Академический Документы

Профессиональный Документы

Культура Документы

2013 Tax Rates

Загружено:

api-241405153Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2013 Tax Rates

Загружено:

api-241405153Авторское право:

Доступные форматы

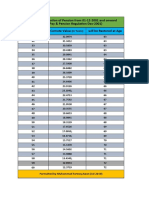

2013 Tax Rates - Single Taxpayers - Standard Deduction $6,100 10% 15% 25% 28% 33% 35% 39.

6% 0 to $8,925 $8,925 to $36,250 $36,250 to $87,850 $87,850 to $183,250 $183,250 to $398,350 $398,350 to $400,000 Over $400,000

2013 Tax Rates - Married Jointly & Surviving Spouses - Standard Deduction $12,200 10% 15% 25% 28% 33% 35% 39.6% 0 to $17,850 $17,850 to $72,500 $72,500 to $146,400 $146,400 to $223,050 $223,050 to $398,350 $398,350 to $450,000 Over $450,000

2013 Tax Rates - Married Filing Separately - Standard Deduction $6,100 10% 15% 25% 28% 33% 35% 39.6% 0 to $8,925 $8,925 to $36,250 $36,250 to $73,200 $73,200 to $111,525 $111,525 to $199,175 $199,175 to $225,000 Over $225,000

2013 Tax Rates - Head of Household - Standard Deduction $8,950 10% 15% 0 to $12,750 $12,750 to $48,600

25% 28% 33% 35% 39.6% 2013 Tax Rates - Estates & Trusts 15% 25% 28% 33% 39.6%

$48,600 to $125,450 $125,450 to $203,150 $203,150 to $398,350 $398,350 to $425,000 Over $425,000

0 to $2,450 $2,450 to $5,700 $5,700 to $8,750 $8,750 to $11,950 Over $11,950

Social Security

Social Security Tax Rate: Employers Social Security Tax Rate: Employees Social Security Tax Rate: Self-Employed Maximum Taxable Earnings Medicare Base Salary Medicare Tax Rate Additional Medicare Tax for income above $200,000 (single filers) or $250,000 (joint filers) Medicare tax on investment income ($200,000 single filers, $250,000 joint filers)

2013 Tax Rates 6.2% 6.2% 12.4% $113,700 Unlimited 1.45% 0.9%

3.8%

Miscellaneous

Personal Exemption Business expensing limit: Cap on equipment purchases Business expensing limit: New and Used Equipment and Software Prior-year safe harbor for estimated taxes of higherincome

2013 Tax Rates $3,900 $2,000,000 $500,000

110% of your 2013 tax liability

Standard mileage rate for business driving Standard mileage rate for medical/moving driving Standard mileage rate for charitable driving Child Tax Credit Unearned income maximum for children under 19 before kiddies tax applies Maximum capital gains tax rate for taxpayers in the 10% or 15% bracket Maximum capital gains tax rate for taxpayers above the 15% bracket but below the 39.6% bracket Maximum capital gains tax rate for taxpayers in the 39.6% bracket Capital gains tax rate for un-recaptured Sec. 1250 gains Capital gains tax rate on collectibles Maximum contribution for Traditional/Roth IRA

56.5 cents 24 cents 14 cents $1,000 $1,000

0%

15%

20%

25% 28% $5,500 if under age 50 $6,500 if 50 or older

Maximum employee contribution to SIMPLE IRA

$12,000 if under age 50 $14,500 if 50 or older

Maximum Contribution to SEP IRA

25% of eligible compensation up to $51,000

401(k) maximum employee contribution limit

$17,500 if under age 50 $23,000 if 50 or older

Estate tax exemption Annual Exclusion for Gifts

$5,250,000 $14,000

Education

American Opportunity Credit (Hope) Lifetime Learning Credit Student Loan Interest Deduction Coverdell Education Savings Contribution

2013 Tax Rates $2,500 $2,000 $2,500 $2,000

Standard Meal Rates for Family Child Care Providers for 2013 income tax returns

Continental U.S.

For each breakfast For each lunch or supper For each snack (up to 3 per day for each child)

2013 Tax Rates $1.27 $2.38 $0.71 2013 Tax Rates $2.03 $3.86 $1.15 2013 Tax Rates $1.48 $2.79 $0.83

Alaska

For each breakfast For each lunch or supper For each snack (up to 3 per day for each child)

Hawaii

For each breakfast For each lunch or supper For each snack (up to 3 per day for each child)

Вам также может понравиться

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОт EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОценок пока нет

- 2013 Tax Ref. Guide RateДокумент2 страницы2013 Tax Ref. Guide RateeabooksОценок пока нет

- New Hire Benefits Summary: Medical Plan OptionsДокумент3 страницыNew Hire Benefits Summary: Medical Plan OptionsRavi Prakash MayreddyОценок пока нет

- 2013 Federal Tax Amounts and LimitsДокумент2 страницы2013 Federal Tax Amounts and LimitsJane ZuckerОценок пока нет

- Your 2013 Income Taxes Have Gone UP Folks!Документ2 страницыYour 2013 Income Taxes Have Gone UP Folks!mikerogeroОценок пока нет

- ExtraTaxProblem-TY2020 Student - SUSANДокумент6 страницExtraTaxProblem-TY2020 Student - SUSANhhunter530Оценок пока нет

- 2019 Tax GuideДокумент20 страниц2019 Tax GuidetaulantzeОценок пока нет

- Formula Sheet: Income Tax Rates 2012/13Документ6 страницFormula Sheet: Income Tax Rates 2012/13scribbyscribОценок пока нет

- RG146 Pocket GuideДокумент30 страницRG146 Pocket GuideMentor RG146Оценок пока нет

- Tax Data Card 30 June 2014Документ9 страницTax Data Card 30 June 2014api-300877373Оценок пока нет

- Pam 61 eДокумент1 страницаPam 61 eNaga RajОценок пока нет

- Rideeco Savings Calculator: Locate Your Tax Bracket in The ChartДокумент1 страницаRideeco Savings Calculator: Locate Your Tax Bracket in The ChartRideECO Commuter Benefit ProgramОценок пока нет

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingДокумент4 страницыSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553Оценок пока нет

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerДокумент21 страницаTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerОценок пока нет

- An Assignment of Tax Planning On "Tax System in United States of America"Документ23 страницыAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniОценок пока нет

- 2015 Brackets & Planning Limits (Janney)Документ5 страниц2015 Brackets & Planning Limits (Janney)John CortapassoОценок пока нет

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesДокумент3 страницыTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiОценок пока нет

- 17vs18taxbracket FinalДокумент2 страницы17vs18taxbracket Finalapi-426611448Оценок пока нет

- 2013 AustralianTax Bracket CalculatorДокумент1 страница2013 AustralianTax Bracket Calculatormsimbolon32Оценок пока нет

- TABL2751 Tax Rates 2021 - UpdatedДокумент4 страницыTABL2751 Tax Rates 2021 - UpdatedPeper12345Оценок пока нет

- Budget SummaryДокумент16 страницBudget SummaryMichael FelthamОценок пока нет

- 250 WDP MveДокумент28 страниц250 WDP MveMichael Van EssenОценок пока нет

- Median Wage Policy With OED DataДокумент14 страницMedian Wage Policy With OED DataMail TribuneОценок пока нет

- TABL 2751 Tax Rates 2022Документ4 страницыTABL 2751 Tax Rates 2022Crystal CheahОценок пока нет

- Form 1040-ES 2013Документ11 страницForm 1040-ES 2013Zeeshan AliОценок пока нет

- Individual Income Tax RatesДокумент6 страницIndividual Income Tax RatesLydia Mohammad SarkawiОценок пока нет

- Wilkinskennedy-Taxrates2015 2016Документ8 страницWilkinskennedy-Taxrates2015 2016MARIEОценок пока нет

- Joint Explanatory StatementДокумент570 страницJoint Explanatory Statementacohnthehill50% (4)

- JACAM Benefit OverviewДокумент7 страницJACAM Benefit OverviewStephenDohertyОценок пока нет

- Kiwisaver CalculatorДокумент14 страницKiwisaver CalculatorazuanjjОценок пока нет

- Millers' Tax Computati: Known ParametersДокумент2 страницыMillers' Tax Computati: Known ParametersYadav_BaeОценок пока нет

- Basic Income Tax StructureДокумент69 страницBasic Income Tax StructureAditya AnandОценок пока нет

- Tax Rates, Allowances and Amounts Tax-Free Income and AllowancesДокумент4 страницыTax Rates, Allowances and Amounts Tax-Free Income and AllowancesdttquyОценок пока нет

- Calculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014Документ2 страницыCalculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014frabziОценок пока нет

- Old Vs New Tax Regime Comparative AnalysisДокумент11 страницOld Vs New Tax Regime Comparative AnalysisAkchu KadОценок пока нет

- 529credit SS1Документ1 страница529credit SS1loristurdevantОценок пока нет

- Tax Law Snapshot 2014Документ4 страницыTax Law Snapshot 2014HosameldeenSalehОценок пока нет

- Guide To Save Tax in UKДокумент8 страницGuide To Save Tax in UKCyrus KhanОценок пока нет

- G10488 EC PEP Core Reference Schedule - ENДокумент11 страницG10488 EC PEP Core Reference Schedule - ENpawand347Оценок пока нет

- What Is A 'Marginal Tax Rate'Документ2 страницыWhat Is A 'Marginal Tax Rate'Parveen SinghОценок пока нет

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Документ3 страницыTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangОценок пока нет

- F 1040 EsДокумент12 страницF 1040 EsEndu EnduroОценок пока нет

- 2007 Tax RatesДокумент3 страницы2007 Tax RatesmobiletaxboysОценок пока нет

- Incorporation For Physicians in British Columbia CanadaДокумент9 страницIncorporation For Physicians in British Columbia CanadachadОценок пока нет

- Tax Reform Acceleration and InclusionДокумент28 страницTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreОценок пока нет

- Windes 2021 Year End Year Round Tax Planning GuideДокумент20 страницWindes 2021 Year End Year Round Tax Planning GuideBrian SneeОценок пока нет

- Trump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointДокумент3 страницыTrump's Tax Plan: Income Tax Rate Income Levels For Those Filing As: 2018-2025 Single Married-JointJefri David SimanjuntakОценок пока нет

- DP03 Selected Economic Characteristics 2012 American Community Survey 1-Year EstimatesДокумент5 страницDP03 Selected Economic Characteristics 2012 American Community Survey 1-Year Estimatesapi-28460727Оценок пока нет

- Chamber Rate SheetДокумент1 страницаChamber Rate SheetBshale1Оценок пока нет

- Budget Summary 2013Документ6 страницBudget Summary 2013வெங்கடேஷ் ராமசாமிОценок пока нет

- Tax Topics: Blanche Lark ChristersonДокумент6 страницTax Topics: Blanche Lark Christersonapi-301040925Оценок пока нет

- Chapter 08 Test BankДокумент158 страницChapter 08 Test BankBrandon LeeОценок пока нет

- A Guide To 2013 Tax Changes (And More)Документ15 страницA Guide To 2013 Tax Changes (And More)Doug PotashОценок пока нет

- SeKON Employee Benefits Summary 2016Документ3 страницыSeKON Employee Benefits Summary 2016Ali HajassdolahОценок пока нет

- Iul PresentationДокумент6 страницIul Presentationapi-258221737100% (1)

- 2016 Fast Facts NyДокумент1 страница2016 Fast Facts NyAldrianОценок пока нет

- Tax Rates Ontario 2019Документ2 страницыTax Rates Ontario 2019Pratik BajajОценок пока нет

- What You Need To Know For Tax Season 2023 - ReviewДокумент34 страницыWhat You Need To Know For Tax Season 2023 - ReviewJagmohan TeamentigrityОценок пока нет

- Personal FinanceДокумент10 страницPersonal FinanceJovilyn WatinОценок пока нет

- In Re Atty Bernardo ZialcitaДокумент3 страницыIn Re Atty Bernardo ZialcitaMCОценок пока нет

- Chapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RateДокумент3 страницыChapter-3: Inter-Temporal Tax Planning Using Alternative Tax Vehicles Constant Tax RatetanvirОценок пока нет

- Water and Sewerage Act: Laws of Trinidad and TobagoДокумент116 страницWater and Sewerage Act: Laws of Trinidad and TobagokbonairОценок пока нет

- EPIC - THE EPIC PATH Book-MinДокумент29 страницEPIC - THE EPIC PATH Book-MinAhmed MohamedОценок пока нет

- School Pensions Press ConnectsДокумент58 страницSchool Pensions Press ConnectslaxdesignОценок пока нет

- Time Value of MoneyДокумент9 страницTime Value of Moneyelarabel abellareОценок пока нет

- Transfar Claim EpfoДокумент2 страницыTransfar Claim EpfoRahul SharmaОценок пока нет

- Assignment 4, Managing Personal FinanceДокумент2 страницыAssignment 4, Managing Personal FinancekckotigalaОценок пока нет

- 2011 Quebec Tax FormsДокумент4 страницы2011 Quebec Tax FormsManideep GuptaОценок пока нет

- Compensation & BenefitsДокумент9 страницCompensation & BenefitsmzakifОценок пока нет

- DOPTs Frequently Asked Questions FAQs On Compassionate Appointment 12.06.2013Документ12 страницDOPTs Frequently Asked Questions FAQs On Compassionate Appointment 12.06.2013YELLAMANDA SANKATIОценок пока нет

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 484306020280519 Assessment Year: 2019-20Документ6 страницItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 484306020280519 Assessment Year: 2019-20Ronit TiwariОценок пока нет

- Form PДокумент2 страницыForm PMarya Maaz 10BОценок пока нет

- PHBP Pension Status Form 2023Документ2 страницыPHBP Pension Status Form 2023PABLO VELEZ CEVALLOSОценок пока нет

- Career Management and Development: by Khursheed YusufДокумент42 страницыCareer Management and Development: by Khursheed YusufM.Azeem SarwarОценок пока нет

- Personal Income Tax in NigeriaДокумент118 страницPersonal Income Tax in NigeriaOsho Olumide100% (8)

- fw4v PDFДокумент2 страницыfw4v PDFAnonymous KmCLdfNShbОценок пока нет

- Restoration TableДокумент2 страницыRestoration TableMuhammad Farooq AwanОценок пока нет

- Tax CalculationДокумент6 страницTax CalculationClarencia VeronicaОценок пока нет

- BIR Ruling (DA-243-00)Документ3 страницыBIR Ruling (DA-243-00)bulasa.jefferson16Оценок пока нет

- NVS - NWDA - Pension-Supremecourt - JudgmentДокумент32 страницыNVS - NWDA - Pension-Supremecourt - JudgmentRavishankarОценок пока нет

- Metlife Information Request FormДокумент1 страницаMetlife Information Request Formbscherff222Оценок пока нет

- Armed Forces Pension Scheme 1975 Your Pension Scheme ExplainedДокумент32 страницыArmed Forces Pension Scheme 1975 Your Pension Scheme ExplainedbobОценок пока нет

- Pension FundsДокумент33 страницыPension Fundsluvisfact7616Оценок пока нет

- Act 239 Statutory and Local Authorities Pensions Act 1980Документ30 страницAct 239 Statutory and Local Authorities Pensions Act 1980Adam Haida & CoОценок пока нет

- A Project On Insurance and Pension: by KuldeepДокумент26 страницA Project On Insurance and Pension: by KuldeepdhimankuldeepОценок пока нет

- Working and Progress of Life Insurance Corporation of IndiaДокумент21 страницаWorking and Progress of Life Insurance Corporation of IndiaarcherselevatorsОценок пока нет

- 4.1 Questions On Income From SalaryДокумент4 страницы4.1 Questions On Income From SalaryAashi GuptaОценок пока нет

- Taxpack 2004: To Help You Prepare and Lodge Your Tax ReturnДокумент132 страницыTaxpack 2004: To Help You Prepare and Lodge Your Tax ReturnRanji SoulОценок пока нет

- Rockwell Land: Q2/H1 Financial StatementДокумент45 страницRockwell Land: Q2/H1 Financial StatementBusinessWorldОценок пока нет