Академический Документы

Профессиональный Документы

Культура Документы

BCG Matrix and BPSM Unit II To V

Загружено:

Sunil KakkarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BCG Matrix and BPSM Unit II To V

Загружено:

Sunil KakkarАвторское право:

Доступные форматы

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Boston Consulting Group (BCG) Matrix is a four celled matrix (a 2 * 2 matrix) developed by BCG, USA. It is the most renowned corporate portfolio analysis tool. It provides a graphic representation for an organization to examine different businesses in its portfolio on the basis of their related market share and industry growth rates. It is a two dimensional analysis on management of SBUs (Strategic Business Units). In other words, it is a comparative analysis of business potential and the evaluation of environment. According to this matrix, business could be classified as high or low according to their industry growth rate and relative market share. Relative Market Share = SBU Sales this year leading competitors sales this year. Market Growth Rate = Industry sales this year Industry Sales last year.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 1

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

The analysis requires that both measures be calculated for each SBU. The dimension of business strength, relative market share, will measure comparative advantage indicated by market dominance. The key theory underlying this is existence of an experience curve and that market share is achieved due to overall cost leadership. BCG matrix has four cells, with the horizontal axis representing relative market share and the vertical axis denoting market growth rate. The mid-point of relative market share is set at 1.0. if all the SBUs are in same industry, the average growth rate of the industry is used. While, if all the SBUs are located in different industries, then the mid-point is set at the growth rate for the economy. Resources are allocated to the business units according to their situation on the grid. The four cells of this matrix have been called as stars, cash cows, question marks and dogs. Each of these cells represents a particular type of business.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 2

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

The BCG matrix (aka B.C.G. analysis, BCG-matrix, Boston Box, Boston Matrix, Boston Consulting Group analysis). Created by Bruce Henderson for the Boston Consulting Group in 1970 to help corporations toAnalyzing their business units or product lines. help the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis. To use the chart, analysts plot a scatter graph to rank the business units (or products) on the basis of their relative market shares and growth rates.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

As a particular industry matures and its growth slows, all business units become either cash cows or dogs. The natural cycle for most business units is that they start as question marks, then turn into stars. Eventually the market stops growing thus the business unit becomes a cash cow. At the end of the cycle the cash cow turns into a dog.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

The overall goal of this ranking was to help corporate analysts decide which of their business units to fund, and how much; and which units to sell. Managers were supposed to gain perspective from this analysis that allowed them to plan with confidence to use money generated by the cash cows to fund the stars and, possibly, the question marks. As the BCG stated in 1970: Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities. The balanced portfolio has: stars whose high share and high growth assure the future; cash cows that supply funds for that future growth; and question marks to be converted into stars with the added funds.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 5

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

For each product or service, the 'area' of the circle represents the value of its sales, thus offers a very useful 'map' of the organization's product (or service) strengths and weaknesses, at least in terms of current profitability, as well as the likely cashflows. The need which prompted this idea was, indeed, that of managing cashflow. It was reasoned that one of the main indicators of cash generation was relative market share, and one which pointed to cash usage was that of market growth rate.

Derivatives can also be used to create a 'product portfolio' analysis of services. So Information System services can be treated accordingly.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 6

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

StarsStars represent business units having large market share in a fast growing industry. They may generate cash but because of fast growing market, stars require huge investments to maintain their lead. Net cash flow is usually modest. SBUs located in this cell are attractive as they are located in a robust industry and these business units are highly competitive in the industry. If successful, a star will become a cash cow when the industry matures.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 8

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Cash Cows- Cash Cows represents business units having a large market share in a mature, slow growing industry. Cash cows require little investment and generate cash that can be utilized for investment in other business units. These SBUs are the corporations key source of cash, and are specifically the core business. They are the base of an organization. These businesses usually follow stability strategies. When cash cows loose their appeal and move towards deterioration, then a retrenchment policy may be pursued.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 9

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Question MarksBusiness units having low relative market share and located in a high growth industry. They requirehuge amount of cash to maintain or gain market share. attention to determine if the venture can be viable. Question marks are generally new goods and services which have a good commercial prospective. There is no specific strategy which can be adopted If--the firm thinks it has dominant market share, then it can adopt expansion strategy, else retrenchment strategy can be adopted. Most businesses start as question marks as the company tries to enter a high growth market in which there is already a marketshare. If ignored, then question marks may become dogs, while if huge investment is made, then they have potential of becoming stars.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

10

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Dogs-

Businesses having weak market shares in low-growth markets. They neither generate cash nor require huge amount of cash. Due to low market share, these business units face cost disadvantages. Generally retrenchment strategies are adopted because these firms can gain market share only at the expense of competitors/rival firms. These business firms have weak market share because of high costs, poor quality, ineffective marketing, etc. Unless a dog has some other strategic aim, it should be liquidated if there is fewer prospects for it to gain market share. Number of dogs should be avoided and minimized in an organization.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

11

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Stars (high growth, high market share) Stars are using large amounts of cash. Stars are leaders in the business. Therefore they should also generate large amounts of cash. Stars are frequently roughly in balance on net cash flow. However if needed any attempt should be made to hold your market share in Stars, because the rewards will be Cash Cows if market share is kept. Cash Cows (low growth, high market share) Profits and cash generation should be high. Because of the low growth, investments which are needed should be low. Cash Cows are often the stars of yesterday and they are the foundation of a company.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 12

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Dogs (low growth, low market share) Avoid and minimize the number of Dogs in a company. Watch out for expensive rescue plans. Dogs must deliver cash, otherwise they must be liquidated. Question Marks (high growth, low market share) Question Marks have the worst cash characteristics of all, because they have high cash demands and generate low returns, because of their low market share. If the market share remains unchanged, Question Marks will simply absorb great amounts of cash. Either invest heavily, or sell off, or invest nothing and generate any cash that you can. Increase market share or deliver cash.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 13

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Other uses and benefits of the BCG Matrix If a company is able to use the experience curve to its advantage, it should be able to manufacture and sell new products at a price that is low enough to get early market share leadership. Once it becomes a star, it is destined to be profitable. BCG model is helpful for managers to evaluate balance in the firms current portfolio of Stars, Cash Cows, Question Marks and Dogs. BCG method is applicable to large companies that seek volume and experience effects. The model is simple and easy to understand. It provides a base for management to decide and prepare for future actions.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 14

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Limitations of BCG Matrix The BCG Matrix produces a framework for allocating resources among different business units and makes it possible to compare many business units at a glance. But BCG Matrix is not free from limitations, such asBCG matrix classifies businesses as low and high, but generally businesses can be medium also. Thus, the true nature of business may not be reflected. Market is not clearly defined in this model. High market share does not always leads to high profits. There are high costs also involved with high market share. Growth rate and relative market share are not the only indicators of profitability. This model ignores and overlooks other indicators of profitability. At times, dogs may help other businesses in gaining competitive advantage. They can earn even more than cash cows sometimes. This four-celled approach is considered as to be too simplistic .

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 15

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Other uses and benefits of the BCG Matrix If a company is able to use the experience curve to its advantage, it should be able to manufacture and sell new products at a price that is low enough to get early market share leadership. Once it becomes a star, it is destined to be profitable. BCG model is helpful for managers to evaluate balance in the firms current portfolio of Stars, Cash Cows, Question Marks and Dogs. BCG method is applicable to large companies that seek volume and experience effects. The model is simple and easy to understand. It provides a base for management to decide and prepare for future actions.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 16

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Phases of Strategic Management: Define the Mission, Purpose, objectives. Formulate the strategy Implement the strategy Evaluate the strategy after implementation for the expected outcome.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

17

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Elements of strategic management process: Define the Business Set the Mission determine the purpose Establish the objectives Perform the Environment Scanning Obtain Corporate Appraisal Evolve the alternatives Exercise the choices Formulate the strategy Prepare the strategic plan Evaluate the strategy.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 18

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Determinants of Strategy ( Considerations that affects the strategy) Demand for goods and services Supply of goods and services Competition Key success factors(KSF) Growth potential and profit prospects Market strength Financial capacity of the organization

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 19

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Attributes of the professional management Knowledge Attitude Skills Technical Human Conceptual Analytical Administrative Managerial Etc.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 20

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Levels of strategic management: Corporate level: Board of Directors, Chief Executive Officers- looking after the running the company as a whole, deciding about the type of the business the organization is in. Business level: SBU Strategic Business Unit: e.g. Divisional G.M. generally depends on the number of product mix, profit centers. Operating level: use to take technical decisions, e.g. marketing, finance, operations, manufacturing, etc.

Level

Concep Human tual Skills Skills High Medium High Medium

Technic al Skills

Top

Low Medium High

Middle Mediu m Low Low

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

21

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Areas of Alternatives: Production strategies Finance strategies Marketing strategies Personnel strategies etc.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

22

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Strategic Options: Strategies of Survival Stable growth strategy Growth strategy End game strategy Retrenchment strategy Combination of strategy Business unit strategies

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

23

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

1. Strategies for Survival:

Hold or Maintain: ( Suitable whenever there is a Risk of Loss) Pull Back and Redeploy: Narrow down the supply & Redesign resources Milk or Harvest: suits for short term gain, Best if the product is on the verge of Obsolescence, product life cycle ends, Customer confidence declining in the product. Liquidation and Divestment: Withdraw from the business on failure at every stage to save the business.

2. Stable Growth Strategy: Low risk, Steady growth, Change in resource allocation. 3. Growth Strategies: a. Product life cycle: b. Expansion: c. Concentrating on one product: d. Vertical Integration: in two possible directions e. Concentric diversification: Add new product similar to product line f. Horizontal diversification: Buy the Competitor, Take over. g. Conglomerate diversification: Add new product different than product line

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 24

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

4. End Game Strategy: In situation where product demand declines, modify leadership, diversification in niche etc helps rescue the problem Retrenchment Strategies: In situation like recession, poor financial performance of the organization. Turn around Strategy: Cut back on personnel, expenses, cost, promotions, overheads etc to increase the efficiency, productivity and performance. Divestment Strategy: Sell the product line to another business i.e. hand over the entire business or brand to other units. e.g. Dalda, soap, tractor etc. Liquidation Strategy: In the extreme case sell out the entire business Combination of the Strategies: Simultaneous: Two or more strategies at a time Sequential: Time bound implementation of plan one by one Business Unit Strategies: a. Overall cost leadership i.e. keep the costs lower than competitors. b. Differentiation Strategy: Maintain the Uniqueness in the business line. c. Focus Strategies: Concentrate on particular group of customers.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

25

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Mintzberg's 5 Ps for Strategy The word "strategy" has been used implicitly in different ways even if it has traditionally been defined in only one. Explicit recognition of multiple definitions can help people to manoeuvre through this difficult field. Mintzberg provides five definitions of strategy: Plan Ploy Pattern Position Perspective.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 26

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

PLAN Strategy is a plan - some sort of consciously intended course of action, a guideline (or set of guidelines) to deal with a situation. By this definition strategies have two essential characteristics: they are made in advance of the actions to which they apply, and they are developed consciously and purposefully. PLOY As plan, a strategy can be a ploy too, really just a specific manoeuvre intended to outwit an opponent or competitor.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 27

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

PATTERN If strategies can be intended (whether as general plans or specific ploys), they can also be realised. In other words, defining strategy as plan is not sufficient; we also need a definition that encompasses the resulting behaviour: Strategy is a pattern - specifically, a pattern in a stream of actions. Strategy is consistency in behaviour, whether or not intended. The definitions of strategy as plan and pattern can be quite independent of one another: plans may go unrealised, while patterns may appear without preconception. Plans are intended strategy, whereas patterns are realised strategy; from this we can distinguish deliberate strategies, where intentions that existed previously were realised, and emergent strategies where patterns developed in the absence of intentions, or despite them.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 28

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

POSITION Strategy is a position - specifically a means of locating an organisation in an "environment". By this definition strategy becomes the mediating force, or "match", between organisation and environment, that is, between the internal and the external context. PERSPECTIVE Strategy is a perspective - its content consisting not just of a chosen position, but of an ingrained way of perceiving the world. Strategy in this respect is to the organisation what personality is to the individual. What is of key importance is that strategy is a perspective shared by members of an organisation, through their intentions and / or by their actions. In effect, when we talk of strategy in this context, we are entering the realm of the collective mind individuals united by common thinking and / or behaviour.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 29

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

The 7-S Framework It is a management model which describes 7 factors to organize a company in an holistic and effective way. The model is developed by McKinsey is termed as 7-S Framework. These factors are helpful to determine the way in which a corporation operates. Managers needed to take into account all of the seven factors so as to achieve the successful implementation of a strategy for the organization, large or small. Since all are interdependent, the failure to pay proper attention to one of them may effect all others as well. Origin of the 7-S Framework. History The 7-S Framework was first mentioned in "The Art Of Japanese Management" by Richard Pascale and Anthony Athos in 1981while investigating about the successful performance of the Japanese industry. At around the same time that Tom Peters and Robert Waterman were exploring what made a company excellent. The Seven S model was born at a meeting of these four authors in 1978. It appeared also in "In Search of Excellence" by Peters and Waterman, and was taken up as a basic tool by the global management consultancy company McKinsey. Since then it is known as their 7-S model.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

30

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

1.Shared Values The interconnecting center of McKinsey's model is: Shared Values. What does the organization stands for and what it believes in. Central beliefs and attitudes. 2. Strategy Plans for the allocation of a firms scarce resources, over time, to reach identified goals. Environment, competition, customers.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

31

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

3. Structure The way in which the organization's units relate to each other: centralized, functional divisions (top-down); decentralized; a matrix, a network, a holding, etc. 4. Systems The procedures, processes and routines that characterize how the work should be done: financial systems; recruiting, promotion and performance appraisal systems; information systems.

5. Staff Numbers and types of personnel within the organization. 6. Style Cultural style of the organization and how key managers behave in achieving the organization's goals. 7. Skills Distinctive capabilities of personnel or of the organization as a whole. Compare: Core Competences.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

32

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

The ADL Matrix from Arthur D. Little is a portfolio management method.

The ADL portfolio management approach uses an industry assessment and a business strength assessment as its dimensions. The industry measurement is an identification of the life cycle of the industry. The business strength measure is a categorization of the corporation's SBU's into one of five (six) competitive positions: dominant, strong, favorable, tenable, weak (and non-viable). This yields a matrix of 5 competitive positions by 4 life cycle stages. Positioning in the matrix identifies a general strategy. Defining the line of business in the ADL matrix In the ADL Matrix approach, the strategist must identify discrete businesses by finding commonalities among products and business lines using the following criteria as guidelines:Common rivals Prices, Customers, Quality/Style, Substitutability, Divestment or liquidation.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

33

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

34

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

ASSESSING THE INDUSTRY LIFE CYCLE STAGE IN THE ADL MATRIX The assessment of the Industry Life Cycle stage of each company is made on the basis of: Business market share, Investment, and Profitability and cash flow. ASSESSING THE COMPETITIVE POSITION IN THE ADL MATRIX The competitive position of a firm is based on an assessment of the following criteria: Dominant. Rare, often the result from a almost-monopoly or protected leadership. Strong. A strong company can follow a strategy without too much consideration of moves by rival companies. Favorable. Industry is fragmented. No clear leader among stronger rivals. Tenable. The company has a niche, either geographical or defined by the product. Weak. Business is too small to be profitable or survive over the long term. Critical weaknesses. LIMITATIONS Some known limitations of the ADL Matrix are: There is no standard life cycle length. Determining the current industry life cycle phase is difficult. Competitors may influence the length of the life cycle.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 35

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Strategic Review Evaluation and Control Levels of review: 1. Strategic 2. operational Basic Steps in the process of review:1. Develop Criteria for evaluation 2. Measure actual Performance 3. define Tolerance Limits / Acceptance levels 4. Analyze deviation from acceptable limits 5. Get feedback 6. Analyze and modify the process.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 36

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Need of Evaluation to1. Check whether decisions are in tune with the Policy 2. Check whether sufficient resources are made available 3. Check whether resources are used wisely 4. Check whether events are as anticipated 5. Check whether Goals are achieved 6. Check whether to continue with the plan

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 37

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

What to Evaluate? 1. Objectives 2. environment 3. Internal Conditions 4. Resource Capitalization 5. Risk 6. Time Horizon 7. Feasibility

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

38

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Check while developing the criteria for evaluation 1. Performance Target and Standards 2. Quantitative criteria ( ROI, Dividend, Turn Over, Mkt Share etc) 3. Qualitative criteria like Consistency, Appropriateness, Workability Systems Approach for Control Action Objectives Set Standards Measure & Monitor Analyze deviation Feedback Modify Implement. ( Have Flow Chart Method)

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 39

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Control is a continuous and Dynamic Process, there fore have

1.Budgets 2. Audits 3. Time based Control like PERT,CPM, GERT ( Graphical Evaluation & Review Tech.) PDM ( Precedence Diagramming Method) 4. Strategy Audit on ( Validity, Consistency, Effectiveness) 5. MIS 6. Motivation & Reward system

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 40

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Beneficiaries of Strategic Control: Shareholders, Creditors, Govt, Board of Direcotors, CEO, Finance, Profit Centers, Middle level management. Problems in Evaluation and Control: Difficulty in deciding Limit of Strategic Control Difficulty in measurements of control Resistance to change and Evaluation

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 41

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Types of Strategic Control: Premise of Control Implementation of Control Strategic Surveillance Special alert Control Methods / Techniques in Strategic Evaluation & Control: Strategic Control: (i) Strategic momentum (ii) Strategic Leap Control Assumption:- There is no change in the strategy 1. Responsibility Control Centre :- From Core Mgmt Control system ( Revenue, Expenses, Profits, Investments) 2. Underlying Success Factors: ( Key Success Factors like KPI Key Performance Index) 3. Generic Strategies: ( Based on Comparison with other organization strategies)

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

42

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Strategic Leap Control: ( Environment is relatively Unstable it

helps to redefine strategy)

1. 2. 3. 4. 5.

Types of Strategic leap Control: Strategic issue management Strategic Field assignment Modeling Scenarios

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

43

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Evaluation Method for Operational Controls: 1. Financial Techniques: Budgetary Control , ZERO Based Budgets, Financial Analysis, PARTAVA System 2. Network Technique: PERT CPM 3. MBO Management By Objectives: Performance of Jr. Sr. Executives 4. MOU Memorandum of Understanding 5. Strategic Audit: Validity, Consistency, Effectiveness.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 44

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Some Quotes

The price of greatness is responsibility. A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty. Continuous effort - not strength or intelligence - is the key to unlocking our potential The farther backward you can look, the farther forward you are likely to see. You have enemies? Good. That means you've stood up for something, sometime in your life.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

45

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

However beautiful the strategy, you should occasionally look at the results Sir Winston Churchill 1874-1965, English statesman

There is always a better strategy than the one you have; you just haven't thought of it yet

Sir Brian Pitman, former CEO of Lloyds TSB, Harvard Business Review, April 2003

Unless a variety of opinions are laid before us, we have no opportunity of selection, but are bound of necessity to adopt the particular view which may have been brought forward

Herodotus, 5th century BC, Greek historian

The processes used to arrive at the total strategy are typically fragmented, evolutionary, and largely intuitive

James Quinn in Strategic Change: Logical Incrementalism, 1978

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 46

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

How many senior executives discuss the crucial distinction between competitive strategy at the level of a business and competitive strategy at the level of an entire company?

C.K. Prahalad and Gary Hamel, in their article: The core competence of the corporation, 1990

What's the use of running if you are not on the right road

German proverb

I claim not to have controlled events, but confess plainly that events have controlled me

Abraham Lincoln 1809-1865, sixteenth American president

Perception is strong and sight weak. In strategy it is important to see distant things as if they were close and to take a distanced view of close things

Miyamoto Musashi 1584-1645, legendary Japanese swordsman

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 47

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Do not repeat the tactics which have gained you one victory, but let your methods be regulated by the infinite variety of circumstances

Sun Tzu c. 490 BC, Chinese military strategist

There is always a better strategy than the one you have; you just haven't thought of it yet

Sir Brian Pitman, former CEO of Lloyds TSB, Harvard Business Review, April 2003

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

48

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Unless a variety of opinions are laid before us, we have no opportunity of selection, but are bound of necessity to adopt the particular view which may have been brought forward

Herodotus, 5th century BC, Greek historian

The processes used to arrive at the total strategy are typically fragmented, evolutionary, and largely intuitive

James Quinn in Strategic Change: Logical Incrementalism, 1978

How many senior executives discuss the crucial distinction between competitive strategy at the level of a business and competitive strategy at the level of an entire company?

C.K. Prahalad and Gary Hamel, in their article: The core competence of the corporation, 1990

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

49

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

What's the use of running if you are not on the right road

German proverb

I claim not to have controlled events, but confess plainly that events have controlled me

Abraham Lincoln 1809-1865, sixteenth American president

Perception is strong and sight weak. In strategy it is important to see distant things as if they were close and to take a distanced view of close things

Miyamoto Musashi 1584-1645, legendary Japanese swordsman

Do not repeat the tactics which have gained you one victory, but let your methods be regulated by the infinite variety of circumstances

Sun Tzu c. 490 BC, Chinese military strategist

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 50

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Explanation of Benchmarking. Benchmarking is a systematic tool that allows a company to determine whether its performance of organizational processes and activities represent the best practices. Benchmarking models are useful to determining how well a business unit, division, organization or corporation is performing compared with other similar organizations. A benchmark is a point of reference for a measurement. The term 'benchmark' presumably originates from the practice of making dimensional height measurements of an object on a workbench using a gradual scale or similar tool, and using the surface of the workbench as the origin for the measurements.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

51

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

52

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

1. 2. 3. 4. 5.

Business benchmarking is related to Kaizen and competitive advantage thinking. BENEFITS OF BENCHMARKING. Improving communication Professionalizing the organization / processes, or for Budgetary reasons In outsourcing projects Traditionally, performance measures are compared with previous measures from the same organization at different times. Although this can be a good indication of the speed of improvement within the organization, it could be that although the organization is improving, the competition is improving faster... FIVE TYPES OF BENCHMARKING Internal benchmarking (benchmark within a corporation, for example between business units) Competitive benchmarking (benchmark performance or processes with competitors) Functional benchmarking (benchmark similar processes within an industry) Generic benchmarking (comparing operations between unrelated industries) Collaborative benchmarking (carried out collaboratively by groups of companies (e.g. subsidiaries of a multinational in different countries or an industry organization).

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

53

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

TYPICAL STEPS IN A BENCHMARKING PROCESS Scope definition Choose benchmark partner(s) Determine measurement methods, units, indicators and data collection method Data collection Analysis of the discrepancies Present the results and discuss implications / improvement areas and goals Make improvement plans or new procedures Monitor progress and plan ongoing benchmark. COST OF BENCHMARKING There are costs to benchmarking, although many companies find that it pays for itself. The three main types of costs are: 1. Visit costs - This includes hotel rooms, travel costs, meals, a token gift, and lost labour time. 2. Time costs - Members of the benchmarking team will be investing time in researching problems, finding exceptional companies to study, visits, and implementation. This will take them away from their regular tasks for part of each day so additional staff might be required. 3. Benchmarking database costs - Organizations that institutionalize benchmarking into their daily procedures find it is useful to create and maintain a database of best practices and the companies associated with each best practice.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com 54

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

LIMITATIONS OF BENCHMARKING Benchmarking is a tough process that needs a lot of commitment to succeed. Time-consuming and expensive. More than once benchmarking projects end with the 'they are different from us' syndrome or competitive sensitivity prevents the free flow of information that is necessary. Comparing performances and processes with 'best in class' is important and should ideally be done on a continuous basis (the competition is improving its processes also...). Is the success of the target company really attributable to the practice that is benchmarked? Are the companies comparable in strategy, size, model, culture? What are the downsides of adopting a practice?

Book: Christopher E. Bogan, Michael J. English - Benchmarking for Best Practices Book: Peter Bolstorff, Robert Rosenbaum - Supply Chain Excellence Book: Joe Zhu - Quantitative Models for Performance Evaluation and Benchmarking Stanley Stringer - USA How should I put together a Peer Group? "How do I determine the right companies to compose a Peer Group... Does anybody have an approach or criteria?"

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

55

MBA III SEMESTER : BUSINESS POLICY AND STRATEGIC MANAGEMENT

Course No 301 Paper No. XVIII

Assignment

Use the suitable tools while developing and evaluating a strategy Analyse using the same for your presentation

Thanks.

Dr.N.C.Dhande SRTM University Nanded, nishika.dhan@gmail.com

56

Вам также может понравиться

- BCG Matrix and GE 9 Cell PlaningДокумент5 страницBCG Matrix and GE 9 Cell PlaningAmit Vasantbhai50% (2)

- SM Unit 4Документ27 страницSM Unit 4mohammadimran4310Оценок пока нет

- STRATEGIC PLANNING PROCESS IN MARKETING - Chap 9Документ14 страницSTRATEGIC PLANNING PROCESS IN MARKETING - Chap 9Tania MajumderОценок пока нет

- Meaning of CommunicationДокумент4 страницыMeaning of CommunicationAMALA AОценок пока нет

- Strategic Analysis Tools and TechniquesДокумент10 страницStrategic Analysis Tools and TechniquesANKUR CHOUDHARYОценок пока нет

- Chapter 7 BCG MatrixДокумент5 страницChapter 7 BCG Matriximranpathan30Оценок пока нет

- BCG MatrixДокумент8 страницBCG MatrixShagun ShekharОценок пока нет

- Module 2Документ45 страницModule 2amit thakurОценок пока нет

- UNIT-4-Choice of Business Strategies: Understanding The ToolДокумент12 страницUNIT-4-Choice of Business Strategies: Understanding The ToolNishath NawazОценок пока нет

- G12 ABM Marketing Lesson 3 HandoutsДокумент11 страницG12 ABM Marketing Lesson 3 HandoutsLeo SuingОценок пока нет

- Marketing ModelsДокумент28 страницMarketing ModelsRecrupp VideosОценок пока нет

- BCG Matrix and GE Nine Cells MatrixДокумент15 страницBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Tata DataДокумент2 страницыTata DataRoshan KumarОценок пока нет

- Analysing Strategy (BCG Matrix)Документ6 страницAnalysing Strategy (BCG Matrix)yadavpankaj1992Оценок пока нет

- BCG Matrix: Presented byДокумент10 страницBCG Matrix: Presented by2285 Rishika VaidyaОценок пока нет

- Boston Consulting GroupДокумент3 страницыBoston Consulting GroupPuran SinghОценок пока нет

- BCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonДокумент4 страницыBCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonRuhul Amin Rasel100% (1)

- Bmt1035-Strategic Management: FALL SEMESTER: 2021-22 Digital Assignment-07Документ8 страницBmt1035-Strategic Management: FALL SEMESTER: 2021-22 Digital Assignment-07Vasu Dev KanchetiОценок пока нет

- BPSM Avi AssingmentДокумент9 страницBPSM Avi AssingmentAvi JainОценок пока нет

- BCG Matrix Explained: A Guide to the Boston Consulting Group Analysis ToolДокумент2 страницыBCG Matrix Explained: A Guide to the Boston Consulting Group Analysis ToolShakib Ahmed Emon 0389Оценок пока нет

- 4. SBU Portfolio ManagementДокумент16 страниц4. SBU Portfolio ManagementTYBMS F 3023 JAIN RIYA PUKHRAJОценок пока нет

- Black Book SMДокумент37 страницBlack Book SMamitpandey6592Оценок пока нет

- Vickey Verma AssignmentДокумент20 страницVickey Verma AssignmentSheetal VermaОценок пока нет

- SMU A S: Marketing ManagementДокумент19 страницSMU A S: Marketing ManagementGYANENDRA KUMAR MISHRAОценок пока нет

- BCG MatrixДокумент2 страницыBCG Matrixsukhiromana0Оценок пока нет

- BCG Notes FinalДокумент10 страницBCG Notes FinalHarsora UrvilОценок пока нет

- MMK College Fybmm: Ii Semester: IntroductionДокумент13 страницMMK College Fybmm: Ii Semester: IntroductionnaarniyaОценок пока нет

- Implementation of BCG Matrix in Malaysia CompanyДокумент21 страницаImplementation of BCG Matrix in Malaysia CompanyMisz Azzyati75% (4)

- Content:: Module 3: Strategy FormulationДокумент26 страницContent:: Module 3: Strategy Formulationrakshith bond007Оценок пока нет

- Understanding The BCG Model Limitations / Problems of BCG ModelДокумент13 страницUnderstanding The BCG Model Limitations / Problems of BCG Modelshovit singhОценок пока нет

- Assignment ON BCG Model and Ge9: Submitted To: Prof - Ratneshpal SinghДокумент9 страницAssignment ON BCG Model and Ge9: Submitted To: Prof - Ratneshpal SinghJaininder SharmaОценок пока нет

- MB0052 - Strategic Management and Business Policy - 4 CreditsДокумент8 страницMB0052 - Strategic Management and Business Policy - 4 CreditsRajesh SinghОценок пока нет

- Lectura 3 G1Документ12 страницLectura 3 G1MARLENI LIZBETH AYBAR VILAОценок пока нет

- Principles of Management ProjectДокумент33 страницыPrinciples of Management ProjectVikram Aditya0% (2)

- Strategic Choice - Traditional ApproachДокумент50 страницStrategic Choice - Traditional Approacharab1108100% (1)

- Portfolio Approach To StrategyДокумент7 страницPortfolio Approach To StrategyRenitaFerreira100% (2)

- Bacc20-A2 Seow-Yee-Juh B200042a SM ExamДокумент7 страницBacc20-A2 Seow-Yee-Juh B200042a SM ExamBBMK21-A2 You SengОценок пока нет

- Assignment 2 - 1668854523Документ6 страницAssignment 2 - 1668854523Ridhi GambhirОценок пока нет

- SM Chapter 2Документ34 страницыSM Chapter 2Masood khanОценок пока нет

- Strstegic Analysis and ChoiceДокумент32 страницыStrstegic Analysis and Choiceigupta_4Оценок пока нет

- Matrix Is Designed Precisely To Augment A Multidivisional Firm's Efforts To Formulate SuchДокумент3 страницыMatrix Is Designed Precisely To Augment A Multidivisional Firm's Efforts To Formulate SuchSoumitra ChakrabortyОценок пока нет

- Understand the BCG growth-share matrix with this guideДокумент5 страницUnderstand the BCG growth-share matrix with this guideChanthini VinayagamОценок пока нет

- Pom PlanningДокумент50 страницPom PlanningBhaumik Gandhi100% (1)

- Assignment Human Resource Planning 086Документ4 страницыAssignment Human Resource Planning 086Mani RayОценок пока нет

- Portfolio AnalysisДокумент36 страницPortfolio Analysissalman200867100% (2)

- BCG MatrixДокумент6 страницBCG MatrixSpandana AchantaОценок пока нет

- Chapter 2 POMДокумент6 страницChapter 2 POMMeghnaОценок пока нет

- BCG MatrixДокумент14 страницBCG MatrixBeatrice Musiimenta Wa MpireОценок пока нет

- Growth Share Matrix - Boston Consulting Group's Strategic ToolДокумент10 страницGrowth Share Matrix - Boston Consulting Group's Strategic ToolMuhd Ridho BaihaqueОценок пока нет

- Unit III Part III Corporate Level AnalysisДокумент11 страницUnit III Part III Corporate Level AnalysisAbhinav ShrivastavaОценок пока нет

- Boston Consulting Group Matrix: Bhumika More SIES Nerul College of ASCДокумент27 страницBoston Consulting Group Matrix: Bhumika More SIES Nerul College of ASCLatika RathaurОценок пока нет

- BCG Matrix Literature ReviewДокумент8 страницBCG Matrix Literature Reviewea59a2k5100% (1)

- Mba - Ii Sem Marketing Management-MB0030: Name: Mushtaq Ahmad para Registration No.: 520950361Документ17 страницMba - Ii Sem Marketing Management-MB0030: Name: Mushtaq Ahmad para Registration No.: 520950361para2233Оценок пока нет

- Bcg-Matrix SVGДокумент7 страницBcg-Matrix SVGPriyanka KansaraОценок пока нет

- BCG & Ansoff - ModelДокумент9 страницBCG & Ansoff - ModelMd Shahnawaz IslamОценок пока нет

- Name: Saptarshi Das Mba - 4 Semester Reg. No. 511010222Документ16 страницName: Saptarshi Das Mba - 4 Semester Reg. No. 511010222Nayan DasОценок пока нет

- Dog Products: The Usual Marketing Advice Here Is To Aim To Remove Any Dogs From Your ProductДокумент6 страницDog Products: The Usual Marketing Advice Here Is To Aim To Remove Any Dogs From Your ProductIstiaque AhmedОценок пока нет

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementОт EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementРейтинг: 2 из 5 звезд2/5 (1)

- How to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesОт EverandHow to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesОценок пока нет

- Cima BPP Learning Text EcoДокумент241 страницаCima BPP Learning Text EcoSunil KakkarОценок пока нет

- Org BehaviorДокумент1 страницаOrg BehaviorSunil KakkarОценок пока нет

- MP 102Документ238 страницMP 102shruti1806Оценок пока нет

- Syllabus PHD ManagementДокумент16 страницSyllabus PHD Managementsachin_taj05100% (1)

- Marketing of ServicesДокумент33 страницыMarketing of ServicesSunil KakkarОценок пока нет

- 3 IntroДокумент14 страниц3 IntroSunil KakkarОценок пока нет

- GE Nine Cell MatrixДокумент1 страницаGE Nine Cell MatrixSunil Kakkar100% (4)

- Workers Participation in ManagementДокумент18 страницWorkers Participation in ManagementSunil KakkarОценок пока нет

- Export PromotionДокумент10 страницExport PromotionSunil KakkarОценок пока нет

- Global Is at IonДокумент8 страницGlobal Is at IonSunil KakkarОценок пока нет

- Industrial Policy RajasthanДокумент4 страницыIndustrial Policy RajasthanSunil KakkarОценок пока нет

- Foreign Trade in IndiaДокумент6 страницForeign Trade in IndiaSunil KakkarОценок пока нет

- Constitutional limits on foreign ownershipДокумент5 страницConstitutional limits on foreign ownershipKarl Marxcuz Reyes100% (1)

- FInal - Module 1 - Finalizing Evaluated Business PlanДокумент33 страницыFInal - Module 1 - Finalizing Evaluated Business Planbryan tolab100% (2)

- Financial management toolkit for MFIsДокумент45 страницFinancial management toolkit for MFIsAndreea Cismaru100% (3)

- NBP MCQs SampleДокумент4 страницыNBP MCQs Samplem usmanОценок пока нет

- Tax 2 Case DigestsДокумент37 страницTax 2 Case DigestsSherlyn Paran Paquit-SeldaОценок пока нет

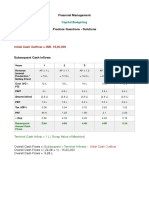

- Financial Management Capital Budgeting Practice Questions SolutionsДокумент5 страницFinancial Management Capital Budgeting Practice Questions SolutionsAnchit JassalОценок пока нет

- Alternative Investments and StrategiesДокумент414 страницAlternative Investments and StrategiesJeremiahOmwoyoОценок пока нет

- Accounting & Auditing Solved MCQs PDFДокумент224 страницыAccounting & Auditing Solved MCQs PDFMaria QuiОценок пока нет

- List of NBFCs (A Category)Документ65 страницList of NBFCs (A Category)Priya SheelОценок пока нет

- MRF Microsec 260413Документ5 страницMRF Microsec 260413Aditya SoumavaОценок пока нет

- The Financialisation Hypothesis and Marxism: A Positive Contribution or A Trojan Horse?'Документ13 страницThe Financialisation Hypothesis and Marxism: A Positive Contribution or A Trojan Horse?'smavroОценок пока нет

- Unintended Consequences: by John MauldinДокумент11 страницUnintended Consequences: by John Mauldinrichardck61Оценок пока нет

- Assessing Trading System Health BandyДокумент33 страницыAssessing Trading System Health Bandypappu6600100% (1)

- Informal Risk and Venture CapitalДокумент15 страницInformal Risk and Venture CapitalZoofi ShanОценок пока нет

- Philippine National Bank vs. Court of Appeals G.R. No. 97995 - January 21, 1993 FactsДокумент5 страницPhilippine National Bank vs. Court of Appeals G.R. No. 97995 - January 21, 1993 FactsPatricia SanchezОценок пока нет

- Usali DigitalДокумент388 страницUsali DigitalNayibe Ramirez78% (9)

- He Imes Eader: It'S Goodbye GadhafiДокумент42 страницыHe Imes Eader: It'S Goodbye GadhafiThe Times LeaderОценок пока нет

- Final Exam ReviewДокумент5 страницFinal Exam ReviewBlake CrusiusОценок пока нет

- StatementДокумент4 страницыStatementAaron Montoya100% (1)

- Super Sharp Pitchfork by Ahmed MaherДокумент19 страницSuper Sharp Pitchfork by Ahmed MaheraddinfoОценок пока нет

- Morgan Stanley: About The CompanyДокумент1 страницаMorgan Stanley: About The Companyaakash urangapuliОценок пока нет

- Summer Internship Project ReportДокумент58 страницSummer Internship Project ReportArjun Gami67% (3)

- Ratio Analysis of Union BankДокумент67 страницRatio Analysis of Union BankrpsinghsikarwarОценок пока нет

- Mutual Funds and Unit Investment Trust Funds, What's The DifferenceДокумент14 страницMutual Funds and Unit Investment Trust Funds, What's The DifferenceAlfred Russel WallaceОценок пока нет

- CFTC v. Jon Cozine Et AlДокумент47 страницCFTC v. Jon Cozine Et AlDoug MataconisОценок пока нет

- Abhay-Pattnaik Rainforest Capital Profile PDFДокумент1 страницаAbhay-Pattnaik Rainforest Capital Profile PDFSethra SenОценок пока нет

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Документ9 страницTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaОценок пока нет

- Financial Measures To Measure Corporate PerformanceДокумент21 страницаFinancial Measures To Measure Corporate PerformanceArushi GuptaОценок пока нет

- East Coast Asset Management (Q4 2009) Investor LetterДокумент10 страницEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comОценок пока нет

- ECONOM1 Module 8 Natl Y DetДокумент48 страницECONOM1 Module 8 Natl Y DetMartin Tongco FontanillaОценок пока нет