Академический Документы

Профессиональный Документы

Культура Документы

Survey

Загружено:

Leena LalwaniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Survey

Загружено:

Leena LalwaniАвторское право:

Доступные форматы

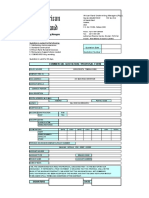

AGE

: Male Married Owned House Yes No Female Unmarried Rented House

GENDER : Marital status: You live in:

Sole Bread owner: Occupation: No. of dependants:

Annual personal income: Household income:

Life insurance

1. No of dependants occupation annual personal income household income Could you tell us all the different types of insurance you currently have? Life insurance Mortgage protection insurance Term Insurance Retirement plans Endowment Insurance Medical/Health insurance Critical illness Personal accident insurance Whole-life insurance Auto/Car insurance Money back insurance Travel insurance Unit-linked insurance All of them

2. Now, thinking of all the personal insurance policies you currently have, how much in total are you covered for death cover only? Less than Rs 50,000

Rs 50,001-100,000 Rs 100,001-300,000 Rs 300,001-500,000 Rs 500,001-750,000 Rs 750,001-10,00,000 Rs 10,00,001-15,00,000 Above Rs 15 lakh Do not know/cant recall

3. Please tell us how well do you think you are covered? Definitely not well-covered Probably well-covered May or may not be well-covered Probably not well-covered Definitely not well-covered 4. How long do you think the death cover amount will cover your family/ beneficiaries? Less than one year 11-15 years 1-3 years More than 15 years 4-7 years do not know/can't recall 8-10 years

5. Please tell us if you have any plans to get insurance? Definitely have plans to buy Probably have plans to buy May/May not have plans to buy Probably have no plans to buy Definitely have no plans to buy

6. What are the reasons why you have no plans of buying insurance? It is too expensive Insurance is not important, no reason to get it It is not necessary or worth doing It is too hard to understand/confusing I do not trust insurance companies It is too much hassle to get

It is not worth of good value Employer sponsored cover is sufficient for me Insurance is not worth investing I am well-covered by my Employer do not know All of them

Non life insurance

1. Most Important Reason to Have Insurance To protect against high medical bill To pay for everyday health care expenses 2. Feelings of Vulnerability If you had a plan that did not pay for (ITEM) but covered everything else, would you feel Vulnerable to high medical bills Well-protected by your insurance 3. Whats Important in a Health Plan Low cost Range of benefits Choice of doctors Reasons for Choosing Current Plan Cost of the plan was less than other options Plan covered wide range of benefits or a specific benefit you need You liked the choice of doctors and hospitals Plan was easy to understand and required minimal paperwork Other reason

4. Health Plan Grades 'A for Excellent B for good C for average D for poor

F for failing 5. Assessment of Current Plan My health insurance is good and I feel well protected when it comes to my familys health care needs My health insurance is adequate, but I worry that my family might have health care needs that it wont pay for My health insurance is inadequate, and I feel very worried about my familys health care needs not being paid for 6. Reason why you dont have insurance It is too expensive You dont know how to get insurance Employer offers plan, but you are not eligible because of waiting periods or part-time work Other family member has insurance, but it doesnt cover you You dont think you need insurance Cant get it due to poor health, illness, or age

Вам также может понравиться

- Male Female Married Single Own House Rented House Yes NoДокумент8 страницMale Female Married Single Own House Rented House Yes NoAbhishek JainОценок пока нет

- The New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanОт EverandThe New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanРейтинг: 4 из 5 звезд4/5 (1)

- Help Me, My Husband Had a Stroke: A Practical Guide for CaregiversОт EverandHelp Me, My Husband Had a Stroke: A Practical Guide for CaregiversОценок пока нет

- Retirement Savings and Investing for Beginners: The Easy Way to Save and Invest for Early Retirement and Financial Freedom, No Matter Your AgeОт EverandRetirement Savings and Investing for Beginners: The Easy Way to Save and Invest for Early Retirement and Financial Freedom, No Matter Your AgeОценок пока нет

- RETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysОт EverandRETIREMENT BOX SET: The Ultimate Retirement Investing Guide! Smart Investing Solutions for Stress Free Retirement DaysОценок пока нет

- RETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeОт EverandRETIREMENT: SMART INVESTING SOLUTIONS FOR THE BUDGETING MINDSET. Keeping Finance Simple while Achieving Financial Freedom and Being Debt FreeОценок пока нет

- The Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsОт EverandThe Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsОценок пока нет

- Group 2 Insurance and Mutual Fund CompanyДокумент25 страницGroup 2 Insurance and Mutual Fund CompanyShirley GarciaОценок пока нет

- Financial Retirement PlanДокумент2 страницыFinancial Retirement PlansscalОценок пока нет

- Passive Income and Aggressive Retirement: Change Your Relationship With Money. Transform Your Financial Future. Attain Freedom and Independence and Retire EarlyОт EverandPassive Income and Aggressive Retirement: Change Your Relationship With Money. Transform Your Financial Future. Attain Freedom and Independence and Retire EarlyРейтинг: 4 из 5 звезд4/5 (1)

- The 5 Years Before You Retire, Updated Edition: Retirement Planning When You Need It the MostОт EverandThe 5 Years Before You Retire, Updated Edition: Retirement Planning When You Need It the MostРейтинг: 3 из 5 звезд3/5 (1)

- Life Insurance For Above 50Документ7 страницLife Insurance For Above 50NisaОценок пока нет

- You Can Retire Early!: Everything You Need to Achieve Financial Independence When You Want ItОт EverandYou Can Retire Early!: Everything You Need to Achieve Financial Independence When You Want ItРейтинг: 3.5 из 5 звезд3.5/5 (3)

- The Relaxing Retirement Formula: For the Confidence to Liberate What You’ve Saved and Start Living the Life You've EarnedОт EverandThe Relaxing Retirement Formula: For the Confidence to Liberate What You’ve Saved and Start Living the Life You've EarnedОценок пока нет

- Social Security 101: From Medicare to Spousal Benefits, an Essential Primer on Government Retirement AidОт EverandSocial Security 101: From Medicare to Spousal Benefits, an Essential Primer on Government Retirement AidРейтинг: 3 из 5 звезд3/5 (3)

- Life Insurance: Strategy GuideДокумент25 страницLife Insurance: Strategy Guidemaddumasooriya100% (8)

- Baby Boomer Survival Guide, Second Edition: Live, Prosper, and Thrive in Your RetirementОт EverandBaby Boomer Survival Guide, Second Edition: Live, Prosper, and Thrive in Your RetirementОценок пока нет

- Questionnaire No: Date: Name: AddressДокумент3 страницыQuestionnaire No: Date: Name: Addressvasanth75abcОценок пока нет

- Preparing for Retirement Today: Dealing with the Financial and Physical IssuesОт EverandPreparing for Retirement Today: Dealing with the Financial and Physical IssuesОценок пока нет

- Healing Self-Care Primer: How to Create a Diy Self-Care Health & Healing Program.От EverandHealing Self-Care Primer: How to Create a Diy Self-Care Health & Healing Program.Оценок пока нет

- Retirement Planning For Women: ING Special ReportДокумент4 страницыRetirement Planning For Women: ING Special Reportiyer_anusha81Оценок пока нет

- Fun Things To Do In Retirement: Discover How to Combat Boredom, Spice Up Your Life, and Explore Creative and Adventurous Hobbies for an Exciting Life | More than 67 Ways to Overcome the Challenges of Monotony to Create FulfillmentОт EverandFun Things To Do In Retirement: Discover How to Combat Boredom, Spice Up Your Life, and Explore Creative and Adventurous Hobbies for an Exciting Life | More than 67 Ways to Overcome the Challenges of Monotony to Create FulfillmentОценок пока нет

- Your Policy ExplainedДокумент29 страницYour Policy ExplaineddeonptОценок пока нет

- The Personal Finance Handbook: The Only Newbie Guide You'll Need for Adulting & Personal FinanceОт EverandThe Personal Finance Handbook: The Only Newbie Guide You'll Need for Adulting & Personal FinanceОценок пока нет

- Income Investing Secrets: How to Receive Ever-Growing Dividend and Interest Checks, Safeguard Your Portfolio and Retire WealthyОт EverandIncome Investing Secrets: How to Receive Ever-Growing Dividend and Interest Checks, Safeguard Your Portfolio and Retire WealthyОценок пока нет

- Protection Planning 2013Документ28 страницProtection Planning 2013JessОценок пока нет

- Financial Planning Financial Plan Life's Financial GoalsДокумент5 страницFinancial Planning Financial Plan Life's Financial GoalspeebeeyooОценок пока нет

- Pru Life U.K.: Group SeminarДокумент14 страницPru Life U.K.: Group SeminarAda AdelineОценок пока нет

- Do I Need Life Insurance?Документ2 страницыDo I Need Life Insurance?joery clarizaОценок пока нет

- Heartbeat Platinum BrochureДокумент16 страницHeartbeat Platinum BrochureankancОценок пока нет

- A Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeОт EverandA Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeОценок пока нет

- How to Survive the Coming Retirement Storm: A Five-Step Process for Success in Volatile TimesОт EverandHow to Survive the Coming Retirement Storm: A Five-Step Process for Success in Volatile TimesОценок пока нет

- The Essential Guide To Retirement Readiness: Finances • Health & Wellness • Relationships • Life PurposeОт EverandThe Essential Guide To Retirement Readiness: Finances • Health & Wellness • Relationships • Life PurposeОценок пока нет

- How to Retire Happy, Fourth Edition: The 12 Most Important Decisions You Must Make Before You RetireОт EverandHow to Retire Happy, Fourth Edition: The 12 Most Important Decisions You Must Make Before You RetireРейтинг: 3 из 5 звезд3/5 (9)

- How to Retire Comfortably and Happy on Less Money Than the Financial Experts Say You Need: Insider Secrets to Spending Less While Living MoreОт EverandHow to Retire Comfortably and Happy on Less Money Than the Financial Experts Say You Need: Insider Secrets to Spending Less While Living MoreРейтинг: 5 из 5 звезд5/5 (1)

- Now That You're 65 - 20 Things You Need To KnowДокумент4 страницыNow That You're 65 - 20 Things You Need To KnowjacksonОценок пока нет

- Retirement Planning: The Soon-to-be Senior's Guidebook to an Enjoyable and Hassle-Free RetirementОт EverandRetirement Planning: The Soon-to-be Senior's Guidebook to an Enjoyable and Hassle-Free RetirementОценок пока нет

- Awareness of CRITICAL ILLNESS & Medical CostДокумент2 страницыAwareness of CRITICAL ILLNESS & Medical CostDante MijaresОценок пока нет

- The Seven Winning Numbers: Your path to creating wealth with certainty (leave nothing to chance)От EverandThe Seven Winning Numbers: Your path to creating wealth with certainty (leave nothing to chance)Оценок пока нет

- Profile of The RespondentsДокумент5 страницProfile of The RespondentsJM RomiasОценок пока нет

- Employee Enrollment Application: Group Size 51+ Eligible Employees - Medically UnderwrittenДокумент6 страницEmployee Enrollment Application: Group Size 51+ Eligible Employees - Medically Underwrittenmdugan5026Оценок пока нет

- The Paradigm to Financial Freedom : Discover the Secrets to Building Wealth, Retire Early, and Enjoy Life to the Fullest.От EverandThe Paradigm to Financial Freedom : Discover the Secrets to Building Wealth, Retire Early, and Enjoy Life to the Fullest.Оценок пока нет

- Everything You Always Wanted to Know About Social Security Disability LawОт EverandEverything You Always Wanted to Know About Social Security Disability LawОценок пока нет

- Comparitive Analysis of Mutual Funds and Ulips - Project ReportДокумент134 страницыComparitive Analysis of Mutual Funds and Ulips - Project Reportkamdica95% (21)

- Gagan Puri HDFC CASA ReportДокумент72 страницыGagan Puri HDFC CASA Reportgaganpuripali100% (2)

- Internship Report On UBL 2011 PDFДокумент63 страницыInternship Report On UBL 2011 PDFInamullah KhanОценок пока нет

- 10.7 Mechanical Theories of The Money SupplyДокумент7 страниц10.7 Mechanical Theories of The Money SupplyHashifaGemelliaОценок пока нет

- Euro Currency Market and Its Instruments: Presentation byДокумент21 страницаEuro Currency Market and Its Instruments: Presentation bypavan3690Оценок пока нет

- Xii Mcqs CH - 4 Change in PSRДокумент4 страницыXii Mcqs CH - 4 Change in PSRJoanna GarciaОценок пока нет

- Solution For Individual Assignment MCQ And14!29!14-31Документ5 страницSolution For Individual Assignment MCQ And14!29!14-31Sagita RajagukgukОценок пока нет

- Commercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDДокумент6 страницCommercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDezinhleОценок пока нет

- Insurance LectureДокумент4 страницыInsurance LectureDenardConwiBesaОценок пока нет

- Right of Lien by BankersДокумент13 страницRight of Lien by Bankersgeegostral chhabraОценок пока нет

- Opinio New CommissionДокумент3 страницыOpinio New CommissionAbhishek GuptaОценок пока нет

- Case Advertising AgencyДокумент3 страницыCase Advertising AgencyNicolas ErnestoОценок пока нет

- Institute and Faculty of Actuaries: Subject SA3 - General Insurance Specialist AdvancedДокумент5 страницInstitute and Faculty of Actuaries: Subject SA3 - General Insurance Specialist AdvancedbaidshryansОценок пока нет

- FINA3303 Lecture 4 Post PDFДокумент26 страницFINA3303 Lecture 4 Post PDFTsui KelvinОценок пока нет

- Bus 303 Final Assignment DoneДокумент10 страницBus 303 Final Assignment DonePorosh Uddin Ahmed TaposhОценок пока нет

- Investing in Government Securities in TanzaniaДокумент4 страницыInvesting in Government Securities in TanzaniaAnonymous FnM14a0Оценок пока нет

- Numerical On Final AccountДокумент7 страницNumerical On Final AccountVikas giri100% (1)

- Aditya Birla GroupДокумент45 страницAditya Birla GroupCalaghan EnthiadoОценок пока нет

- PCE Trial Exam 1Документ55 страницPCE Trial Exam 1Kenny Chen68% (22)

- The Following Information Relates To Questions 1-7: Components of Periodic Benefit CostДокумент6 страницThe Following Information Relates To Questions 1-7: Components of Periodic Benefit CostGHINA NURRAMDHANОценок пока нет

- Theory Base of Accounting Class 11 Notes Accountancy Chapter 2Документ6 страницTheory Base of Accounting Class 11 Notes Accountancy Chapter 2SSDLHO sevenseasОценок пока нет

- Firequote - Alma Castillo and or Rodrigo MoralesДокумент7 страницFirequote - Alma Castillo and or Rodrigo MoralesJasper SasaОценок пока нет

- National Pension System (NPS) : SR - No ParticularДокумент8 страницNational Pension System (NPS) : SR - No ParticularLalita PhegadeОценок пока нет

- FIN2014 Tutorial 2 - v2023Документ8 страницFIN2014 Tutorial 2 - v2023felicia tanОценок пока нет

- Statements 30APR23Документ9 страницStatements 30APR23Mohamed MohamedОценок пока нет

- RBI Clarification WRT Rti Query On Signing of Financials by CAsДокумент2 страницыRBI Clarification WRT Rti Query On Signing of Financials by CAsRewati PaithankarОценок пока нет

- Electronic Contribution Collection List SummaryДокумент2 страницыElectronic Contribution Collection List SummaryMark Kevin IIIОценок пока нет

- Department of Labor: 96 19484Документ5 страницDepartment of Labor: 96 19484USA_DepartmentOfLaborОценок пока нет

- Kaustav Basu: Date As On CRN Account Number Period Currency Home Branch AddressДокумент1 страницаKaustav Basu: Date As On CRN Account Number Period Currency Home Branch AddressANIL MANDIОценок пока нет

- Step 1: Analysis of The Subsidiary's Net AssetsДокумент10 страницStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitОценок пока нет