Академический Документы

Профессиональный Документы

Культура Документы

International Standard Banking Practice For The Examination of Documents Under Documentary Credits Subject To UCP 600 (ISBP) Publication No. 681

Загружено:

dadipИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

International Standard Banking Practice For The Examination of Documents Under Documentary Credits Subject To UCP 600 (ISBP) Publication No. 681

Загружено:

dadipАвторское право:

Доступные форматы

International Standard Banking Practice for the Examination of Documents under Documentary Credits subject to UCP 6 !

ISBP" Publication #o$ 6%&

'ahmood(ur()ahman *ssistant Professor+ BIB'

International Standard Banking Practice (ISBP) was issued by the ICC Banking Commission for the first time in 2002, with a iew to documenting standard banking !ractices which are consistent with "CP #00 and the $!inions and %ecisions of the ICC Banking Commission& 'his document does neither amend "CP #00 nor o erride it& It e(!lains how the !ractices articulated in "CP #00 are a!!lied by documentary !ractitioners& 'his !ublication and the "CP should be read in their entirety and not in isolation& It is, of course, recogni)ed that the law in some countries may com!el a different !ractice than those stated here& 'his !ublication com!iles the entire !o!ular international standard banking !ractices for all !arties to a documentary credit more !recisely linked with e(amination of documents& It has become an in aluable aid to banks, cor!orations, logistics s!ecialists and insurance com!anies alike, on a global basis& 'he e(isting ersion of ISBP is an u!dated ersion as o!!osed to a re ision of ICC Publication #*+ modified in line with !resent ersion of "CP%C #00& 'his !ublication has e ol ed into a necessary com!anion to the "CP for determining com!liance of documents with the terms of letters of credit& It should be noted that any term in a documentary credit which modifies or e(cludes the a!!licability of a !ro ision of "CP #00 may also ha e an im!act on international standard banking !ractice& 'herefore, in considering the !ractices described in this !ublication, !arties must take into account any term in a documentary credit that e(!ressly modifies or e(cludes a rule contained in "CP #00& 'his document has got ,-+ articles in it and all those articles ha e only !ut some light on how the different documents related with documentary letter of credit is going to be e(amined& 'he ISBP e(!lains how documents e(amination !ractices referred to in the "CP #00 are a!!lied by .C !ractioners& 'he !arties that are directly im!acted by the ISBP are the banks in ol ed and the beneficiary&

*rticle no

Co,erage PRELIMINARY CONSIDERATIONS

ISBP #-, /rticle, 0 +

'he /!!lication and Issuance of the Credit GENERAL PRINCIPLES

ISBP #-, /rticle# 0 1

/bbre iations

ISBP #-, /rticle ISBP #-, /rticle 2 0 ,2 ISBP #-, /rticle ,3 0 ,ISBP #-, /rticle ,2 0 20 ISBP #-, /rticle 2, ISBP #-, /rticle 22 ISBP #-, /rticle 23 ISBP #-, /rticle 2* ISBP #-, /rticle 2+ ISBP #-, /rticle 2# 021 ISBP #-, /rticle 2- 0 33 ISBP #-, /rticle 3* 0 3# ISBP #-, /rticle 31 0 *0 ISBP #-, /rticle *, 0 *2 ISBP #-, /rticle *3 0 ** ISBP #-, /rticle *+ 0 *1 ISBP #-, /rticle *ISBP #-, /rticle *2

Certifications and %eclarations Corrections and /lterations %ates %ocuments for which the "CP #00 'rans!ort /rticles do not /!!ly 4(!ressions not defined in "CP #00 Issuer of %ocuments .anguage 5athematical Calculations 5iss!ellings or 'y!ing 4rrors 5ulti!le Pages and /ttachments or 6iders $riginals and Co!ies Shi!!ing 5arks Signatures 'itle of %ocuments and Combined %ocuments DRAFTS AND CALCULATION OF MATURITY DATE 'enor 5aturity %ate Banking %ays, 7race %ays, %elays in 6emittance 4ndorsement

ISBP #-, /rticle +0 0 +, ISBP #-, /rticle +2 0 +3 ISBP #-, /rticle +* ISBP #-, /rticle ++ 0 +# ISBP #-, /rticle +1 ISBP #-, /rticle +- 0 #1

/mounts 8ow the %raft is %rawn %rafts on the /!!licant Corrections and /lterations INVOICES %efinition of In oice %escri!tion of the 7oods, Ser ices or Performance and other 7eneral Issues related to In oices

TRANSPORT DOCUMENT COVERING AT LEAST TWO DIFFERENT MODES OF TRANSPORT ISBP #-, /rticle #- 0 #2 ISBP #-, /rticle 10 ISBP #-, /rticle 1, 0 12 ISBP #-, /rticle 13 01* ISBP #-, /rticle 1+ ISBP #-, /rticle 1# 0 1ISBP #-, /rticle 12 0 -, ISBP #-, /rticle -2 0 -3 ISBP #-, /rticle -* ISBP #-, /rticle -+ 0 -# ISBP #-, /rticle -1 0 -2 /!!lication of "CP #00 article ,2 9ull Set of $riginals Signing of 5ultimodal 'rans!ort %ocuments $n Board :otations Place of taking in Charge, %is!atch, .oading on Board and %estination Consignee, $rder Party, Shi!!er and 4ndorsement, :otify Party 'ranshi!ment and Partial Shi!ment Clean 5ultimodal 'rans!ort %ocuments 7oods %escri!tion Corrections and /lterations 9reight and /dditional Costs

ISBP #-, /rticle 20 ISBP #-, /rticle 2, 0 22 ISBP #-, /rticle 23 ISBP #-, /rticle 2* 0 2+ ISBP #-, /rticle 2# 0 21 ISBP #-, /rticle 2-0,00 ISBP #-, /rticle,0,0,03 ISBP #-, /rticle,0*0,0+ ISBP #-, /rticle,0#0,01 ISBP #-, /rticle,0ISBP #-, /rticle,020,,0 ISBP #-, /rticle,,,0,,3

7oods co ered by more than one 5ultimodal 'rans!ort %ocument BILL OF LADING /!!lication of "CP #00 article 20 9ull set of $riginals Signing of Bills of .adding $n board :otations Ports of .oading and Ports of %ischarge Consignee, $rder Party, Shi!!er and 4ndorsement, :otify Party 'ranshi!ment and Partial Shi!ment Clean Bills of .ading 7oods %escri!tion Corrections and /lterations 9reight and /dditional Costs

ISBP #-, /rticle,,*

7oods co ered by more than one Bill of .ading CHARTER PARTY BILL OF LADING

ISBP #-, /rticle,,+0,,# ISBP #-, /rticle,,1 ISBP #-, /rticle,,-

/!!lication of "CP #00 article 22 9ull set of $riginals Signing of Charter Party Bills of .adding

ISBP #-, /rticle,,20,20 ISBP #-, /rticle,2, ISBP #-, /rticle,220,2* ISBP #-, /rticle,2+ ISBP #-, /rticle,2#0,21 ISBP #-, ISBP #-, /rticle,220,30 ISBP #-, /rticle,3,0,32

$n board :otations Ports of .oading and Ports of %ischarge Consignee, $rder Party, Shi!!er and 4ndorsement, :otify Party Partial Shi!ment Clean Charter Party Bills of .ading 7oods %escri!tion Corrections and /lterations 9reight and /dditional Costs AIR TRANSPORT DOCUMENT

ISBP #-, /rticle,3*0,3+ ISBP #-, /rticle,3# ISBP #-, /rticle,310,3ISBP #-, /rticle,320,*0 ISBP #-, /rticle,*,0,*2 ISBP #-, /rticle,*30,** ISBP #-, /rticle,*+0,*1 ISBP #-, /rticle,*-0,*2

/!!lication of "CP #00 article 23 $riginal /ir 'rans!ort %ocuments Signing of /ir 'rans!ort %ocuments 7oods acce!ted for Carriage, %ate of Shi!ment, and re;uirement for an /ctual %ate of %is!atch /ir!orts of %e!arture and %estination Consignee, $rder Party and :otify Party 'ranshi!ment and Partial Shi!ment Clean /ir 'rans!ort %ocuments

ISBP #-, /rticle,+0 ISBP #-, /rticle,+,0,+2 ISBP #-, /rticle,+30,+#

7oods %escri!tion Corrections and /lterations 9reight and /dditional Costs

ROAD, RAIL OR INLAND WATERWAY TRANSPORT DOCUMENTS ISBP #-, /rticle,+1 ISBP #-, /rticle,+ISBP #-, /rticle,+20,#, ISBP #-, /rticle,#20,#3 ISBP #-, /rticle,#* /!!lication of "CP #00 article 2* $riginal and %u!licate of 6oad, 6ail or Inland <aterway 'rans!ort %ocuments Carrier and Signing of 6oad, 6ail or Inland <aterway 'rans!ort %ocuments $rder Party and :otify Party Partial Shi!ment

ISBP #-, /rticle,#+ ISBP #-, /rticle,##0,#1 ISBP #-, /rticle,#-0,#2

7oods %escri!tion Corrections and /lterations 9reight and /dditional Costs INSURANCE DOCUMENT AND COVERAGE

ISBP #-, /rticle,10 ISBP #-, /rticle,1,0,12 ISBP #-, /rticle,130,1* ISBP #-, /rticle,1+

/!!lication of "CP #00 article 2Issuers of Insurance %ocuments 6isks to be Co ered %ates

ISBP #-, /rticle,1#0,1ISBP #-, /rticle,120,-0

Percentage and /mount Insured Party and 4ndorsement CERTIFICATES OF ORIGIN

ISBP #-, /rticle,-, ISBP #-, /rticle,-2 ISBP #-, /rticle,-30,-+

Basic 6e;uirement Issuers of Certificates of $rigin Contents of Certificates of $rigin

'o a oid unnecessary costs, delays, and dis!utes in e(amination of documents, the a!!licant and the beneficiary should carefully consider <hich documents are re;uired %ata content of documents Issuer (s) of documents 'ime frame for !resentation

'he a!!licant bears the risk of ambiguity in its instructions to issue or amend a credit& 'he a!!licant should be aware that "CP #00 contains articles that define terms in a manner that may !roduce une(!ected results unless the a!!licant fully ac;uaints itself with these !ro isions& / re;uest to issue or amend a credit authori)es an issuing bank to su!!lement or de elo! the terms& / credit should not re;uire !resentation of documents that are to be issued or countersigned by the a!!licant& 5any of the !roblems that arise at the e(amination stage could be a oided or resol ed by careful attention to detail in the underlying transaction, the credit a!!lication and issuance of the credit as discussed& 'he use of generally acce!ted abbre iations in documents (cro!&, .td&, Co&, mt&, mfr&, =gs&, Int>l& etc&) instead of words re;uired in the .C (and ice ersa) does not make a document discre!ant but slash marks ?@?may ha e different meanings and, unless a!!arent in the conte(t used, should not be used as a substitute for a word& If a certification or declaration re;uired by the credit is contained within another document which is signed and dated, then the certification or declaration does not re;uire a se!arate

signature or date if that certification or declaration (a!!ears) to ha e been gi en by the same entity that issued and signed the document& Corrections and alterations to documents issued by the beneficiary (including commercial in oices and certificates) need not be authenticated e(ce!t when such documents are legali)ed, isaed, counter0signed, etc, by another !arty& Corrections and alterations in documents issued by the beneficiary itself, e(ce!t drafts, which ha e not been legali)ed, isaed, certified or similar, need not be authenticated& Corrections and alterations to documents issued by the beneficiary and legali)ed, certified, etc&, by another !arty do not com!ly without authentication& /uthentication of corrections@alterations to documents other than those issued by the beneficiary is re;uired& 'he !arty ca!able of authenticating the document0 Issuer of document / !arty authori)ed by the issuer

In case of legali)ed, certified documents, the !arty which legali)ed, certified the document, (or a !arty authori)ed by the legali)ing, certifying !arty)& 5anners of /uthentication0 'he authentication must show by whom it has been made including the initial or signature of the !arty authenticating the document& If the authentication a!!ears to ha e been made by a !arty other than the issuer of the document, the authentication must clearly show the ca!acity of that !arty& <here a document contains more than one correction (or alteration), either each correction (or alteration) must be authenticated se!arately or one authentication must be linked to all corrections in an a!!ro!riate way&

'he use of multi!le ty!e styles or font si)es or handwriting in the same document does not, by itself, signify a correction or alteration& 4 en if a credit does not s!ecifically re;uire, the following documents must be dated0 %raft 'rans!ort %ocuments Insurance %ocuments Certificate of $rigin

It is Ae(!ectedB that other certificates and declarations be dated, but com!liance of such certificates and declarations, with res!ect to date re;uirement de!ends on0 'he ty!e of certification or declaration re;uired 'he re;uired wording

'he wording that a!!ears within it

/ny document may be dated after the date of shi!ment, including B@., Ins!ection Certificate, insurance document etc& %ocuments must not indicate that they were issued after the date they are !resented& / document indicating a date of !re!aration and a later date of signing is deemed to be issued on the date of signing& /ny document, including a certificate of analysis, ins!ection certificate and !re0shi!ment ins!ection certificate, may be dated after the date of shi!ment& 8owe er, if a credit re;uires a document e idencing a !re0shi!ment e ent (e&g&, !re0shi!ment ins!ection certificate), the document must, either by its title or content, indicate that the e ent (e&g&, ins!ection) took !lace !rior to or on the date of shi!ment& / re;uirement for an ?ins!ection certificate? does not constitute a re;uirement to e idence a !re0shi!ment e ent& %ates may be e(!ressed in different formats0 *@+@200-C /!ril +, 200-C + /!ril 200-

Pro ided that the date intended can be determined from the document or from other documents included in the !resentation, any of these formats are acce!table& 'o a oid confusion it is recommended that the name of the month should be used instead of the number& <ithin 2 days after? indicates a !eriod from the date of the e ent until 2 days after the e ent& A:ot later than 2 days after? does not indicate a !eriod, only a latest date& If an ad ice must not be dated !rior to a s!ecific date, the credit must so state& ?at least 2 days before? indicates that something must take !lace not later than 2 days before an e ent& 'here is no limit as to how early it may take !lace& ?within 2 days of? indicates a !eriod 2 days !rior to the e ent until 2 days after the e ent& 'he term ?within? when used in connection with a date e(cludes that date in the calculation of the !eriod& "CP #00 'rans!ort articles ,202+ do not a!!ly to0 Certain documents commonly used in relation to trans!ortation of goods Co!ies of trans!ort document

Shi!!ing documents, Stale documents acce!table, 3rd !arty documents, e(!orting country0such e(!ressions are not defined in "CP #00 but are included in some .Cs& 'o a oid misinter!retation, it is recommended that, they should not be used or if used, the res!ecti e .Cs should gi e the clear meanings& $therwise they shall be inter!reted as follows0 Shi!!ing %ocuments05eans all documents re;uired by the credit and not only trans!ort documents, but e(cluding drafts& / re;uirement in an .C that all shi!!ing documents to indicate A(((B, shall be satisfied by indicating A(((B on documents , e en if not indicated on a re;uired draft& Stale %ocument 0%ocuments !resented later than 2, calendar days after the date of shi!ment& 'hese are acce!table as long as they are !resented within the e(!iry date for !resentation as stated in the credit and if not !rohibited& 3rd Party %ocuments0 /ll documents, e(cluding drafts, but including in oice, may be issued by a !arty other than the beneficiary which are acce!table if not !rohibited in the credit&

4(!orting country Beneficiary>s domicile, Country of origin of the goods, Country of recei!t of the goods by a carrier, or Country from which shi!ment or dis!atch is to be made

'he re;uirement in the credit that a document is to be issued by a named !erson or entity is satisfied when0 'he document a!!ears to be issued by the named !erson or entity by using of letterhead of that !erson or entity& $r in the absence of letterhead, a!!ears to be issued, com!leted and or signed by, or on behalf of the named !erson or entity&

It is e(!ected that documents issued by the beneficiary will be in the language of the credit& <hen a credit states that documents in two or more languages are acce!table, a nominated bank may, in its ad ice of the credit, limit the number of acce!table languages as a condition of its engagement in the credit& %etailed mathematical calculations in documents will not be checked by banks and banks are only obliged to check total against the credit and other re;uired documents& If a miss!elling or ty!ing error does not affect the meaning of the word or the sentence in which it occurs, it will not make the document discre!ant& "nless the credit or a document !ro ides otherwise, !ages which are !hysically bound together, se;uentially numbered or contain internal cross references, howe er named or entitled, are to be e(amined as one document, e en if some of the !ages are regarded as an attachment& <here a document consists of more than one !age, it must be !ossible to determine that the !ages are !art of the same document& /ny re;uirement for information, signature or endorsement may a!!ear anywhere on the document (on any one !age of the multi!le !ages, attachments, or riders) unless the credit or the document itself indicates where a signature or endorsement is to a!!ear& <hen an .C calls for a document and it does not s!ecify whether the re;uirement is for an original or a co!y, then it is understood that only an original satisfies the re;uirement& %ocuments issued in more than one original may be marked A$riginal, %u!licate, 'ri!licate, 9irst $riginal, Second $riginalB etc&, as usually a!!ears on Bills of .ading& :one of these markings will dis;ualify a document as an original& <here a credit calls for a co!y of a trans!ort document and indicates the dis!osal instructions for the original of that trans!ort document, an original trans!ort document will not be acce!table& If an .C s!ecifies the details of shi!!ing mark (enabling identification of a bo(, bag or !ackage), the document(s) mentioning the marks must show these details, but additional information is

acce!table !ro ided it is not in conflict with the .C terms& Some documents include information in e(cess of what would normally be considered shi!!ing marks, such as ty!e of goods or handling instructions& 'he fact that some documents show such additional information while others do not is not a discre!ancy& 'rans!ort documents co ering containeri)ed goods may only show container no& under the heading Ashi!!ing marksB& $ther documents that show detailed markings will not be considered as in conflict for that reason& 4 en if a credit does not state, the following documents must be signed0 %raft 'rans!ort %ocuments Insurance %ocuments Certificates and declaration

/ signature need not be hand written& Signatures include stam!s, !erforated signatures, symbols and electronic or mechanical means of authentication& 'he fact that a document has a bo( or a s!ace for a signature does not necessarily mean that such a bo( or s!ace must be com!leted with a signature& 'he following does not ;ualify as a signed original document0 Photoco!y of a signed document& Co!y recei ed by fa( of original signed documents& Co!ies of documents need not be signed&

%ocuments may be0 'itled as call for in the credit Bear a similar title Be untitled (but meets a Acontent criteriaB)

%ocuments listed in an .C should be !resented as se!arate documentsC combining documents is generally not acce!table& %raft is a document for the bank (not for the a!!licant)&'he tenor must be in accordance with the terms of the credit& It must be !ossible to establish a maturity date from the data in the draft, if a credit calls for drafts at a tenor #0 days after the bill of lading date& If a draft is drawn at a tenor other than sight or a certain !eriod after sight (30 days after sight), then, it must be !ossible to establish the maturity date from the data of the draft itself&

9or calculation of maturity date, if a tenor refers to ((( days after bill of lading date, then the shi!ment date is deemed to be the bill of lading date, e en if the bill of lading date is before or after the shi!ment date& 'he use of the words A9romB and A/fterB for the !ur!oses of establishing maturity dates, e(cludes the date of the Ae entB& If a B@. shows more than one Aon boardB notation (i&e& transhi!ment effected), the earliest Aon boardB date will be used for calculation of maturity date& If an .C sti!ulates a tenor to be ((( days from shi!ment date and more than one B@. are !resented under one !resentation, then the latest Ashi!ment dateB will be used for calculation of maturity date& 'his same !rinci!le a!!lies to all trans!ort documents& If a draft states a maturity date by using an actual date, the date must ha e been calculated in accordance with the re;uirements of the credit& 4stablishment of 5aturity date for drafts drawn at A(((B days sight0 9irstly Awhose sightBD E Sight of the drawee bank as re;uired in the .C (or nominated bank if the .C is a ailable by deferred !ayment) and secondly, whether documents are taken u! or refused& /s in the case of com!lying documents, or in the case of non0com!lying documents where the drawee bank has not !ro ided a notice of refusal, the maturity date will be FFF days after the date of recei!t of documents by the drawee bank& In the case of non0com!lying documents where the drawee bank has !ro ided a notice of refusal and subse;uent a!!ro al, at the latest FFF days after the date of acce!tance of the draft by the drawee bank& 'he date of acce!tance of the draft must be no later than the date the issuing bank acce!ts the wai er of the a!!licant&

'he amounts in words must accurately reflect the amounts in figures& %rafts must be drawn in the currency of the credit& 'he draft must be endorsed, if necessary& 'he amount must agree with that of the in oice& %raft must be drawn by the beneficiary& %raft must be drawn on the !arty stated in the credit& %raft drawn on the a!!licant (if called for in the .C), shall be e(amined in accordance with "CP article ,* f& Corrections and alterations on a draft, if any, must a!!ear to be authenticated by the drawer& Payment must be a ailable in immediately a ailable funds on the due date at the !lace where the draft or documents are !ayable, !ro ided such due date is a banking day in that !lace& If the due date is a non0banking day, !ayment will be due on the first banking day following the due date& %elays in the remittance of funds, such as grace days, the time it takes to remit funds, etc&, must not be in addition to the stated or agreed due date as defined by the draft or documents& /n .C re;uiring an Ain oiceB without further definition will be satisfied by any ty!e of in oice !resented such as0

Commercial in oice Consular in oice Customs in oice

If an .C re;uires !resentation of a Acommercial in oice !resentation of a document titled Ain oiceB would be acce!table& In oices identified as APro 9ormaB, APro isionalB, or the like are not acce!table& (unless s!ecifically authori)ed by the .C)& /n Ain oiceB must a!!ear on its face to ha e been issued by the beneficiary named in the .C& 'ele(, fa( no&, email, etc forming !art of the address (as stated in the .C)0 :eed not be stated on the Ain oiceB If stated on the Ain oiceB, need not be identical to that stated in the .C&

/n Ain oiceB must be made out in the name of the a!!licant (mentioning address is like that of beneficiary)& /n Ain oiceB need not be signed or dated& 'he descri!tion of the goods in in oice must corres!ond with that of .C& :o re;uirement for a mirror image& 'he goods descri!tion on in oice must reflect what goods ha e actually been shi!!ed& /n in oice must show the alue of goods shi!!ed, currency and unit !rices if any must agree with that shown in the .C& 'he in oice must show any discounts or ad ance !ayments shown in the .C& /n in oice may show a deduction co ering ad ance !ayment, discount, etc& e en if the deduction is not stated in the .C& If 'rade 'erms (Incoterms) are !art of the goods descri!tion or amount, the in oice must state the trade term s!ecified in the .C& /ny charges and costs shown beyond this alue are not allowed& 'he ;uantity of merchandise, weights and measurements shown on the in oice must not conflict with those a!!earing on other documents& /n in oice must not show merchandise not called for in the .C& /n in oice must not show o er0shi!ment e(ce!t !ro ided for under "CP #00 article 30 b& <hen !artial shi!ments are !rohibited, a tolerance of +G less in the in oice amount is acce!table, !ro ided that ;uantity is shi!!ed in full and any unit !rice (if stated in the .C) has not been reduced& 'he ;uantity of the goods re;uired in the credit may ary within a tolerance of H@0 +G& 'his does not a!!ly if a credit states that the ;uantity must not be e(ceeded or reduced, or if a credit states the ;uantity in terms of a sti!ulated number of !acking units or indi idual items& / ariance of u! to H+G in the goods ;uantity does not allow the amount of the drawing to e(ceed the amount of the credit& 4 en when !artial shi!ments are !rohibited, a tolerance of +G less in the credit amount is acce!table, !ro ided that the ;uantity is shi!!ed in full and that any unit !rice, if stated in the credit, has not been reduced& If no ;uantity is stated in the credit, the in oice will be considered to co er the full ;uantity& If a credit calls for installment shi!ments, each shi!ment must be in accordance with the installment schedule& In matching deli ery and !ayment, the link is the trans!ort document& 'rans!ort documents gi e !roof of shi!ment@carriage of goods from !ort of loading@!lace of recei!t to !ort of discharge@!lace of destination& "sually, trans!ort documents are the documents of title of goods and act as the e idence of contract for the carriage or trans!ortation of the goods between the

shi!!er and the carrier& 9or a trans!ort document to become a document of ?title to goods?, following two features must be satisfiedI 'he !erson@institution in !ossession of the document is deemed both by law and usage to be in !ossession of the actual goods& 'he !ossessor of the document can transfer the goods re!resented by the document to any !erson by endorsement or by deli ery or by endorsement accom!anied by deli ery&

Standards common to '%s0 'rans!ort documents must be signed (not necessarily in hand0writing) 'itle of '% is not the criterion, the "CP uses the wording Ahowe er namedB& :ame of the Carrier (with the e(ce!tion of ACharter Party B@.& %escri!tion of goods (may be shown in general terms)& Clean '% (word clean need not a!!ear on '%)&

If an .C states that A9reight 9orwarder '% is acce!tableB then the '% may be signed by a 99 in the ca!acity of 99 and the name of the carrier need not be shown& 'rans!ort documents may take the form of either 5ultimodal 'rans!ort %ocument or it could be Single 5odal 'rans!ort %ocument (5arine B@., Charter Party B@., /ir 'rans!ort %ocument0/ir <ay Bill, 6oad, 6ailway J Inland <aterway 'rans!ort %ocument06ail 6ecei!t, 'ruck 6ecei!t Courier 6ecei!t, Postal 6ecei!t etc&) de!ending u!on the mode of trans!ortation& /s in our country sea way mode is mostly used, so, im!ortant !ro isions regarding marine B@. are discussed below& If a credit re;uires !resentation of a bill of lading (AmarineB, AoceanB or A!ort0to0!ortB or similar) co ering sea shi!ment only, "CP #00 article 20 is a!!licable& 'o com!ly with "CP #00 article 20, a bill of lading must a!!ear to co er a !ort0to0!ort shi!ment but need not be titled A5arine B@.B& / "CP #00 article 20 trans!ort document must indicate the number of originals that ha e been issued& 'rans!ort documents marked A9irst $riginalB, ASecond $riginalB,A'hird $riginalB, A$riginalB, A%u!licateB, A'ri!licateB, etc&, or similar e(!ressions are all originals& Bills of lading need not be marked AoriginalB to be acce!table as an original bill of lading& $riginal bills of lading must be signed in the form described in "CP #00 sub0article 20(a)(i) and indicate the name of the carrier, identified as the carrier& If an agent signs a bill of lading on behalf of the carrier, the agent must be identified as agent and must identify on whose behalf it is signing, unless the carrier has been identified elsewhere on the bill of lading& If the master (ca!tain) signs the bill of lading, the signature of the master (ca!tain) must be identified as AmasterB (Aca!tainB)& In this e ent, the name of the master (ca!tain) need not be stated&

If a !re0!rinted AShi!!ed on boardB bill of lading is !resented, its issuance date will be deemed to be the date of shi!ment unless it bears a se!arate dated on board notation, in which e ent the date of the on board notation will be deemed to be the date of shi!ment whether or not the on board date is before or after the issuance date of the bill of lading& AShi!!ed in a!!arent good orderB, A.aden on boardB, Aclean on boardB or other !hrases incor!orating words such as Ashi!!edB or Aon boardB ha e the same effect as AShi!!ed on boardB& If a credit gi es a geogra!hical area or range of !orts of loading or discharge (e&g&, A/ny 4uro!ean PortB), the bill of lading must indicate the actual !ort of loading or discharge, which must be within the geogra!hical area or range stated in the credit& If a credit !rohibits !artial shi!ments and more than one set of original bills of lading are !resented co ering shi!ment from one or more !orts of loading (as s!ecifically allowed, or within the geogra!hical area or range stated in the credit), such documents are acce!table !ro ided that they co er the shi!ment of goods on the same essel and same Kourney and are destined for the same !ort of discharge& In the e ent that more than one set of bills of lading are !resented and incor!orate different dates of shi!ment, the latest of these dates of shi!ment will be taken for the calculation of any !resentation !eriod and must fall on or before the latest shi!ment date s!ecified in the credit& Shi!ment on more than one essel is a !artial shi!ment, e en if the essels lea e on the same day for the same destination& If a bill of lading states that the goods in a container are co ered by that bill of lading !lus one or more other bills of lading, and the bill of lading states that all bills of lading must be surrendered, or words of similar effect, this means that all bills of lading related to that container must be !resented in order for the container to be released& Such a bill of lading is not acce!table unless all the bills of lading form !art of the same !resentation under the same credit& If a credit re;uires a bill of lading to show that the goods are consigned to a named !arty, e&g&, Aconsigned to Bank FB (a Astraight bill of ladingB), rather than Ato orderB or Ato order of Bank FB, the bill of lading must not contain words such as Ato orderB or Ato order ofB that !recede the name of that named !arty, whether ty!ed or !re0!rinted& .ikewise, if a credit re;uires the goods to be consigned Ato orderB or Ato order ofB a named !arty, the bill of lading must not show that the goods are consigned straight to the named !arty& If a bill of lading is issued to order or to order of the shi!!er, it must be endorsed by the shi!!er& /n endorsement indicating that it is made for or on behalf of the shi!!er is acce!table& If a credit does not state a notify !arty, the res!ecti e field on the bill of lading may be left blank or com!leted in any manner& 'ranshi!ment is the unloading from one essel and reloading to another essel during the carriage from the !ort of loading to the !ort of discharge stated in the credit& If it does not occur between these two !orts, unloading and reloading is not considered to be 'ranshi!ment& Clauses or notations on bills of lading which e(!ressly declare a defecti e condition of the goods or !ackaging are not acce!table& Clauses or notations which do not e(!ressly declare a defecti e condition of the goods or !ackaging (e&g&, A!ackaging may not be sufficient for the sea KourneyB) do not constitute a discre!ancy& / statement that the !ackaging Ais not sufficient for the sea KourneyB would not be acce!table& If the word AcleanB a!!ears on a bill of lading and has been

deleted, the bill of lading will not be deemed to be claused or unclean unless it s!ecifically bears a clause or notation declaring that the goods or !ackaging are defecti e& / goods descri!tion in the bill of lading may be shown in general terms not in conflict with that stated in the credit& Corrections and alterations on a bill of lading must be authenticated where, such authentication must be made by the carrier, master (ca!tain) or any of agents (who may be different from the agent that may ha e issued or signed it), they are identified as an agent of the carrier or the master (ca!tain)& :on0negotiable co!ies of bills of lading do not need to include any signature on, or authentication of, any alterations or corrections that may ha e been made on the original& If a credit re;uires that a bill of lading show that freight has been !aid or is !ayable at destination, the bill of lading must be marked accordingly& /!!licants and issuing banks should be s!ecific in stating the re;uirements of to show whether freight is to be !re!aid or collected& If a credit states that costs additional to freight are not acce!table, a bill of lading must not indicate that costs additional to the freight ha e been or will be incurred& Such indication may be by e(!ress reference to additional costs or by the use of shi!ment terms which refer to costs associated with the loading or unloading of goods, such as 9ree In (9I), 9ree $ut (9$), 9ree In and $ut (9I$) and 9ree In and $ut Stowed (9I$S)& / reference in the trans!ort document to costs which may be le ied as a result of a delay in unloading the goods or after the goods ha e been unloaded, e&g&, costs co ering the late return of containers, is not considered to be an indication of additional costs in this conte(t& 5oreo er, there are some im!ortant !ro isions in ISBP #-, regarding the e(amination of Insurance %ocument as well as arious $ther %ocuments more s!ecifically Certificate of $rigin& )eferenceICC Documents

Вам также может понравиться

- 3pals Afs 2013Документ23 страницы3pals Afs 2013bryanramos1993Оценок пока нет

- Financial Regulations March 2010Документ46 страницFinancial Regulations March 2010stan4dddОценок пока нет

- News Overview: BB Takes Moves To Check Fraud in Banking SectorДокумент5 страницNews Overview: BB Takes Moves To Check Fraud in Banking SectorSanzidaKhabirОценок пока нет

- Call NoticeДокумент2 страницыCall NoticeLightRIОценок пока нет

- Tax 1 Iv-E Digests (Partial) July 3 Session: Iv2.A. Due Process Clause Commissioner of Customs v. CTA & Campos Rueda CoДокумент10 страницTax 1 Iv-E Digests (Partial) July 3 Session: Iv2.A. Due Process Clause Commissioner of Customs v. CTA & Campos Rueda CokaruleynОценок пока нет

- Untitled 2Документ63 страницыUntitled 2Michael SweetОценок пока нет

- Ch5 - ImportantДокумент49 страницCh5 - Importantsalehin1969Оценок пока нет

- Commercial PaperДокумент6 страницCommercial PapervmktptОценок пока нет

- Master Procurement Document For WorksДокумент184 страницыMaster Procurement Document For WorksNat TikusОценок пока нет

- Annex VII E3h8 Expendverif enДокумент22 страницыAnnex VII E3h8 Expendverif ensdiamanОценок пока нет

- Report On BSTIДокумент16 страницReport On BSTIRaselAhmed082100% (1)

- Manual de Politici Proceduri Contabile Proprii: SC ................ SRLДокумент12 страницManual de Politici Proceduri Contabile Proprii: SC ................ SRLevidexpertОценок пока нет

- MMF 26th Feb 2014 Fact SheetДокумент1 страницаMMF 26th Feb 2014 Fact SheetfaisaladeemОценок пока нет

- Reserve Bank of India (Note Refund) Rules, 2009Документ12 страницReserve Bank of India (Note Refund) Rules, 2009studentno123Оценок пока нет

- Taxation II-Cases and DigestsДокумент33 страницыTaxation II-Cases and DigestsJhuRise Ann ManganaОценок пока нет

- Evaluation of Job Satisfaction of Social Islami Bank Limited.Документ73 страницыEvaluation of Job Satisfaction of Social Islami Bank Limited.Redwan FerdousОценок пока нет

- Letters of Credit CasesДокумент21 страницаLetters of Credit CasesbalbasjuliusОценок пока нет

- Interim Order in The Matter of Progress Cultivation Limited.Документ12 страницInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderОценок пока нет

- Time-Varying Correlation and The Benefits of Cross-Asset Class DiversificationДокумент63 страницыTime-Varying Correlation and The Benefits of Cross-Asset Class DiversificationTalin MachinОценок пока нет

- Enron A CG RevisedДокумент24 страницыEnron A CG RevisedIrhash ArdhiantaОценок пока нет

- B. Assignment Sheet1 WimДокумент10 страницB. Assignment Sheet1 Wimاحمد حريس محمد ادريسОценок пока нет

- Maritime Industry Authority: Parkview Plaza (Masagana Telamart, Inc.) Taft Avenue Cor. T.M. Kalaw Street, Ermita, ManilaДокумент18 страницMaritime Industry Authority: Parkview Plaza (Masagana Telamart, Inc.) Taft Avenue Cor. T.M. Kalaw Street, Ermita, ManilaEllen Nalia-MoraОценок пока нет

- Foreign Exchange 1Документ25 страницForeign Exchange 1Masud Khan ShakilОценок пока нет

- Investment Letter of IntentДокумент8 страницInvestment Letter of IntentMuhamad Azizi75% (4)

- Company Law Assignment On Rules Regarding Registration and Incorporation of A CompanyДокумент28 страницCompany Law Assignment On Rules Regarding Registration and Incorporation of A CompanyAnirudh AroraОценок пока нет

- Guidance Manual FinalДокумент27 страницGuidance Manual FinalrosdobОценок пока нет

- Tax Audit: Check - ListДокумент26 страницTax Audit: Check - ListMohit GabaОценок пока нет

- Audit of HotelДокумент14 страницAudit of HotelTimothy RichardsonОценок пока нет

- Commission On Banking Technique and PracticeДокумент37 страницCommission On Banking Technique and Practicepiash246Оценок пока нет

- FIDIC Conditions of Contract For Construction, Vesion 1999Документ15 страницFIDIC Conditions of Contract For Construction, Vesion 1999Azam Islam KhanОценок пока нет

- Amity AssignmentДокумент16 страницAmity AssignmentAnkita SrivastavОценок пока нет

- University of Mumbai: Project On: Financial ServicesДокумент50 страницUniversity of Mumbai: Project On: Financial Serviceskunalshah316Оценок пока нет

- Memo98-016.Doc Coa Signboard AmendmentДокумент3 страницыMemo98-016.Doc Coa Signboard AmendmentrubydelacruzОценок пока нет

- PSAKДокумент21 страницаPSAKAlfan Zulfahnur FirdausОценок пока нет

- Supreme Court: As "An Association ComposedДокумент4 страницыSupreme Court: As "An Association Composedpflorendo_1Оценок пока нет

- 2009 Handbook of International Standard On AuditДокумент702 страницы2009 Handbook of International Standard On AuditIcyy Dela PeñaОценок пока нет

- Consumer Law CertificationДокумент6 страницConsumer Law CertificationVskills CertificationОценок пока нет

- Letter of Consent - Final3195544137Документ16 страницLetter of Consent - Final3195544137emufarmingОценок пока нет

- O o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentДокумент18 страницO o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentmkОценок пока нет

- Louw12 AuditingДокумент44 страницыLouw12 Auditingredearth2929Оценок пока нет

- 5 Solar - Inst-To-bidders - FinalДокумент19 страниц5 Solar - Inst-To-bidders - FinalHariharasudhan AnnaduraiОценок пока нет

- PROJECT QUALITY PLANДокумент69 страницPROJECT QUALITY PLANnatrix029Оценок пока нет

- Strict Compliance in Documentary CreditsДокумент14 страницStrict Compliance in Documentary CreditsDineshkumar100% (1)

- New PBD TemplateДокумент198 страницNew PBD TemplateJeric IsraelОценок пока нет

- P2 - 104 - Consignment Sales and Corporate Liquidation - Key AnswersДокумент4 страницыP2 - 104 - Consignment Sales and Corporate Liquidation - Key AnswersJM Tomas Rubianes0% (1)

- Reliance Auditors' Report on Financial StatementsДокумент6 страницReliance Auditors' Report on Financial Statementsjinalshah21097946Оценок пока нет

- Abakada V ExecДокумент8 страницAbakada V ExecAnonymous yiqdcRgYdJОценок пока нет

- Ajara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi MargДокумент32 страницыAjara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi Margpramesh1010Оценок пока нет

- Solar SystemsДокумент80 страницSolar SystemssurendrasimhaОценок пока нет

- SMCH 18 BeamsДокумент19 страницSMCH 18 BeamsAtika DaretyОценок пока нет

- VAT Update on Circular 06/2012Документ6 страницVAT Update on Circular 06/2012DzungОценок пока нет

- MarcopperДокумент12 страницMarcopperMary Ann IsananОценок пока нет

- Risk ManagementДокумент62 страницыRisk ManagementBhavik ShahОценок пока нет

- RMC No 24-2015Документ4 страницыRMC No 24-2015gelskОценок пока нет

- 2009 Revised Rules of Procedure of The CoaДокумент19 страниц2009 Revised Rules of Procedure of The CoaBelarmino NavarroОценок пока нет

- ICC document examines international banking practicesДокумент52 страницыICC document examines international banking practicesParag Jain67% (3)

- Auditors' Report To The President of IndiaДокумент3 страницыAuditors' Report To The President of IndiaSunil ShawОценок пока нет

- Wiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesОт EverandWiley GAAP 2019: Interpretation and Application of Generally Accepted Accounting PrinciplesОценок пока нет

- Wiley GAAP 2015: Interpretation and Application of Generally Accepted Accounting PrinciplesОт EverandWiley GAAP 2015: Interpretation and Application of Generally Accepted Accounting PrinciplesОценок пока нет

- Analysis of PMJDY scheme and its role in financial inclusionДокумент14 страницAnalysis of PMJDY scheme and its role in financial inclusionBikash Kumar Nayak100% (1)

- Incoterms Chart PDFДокумент1 страницаIncoterms Chart PDFJally CalimlimОценок пока нет

- How To Future-Proof Your Career in The Time of Covid-19 - Handouts PDFДокумент26 страницHow To Future-Proof Your Career in The Time of Covid-19 - Handouts PDFMaria Giselle AgustinОценок пока нет

- Recruitment and Selection of Life Insurance AgentДокумент80 страницRecruitment and Selection of Life Insurance AgentHirak SinhaОценок пока нет

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartДокумент15 страницSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Comparison of loan and deposit schemes of Indian Overseas Bank and Development Credit Bank of IndiaДокумент13 страницComparison of loan and deposit schemes of Indian Overseas Bank and Development Credit Bank of IndiaKaran GujralОценок пока нет

- Banking Laws Reviewer Partyduh NotesДокумент55 страницBanking Laws Reviewer Partyduh NotesClint D. Lumberio100% (1)

- Deposit Pay in Slip in MizoДокумент2 страницыDeposit Pay in Slip in MizolokananthanОценок пока нет

- Impact of Financial Inclusion on Daily Wage EarnersДокумент8 страницImpact of Financial Inclusion on Daily Wage EarnersDevikaОценок пока нет

- National Bank of Pakistan overviewДокумент35 страницNational Bank of Pakistan overviewShazy ButtОценок пока нет

- Format .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Документ8 страницFormat .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Impact JournalsОценок пока нет

- Senarai Peserta Larian Virtual 3.0Документ13 страницSenarai Peserta Larian Virtual 3.0MAZUAN BIN MUJAIL MoeОценок пока нет

- 5-Year Projected Income Statement: Arnel's CanteenДокумент5 страниц5-Year Projected Income Statement: Arnel's CanteenKathleen Queen BermudoОценок пока нет

- List of All CompaniesДокумент86 страницList of All CompaniesRaj Sa100% (2)

- Bank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanДокумент3 страницыBank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanJAGDISH GIANCHANDANIОценок пока нет

- Internship Report On Finance MBAДокумент95 страницInternship Report On Finance MBABhaskar GuptaОценок пока нет

- View your account statement onlineДокумент2 страницыView your account statement onlineAnand JainОценок пока нет

- ABSLI Guaranteed Milestone Plan BrochureДокумент15 страницABSLI Guaranteed Milestone Plan Brochurekota praveenОценок пока нет

- The FEDERAL BANK LIMITED Email: Careers@Federalbank - Co.in Website: WWW - Federalbank.co - inДокумент12 страницThe FEDERAL BANK LIMITED Email: Careers@Federalbank - Co.in Website: WWW - Federalbank.co - inaravindmkaranavarОценок пока нет

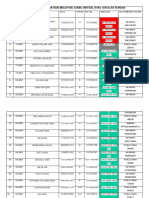

- Import License No. Hs Code Descrip On Pcs Fob Cif BM % BMT % PPN % PPNBM % PPH % BM (RP) BMT (RP) PPN (RP) PPNBM (RP) PPH (RP) Border Post BorderДокумент1 страницаImport License No. Hs Code Descrip On Pcs Fob Cif BM % BMT % PPN % PPNBM % PPH % BM (RP) BMT (RP) PPN (RP) PPNBM (RP) PPH (RP) Border Post BorderarcandraОценок пока нет

- Subject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Документ6 страницSubject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Abhishek ShresthaОценок пока нет

- ACT 6692 Mod 22 AssignmentДокумент3 страницыACT 6692 Mod 22 AssignmentjakobbgldtsОценок пока нет

- Sample Promissory NoteДокумент4 страницыSample Promissory NoteJorge Poveda100% (1)

- Office of The Auditor Construction Industry Authority of The PhilippinesДокумент3 страницыOffice of The Auditor Construction Industry Authority of The PhilippinesHoven MacasinagОценок пока нет

- Birla Sun Life Insurance: Soumya Katiyar JN180245 PGDM-SMДокумент17 страницBirla Sun Life Insurance: Soumya Katiyar JN180245 PGDM-SMSupriyo BiswasОценок пока нет

- OctoberДокумент3 страницыOctoberMuhammad IqbalОценок пока нет

- Travel and Expense PolicyДокумент6 страницTravel and Expense PolicyLee Cogburn100% (1)

- A Comparative Study of Financial Permormance of State Bank of India and ICICI BankДокумент10 страницA Comparative Study of Financial Permormance of State Bank of India and ICICI Bankprteek kumarОценок пока нет

- HDFC Bank PresentationДокумент14 страницHDFC Bank PresentationvinaytoshchoudharyОценок пока нет

- CicДокумент25 страницCicjunjie buliganОценок пока нет