Академический Документы

Профессиональный Документы

Культура Документы

RBD Still Waters Rate Sheet

Загружено:

ProperjiАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

RBD Still Waters Rate Sheet

Загружено:

ProperjiАвторское право:

Price of Private Residences

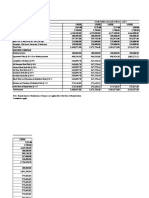

Plot Specifications Ground Floor First Floor Second Floor Balcony & Pergola Coverd Car Parking Terrace Total Area (Sq.ft.) Saleable Area (1/3 of Car Park + Terrace) Plot area (Sq. Ft.) Cost of Unit BESCOM & BWSSB Club Membership Generator Total Cost Applicable taxes extra 30'x50' 814 897 605 78 212 292 2,898 2,563 1,500 16,832,002 420,800 250,000 125,000 17,627,802 30'x55' 858 895 605 267 223 292 3,140 2,797 1,650 18,435,022 460,876 250,000 125,000 19,270,898 30'x 56'2" 905 934 648 153 267 269 3,175 2,818 1,685 18,683,001 422,696 250,000 125,000 19,480,697 30'x 60' 972 981 769 64 275 284 3,345 2,973 1,800 19,819,409 445,922 250,000 125,000 20,640,331 60'x40' 1,297 1,247 863 44 280 563 4,294 3,732 2,400 25,568,067 559,787 250,000 125,000 26,502,854

Payment Schedule

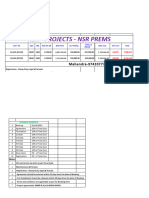

Description On Booking Letter of Confirmation On receipt of individual sanction plan On completion of Foundation On completion of first floor slab On completion of second Floor slab On completion of Terrace slab On completion of Block work On completion of plumbing & Electricals On completion of internal Plastering On completion of External Plastering On completion of flooring On completion Unit Landscape On possession Consideration

10% 10% 5% 10% 5% 5% 5% 5% 10% 5% 5% 10% 10% 5%

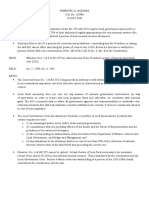

Note : Preferential Location Charges for : Green, East, North & Lake facing plots is 7% AND Corner Plots :14% Legal Charges - At the time of Registeration : Rs. 50,000/One year advance Maintenance fees- Payable on possession (Rs. 2/- per sq.ft. p.m. : thereafter as decided by the Association) One year advance Club fees- Payable on possession Initial Sinking Fund Rs.1,00,000/- Payable on possession , thereafter amount & frequency payable as decided by the Association. Property Assessment and Khata Transfer Charges Rs. 50,000/- Approx. (Dependent on government charges) Payable on possession Service Tax & VAT towards the services of Power, Sanitary, Water will be payable before possession on the actuals. VAT/Service Tax is applicable on total construction Agreement Value and proportionately payable along with Payment Schedule. KPTCL/BWSSB, Statutory Charges are tentative and as per existing norms and are to be paid on actuals at the time of possession. Stamp Duty : 5.65% / Registration : 1% ( Government Rates) - Charges to be paid on actuals at the time of possession. Stamp Duty as per government norms is payable for the Agreement for Sale & The Construction Agreement. This Cost Sheet is not a legal offering & does not confirm availability. These Prices are valid for limited Period All rates specified above are subject to change. Date : 20th June 2013

Вам также может понравиться

- Electrical & Mechanical Components World Summary: Market Values & Financials by CountryОт EverandElectrical & Mechanical Components World Summary: Market Values & Financials by CountryОценок пока нет

- 1200 PrelaunchДокумент1 страница1200 PrelaunchChirag CharlesОценок пока нет

- PP VillasДокумент3 страницыPP Villastv20692Оценок пока нет

- BSP: 26000-/ Sq. Yd.: Price List Payment Plan and Other ChargesДокумент2 страницыBSP: 26000-/ Sq. Yd.: Price List Payment Plan and Other ChargesSandeep ChoudharyОценок пока нет

- Vedic Payment PlanДокумент2 страницыVedic Payment PlanvardhmanОценок пока нет

- May-2023 SBR Minara - Cost BreakupДокумент1 страницаMay-2023 SBR Minara - Cost BreakupNishant SharmaОценок пока нет

- Price List Phase 3 - May 2023 (4850)Документ2 страницыPrice List Phase 3 - May 2023 (4850)Sumit PatelОценок пока нет

- G99 - Payment PlanДокумент1 страницаG99 - Payment Planbigdealsin14Оценок пока нет

- Cash Flow AnalysisДокумент3 страницыCash Flow Analysiscaniinvest01Оценок пока нет

- PRICE LIST (Effective 15 April 2013)Документ2 страницыPRICE LIST (Effective 15 April 2013)bigdealsin14Оценок пока нет

- Sherrard Developments ProformaДокумент4 страницыSherrard Developments ProformaBrook SherrardОценок пока нет

- Price List - The MeadowsДокумент2 страницыPrice List - The MeadowsParthiv ShahОценок пока нет

- Krrish Price ListДокумент5 страницKrrish Price ListPriyankar MathuriaОценок пока нет

- Woodview Residences: Price List-BmayДокумент1 страницаWoodview Residences: Price List-BmayleouditОценок пока нет

- Raheja Developers - Installment Payment PlanДокумент6 страницRaheja Developers - Installment Payment PlanNishit GargОценок пока нет

- Price List AkashaДокумент3 страницыPrice List AkashaNishit GargОценок пока нет

- Meaford Haven Proforma Sept 2013Документ7 страницMeaford Haven Proforma Sept 2013api-204895087Оценок пока нет

- Price ListДокумент7 страницPrice ListyahooshuvajoyОценок пока нет

- Prince Highlands: Deluxe Flat Rate at Rs. 5000 Per SQ - Ft. (No Car Park)Документ6 страницPrince Highlands: Deluxe Flat Rate at Rs. 5000 Per SQ - Ft. (No Car Park)KannanОценок пока нет

- NCC Urban Infrastructure Limited: Cost SheetДокумент1 страницаNCC Urban Infrastructure Limited: Cost SheetRaghunandan RaoОценок пока нет

- 2bhk 28.08Документ5 страниц2bhk 28.08Ashish RotheОценок пока нет

- Vardhman's Metropolis II: Price List W.E.FДокумент3 страницыVardhman's Metropolis II: Price List W.E.FUday KakkarОценок пока нет

- Positive Before Tax & Positive After Tax - Property ValuationДокумент3 страницыPositive Before Tax & Positive After Tax - Property Valuationcaniinvest01Оценок пока нет

- Badminton Carrom & Chess & Net Cricket Pitch and Club Gaming Arcade With TT, PoolДокумент3 страницыBadminton Carrom & Chess & Net Cricket Pitch and Club Gaming Arcade With TT, PoolRajatGinodiaОценок пока нет

- JuneДокумент11 страницJuneipshyОценок пока нет

- Payment PlanДокумент3 страницыPayment Planapi-201126283Оценок пока нет

- GL-57 Provisional Cost SheetДокумент2 страницыGL-57 Provisional Cost Sheetorangeideas7Оценок пока нет

- Financials - Avishkar ShelterДокумент7 страницFinancials - Avishkar ShelterGopal AgarwalОценок пока нет

- Godrej Central PricelistДокумент108 страницGodrej Central Pricelistbigdealsin14Оценок пока нет

- Annexure - A 2BHK - SMALL (B1&B2) : Crescent Lake Homes - Price Chart & Payment ScheduleДокумент3 страницыAnnexure - A 2BHK - SMALL (B1&B2) : Crescent Lake Homes - Price Chart & Payment ScheduleRam MohanОценок пока нет

- Possession. (Per SQ - FT) : Merlin Price ListДокумент9 страницPossession. (Per SQ - FT) : Merlin Price Listbigdealsin14Оценок пока нет

- Ace City Price List: Ace City. Plot No GH - 01, Sector - 01 Gr. Noida WestДокумент1 страницаAce City Price List: Ace City. Plot No GH - 01, Sector - 01 Gr. Noida Westthinkprabhakar5455Оценок пока нет

- Woodshire Price List: SQ - FT.)Документ1 страницаWoodshire Price List: SQ - FT.)bigdealsin14Оценок пока нет

- Plan - I Price List & Payment Plan W.E.F 1St July, 2015: 1176000 1380000 1740000 1980000 2340000 2820000 in 45 DaysДокумент2 страницыPlan - I Price List & Payment Plan W.E.F 1St July, 2015: 1176000 1380000 1740000 1980000 2340000 2820000 in 45 DaysJaiyansh VatsОценок пока нет

- Villa Cost Break Up: 3 BHK Independent VillasДокумент1 страницаVilla Cost Break Up: 3 BHK Independent Villasmotlakuntalakshmi771Оценок пока нет

- Tay Township User Fees and Service Charges BylawДокумент27 страницTay Township User Fees and Service Charges BylawMidland_MirrorОценок пока нет

- Nitesh Napa Valley PaymentplanДокумент1 страницаNitesh Napa Valley Paymentplanbigdealsin14Оценок пока нет

- Century Properties Miscellaneous FeesДокумент1 страницаCentury Properties Miscellaneous Feesken.duncan6961Оценок пока нет

- Aparna Elixir - Price ListДокумент1 страницаAparna Elixir - Price ListUday UddantiОценок пока нет

- PRICE LIST (Tower A/B/C/D) : Basic Sale Price (BSP) Car Park Allotment ChargesДокумент3 страницыPRICE LIST (Tower A/B/C/D) : Basic Sale Price (BSP) Car Park Allotment Chargesrajiv kukrejaОценок пока нет

- Cost Breakup - Green Bay D4 802: Details Price in RsДокумент1 страницаCost Breakup - Green Bay D4 802: Details Price in RsAvilashОценок пока нет

- Skylark Ithaca Price ListДокумент1 страницаSkylark Ithaca Price ListsunilbsОценок пока нет

- Cost Sheet Indiabulls Park CLP (IBREL)Документ15 страницCost Sheet Indiabulls Park CLP (IBREL)vikas2354_268878339Оценок пока нет

- Prems Price ListДокумент2 страницыPrems Price ListChaithu NsОценок пока нет

- Astaire Gardens BPTP BY BPTP +91 999 999 38877Документ24 страницыAstaire Gardens BPTP BY BPTP +91 999 999 38877Ayaan Khan Deal SquareОценок пока нет

- Wireless Line Summary For: 425-508-3983: Monthly Service ChargesДокумент229 страницWireless Line Summary For: 425-508-3983: Monthly Service ChargesFinally Home RescueОценок пока нет

- Skylark Ithaca Price List - Regular Payment - 3700 Per SFTДокумент7 страницSkylark Ithaca Price List - Regular Payment - 3700 Per SFTEric JohnsonОценок пока нет

- 4Документ1 страница4SonalAggarwalОценок пока нет

- Encasa BrochureДокумент12 страницEncasa Brochuremanoj_dalalОценок пока нет

- My Home Bhooja Price ListДокумент1 страницаMy Home Bhooja Price Listmuzeebur rahmanОценок пока нет

- Sagrados Price List & Payment PlanДокумент3 страницыSagrados Price List & Payment Planbigdealsin14Оценок пока нет

- Sarjapur Orchard-PRICE LIST-21.07.2023 - NewДокумент1 страницаSarjapur Orchard-PRICE LIST-21.07.2023 - NewMano3331Оценок пока нет

- Active Acres BrochureДокумент17 страницActive Acres Brochurebigdealsin14Оценок пока нет

- Finance Bill, 2013Документ52 страницыFinance Bill, 2013elinzolaОценок пока нет

- Balaji Ashirvaad Apt Price List New 01032018Документ14 страницBalaji Ashirvaad Apt Price List New 01032018Abhishek Kumar JhaОценок пока нет

- Grand Circuit Details For FunДокумент4 страницыGrand Circuit Details For Funds_6116481Оценок пока нет

- Gurgaon 21 - Price List As On 30th March 2012Документ1 страницаGurgaon 21 - Price List As On 30th March 2012rkrgupta991Оценок пока нет

- Price List - TownhomesДокумент1 страницаPrice List - Townhomesbigdealsin14Оценок пока нет

- Prince Village-Phase Ii: PRICE at Rs.4500/-Per SQ - Ft.for 1BHK (No Car Park)Документ3 страницыPrince Village-Phase Ii: PRICE at Rs.4500/-Per SQ - Ft.for 1BHK (No Car Park)Nirmal CoolОценок пока нет

- Skylark Ithaca Price List-Penthouse Regular PaymentДокумент1 страницаSkylark Ithaca Price List-Penthouse Regular PaymentProperjiОценок пока нет

- Skylark Ithaca Price List - Regular Payment - 3700 Per SFTДокумент7 страницSkylark Ithaca Price List - Regular Payment - 3700 Per SFTEric JohnsonОценок пока нет

- Skylark Ithaca Price List Penthouse UpfrontДокумент1 страницаSkylark Ithaca Price List Penthouse UpfrontProperjiОценок пока нет

- Skylark Ithaca - Price ListДокумент7 страницSkylark Ithaca - Price ListProperjiОценок пока нет

- CENTURY SARAS PricelistДокумент3 страницыCENTURY SARAS PricelistProperjiОценок пока нет

- Sobha Valley View Pre-Launch AnalysisДокумент6 страницSobha Valley View Pre-Launch AnalysisProperjiОценок пока нет

- Zambia 2013 Article Iv ConsultationДокумент86 страницZambia 2013 Article Iv ConsultationChola MukangaОценок пока нет

- LPG in IndiaДокумент14 страницLPG in Indiasangeetha_sasid2201Оценок пока нет

- Td1on Ws LP 10eДокумент6 страницTd1on Ws LP 10eonyidoeОценок пока нет

- IB Economics - Microeconomics NotesДокумент15 страницIB Economics - Microeconomics NotesMICHELLE KARTIKA HS STUDENT100% (1)

- Eschool Ela Career Development Unit 3-Module 1 Assessment - BudgetingДокумент2 страницыEschool Ela Career Development Unit 3-Module 1 Assessment - Budgetingapi-463452419Оценок пока нет

- Money SupplyДокумент27 страницMoney SupplyElsieJoyAmoraPerezОценок пока нет

- Test Bank For Introduction To International EconomicTB SampleДокумент12 страницTest Bank For Introduction To International EconomicTB SampleNishant ShrivastavaОценок пока нет

- Taxation Affecting Tourism Industry in The PhilippinesДокумент33 страницыTaxation Affecting Tourism Industry in The Philippinesrheaangelique_triasОценок пока нет

- Case Digest Pimentel Vs AguirreДокумент1 страницаCase Digest Pimentel Vs Aguirrenicole coОценок пока нет

- Effects of Credit On Economic Growth, Unemployment and PovertyДокумент13 страницEffects of Credit On Economic Growth, Unemployment and PovertyrobyОценок пока нет

- Rise of Chinese EconomyДокумент2 страницыRise of Chinese EconomySikandar HayatОценок пока нет

- Foreign Exchange Consensus Forecasts by Consensus Economics Inc.Документ36 страницForeign Exchange Consensus Forecasts by Consensus Economics Inc.Consensus EconomicsОценок пока нет

- Ketels European Clusters 2004Документ5 страницKetels European Clusters 2004gianvittorio100% (1)

- Sangakural Jan Feb 2018Документ116 страницSangakural Jan Feb 2018Arivukkadal AОценок пока нет

- Zimbabwe RBZ Dec06 PDFДокумент8 страницZimbabwe RBZ Dec06 PDFKristi DuranОценок пока нет

- Philippine IndustrializationДокумент22 страницыPhilippine IndustrializationRaziele Raneses50% (2)

- Digest in Tax CIR Vs Magsaysay LinesДокумент3 страницыDigest in Tax CIR Vs Magsaysay Linesenrique balinduaОценок пока нет

- Agony of ReformДокумент3 страницыAgony of ReformHarmon SolanteОценок пока нет

- Local Public Finance: Christine Joy S. Octobre September 7, 2017Документ22 страницыLocal Public Finance: Christine Joy S. Octobre September 7, 2017Hashim A. SaripОценок пока нет

- Introducción A La Macroeconomía - WilliamsonДокумент22 страницыIntroducción A La Macroeconomía - WilliamsonCarlos García SandovalОценок пока нет

- 3.03 TemplateДокумент3 страницы3.03 TemplateDestiny LittleОценок пока нет

- Benjamin J. Cohen, Bretton Woods SystemДокумент11 страницBenjamin J. Cohen, Bretton Woods SystemVarun Kundal67% (3)

- Lesson 2 Reviewer CONTEMPДокумент5 страницLesson 2 Reviewer CONTEMPVenus Astudillo LlabadoОценок пока нет

- SolutionsManual Ch30Документ16 страницSolutionsManual Ch30Thiba SathivelОценок пока нет

- Examiners' Report June 2013 GCE Economics 6EC04 01Документ72 страницыExaminers' Report June 2013 GCE Economics 6EC04 01RashmiJurangpathyОценок пока нет

- Common Characteristics of Developing CountriesДокумент5 страницCommon Characteristics of Developing CountriesFaisal AhmedОценок пока нет

- FIN Midterm ExamДокумент2 страницыFIN Midterm ExamCharisa SamsonОценок пока нет

- Purchasing Power ParityДокумент25 страницPurchasing Power Parityspurtbd0% (1)

- Chapter 1 QuizДокумент4 страницыChapter 1 QuizAJ SuttonОценок пока нет

- E - Portfolio Assignment MacroДокумент8 страницE - Portfolio Assignment Macroapi-316969642Оценок пока нет