Академический Документы

Профессиональный Документы

Культура Документы

Brent Daily Report APR 09 2013

Загружено:

Ema EmИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Brent Daily Report APR 09 2013

Загружено:

Ema EmАвторское право:

Доступные форматы

Brent Daily Report

Contract Open High Low Close Volume OI CHANGE LCOK3

104.28 105.55 103.4 104.66 245683 1152024 0.2

Tuesday, April 09, 2013

Price Camarilla

105.84 105.25 104.07 103.48

LCOK3-M3 LCOM3-N3

-0.07 -0.02 -0.25 -0.11 105365 0 0.09 0.16 0.07 0.11 51334 #VALUE!

Week

18-22 25-01 4-8 11-15

16:30 CFDs(Not updated ) Today(May ) Yesterday 0.28 0.33 0.33 0.33 0.13 0.11 -0.07 -0.07

Last week 0.63 0.54 0.34 0.1

Correlation with other crude instruments

Supports

-0.18 -0.26 -0.3 *** * ** ***

Brent Spreads Resistances

-0.08 -0.01 0.05 0.1 ** *** ** ****

6.00 5.00 4.00 3.00 2.00

1.20

1.00

-0.48

0.80

Key Fundamentals Forties continues to remain weak because of over supply and poor demand from refineries. Refinery maintenance in Europe and russia continue to keep demand at bay and both Forties and NWE Urals might be weak for some more time. Forties might have been weaker had it not been for some exports to US where expensive LLS is providing arbitrage opportunities. Some traders have been saying that exports to South Korea might be reduced to less than half due to changes in tax laws from July.

1.00 0.00 Jan-13 -1.00 -2.00 -3.00 -4.00 Brent-Dubai EFS (LH Axis) Ural-Brent spread (LH axis) Brent Spread (RH Axis)

0.60

Feb-13

Mar-13

Apr-13

0.40

0.20

0.00

Technical Snapshot and Analyst's opinion The spread got to our target of -0.26 (well almost). Now 0.26 is the important 161.8 extension level.We normally see corrections from this level. So technically, the spread might take a correction to the upside today. Levels to the upside can be -0.07, -0.01 and 0.05... In case we keep moving down -0.26 can again be a decent support once again...below that the spread can target 0.48. Similar to the first spread, the second spread is also supported at 161.8 extension target of 0.08 So second spread can also be strong today and target 0.20, 0.22 and 0.30 NB: if the spread stays weak and breaks below 0.08...it should target -0.05

GHF Group, 2012

Page 1

OTHER MARKETS PRODUCTS PRICE CHANGE PRODUCTS RBOB 1560.25 1 S&P500 #N/A service Record permissioned not service permissioned GAS OIL DAX #N/A Record not #N/A Record not service permissioned HEATING OIL FTSE #N/A Record not service permissioned 1.3022 0.0013 EURO BONNY LIGHT 1575.41 2.32 GOLD URALS #N/A Record not #N/A service Record permissioned not service permissioned WTI COPPER

OTHER COMMODITIES PRICE Daily change Monthly change 2.921 0.011 0.037 887.25 6.5 -38.5 2.960 0.006 -0.004 110.57 102.43 93.62 0.26 1.79

Technicals Daily MA

5 8 13 34 50 100 200

BRENT 105.42 107.36 107.79 109.80 112.12 111.32 110.50

BONDS US 10 YR BUND ITALY 10 YR SPAIN 10 YR

YIELD

1.7418 1.255 4.339 4.737

CHANGE

-0.003 0.019 -0.002 -0.009

BRENT OUTRIGHT Supports

104.35 104.1 103.6 103.1 *** ** *** **

Resistances

105.15 105.50/70 106.60 107.5 *** *** *** **

Technical Snapshot The outright once again took an up move from the trendline and we are already 150 ticks above. We have posted a little double bottom on the outrights here.. 105.55 to 105.65 shall be an important range if outrights have to move higher. Break above this range can be bought. (Not saying that the outrights should be strong...but if they break above this range, they can be strong). To the downside 104.35 and 104.10 shall be important supports.

Key fundamentals & Analyst's opinion Euro has turned stronger since the last few days but oil hasnt participated in the rally. The usual correlation with SnP has broken off some time ago and oil doesnt seem to be a favorite of Risk on Risk off operators anymore. Lots of things are being said about end of peak oil theories. With the US producing more and more oil everyday, thanks to the Shale boom, the worlds biggest oil importer is importing ever decreasing volumes of oil. Also being talked about are stories of how natural gas and natural gas liquids, also abundant due to shale revolution, are turning out to be cheaper substitutes for oil. These, stories have slowly turned the sentiment weaker on oil and hence it is much weaker than the other risk assets with whom it was correlated.

GHF Group, 2012

Page 1

FORWARD CURVE

117 115 113 111 109 107 105 103 101 Mar-13 Jun-13

Forward Curve - Brent

1 DAYSep-13 1 MONTH

1 WeekDec-13

Mar-14

Comments:

2500

LOADING PROGRAM All values in Cargoes No. of Cargoes MoM change YoY change 116000 16000 0 BRENT 426000 26000 -90000 FORTIES 155000 35000 -38000 OSEBERG 194000 -6000 17000 EKOFISK 820000 71000 -111000 BFOE TOTAL NSEA TOTAL URALS WAF Note: 20000 bbls/day == 1 cargo .

LOADING PROGRAM (in thousands)

2000 Current Last month Last year

1500

1000

500

0 Brent Forties Oseberg Ekofisk BFOE NSEA

Important deals during Platt's Window Forties differential were weaker again. CFDs were weaker too.

REFINERY PROFIT MARGINS ROTTERDAM $/BARREL BRENT CRACK BRENT HYDRO

09/04/2013 5.72 4.34 5.23 6.89 3.39 2.58 2.32 4.92

Real Time Energy Data INDICATOR US API WEEKLY CRUDE STOCKS US API WEEKLY GASOLINE STK US API DST. STOCKS US API CUSHING NUMBER US EIA WEEKLY CRUDE STOCKS US EIA DIST. STOCKS US EIA GASOLINE STK. US WEEKLY REFINING UTILITY ACTUAL SURVEY

1.467 -1.600 -1.333 1.467 -1.333 -1.600

PRIOR

4.709 -5.026 -1.850 -0.287 2.707 -2.266 -0.572 0.6

AVERAGE

LAST 5 DAYS LAST 15 DAYS LAST 365 DAYS

GHF Group, 2012

Page 1

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Depp V NGN May 18 DecisionДокумент9 страницDepp V NGN May 18 DecisionTHROnline100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Exam Paper Domestic Relations January 2016Документ5 страницExam Paper Domestic Relations January 2016Ema EmОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Curs 8 - Shakespeare IntroductionДокумент9 страницCurs 8 - Shakespeare IntroductionEma EmОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- QuizДокумент3 страницыQuizEma EmОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Curs 6 - Renaissance IДокумент11 страницCurs 6 - Renaissance ILorena RoantaОценок пока нет

- A Portrait of The Artist As A Young Man Is JoyceДокумент3 страницыA Portrait of The Artist As A Young Man Is JoyceEma EmОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Is Your Coffee As Strong As Your German ApologiesДокумент6 страницIs Your Coffee As Strong As Your German ApologiesIulianZaharescuОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Plan International UK The State of Girls Rights in The UK 2016Документ87 страницPlan International UK The State of Girls Rights in The UK 2016Ema EmОценок пока нет

- Frankenstein (Mary Shelley)Документ139 страницFrankenstein (Mary Shelley)StokeParkSchoolОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- BeowulfДокумент84 страницыBeowulfEma EmОценок пока нет

- Writer and The Nineteenth-Century Literary Imagination. Have She Is Seen byДокумент1 страницаWriter and The Nineteenth-Century Literary Imagination. Have She Is Seen byEma EmОценок пока нет

- Sample LessonplansДокумент60 страницSample LessonplansReham IsmailОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Testheft Dreyer SchmittДокумент162 страницыTestheft Dreyer SchmittDiana Dumitrascu71% (7)

- Norwegian Dialects - Background: - PastДокумент13 страницNorwegian Dialects - Background: - PastEma EmОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Application for Summer InstituteДокумент10 страницApplication for Summer InstituteEma EmОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Relativs TzeДокумент3 страницыRelativs TzeEma EmОценок пока нет

- An Occurrence at Owl Creek BridgeДокумент8 страницAn Occurrence at Owl Creek BridgeEma EmОценок пока нет

- 1383941269.843group 1-Assimilation Rules-20041207Документ15 страниц1383941269.843group 1-Assimilation Rules-20041207Ema EmОценок пока нет

- Corn Report Apr 11 2013Документ1 страницаCorn Report Apr 11 2013Ema Em100% (1)

- John F Carter - How I Trade FoДокумент259 страницJohn F Carter - How I Trade FoEma Em87% (15)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- John F Carter - How I Trade FoДокумент259 страницJohn F Carter - How I Trade FoEma Em87% (15)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- JN Financial Brochure V 2 March 2010Документ12 страницJN Financial Brochure V 2 March 2010Ema EmОценок пока нет

- Exchange Rates and International Finance, 4thДокумент513 страницExchange Rates and International Finance, 4thXinquan Liu75% (4)

- David Stendahl Money Management Strategies For Serious TradersДокумент46 страницDavid Stendahl Money Management Strategies For Serious TradersIan Moncrieffe100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- SAP 4.6 Basic Skills Self-StudyДокумент153 страницыSAP 4.6 Basic Skills Self-Studyapi-3758541100% (2)

- EnglezaДокумент1 страницаEnglezaEma EmОценок пока нет

- European Monthly SummaryДокумент2 страницыEuropean Monthly SummaryEma EmОценок пока нет

- User Manual UFD - Vivid Edition - 0097Документ162 страницыUser Manual UFD - Vivid Edition - 0097Diego MontalvanОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Vitrinite Reflectance (Ro) AnalysisДокумент3 страницыVitrinite Reflectance (Ro) AnalysisJustin ViberОценок пока нет

- WOBBE NUMBER Methane NumberДокумент9 страницWOBBE NUMBER Methane NumberLucianaОценок пока нет

- 1 Overview of UOP Gas Processing Technologies and ApplicationsДокумент25 страниц1 Overview of UOP Gas Processing Technologies and ApplicationsCS100% (4)

- Environment Clearance Status Query Form: SearchДокумент10 страницEnvironment Clearance Status Query Form: SearchPankaj RajbharОценок пока нет

- Gas CondensateДокумент10 страницGas CondensateMurad RustamliОценок пока нет

- Nex OctaneДокумент2 страницыNex OctaneAndreiОценок пока нет

- HydrocarbonДокумент27 страницHydrocarbonXII- RohitОценок пока нет

- MansouriaДокумент221 страницаMansourianashwannoori100% (1)

- Presulfiding ProcessДокумент6 страницPresulfiding ProcessNazar AhmedОценок пока нет

- Type-Iii CNG Cascade B-PlanДокумент21 страницаType-Iii CNG Cascade B-PlansameerrmdbОценок пока нет

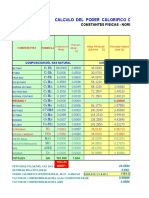

- ASTM3588ok 1Документ4 страницыASTM3588ok 1Karina GarciaОценок пока нет

- Crude Oil API Gravity and Sulfur ContentДокумент6 страницCrude Oil API Gravity and Sulfur ContentPriya NarayanОценок пока нет

- Introduction to Petroleum Engineering Course OutlineДокумент19 страницIntroduction to Petroleum Engineering Course OutlineshanecarlОценок пока нет

- Heating Oil and Propane Update - Energy Information AdministrationДокумент6 страницHeating Oil and Propane Update - Energy Information AdministrationjohnОценок пока нет

- Shell History Timeline PDFДокумент3 страницыShell History Timeline PDFGabriel Enciso CoralОценок пока нет

- Profil PT. Kimia Farma Plant SemarangДокумент14 страницProfil PT. Kimia Farma Plant SemarangSeptian Wii0% (1)

- Alawad BookДокумент8 страницAlawad BookSaid DjaballahОценок пока нет

- Tanabe Air Compressor ManualДокумент103 страницыTanabe Air Compressor Manualjin shodanОценок пока нет

- Properties : Naphtha (Документ3 страницыProperties : Naphtha (Sampathkumar AttuluriОценок пока нет

- Chevron Group II AEO Performance - Summary20150512Документ7 страницChevron Group II AEO Performance - Summary20150512Oscar CampoОценок пока нет

- Alkanes and CycloalkanesДокумент5 страницAlkanes and CycloalkanesAlineОценок пока нет

- EOR Screening ConceptsДокумент14 страницEOR Screening ConceptsPankaj KumarОценок пока нет

- Steam-assisted gravity drainage: A breakthrough EOR technologyДокумент6 страницSteam-assisted gravity drainage: A breakthrough EOR technologyDavidandyОценок пока нет

- Aniline Point & Diesel IndexДокумент1 страницаAniline Point & Diesel IndexSerena Serena0% (1)

- Primary PetrolДокумент2 страницыPrimary PetrolHarikesa KalasilvanОценок пока нет

- HP Top Project AwardsДокумент9 страницHP Top Project AwardsSterlingОценок пока нет

- What and Why Is AapgДокумент3 страницыWhat and Why Is Aapgkevar diannОценок пока нет

- Meditran S40Документ1 страницаMeditran S40rani wulansariОценок пока нет

- M.V. Ramform Victory: Arrival Timor Sea 11-Jun-06 Stability FormДокумент5 страницM.V. Ramform Victory: Arrival Timor Sea 11-Jun-06 Stability FormringboltОценок пока нет

- 1-The Hydropyrolysis of Coal To BTXДокумент10 страниц1-The Hydropyrolysis of Coal To BTXNojus DekerisОценок пока нет