Академический Документы

Профессиональный Документы

Культура Документы

"Cause of Crisis and The Solution": Accountancy Business and The Public Interest, Vol. 8, No. 1, 2009

Загружено:

Bayu PrabowoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

"Cause of Crisis and The Solution": Accountancy Business and The Public Interest, Vol. 8, No. 1, 2009

Загружено:

Bayu PrabowoАвторское право:

Доступные форматы

Accountancy Business and the Public Interest, Vol. 8, No.

1, 2009

CAUSE OF CRISIS AND THE SOLUTION

by Rodney Shakespeare Visiting Professor of Binary Economics, Trisakti University, Jakarta 11, Charman House, Hemans Estate, London, SW8 4SP, 020 7771 1107 rodney.shakespeare1@btopenworld.com and Peter Challen Canon Emeritus of Southwark, and Sloan Fellow of the London Business School Chair, Christian Council for Monetary Justice 21 Bousfield Rd. London SE14 5TP 020 7207 0509 peterchallen@gmail.com

97

Accountancy Business and the Public Interest, Vol. 8, No. 1, 2009

CAUSE OF CRISIS AND THE SOLUTION

Recession, depression -- these are weasel words because we are looking downward towards a slump, and a long one at that. At the same time, there is a burgeoning environmental crisis. Are the causes of the economic and

environmental crisis understood? Is there a solution or is the reality that we can only wail and wring our hands?

The main cause of the global economic crisis lies in something of which most people are not aware -- that the banking system creates money out of nothing, adds interest and administration cost and does NOT direct the money towards the development and spreading of productive capacity and the associated consuming capacity. Because of the failure to ensure that the newly created money really does serve the efficiency and justice purposes of a modern market economy, colossal imbalances build up; in particular, there is an accretion of debt. The debt happens because the system does not create enough money for the repayment of the principal of a loan as well as the interest and this results not only in the build-up of debt but also, because there is continual pressure to create more money, in inflation as well. In particular, the system does not implement the basic requirement of Say's Theorem that producers and consumers should be the same people. Furthermore, the weaknesses of the economic and financial system also prevent a solution to the major environmental problems.

And the situation is being made worse because all the present touted remedies require what is called "borrowing" which is really the borrowing of the money created out of nothing by the banking system, which is the basic cause of all the trouble in the first place. USA Congressman Dennis Kucinich recently expressed this succinctly by saying that the USA is bailing out the Wall Street banks with money borrowed from those banks.

To any reasonably sane person it would seem impossible that the banks should be in insolvency crisis and then solvency should then be attempted with money borrowed from those very same banks. But Kucinich's statement 98

Accountancy Business and the Public Interest, Vol. 8, No. 1, 2009

gets to the heart of the situation revealing the truly Alice in Wonderland nature of what is, and has been for a long time, going on.

The crux of the solution is to recognise the basic cause of the crisis --- the money being endlessly created for wrong purpose -- and then to stop the creation. The usual expression of this is to say that when you are in a hole it is best to stop digging deeper. In practice that means (by a gradual rise to 100% banking reserves) stopping the banks from creating money out of nothing. Rather they should do what most people believe they do do -- i.e. lend their own capital. In addition they should be allowed to lend, with

permission, the deposits of their customers.

It should be also noted that the regulation of the banks would not be enough because, at the heart of neoclassical economic doctrine is the belief that there is something wonderful -- called endogenous money -- which produces all the miracles of the 'free market'. 'Endogenous money' is defined as bank-created interest-bearing money which serves the 'free market '' and thus, it is claimed, all the outcomes are both efficient and justice.

But this is false. The 'free market' is not free, nor efficient, nor fair.

The answer to this unreality is to first acknowledge the banks' reckless and disgraceful behaviour and then to open up a new money supply originating with the national bank. This supply would be free of interest (but not of

administration cost) and thus would be potentially capable of halving, even quartering, the cost of all capital investment. The new supply would then be administered by the banks for the purposes of developing and spreading productive (and so consuming) capacity in the population thereby implementing the desired balance of Say's Theorem. Most remarkably of all, this would forward efficiency at the same time as it forwards social and economic justice.

The way forward can be summarised as the use of state generated interestfree loans for 99

Accountancy Business and the Public Interest, Vol. 8, No. 1, 2009

a)

the purposes of spreading ownership in medium and large corporations

in the private sector, b) c) d) e) f) g) environmental capital projects micro credit student loans private housing (in particular circumstances) small business/farms public capital projects e.g., infrastructutre

In all the cases, the cost is halved, even quartered.

In our book 'Seven Steps to Justice' (2002) we propose the following steps which would include redistribution of income by reason of developing and spreading ownership of the nation's productive capacity. This is more recently re-itereated on www.binaryeconomics.net

Step One That there be open, regular and public acknowledgement by state, economists and academia that the present western banking system is an unjust monopoly that creates 97% of the money supply as interest-bearing debt. Step Two That interest-free loans (i.e. state-issued repayable money created free of charge beyond administrative and other necessary cost) be used, via community investment corporations and the like, for capital investment needed by the public sector thus enabling such investment to be one half, even one third, of the present cost. Step Three That interest-free loans (i.e. state-issued repayable money created free of charge beyond administrative and other necessary cost including loan insurance) be used, on the principles of binary economics, for private capital investment which will create ownership stakes and property incomes for all income groups, especially the poor. Step Four That interest-free loans (i.e. state-issued repayable money created free of charge beyond administrative and other necessary cost including loan 100

Accountancy Business and the Public Interest, Vol. 8, No. 1, 2009

insurance) be used for loans to start-up and small business for socially desirable enterprise. Step Five That, since Steps Two, Three and Four above, while enhancing productive capacity and individual productiveness, are counter-inflationary and ultimately diminish the money supply, debt-free money (state-issued, non-repayable money for public or wide ownership purposes) should be issued for another individual basic income to the extent necessary to keep a stable level of prices. The amount should be decided by a body free from operational

control by politicians. Step Six That women be addressed as to the role they can play in getting two basic incomes for all individuals throughout the world. Step Seven Uses Steps two to six to find a new long term solution for the problems of the Middle East and Kashmir. A solution is urgent and would be about as clear a gain to the human race as anything could be.

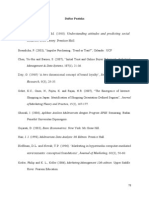

Implementation of the Seven Steps will create healthy non-inflationary economies and societies in which all individuals attain a sturdy independence becoming economically productive to the extent necessary to satisfy their reasonable needs. The diagram below illustrates the persistent flow of finance in this interest-free system.

101

Accountancy Business and the Public Interest, Vol. 8, No. 1, 2009

A MAP OF A RECIPROCAL FLOW OF FINANCE

----------------------------------------------------

Interest-free loans for environmental capital and other purposes come from

Central Bank

and are lent to approved institutions Grameen Bank or other nongovernmental organisation

Bank

Bank

Government

farms

which may charge for administration cost but may NOT add interest as they lend for small business micro-finance motor-repair chickens fish ponds medium and large business IF wider ownership is promoted

public capital bridges, schools hospitals, roads sewage works water supplies

environmental projects tidal barrages solar electricity wind farms magnetic energy generation

student loans thereby halving or more the cost

102

Вам также может понравиться

- Wolf, M. (Financial Times) - Strip Private Banks of Their Power To Create Money (2014)Документ12 страницWolf, M. (Financial Times) - Strip Private Banks of Their Power To Create Money (2014)Sam SamОценок пока нет

- Michel Bauwens: Debt-Free Money May Well Be The Solution To Restoring A Sane Monetary SystemДокумент4 страницыMichel Bauwens: Debt-Free Money May Well Be The Solution To Restoring A Sane Monetary SystemSimply Debt SolutionsОценок пока нет

- MY DEBATES WITH MMTersДокумент31 страницаMY DEBATES WITH MMTersxan30tosОценок пока нет

- The Six Root Causes of The Financial Crisis: Blog Posts Future of FinanceДокумент4 страницыThe Six Root Causes of The Financial Crisis: Blog Posts Future of Financeankit kumarОценок пока нет

- Failure of Financial Innovation Dec 2009 TrimbathДокумент22 страницыFailure of Financial Innovation Dec 2009 TrimbatheconlawОценок пока нет

- Mervyn King Speech On Too Big To FailДокумент10 страницMervyn King Speech On Too Big To FailCale SmithОценок пока нет

- Reimagining Financial Inclusion: Tackling the flaws of our formal financial systemОт EverandReimagining Financial Inclusion: Tackling the flaws of our formal financial systemОценок пока нет

- Wheres The Money-BLДокумент32 страницыWheres The Money-BLMandela E'mmaОценок пока нет

- Shaikh First Great Depression of The 21st Century 8-23-10Документ20 страницShaikh First Great Depression of The 21st Century 8-23-10Nguyen Quoc AnhОценок пока нет

- The End of Banking: Money, Credit, And the Digital RevolutionОт EverandThe End of Banking: Money, Credit, And the Digital RevolutionРейтинг: 4 из 5 звезд4/5 (1)

- Islamic Banking and FinanceДокумент2 страницыIslamic Banking and FinanceAbdul RehmanОценок пока нет

- Democratizing MoneyДокумент8 страницDemocratizing MoneylivemomentsОценок пока нет

- LSE - The Future of FinanceДокумент294 страницыLSE - The Future of FinancethirdeyepОценок пока нет

- Essence of Islamic Finance: January 2010Документ7 страницEssence of Islamic Finance: January 2010Şehmus AYDINОценок пока нет

- Wray 2008. Financial Markets Meltdown. What Can We Learn From MinskyДокумент53 страницыWray 2008. Financial Markets Meltdown. What Can We Learn From MinskyppphhwОценок пока нет

- The Big Short Case StudyДокумент5 страницThe Big Short Case StudyMaricar RoqueОценок пока нет

- The 2008 Financial CrisisДокумент14 страницThe 2008 Financial Crisisann3cha100% (1)

- Dealing With The Financial CrisisДокумент8 страницDealing With The Financial CrisisgreatbilalОценок пока нет

- Esr Assignmt 1nov11Документ12 страницEsr Assignmt 1nov11hashimhafiz10% (1)

- Where Does Money Come FromДокумент32 страницыWhere Does Money Come FromiaintОценок пока нет

- Beyond Bailouts, Let's Put Life Ahead of MoneyДокумент4 страницыBeyond Bailouts, Let's Put Life Ahead of MoneyDaisyОценок пока нет

- Basic Income in Times of Grave Economic CrisisДокумент10 страницBasic Income in Times of Grave Economic Crisismoebius70Оценок пока нет

- Liquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkДокумент10 страницLiquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkAnonymous i8ErYPОценок пока нет

- Ferguson 2009 1Документ4 страницыFerguson 2009 1Tom DavisОценок пока нет

- Should Banks Be Narrowed An Evaluation oДокумент33 страницыShould Banks Be Narrowed An Evaluation oHector J. RubiniОценок пока нет

- ChapraДокумент14 страницChaprasilvi dianaОценок пока нет

- Where's The Money To Come From??Документ32 страницыWhere's The Money To Come From??kronblom100% (1)

- The Cyclical Nature of The World of Financial HistoryДокумент3 страницыThe Cyclical Nature of The World of Financial HistoryRia ChowdhuryОценок пока нет

- How Are You Going to Pay for That?: Smart Answers to the Dumbest Question in PoliticsОт EverandHow Are You Going to Pay for That?: Smart Answers to the Dumbest Question in PoliticsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Boom or BustДокумент3 страницыBoom or Bustapi-127186411Оценок пока нет

- William C Dudley: Solving The Too Big To Fail ProblemДокумент9 страницWilliam C Dudley: Solving The Too Big To Fail ProblemForeclosure FraudОценок пока нет

- Presentation To The Third Seminar of The FI On The Economic CrisisДокумент22 страницыPresentation To The Third Seminar of The FI On The Economic CrisisValentín HuarteОценок пока нет

- The Global Financial Crisis and The Shift To Shadow Banking: Working Paper No. 587Документ30 страницThe Global Financial Crisis and The Shift To Shadow Banking: Working Paper No. 587henfaОценок пока нет

- Come Across An Article That Gives AДокумент4 страницыCome Across An Article That Gives AElvin NasibovОценок пока нет

- The Nature of Money, 206ppДокумент206 страницThe Nature of Money, 206ppLocal Money100% (1)

- Fractional Reserve System - A Critical Review From The Perspective of Islamic EconomicsДокумент48 страницFractional Reserve System - A Critical Review From The Perspective of Islamic EconomicsFahimОценок пока нет

- Financial Market and EconomyДокумент12 страницFinancial Market and EconomyPraise Cabalum BuenaflorОценок пока нет

- Kir Man Economic CrisisДокумент38 страницKir Man Economic CrisisAlejandro López VeraОценок пока нет

- Structural Causes of The Global Financial Crisis A Critical Assessment of The New Financial ArchitectureДокумент18 страницStructural Causes of The Global Financial Crisis A Critical Assessment of The New Financial ArchitectureremivictorinОценок пока нет

- Crotty y Epstein - The Costs and Contradictions of The Lender-Of-Last Resort Function in Contemporary Capitalism The Sub-Prime Crisis of 2007 - 2008Документ56 страницCrotty y Epstein - The Costs and Contradictions of The Lender-Of-Last Resort Function in Contemporary Capitalism The Sub-Prime Crisis of 2007 - 2008francoacebeyОценок пока нет

- Endogenous Systemic Liquidity RiskДокумент42 страницыEndogenous Systemic Liquidity Riskvidovdan9852Оценок пока нет

- Xii-Gas2 Purity: By: Jade R. MarañonДокумент29 страницXii-Gas2 Purity: By: Jade R. MarañonMerlanie MaganaОценок пока нет

- TIE W08 FinSafetyNetДокумент14 страницTIE W08 FinSafetyNetRadhya KhairifarhanОценок пока нет

- The Economi of Success: Twelve Things Politicians Don't Want You to KnowОт EverandThe Economi of Success: Twelve Things Politicians Don't Want You to KnowОценок пока нет

- ... For Economic EducationДокумент3 страницы... For Economic EducationsilberksouzaОценок пока нет

- ReflectionsOnFinanceAndTheGoodSoci PreviewДокумент9 страницReflectionsOnFinanceAndTheGoodSoci PreviewWalter ArceОценок пока нет

- Fairy Tale Capitalism: Fact and Fiction Behind Too Big to FailОт EverandFairy Tale Capitalism: Fact and Fiction Behind Too Big to FailОценок пока нет

- Article Fiscal PolicyДокумент4 страницыArticle Fiscal PolicyLaiba RizwanОценок пока нет

- Reinventing Banking: Capitalizing On CrisisДокумент28 страницReinventing Banking: Capitalizing On Crisisworrl samОценок пока нет

- Family Tree KBM Roda-4: Motor Penggerak Transmisi Drive Axle Steering SystemДокумент5 страницFamily Tree KBM Roda-4: Motor Penggerak Transmisi Drive Axle Steering SystemBayu PrabowoОценок пока нет

- Collection 2010: Big Kids GirlsДокумент7 страницCollection 2010: Big Kids GirlsBayu PrabowoОценок пока нет

- Factors Affecting Business Success of Small & Medium Enterprises (Smes) in ThailandДокумент11 страницFactors Affecting Business Success of Small & Medium Enterprises (Smes) in ThailandBayu PrabowoОценок пока нет

- Daftar PustakaДокумент23 страницыDaftar PustakaBayu PrabowoОценок пока нет

- Technometric Benchmarking: Identifying Sources of Superior Customer ValueДокумент27 страницTechnometric Benchmarking: Identifying Sources of Superior Customer ValueBayu PrabowoОценок пока нет

- AWP 4A Syllabus Fall 2021 (Misinformation)Документ11 страницAWP 4A Syllabus Fall 2021 (Misinformation)camОценок пока нет

- The Eclectic (OLI) Paradigm of International Production - Past, Present and FutureДокумент19 страницThe Eclectic (OLI) Paradigm of International Production - Past, Present and FutureJomit C PОценок пока нет

- Caribbean Examination Council: School Based AssessmentДокумент17 страницCaribbean Examination Council: School Based AssessmentDiana FrillsОценок пока нет

- Docker Tutorial: Anthony BaireДокумент99 страницDocker Tutorial: Anthony BairesuderОценок пока нет

- Fall 2015 The Language of Anatomy PDFДокумент14 страницFall 2015 The Language of Anatomy PDFpikminixОценок пока нет

- Nurse Education Today: Natalie M. Agius, Ann WilkinsonДокумент8 страницNurse Education Today: Natalie M. Agius, Ann WilkinsonSobiaОценок пока нет

- Quantum Data-Fitting: PACS Numbers: 03.67.-A, 03.67.ac, 42.50.DvДокумент6 страницQuantum Data-Fitting: PACS Numbers: 03.67.-A, 03.67.ac, 42.50.Dvohenri100Оценок пока нет

- The Complete Guide To Installing The 44 Split Defense PDFДокумент171 страницаThe Complete Guide To Installing The 44 Split Defense PDFsaid100% (1)

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersДокумент41 страницаNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediОценок пока нет

- Ricoh Aficio SP C420DN PARTS CATALOGДокумент82 страницыRicoh Aficio SP C420DN PARTS CATALOGYury Kobzar100% (2)

- Network Tools and Protocols Lab 2: Introduction To Iperf3Документ17 страницNetwork Tools and Protocols Lab 2: Introduction To Iperf3Fabio MenesesОценок пока нет

- FM Assignment 17-M-518 MMM - Eicher MotorДокумент33 страницыFM Assignment 17-M-518 MMM - Eicher MotorTrilokОценок пока нет

- Jean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Документ10 страницJean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Javier PerezОценок пока нет

- TOS 1st QuarterДокумент6 страницTOS 1st QuarterQuerisa Ingrid MortelОценок пока нет

- Webinar WinCC SCADA NL 29052018Документ62 страницыWebinar WinCC SCADA NL 29052018AlexОценок пока нет

- Creating Enterprise LeadersДокумент148 страницCreating Enterprise LeadersValuAidОценок пока нет

- Prishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLДокумент12 страницPrishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLsudharaj86038Оценок пока нет

- New DOCX DocumentДокумент2 страницыNew DOCX DocumentPunjabi FootballОценок пока нет

- Catalogo Repetidor EnergyAxisДокумент2 страницыCatalogo Repetidor EnergyAxisolguita22Оценок пока нет

- Learning Spoken English in Half The TimeДокумент86 страницLearning Spoken English in Half The TimeΔέσποινα ΤζουτОценок пока нет

- Javascript PrefiДокумент66 страницJavascript Prefiguendelyn omegaОценок пока нет

- Internal Audit, Compliance& Ethics and Risk Management: Section 1) 1.1)Документ6 страницInternal Audit, Compliance& Ethics and Risk Management: Section 1) 1.1)Noora Al ShehhiОценок пока нет

- Module 5 - Elements of Financial StatementsДокумент34 страницыModule 5 - Elements of Financial StatementsRandolph ColladoОценок пока нет

- Essentials of Repertorization Tiwari Link PageДокумент11 страницEssentials of Repertorization Tiwari Link PageBibin TSОценок пока нет

- 1623 Asm2Документ21 страница1623 Asm2Duc Anh nguyenОценок пока нет

- Lesson 5 Flight of Projectile, Air Resistance Neglected: OverviewДокумент7 страницLesson 5 Flight of Projectile, Air Resistance Neglected: OverviewNadjer C. AdamОценок пока нет

- BVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFДокумент3 страницыBVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFRiska Putri AmirОценок пока нет

- Test Report For Feeder Protection RelayДокумент3 страницыTest Report For Feeder Protection RelayHari haranОценок пока нет

- Specification For Neoprene Coating On The Riser CasingДокумент17 страницSpecification For Neoprene Coating On The Riser CasingLambang AsmaraОценок пока нет