Академический Документы

Профессиональный Документы

Культура Документы

Non Deductible Expenses

Загружено:

ahmadsiraziИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Non Deductible Expenses

Загружено:

ahmadsiraziАвторское право:

Доступные форматы

Tax Treatment of Entertainment Expenses

This article appeared on The SME paper, Malaysia on July 14 - July 27 issue 083 TAX TREATMENT OF ENTERTAINMENT EXPENSES These are some of the questions commonly asked by my clients, my relatives and my friends on the treatment of entertainment expenses: (1) Shin, I recently gave ang pow to my customer for his son's wedding. I consider the ang pow as my company's entertainment expense. Is the ang pow tax deductible? (2) Shin, I buy an expensive lunch for a potential customer. I charged it to my company's entertainment expense, because I need to "entertain" him hoping to close the sales. Is the lunch expense tax deductible? Now, before I reply yes or no (and more so to make sure that those who ask are truly convinced), I usually start with providing the definition of entertainment. Definition of entertainment Entertainment is defined in the Income Tax Act as (a) the provision of food, drink, recreation or hospitality of any kind and (b) the provision of accommodation or travel in connection with or for the purpose of facilitating entertainment of the kind mentioned in (a); by a person or an employee in connection with a trade or business carried out by that person. So if we look back to question number (1), ang pow does not fall within the Income Tax definition of entertainment as it is cash contribution and is not provision of food, drink, recreation or hospitality of any kind. It is therefore not a tax deductible expense. As for question number (2), buying an expensive lunch for a potential customer falls within the Income Tax definition of entertainment. However, entertainment provided to apotential customer is not allowed a deduction because it is not wholly and exclusively incurred in the production of gross income under subsection 33(1) of the Income Tax Act (entertainment for existing customer is allowed 50% deduction). 2 simple steps to determine the deductibility of entertainment From the examples above, you can see that there are 2 steps in determining whether an entertainment expense can be allowed as a deduction: Step 1: Does the expense fall within the definition of entertainment. If not, no deduction is allowed. Step 2: If the expense falls within the definition determined in step (1), the taxpayer has to determine whether the expense is wholly and exclusively incurred in the production of gross income. If not no deduction is allowed. The 3rd step: To determine whether entertainment is 100% OR 50% deductible Step 3: Now the good news is there are 8 categories of entertainment expenses that are

100% tax deductible. Expenses incurred in the following entertainment will qualify for full deduction: Entertainment expense Provision of entertainment such as food, drink and recreation to employees. 1. Examples - Free meals and refreshments for staff, annual dinners and family day. A taxpayer whose business consist of providing entertainment to paying customers such as restaurant or cinema. 2. Examples - Meals provided by airlines or other transportation business to passengers and cultural shows provided by hotels or restaurants. 3. Promotional gifts at trade fairs, trade exhibitions or industrial exhibitions held outside Malaysia for the purpose of promoting exports. Examples - Souvenirs, bags and travel ticket to visitors at trade fairs. Promotional samples of tax payers' products 4. Examples - Free samples to guests at launching of product and giving away of health drink samples to school children. Provision of entertainment for cultural or sporting events which are open to the members of public for the purpose of promoting the business. Yes Yes Yes Yes 100% deductible

5.

Yes

Promotional gifts within Malaysia consisting of articles incorporating a conspicuous advertisement or logo of the business. The promotional gifts 6. need not be the product of the business as long as the business logo is affixed on those articles. The promotional gift should be given to the public on a non-discriminatory basis. Provision of entertainment which is related wholly to sales arising from that business. Examples: - Expenses incurred on food and drink during launching of a new housing 7. project - Redemption vouchers and lucky draw prizes given for purchases made - Free gifts for purchases exceeding a certain amount - Redemption gifts based on a scheme of accumulated points - Free service charges or contribution to sinking fund by property developers - Expenditure on trips given as an incentive to dealers for achieving sales target - Expenditure incurred on refreshments given to its customers while waiting for their cars to be serviced. Provision of benefit to an employee consisting of leave passage 8. Examples - Costs of travel to facilitate yearly event within Malaysia which involves employer, employee and immediate family members of the employee

Yes

Yes

Yes

Entertainment expenses which qualify under Steps 1 and 2 but which do not fall under any of the above categories of expenses are only allowed 50% deduction. Examples of such expenses include: Entertainment expense 2. Gift of flower for customer's opening of new outlet 3. Entertainment to existing customers or suppliers 4. Hampers for customers during festive seasons 50% deductible Yes Yes Yes

1. Gifts without business logo for customer's annual dinner Yes

In answering the questions asked by my clients, relatives and friends on the tax treatment of entertainment expenses I would normally conclude with a caution on the increasing importance to keep proper records (such as invoices, receipts and payment vouchers to support the claim) and to determine the appropriate tax treatment of entertainment expenses. In the event of field audit by Inland Revenue Officers and additional 45% penalty will be imposed on top of the additional tax payable on discovery of any understatement of tax due to claims of expenses which are not tax deductible.

5.7 Non Deductible Expenses The following expenses are not allowed as a deduction against profits in arriving at the adjusted income of the business : domestic or private expenses e.g. o wages paid to a domestic-help employed to work in his home, o cost of travelling from home to place of business (1/3 add back for sole trader) o drawings from business for private use. o salary drawn by the businessman himself o the businessman repairs his private residence(1/3 add back for sole trader) o the businessman take insurance policies on himself and his family o legal expenses not directly associate with producing business profits (legal fees for purchase private property) o cost to appeal for tax assessment o penalty capital withdrawn or any sum used or intended to be used as capital, e.g. o payments for purchase of fixed assets or private assets (private residence, cars,shares) o the businessman withdraw the money for the purchase of investment(shares or real property) free leave passage provided to employees. entertainment expenditure including entertainment allowances paid to employees. payments made to any unapproved pension or provident fund for his employees.

general provision for doubtful debts or non-trading bad debts written off. depreciation of fixed assets. bonus payment to an employee in excess of two-twelfths of his wages or salary (with effect from 17.10.1997). Renovation or construction cost of premises Fines on traffic New licensing and registration fees New painting on premises Donation without marked tax exempted Legal fees for bank loan for property acquisition Entrance fees to club Registration of trademark Fees for designing company logo Contribution to unapproved pension / bodies Wedding gift to customer Entertainment for annual general meeting of company Cash contribution for customers annual dinner

The following expenses are tax deductible: Others Deductible Expenses Accounting fees secretarial fees Advertisements Bank charges Electricity, Water & Telephone bills Newspapers and periodicals Promotional gifts to customers Printing & stationery Rental Renewal & licensing fees Repainting & Rewiring the premises Sales commission Travelling expenses Entertainment for staffs

o o o o o o Staff annual (anniversary) dinner Family outings for employees Promotional gifts given put at overseas trade fair Samples of companys own product Foods, drinks for staff Promotional gifts with companys own product

o o o o o

Provision of entertainment for cultural or sporting events that are opened to public wholly to promote the companys business Provision for entertainment in the ordinary course of business Contribution to staff sports and recreational club The provision of entertainment related wholly to sales arising from the business: Food and drinks for the launching of a new product Redemption vouchers given for purchases made Discount vouchers, concert or movie tickets, meal or gifts vouchers and cash vouchers Free gifts for purchases exceeding a certain amount Redemption of gift based on a scheme of accumulated points free maintenance/service charges or contribution to sinking fund by property developers Lucky draw prizes to customers Expenditure on trips given as an incentive to dealers for achieving the sales target

Вам также может понравиться

- Anti-Bribery Policy - UPloadДокумент2 страницыAnti-Bribery Policy - UPloadNitin100% (1)

- Tax QuestionsДокумент203 страницыTax QuestionsReymond PacaldoОценок пока нет

- Principles of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankДокумент161 страницаPrinciples of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankAbby Navarro100% (1)

- Business Gift PolicyДокумент8 страницBusiness Gift PolicyJustinFinneranОценок пока нет

- Fringe BenefitsДокумент24 страницыFringe Benefitsmildred ramirezОценок пока нет

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedДокумент1 страницаPayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashОценок пока нет

- 8.1 Assignment - Regular Income TaxДокумент3 страницы8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Deductions From Gross Income Lesson 13Документ72 страницыDeductions From Gross Income Lesson 13Mikaela SamonteОценок пока нет

- BIR How To Compute Fringe Benefit Tax REL PARTYДокумент69 страницBIR How To Compute Fringe Benefit Tax REL PARTYRyoОценок пока нет

- Account, Audit and Control Account, Audit and ControlДокумент5 страницAccount, Audit and Control Account, Audit and ControlMelissa Formento LustadoОценок пока нет

- BIR-How To Compute Fringe Benefit Tax, REL PARTYДокумент69 страницBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- Meals and EntertainmentДокумент3 страницыMeals and EntertainmentJamie Rose RatliffОценок пока нет

- Allowable Deductions For Individuals and Corporations Engaged in Business / Individuals in The Exercise of ProfessionДокумент28 страницAllowable Deductions For Individuals and Corporations Engaged in Business / Individuals in The Exercise of ProfessionAlyssa Camille DiñoОценок пока нет

- Taxation in EthiopiaДокумент50 страницTaxation in EthiopiaTefera Thaimanot100% (3)

- Tax Midterm ReviewerДокумент18 страницTax Midterm ReviewerAyessa GayamoОценок пока нет

- Charging VAT: For A Full List of Exempt Goods and Services Please Click On This LinkДокумент4 страницыCharging VAT: For A Full List of Exempt Goods and Services Please Click On This LinkZita BerniceОценок пока нет

- Dfinal - Allow DeductionsДокумент76 страницDfinal - Allow DeductionsRexell DepalacОценок пока нет

- 02A Income Taxes: Clwtaxn de La Salle UniversityДокумент46 страниц02A Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolОценок пока нет

- FTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Документ5 страницFTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Marj Fulgueras-GoОценок пока нет

- Unit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeДокумент10 страницUnit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeJoseph Anthony RomeroОценок пока нет

- Les On Deductibility of Expenses.04.04.08Документ3 страницыLes On Deductibility of Expenses.04.04.08Christine BobisОценок пока нет

- Contribut Ions To Pension and TrustsДокумент3 страницыContribut Ions To Pension and TrustsMiracle GraceОценок пока нет

- 05b Concept of Taxable IncomeДокумент36 страниц05b Concept of Taxable IncomeGolden ChildОценок пока нет

- Income Tax BotswanaДокумент15 страницIncome Tax BotswanaFrancisОценок пока нет

- Allowable DeductionДокумент33 страницыAllowable DeductionJobell CaballeroОценок пока нет

- Most CommonДокумент6 страницMost CommonSalah habbiОценок пока нет

- How To Report Income Tax and Why Is It So ImportantДокумент10 страницHow To Report Income Tax and Why Is It So ImportantBerliana CristinОценок пока нет

- S33 - Deductible Business ExpensesДокумент39 страницS33 - Deductible Business ExpensesXs SarahОценок пока нет

- Tax Guide For Professionals BIRДокумент8 страницTax Guide For Professionals BIRPY CaunanОценок пока нет

- M1PLR Introduction To Business TaxesДокумент2 страницыM1PLR Introduction To Business TaxesClaricel JoyОценок пока нет

- Worldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Документ13 страницWorldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Sarvesh AhluwaliaОценок пока нет

- Acc212 Handout:: Midlands State University Department of AccountingДокумент23 страницыAcc212 Handout:: Midlands State University Department of AccountingPhebieon MukwenhaОценок пока нет

- Debit Note & Credit NoteДокумент9 страницDebit Note & Credit NoteconciliataxesОценок пока нет

- Chapter 10 Tabag - Serrano NotesДокумент5 страницChapter 10 Tabag - Serrano NotesNatalie SerranoОценок пока нет

- Chapter 10 Tabag - Serrano NotesДокумент5 страницChapter 10 Tabag - Serrano NotesNatalie SerranoОценок пока нет

- Entertainment & Discount PolicyДокумент5 страницEntertainment & Discount PolicyChris FongОценок пока нет

- REVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A CeilingДокумент1 страницаREVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A CeilingCliff DaquioagОценок пока нет

- Entrep - Summary Report Sophia GandaДокумент3 страницыEntrep - Summary Report Sophia GandaRenelle HabacОценок пока нет

- Gross Income TaxationДокумент47 страницGross Income TaxationJade Carlo ManuelОценок пока нет

- Deductions From Gross Income ShortДокумент53 страницыDeductions From Gross Income ShortXander ClockОценок пока нет

- RR 10-02Документ5 страницRR 10-02matinikkiОценок пока нет

- Tax Tips For Real Estate AgentsДокумент13 страницTax Tips For Real Estate Agentsnikop11422100% (1)

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeДокумент8 страницUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroОценок пока нет

- Accounting NotesДокумент29 страницAccounting NotesLia Nicole BungabongОценок пока нет

- Chapter 2Документ11 страницChapter 2Earl Jose PanoyОценок пока нет

- Divers and Diving Supervisors Revenue Expences Under CISДокумент5 страницDivers and Diving Supervisors Revenue Expences Under CISCailean FraserОценок пока нет

- M10 Introduction To Business Taxation StudentsДокумент33 страницыM10 Introduction To Business Taxation StudentsTokis SabaОценок пока нет

- Fringe Benefits TaxДокумент3 страницыFringe Benefits TaxGrace EspirituОценок пока нет

- Chapter 10 Compensation IncomeДокумент4 страницыChapter 10 Compensation IncomeJason MablesОценок пока нет

- Chapter 3 Taxation Part 1Документ28 страницChapter 3 Taxation Part 1Alhysa Rosales CatapangОценок пока нет

- tAX LESSON B .Документ10 страницtAX LESSON B .intramuramazingОценок пока нет

- Taxation AssignmentДокумент4 страницыTaxation AssignmentAhmedОценок пока нет

- IRS TaxCodeДокумент5 страницIRS TaxCodeMt EmptyОценок пока нет

- Analysis Group 4Документ5 страницAnalysis Group 4Clarise DatayloОценок пока нет

- Taxation For Professional Services: TopicДокумент35 страницTaxation For Professional Services: TopicLANCEОценок пока нет

- Chapter 11 - Fringe Benefits PDFДокумент12 страницChapter 11 - Fringe Benefits PDFJohn RavenОценок пока нет

- J.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleОт EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleРейтинг: 3 из 5 звезд3/5 (1)

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleОт EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleРейтинг: 3 из 5 звезд3/5 (1)

- J.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersОт EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersОценок пока нет

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineОт EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineОценок пока нет

- AbootalebiДокумент11 страницAbootalebiMan Ana Man AntaОценок пока нет

- Figures Include Direct Business Transaction (DBT)Документ1 страницаFigures Include Direct Business Transaction (DBT)ahmadsiraziОценок пока нет

- Alfarabi, Avicenna, AverroesДокумент29 страницAlfarabi, Avicenna, AverroesahmadsiraziОценок пока нет

- Has Political Islam FailedДокумент25 страницHas Political Islam FailedahmadsiraziОценок пока нет

- Kebangkitan Demokrsi IslamДокумент15 страницKebangkitan Demokrsi IslamahmadsiraziОценок пока нет

- Al Attas Philosophy of Science by AdiasetiaДокумент50 страницAl Attas Philosophy of Science by AdiasetiaFaris ShahinОценок пока нет

- Open Democracy - December 2012: Extrait Du Tariq RamadanДокумент5 страницOpen Democracy - December 2012: Extrait Du Tariq RamadanahmadsiraziОценок пока нет

- Islamic: Rise and Fall ofДокумент1 страницаIslamic: Rise and Fall ofahmadsiraziОценок пока нет

- Concept of ShuraДокумент1 страницаConcept of ShuraahmadsiraziОценок пока нет

- Plotting The Future of Islamic StudiesДокумент5 страницPlotting The Future of Islamic StudiesahmadsiraziОценок пока нет

- Professor Tariq Ramadan Is Back To USAДокумент7 страницProfessor Tariq Ramadan Is Back To USAahmadsiraziОценок пока нет

- Liberties of The FaithfulДокумент6 страницLiberties of The FaithfulahmadsiraziОценок пока нет

- Veiled TruthsДокумент8 страницVeiled TruthsahmadsiraziОценок пока нет

- Playing With IslamДокумент3 страницыPlaying With IslamahmadsiraziОценок пока нет

- Means and EndsДокумент4 страницыMeans and EndsahmadsiraziОценок пока нет

- N International Call For Moratorium On Corporal Punishment, Stoning and The Death Penalty in The IslamicДокумент8 страницN International Call For Moratorium On Corporal Punishment, Stoning and The Death Penalty in The IslamicahmadsiraziОценок пока нет

- No To Forced Marriages Our Duty Our ConscienceДокумент3 страницыNo To Forced Marriages Our Duty Our ConscienceahmadsiraziОценок пока нет

- Media Ethics and PoliticsДокумент3 страницыMedia Ethics and PoliticsahmadsiraziОценок пока нет

- Muslim Studies Too Political Islamic ScholarДокумент3 страницыMuslim Studies Too Political Islamic ScholarahmadsiraziОценок пока нет

- Muslims Must Have Faith in AmericaДокумент3 страницыMuslims Must Have Faith in AmericaahmadsiraziОценок пока нет

- Malaysia Which Challenges Towards Which ModernityДокумент3 страницыMalaysia Which Challenges Towards Which ModernityahmadsiraziОценок пока нет

- Malaysia Which Challenges Towards Which ModernityДокумент3 страницыMalaysia Which Challenges Towards Which ModernityahmadsiraziОценок пока нет

- Live Dialogue Around The Call For A MoratoriumДокумент4 страницыLive Dialogue Around The Call For A MoratoriumahmadsiraziОценок пока нет

- Mystery of The Islamic Scholar Who Was Barred by The USДокумент7 страницMystery of The Islamic Scholar Who Was Barred by The USahmadsiraziОценок пока нет

- Chapter08 Fixed AssetsДокумент16 страницChapter08 Fixed AssetsahmadsiraziОценок пока нет

- Islamic Education in The UK A View To The FutureДокумент6 страницIslamic Education in The UK A View To The FutureahmadsiraziОценок пока нет

- Lessons From RamadanДокумент3 страницыLessons From RamadanahmadsiraziОценок пока нет

- Islam and The Arab AwakeningДокумент3 страницыIslam and The Arab AwakeningahmadsiraziОценок пока нет

- Islam Today The Need To Explore Its ComplexitiesДокумент6 страницIslam Today The Need To Explore Its ComplexitiesahmadsiraziОценок пока нет

- Islam's New Revolutionary: Extrait Du Tariq RamadanДокумент4 страницыIslam's New Revolutionary: Extrait Du Tariq RamadanahmadsiraziОценок пока нет

- Press Release Template 01Документ2 страницыPress Release Template 01mkb07Оценок пока нет

- Actg Coach Actg Princ1Документ3 страницыActg Coach Actg Princ1Amir IrfanОценок пока нет

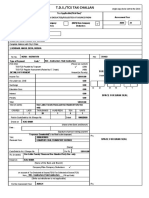

- Ganapati TDS ChalanДокумент3 страницыGanapati TDS ChalanPruthiv RajОценок пока нет

- Order 1296XДокумент2 страницыOrder 1296XClarisse IvyОценок пока нет

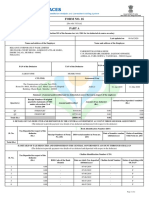

- Form No. 16: Part AДокумент8 страницForm No. 16: Part AParikshit ModiОценок пока нет

- Himanshu Sharma PDFДокумент1 страницаHimanshu Sharma PDFHimanshu SharmaОценок пока нет

- Spa Services: Revenue ParametersДокумент2 страницыSpa Services: Revenue ParametersJosel Millan UbaldoОценок пока нет

- Bos 59504Документ48 страницBos 59504swati dubeyОценок пока нет

- Congressional Record: March 27,1943, Page 2580Документ10 страницCongressional Record: March 27,1943, Page 2580Luis A del MazoОценок пока нет

- Batch 3 - Taxation 1 / Atty. Dante MarananДокумент9 страницBatch 3 - Taxation 1 / Atty. Dante MarananJОценок пока нет

- Nepal TaxДокумент7 страницNepal Taxsanjay kafleОценок пока нет

- Income Taxation by Nick Aduana Answer KeyДокумент113 страницIncome Taxation by Nick Aduana Answer KeyJonbon Tabas100% (1)

- In Case of Denial of Protest: Referral To Solgen For CollectionДокумент2 страницыIn Case of Denial of Protest: Referral To Solgen For Collectionkim_santos_20Оценок пока нет

- Coral ServiceДокумент25 страницCoral ServiceNicolas ErnestoОценок пока нет

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedДокумент1 страницаNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroОценок пока нет

- IRS Processing Codes and InformationДокумент613 страницIRS Processing Codes and Informationsabiont100% (1)

- Form No 16Документ2 страницыForm No 16Chasa raviОценок пока нет

- 1601E - August 2008Документ3 страницы1601E - August 2008Jaime II LustadoОценок пока нет

- Pakistan Taxation SystemДокумент4 страницыPakistan Taxation SystemAdil BalochОценок пока нет

- Invoice TableauДокумент1 страницаInvoice Tableauameen9956Оценок пока нет

- Bir Form 1604E - Schedule 3 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2020Документ4 страницыBir Form 1604E - Schedule 3 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2020Ric Dela CruzОценок пока нет

- How To Pass Accounting Entries Under GSTДокумент6 страницHow To Pass Accounting Entries Under GSTSunando Narayan BiswasОценок пока нет

- Excise Tax - Taxable Person Guide - EnglishДокумент33 страницыExcise Tax - Taxable Person Guide - EnglishpennacchiettiОценок пока нет

- Cao 02-1991Документ2 страницыCao 02-1991Joshua BasilioОценок пока нет

- Maibarara Geothermal Inc. vs. Commissioner of Internal RevenueДокумент14 страницMaibarara Geothermal Inc. vs. Commissioner of Internal RevenueRuth EsparteroОценок пока нет

- From The Following Receipts and Payments Account of Patel: Education Society 31st MarchДокумент2 страницыFrom The Following Receipts and Payments Account of Patel: Education Society 31st MarchPranav ManianОценок пока нет