Академический Документы

Профессиональный Документы

Культура Документы

While We Wait For Housing Finance Reform Legislation - Let's Reform Housing Finance

Загружено:

JH_CarrОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

While We Wait For Housing Finance Reform Legislation - Let's Reform Housing Finance

Загружено:

JH_CarrАвторское право:

Доступные форматы

"#$%& "& "'$( )*+ ,*-.$/0 1$/'/2& 3&)*+4 5&0$.

%'($*/

65&(7. 3&)*+4 ,*-.$/0 1$/'/2&

8y

!ames P. Carr

Cn behalf of

1he CpporLunlLy Agenda

naLlonal lalr Pouslng Alllance and

1he naLlonal AssoclaLlon of 8eal LsLaLe 8rokers

november 12, 2013

AfLer Lhe collapse of Lhe houslng markeL, numerous proposals Lo resLrucLure and resLore

our damaged houslng flnance sysLem have been advanced, lncludlng many LhaL aLLempL

Lo flx glarlng weaknesses ln morLgage lendlng ln Lhe years leadlng up Lo Lhe recenL

collapse of Lhe houslng markeL. lundamenLal problems lncluded, for example, Lhe

lmpllclL federal guaranLee of home morLgages LhaL enabled prlvaLe flnanclal flrms Lo

pockeL excesslve earnlngs whlle leavlng Lhe Amerlcan Laxpayers Lo pay Lhe cosLly Lab for

Lhe ballouLs LhaL were requlred followlng Lhe crash of Lhe subprlme lendlng lndusLry.

1he ellmlnaLlon of lannle Mae and lreddle Mac ls aL Lhe core of almosL every ma[or

proposal LhaL alms aL revamplng Lhe morLgage flnance sysLem. Powever, Lhe reallLy ls

LhaL houslng flnance reform LhaL requlres Lhe wholesale replacemenL of Lhe CSLs wlll

Lake many years Lo be approved and lmplemenLed. A flve-year Llme horlzon ls a

reasonable esLlmaLe even under opLlmlsLlc esLlmaLes.

1he convenLlonal houslng markeL cannoL walL for Lhe lengLhy leglslaLlve process Lo run lLs

course. 1here are conLlnulng slgnlflcanL problems LhaL are unnecessarlly llmlLlng access

Lo homeownershlp. ConvenLlonal lendlng ls all buL closed Lo people of color, low- and

moderaLe-lncome households, and flrsL-Llme homebuyers. lndeed, more Lhan 70 percenL

of CSL acLlvlLy ls reflnanclng exlsLlng loans. Whlle reflnanclng helps famllles lower Lhelr

long-Lerm cosL of borrowlng and adds proflLs Lo Lhe boLLom llne for flnanclal flrms,

reflnanclng does noL expand homeownershlp. Lack of access Lo affordable home loans

noL only undermlnes asseL bulldlng opporLunlLles for Amerlca's famllles buL also

conLrlbuLes Lo a conLlnulng drag on Lhe u.S. economy.

Amerlcan homeowners, however, are noL aL Lhe mercy of an lncreaslngly parLlsan and

lneffecLlve leglslaLure. A revlew of Lhe prlnclpal goals for a new houslng flnance sysLem

reveals LhaL many of Lhe ma[or goals of resLrucLurlng Lhe sysLem could be achleved

Lhrough admlnlsLraLlve acLlons. Speclflcally, leglslaLlve acLlon Lo achleve Lhese alms ls noL

requlred. 1herefore, Lhere ls no reason Lo leave Lhe houslng markeL ln llmbo as we walL

Lo secure Lhe ma[or goals of a dramaLlcally lmproved home morLgage markeL. AL a

mlnlmum, admlnlsLraLlve changes LhaL can affecL slgnlflcanL change should be pursued

now as an lnLerlm sLep Loward houslng flnance reform.

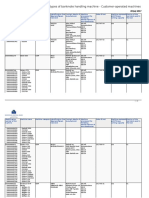

1he maLrlx below hlghllghLs Len key goals of houslng flnance reform and Lhe Lype of

acLlon-admlnlsLraLlve versus leglslaLlve--requlred Lo advance Lhese goals. 1hese key

goals draw heavlly on work pursued as parL of Lhe Pome for Cood Campalgn, a mulLl-

pronged, mulLl-year efforL launched by Lhe naLlonal AssoclaLlon of La 8aza and 1he

CpporLunlLy Agenda and [olned by a broad coallLlon of more Lhan 30 nonproflL houslng,

clvll rlghLs and research organlzaLlons lncludlng Lhe naLlonal urban League, naLlonal

CAACu, klrwan lnsLlLuLe of 1he Chlo SLaLe unlverslLy, CenLer for 8esponslble Lendlng,

unC CenLer for CommunlLy CaplLal, and Lhe naLlonal lalr Pouslng Alllance. 1he goals also

draw on recenL LesLlmony by !ulla Cordon, ulrecLor of Pouslng llnance and ollcy for Lhe

CenLer for Amerlcan rogress, before Lhe u.S. SenaLe CommlLLee for 8anklng, Pouslng

and urban Affalrs. llnally, Lhe goals reflecL key prlnclples for secondary markeL reform

LhaL were developed by Lhe naLlon's leadlng clvll rlghLs organlzaLlons.

1he key goals also demonsLraLe Lhe lmporLance and power of Lhe leadershlp aL Lhe

lederal Pouslng llnance Agency (lPlA) and ueparLmenL of Pouslng and urban

uevelopmenL, Lhe regulaLors for lannle Mae and lreddle Mac. 1hey furLher hlghllghL Lhe

facL LhaL new leadershlp ls needed aL Lhe lPlA LhaL ls focused on Lhe recovery of Lhe

home morLgage markeL and Lhe reesLabllshmenL of homeownershlp as a cornersLone of

Lhe Amerlcan uream. Maklng access Lo homeownershlp Lhe prlorlLy aL lPlA would

greaLly llfL Lhe economlc forLunes of our naLlon's famllles, communlLles, and overall

economy.

!"# %"& '()*+ ,( -./0"1" 2(3+0#4 50#)#." 6"7(89 )#: ,/" 6";308": -:90#0+,8),01" (8 <"40+*),01" -.,0(#+

%"& '()* 6";308": -:90#0+,8),01" -.,0(# 6";308": <"40+*),01" -.,0(#

1. rovlde a llquld and rellable source of credlL

for houslng ln all geographles, lncludlng urban,

suburban, and rural locaLlons, Lo all credlL-

worLhy borrowers, lncludlng low-and moderaLe

lncome famllles and famllles of color, as well as

dlverse producLs Lo accommodaLe a wlde range

of houslng Lypes, lncludlng houslng co-ops,

communlLy land LrusLs, manufacLured houslng,

senlor houslng, small renLal sLrucLures, energy

efflclenL dwelllngs, and cohouslng.

8eflne and enhance Lhe underwrlLlng crlLerla of

lannle Mae and lreddle Mac Lo more effecLlvely

serve all houslng markeLs, lncludlng lmplemenLlng

Lhe uuLy Lo Serve rule and expandlng raLher Lhan

conLracLlng Lhe houslng goals. Changes could

lnclude more accuraLe rlsk assessmenL Lools and

models for borrowers wlLh nonLradlLlonal credlL

hlsLorles as well as plloLlng new and lnnovaLlve

morLgage producLs Lo remaln abreasL of Lhe

growlng demographlc dlverslLy of Lhe Amerlcan

publlc. Also, guaranLee fees and relaLed charges

should be reexamlned Lo ensure LhaL Lhey relaLe

only Lo rlsk and are noL belng seL arblLrarlly hlgh

Lo achleve obscure and unproducLlve pollcy or

pollLlcal goals.

[none]

2. AfflrmaLlvely furLher falr houslng and equal

credlL access.

Puu and lPlA can work ln Landem Lo ensure LhaL

lannle and lreddle are effecLlvely servlng

communlLles of color and under-served groups.

CurrenLly, Lhe CSLs' markeL peneLraLlon ln Lhese

areas ls lnadequaLely low. 8oLh Puu and lPlA

have acknowledged LhaL Lhe CSLs have an

AfflrmaLlvely lurLherlng lalr Pouslng (AllP)

obllgaLlon and musL comply wlLh Lhe lalr Pouslng

AcL. Accordlngly, Lhe agencles musL perform Lhe

proper analyses Lo ensure Lhe CSLs' compllance

wlLh Lhe lalr Pouslng AcL.

[none]

3. Lnsure counLercycllcal sLablllLy for morLgage

credlL ln Llmes of economlc downLurns or

exogenous shocks LhaL cause prlvaLe caplLal Lo

wlLhdraw.

lannle Mae, lreddle Mac and Lhe lederal Pouslng

AdmlnlsLraLlon (lPA) currenLly perform a

counLercycllcal role ln morLgage flnance. 1hls role

could be enhanced lf Lhe agencles were Lo adopL

underwrlLlng and prlclng rules LhaL reflecL

performance rlsks and promoLe healLhy, safe and

sound lendlng.

[none]

4. CuaranLee LhaL Lhe rlsks lnvolved ln houslng

flnance are fully lnLernallzed wlLhln Lhe

morLgage flnance sysLem, lncludlng adequaLe

caplLal levels for prlvaLe lenders.

1o Lhe exLenL LhaL Lhe CSLs are noL already

adequaLely replenlshlng rlsk reserves, Lhe

1reasury ueparLmenL could hold some of Lhe CSL

repaymenLs Lo caplLallze Lhls reserve pool raLher

Lhan passlng all proflLs Lhrough Lo general

revenues.

[none]

3. LlmlL excesslve rlsk-Laklng (as opposed Lo

leglLlmaLe lnnovaLlon).

lPlA already has adequaLe auLhorlLy Lo ensure

Lhls goal. lurLher, Lhe recenLly enacLed Cuallfled

MorLgage 8ule (CM) adds an addlLlonal level of

safeLy. resumably, Lhe Cuallfled 8esldenLlal

MorLgage 8ule, whlch has been proposed by Lhe

regulaLors, wlll provlde addlLlonal proLecLlons.

[none]

6. Lnsure LhaL underwrlLlng and documenLaLlon

sLandards are LransparenL, clear, and

conslsLenL so LhaL consumers, lnvesLors, and

regulaLors can accuraLely assess and prlce rlsk

and regulaLors can hold lnsLlLuLlons

accounLable.

1he Cl8, lPlA, lederal 8eserve 8oard, CCC,

Puu, nCuA and Lhe lulC already have adequaLe

and approprlaLe auLhorlLy Lo proLecL consumer,

lnvesLor and lender lnLeresLs. 1he lPlA and Puu

could work wlLh all of Lhese agencles Lo furLher

enhance consumer proLecLlons and provlde useful

daLa and lnformaLlon for lmproved publlc

assessmenL.

[none]

7. Lmploy more sophlsLlcaLed measures of

credlL rlsk approprlaLe Lo varlous underserved

borrower groups and lnvesL ln and share

publlcly daLa and lnformaLlon on Lhe effecLlve

reach of loan producLs by borrower and

communlLy demographlc characLerlsLlcs.

lPlA ls already parLnerlng wlLh Lhe Cl8 on Lhe

naLlonal MorLgage uaLabase, whlch wlll enable

reachlng Lhls goal. lPlA and Puu could also work

Lo achleve a more robusL dlsclosure of CSL plans

and performance daLa as well as enhanced PMuA

updaLes. lnformaLlon should be made wldely

avallable Lo Lhe publlc ln language LhaL ls easy Lo

undersLand and ln a formaL LhaL empowers

nonproflLs, clvlc organlzaLlons and local agencles

Lo beLLer undersLand lendlng paLLerns ln Lhelr

communlLles.

[none]

8. LsLabllsh and enforce servlclng rules LhaL

balance Lhe flnanclal lnLeresLs of lnvesLors wlLh

Lhose of borrowers and LhaL guaranLees

conslsLenL and hlgh quallLy servlclng

performance across lnsLlLuLlons.

lPlA has already esLabllshed hlgh servlclng

sLandards for companles LhaL work wlLh Lhe CSLs.

lPlA should work wlLh Lhe Cl8 Lo furLher

LlghLen Lhose sLandards Lo more effecLlvely

balance consumer and lnvesLor lnLeresLs Lo

promoLe home reLenLlon, avold unnecessary

foreclosures and ensure proper malnLenance of

vacanL and abandoned properLles.

[none]

9. CaplLallze Lhe naLlonal Pouslng 1rusL lund

and CaplLal MagneL lund as requlred by

sLaLuLe.

lPlA ls already requlred Lo fund, and should be

conLrlbuLlng Lo, boLh programs, buL uses Lhe

conLlnulng conservaLorshlp sLaLus of Lhe CSLs as

Lhe [usLlflcaLlon Lo avold dolng so.

[none]

10. SupporL affordable renLal houslng, lncludlng

LesLlng new flnanclal producLs for renLal as well

as renL-Lo-own and shared equlLy

homeownershlp. Also promoLe comprehenslve

houslng rehablllLaLlon and developmenL,

parLlcularly Lo leverage foreclosed and vacanL

and abandoned properLles Lo creaLe affordable

owner-occupled and renLal houslng for Lhe

beneflL of moderaLe and lower-lncome famllles

and communlLles.

1he CSLs already have sLrong and very successful

mulLlfamlly flnance programs, and Lhe lPlA can

easlly permlL furLher lnnovaLlon and expanslon.

lPlA currenLly has Lhe auLhorlLy Lo work ln all of

Lhese areas buL has noL yeL exerclsed LhaL

auLhorlLy Lo lmprove homeownershlp and houslng

opporLunlLles for low and moderaLe lncome

households.

[none]

All 10 of Lhese goals can be lmplemenLed now and no furLher Llme should be delayed ln

achlevlng Lhem. Moreover, whlle mosL of Lhese goals are achlevable, Lhey wlll noL necessarlly be

easy Lo accompllsh. Achlevlng a greaLer level of affordable and susLalnable lendlng, for example,

would requlre Lhe CSLs Lo work closely wlLh lenders Lo address lssues such as credlL overlays and

lender concerns abouL buybacks under reps and warranLs. lL would requlre assurances of Lhe

CSLs Lo work wlLh lenders Lo expand Lhe markeLs ln a safe, sound, and proflLable manner. 8uL

agaln, a lack of slmpllclLy should noL be reason Lo fall Lo acL.

llnally, Lhls paper ls noL lnLended Lo suggesL LhaL more slgnlflcanL leglslaLlve changes should noL

be pursued. ln facL, Lhls proposal Lo acL admlnlsLraLlvely assumes Lhe conLlnulng conservaLorshlp

sLaLus for lannle Mae and lreddle Mac. 1haL sLaLus ls, however, noL a preferred long-Lerm

soluLlon and should be addressed ln some fashlon as soon as posslble.

"#$%& &'( )%&'$*+

!lm Carr ls a houslng flnance, banklng and urban pollcy consulLanL. Pe ls also a Senlor lellow

wlLh Lhe CenLer for Amerlcan rogress and ulsLlngulshed Scholar wlLh 1he CpporLunlLy Agenda.

revlously, he served as Chlef 8uslness Cfflcer for Lhe naLlonal CommunlLy 8elnvesLmenL

CoallLlon and as Senlor vlce resldenL for llnanclal lnnovaLlon, lannlng and 8esearch for Lhe

lannle Mae loundaLlon.

"#$%& &'( ,-$.,$*,+

1he CpporLunlLy Agenda launched ln 2006 wlLh Lhe mlsslon of bulldlng Lhe naLlonal wlll Lo

expand opporLunlLy ln Amerlca. locused on movlng hearLs, mlnds, and pollcy over Llme, Lhe

organlzaLlon works wlLh soclal [usLlce groups, leaders, and movemenLs Lo advance soluLlons LhaL

expand opporLunlLy for everyone.

1he naLlonal lalr Pouslng Alllance (www.naLlonalfalrhouslng.org) was founded ln 1988, Lhe

naLlonal lalr Pouslng Alllance ls a consorLlum of more Lhan 220 prlvaLe, non-proflL falr houslng

organlzaLlons, sLaLe and local clvll rlghLs agencles, and lndlvlduals from LhroughouL Lhe unlLed

SLaLes. PeadquarLered ln WashlngLon, u.C., nlPA, Lhrough comprehenslve educaLlon, advocacy

and enforcemenL programs, provldes equal access Lo aparLmenLs, houses, morLgage loans and

lnsurance pollcles for all resldenLs of Lhe naLlon.

1he naLlonal AssoclaLlon of 8eal LsLaLe 8rokers (nA8L8) was formed ln 1947 by Afrlcan-

Amerlcan real esLaLe professlonals ouL of a need Lo secure Lhe rlghL Lo equal houslng

opporLunlLles, regardless of race, creed, or color. lor more Lhan 63 years, nA8L8 has

parLlclpaLed ln meanlngful legal challenges and has supporLed leglslaLlve lnlLlaLlves LhaL ensure

Lhe avallablllLy of falr and affordable houslng for all Amerlcans.

Вам также может понравиться

- GPES Final Essay v4Документ9 страницGPES Final Essay v4zeefactorОценок пока нет

- Hindi EssaysДокумент5 страницHindi EssaysIona DsouzaОценок пока нет

- EPA Draft Climate Adaptation Implementation Plan PDFДокумент46 страницEPA Draft Climate Adaptation Implementation Plan PDFBob BerwynОценок пока нет

- Mobile RemittancesДокумент33 страницыMobile RemittancesWill SinkОценок пока нет

- Sanders DavidsonДокумент6 страницSanders Davidsonsss1453Оценок пока нет

- Medicaid Reform Advisory Group CommentsДокумент14 страницMedicaid Reform Advisory Group CommentsCarolinaMercuryОценок пока нет

- Budgeting For Change and Jobs: 24 February 2014Документ40 страницBudgeting For Change and Jobs: 24 February 2014api-26287609Оценок пока нет

- W03h2plan GuanunamarkДокумент16 страницW03h2plan Guanunamarkapi-242801321Оценок пока нет

- Steeple AnalysisДокумент6 страницSteeple AnalysisAbdul Basit KhawajaОценок пока нет

- Dea TrasnslitДокумент4 страницыDea TrasnslitYvci Lhokseumawe ChapterОценок пока нет

- About R.P. Reid ConsultingДокумент7 страницAbout R.P. Reid ConsultingrpreidОценок пока нет

- Loyalty Is Dead. Long Live EngagementДокумент5 страницLoyalty Is Dead. Long Live EngagementThe Chief Customer Officer CouncilОценок пока нет

- 7001Документ20 страниц7001Prateek Singhvi100% (1)

- Gilmore Kean Makes Remarkable Progress in Turning Around the Housing Authority of New OrleansДокумент260 страницGilmore Kean Makes Remarkable Progress in Turning Around the Housing Authority of New OrleansDevraj ChoudhariОценок пока нет

- Verizon - Economic LandscapeДокумент8 страницVerizon - Economic LandscapevickymagginasОценок пока нет

- Asma Baji-Research TeamДокумент6 страницAsma Baji-Research TeamRehan YousafОценок пока нет

- Strategic Analysis of WRSX Group - The WritePass JournalДокумент9 страницStrategic Analysis of WRSX Group - The WritePass JournalBeeBie Samita KhОценок пока нет

- Chief Executive OfficerДокумент10 страницChief Executive Officermayank_pceОценок пока нет

- 3ksha: Shiksha - Deeksha - SamikshaДокумент10 страниц3ksha: Shiksha - Deeksha - SamikshatrikshaaОценок пока нет

- Prairie Sun Point-By-point Critique of City EvaluationДокумент5 страницPrairie Sun Point-By-point Critique of City EvaluationdmronlineОценок пока нет

- October Issue - Event MarketingДокумент7 страницOctober Issue - Event MarketingSilenzio UnoОценок пока нет

- 2014-06-25 FY15 Schedule C Template - Final (MMV NYCCouncil Slush Funds Report)Документ414 страниц2014-06-25 FY15 Schedule C Template - Final (MMV NYCCouncil Slush Funds Report)ConnaissableОценок пока нет

- The Tweet Heard 'Round The WorldДокумент4 страницыThe Tweet Heard 'Round The WorldThe Chief Customer Officer CouncilОценок пока нет

- Assess The SceneДокумент4 страницыAssess The SceneThe Chief Customer Officer CouncilОценок пока нет

- VALUEx Vail 2014 - Visa PresentationДокумент19 страницVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- International Entrepreneurship OpportunitiesДокумент19 страницInternational Entrepreneurship OpportunitiesRaul Suvera100% (1)

- Using Data To Prove Your ValueДокумент4 страницыUsing Data To Prove Your ValueThe Chief Customer Officer CouncilОценок пока нет

- Manage Operation PlanДокумент24 страницыManage Operation Plandamanrana100% (2)

- Introduction To Results ManagementДокумент47 страницIntroduction To Results ManagementamadouissakaОценок пока нет

- Business LicensingДокумент31 страницаBusiness LicensingAPPROCenterОценок пока нет

- Regional Scout Plan 2013-2016Документ30 страницRegional Scout Plan 2013-2016EuroScoutInfoОценок пока нет

- ROI Marketing DocumentДокумент17 страницROI Marketing Documentaprison_irsyamОценок пока нет

- Bikeshare Hawaii Exec. Director Job Description - April 2014Документ3 страницыBikeshare Hawaii Exec. Director Job Description - April 2014Andy PalanisamyОценок пока нет

- Case 1 - Strategic Competitive BiddingДокумент5 страницCase 1 - Strategic Competitive Biddingdso1Оценок пока нет

- SH Wet AДокумент5 страницSH Wet ANimidha BumbОценок пока нет

- ContentsДокумент16 страницContentsjisha1808Оценок пока нет

- Chancellor Michael Harris Leads Economic Impact Study of IU Kokomo, regional TrAansformation through Triple Helix, פרופסור וצ'נסלור מייקל הריסДокумент16 страницChancellor Michael Harris Leads Economic Impact Study of IU Kokomo, regional TrAansformation through Triple Helix, פרופסור וצ'נסלור מייקל הריסMichael Harris IU KokomoОценок пока нет

- Project Management Term Paper 2-28-11Документ9 страницProject Management Term Paper 2-28-11ecorrymatthewsОценок пока нет

- Dos and Don'ts of Crowdfunding For DevelopmentДокумент5 страницDos and Don'ts of Crowdfunding For DevelopmentUNDP in Europe and Central AsiaОценок пока нет

- Busting 7 Myths About Master Data Management: Knowledge Integrity IncorporatedДокумент13 страницBusting 7 Myths About Master Data Management: Knowledge Integrity IncorporatedAry AntoniettoОценок пока нет

- WSU Report FinalДокумент22 страницыWSU Report FinalMassLiveОценок пока нет

- Accelerating PPP in IndiaДокумент48 страницAccelerating PPP in IndiagatewayglobalОценок пока нет

- Beacon Economics Report: Understanding The Potential Economic Impacts of Local Air Quality Regulations On The City of Richmond, CAДокумент17 страницBeacon Economics Report: Understanding The Potential Economic Impacts of Local Air Quality Regulations On The City of Richmond, CACVX_Richmond_RenewalОценок пока нет

- Analysis of Thought Works Inc & Communispace Case StudiesДокумент10 страницAnalysis of Thought Works Inc & Communispace Case StudiesGaurav NigamОценок пока нет

- Employment Opportunity - February 2014Документ2 страницыEmployment Opportunity - February 2014zainul_mzige21Оценок пока нет

- FI2020 Roadmap PrinciplesДокумент2 страницыFI2020 Roadmap PrinciplesCenter for Financial Inclusion100% (1)

- Ending OverlendingДокумент46 страницEnding OverlendingChris LeОценок пока нет

- Strategic Project ManagementДокумент13 страницStrategic Project Managementayeshaacademicuk20Оценок пока нет

- Microsoft Word - PRDE Flex 13 - 0910 Final SubmissionДокумент178 страницMicrosoft Word - PRDE Flex 13 - 0910 Final SubmissionCarmen GreeneОценок пока нет

- Values That Drive Us: Uplifting Lives, Powering ProgressДокумент45 страницValues That Drive Us: Uplifting Lives, Powering ProgressTABAH RIZKIОценок пока нет

- Ib ProjjectДокумент23 страницыIb ProjjectRaja AdilОценок пока нет

- DisarmingTheGreens Libertiamo Palm Oil ReportДокумент11 страницDisarmingTheGreens Libertiamo Palm Oil Reportlamosy78Оценок пока нет

- ILaunch Position DescriptionДокумент1 страницаILaunch Position DescriptionhawaiisurrfferОценок пока нет

- Project Blue Assessing The Future Trends For Financial ServicesДокумент24 страницыProject Blue Assessing The Future Trends For Financial ServicessanjivsingОценок пока нет

- M&E in AdvocacyДокумент29 страницM&E in AdvocacyNiamh de BarraОценок пока нет

- Supply Chain Finance Solutions: Relevance - Propositions - Market ValueОт EverandSupply Chain Finance Solutions: Relevance - Propositions - Market ValueОценок пока нет

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesОт EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesОценок пока нет

- The Lean Six Sigma Guide to Doing More With Less: Cut Costs, Reduce Waste, and Lower Your OverheadОт EverandThe Lean Six Sigma Guide to Doing More With Less: Cut Costs, Reduce Waste, and Lower Your OverheadРейтинг: 4.5 из 5 звезд4.5/5 (10)

- The Past and Future of Fannie Mae and Freddie Mac and Future of HomeownerhipДокумент11 страницThe Past and Future of Fannie Mae and Freddie Mac and Future of HomeownerhipJH_CarrОценок пока нет

- The Impacts of Housing Finance Reform On Borrowers and Communities of ColorДокумент15 страницThe Impacts of Housing Finance Reform On Borrowers and Communities of ColorJH_CarrОценок пока нет

- AEO - Microbusinesses in The United States: Characteristics and Sector Participation - TablesДокумент8 страницAEO - Microbusinesses in The United States: Characteristics and Sector Participation - TablesJH_CarrОценок пока нет

- Hensarling Bill Moves Further Away From Housing Finance ReformДокумент3 страницыHensarling Bill Moves Further Away From Housing Finance ReformJH_CarrОценок пока нет

- The Great (Fake) DebateДокумент3 страницыThe Great (Fake) DebateJH_CarrОценок пока нет

- Microbusinesses in The United States: Characteristics and Sector Participation - Power PointДокумент29 страницMicrobusinesses in The United States: Characteristics and Sector Participation - Power PointJH_CarrОценок пока нет

- Microbusinesses in The US: Characteristics and Sector ParticipationДокумент90 страницMicrobusinesses in The US: Characteristics and Sector ParticipationJH_CarrОценок пока нет

- Fifty Years After The March On Washington, Equality Remains A DreamДокумент2 страницыFifty Years After The March On Washington, Equality Remains A DreamJH_CarrОценок пока нет

- Microbusinesses in Georgia - Characteristics and Economic ImpactДокумент60 страницMicrobusinesses in Georgia - Characteristics and Economic ImpactJH_CarrОценок пока нет

- The Challenges To Homeownership in AmericaДокумент8 страницThe Challenges To Homeownership in AmericaJH_CarrОценок пока нет

- FHA's Delicate Balancing ActДокумент5 страницFHA's Delicate Balancing ActJH_CarrОценок пока нет

- Rethinking The Federal Housing AdministrationДокумент8 страницRethinking The Federal Housing AdministrationJH_CarrОценок пока нет

- Disturbing But Not Surprising: Biased Treatment in Bankruptcy ProtectionДокумент2 страницыDisturbing But Not Surprising: Biased Treatment in Bankruptcy ProtectionJH_CarrОценок пока нет

- A Stimulus For The Middle ClassДокумент3 страницыA Stimulus For The Middle ClassJH_CarrОценок пока нет

- Spending Cut. Now, GOP, Where Are The Jobs?Документ3 страницыSpending Cut. Now, GOP, Where Are The Jobs?JH_CarrОценок пока нет

- Taking The Bull by The HornsДокумент10 страницTaking The Bull by The HornsJH_CarrОценок пока нет

- A Bolder Vision For The Secondary Mortgage MarketДокумент5 страницA Bolder Vision For The Secondary Mortgage MarketJH_CarrОценок пока нет

- Lessons Offered But Not Learned by The Financial CrisisДокумент7 страницLessons Offered But Not Learned by The Financial CrisisJH_CarrОценок пока нет

- Analyzing Determinants of Foreclosure of Middle-Income Borrowers of Color in The Atlanta, GA Metropolitan AreaДокумент36 страницAnalyzing Determinants of Foreclosure of Middle-Income Borrowers of Color in The Atlanta, GA Metropolitan AreaJH_CarrОценок пока нет

- Analyzing Foreclosures Among High-Income Black/African American and Hispanic/Latino Borrowers in Prince George's County, MarylandДокумент29 страницAnalyzing Foreclosures Among High-Income Black/African American and Hispanic/Latino Borrowers in Prince George's County, MarylandJH_CarrОценок пока нет

- Five Realities of The Foreclosure CrisisДокумент24 страницыFive Realities of The Foreclosure CrisisJH_CarrОценок пока нет

- Principal Reduction: A Lifeline For Underwater HomeownersДокумент3 страницыPrincipal Reduction: A Lifeline For Underwater HomeownersJH_CarrОценок пока нет

- Reform That Hurts HomebuyersДокумент3 страницыReform That Hurts HomebuyersJH_CarrОценок пока нет

- Reconsidering U.S. Housing PolicyДокумент28 страницReconsidering U.S. Housing PolicyJH_CarrОценок пока нет

- Rebuilding Communities in Economic Distress: Local Strategies To Sustain Homeownership, Reclaim Vacant Properties, and Promote Community-Based EmploymentДокумент50 страницRebuilding Communities in Economic Distress: Local Strategies To Sustain Homeownership, Reclaim Vacant Properties, and Promote Community-Based EmploymentJH_CarrОценок пока нет

- State of Housing in Black AmericaДокумент58 страницState of Housing in Black AmericaJH_CarrОценок пока нет

- Long-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorДокумент49 страницLong-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorJH_CarrОценок пока нет

- The Next America - Minorities in The Housing MarketДокумент3 страницыThe Next America - Minorities in The Housing MarketJH_CarrОценок пока нет

- FHAs Delicate Balancing ActДокумент4 страницыFHAs Delicate Balancing ActJH_CarrОценок пока нет

- Remittance Application FormДокумент2 страницыRemittance Application FormasifwtОценок пока нет

- Rep. Lesser July 10 SEEC FilingДокумент231 страницаRep. Lesser July 10 SEEC FilingCassandra DayОценок пока нет

- Your Personal Chequing Account StatementДокумент1 страницаYour Personal Chequing Account StatementbeshoyОценок пока нет

- Q.33. What Are The Guidelines For Delayed Payment of Dues To The MSE Borrowers - Ministry of Micro, Small & Medium EnterprisesДокумент1 страницаQ.33. What Are The Guidelines For Delayed Payment of Dues To The MSE Borrowers - Ministry of Micro, Small & Medium Enterprisesgrandhi mithileshОценок пока нет

- Multiple Choice Questions 1 Which of The Following Combinations CorrectlyДокумент1 страницаMultiple Choice Questions 1 Which of The Following Combinations CorrectlyLet's Talk With HassanОценок пока нет

- Studio Renovations: Barbados Community College Division of Fine Arts - Music MathsДокумент10 страницStudio Renovations: Barbados Community College Division of Fine Arts - Music MathsShanice JohnОценок пока нет

- What Is The Mandrake MechanismДокумент16 страницWhat Is The Mandrake Mechanismcanauzzie100% (1)

- 2023 02 23 12 53 21dec 22 - 410501Документ5 страниц2023 02 23 12 53 21dec 22 - 410501bibhuti bhusan routОценок пока нет

- Bahl - Ib Cad Procedural Manual - Final 2018Документ100 страницBahl - Ib Cad Procedural Manual - Final 2018Mehwish ShahzadОценок пока нет

- RECEIPT FOR PLOTДокумент8 страницRECEIPT FOR PLOTAsim Namat AliОценок пока нет

- Bar Exam Review of Negotiable Instruments LawДокумент20 страницBar Exam Review of Negotiable Instruments LawCyrus77% (13)

- CRR, SLR: Dr.S.C.BihariДокумент16 страницCRR, SLR: Dr.S.C.BihariAbhi2636100% (1)

- Mortgage Lab Signature AssignmentДокумент3 страницыMortgage Lab Signature Assignmentapi-518277133Оценок пока нет

- Onboarding Direct Deposit Enrollment Form: The Halal Shack Thanusha DantuluriДокумент1 страницаOnboarding Direct Deposit Enrollment Form: The Halal Shack Thanusha DantuluriThanushaОценок пока нет

- mBridge Phase 3 expands CBDC collaborationДокумент72 страницыmBridge Phase 3 expands CBDC collaborationTyxon0% (1)

- Journal Entries MCQs - PRC-04 AccountingДокумент4 страницыJournal Entries MCQs - PRC-04 AccountingGideon TurnerОценок пока нет

- C B T P C B B: Tamford Niversity Anglades HДокумент75 страницC B T P C B B: Tamford Niversity Anglades HMarinela DaumarОценок пока нет

- IntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFДокумент9 страницIntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFAndrea Nicole BanzonОценок пока нет

- Questions For Financial Functions in ExcelДокумент20 страницQuestions For Financial Functions in ExcelTarunSainiОценок пока нет

- Module II: Credit Operations: Chapter 1 (A) : Retail Lending - Home LoansДокумент22 страницыModule II: Credit Operations: Chapter 1 (A) : Retail Lending - Home LoansMikeОценок пока нет

- 91906003-Foreign Exchange Operations & Performance Analysis of Islami Banks in BangladeshДокумент39 страниц91906003-Foreign Exchange Operations & Performance Analysis of Islami Banks in BangladeshHumaira TahsinОценок пока нет

- 2015fin MS130Документ3 страницы2015fin MS130Balu Mahendra SusarlaОценок пока нет

- Internship Report Askari BankДокумент107 страницInternship Report Askari Bankafgan52Оценок пока нет

- Chapter 4: Financial IntermediationДокумент15 страницChapter 4: Financial IntermediationJhermaine SantiagoОценок пока нет

- A Study On RDCC BankДокумент94 страницыA Study On RDCC BankBettappa patil33% (3)

- Chapter 3: Calculating Mortgage ReturnsДокумент14 страницChapter 3: Calculating Mortgage Returnsbaorunchen100% (1)

- Customer Operated Machines 2017-07-28.enДокумент41 страницаCustomer Operated Machines 2017-07-28.endiscovery_saОценок пока нет

- UBL Internship Report 2016Документ52 страницыUBL Internship Report 2016SARDAR WAQAR HASSANОценок пока нет

- What is the Truth in Lending Act? (TILAДокумент9 страницWhat is the Truth in Lending Act? (TILARenee FisherОценок пока нет

- Find Simple and Compound Interest Rates for Business InvestmentsДокумент1 страницаFind Simple and Compound Interest Rates for Business InvestmentsBear GummyОценок пока нет