Академический Документы

Профессиональный Документы

Культура Документы

Indian Money Market

Загружено:

aasisranjanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Indian Money Market

Загружено:

aasisranjanАвторское право:

Доступные форматы

08/06/2009

1

MONEY MONEY

MARKET MARKET MARKET MARKET

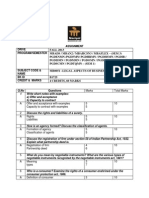

CONTENTS CONTENTS

What is Money Market? What is Money Market? yy

Features of Money Market? Features of Money Market?

Objective of Money Market? Objective of Money Market?

Importance of Money Market? Importance of Money Market?

Composition of Money Market? Composition of Money Market? Composition of Money Market? Composition of Money Market?

Instrument of Money Market? Instrument of Money Market?

Structure of Indian Money Market? Structure of Indian Money Market?

Disadvantage of Money Market? Disadvantage of Money Market?

08/06/2009

2

Continued. Continued.

Characteristic features of a developed Characteristic features of a developed

M k t? M k t? money Market? money Market?

Recent development in Money Market? Recent development in Money Market?

Summary Summary

1! What is Money Market? 1! What is Money Market?

As As per per RBI RBI definitions definitions AA market market for for short short terms terms

financial financial assets assets that that are are close close substitute substitute for for financial financial assets assets that that are are close close substitute substitute for for

money, money, facilitates facilitates the the exchange exchange of of money money in in

primary primary and and secondary secondary market market. .

The The money money market market is is a a mechanism mechanism that that deals deals

with with the the lending lending and and borrowing borrowing of of short short term term

funds funds (less (less than than one one year) year).. (( y ) y )

AA segment segment of of the the financial financial market market in in which which

financial financial instruments instruments with with high high liquidity liquidity and and very very

short short maturities maturities are are traded traded..

08/06/2009

3

Continued. Continued.

It It doesnt doesnt actually actually deal deal in in cash cash or or money money

b t b t d l d l ith ith b tit t b tit t ff hh lik lik t d t d but but deals deals with with substitute substitute of of cash cash like like trade trade

bills, bills, promissory promissory notes notes && govt govt papers papers

which which can can converted converted into into cash cash without without any any

loss loss at at low lowtransaction transaction cost cost..

It It includes includes all all individual, individual, institution institution and and

intermediaries intermediaries..

2 ! Features of Money Market? 2 ! Features of Money Market?

It It is is a a market market purely purely for for short short--terms terms funds funds or or

financial financial assets assets called called near near money money..

It It deals deals with with financial financial assets assets having having a a maturity maturity

period period less less than than one one year year only only. .

In In Money Money Market Market transaction transaction can can not not take take place place

formal formal like like stock stock exchange, exchange, only only through through oral oral

communication, communication, relevant relevant document document and and written written

communication communication transaction transaction can can be be done done. .

08/06/2009

4

Continued.. Continued..

Transaction Transaction have have to to be be conducted conducted without without the the

help help of of brokers brokers help help of of brokers brokers..

It It is is not not aa single single homogeneous homogeneous market, market, it it

comprises comprises of of several several submarket submarket like like call call money money

market, market, acceptance acceptance &&bill bill market market..

The The component component of of Money Money Market Market are are the the

commercial commercial banks, banks, acceptance acceptance houses houses & & NBFC NBFC

(Non (Non- -banking banking financial financial companies) companies)..

3 ! Objective of Money Market? 3 ! Objective of Money Market?

To To provide provide a a parking parking place place to to employ employ short short term term

surplus surplus funds funds. .

To To provide provide room room for for overcoming overcoming short short term term

deficits deficits..

To To enable enable the the central central bank bank to to influence influence and and

regulate regulate liquidity liquidity in in the the economy economy through through its its eguate eguate qudty qudty t e t e eco o y eco o y t oug t oug ts ts

intervention intervention in in this this market market..

To To provide provide a a reasonable reasonable access access to to users users of of short short--

term term funds funds to to meet meet their their requirement requirement quickly, quickly,

adequately adequately at at reasonable reasonable cost cost..

08/06/2009

5

4 ! Importance of Money Market? 4 ! Importance of Money Market?

oo Development Development of of trade trade &&industry industry.. oo Development Development of of trade trade &&industry industry..

oo Development Development of of capital capital market market..

oo Smooth Smooth functioning functioning of of commercial commercial banks banks. .

oo Effective Effective central central bank bank control control. .

Formulation Formulation of of suitable suitable monetary monetary policy policy oo Formulation Formulation of of suitable suitable monetary monetary policy policy..

oo Non Non inflationary inflationary source source of of finance finance to to

government government..

5 ! Composition of Money Market? 5 ! Composition of Money Market?

Money Money Market Market consists consists of of aa number number of of sub sub- -

k t k t hi h hi h ll ti l ll ti l tit t tit t th th markets markets which which collectively collectively constitute constitute the the

money money market market.. They They are, are,

Call Money Market Call Money Market

Commercial bills market or discount Commercial bills market or discount

market market market market

Acceptance market Acceptance market

Treasury bill market Treasury bill market

08/06/2009

6

6 ! Instrument of Money Market? 6 ! Instrument of Money Market?

AA variety variety of of instrument instrument are are available available in in a a developed developed

money money market market In In India India till till 1986 1986 only only aa few few money money market market.. In In India India till till 1986 1986,, only only aa few few

instrument instrument were were available available. .

They were They were

Treasury bills Treasury bills

Money at call and short notice in the call loan Money at call and short notice in the call loan

market. market.

Commercial bills, promissory notes in the bill Commercial bills, promissory notes in the bill

market. market.

New instrument New instrument

Now, in addition to the above the following new Now, in addition to the above the following new Now, in addition to the above the following new Now, in addition to the above the following new

instrument are available: instrument are available:

Commercial papers. Commercial papers.

Certificate of deposit. Certificate of deposit.

Inter Inter--bank participation certificates. bank participation certificates.

Repo inst ment Repo inst ment Repo instrument Repo instrument

Banker's Acceptance Banker's Acceptance

Repurchase agreement Repurchase agreement

Money Market mutual fund Money Market mutual fund

08/06/2009

7

Treasury Bills (T Treasury Bills (T- -Bills) Bills)

(T (T--bills) bills) are are the the most most marketable marketable money money market market (T (T bills) bills) are are the the most most marketable marketable money money market market

security security..

They They are are issued issued with with three three--month, month, six six--month month

and and one one- -year year maturities maturities..

TT--bills bills are are purchased purchased for for aa price price that that is is less less than than

their their par(face) par(face) value value; ; when when they they mature, mature, the the

tt th th h ld h ld th th f ll f ll ll government government pays pays the the holder holder the the full full par par value value..

TT--Bills Bills are are so so popular popular among among money money market market

instruments instruments because because of of affordability affordability to to the the

individual individual investors investors..

CDs are short CDs are short- -term borrowings in the form of term borrowings in the form of

Usance Usance Promissory Notes having a maturity of Promissory Notes having a maturity of

Certificate of deposit (CD) Certificate of deposit (CD)

Usance Usance Promissory Notes having a maturity of Promissory Notes having a maturity of

not less than 15 days up to a maximum of one not less than 15 days up to a maximum of one

year. year.

CD is subject to payment of Stamp Duty under CD is subject to payment of Stamp Duty under

Indian Stamp Act, 1899 (Central Act) Indian Stamp Act, 1899 (Central Act)

They are like bank termdeposits accounts They are like bank termdeposits accounts They are like bank term deposits accounts. They are like bank term deposits accounts.

Unlike traditional time deposits these are freely Unlike traditional time deposits these are freely

negotiable instruments and are often referred to negotiable instruments and are often referred to

as Negotiable Certificate of Deposits as Negotiable Certificate of Deposits

08/06/2009

8

AA CD CDis is a a time time deposit deposit with with aa bank bank. .

Lik Lik tt ti ti d it d it f d f d tt Like Like most most time time deposit, deposit, funds funds can can not not

withdrawn withdrawn before before maturity maturity without without paying paying

aa penalty penalty. .

CDs CDs have have specific specific maturity maturity date, date, interest interest

rate rate and and it it can can be be issued issued in in any any

d i ti d i ti denomination denomination. .

The The main main advantage advantage of of CD CDis is their their safety safety..

Anyone Anyone can can earn earn more more than than a a saving saving

account account interest interest..

Features of CD Features of CD

CDs can be issued by all scheduled commercial CDs can be issued by all scheduled commercial

banks except RRBs banks except RRBs banks except RRBs banks except RRBs

Minimum period 15 days Minimum period 15 days

Maximum period 1 year Maximum period 1 year

Minimum Amount Rs 1 lac and in multiples of Minimum Amount Rs 1 lac and in multiples of

Rs. 1 lac Rs. 1 lac

CDs are transferable by endorsement CDs are transferable by endorsement

CRR & SLR are to be maintained CRR & SLR are to be maintained

CDs are to be stamped CDs are to be stamped

08/06/2009

9

Commercial Paper Commercial Paper

Commercial Paper (CP) is an unsecured Commercial Paper (CP) is an unsecured

k t i t t i d i th k t i t t i d i th money market instrument issued in the money market instrument issued in the

form of a promissory note. form of a promissory note.

Who can issue Commercial Paper Who can issue Commercial Paper

(CP) (CP)

Highly rated corporate borrowers, primary Highly rated corporate borrowers, primary Highly rated corporate borrowers, primary Highly rated corporate borrowers, primary

dealers (PDs) and satellite dealers (SDs) dealers (PDs) and satellite dealers (SDs)

and all and all- -India financial institutions (FIs) India financial institutions (FIs)

Commercial paper (CP) Commercial paper (CP)

CP CP is is aa short short term term unsecured unsecured loan loan issued issued by by aa CP CP is is aa short short term term unsecured unsecured loan loan issued issued by by aa

corporation corporation typically typically financing financing day day to to day day

operation operation..

CP CP is is very very safe safe investment investment because because the the financial financial

situation situation of of aa company company can can easily easily be be predicted predicted

ff th th over over aa few fewmonths months..

Only Only company company with with high high credit credit rating rating issues issues

CPs CPs. .

08/06/2009

10

Eligibility for issue of CP Eligibility for issue of CP

th t ibl t th f th th th t ibl t th f th th a) a) the tangible net worth of the company, as per the the tangible net worth of the company, as per the

latest audited balance sheet, is not less than Rs. 4 latest audited balance sheet, is not less than Rs. 4

crore crore;;

b) b) (b) the working capital (fund (b) the working capital (fund--based) limit of the based) limit of the

company from the banking system is not less than company from the banking system is not less than

Rs.4 Rs.4 crore crore

c) c) and the and the borrowal borrowal account of the company is account of the company is

classified as a Standard Asset by the financing classified as a Standard Asset by the financing

bank/s. bank/s.

Rating Requirement Rating Requirement

All eligible participants should obtain the credit All eligible participants should obtain the credit

rating for issuance of Commercial Paper rating for issuance of Commercial Paper g p g p

Credit Rating Information Services of India Ltd. Credit Rating Information Services of India Ltd.

(CRISIL) (CRISIL)

Investment Information and Credit Rating Investment Information and Credit Rating

Agency of India Ltd. (ICRA) Agency of India Ltd. (ICRA)

Credit Analysis and Research Ltd. (CARE) Credit Analysis and Research Ltd. (CARE)

Duff &Phelps Credit Rating India Pvt Ltd (DCR Duff &Phelps Credit Rating India Pvt Ltd (DCR Duff & Phelps Credit Rating India Pvt. Ltd. (DCR Duff & Phelps Credit Rating India Pvt. Ltd. (DCR

India) India)

The minimum credit rating shall be P The minimum credit rating shall be P- -2 of 2 of

CRISIL or such equivalent rating by other CRISIL or such equivalent rating by other

agencies agencies

08/06/2009

11

Maturity Maturity

CP can be issued for maturities between a CP can be issued for maturities between a

i i f 15 d d i t i i f 15 d d i t minimum of 15 days and a maximum upto minimum of 15 days and a maximum upto

one year from the date of issue. one year from the date of issue.

If the maturity date is a holiday, the If the maturity date is a holiday, the

company would be liable to make company would be liable to make

payment on the immediate preceding payment on the immediate preceding payment on the immediate preceding payment on the immediate preceding

working day. working day.

Denomination Denomination

Minimum of Rs. 5,00,000/ Minimum of Rs. 5,00,000/- - and multiple and multiple

th f th f thereof. thereof.

Very little activity in Very little activity in Sec Sec. Mkt . Mkt. .

Secondary Market in CPs Secondary Market in CPs

08/06/2009

12

To whom issued To whom issued

CP is issued to and held by individuals, CP is issued to and held by individuals,

b ki i th t b ki i th t banking companies, other corporate banking companies, other corporate

bodies registered or incorporated in India bodies registered or incorporated in India

and unincorporated bodies, Non and unincorporated bodies, Non- -Resident Resident

Indians (NRIs) and Foreign Institutional Indians (NRIs) and Foreign Institutional

Investors (FIIs). Investors (FIIs).

Repurchase agreement (Repos) Repurchase agreement (Repos)

Repo Repo is is a a form form of of overnight overnight borrowing borrowing and and is is pp gg gg

used used by by those those who who deal deal in in government government

securities securities..

They They are are usually usually very very short short term term repurchases repurchases

agreement, agreement, from fromovernight overnight to to 30 30 days days of of more more..

The The short short term term maturity maturity and and government government The The short short term term maturity maturity and and government government

backing backing usually usually mean mean that that Repos Repos provide provide

lenders lenders with with extreamly extreamly low lowrisk risk. .

Repos Repos are are safe safe collateral collateral for for loans loans. .

08/06/2009

13

Repo Repo

Uses of Repo Uses of Repo

It helps banks to invest surplus cash It helps banks to invest surplus cash It helps banks to invest surplus cash It helps banks to invest surplus cash

It helps investor achieve money market returns It helps investor achieve money market returns

with sovereign risk. with sovereign risk.

It helps borrower to raise funds at better rates It helps borrower to raise funds at better rates

An SLR surplus and CRR deficit bank can use the An SLR surplus and CRR deficit bank can use the

Repo deals as a convenient way of adjusting Repo deals as a convenient way of adjusting p y j g p y j g

SLR/CRR positions simultaneously. SLR/CRR positions simultaneously.

RBI uses Repo and Reverse repo as instruments RBI uses Repo and Reverse repo as instruments

for liquidity adjustment in the system for liquidity adjustment in the system

Meaning of Repo Meaning of Repo

It is a transaction in which two parties agree to It is a transaction in which two parties agree to

sell and repurchase the same security Under sell and repurchase the same security Under sell and repurchase the same security. Under sell and repurchase the same security. Under

such an agreement the seller sells specified such an agreement the seller sells specified

securities with an agreement to repurchase the securities with an agreement to repurchase the

same at a mutually decided future date and a same at a mutually decided future date and a

price price

The Repo/Reverse Repo transaction can only be The Repo/Reverse Repo transaction can only be

done at Mumbai between parties approved by done at Mumbai between parties approved by done at Mumbai between parties approved by done at Mumbai between parties approved by

RBI and in securities as approved by RBI RBI and in securities as approved by RBI

(Treasury Bills, Central/State Govt securities). (Treasury Bills, Central/State Govt securities).

08/06/2009

14

Banker's Acceptance Banker's Acceptance

AA bankers bankers acceptance acceptance (BA) (BA) is is a a short short--term term

credit credit investment investment created created by by aa non non--financial financial credit credit investment investment created created by by aa non non--financial financial

firm firm..

BAs BAs are are guaranteed guaranteed by by a a bank bank to to make make

payment payment..

Acceptances Acceptances are are traded traded at at discounts discounts from from face face

value value in in the the secondary secondary market market..

BA BA acts acts as as aa negotiable negotiable time time draft draft for for financing financing BA BA acts acts as as aa negotiable negotiable time time draft draft for for financing financing

imports, imports, exports exports or or other other transactions transactions in in goods goods..

This This is is especially especially useful useful when when the the credit credit

worthiness worthiness of of aa foreign foreign trade trade partner partner is is

unknown unknown. .

Call Money Market Call Money Market

The call money market is an integral part of The call money market is an integral part of

the Indian Money Market where the day the Indian Money Market where the day the Indian Money Market, where the day the Indian Money Market, where the day--

to to--day surplus funds (mostly of banks) are day surplus funds (mostly of banks) are

traded. The loans are of short traded. The loans are of short- -term term

duration varying from 1 to 14 days. duration varying from 1 to 14 days.

The money that is lent for one day in this The money that is lent for one day in this

market is known as " market is known as "Call Money Call Money" and if it " and if it market is known as market is known as Call Money Call Money , and if it , and if it

exceeds one day (but less than 15 days) it exceeds one day (but less than 15 days) it

is referred to as " is referred to as "Notice Money Notice Money". ".

08/06/2009

15

Call Money Market Call Money Market

Banks borrow in this market for the Banks borrow in this market for the

following purpose following purpose following purpose following purpose

To fill the gaps or temporary mismatches To fill the gaps or temporary mismatches

in funds in funds

To meet the CRR & SLR mandatory To meet the CRR & SLR mandatory

requirements as stipulated by the Central requirements as stipulated by the Central

b k b k bank bank

To meet sudden demand for funds arising To meet sudden demand for funds arising

out of large outflows. out of large outflows.

Factors influencing interest Factors influencing interest

rates rates

The factors which govern the interest rates are The factors which govern the interest rates are

mostly economy related and are commonly mostly economy related and are commonly y y y y y y

referred to as referred to as macroeconomic factors macroeconomic factors. Some of . Some of

these factors are: these factors are:

1) 1) Demand for money Demand for money

2) 2) Government borrowings Government borrowings

3) 3) Supply of money Supply of money

4) 4) Inflation rate Inflation rate 4) 4) Inflation rate Inflation rate

5) 5) The Reserve Bank of India and the Government The Reserve Bank of India and the Government

policies which determine some of the variables policies which determine some of the variables

mentioned above. mentioned above.

08/06/2009

16

Treasury Bills Treasury Bills

Treasury bills, commonly referred to as T Treasury bills, commonly referred to as T- -Bills Bills

are issued by Government of India against their are issued by Government of India against their are issued by Government of India against their are issued by Government of India against their

short term borrowing requirements with short term borrowing requirements with

maturities ranging between 14 to 364 days. maturities ranging between 14 to 364 days.

All these are issued at a discount All these are issued at a discount- -to to--face value. face value.

For example a Treasury bill of Rs. 100.00 face For example a Treasury bill of Rs. 100.00 face

value issued for Rs 91 50 gets redeemed at the value issued for Rs 91 50 gets redeemed at the value issued for Rs. 91.50 gets redeemed at the value issued for Rs. 91.50 gets redeemed at the

end of it's tenure at Rs. 100.00. end of it's tenure at Rs. 100.00.

Who can invest in T Who can invest in T- -Bill Bill

Banks, Primary Dealers, State Banks, Primary Dealers, State

Governments, Provident Funds, Financial Governments, Provident Funds, Financial

Institutions, Insurance Companies, NBFCs, Institutions, Insurance Companies, NBFCs,

FIIs (as per prescribed norms), NRIs & FIIs (as per prescribed norms), NRIs &

OCBs can invest in T OCBs can invest in T--Bills. Bills. OCBs can invest in T OCBs can invest in T Bills. Bills.

08/06/2009

17

What is auction of Securities What is auction of Securities

Auction is a process of calling of bids with Auction is a process of calling of bids with

bj ti f i i t th k t bj ti f i i t th k t an objective of arriving at the market an objective of arriving at the market

price. It is basically a price discovery price. It is basically a price discovery

mechanism mechanism

Primary Dealers & Satellite Primary Dealers & Satellite

Dealers Dealers

P i D l b f d t M h t P i D l b f d t M h t Primary Dealers can be referred to as Merchant Primary Dealers can be referred to as Merchant

Bankers to Government of India, comprising the Bankers to Government of India, comprising the

first tier of the government securities market. first tier of the government securities market.

Satellite Dealers work in tandem with the Satellite Dealers work in tandem with the

Primary Dealers forming the second tier of the Primary Dealers forming the second tier of the

market to cater to the retail requirements of the market to cater to the retail requirements of the market to cater to the retail requirements of the market to cater to the retail requirements of the

market. market.

These were formed during the year 1994 These were formed during the year 1994- -96 to 96 to

strengthen the market infrastructure strengthen the market infrastructure

08/06/2009

18

What role do Primary Dealers What role do Primary Dealers

play? play?

The role of Primary Dealers is to; The role of Primary Dealers is to;

(i) it ti i ti P i i l i (i) it ti i ti P i i l i (i) commit participation as Principals in (i) commit participation as Principals in

Government of India issues through Government of India issues through

bidding in auctions bidding in auctions

(ii) provide underwriting services (ii) provide underwriting services

(iii) offer firm buy (iii) offer firm buy - - sell / bid ask quotes sell / bid ask quotes

for T for T--Bills & dated securities Bills & dated securities

(v) Development of Secondary Debt (v) Development of Secondary Debt

Market Market

7 ! Structure of Indian Money 7 ! Structure of Indian Money

Market? Market?

I : I :-- ORGANISED STRUCTURE ORGANISED STRUCTURE

1 R b k f I di 1 R b k f I di 1. Reserve bank of India. 1. Reserve bank of India.

2. DFHI (discount and finance house of India). 2. DFHI (discount and finance house of India).

3. Commercial banks 3. Commercial banks

i. Public sector banks i. Public sector banks

SBI with 7 subsidiaries SBI with 7 subsidiaries

Cooperative banks Cooperative banks

20 nationalised banks 20 nationalised banks

ii. Private banks ii. Private banks

Indian Banks Indian Banks

Foreign banks Foreign banks

4. Development bank 4. Development bank

IDBI, IFCI, ICICI, NABARD, LIC, GIC, UTI etc. IDBI, IFCI, ICICI, NABARD, LIC, GIC, UTI etc.

08/06/2009

19

Continued.. Continued..

II. UNORGANISED SECTOR II. UNORGANISED SECTOR

1. Indigenous banks 1. Indigenous banks 1. Indigenous banks 1. Indigenous banks

2 Money lenders 2 Money lenders

3. Chits 3. Chits

4. Nidhis 4. Nidhis

I I I . CO I I I . CO--OPERATIVE SECTOR OPERATIVE SECTOR

1. State cooperative 1. State cooperative

i t l ti b k i t l ti b k i. central cooperative banks i. central cooperative banks

Primary Agri credit societies Primary Agri credit societies

Primary urban banks Primary urban banks

2. State Land development banks 2. State Land development banks

central land development banks central land development banks

Primary land development banks Primary land development banks

8 ! Disadvantage of Money Market 8 ! Disadvantage of Money Market

Purchasing power of your money goes Purchasing power of your money goes Purchasing power of your money goes Purchasing power of your money goes

down, in case of up in inflation. down, in case of up in inflation.

Absence of integration. Absence of integration.

Absence of Bill market. Absence of Bill market.

No contact with foreign Money markets. No contact with foreign Money markets.

Limited instruments. Limited instruments.

Limited secondary market. Limited secondary market.

Limited participants. Limited participants.

08/06/2009

20

9 ! Characteristic features of a 9 ! Characteristic features of a

developed money Market? developed money Market?

Highly organaised banking system Highly organaised banking system Highly organaised banking system Highly organaised banking system

Presence of central bank Presence of central bank

Availability of proper credit instrument Availability of proper credit instrument

Existence of sub Existence of sub- -market market

Ample resources Ample resources Ample resources Ample resources

Existence of secondary market Existence of secondary market

Demand and supply of fund Demand and supply of fund

10 ! Recent development in 10 ! Recent development in

Money Market Money Market

Integration of unorganised sector with the Integration of unorganised sector with the

organised sector organised sector organised sector organised sector

Widening of call Money market Widening of call Money market

Introduction of innovative instrument Introduction of innovative instrument

Offering of Market rates of interest Offering of Market rates of interest

Promotion of bill culture Promotion of bill culture

Entry of Money market mutual funds Entry of Money market mutual funds y y y y

Setting up of credit rating agencies Setting up of credit rating agencies

Adoption of suitable monetary policy Adoption of suitable monetary policy

Establishment of DFHI Establishment of DFHI

Setting up of security trading corporation of India Setting up of security trading corporation of India

ltd. (STCI) ltd. (STCI)

08/06/2009

21

11 ! 11 ! Summary Summary

The The money money market market specializes specializes in in debt debt securities securities

that that mature mature in in less less than than one one year year..

Money Money market market securities securities are are very very liquid, liquid, and and are are

considered considered very very safe safe.. As As a a result, result, they they offer offer aa

lower lower return return than than other other securities securities..

The The easiest easiest way way for for individuals individuals to to gain gain access access to to

the the money money market market is is through through aa money money market market

mutual mutual fund fund. .

TT--bills bills are are short short- -term term government government securities securities

that that mature mature in in one one year year or or less less from fromtheir their issue issue

date date..

TT- -bills bills are are considered considered to to be be one one of of the the safest safest

investments investments..

Continued. Continued.

AA certificate certificate of of deposit deposit (CD) (CD) is is a a time time deposit deposit with with aa

bank bank. .

Annual Annual percentage percentage yield yield (APY) (APY) takes takes into into account account p g p g yy ( ) ( )

compound compound interest, interest, annual annual percentage percentage rate rate (APR) (APR)

does does not not..

CDs CDs are are safe, safe, but but the the returns returns aren't aren't great, great, and and your your

money money is is tied tied up up for for the the length length of of the the CD CD. .

Commercial Commercial paper paper is is an an unsecured, unsecured, short short--term term loan loan

issued issued by by a a corporation corporation.. Returns Returns are are higher higher than than TT--

bills bills because because of of the the higher higher default default risk risk bills bills because because of of the the higher higher default default risk risk..

Bankers Bankers acceptance acceptance (BA) (BA) are are negotiable negotiable time time draft draft

for for financing financing transactions transactions in in goods goods..

Repurchase Repurchase agreement agreement (repos) (repos) are are aa form form of of

overnight overnight borrowing borrowing backed backed by by government government

securities securities..

08/06/2009

22

Thank you Thank you

Вам также может понравиться

- A PPT On Money MarketДокумент25 страницA PPT On Money MarketBrinder SinghОценок пока нет

- C C C C: "P P P P PДокумент25 страницC C C C: "P P P P PShalu Dua KatyalОценок пока нет

- Presentation On Money Market: Presented Presented byДокумент22 страницыPresentation On Money Market: Presented Presented byPranay ChauhanОценок пока нет

- PRESENTATION ON MONEY MARKETSДокумент22 страницыPRESENTATION ON MONEY MARKETSAnkit PatodiaОценок пока нет

- On Money Market 1 120917062016 Phpapp01Документ25 страницOn Money Market 1 120917062016 Phpapp01abhimanbeheraОценок пока нет

- On Money MarketДокумент25 страницOn Money Marketanoopwc67% (3)

- Money MarketДокумент25 страницMoney MarketUrvashi SinghОценок пока нет

- MoneyMktGuideДокумент15 страницMoneyMktGuideAthar IqbalОценок пока нет

- Money Market in India: An OverviewДокумент24 страницыMoney Market in India: An OverviewShalu ShaliniОценок пока нет

- Factors Operating in the Money Market ExplainedДокумент26 страницFactors Operating in the Money Market Explaineddeepesh_sinhaОценок пока нет

- Money MarketДокумент20 страницMoney MarketDev AshishОценок пока нет

- Finnancial Enviroment of BusinessДокумент22 страницыFinnancial Enviroment of Businesssuru2331Оценок пока нет

- A PPT On Money MarketДокумент25 страницA PPT On Money MarketBasanta100% (27)

- Vinaya (Copy)Документ23 страницыVinaya (Copy)ferinaОценок пока нет

- Money MarketДокумент67 страницMoney MarketAvinash Veerendra TakОценок пока нет

- Money Market Instruments: Presented By:-Vipra Aggarwal (B29)Документ22 страницыMoney Market Instruments: Presented By:-Vipra Aggarwal (B29)vipraaggarwalОценок пока нет

- Smo Module-IДокумент58 страницSmo Module-INafs100% (1)

- Money MarketДокумент37 страницMoney MarketShaishav BhesaniaОценок пока нет

- Money Market: BY-Rajbir SinghДокумент19 страницMoney Market: BY-Rajbir Singhaman7300Оценок пока нет

- Money Market in India: Presented By, Reeshma.V.RДокумент18 страницMoney Market in India: Presented By, Reeshma.V.RReeshmaVariyathОценок пока нет

- Money MarketДокумент22 страницыMoney MarketRadhika ChauhanОценок пока нет

- Chapter 4 - Money MarketДокумент77 страницChapter 4 - Money Marketsejal100% (6)

- Understanding - Money MarketДокумент39 страницUnderstanding - Money MarketaartipujariОценок пока нет

- Define Money Market and Its ComponentsДокумент5 страницDefine Money Market and Its ComponentssunayanachauhanОценок пока нет

- Money Market (Project)Документ75 страницMoney Market (Project)Prajakta Patil50% (10)

- Money MarketДокумент21 страницаMoney MarketanuradhaОценок пока нет

- Indian Money Market OverviewДокумент21 страницаIndian Money Market OverviewRitesh MishraОценок пока нет

- UNIT 2 Fms NCДокумент17 страницUNIT 2 Fms NCHemalathaОценок пока нет

- Financial MarketДокумент8 страницFinancial MarketDileep Kumar SinghОценок пока нет

- Yy YyДокумент24 страницыYy YySandeep BirmanОценок пока нет

- Money Market Means Market Where Money or Its: Equivalent Can Be TradedДокумент62 страницыMoney Market Means Market Where Money or Its: Equivalent Can Be Tradedtrupti_viradiyaОценок пока нет

- Presentation On Money Market: Manasi JinalДокумент22 страницыPresentation On Money Market: Manasi JinalYashBhattОценок пока нет

- Developing The Money Market in India: Dr. Muhammad ShafiДокумент40 страницDeveloping The Money Market in India: Dr. Muhammad ShafiPradeep KumarОценок пока нет

- Financial MarketДокумент25 страницFinancial MarketAkash ChatterjeeОценок пока нет

- On Money MarketДокумент18 страницOn Money MarketMukesh ManwaniОценок пока нет

- Indian Money MarketДокумент17 страницIndian Money MarketIshmeet KaurОценок пока нет

- Black Book 2 1Документ60 страницBlack Book 2 1Madeeha MukadamОценок пока нет

- Money Market & InstrumentsДокумент40 страницMoney Market & InstrumentssujithchandrasekharaОценок пока нет

- INDIAN FINANCIAL MARKETSДокумент52 страницыINDIAN FINANCIAL MARKETSDhruv MishraОценок пока нет

- Indian Money MarketДокумент20 страницIndian Money Marketsubha_bkpОценок пока нет

- Structure of Indian Money Market - and Capital MarketДокумент3 страницыStructure of Indian Money Market - and Capital MarketThanasekaran Tharuman100% (1)

- Meaning of Money MarketДокумент17 страницMeaning of Money MarketPragati ShirbhateОценок пока нет

- Money Market and Capital Market.Документ25 страницMoney Market and Capital Market.Syed Usama Hamid100% (1)

- Money Market in IndiaДокумент39 страницMoney Market in IndiaPraveen SharmaОценок пока нет

- Money market guideДокумент4 страницыMoney market guideAbhishek ChauhanОценок пока нет

- Money Market PDFДокумент24 страницыMoney Market PDFRuchir KelkarОценок пока нет

- Money Market: Presented By: Ashutosh Saurabh MBA/10024/16Документ21 страницаMoney Market: Presented By: Ashutosh Saurabh MBA/10024/16ashuОценок пока нет

- 3.FIM-Module III-Money Market and Capital MarketДокумент12 страниц3.FIM-Module III-Money Market and Capital MarketAmarendra PattnaikОценок пока нет

- Money MarketДокумент21 страницаMoney MarketAayush JaiswalОценок пока нет

- Objectives of The Money Market in IndiaДокумент13 страницObjectives of The Money Market in IndiaVineet SinghОценок пока нет

- Indian debt market outlook guideДокумент85 страницIndian debt market outlook guideSumedh JadhavОценок пока нет

- Financial Markets and Institutions - PART1Документ75 страницFinancial Markets and Institutions - PART1shweta_46664100% (3)

- Various Instruments in Capital MarketДокумент31 страницаVarious Instruments in Capital MarketAzim SamnaniОценок пока нет

- A Study On Money MarketДокумент77 страницA Study On Money MarketNaveen KuttyОценок пока нет

- Investing for Beginners: Stock Market and Rental Property - Build Passive Income Like a Real Estate Agent and Learn the Best Day Trading Strategies for Forex, Options, Swings & BondsОт EverandInvesting for Beginners: Stock Market and Rental Property - Build Passive Income Like a Real Estate Agent and Learn the Best Day Trading Strategies for Forex, Options, Swings & BondsОценок пока нет

- Equity Investment for CFA level 1: CFA level 1, #2От EverandEquity Investment for CFA level 1: CFA level 1, #2Рейтинг: 5 из 5 звезд5/5 (1)

- Glossary of Terms in Treasury ManagementДокумент91 страницаGlossary of Terms in Treasury ManagementaasisranjanОценок пока нет

- Green Getaways - 8 Best Eco-Friendly Stays in IndiaДокумент6 страницGreen Getaways - 8 Best Eco-Friendly Stays in Indiaaasisranjan0% (1)

- International Portfolio Investment Q & AДокумент7 страницInternational Portfolio Investment Q & AaasisranjanОценок пока нет

- MB0051 - Legal Aspects of BusinessДокумент2 страницыMB0051 - Legal Aspects of BusinessaasisranjanОценок пока нет

- MF0012Документ2 страницыMF0012Smu DocОценок пока нет

- Efficient Capital MarketsДокумент55 страницEfficient Capital MarketsaasisranjanОценок пока нет

- Unicenta Taxes Management GuideДокумент4 страницыUnicenta Taxes Management GuideJavier GomezОценок пока нет

- Financial Mgmt-Ass 1Документ3 страницыFinancial Mgmt-Ass 1aasisranjanОценок пока нет

- RBI Grade B Previous PaperДокумент20 страницRBI Grade B Previous PaperaasisranjanОценок пока нет

- Understanding Welding Symbols Terms and DefinitionsДокумент23 страницыUnderstanding Welding Symbols Terms and DefinitionsseymaОценок пока нет

- Strategic Reward Systems IДокумент30 страницStrategic Reward Systems IhotteabkkОценок пока нет

- India's Best Students - DR M..Документ3 страницыIndia's Best Students - DR M..aasisranjanОценок пока нет

- Yalit - Beowulf AnnotatedДокумент6 страницYalit - Beowulf Annotatedapi-25329773450% (2)

- Bosona and GebresenbetДокумент8 страницBosona and GebresenbetJOHNKОценок пока нет

- Makato and The Cowrie ShellДокумент3 страницыMakato and The Cowrie ShellMhay Serna80% (5)

- Developer Extensibility For SAP S4HANA Cloud On The SAP API Business HubДокумент8 страницDeveloper Extensibility For SAP S4HANA Cloud On The SAP API Business Hubkoizak3Оценок пока нет

- Reflection Paper AristotleДокумент3 страницыReflection Paper AristotleMelissa Sullivan67% (9)

- AMP ChecklistДокумент14 страницAMP ChecklistSujoy GhoshОценок пока нет

- MEP Civil Clearance 15-July-2017Документ4 страницыMEP Civil Clearance 15-July-2017Mario R. KallabОценок пока нет

- Customer Satisfaction HDFC Bank - 1Документ34 страницыCustomer Satisfaction HDFC Bank - 1Deep GujareОценок пока нет

- Software Quality Assurance FundamentalsДокумент6 страницSoftware Quality Assurance FundamentalsTrendkill Trendkill TrendkillОценок пока нет

- Fruits and Vegetables Coloring Book PDFДокумент20 страницFruits and Vegetables Coloring Book PDFsadabahmadОценок пока нет

- University of Education: FreemasonryДокумент41 страницаUniversity of Education: FreemasonryWaqar KhanОценок пока нет

- James Tucker - Teaching Resume 1Документ3 страницыJames Tucker - Teaching Resume 1api-723079887Оценок пока нет

- Q1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Документ5 страницQ1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Vranda AgarwalОценок пока нет

- NDRRMF GuidebookДокумент126 страницNDRRMF GuidebookS B100% (1)

- Anafuda Cards Koi KoiДокумент5 страницAnafuda Cards Koi Koii.margarida33Оценок пока нет

- MOWILEX Balinese Woodcarving A Heritage To Treasure LatestДокумент85 страницMOWILEX Balinese Woodcarving A Heritage To Treasure LatestBayus WalistyoajiОценок пока нет

- The Sanctuary Made Simple Lawrence NelsonДокумент101 страницаThe Sanctuary Made Simple Lawrence NelsonSulphur92% (12)

- Procter &gamble: Our PurposeДокумент39 страницProcter &gamble: Our Purposemubasharabdali5373Оценок пока нет

- Lembar Jawaban Siswa - Corona-2020Документ23 страницыLembar Jawaban Siswa - Corona-2020Kurnia RusandiОценок пока нет

- Lecture-1 An Introduction To Indian PhilosophyДокумент14 страницLecture-1 An Introduction To Indian PhilosophySravan Kumar Reddy100% (1)

- Leave Travel Concession PDFДокумент7 страницLeave Travel Concession PDFMagesssОценок пока нет

- 2 PBДокумент17 страниц2 PBNasrullah hidayahОценок пока нет

- 2021 Pslce Selection - ShedДокумент254 страницы2021 Pslce Selection - ShedMolley KachingweОценок пока нет

- Literary Structure and Theology in The Book of RuthДокумент8 страницLiterary Structure and Theology in The Book of RuthDavid SalazarОценок пока нет

- SNETEL Brochure 2021Документ6 страницSNETEL Brochure 2021NamОценок пока нет

- Jack Mierzejewski 04-09 A4Документ7 страницJack Mierzejewski 04-09 A4nine7tОценок пока нет

- Preventing At-Risk Youth Through Community ParticipationДокумент11 страницPreventing At-Risk Youth Through Community ParticipationRhyolite LanceОценок пока нет

- What Is The Meaning of Tawheed and What Are Its Categories?Документ7 страницWhat Is The Meaning of Tawheed and What Are Its Categories?ausaf9900Оценок пока нет

- Human Resources ManagementДокумент18 страницHuman Resources ManagementztrinhОценок пока нет

- PHILIP MORRIS Vs FORTUNE TOBACCOДокумент2 страницыPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRОценок пока нет