Академический Документы

Профессиональный Документы

Культура Документы

Game of Investing.

Загружено:

Bhakti DabholkarИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Game of Investing.

Загружено:

Bhakti DabholkarАвторское право:

Доступные форматы

Game of Investing requires certain qualities & virtues falls as in ---

CONTRARY THINKING -

Investors trend to follow group or crowd coz as a difficult subject investment,

generally people don't trust their own decisions & judgements.But this produces poor

investments. If everyone fancies a certain share, it soon become overpriced. Thanks

to "bandwagon policy",it is likely to remain bullish for a period longer than what is

rationally justificable. But sooner or later market correct itself and often price falls

drastically down and sharply causing widespread losses.

Given the risk of imitating others and joining the crowd must cultivate habit of

contrary thinking. But again, should not ofcourse interepreted to mean that you

should always go against the prevailing market sentiment. You will miss money

opportunities presented by the market swings. The best one can say is "Go with the

market during incipient and intermediate phases of bullishness and bearishness but

go agains the markets when it moves towards the extremes

Avoide stocks which have high price ratio.A high relative price earings ratio reflects

that stock is popular with investors. Recognize in the world of investment, many

people have temptation to play wrong game. Sell to the optimistic & buy from

pessimestic. While farmer hopes the further will be marvelouos,the latter fear that it

will be awful. But reality often lies in somewhere between. So its good policy to

between the too extremes.

Desperate your buying/selling,dont be overzeoulous.,fix targets, dont buy when

market is narrow and sell when market is at peak. Follow market trend and correct

timing which is provided thus handsight wisdom. Never look back once you book

profit whether it goes up or down.

PATIENCE -- Young investors are generally aggressive and impatient and in hurry to

make quick money and ultimately takes wrong decision and conduct poor investment

strategy. Old people display high degree of patience. Understand your own impulses

and investment towards greed & fear, surmount these emotions that can wrap your

judgement & capitalize on the greed & fear of other investors.

Flexibility & openness - Nothing is more certain than change in the world of

investment. More economic conditions changes, new technologies and industries

emerge, consumer tastes & preferences shift, investment habits alter and so on. All

the developments on industry & consumption prospects on one hand & investors

expection on other. Decisiveness refers to an ability to quickly weight and balances a

variety of factors from a basic judgements & act promptly. It reflects to take decision

after doing proper homework ofcourse! Without being overwhelmed by uncertanities

characterising the investment situation.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Ayodhya VerdictДокумент2 страницыAyodhya VerdictBhakti DabholkarОценок пока нет

- Invest in Real EState Now!!Документ4 страницыInvest in Real EState Now!!Bhakti DabholkarОценок пока нет

- RBI Monetary PolicyДокумент4 страницыRBI Monetary PolicyBhakti DabholkarОценок пока нет

- Right To TokenismДокумент3 страницыRight To TokenismBhakti DabholkarОценок пока нет

- Best Funds To Save Taxes.Документ2 страницыBest Funds To Save Taxes.Bhakti DabholkarОценок пока нет

- Buoyant Indian Financial MarketsДокумент3 страницыBuoyant Indian Financial MarketsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (3)

- How To Find The Right Stock PriceДокумент4 страницыHow To Find The Right Stock PriceBhakti DabholkarОценок пока нет

- Protection - An Umbrella For Investments in Reckless MarketДокумент6 страницProtection - An Umbrella For Investments in Reckless MarketBhakti DabholkarОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Rudy Wong Case StudyДокумент7 страницRudy Wong Case StudyUnknwn Nouwn100% (3)

- Donald Kieso Chapt 5Документ76 страницDonald Kieso Chapt 5Ridha Ansari100% (1)

- Forward Foreign Exchange ContractsДокумент26 страницForward Foreign Exchange ContractsmuffadОценок пока нет

- What Is EquityДокумент2 страницыWhat Is EquityJHERICA SURELLОценок пока нет

- Investing For CashflowДокумент18 страницInvesting For CashflownathanОценок пока нет

- Alpha New Trader GuideДокумент9 страницAlpha New Trader GuideChaitanya ShethОценок пока нет

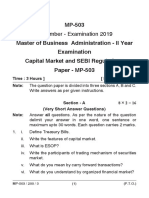

- MP 503Документ3 страницыMP 503ao slr1Оценок пока нет

- Investers' Perception On Mutual Funds: Final Research Project ReportДокумент28 страницInvesters' Perception On Mutual Funds: Final Research Project ReportAryan Sharma54Оценок пока нет

- ADR CasesДокумент122 страницыADR Casesmae krisnalyn niezОценок пока нет

- Exam1 Solutions 40610 2008Документ7 страницExam1 Solutions 40610 2008JordanОценок пока нет

- T1 Introduction (Answer)Документ5 страницT1 Introduction (Answer)Wen Kai YeamОценок пока нет

- Edmonds V Getty OrderДокумент13 страницEdmonds V Getty OrderCopyright Anti-Bullying Act (CABA Law)Оценок пока нет

- Unit # 2 CAPITAL AND MONY MARKETДокумент9 страницUnit # 2 CAPITAL AND MONY MARKETDija AwanОценок пока нет

- Business Studies Class Xii Revised Support MaterialДокумент202 страницыBusiness Studies Class Xii Revised Support MaterialMazin MohammadОценок пока нет

- 36 Theory and Practice of Corporate GovernanceДокумент36 страниц36 Theory and Practice of Corporate Governancem_dattaias86% (7)

- FM Project 1 - Textile IndustryДокумент13 страницFM Project 1 - Textile IndustrySaharsh SaraogiОценок пока нет

- Estates Solution Manual 5th EditionДокумент158 страницEstates Solution Manual 5th EditionRachelle DouglasОценок пока нет

- MSC Accounting - SEMINAR PAPER On FORENSIC AUDITДокумент28 страницMSC Accounting - SEMINAR PAPER On FORENSIC AUDITRaymond Okoro88% (16)

- Dow TheoryДокумент17 страницDow TheoryrahmathahajabaОценок пока нет

- Cost of CapitalДокумент4 страницыCost of CapitalNusratJahanHeabaОценок пока нет

- RR 30-2002 CompromiseДокумент11 страницRR 30-2002 CompromiseBobby Olavides SebastianОценок пока нет

- SOURCES OF BUSINESS FINANCE (Compatibility Mode) PDFДокумент30 страницSOURCES OF BUSINESS FINANCE (Compatibility Mode) PDFAmeya PatilОценок пока нет

- SamTREND - EquitiesДокумент20 страницSamTREND - EquitiesPratik PatelОценок пока нет

- Morning Review - 090110Документ10 страницMorning Review - 090110pdoorОценок пока нет

- OTC Exchange of IndiaДокумент2 страницыOTC Exchange of Indiaarshad89057Оценок пока нет

- Tax - Mindanao II Geothermal Partnership vs. Cir DigestДокумент4 страницыTax - Mindanao II Geothermal Partnership vs. Cir DigestMaria Cherrylen Castor Quijada100% (1)

- Financial SystemДокумент24 страницыFinancial Systemvinit.ambat13510Оценок пока нет

- GBL 1 Banas v. Asia PacificДокумент1 страницаGBL 1 Banas v. Asia PacificChieney AguhobОценок пока нет

- Merchant Bank in IndiaДокумент14 страницMerchant Bank in IndiaRk BainsОценок пока нет

- EY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018Документ64 страницыEY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018pankajddeore100% (1)