Академический Документы

Профессиональный Документы

Культура Документы

Chapter 10: Fraud Management: Certificate in Health Insurance

Загружено:

Jonathon Cabrera0 оценок0% нашли этот документ полезным (0 голосов)

41 просмотров0 страницThe information given in this course material is merely for reference. Certain third party terminologies or matter that may be appearing in the course are used only for contextual identification and explanation, without an intention to infringe.

Исходное описание:

Оригинальное название

Chapter 10_Fraud Management

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe information given in this course material is merely for reference. Certain third party terminologies or matter that may be appearing in the course are used only for contextual identification and explanation, without an intention to infringe.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

41 просмотров0 страницChapter 10: Fraud Management: Certificate in Health Insurance

Загружено:

Jonathon CabreraThe information given in this course material is merely for reference. Certain third party terminologies or matter that may be appearing in the course are used only for contextual identification and explanation, without an intention to infringe.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 0

Page 1 of 21

Chapter 10: Fraud Management

Certificate in Health Insurance

Confidentiality statement

This document should not be carried outside the physical and virtual boundaries of TCS and

its client work locations. Sharing of this document with any person other than a TCSer will

tantamount to violation of the confidentiality agreement signed when joining TCS.

Notice

The information given in this course material is merely for reference. Certain third party

terminologies or matter that may be appearing in the course are used only for contextual

identification and explanation, without an intention to infringe.

Certificate in Health Insurance TCS Business Domain Academy

Page 3 of 21

Contents

Chapter - 10 Fraud Management .................................................................................... 4

Introduction ...................................................................................................................... 4

10.1 Healthcare Fraud Statistics .................................................................................... 5

10.1.1 Health Insurance Fraud (USA) ........................................................................ 5

10.1.2 Medicare Fraud (USA) .................................................................................... 5

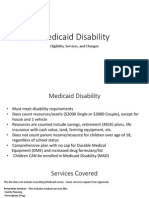

10.1.3 Medicaid Fraud (USA) ....................................................................................6

10.2 Definition of Healthcare Fraud & Abuse .................................................................6

10.3 Difficulties in fraud control.....................................................................................9

10.4 Impact of Fraud on Individuals (beyond financial loss) ......................................... 10

10.5 Fraud Management Activities .............................................................................. 11

10.6 Key Characteristics of an Efficient Fraud Management System ........................... 14

10.7 Laws Regulating Fraud & Abuse .......................................................................... 16

Summary ........................................................................................................................ 18

References ...................................................................................................................... 20

Certificate in Health Insurance TCS Business Domain Academy

Page 4 of 21

Chapter - 10 Fraud Management

Introduction

Fraud is an inherent problem for healthcare and health insurance. It is responsible for

substantial amount of losses to the insurers ranging billions of dollars annually across the

globe. Insurance companies are finding out ways and means to combat this problem. It

impacts all the stakeholders - for insurers by way of higher cost of financing, for providers

by way of stringent monitoring, for insured public by way of higher premiums. This chapter

tries to give insight into various types of fraud and methodologies to tackle them.

Learning Objectives

On completion of this chapter, you will understand the:

Various types of fraud

Characteristics of fraud

Technologies used in tackling fraud

Framework for handling fraud

Various laws regulating fraud

Certificate in Health Insurance TCS Business Domain Academy

Page 5 of 21

10.1 Healthcare Fraud Statistics

10.1.1 Health Insurance Fraud (USA)

Based on a report by National Health Care Anti-Fraud Association 2008, US spends

more than $2 trillion on healthcare of which 3% of that spending, $68 billion is lost

on fraud.

Around 1415 individuals and organizations are banned from federal programs for

fraud and abuse, and about 293 criminal actions & 243 civil actions were taken, as

per the report of Department of Health and Human Services, 2009

Confusing Explanation of Benefits (EOB) is also considered to be one of the reasons

According to a survey, 70% of the EOB forms issued by healthcare providers

confuse people

Nearly 40% of Americans dont understand their medical bills or EOBs to

understand to what services they are paying and whether it is valid or not,

survey reveals.

Almost 16% of the people dont understand the description of procedures

that they received

Small businesses and individual consumers are the prime targets of fake healthcare

plans (insurance policies), several health plans were shut down by the state

insurance department for selling unlicensed coverage

On an average, private health insurers spend about $1.9 million annually for anti-

fraud investigative unit

Every $2 million spent on fighting healthcare fraud generates a return of $17.3

million in terms of recoveries, judgments by courts and other anti-fraud savings

10.1.2 Medicare Fraud (USA)

Medicare and Medicaid made an estimated $23.7 billion in improper payments

in 2007. These included $10.8 billion for Medicare and $12.9 billion for

Medicaid. (U.S. Office of Management and Budget, 2008)

Every $1 the U.S. government invests in combating Medicare and Medicaid

fraud saves $1.55. (U.S. Department of Health & Human Services, 2009)

Medicare paid dead physicians 478,500 claims totalling up to $92 million from

2000 to 2007. These claims included 16,548 to 18,240 deceased physicians. (U.S.

Senate Permanent Committee on Investigations, 2008)

Certificate in Health Insurance TCS Business Domain Academy

Page 6 of 21

Nearly one of three claims (29 percent) Medicare paid for durable medical

equipment was erroneous in FY 2006. (Inspector General report, Department of

Health and Human Services, 2008)

Medicare and private health insurers pay up to $16 billion a year for needless

imaging tests ordered by doctors. (American College of Radiology, 2004)

10.1.3 Medicaid Fraud (USA)

The 50 state Medicaid fraud control units obtained a collective 1,205

convictions, and claimed total recoveries of more than $1.1 billion in court-

ordered restitution, fines, civil settlements, and penalties. (Annual Report, Office

of Inspector General, U.S. Department of Health and Human Services, FY 2007)

Of the 3,308 persons and entities excluded from participation in Medicare,

Medicaid and other federal health care programs in FY 2007, 805 were based on

referrals made by state Medicaid fraud control units.

The number of successful civil actions totalled 607.

More than 61 percent of medical providers (4,319) banned from state Medicaid

programs in 2004 and 2005 didnt show up in the federal database of state-

banned providers. This makes it easier for banned providers to set up shop in

other states and continue doing business with federal health-insurance

programs.

10.2 Definition of Healthcare Fraud & Abuse

Fraud refers to an intentional deception or misrepresentation made by a person with the

knowledge that the deception could result in some unauthorized benefit to him/her or some

other person. It also includes any act that constitutes to be fraud under the statute.

Abuse refers to provider practices that are inconsistent with sound fiscal, business, or

medical practices, and result in an unnecessary cost to Health programs, or in

reimbursement for services that are not medically necessary or fail to meet professionally

recognized standards for health care. It also includes recipient practices that result in

unnecessary costs to the Health program.

Certificate in Health Insurance TCS Business Domain Academy

Page 7 of 21

10.3 Classification of Fraud

Healthcare fraud can occur from the provider side as well as the recipient side. Based on the

nature and motive of fraud, healthcare fraud can be classified accordingly.

Based on who is performing the fraud, it can be classified into:

Provider fraud: It refers to participating and non-participating providers who

indulge in fraud by submitting false claims. People involved in this type of fraud

include:

Providers

Hospitals

Agencies

Organizations

Institutional providers

Employee of provider

Billing service

Any person eligible to file claims

These participants commit fraud by multiple means, which include:

Multiple billing or billing for services not rendered

Misrepresenting the condition and performing diagnosis which is either

unnecessary or costly

Upcoding, which refers to submitting bills for services that costs more than

what is actually provided

Unbundling, which refers to separate bills for each phase of treatment

Ping-ponging, which refers to billing multiple providers for services

rendered to a single patient

Kickbacks, which refer to accepting monetary benefits for referring a

patient

Providers billing uncovered services as covered services

Luring unsuspecting citizens to clinics in the name of free checkups to grab

their health insurance information and using it for fraudulent billing

purposes

Certificate in Health Insurance TCS Business Domain Academy

Page 8 of 21

Increasing the billing of patients by prolonging their stay at hospitals in the

name of observation

Medical equipment suppliers charging the insurance companies for

different and more expensive equipment rather than what is actually given

to the patient

Disproportionate billing in ambulance services

Subscriber fraud: It refers to the fraud committed by the subscribers of the

insurance by taking advantage of the policy terms and situation. Subscribers can

indulge into this type of fraud by many ways, which include:

Impersonation the policy holder and availing medical services under their

name

Taking a policy for an ineligible person and providing coverage

Submitting falsified receipts and alteration of claims

Claiming reimbursements for non-existent services and medication

Based on the type or nature of fraud committed it can be classified into:

Opportunistic fraud: It is generally performed by an individual who is in a position

to manipulate the claims which can be done either by inflating the services in the

claim or availing same services from multiple providers. Insider knowledge is not

essential in committing this type of fraud. Magnitude of losses in this type of fraud

is meager. Doctors, nurses, pharmacists with a temptation to increase their revenue

commit to this type of fraud either by billing for services not rendered or that are

exaggerated.

Professional fraud: It is usually performed by organized group by creating multiple,

fake identities targeting numerous organizations. They are completely aware of the

functioning of fraud detection systems and hence try not to get caught by the

system. They try to take assistance of insiders in committing this fraud. Magnitude

of losses in this type of fraud is huge. It is operated as a network with a lot of hidden

linkages.

Certificate in Health Insurance TCS Business Domain Academy

Page 9 of 21

10.4 Difficulties in fraud control

Identification of fraud itself is difficult in health insurance and so is its difficulty in measuring

the magnitude of losses incurred. Because of the complexity in the nature of services

involved and the mode of transactions irrespective of the fraud management systems that

are put in place it is difficult to control fraud in health insurance. Some of the factors that

make it difficult are:-

Insurers are considered as socially acceptable targets by population: Insurers are

considered to be rich, anonymous and an easy target for fraud. Insurance

companies and government agencies are the primary targets and the ones that

encounter financial losses because of this healthcare fraud.

Most of the healthcare fraud schemes are non-self-revealing: Subscribers are

generally not educated enough about the Explanation of the Medical Benefits

(EOMB) because insurers try to sell policies that dont meet the requirements of the

subscribers. Hence EOMB do not have effects as expected for several reasons like:

Recipients of EOMBs have no financial incentive for paying attention to

them

Recipients cannot understand most of the terms mentioned in it

Most fraud schemes intentionally target vulnerable population who

generally are not able or willing to complain.

Distinction between the administrative budget & funds: Program administrative

cost refers to cost incurred in handling the claims which also includes investments

into fraud control measures. Program cost refers to expenditure incurred in paying

the claims. If distinction is created between these two then the program becomes

easily vulnerable to fraud. Hence a fair balance needs to be achieved.

Respectability of the healthcare profession: Society places a lot of trust on the

healthcare professionals which makes it even more difficult to control the fraud.

Policing the medical practitioners is an attack on the integrity of their profession.

Lack of clear distinction between criminal fraud and other kinds of abuse:

Criminal fraud is defined as a deliberate misrepresentation or deception for gaining

Certificate in Health Insurance TCS Business Domain Academy

Page 10 of 21

an improper advantage. If deception or misrepresentation is for medical necessity it

is difficult to distinguish between fraud and abuse.

There are a lot of problems with this distinguishing ambiguity, like:

It reflects the reluctance of medical profession to explicitly condemn the

fraudulent practices

This makes it extremely difficult to assess the problem systematically, as

the assessment methodology need to clearly classify outcomes

Most of the payment agencies in order to protect their provider networks

handle such cases through administration instead of handling them through

investigative units

10.5 Impact of Fraud on Individuals (beyond financial loss)

The impact of fraud on individuals goes beyond the rise in the cost of medical services by

ways of:-

Falsification of patients' diagnoses and/or treatment histories: Most of the times

healthcare fraud is committed by falsifying a patients:-

Medical condition by expressing the severe conditions that they do not have

Treatment history by false diagnosis

If this is not discovered, this inflated diagnosis becomes part of the patients

medical history in the records of insurer.

Theft of patients finite health insurance benefits: In case of private insurance,

generally there will be a lifetime cap or a limit on the benefits of the policy.

Hence, if a false claim is raised under the patients name it would add to the limit

under the patients name which would create a problem when the patient genuinely

needs it.

Physical risk to patients: Certain fraud schemes deliberately put patients health at

risk by performing unnecessary surgeries, certain drug therapies, invasive testing

etc..,

Certificate in Health Insurance TCS Business Domain Academy

Page 11 of 21

Hence, healthcare fraud can be considered as a serious crime that impacts all the

stakeholders in the healthcare system which includes insurers, healthcare providers,

subscribers, patients, concerned government agencies and tax payers. So it is a costly

reality which the society and government cannot afford to ignore.

10.6 Fraud Management Activities

There are two ways of handling fraud, one is curative and other is preventive.

Curative: In this case, fraud is detected only after its occurrence, based on the data

collected. When any suspicious claim is raised, investigation will be called for by

providing analyst with enough information to confirm fraud and a follow up process

is initiated through some legal actions or a redress process.

Preventive: It tries to prevent fraud from happening. Hence the insurer has to

identify fraud or abuse, do necessary investigation and prevent it from happening

so that claim is not settled. It includes an early detection, investigation prevention

and sanction. After identifying fraud and successful prevention insurer can proceed

with legal actions on fraudsters in order to prevent it from happening in the future.

Based on the British National Health Cares strategy, there are six activities an insurance

company must undertake in order to successfully combat fraud, which include:-

deterrence,

prevention,

detection,

investigation,

sanction and redress, and

performance monitoring

Hence the above mentioned ways of handling fraud in accordance with the British National

Health Cares strategy can be described in the following manner:

Certificate in Health Insurance TCS Business Domain Academy

Page 12 of 21

Figure 1 British National Health Cares strategy

So the fraud management activities can be grouped into two functions. First being fraud

deterrence which tries to eliminate the reason for fraud to happen. This can be achieved by

launching necessary information that is captured through core fraud management

processes. This helps in detecting fraud and also decreasing it. Second being a continuous

activity that monitors the efficiency and effectiveness of fraud management processes.

Each of those activities is explained below.

Deterrence: Fraud deterrence deals with eliminating the reasons because of which

fraud occurs. Generally there are three reasons because of which fraud occurs:

Incentive/pressure: A persons need for money is out of reach of insurance

company and hence cannot be controlled. This depends of fraudsters

financial status and well being of the country as a whole.

Opportunity for fraud: Loop holes in the system would provoke this type of

fraud which includes inefficient control mechanisms and inadequate efforts

in fraud control. This can be controlled by employing efficient fraud

management system.

Rationale: The opinion a fraudster has got on the fraud itself. It can be

curbed by timely and efficient sanctioning of discovered fraud.

Hence, the insurance company will have to minimize the opportunity for fraud and

reduce the fraudsters rationale about committing fraud.

Certificate in Health Insurance TCS Business Domain Academy

Page 13 of 21

Prevention: Fraud can be prevented if it is detected before the damage claim is

settled. The difference between detection and prevention being that there will not

be adequate data while trying to prevent fraud. Hence an early detection of fraud is

termed as prevention.

Fraud prevention is more advantageous to the insurance company as time, efforts

and money can be saved in legal proceedings, which is not the case in detection.

Detection: Fraud detection deals with detecting,

Known types of fraud

Abuse and irregularities

Anomalies that are not directly linked to fraud

An effective fraud detection methodology takes into account certain important

characteristics:

Data: In this electronic world, data is abundant and retrieving labeled data is

difficult. Moreover most of the labeled data is legitimate than fraudulent.

Exactly defining data as fraudulent is also difficult. Confirming a fraudulent

claim is a lengthy legal procedure, most of which end by the way of

settlements. Omission error is another characteristic of fraud detection

which means data which is considered not fraudulent manually might still

actually be fraudulent, this happens when expert is not aware of such cases

of fraud.

Fraudsters: They change their tactics regularly so as to not to get detected.

At times it becomes real difficult to distinguish legitimate cases from the

fraud ones.

Organization: In order to be attractive in the market insurers constantly

innovate their products, which gives newer opportunities for fraudsters.

Without proper evidence insurers cannot accuse people of fraud because if

not proven they might lose some good customers. This is the reason at

times insurance companies let away their customers who commit smaller

fraud. Because the opportunity cost of losing a customer is higher than

letting away a fraud.

Hence a fraud detection system must employ efficient tools that adapt to dynamic

environments and detect irregularities and claims which are economically sound.

Certificate in Health Insurance TCS Business Domain Academy

Page 14 of 21

Investigation: All the suspicious claims comes into the purview of investigator who

decides whether it is fraudulent or not. Accordingly, company takes a follow up

action and gathers evidences to make the case strong.

Evidences include gathering data that is distributed across several data sources.

Few of them might not be in an electronic form. Hence it is essential to differentiate

true fraud from false alerts.

Sanction & Redress: Upon detecting any fraud it is essential to seek redress and

also create public awareness against fraud. Laws relating to healthcare fraud vary

from country to country and so do the prosecution. Accordingly insurance

companies proceed with sanctioning the fraudsters and reimbursing the losses.

Monitoring: Primary objective of any fraud management function is to minimize

losses due to fraud which can be achieved over a period of time by constantly

monitoring the counter-fraud efforts.

10.7 Key Characteristics of an Efficient Fraud Management System

In order to achieve goals set through fraud management activities there are certain

characteristics that a fraud management system should possess to be termed as efficient.

Each of them is described in detail below.

Provides efficient data for informing general public about fraud: Public must be

informed about the consequences of the fraud, the burden of which is going to be

translated to public through increased premium. Fraud deterrence can be achieved

through this.

Apart from that subscribers must be educated about the counter-fraud measures

which help in detecting and preventing all types of fraud. All the relevant

information must be stored in the fraud management system which includes case-

wise information, for instance details about fraudsters mode of operations,

statistical data of counter-fraud activity, and statistical data of the efficiency of a

fraud management system.

Certificate in Health Insurance TCS Business Domain Academy

Page 15 of 21

Employing rapid fraud detection methods: A fraud detection system which

detects fraud quickly can successfully prevent it. This can be achieved by using state

of art applications that uses efficient algorithms which yields better results.

Use adaptive and incremental methods: As fraudsters evolve in their way of

functioning, fraud detection controls must constantly update to these newer types

of fraud and fraudsters. This adaption can either be manual or automated. Based on

supervised and unsupervised methods which detects anomalies and outliers,

investigators initially can detect frauds manually and can feed the logic into the

application.

Use methods that provide explanations: Insurance companies must justify their

decisions. So for every suspicion they need to explain the rationale behind it. Hence

the applications should not only yield better results but also need to have the ability

to explain them.

Possess good reporting capabilities: Efficiency of the fraud management system

lies in its ability to generate reports that retrieves data from various sources and

communicates them properly.

This data can be utilized in fraud deterrence, where it combines all the relevant

statistical data in generating knowledge and evidence that can be used in sanction

redress activities.

Enables knowledge and information sharing: Knowledge and information when

shared in the organization increases learning and also becomes easy to train the

new recruits. Also the organization should ensure that this knowledge will not pass

out of the organization. If this sharing is through internet then proper access

controls corresponding to role are put in place.

Supports appropriate redress and escalation processes: Redress and escalation

process should be part of a fraud management system which means:

Advice on the process to choose

Advise appropriate escalation

Support the processes

Certificate in Health Insurance TCS Business Domain Academy

Page 16 of 21

A lot of constraints come into picture while choosing the right process, which

include:

type of fraud

cost of potential fraud

outcome of the prosecution

information or evidence available

other partys financial health

country specifics etc..,

The system should propose a process that generates reports with enough evidence

for the insurance company to confidently confront the fraudster.

10.8 Laws Regulating Fraud & Abuse

In USA, there are few laws that regulate fraud & abuse which are explained below.

False Claims Act: Under the False Claims Act (FCA), 31 U.S.C. 3729-3733, those

who knowingly submit, or cause another person or entity to submit, false claims for

payment of government funds are liable for three times the governments damages

plus civil penalties of $5,500 to $11,000 per false claim.

Stark Law: Self-Referral (Stark Law) Statutes, Social Security Act, 1877, pertains to

physician referrals under Medicare and Medicaid. Referrals for the provisions of

health care services, if the referring physician or an immediate family member has a

financial relationship with the entity that receives the referral, is not permitted.

Anti-Kickback Statute: Under the Anti-Kickback Statute, 41 U.S.C, it is a criminal

offense to knowingly and willfully offer, pay, solicit or receive any remuneration for

any item or service that is reimbursable by any Federal healthcare program.

Penalties many include exclusion from federal health care programs, criminal

penalties, jail and civil penalties for each violation.

Certificate in Health Insurance TCS Business Domain Academy

Page 17 of 21

HIPAA: The Health Insurance Portability and Accountability Act (HIPAA), 45 CFR,

Title II, 201-250, provides clear definition for Fraud & Abuse control programs,

establishment of criminal and civil penalties and sanctions for noncompliance.

Deficit Reduction Act: The Deficit Reduction Act (DRA), Public Law No. 109-171,

6032, passed in 2005, is designed to restrain Federal spending while maintaining the

commitment to the federal program beneficiaries. The Act requires compliance for

continued participation in the programs. The development of policies and

education relating to false claims, whistleblower protections and procedures for

detecting and preventing fraud & abuse must be implemented.

The False Claims Act Whistleblower Employee Protection Act: Under this

legislation, 31 U.S.C. 3730(h),a company is prohibited from discharging, demoting,

suspending, threatening, harassing or discriminating against any employee because

of lawful acts done by the employee on behalf of the employer or because the

employee testifies or assists in an investigation of the employer.

Certificate in Health Insurance TCS Business Domain Academy

Page 18 of 21

Summary

Around 1415 individuals and organizations are banned from federal programs for

fraud and abuse, and about 293 criminal actions & 243 civil actions were taken, as

per the report of Department of Health and Human Services, 2009

Medicare and Medicaid made an estimated $23.7 billion in improper payments in

2007. These included $10.8 billion for Medicare and $12.9 billion for Medicaid.

The 50 state Medicaid fraud control units obtained a collective 1,205 convictions,

and claimed total recoveries of more than $1.1 billion in court-ordered restitution,

fines, civil settlements, and penalties

Fraud refers to an intentional deception or misrepresentation made by a person

with the knowledge that the deception could result in some unauthorized benefit to

him/her or some other person.

Based on who is performing the fraud, healthcare fraud can be classified into:

Provider fraud

Subscriber fraud

Based on the type or nature of fraud committed it can be classified into:

Opportunistic fraud

Professional fraud

Factors hindering fraud control are:-

Insurers are considered as socially acceptable targets by population

Most of the healthcare fraud schemes are non-self-revealing

Distinction between the administrative budget & funds

Respectability of the healthcare profession

Lack of clear distinction between criminal fraud and other kinds of abuse

Fraud can have an impact on individuals which is beyond financial loss, like:-

Falsification of patients' diagnoses and/or treatment histories

Theft of patients finite health insurance benefits

Physical risk to patients

Fraud management activities are categorized into:-

Curative

Preventive

Certificate in Health Insurance TCS Business Domain Academy

Page 19 of 21

Six activities an insurance company must undertake in order to successfully combat

fraud as per the British National Health Cares strategy are:-

deterrence,

prevention,

detection,

investigation,

sanction and redress, and

performance monitoring

Fraud can occur because of incentive/pressure, opportunity for fraud, rationale

behind committing fraud

Fraud detection methodology takes into account following characteristics:-

Data corresponding to fraudulent cases

Information about fraudsters

Organization activities

Key Characteristics of an Efficient Fraud Management System are:-

Provides efficient data for informing general public about fraud

Employing rapid fraud detection methods

Use adaptive and incremental methods

Use methods that provide explanations

Possess good reporting capabilities

Enables knowledge and information sharing

Supports appropriate redress and escalation processes

Laws Regulating Fraud & Abuse (USA)

False Claims Act

Stark Law

Anti-Kickback Statute

HIPAA

Deficit Reduction Act

The False Claims Act Whistleblower Employee Protection Act

Certificate in Health Insurance TCS Business Domain Academy

Page 20 of 21

References

http://www.coburn.senate.gov/public/index.cfm?a=Files.Serve&File_id=4ad6b41c-9348-4395-

a64b-7d41a2f5d5c1

http://www.maine.gov/pfr/legislative/documents/BOI_Fraud_Report_Final_120909.pdf

tefan Furlan, Marko Bajec, Holistic Approach to Fraud Management in Health Insurance,

Journal of Information and Organizational Sciences

Susan P. Hanson, Bonnie S. Cassidy, RHIOsBuild in Healthcare Fraud Management

from the Beginning, Journal of Healthcare Information Management Vol. 20, No. 3

Fraud in insurance on rise, Survey 201011, Ernst & Young Report

David Ferguson, Fraud in Healthcare How technology supports this, SAS

A Study of Health Care Fraud and Abuse: Implications for Professionals Managing

Health Information, AHIMA Foundation, November 4, 2010

Annual Report, Office of Inspector General, U.S. Department of Health and Human Services,

FY 2007

US Senate Report on Medicare Vulnerabilities, U.S. Office of Management and Budget,

2008

Notice

The information given in this course material is merely for reference. Certain third party

terminologies or matter that maybe appearing in the course are used only for contextual

identification and explanation, without an intention to infringe.

Page 21 of 21

Вам также может понравиться

- Recognize and Report Medicaid FraudДокумент2 страницыRecognize and Report Medicaid FraudMike DeWineОценок пока нет

- FRAUD Risk Assessment TemplateДокумент10 страницFRAUD Risk Assessment TemplaterickmortyОценок пока нет

- Machine Learning Model Detects Vehicle Insurance Fraud ClaimsДокумент6 страницMachine Learning Model Detects Vehicle Insurance Fraud ClaimsRoshan VelpulaОценок пока нет

- Fraud DetectionДокумент9 страницFraud DetectionBon Carlo Medina MelocotonОценок пока нет

- Continuous Fraud DetectionДокумент23 страницыContinuous Fraud Detectionbudi.hw748Оценок пока нет

- Forensic vs Investigative Audit GuideДокумент44 страницыForensic vs Investigative Audit GuideRegsa Agstaria100% (1)

- Fraud Prevention PolicyДокумент2 страницыFraud Prevention PolicyAbhishek KumarОценок пока нет

- Fraud Detection With Active DataДокумент35 страницFraud Detection With Active DataRic Nacional100% (1)

- Internet Fraud 6monthreport 2000 AДокумент14 страницInternet Fraud 6monthreport 2000 AFlaviub23Оценок пока нет

- Managing Fraud Risks with the Fraud DiamondДокумент5 страницManaging Fraud Risks with the Fraud DiamondveranitaОценок пока нет

- Research Paper (Comparative Analysis of Global Financial Laws)Документ17 страницResearch Paper (Comparative Analysis of Global Financial Laws)Soumya SaranjiОценок пока нет

- ACFE FinTech Fraud Summit PresentationДокумент16 страницACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- College Fraud Prevention PolicyДокумент4 страницыCollege Fraud Prevention PolicyFerdinand MangaoangОценок пока нет

- Vijay Shinde: Planning Skills For Managing Business Operations & Meeting Top / Bottom-Line ObjectivesДокумент3 страницыVijay Shinde: Planning Skills For Managing Business Operations & Meeting Top / Bottom-Line Objectivesvijay shindeОценок пока нет

- Introduction, Conceptual Framework of The Study & Research DesignДокумент16 страницIntroduction, Conceptual Framework of The Study & Research DesignSтυριd・ 3尺ㄖ尺Оценок пока нет

- Ex-Logitech CFO Accused of Inflating Income Through Improper AccountingДокумент3 страницыEx-Logitech CFO Accused of Inflating Income Through Improper AccountingAgung KurniawanОценок пока нет

- Fraud Risk Document With AppendixДокумент17 страницFraud Risk Document With AppendixNathalie PadillaОценок пока нет

- Fraud IndicatorsДокумент26 страницFraud IndicatorsIena SharinaОценок пока нет

- Forensic BrochureДокумент5 страницForensic Brochuremsamala09Оценок пока нет

- Clustering Approaches For Financial Data Analysis PDFДокумент7 страницClustering Approaches For Financial Data Analysis PDFNewton LinchenОценок пока нет

- Bank FocusДокумент11 страницBank FocustempesoyОценок пока нет

- McKinsey on Advanced Analytics in Banking Combats Payments FraudДокумент9 страницMcKinsey on Advanced Analytics in Banking Combats Payments FraudchiragrawatОценок пока нет

- DP Fraud Detection HEALTHCAREДокумент8 страницDP Fraud Detection HEALTHCARErajsalgyanОценок пока нет

- Cases CH 8Документ4 страницыCases CH 8YurmaОценок пока нет

- Medicaid Disability WebinarДокумент9 страницMedicaid Disability WebinarIndiana Family to FamilyОценок пока нет

- PWC Forensic Report On MCXДокумент15 страницPWC Forensic Report On MCXdiffsoftОценок пока нет

- Forensic Accounting: An IntroductionДокумент43 страницыForensic Accounting: An Introductionkhalid1173100% (1)

- IBM Banking: Financial Crime SolutionsДокумент2 страницыIBM Banking: Financial Crime SolutionsIBMBankingОценок пока нет

- Investigate Fraud ChapterДокумент36 страницInvestigate Fraud ChapterNURUL SYAZWANI BINTI MOHD ZAUZIОценок пока нет

- US Internal Revenue Service: p4579Документ208 страницUS Internal Revenue Service: p4579IRSОценок пока нет

- Fraud Detection in Banking Using Data MiningДокумент5 страницFraud Detection in Banking Using Data MiningMeena BhagatОценок пока нет

- ACH Guides Managing Fraud RiskДокумент24 страницыACH Guides Managing Fraud RiskRafik BelkahlaОценок пока нет

- Overview & Approach Forensic Audit RLKДокумент33 страницыOverview & Approach Forensic Audit RLKDINGDINGWALAОценок пока нет

- Fraud Detection Using GraphDB - 2014Документ11 страницFraud Detection Using GraphDB - 2014Ryan AllenОценок пока нет

- Real Property Evaluations GuideДокумент6 страницReal Property Evaluations GuideIchi MendozaОценок пока нет

- Enterrprise Fraud ManagementДокумент18 страницEnterrprise Fraud ManagementrkappearОценок пока нет

- Anti Money LaundryДокумент15 страницAnti Money LaundryacanoОценок пока нет

- Chapter 17 - Occupational Fraud and Abuse - The Big Picture - Principles of Fraud Examination, 4th EditionДокумент11 страницChapter 17 - Occupational Fraud and Abuse - The Big Picture - Principles of Fraud Examination, 4th Editionscribd20014Оценок пока нет

- CMT Level 1 Exam Reading AssignmentsДокумент4 страницыCMT Level 1 Exam Reading AssignmentsForu FormeОценок пока нет

- Nextgen Risk Management: How Do Machines Make Decisions?Документ18 страницNextgen Risk Management: How Do Machines Make Decisions?FaisalОценок пока нет

- Ibm ReportДокумент7 страницIbm ReportleejolieОценок пока нет

- Building Credit Scoring ModelsДокумент11 страницBuilding Credit Scoring ModelsRnaidoo1972Оценок пока нет

- FAFP Backgroud PDFДокумент165 страницFAFP Backgroud PDFRahul KhannaОценок пока нет

- FIN 562 Class 1 Slides Winter.2017Документ56 страницFIN 562 Class 1 Slides Winter.2017Kethana SamineniОценок пока нет

- Fraud Risk Factors and Auditing Standards: An Integrated Identification of A Fraud Risk Management ModelДокумент270 страницFraud Risk Factors and Auditing Standards: An Integrated Identification of A Fraud Risk Management ModelAnupam BaliОценок пока нет

- Data Breach Reports 2015Документ33 страницыData Breach Reports 2015lovemytoolОценок пока нет

- Case Study: Equifax Data BreachДокумент2 страницыCase Study: Equifax Data BreachAleksandar HoltbyОценок пока нет

- Fraud AuditingДокумент38 страницFraud AuditingTauqeer100% (3)

- Bringing Health Care To Your Fingertips Ahead of The Curve SeriesДокумент30 страницBringing Health Care To Your Fingertips Ahead of The Curve SeriespowerforwardОценок пока нет

- Whisleblower ACFE SlidesДокумент64 страницыWhisleblower ACFE SlidesveverexОценок пока нет

- Identity Proofing Requirements 2014-10-28Документ16 страницIdentity Proofing Requirements 2014-10-28Rabindra P.SinghОценок пока нет

- Sample Size CalculatorДокумент5 страницSample Size Calculatorpriyanka0809Оценок пока нет

- Online Banking Security and Fraud Prevention in the Digital AgeДокумент5 страницOnline Banking Security and Fraud Prevention in the Digital AgeRajivОценок пока нет

- Fraud Taxonomies and ModelsДокумент14 страницFraud Taxonomies and ModelsVaibhav Banjan100% (1)

- Achieve your targets with this assessment reportДокумент19 страницAchieve your targets with this assessment reportTechnical AniketОценок пока нет

- FraudДокумент7 страницFraudnhsajibОценок пока нет

- Fair Lending Compliance: Intelligence and Implications for Credit Risk ManagementОт EverandFair Lending Compliance: Intelligence and Implications for Credit Risk ManagementОценок пока нет

- Chapter 11 - Legislations Structure and Trends Across NationsДокумент0 страницChapter 11 - Legislations Structure and Trends Across NationsJonathon CabreraОценок пока нет

- Chapter 9 - Risk ManagementДокумент0 страницChapter 9 - Risk ManagementJonathon CabreraОценок пока нет

- Chapter 8 - Managed Care PlansДокумент0 страницChapter 8 - Managed Care PlansJonathon CabreraОценок пока нет

- Chapter 6 - Health Insurance SchemesДокумент0 страницChapter 6 - Health Insurance SchemesJonathon CabreraОценок пока нет

- Chapter 4 - Health Insurance Schemes - GovernmentДокумент0 страницChapter 4 - Health Insurance Schemes - GovernmentJonathon CabreraОценок пока нет

- Chapter 7 - Health Insurance AdministrationДокумент0 страницChapter 7 - Health Insurance AdministrationJonathon CabreraОценок пока нет

- Chapter 5 - Health Insurance SchemesДокумент0 страницChapter 5 - Health Insurance SchemesJonathon CabreraОценок пока нет

- Chapter 2 - Health Insurance ConceptsДокумент0 страницChapter 2 - Health Insurance ConceptsJonathon CabreraОценок пока нет

- Chapter 3 - Health Insurance ClassificationДокумент0 страницChapter 3 - Health Insurance ClassificationJonathon CabreraОценок пока нет

- Chapter 1 Introduction To Health InsuranceДокумент0 страницChapter 1 Introduction To Health InsuranceJonathon CabreraОценок пока нет

- Cause 55780 Original PetitionДокумент45 страницCause 55780 Original PetitionTEDRAdocsОценок пока нет

- Declarations PageДокумент4 страницыDeclarations PageHansel Gabriel Pop MendezОценок пока нет

- Ai Finance 1Документ10 страницAi Finance 1Purnachandrarao SudaОценок пока нет

- How To Submit The Required Documentation: Choose An Option (Online or Fax) and Follow The StepsДокумент2 страницыHow To Submit The Required Documentation: Choose An Option (Online or Fax) and Follow The StepsDarla Hicks100% (1)

- Garcia Vs Montague - AnnulmentДокумент3 страницыGarcia Vs Montague - AnnulmentWinnie Ann Daquil LomosadОценок пока нет

- Chua-Bruce V CAДокумент6 страницChua-Bruce V CANikki Estores GonzalesОценок пока нет

- QBD Ruling on Insurance Claim for Dutch Cargo Vessel DC MerwestoneДокумент47 страницQBD Ruling on Insurance Claim for Dutch Cargo Vessel DC MerwestonemanojvarrierОценок пока нет

- Belita vs. Sy G.R. No. 191087 June 2016Документ14 страницBelita vs. Sy G.R. No. 191087 June 2016Kesca GutierrezОценок пока нет

- Zambrano Vs Phil. Carpet Mfg. G. R. No. 224099Документ10 страницZambrano Vs Phil. Carpet Mfg. G. R. No. 224099milleranОценок пока нет

- NAK Fraud ComplaintДокумент24 страницыNAK Fraud ComplaintDestiny AigbeОценок пока нет

- Tacs 5,6 Trên Máy FtuДокумент12 страницTacs 5,6 Trên Máy FtuHà Nguyễn100% (1)

- 1 s2.0 S2212567114008296 MainДокумент9 страниц1 s2.0 S2212567114008296 MainAxelle GodryckОценок пока нет

- Ayyasamy Vs Paramasivam (Arbitrability of Fraud Dispute)Документ22 страницыAyyasamy Vs Paramasivam (Arbitrability of Fraud Dispute)divyaniОценок пока нет

- 2019 Internet Crime ReportДокумент28 страниц2019 Internet Crime ReportNewsChannel 9Оценок пока нет

- 09 8 6 SCДокумент12 страниц09 8 6 SCRanger Rodz TennysonОценок пока нет

- 2 YapДокумент21 страница2 YapSellamal ServaiОценок пока нет

- Classifications and Types of Criminals and CrimesДокумент13 страницClassifications and Types of Criminals and CrimesOptimistic PashteenОценок пока нет

- MBTC Vs CabilzoДокумент2 страницыMBTC Vs CabilzoDennis JabagatОценок пока нет

- Labor Code Requirements for Union RegistrationДокумент9 страницLabor Code Requirements for Union RegistrationSamuel ValladoresОценок пока нет

- Types of Insurance Frauds and Prevention MethodsTITLEДокумент11 страницTypes of Insurance Frauds and Prevention MethodsTITLEKhushboo BalaniОценок пока нет

- Full Case - GonayonДокумент33 страницыFull Case - GonayonmgeeОценок пока нет

- Judge Fined for Approving Bail Outside JurisdictionДокумент22 страницыJudge Fined for Approving Bail Outside JurisdictionMarielle Joyce G. AristonОценок пока нет

- Carmelito A. Montano, Petitioner, VS. People of The Philippines, RespondentДокумент4 страницыCarmelito A. Montano, Petitioner, VS. People of The Philippines, RespondentOrange Zee MelineОценок пока нет

- Quilala Vs AlcantaraДокумент6 страницQuilala Vs AlcantaraMyra Mae J. DuglasОценок пока нет

- Daniele Pazi-Alvarez, A047 350 423 (BIA Dec. 12, 2016)Документ9 страницDaniele Pazi-Alvarez, A047 350 423 (BIA Dec. 12, 2016)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Indian Contact Act 1872Документ67 страницIndian Contact Act 1872Lokesh Chaudhary100% (1)

- Cooperate Governance and Fraud Management The Role of External Auditor Public Quoted Company in NigeriaДокумент81 страницаCooperate Governance and Fraud Management The Role of External Auditor Public Quoted Company in NigeriaIgbokoyi QuadriОценок пока нет

- Factors Influencing Financial Statement FraudДокумент5 страницFactors Influencing Financial Statement FraudWinda AyuОценок пока нет

- Arrest Warrant and Charge Sheet Samuel Gichuru and Chrysanthus Okemo April 2010Документ32 страницыArrest Warrant and Charge Sheet Samuel Gichuru and Chrysanthus Okemo April 2010Cyprian Nyakundi100% (1)

- Millions of Fake Accounts That Drowning and Burying Wells FargoДокумент67 страницMillions of Fake Accounts That Drowning and Burying Wells Fargothe1uploaderОценок пока нет