Академический Документы

Профессиональный Документы

Культура Документы

KPMG India Report Paints Bleak Power Scenario

Загружено:

laloo01Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

KPMG India Report Paints Bleak Power Scenario

Загружено:

laloo01Авторское право:

Доступные форматы

KPMG India report paints bleak power scenario, but bankers optimistic

Most private plants are operating at 60% of capacity due to non-availability of fuel, says KPMG India report

Anup Roy & | Makarand Gadgil

Nearly 33,000MW of projects set to come up by March 2017 dont have any long-term power purchase agreements with state distribution utilities because of which they can also become non-performing assets. Photo: Harikrishna Katragadda/Mint Mumbai: A shortage of fuel has stranded more than 33,000 megawatts (MW) of power generation in India, and if the situation does not improve fast, Indian banks could be staring at a bad debt of more than Rs.1 trillion, according to a white paper by a global consulting firm, even as bankers said things have improved substantially in the sector and bad debts are not likely to deteriorate in the near future. Bad debt as a percentage of total advances in the power sector stands at 0.57%, according to Reserve Bank of India (RBI) data. However, including restructured advances, the ratio is 19.40% at the end of fiscal ended March against 13.30% a year ago. It was as low as 4.11% in the fiscal to March 2011. This includes advances to state electricity distribution companies (discoms), which together accounted for Rs.1.9 trillion of restructured advances. A big concern today is a lack of financing available for new projects, said the report by KPMG India, titled Recharging the Power Sector. The 13th Five-Year Plan requires Rs.1.27 trillion of private sector equity and the project pipeline looks weak, the report said.

A bank chairman with a big public sector bank contested the claim. The amount of pending projects are huge and drawdowns have not happened against them. There is actually no need immediately to draw a fresh power project but it will be good if the government just pushes the pending projects faster, said the banker who did not want to be named. Once the existing projects fire up, the power scene in the country will change rapidly. Government banks have been financing these projects and will continue to do so if the projects turn viable again. There are stranded power assets and at the same time in many regions consumers are facing power shortages, the KPMG India report said, adding the distribution sector financial losses stood at Rs.67,000 crore in fiscal 2012, while bank exposure to discoms in the form of short-term loans stands at Rs.1.9 trillion. The debt to equity ratio of private power generation firms shot up to 2.64 in fiscal 2013 from 0.91 in fiscal 1995. The cost of power deficit in the form of additional cost of diesel back-up generation is Rs. 43,800 crore a year. Commissioned but stranded power capacity stands at more than 33GW (due to lack of coal and gas) which will result in non-performing assets (NPAs) with investments of over Rs.1 trillion, the report said. 1GW, or gigawatts, is equivalent to 1,000MW. The Electricity Act of 2003 opened up the power generation sector to private firms. It allowed companies with funds, land, fuel and environmental clearances to set up plants anywhere in the country. Since 2003, according to Planning Commission data, private sector firms added around 24,000MW capacity. However, today these private sector companies are facing twofold challengesavailability of fuel and lack of demand from distribution utilities, which are still mostly controlled by the state governments. Most of these plants are operating only at 60% of their capacity due to non-availability of fuel, both coal and gas, according to the KPMG India report. Besides this, nearly 33,000MW of projects which are to come up by March 2017 dont have any long-term power purchase agreements with state distribution utilities because of which they can also become NPAs. These generators dont have bankable agreements because the procurement process of state distribution utilities is extremely slow. Bankers and power sector analysts do not see the situation as dire as painted by the consulting firm. Most of the problems of power sector are because of over enthusiasm of the private sector players to anyhow bag the contracts for supply of power from distribution utilities, said V.P. Raja, former chairman of Maharashtra Electricity Regulatory Commission. In an attempt to quote lowest tariff to get the contract, they did not bother to double-check whether fuel is really available and at what price. Power projects are being cleared fast by the cabinet committee on investments and things are looking up, according to S.L. Bansal, chairman of Oriental Bank of Commerce. There could be delay in revenue generation, but in a power-deficit country like India, projects will eventually pick up. There were problems because discoms were not paying the power generation companies. Now that their loans have been recast and they are paying the companies, things are improving. Of course, there will be cost

overruns, but in most cases the firms have a cost pass-through clause in the agreement, said Bansal. Of course, in power agreements where there is no passthrough clause (or the cost of power is pre-fixed), the promoters will be in deep problem. Theres no need to panic on the power sector, said Bank of Barodachairman S.S. Mundra. He doesnt see the bad-debt situation worsening from the current level. We are nowhere near a situation that oversaturation in power has happened. There is still heavy demand for power and tariffs are getting revised. There is no dearth of coal in the country and power can now be generated with imported coal as well, Mundra said. I dont see why power should continue to remain a big NPA problem for banks in the future. The long-term forecast for power demand is good, Raja said. I believe these are shortterm problems, he said. Sixty five percent of our population is below 25 and we need to find them jobs and if we need to create jobs for them, we need huge power generation capacities; so long-term forecast for power demand looks good.

Вам также может понравиться

- Overhauling Manual PDFДокумент118 страницOverhauling Manual PDFlaloo01Оценок пока нет

- Commercial. Competency PDFДокумент6 страницCommercial. Competency PDFlaloo01Оценок пока нет

- Mineclosure GuidelineДокумент11 страницMineclosure GuidelineAmit KumarОценок пока нет

- Broad Status Report: Thermal Power ProjectsДокумент120 страницBroad Status Report: Thermal Power Projectslaloo01Оценок пока нет

- Functional Competency Directory FOR Contracts & Material RolesДокумент7 страницFunctional Competency Directory FOR Contracts & Material Roleslaloo01Оценок пока нет

- Human RespirationДокумент58 страницHuman Respirationlaloo01Оценок пока нет

- Studies On The Impact of Foreign Direct Investment in The Power ... - Publish Your Master's Thesis, Bachelor's Thesis, Essay or Term PaperДокумент9 страницStudies On The Impact of Foreign Direct Investment in The Power ... - Publish Your Master's Thesis, Bachelor's Thesis, Essay or Term Paperlaloo01Оценок пока нет

- Overhauling Manual PDFДокумент118 страницOverhauling Manual PDFlaloo01Оценок пока нет

- Uttar Pradesh Caste Certificate - Jati Praman Patra - IndiaFilingsДокумент8 страницUttar Pradesh Caste Certificate - Jati Praman Patra - IndiaFilingslaloo01Оценок пока нет

- What Is Tertiary Treatment PlantДокумент8 страницWhat Is Tertiary Treatment Plantlaloo01Оценок пока нет

- Brochure and Registration Form of CDM 14-10-15Документ5 страницBrochure and Registration Form of CDM 14-10-15laloo01Оценок пока нет

- Aycl CMDДокумент7 страницAycl CMDlaloo01Оценок пока нет

- FOREWORD (NOTIFICATION) - Department of Personnel & TrainingДокумент237 страницFOREWORD (NOTIFICATION) - Department of Personnel & Traininglaloo01Оценок пока нет

- Place Homework Into The Basket. 2. Pick Up Powerpoint GuideДокумент51 страницаPlace Homework Into The Basket. 2. Pick Up Powerpoint Guidelaloo01Оценок пока нет

- ! Energy Efficiency HandbookДокумент195 страниц! Energy Efficiency HandbookHarish Gupta (JSHL)Оценок пока нет

- Coal Cons NormsДокумент1 страницаCoal Cons Normsvicky_hyd_13Оценок пока нет

- NTPC Cuts Power Cost by Nearly 14% - The Financial ExpressДокумент2 страницыNTPC Cuts Power Cost by Nearly 14% - The Financial Expresslaloo01Оценок пока нет

- 2 STP (1) (Compatibility Mode)Документ62 страницы2 STP (1) (Compatibility Mode)Somaia Al-AkrasОценок пока нет

- New Application Form For Members (April 2015)Документ2 страницыNew Application Form For Members (April 2015)laloo01Оценок пока нет

- Class 9 Science SyllabusДокумент5 страницClass 9 Science Syllabuslaloo01Оценок пока нет

- NTPC - Cement Manufacturers AssociationДокумент53 страницыNTPC - Cement Manufacturers Associationlaloo01Оценок пока нет

- Approved Offline FormДокумент4 страницыApproved Offline Formlaloo01Оценок пока нет

- CPCB Tel Directory 2016Документ24 страницыCPCB Tel Directory 2016laloo0150% (2)

- Chapter Addresses As On 21.11.2015Документ2 страницыChapter Addresses As On 21.11.2015laloo01Оценок пока нет

- NTPC Arm To Supply 250 M... Next Month - The HinduДокумент2 страницыNTPC Arm To Supply 250 M... Next Month - The Hindulaloo01Оценок пока нет

- Chandrapura Thermal Power Station DVC BokaroДокумент1 страницаChandrapura Thermal Power Station DVC Bokarolaloo01Оценок пока нет

- Darjeeling Heritage Trai... Arjeeling Tourism India - 2Документ1 страницаDarjeeling Heritage Trai... Arjeeling Tourism India - 2laloo01Оценок пока нет

- France For Investing in Several Sectors in BiharДокумент2 страницыFrance For Investing in Several Sectors in Biharlaloo01Оценок пока нет

- CERC Delhi Vacancy28 Last Date Dec 14Документ7 страницCERC Delhi Vacancy28 Last Date Dec 14laloo01Оценок пока нет

- E - Khabar Vol 2 Issue 9 Oct13Документ14 страницE - Khabar Vol 2 Issue 9 Oct13laloo01Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Demonstrative pronouns chartДокумент3 страницыDemonstrative pronouns chartAndrea HenaoОценок пока нет

- Student-Led School Hazard MappingДокумент35 страницStudent-Led School Hazard MappingjuliamarkОценок пока нет

- Godbolt RulingДокумент84 страницыGodbolt RulingAnthony WarrenОценок пока нет

- Cover Letter For Post of Business Process Improvement CoordinatorДокумент3 страницыCover Letter For Post of Business Process Improvement Coordinatorsandeep salgadoОценок пока нет

- ACFrOgC3ap IsdwuxtEJ5MGSg 6Co9vDg1-DSyHV2glL1tO WWhGCRh-t7 ASS BNnVcP81mcNrzk0aEBZuDa-iEDL638Dofbm7MKfW-SmIfrCeQZBWuTSl3az1drvYДокумент4 страницыACFrOgC3ap IsdwuxtEJ5MGSg 6Co9vDg1-DSyHV2glL1tO WWhGCRh-t7 ASS BNnVcP81mcNrzk0aEBZuDa-iEDL638Dofbm7MKfW-SmIfrCeQZBWuTSl3az1drvYjleafe8957Оценок пока нет

- Special Educational Needs, Inclusion and DiversityДокумент665 страницSpecial Educational Needs, Inclusion and DiversityAndrej Hodonj100% (1)

- Unit Test: VocabularyДокумент2 страницыUnit Test: VocabularyTrang PhạmОценок пока нет

- Mixed 14Документ2 страницыMixed 14Rafi AzamОценок пока нет

- Ray Kroc's Visionary Leadership at McDonald'sДокумент4 страницыRay Kroc's Visionary Leadership at McDonald'sViknesh Kumanan100% (1)

- Science Club-6Документ2 страницыScience Club-6Nguyễn Huyền Trang100% (1)

- SH-3 Sea King - History Wars Weapons PDFДокумент2 страницыSH-3 Sea King - History Wars Weapons PDFchelcarОценок пока нет

- The Catholic Encyclopedia, Volume 2 PDFДокумент890 страницThe Catholic Encyclopedia, Volume 2 PDFChristus vincit SV67% (3)

- Architecture FirmДокумент23 страницыArchitecture Firmdolar buhaОценок пока нет

- Dorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionДокумент20 страницDorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionThe College FixОценок пока нет

- Revision FinalДокумент6 страницRevision Finalnermeen mosaОценок пока нет

- Intermediate Macro 1st Edition Barro Solutions ManualДокумент8 страницIntermediate Macro 1st Edition Barro Solutions Manualkietcuongxm5100% (22)

- Between The World and MeДокумент2 страницыBetween The World and Meapi-3886294240% (1)

- Why EIA is Important for Development ProjectsДокумент19 страницWhy EIA is Important for Development Projectsvivek377Оценок пока нет

- Techm Work at Home Contact Center SolutionДокумент11 страницTechm Work at Home Contact Center SolutionRashi ChoudharyОценок пока нет

- Language Teacher Educator IdentityДокумент92 страницыLanguage Teacher Educator IdentityEricka RodriguesОценок пока нет

- Subject and Object Questions WorksheetДокумент3 страницыSubject and Object Questions WorksheetLucas jofreОценок пока нет

- Metocean Design and Operating ConsiderationsДокумент7 страницMetocean Design and Operating ConsiderationsNat Thana AnanОценок пока нет

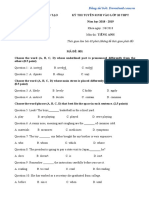

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangДокумент5 страницĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiОценок пока нет

- 24 Directions of Feng ShuiДокумент9 страниц24 Directions of Feng Shuitoml88Оценок пока нет

- Madhuri Economics of Banking Semester 1 ProjectДокумент35 страницMadhuri Economics of Banking Semester 1 ProjectAnaniya TiwariОценок пока нет

- Indian Accounting StandardsДокумент4 страницыIndian Accounting StandardsManjunatha B KumarappaОценок пока нет

- Pattaradday Festival: Celebrating Unity in Santiago City's HistoryДокумент16 страницPattaradday Festival: Celebrating Unity in Santiago City's HistoryJonathan TolentinoОценок пока нет

- Lughaat Al Quran G A ParwezДокумент736 страницLughaat Al Quran G A Parwezscholar786Оценок пока нет

- Dr. Thi Phuoc Lai NguyenДокумент3 страницыDr. Thi Phuoc Lai Nguyenphuoc.tranОценок пока нет

- Ngo Burca Vs RP DigestДокумент1 страницаNgo Burca Vs RP DigestIvy Paz100% (1)