Академический Документы

Профессиональный Документы

Культура Документы

2 Sharecapital PDF

Загружено:

sohail merchantОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2 Sharecapital PDF

Загружено:

sohail merchantАвторское право:

Доступные форматы

From the desk of KP

Company law

Share capital

1) Nature and certificate of shares Shares or other interest of any member in a company shall be movable property transferable as per Articles of the company. Each share shall have a distinctive number and a certificate under the common seal of the company shall be prima facie evidence of the title of the member to the specified shares. 2) Classes and kinds of share capital S 90 A company limited by shares may have different kinds of share capital and classes therein with different rights and privileges as provided by its Memorandum and Articles. The variation in the rights and privileges of the shareholders in a kind of share capital or classes therein may be with reference to the following: a) Different voting rights b) Voting rights disproportionate to the paid up capital of shares held c) Voting rights for specific purpose only d) No voting rights at all e) Different rights for entitlement of dividend, right shares or bonus shares f) Different entitlement to receive notices and to attend the general meeting g) Rights and privileges for indefinite period, for a limited specified period or for a period as determined by special resolution. 3) Only fully paid up shares shall be issued i.e. a company shall not issue partly paid up shares S 91 Issue of security outside Pakistan S 62A A company shall not issue any security outside Pakistan except with the prior approval of SECP. Allotment of shares by subscribing memorandum Every company limited by shares allots its initial capital at the time of incorporation as section 16 states that no subscriber of the Memorandum shall take less than one share. These shares are deemed to have been allotted at the time when each subscriber writes his name in the memorandum and the number of shares he takes.

4)

5)

Share capital

6)

Statement in lieu of prospectus (SILP): a) Prospectus is not required if the promoters of a public company are confident of raising the required capital privately from their relatives, friends or other parties without going into general public. In this case SILP containing specified information signed by every director or proposed director must be filed with the registrar within 3 days before the allotment of shares. b) If SILP is not filed in time or any specified particular is not included in SILP then the company and every officer knowingly involved shall be liable to a fine up to Rs.5,000 plus up to Rs.100 per day. c) A private company is not required to file SILP. However, if a private company is converted into a public company then a prospectus or SILP is required to be filed within 14 days of such conversion. d) If SILP contains any untrue statement then any person who singed the statement shall be punishable with imprisonment up to 2 years or with fine up to Rs.10,000 or both unless he proves that the statement was immaterial or that he had reasonable ground to believe that the statement was true.

7)

Prospectus: a) Definition of prospectus "Prospectus" means any document described or issued as prospectus, and includes any notice, circular, advertisement, or other communication inviting offers from the public for subscription or purchase of any shares in, or debentures of, a body corporate, or inviting deposits from the public, other than deposits invited by a banking company or a financial institution approved by the Federal Government, whether described as prospectus or otherwise. b) General explanation of a prospectus General public takes shares or debentures on the basis of the statement contained in the prospectus. Therefore, the object of the corporate laws in this respect is that the company should provide certain information in the prospectus to enable the prospective investors to decide whether or not to subscribe for the Company's shares or debentures. 2nd schedule to the Companies Ordinance provides details of the information to be provided and reports to be set out in the prospectus and there are heavy penalties and consequences on knowing default or misstatement in the prospectus. c) Classes of prospectus i. Prospectus issued generally i.e. issued to persons who are not existing members or debenture holders (e.g. prospectus issued by a new company making a public issue on its formation) This prospectus must comply with the full statutory requirements including section 53 and the 2nd Schedule.

Share capital

ii.

Prospectus issued generally uniform with shares or debentures already quoted on stock exchange. Prospectus not issued generally i.e. only to the existing shareholders and debenture holders.

iii.

Section 53 and 2nd Schedule are not applicable in the case of (ii) and (iii) above. However other provisions are applicable e.g. provisions in respect of filing of prospectus to the registrar, experts consents, civil liability, criminal liability etc. d) Matters to be specified in the prospectus i. Contents of the Memorandum with the names, addresses and occupations of the signatories to the memorandum and the number and value of shares subscribed by them and their interest in the property and profits of the company. This content is not required if the prospectus is published in newspaper or issued after 2 years from the commencement of business. ii. Description of business and length of time during which the business of the company has been carried on. Names, addresses and occupation of proposed or existing CE, directors, secretary and any other Company in which they hold office. Remuneration to CE and directors Minimum subscription (only in the case of first allotment). For allotment of shares minimum subscription must have been received in cash. Concept of minimum subscription is applicable only for the first allotment by a public company whether listed or not. Minimum subscription in case of a company issuing prospectus: The amount which, in the opinion of the directors, must be raised from public by means of shares in order to provide for the following matters: i. ii. iii. Purchase price of any property purchased or to be purchased Preliminary expense and any commission in respect of the issue Repayment of loan obtained by the company in respect of the above matters Working capital Any other expenditure stating the nature, purpose and estimated amount in each case.

iii.

iv. v.

iv. v.

Share capital

Minimum subscription in case of a company not issuing prospectus: i. The amount fixed by the Memorandum and Articles and specified in SILP as the minimum subscription on which the directors may proceed to allotment. ii. Where no amount is so fixed and specified, the whole of share capital i.e. authorized capital shall be the minimum subscription payable in cash.

vi.

Date and time of opening and closing of subscription list and the amount payable on application on each share. The amount offered and allotted on each previous allotment, if any, within 2 preceding years. Substance and particulars of any contract or arrangement in respect of any preferential rights or options given to any person (e.g. option of conversion from debentures to ordinary shares or preferential right in allotment to NIT, non-residents or employees). Share or debentures issued within 2 preceding years otherwise than in cash. Premium on shares within 2 preceding years. Names of underwriters and the opinion of the directors that the resources of underwriters are sufficient to discharge their obligation. Commission on shares or debentures within 2 preceding years (including underwriting commission) with names, nature, rate etc. Preliminary expenses (not applicable if prospectus is issued after 2 years of commencement of business). Amount or benefits within 2 preceding years or intended to be given to any promoter or officer. Names and addresses of auditors and legal advisors. Interest of every director or promoter in: o o the promotion of the company any property acquired within 2 years or proposed to be acquired.

vii.

viii.

ix.

x. xi.

xii.

xiii.

xiv.

xv. xvi.

xvii.

Pending legal proceedings, other than routine business matters.

e) Reports to be set out Auditor's report is required to be included in the prospectus with respect to:

Share capital

i.

Profits and losses for each of the 5 financial years preceding the issue of prospectus and of it subsidiaries, if any (distinguishing non recurringitems). Assets and liabilities on the last balance sheet date and of its subsidiaries, if any If proceeds of shares or debentures are to be applied in the purchase of any business or more than 50% share of that business, then auditors report as above shall also be in respect of that business.

ii.

iii.

The Chief Executive and Chief Financial Officer of the company and the underwriter to the issue shall certify that the prospectus constitutes a full, true and plain disclosure of all material facts relating to the securities offered by the prospectus. f) Experts i. Expert includes an engineer, a valuer, an accountant or every other person whose profession gives authority to any statement made by him. ii. Experts written consents are required to be obtained which are not withdrawn before the issue of prospectus. Statement is required to be included in the prospectus that experts have given and not withdrawn their consents An expert shall not be a person engaged or interested in the formation or in the management of the company Penalty up to Rs.5,000.

iii.

iv.

v.

g) Civil liability for misstatement in the prospectus The following persons shall be liable to pay compensation to all persons who subscribe for shares or debentures on the faith of the prospectus for all losses or damages they may have sustained by reason of any misleading or untrue statement in the prospectus: i. ii. iii. Every director at the time of issue of the prospectus Every proposed director named in the prospectus Every person who has authorized the issue of prospectus i.e. expert, auditor, legal advisor etc. (they are liable for any misstatement in their report e.g. legal advisor is not liable for any misstatement in the financial statement). Every promoter of the company

iv.

Share capital

Definition of promoter for the purpose of Prospectus: A person who was a party to the preparation of prospectus or a portion thereof containing the untrue statement but does not include consultants who help in the preparation in their professional capacity. If a person is not a director, proposed director or expert or he has withdrawn his consent before publication of the prospectus but his name is given in the prospectus then every person willfully involved shall be liable to indemnify the said person against all damages and expenses to which he may be liable by reason of his name having been inserted in the prospectus. h) Criminal liability for misstatement in the prospectus In the case of any misstatement in the prospectus, every person who signed or authorized the issue of prospectus shall be punishable with imprisonment up to 2 years or fine up to Rs.10,000 or both. i) Defences available against civil and criminal liability i. A person is not liable for civil or criminal liability is he proves that: o o o the untrue statement was immaterial he had reasonable ground to believe that the statement was true As regards any matter not disclosed he proves that he had no knowledge thereof. non compliance arose from an honest mistake of fact on his part. The prospectus was issued without his knowledge or consent and on becoming aware of its issue, he forthwith gave a reasonable public notice of the fact. After the issue of prospectus but before the allotment he withdrew his consent and he gave a reasonable public notice.

o o

ii.

Experts, bankers etc. are not liable merely on the basis of their consents unless any material misstatement is there on their part.

j) Penalty for fraudulently inducing persons to invest money Any person who induces any other person by making false statement to make investment in shares or debentures of a company shall be liable to imprisonment up to 3 years or with fine up to Rs.20,000 or with both. k) Other provisions including approval and registration of prospectus i. Prospectus shall be dated which shall be considered as the date of its publication. Prospectus shall be issued within 30 to 7 days before the date of subscription except as allowed by SECP for any special reasons. It is also required to be published in one English and one Urdu newspaper having circulation in the province of Stock Exchange.

Share capital

Penalty: up to Rs.10,000 + up to Rs.200 per day if not issued in time or any matter or report is short or missing in the prospectus. ii. No person shall issue or publish any prospectus or other document offering for subscription or publicly offering for sale any security unless approved by SECP. Approval from SECP is required within 60 days preceding the date of issue of prospectus i.e. prospectus is required to be issued within 60 days from the date of approval. Prospectus is required to be registered with the Registrar. Application for registration shall accompany the following: o o Prospectus signed by the directors or proposed directors Consents in writing of experts, auditor, legal advisor, attorney, bankers or brokers named in the prospectus

iii.

If the Registrar is satisfied that all the requirements have been complied with, he shall register the prospectus. iv. Approval of Stock Exchange is also required for which Stock Exchange Listing Regulations are required to be complied with. Every prospectus on the face of it shall state that application has been made to the Registrar and Stock Exchange and consents as required have been obtained. Nominal value (i.e. face value) of shares and debentures shall be approved / specified by SECP. Application form for subscription shall be specified by SECP which may include certain declaration or verification and such form shall become a part of prospectus. Application for shares and debentures against prospectus shall be irrevocable. All certificates, statements and declarations made by the applicant shall be binding on him. viii. A Company shall not vary the terms of any contract referred to in the prospectus except with the approval of general meeting. If a person holds more than 10% shares or debentures of a company he cannot offer his shares or debentures for sale to the general public without the approval of SECP and any document for such offer shall be deemed to a be a prospectus. However, a notice, circular, advertisement or any document by a scheduled bank or a financial institution for disinvestment of shares or debentures shall not be deemed to be a prospectus.

v.

vi.

vii.

ix.

Share capital

8)

Further issue of capital S 86 a) When the directors decide to the existing members member. For this purpose any authorized officer of called right issue). to issue further shares, such shares must be offered in proportion to the existing shares held by each a prescribed circular duly signed by the directors or the company shall be sent to each member (also

b) Circular for offer: i. The circular shall contain latest statement of accounts, necessity for issue of further capital and material information about affairs of the company. ii. A singed copy of the circular shall be filed with the Registrar before it is sent to the members. The circular shall specify a date by which the offer shall be deemed to be declined if not accepted or a member may renounce his right in favour of any other person. If the whole or any part of the shares offered to the existing members is declined or is not renounced in favour of any other person i.e. not subscribed then the directors may allot and issue such shares in a manner as they deem fit.

iii.

iv.

c) Exceptions: i. A public company may issue further capital without issue of right shares by passing special resolution and with the permission of the Federal Government. ii. A public company with the approval of SECP may reserve a certain % of further issue for its employees under Employees Stock Option Scheme.

d) Fractional shares: Fractional shares shall not be offered to the members and all fractional shares shall be consolidated and disposed off by the company and the proceed (in excess of paid up value) shall be paid to the entitled members. 9) Issue of shares in lieu of outstanding balance of loan etc. S 87 A company may issue ordinary shares against (or grant option to convert into ordinary shares) outstanding loan, credit, non-interest bearing securities having a term of not less than 3 years to the extent of 20% of such balance as per any contract with a scheduled bank or a financial institution. Example: A bank provided loan of Rs.10 million to the company having a term of 5 years. As per the contract the loan up to Rs.2 million may be converted into ordinary shares. This section is not applicable for a company within 2 years of the commencement of commercial production. Thereafter, this section is applicable subject to the condition that rate of return on such loan, credit or non-interest bearing securities in any 2 of the 3 preceding years falls below the minimum rate of return laid down by the State Bank.

Share capital

10) Time limit for issuance of certificates of shares and debentures S 74 Every company shall complete and have ready certificates of shares and debentures within 90 days after the allotment and within 45 days after the application of transfer of certificates and the company shall: o o o Send the certificates by post; or Deliver the certificates to the persons entitled thereto; or Give notice to the entitled person that the certificates are ready

If the certificates are dealt with by central depository company (CDC) then transfer of certificates shall be made within 5 days of application for the transfer. Penalty up to Rs.100 per day. 11) Issue of duplicate certificates S 75 A company shall issue duplicate certificate of shares or debentures within 45 days of the application if: o A certificate is lost or destroyed; or o A certificate is defaced, mutilated or torn and is surrendered to the company. Before issuing a duplicate certificate the company may make an inquiry as it may consider necessary. The company may charge from the member actual expense on such inquiry and a further amount not exceeding the prescribed amount. If the company is unable to issue duplicate certificates, it shall notify this fact with reason within 30 days of the application. Note for students: Reasons for refusing issuance of duplicate certificates may be: - Dispute in respect of entitlement of certificates - Redemption date, if any, is very near. Penalty up to Rs.500. If a company issues duplicate certificates with the intention of fraud the company shall be liable to a fine up to Rs.20,000 and every officer knowingly involved shall be liable to imprisonment up to 6 months + fine up to Rs.10,000 or both. 12) Transfer of shares and debentures S 76 to 81 a) A company shall not register a transfer of certificates unless proper instrument of transfer duly stamped and signed by the transferor and the transferee has been delivered to the company along with the scrip. b) Application of transfer can be made either by the transferor or the transferee and the company shall complete the transfer within 45 days of application and register the name of transferee in its register of members. c) A financial institution approved by SECP may be appointed as the transfer agent in case of a public company.

Share capital

d) In case of a private company transfer of shares shall be subject to such limitations and restrictions as may have been imposed by the Articles of such company. e) Power of directors to refuse the transfer: The directors shall not refuse to transfer the certificates unless the transfer deed is defective or invalid. In this case the company shall notify the defect within 30 days (5 days in case of CDC) to the transferee who can remove the defect and relodge the transfer with the company. If the company refuses to register a transfer the company shall indicate its refusal with reason thru a notice of refusal within 30 days. Penalty shall be up to Rs.20,000 plus Rs.1,000 per day. Appeal against refusal of transfer: An aggrieved person may file an appeal within 2 months to SECP if defect in the transfer deed is not indicated or the transfer of certificates is refused to be registered by the company. SECP may require the company to disclose the reason for such refusal and after providing reasonable opportunity to the concerned parties and conducting an enquiry SECP shall make an order: o That the transfer or transmission shall be registered and in this case the company shall proceed accordingly within 15 days of the receipt of the order. If the transfer or transmission is not made within 15 days then penalty shall be up to Rs.500 per day. That the companys point of view is correct and the transfer or transmission shall not be registered.

f) If the transfer deed is lost, destroyed or mutilated before its lodgement, the company may register the transfer provided the transferee makes a written application bearing the transfer stamps required by the transfer deed. The company may demand such indemnity as it thinks fit. g) Transfer to nominee or successor-in-interest A member can nominate one or more persons who will acquire the interest in the specified shares in the event of members death. Nomination can be made to spouse, father, mother, brother, sister, son or daughter including a step or adopted child. This nomination may be subject to specified contingencies and may be changed by the shareholder in writing during his lifetime. This nomination shall not restrict the right of the member to dispose off the certificates in the lifetime of the member. The nomination shall be effective on death of the member.

10

Share capital

When a shareholder or debenture holder dies the shares or debentures shall be transferred to his lawful nominee or successor-in-interest subject to the following conditions: i. ii. An application by nominee or successor is made to the company Documents in support of nomination or lawful award of property are produced; and Nominee or successor has furnished a suitable indemnity to the company.

iii.

h) Register of transfer Every company shall keep a register of shares and debentures at its registered office which shall be open for inspection by the members and other persons in the manner as applicable for register of members. i) Transmission to shares or debentures Transmission occurs where title is transferred by virtue of death or insolvency of a member or debenture holder. Difference between transfer and transmission: i. Transfer is voluntary but the transmission is the result of operation of law ii. Transfer is normally for an adequate consideration but in transmission question of adequate consideration does not arise. Transfer deed is lodged for the transfer while for transmission proof of entitlement is lodged with the company. Stamp duty is required to be paid in the case of transfer but in the case of transmission no stamp duty is required.

iii.

iv.

13) Restrictions on allotment a) Restriction as to first allotment Public Issue: i. Minimum subscription must have been subscribed and the full amount thereof has been received in cash. ii. All money received from applicants shall be deposited and kept in a separate bank account until refunded or until certificate of commencement of business is obtained. If the above conditions are not fulfilled within 40 days after the first issue of prospectus then: o All money shall be repaid to the applicants without surcharge (10 days available for repayment) o If not repaid within 50 days after the issue of prospectus, the directors involved in the default shall be liable to repay the amount to applicants with surcharge @ 1.5% for every month or a part thereof after the day 50.

iii.

11

Share capital

b) Restriction as to first allotment No Public Issue: i. A public company which does not issue prospectus is required to deliver to the Registrar a statement in lieu of prospectus at least 3 days before the first allotment signed by every person named as director or proposed director. ii. Minimum subscription must have been subscribed and full amount thereof has been received in cash.

c) General Restrictions on first and subsequent allotments public issue i. Full amount of shares is required to be paid with application (This condition is applicable in all cases including in case of a private company). ii. Company shall take decision of allotment within 10 days of subscription and refund the money to unaccepted or unsuccessful applicants within 10 days of the date of such decision (5 days grace period is allowed). When refund is not made within the specified time then the directors shall be liable to repay the amount with surcharge @ 1.5% for every month or a part thereof after 15th day of such decision. They shall also be liable to a fine up to Rs.5,000 plus up to Rs.100 per day.

iii.

14) Irregular allotment: An allotment shall be considered irregular if: a) The minimum subscription is not received (in the case of first allotment). b) Statement in lieu of prospectus is not filed when it was required to be filed. c) Full amount of shares not received with the application. (Also applicable for a private company); and d) Application money is not kept in a separate bank account (in the case of first allotment) Effects of Irregular Allotment as against the company: Allotment shall be voidable at the instance of the applicant within: a) 30 days after the holding of statutory meeting b) 30 days after the date of allotment where the statutory meeting is not required or allotment is made after statutory meeting. Effects of Irregular Allotment as against Officer: Any officer knowingly involved shall be liable to compensate the company and the allottee for any loss, damage or costs that the company or the allottee may have sustained thereby. Proceeding against any officer in this respect can be initiated up to 2 years from the date of allotment.

12

Share capital

15) Return of allotment S 73 A return of allotment is required to be filed to the Registrar within 30 days from the date of allotment. However, the Registrar has power to extend the said time limit. The return of allotment shall give the following details: a) Number and nominal amount of shares allotted to each allottee, the amount paid on each share and other particulars prescribed by SECP. b) If the allottee is a financial institution then the return of allotment may be filed by the allottee if the same is not filed by the company. In this case the financial institution shall be entitled to recover from the company any cost in respect of filing of return of allotment. c) Particulars of shares allotted for consideration other than in cash. A contract in writing in this respect duly stamped with the stamp duty is required to be produced for inspection of the Registrar and a copy thereof shall be filed to the Registrar verified by: i. ii. An affidavit of a responsible officer that these are true copies; or A certification of the public officer having custody of the original document.

If there is no written contract in respect of allotment of shares for consideration other than in cash then the company shall file particulars of consideration with the same stamp duty within 30 days of the allotment. d) In case of bonus shares, a copy of the resolution authorizing the issue of bonus shares is also required to be attached with the return along with other information. e) In the case of issue at discount the following shall be attached with the return: i. ii. A copy of the resolution passed in general meeting for discount. Copy of the order of SECP sanctioning the issue.

Penalty up to Rs.500 per day.

13

Share capital

16) Power to pay certain commissions S 82 A company is authorized to pay commission to any person in respect of shares or debentures including underwriter in consideration of his subscribing or agreeing to subscribe subject to the following: a) Payment of commission is authorized by the Articles b) Commission shall not exceed such % as may be fixed by SECP c) The amount or % of commission and the number of shares or debentures on which commission is being paid are disclosed: o o in the prospectus in case of a public issue; and in the statement in lieu of prospectus where no public issue is made.

d) A company is authorized to pay brokerage fee not exceeding 1% of the price of shares or debentures. Maximum % may also be fixed by SECP from time to time generally or in a particular case. 17) Premium on issue of shares S 83 A company is authorized to issue shares at premium. In case of public issue, premium is required to be approved thru prospectus by SECP and Stock Exchange. Amount of premium is required to be transferred to an account share premium account which may be applied by the company for the following purposes: a) Writing off preliminary expenses b) Writing off expenses of issue of shares or debentures and commission or discount on issue of shares or debentures c) Payment of premium on redemption of redeemable preference shares or debentures d) Issue of bonus shares 18) Issue of shares at discount S 84 A company is authorized to issue shares at discount subject to the following: a) The issue of shares at a discount must be approved in a general meeting specifying the maximum rate of discount and must be sanctioned by SECP b) Shares at discount can be issued only after one year of commencement of business c) Shares at discount must be issued within 60 days after the sanction by SECP or within such extended time as SECP may allow. d) Prospectus, if issued, must contain particulars of discount

14

Share capital

e) Issue of shares at a discount shall not be deemed to be reduction of capital f) Every balance sheet subsequent to the issue of shares at discount shall contain unamortized balance of discount. 19) Redemption of preference shares S 85 A company limited by shares may redeem fully paid preference shares: a) Out of the proceeds of a fresh issue of shares made for the purpose of redemption. However, premium if any payable on redemption must have been provided for out of profits or share premium account. b) Out of profits otherwise available for dividends. If redemption is to be made out of profits then the same shall be transferred to Capital Redemption Reserve Fund. c) Out of sinking fund created for this purpose. d) Out of sale proceed of any property of the company. Penalty up to Rs.5,000. 20) Invitation for deposits S 88 Deposits (other than by a banking company) shall not be invited without issuing an advertisement which shall be considered a prospectus and therefore almost all the requirements of a prospectus shall be fulfilled. Rules made under Companies (Invitation and Acceptance of Deposits) Rules are required to be fulfilled. Penalty: a) The company shall be punishable with an amount not less than the amount of deposit if contravention relates to the acceptance of deposit b) The company shall be punishable up to Rs.20,000 where contravention relates to invitation of deposits. c) Every officer knowingly involved shall be punishable with imprisonment up to 2 years and also be liable to a fine. 21) Alteration of share capital S 92 to 94 a) A company limited by shares, if authorized by its Articles and approved in general meeting, may alter the conditions of its Memorandum so as to: i. Increase its share capital i.e. authorized capital Note for students: Increase of subscribed and paid up capital within the limit of authorized capital shall not be considered as alteration of share capital.

15

Share capital

ii.

Consolidate and divide its share capital into shares of a larger amount than its existing shares e.g. Rs.5 million authorized capital divided into 500,000 shares of Rs.10 may be altered into Rs.5 million authorized capital divided into 100,000 shares of Rs.50 each. The company shall file a notice to the Registrar within 15 days of the consolidation and division of shares into a larger amount.

iii. iv.

Sub-divide its shares into smaller amount Cancel full or any portion of unsubscribed share capital. Note for students: Cancellation of authorized capital shall not be treated as reduction of capital.

b) Notice is required to be filed to the Registrar within 15 days from the date of general meeting. c) If an increase in the authorized capital is necessary for the purpose of issuance of shares to a financial institution in pursuance of an agreement then the authorized capital shall be deemed to have been increased. Note for students: General meeting is not required where the authorized capital is deemed to have been increased. d) In case of increase in authorized capital, the additional fee as per 6th Schedule to the Ordinance is required to be paid. e) The new shares shall carry the same rights as are given to existing shares i.e. pari passu including rights in respect of bonus shares, dividend, right letter for further issue of capital. 22) Prohibition of purchase, or providing financial assistance for purchase, of own shares S 95 a) A company can not purchase its own shares or the shares of its holding company. However, a company can redeem any of its redeemable security. b) A listed company can purchase its own shares subject to certain conditions. c) A public company limited by shares and a private company which is subsidiary of a public company are prohibited from giving any financial assistance to any person by means of loan, guarantee or security for the purchase of its own shares or the shares of its holding company. Exception: A company can give loan etc. to the following for purchase of its own shares or the shares of its holding company if it is part of service contract: i. ii. Full time employees excluding directors; and Chief Executive of the company who was not a director of the company before his appointment as such.

16

Share capital

d) Penalty for the company and every officer knowingly involved in the default is up to Rs.10,000 in case of a listed company and up to Rs.2,000 in case of other company 23) Power of a company to purchase its own shares S 95A This provision empowers a listed company to purchase its own shares; the salient features are as under: a) Special resolution is required specifying the maximum number of shares, maximum price and the time frame within which the purchase is to be made. b) The company shall have the prescribed debt-equity ratio and current ratio. Notes for students: According to the Companies (Buy-back of Shares) Rules 1999 the company shall have the said ratios as under: o o Debt-equity ratio 75:25 [SECP may allow a higher debt-equity ratio] Current ratio 1:1

c) Notice of general meeting shall accompany an explanatory statement containing all material facts including: i. ii. Justification for the purchase of own shares Source of funding (purchase of shares shall always be in cash and out of the distributable profits). Effect on the financial position of the company; and Nature and extent of the interest, if any, of every director Debt-equity ratio and current ratio

iii. iv. v.

d) If purchase is at premium, the amount of premium shall be charged to Share Premium Account, if any. If no such account is there then the same shall be charged to the distributable profits. e) Purchase of shares shall be made thru a tender system and the mode of tender shall be decided by a special resolution f) Declaration of solvency: Majority of the directors including the chief executive shall make a declaration of solvency verified by an affidavit to the effect that in their opinion the company shall continue as a going concern and is capable to meet its liabilities on time up to the end of the next financial year. g) Shares purchased shall not be resold and shall be cancelled forthwith. h) Capital Re-purchase Reserve Account out of distributable profits is required to be created for this purpose which may be applied for the issue of bonus shares. If the shares are purchased at a price lower than the nominal value of shares, the difference shall be credited to such reserve account.

17

Share capital

i)

A separate register for the said purchase shall be maintained containing the following particulars: i. ii. iii. iv. Number of shares purchased Consideration paid Mode of purchase; and The date of cancellation of shares.

j) A return containing the particulars of shares purchased along with declaration of solvency shall be filed to the SECP and Registrar within 30 days of the purchase. k) Penalty: Fine up to Rs.1 million + imprisonment up to 6 months. 24) Reduction of share capital i.e. paid up capital S 96 to 107 a) A company limited by shares and a company limited by guarantee having share capital may reduce its paid up share capital in the following manner: i. Cancel any paid up capital which is lost or unrepresented by available assets; or Pay-off any paid up capital which is in excess of the needs of the company

ii.

b) For the purpose of reduction of paid up capital the following are required: i. ii. iii. The company is authorized by its Articles to reduce its paid up capital Special resolution for reducing share capital is required; and Confirmation by the Court on petition is required.

c) Confirmation by the Court: If reduction of capital involves payment to shareholders then any creditor may object to the proposed reduction and for this purpose, the Court shall settle a list of creditors so entitled to object. The court may publish notices to fix a time limit for the creditors to enter into the list of creditors. The company shall: o o o Obtain consent from its creditors; or Discharge the liability of the objecting creditors; or Secure payment of their debt or claim

The court may require the company to publish the reasons for reduction of capital and other information with a view to give proper information to the public. If the Court is satisfied (specially with reference to the creditors) then it may confirm the reduction of paid up capital by an order on such terms and conditions as it thinks fit.

18

Share capital

If any officer of the company willfully conceals the name of any creditor or misrepresents the nature or amount of the claim, he shall be punishable with imprisonment up to one year or with fine or both. d) The company shall add to its name the words and reduced as the last words thereof until such date as the Court may fix and those words shall be deemed to be part of the name until that date. However, where the reduction does not involve payment to shareholders the Court may dispense with the requirement of the addition of the words and reduced. e) Registration of confirmation order and minutes: A certified copy of the confirmation order by the Court and minutes of special resolution are required to be filed to the Registrar who shall register the same, issue a certificate to this effect and then the reduction of capital shall become final. Notice of the registration shall be published by the company in such manner as the court may direct. Minutes of special resolution shall become part of the Memorandum of the company.

19

Вам также может понравиться

- Assignment - 2Документ2 страницыAssignment - 2sohail merchantОценок пока нет

- Introduction To SociologyДокумент28 страницIntroduction To Sociologysohail merchant100% (1)

- Assignment 1Документ6 страницAssignment 1sohail merchantОценок пока нет

- Professor's Grade Book: Chart TitleДокумент3 страницыProfessor's Grade Book: Chart Titlesohail merchantОценок пока нет

- How To Create An Interview Winning CДокумент5 страницHow To Create An Interview Winning Csohail merchantОценок пока нет

- Computer TipsДокумент7 страницComputer Tipssohail merchantОценок пока нет

- News PDF-Notification 20152k15 AДокумент3 страницыNews PDF-Notification 20152k15 Asohail merchantОценок пока нет

- QuestionsДокумент28 страницQuestionssohail merchant100% (1)

- Pivot Easy WorkДокумент10 страницPivot Easy Worksohail merchantОценок пока нет

- Piece Rate System and Time Rate SystemДокумент6 страницPiece Rate System and Time Rate Systemsohail merchantОценок пока нет

- I e Presentation SeminarДокумент46 страницI e Presentation Seminarsohail merchantОценок пока нет

- HRM BookДокумент278 страницHRM Booksohail merchantОценок пока нет

- Ch20 InvestmentAppraisalДокумент32 страницыCh20 InvestmentAppraisalsohail merchantОценок пока нет

- Print SMCДокумент8 страницPrint SMCsohail merchantОценок пока нет

- Branch Banking CompleteДокумент195 страницBranch Banking Completesohail merchantОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Karachi Lahore Motorway Project: 911days From The Commencement DateДокумент3 страницыKarachi Lahore Motorway Project: 911days From The Commencement Dateمحمدعمران شريفОценок пока нет

- 8 December 2016 MoneylifeДокумент68 страниц8 December 2016 Moneylifethava477cegОценок пока нет

- UIN: 104N111V02 Page 1 of 3Документ3 страницыUIN: 104N111V02 Page 1 of 3vivek0955158Оценок пока нет

- Bid Document - t2017-015Документ131 страницаBid Document - t2017-015kingsolomon00Оценок пока нет

- Fidic Blue BookДокумент8 страницFidic Blue BookDona Alisyah SiregarОценок пока нет

- Starlight International Pvt. LTD 37, Jalan Besar SingaporeДокумент4 страницыStarlight International Pvt. LTD 37, Jalan Besar SingaporeMUHAMMAD ALDI NUGRAHAОценок пока нет

- Sub - Lease AgreementДокумент5 страницSub - Lease Agreementkamarin80Оценок пока нет

- Project On Punjab National BankДокумент86 страницProject On Punjab National BankPrakash Singh100% (1)

- An Analysis of Factors Affecting The Performance of Insurance Companies in ZimbabweДокумент21 страницаAn Analysis of Factors Affecting The Performance of Insurance Companies in ZimbabweTroden MukwasiОценок пока нет

- Becoming Your Own BankerДокумент14 страницBecoming Your Own Bankereagleye794% (17)

- Paper-6 080219Документ440 страницPaper-6 080219priya pОценок пока нет

- Digest For Bonifacio Bros V MoraДокумент2 страницыDigest For Bonifacio Bros V Moracookbooks&lawbooksОценок пока нет

- Contract Management PDFДокумент115 страницContract Management PDFS SITAPATIОценок пока нет

- Nicl Exam GK Capsule: 25 March, 2015Документ69 страницNicl Exam GK Capsule: 25 March, 2015Jatin YadavОценок пока нет

- MDRTДокумент44 страницыMDRTnava12Оценок пока нет

- Report 20160609171246Документ3 страницыReport 20160609171246Raakesh DoshiОценок пока нет

- San Pedro Local Development Investment Program 2017-2022Документ664 страницыSan Pedro Local Development Investment Program 2017-2022Igi EspeletaОценок пока нет

- Human Resource Management Exam 2Документ4 страницыHuman Resource Management Exam 2RobОценок пока нет

- 18 Recovery Housing Toolkit 5-3-2018Документ42 страницы18 Recovery Housing Toolkit 5-3-2018Russell SloanОценок пока нет

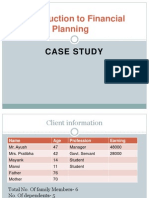

- Introduction To Financial Planning: Case StudyДокумент15 страницIntroduction To Financial Planning: Case StudyNilesh ChavanОценок пока нет

- Risk Management Worksheets Risk Assessment WorksheetДокумент4 страницыRisk Management Worksheets Risk Assessment Worksheetkapil ajmaniОценок пока нет

- Using The RIMS ERM Starter Kit 2013Документ12 страницUsing The RIMS ERM Starter Kit 2013ST KnightОценок пока нет

- KVICДокумент25 страницKVICAnjali MallisseryОценок пока нет

- Alok Annual Report-FY A2017-18Документ180 страницAlok Annual Report-FY A2017-18Aniket RoyОценок пока нет

- Npcil - 2.2 GCC - Supply1Документ67 страницNpcil - 2.2 GCC - Supply1srama_narayanan100% (1)

- 859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesДокумент9 страниц859 - By71h6kcls - Fire - Wordings For Add On Covers ClausesShivОценок пока нет

- Carriage of Goods by Sea ActДокумент3 страницыCarriage of Goods by Sea ActOliverMastileroОценок пока нет

- A Project Report On AN Impact OF Celebrity Endorsement in InsuranceДокумент29 страницA Project Report On AN Impact OF Celebrity Endorsement in Insurancemegha mishraОценок пока нет

- I 843Документ6 страницI 843ayi imaduddinОценок пока нет

- Project Work On: Object ClauseДокумент19 страницProject Work On: Object ClauseShashi RanjanОценок пока нет