Академический Документы

Профессиональный Документы

Культура Документы

Determinants of Lending Behavior

Загружено:

dinesh8maharjanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Determinants of Lending Behavior

Загружено:

dinesh8maharjanАвторское право:

Доступные форматы

factors Affecting Lending Environments in Commercial Banks in Tanzania

Introduction

The primary role of the banking industry is through their financial intermediation and mobilizing the funds. In this practice, there is an available investment for the individuals and companies. This is the common function of a banking institution. The main sources of funds in a bank are the customers deposits. Through the use of lending, the people can acquire their needs according to their agreement with the commercial banks. And by the implementation of the regulations that tends to protect the interests of the banks, there is an assurance that there is a reduction in the failures of the banks even in developing countries.

Background and Problem Statement

Because of the global changes in financial markets and financial market players could lead to changes in the delivery of credit to agriculture and rural developments. The changing competitive landscape could result in expanded niche players, new entrants, and firms exiting the rural and agricultural lending market. Understanding the changing structure of banking institutions should provide useful policy information to assure a safe, sound, competitive and efficient rural and agricultural lending market. The ability of banks to deliver agricultural and rural loans efficiently in the future will play an important role in rural economy. In the early research in terms of factors affecting the commercial bank lending to agriculture (in America, particularly in Texas), through the tobit model the researchers found that the ratio of agricultural loans to bank assets

declined as commercial bank deposits become more sensitive to market rates (Nam, Ellinger, & Katchova, 2007). However, in Tanzania which is a developing country, the scenario might be different. Then, what would be the factors that contribute in the lending environment of the commercial banks in Tanzania?

Research Aim and Objectives

The main aim of the study is to investigate the factors that might affect the lending ability of the commercial banks in Tanzania. And in order to properly gain the information needed, the study has four objectives that needs to be considered. First is to examine the structural and other characteristics of banks which might affect the lending capacity of the banks in different sectors like industries and agriculture, etc. Second is to determine the ability of the business sectors in terms of the agreement between the banks. Third is to identify the capacity of the commercial banks in terms of the liquidation and bankruptcy. And fourth is to measure the effectiveness of the regulations imposed in the financial environment.

Literature Review

The banks offer different services and products. For such, there are car loans, mortgage loans, credit for business financing and many others that require the depositors funds. However, because of the recession and financial crunches, the credits and loans became stricter. Added to that, are the continuous rises of bad debts, which affect the ability of the banks to provide the financial needs. The mismatch of the liabilities being payable on demand became a great problem that constraints the banks

in awarding the credit and loans. This entirely loses the shareholders. In terms of allowing the agricultural and industrial sector in lending, the negotiation and regulations are the only answer of the governmental and public banks. On the other hand, the commercial banks might be reluctant to create any lending transactions because as part of the credit risk management, the loan portfolio became their basis to award the loan or not. This is to avoid the long-standing debts even if there is a government subsidy and assurance. It is evident the last years effects are reflected in the practice of the banking institutions (Tanzanian Bankers, 2006).

Methodology

The applied method in the study is the use of survey and interview among the commercial banks in Tanzania. In the first phase of the study, the survey will be conducted among the financial officers who are handling the credit or loans transactions and activities. Through the use of the survey, the study can gain the idea regarding the implemented standards or protocol before awarding the credit and in collecting the debts they offered. On the other hand, the second phase of the study is through the use of the interview which will be conducted among the administrators or banks managers of the commercial banks. In this way, the researchers can determine the effectiveness of the imposed regulation in lending activities. In addition, the effects of bad debts in the operations of the banks can be also determined.

References:

Nam, S., Ellinger, P.N., & Katchova, A.L., (2007) The Changing Structure of Commercial Banks Lending to Agriculture [Online] Available [Accessed at: 08

http://ageconsearch.umn.edu/bitstream/9913/1/sp07na03.pdf September 2010].

Tanzanian Bankers, (2006) The Land Reform in Tanzania: Opportunities for Agriculture and Mortgage Finance [Online] Available at:

http://www.tanzaniabankers.org/land%20reform.pdf [Accessed 08 September 2010].

Read more: http://ivythesis.typepad.com/term_paper_topics/2010/09/research-proposal-on-11.html#ixzz2lkHY1QZx

Вам также может понравиться

- CG and Ceo CompensationДокумент12 страницCG and Ceo Compensationdinesh8maharjanОценок пока нет

- Roles and Responsibilities of CEO: Presented By: Avtar SinghДокумент12 страницRoles and Responsibilities of CEO: Presented By: Avtar Singhdinesh8maharjanОценок пока нет

- Case 1Документ2 страницыCase 1dinesh8maharjanОценок пока нет

- How To Format Your Computer and Reinstall XPДокумент10 страницHow To Format Your Computer and Reinstall XPdinesh8maharjanОценок пока нет

- BFДокумент14 страницBFsceneoritaОценок пока нет

- Tax Deduction at Source (TDS)Документ15 страницTax Deduction at Source (TDS)dinesh8maharjanОценок пока нет

- Swaps: Interest Rate SwapДокумент9 страницSwaps: Interest Rate Swapdinesh8maharjanОценок пока нет

- Determinants of individual investors' risky portfolio choicesДокумент34 страницыDeterminants of individual investors' risky portfolio choicesdinesh8maharjanОценок пока нет

- Case 1Документ2 страницыCase 1dinesh8maharjanОценок пока нет

- Tax Deduction at Source (TDS)Документ15 страницTax Deduction at Source (TDS)dinesh8maharjanОценок пока нет

- About PAN - 06302010Документ2 страницыAbout PAN - 06302010Pawan KumarОценок пока нет

- Income Tax Act 2058Документ115 страницIncome Tax Act 2058Gyanu KhatriОценок пока нет

- Research Paper Review PortfolioДокумент6 страницResearch Paper Review Portfoliodinesh8maharjanОценок пока нет

- About PAN - 06302010Документ2 страницыAbout PAN - 06302010Pawan KumarОценок пока нет

- Production and Operation Management Project On Nestle MilkpakДокумент107 страницProduction and Operation Management Project On Nestle Milkpakdinesh8maharjanОценок пока нет

- Price Discovery in Illiquid Market.Документ4 страницыPrice Discovery in Illiquid Market.dinesh8maharjanОценок пока нет

- HedgДокумент7 страницHedgdinesh8maharjanОценок пока нет

- Shahnaz Hussain Case StudyДокумент5 страницShahnaz Hussain Case Studydinesh8maharjan0% (1)

- CASE 3 TheRisingEuroHammersAutopartsManufacturersДокумент1 страницаCASE 3 TheRisingEuroHammersAutopartsManufacturersdinesh8maharjanОценок пока нет

- Employment DevelopmentДокумент56 страницEmployment Developmentdinesh8maharjanОценок пока нет

- RecruitmentДокумент9 страницRecruitmentdinesh8maharjanОценок пока нет

- Employment DevelopmentДокумент56 страницEmployment Developmentdinesh8maharjanОценок пока нет

- 0012doing Business in Malaysia GuideДокумент19 страниц0012doing Business in Malaysia GuideMichael TanОценок пока нет

- BraziliaДокумент25 страницBraziliadinesh8maharjanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Treasury BillsДокумент11 страницTreasury BillspoojaОценок пока нет

- Simplify Payments with Simpl BNPL PlatformДокумент5 страницSimplify Payments with Simpl BNPL PlatformAkram KhanОценок пока нет

- Unit 1 FIДокумент26 страницUnit 1 FIRohit SinghОценок пока нет

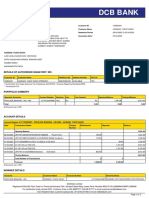

- DCB Bank: Statement of AccountДокумент2 страницыDCB Bank: Statement of AccounthasnainОценок пока нет

- Interim Statement 10-Mar-2023 12-25-49Документ2 страницыInterim Statement 10-Mar-2023 12-25-49zani arslanОценок пока нет

- SAP Payment MethodsДокумент3 страницыSAP Payment MethodsEdaero BcnОценок пока нет

- Caf-1 IaДокумент5 страницCaf-1 IaZohaad HassanОценок пока нет

- Financial Analysis of HDFC BankДокумент48 страницFinancial Analysis of HDFC BankAbhay JainОценок пока нет

- Deed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014Документ9 страницDeed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014mukund100% (1)

- Dabur Balance SheetДокумент30 страницDabur Balance SheetKrishan TiwariОценок пока нет

- Exam in The ABCs of QuickBooksДокумент3 страницыExam in The ABCs of QuickBooksJessa Beloy100% (1)

- Credit Management at Janata BankДокумент58 страницCredit Management at Janata BankRubicon InternationalОценок пока нет

- Islamic Banking Exam QuestionsДокумент24 страницыIslamic Banking Exam Questionsshopno100% (1)

- Annual - Report - 2018 Sonali PDFДокумент388 страницAnnual - Report - 2018 Sonali PDFMd Shakawat HossainОценок пока нет

- Products and Services Offered by Islamic Banks.Документ6 страницProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniОценок пока нет

- IDBI Bank mulls merger of home loan unit to consolidate businessДокумент5 страницIDBI Bank mulls merger of home loan unit to consolidate businessprajuprathuОценок пока нет

- Monthly Statement: Name Address Account Number Statement PeriodДокумент18 страницMonthly Statement: Name Address Account Number Statement PeriodAlexander Weir-WitmerОценок пока нет

- IMC Project State Bank of IndiaДокумент18 страницIMC Project State Bank of IndiaRinni Shukla0% (1)

- Educational Loan HighlightsДокумент4 страницыEducational Loan HighlightsShawn McartyОценок пока нет

- Evidence 6 7Документ3 страницыEvidence 6 7Jennifer JohnsonОценок пока нет

- Akhuwat Foundation Services BreakdownДокумент30 страницAkhuwat Foundation Services BreakdownAdeel KhanОценок пока нет

- Payment Bank Impact On Digital BankingДокумент78 страницPayment Bank Impact On Digital BankingSudharshan Reddy P0% (1)

- RecoveriesДокумент45 страницRecoveriesSona ElvisОценок пока нет

- PDCP V IAC Case DigestДокумент1 страницаPDCP V IAC Case DigestPj PalajeОценок пока нет

- 4-Tier Structure For Urban Cooperative BanksДокумент6 страниц4-Tier Structure For Urban Cooperative BanksNavneet BhandariОценок пока нет

- BRD transaction reportДокумент5 страницBRD transaction reportDavid GeorgeОценок пока нет

- Forward Contracts Prohibitions On PDFДокумент23 страницыForward Contracts Prohibitions On PDFIqbal PramaditaОценок пока нет

- Digital Banking Project - BubunaДокумент20 страницDigital Banking Project - BubunaRaghunath AgarwallaОценок пока нет

- Introduction to ATM: Key Components, Functions, and TroubleshootingДокумент32 страницыIntroduction to ATM: Key Components, Functions, and TroubleshootingMalar100% (1)

- Objection HandlingДокумент4 страницыObjection HandlingPrerna AroraОценок пока нет