Академический Документы

Профессиональный Документы

Культура Документы

Speech For Dr. Amjad Saqib - MFS 2013) - Version 1

Загружено:

Qay AbbeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Speech For Dr. Amjad Saqib - MFS 2013) - Version 1

Загружено:

Qay AbbeАвторское право:

Доступные форматы

Microfinance Summit 2013 Dr. Muhammad Amjad Saqib 1.

More than a decade ago, I was having dinner with old friends and batch mates. Topics rife in such meals are usually old memories, sports, doldrums of professional lives, and politics. No one knew that this dinner will provide over 300,000 people the opportunity to become entrepreneurs in a period of a decade; no one knew that this is going to change the lives of poor - from dependent. I worked for PRSP from 1998 to 2003, and learnt the principles of participatory development and microfinance. How these small loans can bring about a big change. Allah (SWT) provided life to the intangible feeling of brotherhood during that discussion Akhuwat was born and began providing interest free loans to individuals in 2001. In 2003, we registered Akhuwat as a Society. 2. Akhuwat has given a unique model to the microfinance industry as result of these experiences, we see microfinance as one of the most effective tool to help poor come out of poverty. This approach does not only lead to financially stronger families but also generates economic activity. The main objective remains helping the poor and to reduce poverty, to connect the more fortunate with the less fortunate which has been the cornerstone of Akhuwats vision. 3. The feature which adds more exclusivity in the cause is the role Akhuwat assigns to the worship places in its operations. For Muslims, the Mosque occupies a central place in the social, political, and economic activities of the community. Mosque is first and foremost a place for remembering and worshipping the Almighty. 4. The Government of Punjab launched the Chief Ministers Self-Employment Scheme (CMSES) under which a fund of over Rs. 2 billion was created and its implementation outsourced. In the words of the Chief Minister Shahbaz Sharif it is a significant step towards making Pakistan a country as it was envisioned by Quaid-e-Azam and Allama Iqbal. The Akhuwat Model is an experiment which is defining new rules and giving birth to new philosophies. The Akhuwat Model is a successful experiment which has been able to garner support and trust from State. 5. The recent support provided by the Government of Gilgit Baltistan to Akhuwat, helped the organization to establish three offices in the province. Recently, a cumulative disbursement of approximately 300 loans worth Rs. 5 Million was made. The Akhuwat family is extremely excited to enter into an area where mountains are high and Indus in young recognition of the federal and provincial governments of our approach is a testament that interest free microfinance is the way forward. Its the only catalyst of eliminating poverty truly and every passing day is proving the point; going strength to more strength every day. 6. 90% of our loan portfolio is directed towards enterprise development. A significant portion of it goes towards helping and mentoring budding entrepreneurs who are unemployed or belong to the lower income groups. One of the cornerstones of our partnership with the Government of Punjab was to facilitate the unemployed and diploma holders coming out of government run vocational training centers.

7. Through, Akhuwat Educational Assistance Program, a long term interest free loan program. Akhuwat helps deserving students from extremely poor family backgrounds with good high school educational records. This program is meant to alleviate some of the financial burden off of their shoulders so as to allow them to whole-heartedly attain the education they require and deserve. 8. Through this program, many young adults have made positive steps to better their individual lives and break the cycle of inequality they have been accustomed to. Thus not only improving their own lives and those of their families but spreading the true essence of Akhuwat in all their modalities. Students seeking help through this program are studying in LUMS, King Edward Medical University, University of Engineering and Technology, GCU and FAST. 9. Additionally, we do that by protecting our clients. Firstly, by providing loans on interest free basis and providing easy installments. Secondly, by not using tools such as threats and intimidation to recover loans in case they are not able to pay on time. Instead, we counsel and mentor them in order to operate their business model at optimum level and provide them more time to settle their loans. Thirdly, in case of accident, short term or permanent disability or death, Akhuwats Takaful pays the pending payments i.e. charged one time 1% of the total amount loaned. In case of death of a borrower, Akhuwat also provides financial support to the grieving family for funeral and burial procedures. We do not leave them alone in their times of transformation and in their times of grief. Perhaps, that is a reason why we are able to maintain the recovery percentage and are able to achieve an OSS rate of 119%.

Concluding paragraphs Akhuwat, represents the best in society: the willingness and enthusiasm of individuals to help others; the moral obligation that comes with religion to help others but not the prejudices; avoidance of any strong-arm tactics; and helping others not just financially but by transforming their mindsets. Akhuwat has effectually used the principles of Islam such as compassion, social justice and Brotherhood in the field of Micro Finance. The trail of compassion is heavily imprinted and found in the operations of Akhuwat. The massive increases in funding and trust every year is an existing example of Akhuwats focused approach towards donors. From 10,000 rupees, we have reached to a mammoth size of 5 billion; aiming to grow three times in the current fiscal year through the support and recognition of state. Moreover, by not levying interest, providing easy installments, an even easier eligibility criteria and building capacities of the borrowers through counseling are few of the immeasurable examples which unveils empathy in each and every action of Akhuwat. The journey of Akhuwat is a testament of the ability of volunteerism and self-reliance to transform the lives of thousands. It is a story that seeks to inspire and rekindle the faith in the strength of communities and populations to contribute to efforts at poverty alleviation. Bust most importantly it

serves as a reminder of the spirit and objectives which initiated the birth of the microfinance movement. Akhuwat is not just an organization; it is a way of life, a perspective, a collective understanding on how to empower people. Our work does not limit itself to microfinance because our vision isnt limited to economics, our work does not commence at 9 and end at 5 but is a continual and perpetual process in a constant state of evolution, learning how best to serve those in need. Akhuwat adapts to its surroundings and sooner than later we find that the surroundings have started to mirror the values we hold so dear to us; keeping us in check with the reality at ground. It is a counter- capitalist movement in a capitalist culture and the momentum we have gained over the past decade serves as a reminder to us that we are on the right path, the path to alleviation and inevitably, equality. Akhuwat embeds itself so deeply in the lives of the people it comes in contact with that it is beyond anyone to distinguish where Akhuwat stops and real life begins. In the end, I would like to thank all the organizers, for not just holding the Microfinance Summit 2013, but for their relentless efforts to bring Pakistan on the threshold of success and peace; for putting the efforts and for striving to take the poverty struck people out of the clutches of misery and exploitation. Mere words will never be able to express the gratitude truthfully, ever. But, the tears of happiness and joy in the face of those we serve; certainly proves that this sector has brought a positive impact into their lives that this sector is going through the right stages of evolution. The Summit is a change maker, and is going to go down in the history as the event which changed the face of microfinance in the country; revolutionized the way we work. Thank you.

Вам также может понравиться

- Assignment !!!: QuestionsДокумент2 страницыAssignment !!!: QuestionsQay AbbeОценок пока нет

- Environmental Management: Ahore Eads NiversityДокумент1 страницаEnvironmental Management: Ahore Eads NiversityQay AbbeОценок пока нет

- Submitted To: Submitted By: Qamar Abbas (Документ1 страницаSubmitted To: Submitted By: Qamar Abbas (Qay AbbeОценок пока нет

- Mine Leader: Now See Mine Leader Is DR - Muhammad QasimДокумент1 страницаMine Leader: Now See Mine Leader Is DR - Muhammad QasimQay AbbeОценок пока нет

- A Nursery School.: KindergartenДокумент1 страницаA Nursery School.: KindergartenQay AbbeОценок пока нет

- Scope of Strategic Management, Business Policy, Strategic Decision Making ProcessДокумент3 страницыScope of Strategic Management, Business Policy, Strategic Decision Making ProcessQay AbbeОценок пока нет

- KKL LK LKL KLДокумент3 страницыKKL LK LKL KLQay AbbeОценок пока нет

- Assignment ofДокумент2 страницыAssignment ofQay AbbeОценок пока нет

- Shanghai Imega Industry Co., Ltd.Документ9 страницShanghai Imega Industry Co., Ltd.Qay AbbeОценок пока нет

- HAmza CV NewДокумент2 страницыHAmza CV NewQay AbbeОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Lab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabДокумент7 страницLab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabHayat AnsariОценок пока нет

- BMA Recital Hall Booking FormДокумент2 страницыBMA Recital Hall Booking FormPaul Michael BakerОценок пока нет

- Droplet Precautions PatientsДокумент1 страницаDroplet Precautions PatientsMaga42Оценок пока нет

- What Is Retrofit in Solution Manager 7.2Документ17 страницWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUОценок пока нет

- ESG NotesДокумент16 страницESG Notesdhairya.h22Оценок пока нет

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkДокумент9 страницForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaОценок пока нет

- Reflections On Free MarketДокумент394 страницыReflections On Free MarketGRK MurtyОценок пока нет

- CHAPTER 3 Social Responsibility and EthicsДокумент54 страницыCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- 3125 Vitalogic 4000 PDFДокумент444 страницы3125 Vitalogic 4000 PDFvlaimirОценок пока нет

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Документ4 страницыEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedОценок пока нет

- Missouri Courts Appellate PracticeДокумент27 страницMissouri Courts Appellate PracticeGeneОценок пока нет

- Aisladores 34.5 KV Marca Gamma PDFДокумент8 страницAisladores 34.5 KV Marca Gamma PDFRicardo MotiñoОценок пока нет

- Walmart, Amazon, EbayДокумент2 страницыWalmart, Amazon, EbayRELAKU GMAILОценок пока нет

- 1.1. Evolution of Cloud ComputingДокумент31 страница1.1. Evolution of Cloud Computing19epci022 Prem Kumaar RОценок пока нет

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsДокумент27 страницSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunОценок пока нет

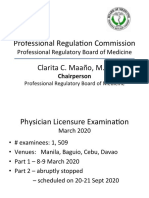

- Professional Regula/on Commission: Clarita C. Maaño, M.DДокумент31 страницаProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartОценок пока нет

- On CatiaДокумент42 страницыOn Catiahimanshuvermac3053100% (1)

- L1 L2 Highway and Railroad EngineeringДокумент7 страницL1 L2 Highway and Railroad Engineeringeutikol69Оценок пока нет

- PCДокумент4 страницыPCHrithik AryaОценок пока нет

- Unit 1Документ3 страницыUnit 1beharenbОценок пока нет

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesДокумент13 страницThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6Оценок пока нет

- Unit 2Документ97 страницUnit 2MOHAN RuttalaОценок пока нет

- JAZEL Resume-2-1-2-1-3-1Документ2 страницыJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoОценок пока нет

- Catalogo AWSДокумент46 страницCatalogo AWScesarОценок пока нет

- BSCSE at UIUДокумент110 страницBSCSE at UIUshamir mahmudОценок пока нет

- Historical Development of AccountingДокумент25 страницHistorical Development of AccountingstrifehartОценок пока нет

- BCG - Your Capabilities Need A Strategy - Mar 2019Документ9 страницBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziОценок пока нет

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Документ4 страницыRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanОценок пока нет

- Epidemiologi DialipidemiaДокумент5 страницEpidemiologi DialipidemianurfitrizuhurhurОценок пока нет

- Accomplishment ReportДокумент1 страницаAccomplishment ReportMaria MiguelОценок пока нет