Академический Документы

Профессиональный Документы

Культура Документы

Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%

Загружено:

api-25890856Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%

Загружено:

api-25890856Авторское право:

Доступные форматы

Worst of Barrier Reverse Convertible on AT&T INC and INTEL CORP

Coupon 4.40% (17.60% p.a.); 3 Months; USD; Barrier at 80%

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 26.08.2009 Client pays USD 1000 (Denomination)

Rating: Fitch A

Underlying AT&T INC INTEL CORP On 25.11.2009 Client receiv es 4.40% (17.60% p.a.) Coupon plus:

Bbg Ticker T US Equity INTC US Equity

Strike Level (100%) USD 25.13 USD 18.55 Scenario 1: if the Underlyings have never traded at or below the Barrier level

Barrier Level (80%) USD 20.10 USD 14.84

Conversion Ratio 39.79 53.91 The Investor will receive a Cash Settlement in the Settlement Currency equal to:

Payment Date 26.08.09 Denomination

Valuation Date 23.11.09

Scenario 2: if one or more Underlyings traded at least once at or below the Barrier

Maturity 25.11.09

EU Saving Tax Option Premium Component 4.31% (17.25% p.a.) a. If the Final Fixing Level of the Underlying with the Worst Performance is above

Interest Component 0.09% (0.35% p.a.) the respective Strike Level, the Investor will receive a Cash Settlement in the

Details Physical Settlement American Barrier Settlement Currency equal to: Denomination

ISIN CH0104432759 b. If the Final Fixing Level of the Underlying with the Worst Performance is at or

Valoren 10443275 below the Strike Level, the Investor will receive a predefined round number

SIX Symbol not listed (i.e. Conversion Ratio) of the Underlying with the Worst Performance per

Denomination.

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________________

- AT&T Inc. is a communications holding company. The Company, through its subsidiaries and affiliates, provides local and long-distance phone service, wireless and data

communications, Internet access and messaging, IP-based and satellite television, security services, telecommunications equipment, and directory advertising and publishing.

- Intel Corporation designs, manufactures, and sells computer components and related products. The Company's major products include microprocessors, chipsets, embedded

processors and microcontrollers, flash memory products, graphics products, network and communications products, systems management software, conferencing products, and digital

imaging products.

Opportunities_________________________________________________________________ Risks______________________________________________________________________________

1. A guaranteed Coupon of 4.40% (17.60% p.a.) 1. Maximum return of 4.40% (17.60% p.a.)

2. Protection against 20% drop in Underlying's price 2. Exposure to v olatility changes

3. Low er v olatility than direct equity exposure

4. Secondary market as liquid as a share

5. Optimization of EU Tax components

Best case scenario____________________________________________________________ Worst case scenario_______________________________________________________________

One or all the Underlyings traded below the Barrier Lev el and on the Final

The Underlyings hav e nev er traded below the Barrier Lev el

Fixing Date close under the Strike Lev el

Redemption: Redemption:

Denomination + Coupon of 4.40% (17.60% p.a.) Underlying (w ith negativ e performance) + Coupon of 4.40% (17.60% p.a.)

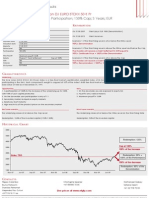

Historical Chart

180%

importer depuis la deuxieme feuille AT&T INC

INTEL CORP

160%

Redemption: Denomination + Coupon of 7.80% (15.60% p.a.)

140%

120%

100%

20% Protection

80%

60%

Redemption: Worst performing Underlying + Coupon of 7.80% (15.60% p.a.)

40%

Nov-07 Feb-08 May-08 Aug-08 Nov-08 Feb-09 May-09 Aug-09

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frat eschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n for the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial instruments

mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket

Superviso ry Autho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial situatio n; the info rmatio n contained in this

do cument do es no t substitute such advice. This publicatio n do es not co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct do cumentatio n can be o btained directly at EFG Financial

P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply for Euro pe, Ho ng Ko ng, Singapo re, the USA , US persons, and the United Kingdo m (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers costs and fees.

EFG Financial Pro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity o f the financial pro ducts. © EFG

Financial P ro ducts A G A ll rights reserved.

Вам также может понравиться

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPДокумент1 страницаCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Оценок пока нет

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDДокумент1 страницаCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Оценок пока нет

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNДокумент1 страницаCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Оценок пока нет

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURДокумент1 страницаCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Оценок пока нет

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNДокумент1 страницаCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Оценок пока нет

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDДокумент1 страницаCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Оценок пока нет

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURДокумент1 страницаCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Оценок пока нет

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDДокумент1 страницаCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552Оценок пока нет

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCДокумент1 страницаCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552Оценок пока нет

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDДокумент1 страницаCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Оценок пока нет

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDДокумент1 страницаCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Оценок пока нет

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALДокумент1 страницаCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Оценок пока нет

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFДокумент1 страницаCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Оценок пока нет

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPДокумент1 страницаCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Оценок пока нет

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFДокумент1 страницаCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Оценок пока нет

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURДокумент1 страницаCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Оценок пока нет

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURДокумент1 страницаCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Оценок пока нет

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURДокумент1 страницаCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552Оценок пока нет

- Single Barrier Reverse Convertible On GERDAU SAДокумент1 страницаSingle Barrier Reverse Convertible On GERDAU SAapi-25889552Оценок пока нет

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRДокумент1 страницаCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Оценок пока нет

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGДокумент1 страницаCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Оценок пока нет

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFДокумент1 страницаCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Оценок пока нет

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDДокумент1 страница15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552Оценок пока нет

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGДокумент1 страницаCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Оценок пока нет

- Express Certificate On CITIGROUP 8% P.A. QuarterlyДокумент1 страницаExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Оценок пока нет

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDДокумент1 страницаCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Оценок пока нет

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAДокумент1 страницаCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Оценок пока нет

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalДокумент1 страницаCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Оценок пока нет

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKДокумент1 страницаCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Оценок пока нет

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECДокумент1 страницаCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552Оценок пока нет

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFДокумент1 страницаCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Оценок пока нет

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAДокумент1 страницаCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552Оценок пока нет

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGДокумент1 страницаCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552Оценок пока нет

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerДокумент1 страницаCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Оценок пока нет

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCДокумент1 страницаCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552Оценок пока нет

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDДокумент1 страница6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552Оценок пока нет

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTДокумент1 страницаCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552Оценок пока нет

- Bonus Certificate On The EURO STOXX 50Документ1 страницаBonus Certificate On The EURO STOXX 50api-25889552Оценок пока нет

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDДокумент1 страница4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552Оценок пока нет

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDДокумент1 страница11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552Оценок пока нет

- 74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010Документ1 страница74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010api-25889552Оценок пока нет

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDДокумент1 страницаCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552Оценок пока нет

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDДокумент1 страница2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552Оценок пока нет

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURДокумент1 страница6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Оценок пока нет

- Doubled-Up Worst of Barrier Reverse ConvertibleДокумент1 страницаDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Оценок пока нет

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURДокумент1 страница1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Оценок пока нет

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Документ1 страница1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Оценок пока нет

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGДокумент1 страницаCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Оценок пока нет

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALДокумент1 страницаCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Оценок пока нет

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNДокумент1 страницаCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552Оценок пока нет

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDДокумент1 страница7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552Оценок пока нет

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDДокумент1 страницаCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856Оценок пока нет

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEДокумент1 страница67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552Оценок пока нет

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Документ1 страница98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552Оценок пока нет

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Документ1 страница86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552Оценок пока нет

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQДокумент1 страницаCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552Оценок пока нет

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Документ1 страница75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552Оценок пока нет

- 17.4% P.A. Autocall With ALPHABET, TESLA, GMДокумент2 страницы17.4% P.A. Autocall With ALPHABET, TESLA, GMVikas SrivastavaОценок пока нет

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Документ1 страница61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552Оценок пока нет

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresОт EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresОценок пока нет

- How Trade, The WTO and The Financial Crisis Reinforce EachДокумент10 страницHow Trade, The WTO and The Financial Crisis Reinforce Eachapi-25890856Оценок пока нет

- Aily Arket Pdate: QuitiesДокумент3 страницыAily Arket Pdate: Quitiesapi-25890856Оценок пока нет

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDДокумент1 страницаCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Оценок пока нет

- NullДокумент1 страницаNullapi-25890856Оценок пока нет

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDДокумент1 страницаCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856Оценок пока нет

- BCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJДокумент3 страницыBCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJapi-25890856100% (2)

- NullДокумент1 страницаNullapi-25890856Оценок пока нет

- NullДокумент4 страницыNullapi-25890856Оценок пока нет

- Single Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%Документ1 страницаSingle Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%api-25890856100% (2)

- Single Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.Документ1 страницаSingle Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.api-25890856100% (2)

- Multi Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andДокумент1 страницаMulti Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andapi-25890856100% (2)

- Managerial Economics Q2Документ2 страницыManagerial Economics Q2Willy DangueОценок пока нет

- Climate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisДокумент56 страницClimate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisMeg Anne Legaspi RiveraОценок пока нет

- 7EC503 International Economics For Business and Finance: 01 - IntroductionДокумент20 страниц7EC503 International Economics For Business and Finance: 01 - IntroductionWahab Nurudeen OpeyemiОценок пока нет

- ADMS 3585 Course Outline Fall 2019 Keele CampusДокумент16 страницADMS 3585 Course Outline Fall 2019 Keele CampusjorОценок пока нет

- Aadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaДокумент1 страницаAadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaLesego MoabiОценок пока нет

- Amhara Bank Annual Report EnglishДокумент93 страницыAmhara Bank Annual Report Englishmgetu123Оценок пока нет

- Commodity Trading: An OverviewДокумент15 страницCommodity Trading: An OverviewvijayxkumarОценок пока нет

- R-APDRP Part-B Tender Specification Pre-Bid MeetingДокумент69 страницR-APDRP Part-B Tender Specification Pre-Bid MeetingChandu GowdaОценок пока нет

- Occupational Safety and Health: Lecture NotesДокумент7 страницOccupational Safety and Health: Lecture NotesJonathan TungalОценок пока нет

- Course Work: Official NameДокумент4 страницыCourse Work: Official NameEnio E. DokaОценок пока нет

- IRV Banikanta Mishra: Practice Assignment - 1Документ9 страницIRV Banikanta Mishra: Practice Assignment - 1SANCHITA PATIОценок пока нет

- TB 14Документ67 страницTB 14Dang ThanhОценок пока нет

- Market SegmentationДокумент21 страницаMarket SegmentationMian Mujeeb RehmanОценок пока нет

- Spaze TowerДокумент1 страницаSpaze TowerShubhamvnsОценок пока нет

- MFAP Performance Summary ReportДокумент17 страницMFAP Performance Summary ReportKhizar Hayat JiskaniОценок пока нет

- Introduction and Company Profile: Retail in IndiaДокумент60 страницIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- Group 4 Group AssignmentДокумент96 страницGroup 4 Group AssignmentKrutarthChaudhari0% (1)

- CIMA P3 Notes - Performance Strategy - Chapter 1Документ14 страницCIMA P3 Notes - Performance Strategy - Chapter 1Mark Horance HawkingОценок пока нет

- SWOT of Coca ColaДокумент4 страницыSWOT of Coca ColaYoongingОценок пока нет

- Heizer 10Документ45 страницHeizer 10anushanОценок пока нет

- Principles of Economics 7th Edition Gregory Mankiw Solutions ManualДокумент25 страницPrinciples of Economics 7th Edition Gregory Mankiw Solutions ManualJacquelineHillqtbs100% (59)

- C01 Exam Practice KitДокумент240 страницC01 Exam Practice Kitlesego100% (2)

- 07 Cafmst14 - CH - 05Документ52 страницы07 Cafmst14 - CH - 05Mahabub AlamОценок пока нет

- Chapter 7Документ42 страницыChapter 7Apef Yok100% (1)

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeДокумент1 страницаPrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneОценок пока нет

- EF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Документ44 страницыEF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Sikha SharmaОценок пока нет

- Managing Organizational Change at Campbell and Bailyn's Boston OfficeДокумент12 страницManaging Organizational Change at Campbell and Bailyn's Boston OfficeBorne KillereОценок пока нет

- Applichem Case SolutionДокумент9 страницApplichem Case Solutiondebjyoti77Оценок пока нет

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartДокумент15 страницSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Tally 9.ERP - The complete guide to accounting featuresДокумент7 страницTally 9.ERP - The complete guide to accounting featuresRAKESH MESHRAMОценок пока нет