 - SolutionДокумент4 страницыBUSS 207 Quiz 4 - Solutiontom dussekОценок пока нет

- Acco 30103 Integrated Review in Afar 1st Evaluation Examination 2022Документ42 страницыAcco 30103 Integrated Review in Afar 1st Evaluation Examination 2022Bunny SonyaОценок пока нет

- Aviva (Pension) H-Av My Future Focus Growth S2Документ4 страницыAviva (Pension) H-Av My Future Focus Growth S2Jason FitchОценок пока нет

- Boragay Recil Marie NSTP Final ExaminationДокумент3 страницыBoragay Recil Marie NSTP Final ExaminationRecil Marie BoragayОценок пока нет

- Money Receipt: Kogta Financial (India) LimitedДокумент2 страницыMoney Receipt: Kogta Financial (India) LimitedMARKOV BOSSОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент8 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAkshat KeshariОценок пока нет

- Case 11 2 Debt Restructuring : RequiredДокумент6 страницCase 11 2 Debt Restructuring : RequiredAlma SiwiОценок пока нет

- Advanced Accounting Hoyle 12th Edition Test BankДокумент8 страницAdvanced Accounting Hoyle 12th Edition Test BankNicholas Becerra100% (33)

- SNGPL - Web Bill DocumentДокумент1 страницаSNGPL - Web Bill DocumentAabirОценок пока нет

- LAW (Forgery Assignment)Документ4 страницыLAW (Forgery Assignment)Ellen RaballeОценок пока нет

- Credit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceДокумент33 страницыCredit Default Swaps (CDS) and Financial Guarantee (FG) InsuranceGeorge Lekatis100% (1)

- New Questionnaire 1.1Документ10 страницNew Questionnaire 1.1Elinet AldovinoОценок пока нет

- AccountingДокумент5 страницAccountingMaitet CarandangОценок пока нет

- The Future of MoneyДокумент4 страницыThe Future of MoneyChipwalter100% (1)

- Application Form For Agriculture Credit Rs.2lto10lДокумент12 страницApplication Form For Agriculture Credit Rs.2lto10lAnitakurmaОценок пока нет

- Impact of Digitalization On Indian Rural Banking Customer: With Reference To Payment SystemsДокумент11 страницImpact of Digitalization On Indian Rural Banking Customer: With Reference To Payment SystemsNikhil RajОценок пока нет

- End of Chapter Problems 3-1 (Cash Count)Документ3 страницыEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthОценок пока нет

- International Banking & Foreign Exchange ManagementДокумент12 страницInternational Banking & Foreign Exchange ManagementrumiОценок пока нет

- 2008 TCFA Annual ConferenceДокумент48 страниц2008 TCFA Annual ConferenceaОценок пока нет

- Effect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)Документ24 страницыEffect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)The IjbmtОценок пока нет

- C243340 SalarySlipIncludeДокумент1 страницаC243340 SalarySlipIncludebenq78786Оценок пока нет