Академический Документы

Профессиональный Документы

Культура Документы

Worldwide Paper Company

Загружено:

Azlan PspОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Worldwide Paper Company

Загружено:

Azlan PspАвторское право:

Доступные форматы

Cck to edt Master subtte stye

6/26/12

Worldwide Paper

Company Case

Group D

Pau Weaver

Mohammed

Wa|uddn Mchae

Domnguez

L Myers

Brton Htchns

Venus Rodan

11

6/26/12

Outline

v

Case Background

v

Swot Analysis

v

Problem Identification

v

Data analysis

v

Recommendation

22

6/26/12

!e Case Background

vIn December 2006,Bob Prescott, the

controer for the Bue Rdge M, was

consderng the addton of a new on-

ste ongwood woodyard

33

6/26/12

"ew WOOD#ARD

In$estment

New Woodyard

Utzes a new technoogy that

aows tree-ength ogs, caed

ongwoods to be processed drecty

44

6/26/12

Current Practice

Bue Rdge M purchases

shortwood from the Shenandoah

M

The Shenandoah m s owned by

a compettor

55

6/26/12

Ad$antages of t!e

In$estment

v

Emnates the need to purchase

shortwood from an outsde supper

(Shenandoah M)

v

Opportunty grow 0to se shortwood

on the open market as a new market

v

Reduces operatng cost and

ncreases revenue

66

6/26/12

PRI%AR# B&"&'IS O' "&W

WOOD#ARD

77

"ew

Woodyard

&(cess

Capacity

S!ortwood

for pulp

production

Sell

s!ortwood in

open market

6/26/12

SWO A"A)#SIS

SR&"*+S

q

Strong Sale support

q

Decreasing Wacc

W&A,"&SS&S

q

Applying outdated WACC

q

Wrong in$estment

decisions in past due to

incorrect WACC

OPPOR-"II&S

q

"ew mac!ine mig!t

decrease t!e operating

cost

q

Independence from t!e

current supplier

q

Increased re$enue from

e(cess capacity

+R&AS

q

Competition from

S!enandoa! mill

88

6/26/12

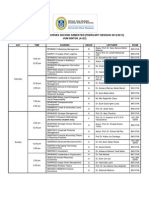

CAS& I"'OR%AIO"

q

The new woodyard woud begn

operatng n 2008

q

Investment ./01 million2outay

woud be spent over two caendar

years:

99

3445 3441

/06 million / 3 million

6/26/12

CAS& I"'OR%AIO"

q

Operatng savngs :

.Buying s!ortwood2 7 .Cost of producing

s!ortwood2

1010

3441 'uture

/3 million /89: million

6/26/12

CAS& I"'OR%AIO"

q

Expected revenues ($ mon) by

seng shortwood on open market :

1111

3441 344; 3404 3400 3403 3408

/< /04 /04 /04 /04 /04

6/26/12

CAS& I"'OR%AIO"

q

Cost of Capta = 5:= of re$enue

q

SG&A = := of re$enue

q

Tax rate = <4=

q

Straig!t>line depreciation ( over the sx

year fe) wth ?ero sal$age vaue

q

Net Workng capta = 04= annual re$enue

q

Deprecaton charges begn after the tota $18

mon outay and machnery starts the

servce

1212

6/26/12

PROB)&% ID&"I'ICAIO"

1) What w the current WACC

be?

1) Whether the expected benefts

were enough to |ustfy the

$18mon capta outay pus

the ncrementa nvestment n

workng capta over the sx-

year fe of the nvestment?

1313

6/26/12

')OW C+AR

1414

'inal

Decisio

n

Calculate

WACC

Calculate "P@A

IRRA PIA %IRR

02

32

8

2

6/26/12

DAA A"A)#SIS> CAS+

')OW

q

Cas! 'low

1515

3445 3441 344; 3404 3400 3403 3408

Termna

vaue

./062 /49<1 /89;4 /<9:4 /<9:4 /<9:4 /<9:4 /3941

6/26/12

DAA A"A)#SIS> O-DA&D

WACC

q

WACC = 15%

v

WPC !as a company policy to use its corporate

Cost of Capital to analy?e in$estment

opportunities

v

WPC !as not c!anged its WACC in 04 years

q

NPV = ($2.14) (Negatve)

q

@iew Worldwide Paper Company9(ls !ere

1616

6/26/12

DAA A"A)#SIS>-PDA&D

WACC

q

Current WACC (US department of Treasure)

1717

6/26/12

PAS 84 #&ARS

1818

6/26/12

DAA A"A)#SIS>-PDA&D

WACC

02 Current WACC B ;965=

32 "P@ B /4953 million

82 IRR B04911=

<2 PIB 094<:

:2 %IRR B 04986=

1919

Worldwide Paper Company>09(ls(

&CC&) +AS

%A*IC

6/26/12

R&CO%%&"DAIO"

WACC ;965= -pdated

"P@ /4953

million

Positi$e

IRR 04911= *reater

t!an

WACC

%IRR 04986= *reater

t!an

WACC

PI 094<: *reater

t!an 0

2020

6/26/12

R&CO%%&"DAIO"

q

DecisionD

The expected benefts are enough to

|ustfy the $18mon capta outay

pus the ncrementa nvestment n

workng capta over the sx-year fe of

the nvestment

Invest in the new longwood

Woodyard

2121

6/26/12

E-&SIO"S

2222

+A",

#O-

Вам также может понравиться

- Tips and Traps For Writing an Effective Business PlanОт EverandTips and Traps For Writing an Effective Business PlanРейтинг: 4 из 5 звезд4/5 (1)

- Worldwide Paper CompanyДокумент22 страницыWorldwide Paper Companyroldanvenus89% (9)

- Disaster-Resilient Infrastructure: Unlocking Opportunities for Asia and the PacificОт EverandDisaster-Resilient Infrastructure: Unlocking Opportunities for Asia and the PacificОценок пока нет

- Effective Small Business Management 10th Edition Scarborough Test BankДокумент31 страницаEffective Small Business Management 10th Edition Scarborough Test Bankreginagwyn0157y100% (32)

- Investing Strategies for the High Net-Worth Investor: Maximize Returns on Taxable PortfoliosОт EverandInvesting Strategies for the High Net-Worth Investor: Maximize Returns on Taxable PortfoliosРейтинг: 5 из 5 звезд5/5 (2)

- December 2013Документ104 страницыDecember 2013Cleaner MagazineОценок пока нет

- Accounting: Demonstration ProblemДокумент23 страницыAccounting: Demonstration ProblemdshilkarОценок пока нет

- Chapter 12 QuestionsДокумент8 страницChapter 12 QuestionsJames AguilarОценок пока нет

- 132 Accountancy Xi, Xii 2023 24Документ8 страниц132 Accountancy Xi, Xii 2023 24Technology worldОценок пока нет

- MASДокумент143 страницыMASSer Cis100% (4)

- ch12Документ32 страницыch12Ara E. Caballero100% (1)

- Case Study SolutionДокумент10 страницCase Study SolutionSidra ArshadОценок пока нет

- NPV Profile ConstructionДокумент6 страницNPV Profile ConstructionTimothy Gikonyo0% (1)

- ch11 TBДокумент30 страницch11 TBsofikhdyОценок пока нет

- Chapter 26 - Capital BudgetingДокумент60 страницChapter 26 - Capital Budgetingmbarecruit75% (4)

- Problem Set4 Ch09 and Ch10-SolutionsДокумент6 страницProblem Set4 Ch09 and Ch10-SolutionszainebkhanОценок пока нет

- Presentation - New Earth Mining IncДокумент12 страницPresentation - New Earth Mining IncShamsuzzaman SunОценок пока нет

- CH 12Документ63 страницыCH 12Grace VersoniОценок пока нет

- CH 12Документ31 страницаCH 12Mochammad RidwanОценок пока нет

- Chapter 1: IntroductionДокумент143 страницыChapter 1: IntroductionmarieieiemОценок пока нет

- How To Start Your Snow Removal CompanyДокумент18 страницHow To Start Your Snow Removal CompanydayodweezyОценок пока нет

- Ch12 Planning For Capital InvestmentsДокумент62 страницыCh12 Planning For Capital Investmentsعبدالله ماجد المطارنهОценок пока нет

- Examination - 2020 Subject: Financial ManagementДокумент5 страницExamination - 2020 Subject: Financial ManagementhareshОценок пока нет

- Apital Udgeting: Long-Range PlanningДокумент55 страницApital Udgeting: Long-Range PlanningPatrick Anthony AranasОценок пока нет

- Chapter # 12 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinДокумент19 страницChapter # 12 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'bОценок пока нет

- Question Details: Call Us On: +1 (646) 980-4914Документ5 страницQuestion Details: Call Us On: +1 (646) 980-4914Nathinael LimenhОценок пока нет

- AU12-FM-Midterm QuizДокумент6 страницAU12-FM-Midterm QuizHan Nguyen GiaОценок пока нет

- The Basics of Capital Budgeting: Learning ObjectivesДокумент35 страницThe Basics of Capital Budgeting: Learning Objectivesnahnah2121Оценок пока нет

- 13 Cost Benefit AnalysisДокумент13 страниц13 Cost Benefit AnalysisJimmy CaneОценок пока нет

- MR Cowdrey Runs A Manufacturing Business He Is Considering WhetherДокумент2 страницыMR Cowdrey Runs A Manufacturing Business He Is Considering WhetherAmit PandeyОценок пока нет

- Capital BudgetingДокумент31 страницаCapital BudgetingKarlovy Dalin100% (2)

- The Following Information For Drake Company Which Adjusts and ClosesДокумент1 страницаThe Following Information For Drake Company Which Adjusts and ClosesTaimur TechnologistОценок пока нет

- Wiley Financial Management Association InternationalДокумент10 страницWiley Financial Management Association InternationalNosan AloОценок пока нет

- Ie 8Документ26 страницIe 8BarışОценок пока нет

- Micron Business Processes: 6 Source and ProcureДокумент5 страницMicron Business Processes: 6 Source and ProcurelastuffОценок пока нет

- 888 Ch12ARQДокумент7 страниц888 Ch12ARQNga BuiОценок пока нет

- Lecture 6. Cash Flow ManagementДокумент33 страницыLecture 6. Cash Flow Managementsudharshan79Оценок пока нет

- Allied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionДокумент23 страницыAllied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionAsad Sheikh89% (18)

- Capital Budgeting 1Документ71 страницаCapital Budgeting 1Tahir AshrafОценок пока нет

- FR Compiler 4.0 - CA Final - by CA Ravi AgarwalДокумент1 312 страницFR Compiler 4.0 - CA Final - by CA Ravi Agarwalaella shivani100% (1)

- TB ch01Документ8 страницTB ch01Jenny Rose GattuОценок пока нет

- Intermediate Accounting CASEДокумент12 страницIntermediate Accounting CASERashimОценок пока нет

- Imp Iir QuestionsДокумент5 страницImp Iir QuestionsYasir RafiqОценок пока нет

- Ebook College Accounting A Contemporary Approach 3Rd Edition Haddock Solutions Manual Full Chapter PDFДокумент68 страницEbook College Accounting A Contemporary Approach 3Rd Edition Haddock Solutions Manual Full Chapter PDFkhucly5cst100% (11)

- 1 Point: Year 0 1 2 3 Cash Flow $34,500 $22,140 $46,800Документ49 страниц1 Point: Year 0 1 2 3 Cash Flow $34,500 $22,140 $46,800chintqhs173417Оценок пока нет

- 335 Chap 11 Capital Budgeting BasicsДокумент13 страниц335 Chap 11 Capital Budgeting BasicsFerdinand DaveОценок пока нет

- RossCF9ce ExcelTemplates Chapter05Документ6 страницRossCF9ce ExcelTemplates Chapter05alankn2004Оценок пока нет

- Final Accounts - Principles of AccountingДокумент9 страницFinal Accounts - Principles of AccountingAbdulla MaseehОценок пока нет

- Solution Manual For Modern Advanced Accounting in Canada Canadian 8Th Edition Hilton Herauf 1259087557 9781259087554 Full Chapter PDFДокумент36 страницSolution Manual For Modern Advanced Accounting in Canada Canadian 8Th Edition Hilton Herauf 1259087557 9781259087554 Full Chapter PDFruth.lerch453100% (12)

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Herauf Solution ManualДокумент29 страницModern Advanced Accounting in Canada Canadian 8th Edition Hilton Herauf Solution Manualandrea100% (22)

- Daffodil International University BBA Program: Course Title: Project Management Course Code: MGT-404Документ8 страницDaffodil International University BBA Program: Course Title: Project Management Course Code: MGT-404Polash DebnathОценок пока нет

- DEME Group Key Financial Figures For The FY 2020 Quick ReviewДокумент27 страницDEME Group Key Financial Figures For The FY 2020 Quick Reviewcitybizlist11Оценок пока нет

- September 2015Документ64 страницыSeptember 2015Gas, Oil & Mining Contractor MagazineОценок пока нет

- CH 08Документ12 страницCH 08AlJabir KpОценок пока нет

- Chapter 4Документ52 страницыChapter 4XI MIPA 1 BILLY SURYAJAYAОценок пока нет

- HSC Business Studies - Past HSC Questions - FinanceДокумент44 страницыHSC Business Studies - Past HSC Questions - Financechocolate.facto77Оценок пока нет

- UNIT - 4-2 - Gursamey....Документ27 страницUNIT - 4-2 - Gursamey....demeketeme2013Оценок пока нет

- Chapter 18Документ17 страницChapter 18queen hassaneenОценок пока нет

- SS1 Business Guided Study Worksheet-1Документ4 страницыSS1 Business Guided Study Worksheet-1Ruchira Sanket Kale100% (1)

- Evadale PM2: Reduction of Sheet Break and Operational DowntimeДокумент29 страницEvadale PM2: Reduction of Sheet Break and Operational DowntimeDavid Alfredo AliagaОценок пока нет

- USM Strategic Plan-Poster-v2 PDFДокумент1 страницаUSM Strategic Plan-Poster-v2 PDFAzlan PspОценок пока нет

- Building A Culture of Data Driven Decision Making in HigherДокумент4 страницыBuilding A Culture of Data Driven Decision Making in HigherAzlan PspОценок пока нет

- World-Class Universities or World Class Systems - Rankings and Hi PDFДокумент23 страницыWorld-Class Universities or World Class Systems - Rankings and Hi PDFAzlan PspОценок пока нет

- Attachment 3-BAFE 2018 Brochure V6Документ3 страницыAttachment 3-BAFE 2018 Brochure V6Azlan PspОценок пока нет

- SETARA '11 Summary Instrument-Conventional PDFДокумент7 страницSETARA '11 Summary Instrument-Conventional PDFAzlan PspОценок пока нет

- Big Data Capabilities Create Business Value - The Mediating Role of Decision-Making ImpactДокумент11 страницBig Data Capabilities Create Business Value - The Mediating Role of Decision-Making ImpactAzlan PspОценок пока нет

- Emcee ScriptДокумент2 страницыEmcee ScriptAzlan PspОценок пока нет

- Theme: World of Stories Topic: The TwinsДокумент46 страницTheme: World of Stories Topic: The TwinsAzlan PspОценок пока нет

- USM Strategic Plan-Poster-v2 PDFДокумент1 страницаUSM Strategic Plan-Poster-v2 PDFAzlan PspОценок пока нет

- Academic Calendar FIRST SEMESTER 2013/2014 (131) SECOND SEMESTER 2013/2014Документ2 страницыAcademic Calendar FIRST SEMESTER 2013/2014 (131) SECOND SEMESTER 2013/2014Amalina SolahuddinОценок пока нет

- Hrcmo GrantsДокумент3 страницыHrcmo GrantsAzlan PspОценок пока нет

- Welcome Ceremony Emcee ScriptДокумент4 страницыWelcome Ceremony Emcee ScriptKhairur Razi89% (122)

- Setara '11 Advertorial BiДокумент1 страницаSetara '11 Advertorial BiAzlan PspОценок пока нет

- Master A122Документ3 страницыMaster A122Azlan PspОценок пока нет

- Worksheet Band2 Y2Документ7 страницWorksheet Band2 Y2Azlan PspОценок пока нет

- Vocabulary MCQДокумент6 страницVocabulary MCQPrakash RaoОценок пока нет

- Emcee SpeechДокумент53 страницыEmcee SpeechAzlan PspОценок пока нет

- Sample WritingДокумент18 страницSample WritingAzlan PspОценок пока нет

- Proverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindДокумент5 страницProverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindAzlan PspОценок пока нет

- Vocabulary MCQДокумент5 страницVocabulary MCQAzlan PspОценок пока нет

- Worksheet Band1 Y2Документ13 страницWorksheet Band1 Y2balanОценок пока нет

- Vocabulary List For PplsДокумент2 страницыVocabulary List For PplsAzlan PspОценок пока нет

- Proverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindДокумент5 страницProverbs Idioms: Kindness Begets Kindness. If You Are Kind To People, They Will Be KindAzlan PspОценок пока нет

- Vocabulary List For PplsДокумент2 страницыVocabulary List For PplsAzlan PspОценок пока нет

- Emcee SpeechДокумент53 страницыEmcee SpeechAzlan PspОценок пока нет

- Emcee ScriptДокумент2 страницыEmcee ScriptAzlan PspОценок пока нет

- All Homework Questions Revised-3Документ30 страницAll Homework Questions Revised-3Azlan PspОценок пока нет

- Decision MakingДокумент23 страницыDecision MakingAzlan PspОценок пока нет

- OligopolyДокумент3 страницыOligopolyAzlan PspОценок пока нет

- Petitioner vs. vs. Respondent: First DivisionДокумент6 страницPetitioner vs. vs. Respondent: First DivisionPolo MartinezОценок пока нет

- CIR vs. PLDT (G.R. No. 140230 December 15, 2005) - 6 H DIGESTДокумент2 страницыCIR vs. PLDT (G.R. No. 140230 December 15, 2005) - 6 H DIGESTHarlene100% (2)

- Chapt-10 Basic Tax PatternsДокумент4 страницыChapt-10 Basic Tax Patternshumnarvios100% (3)

- Vishesh Ticket 28 DecДокумент2 страницыVishesh Ticket 28 DecJitendra Singh JeetОценок пока нет

- San Paolo Development Corporation V CRДокумент1 страницаSan Paolo Development Corporation V CRAnton GabrielОценок пока нет

- RA 10653 Increase of Tax Exemption Benefits (13Документ6 страницRA 10653 Increase of Tax Exemption Benefits (13Rexon SeeОценок пока нет

- 2010-11 PAYG - FN Tax TablesДокумент12 страниц2010-11 PAYG - FN Tax Tablescyclops4569Оценок пока нет

- OnlinePayslip Pages NewPayslipModuleДокумент1 страницаOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- KPMG Infrastructure Report For PSRДокумент94 страницыKPMG Infrastructure Report For PSRi06lealeОценок пока нет

- Bank 1Документ91 страницаBank 1trainticket5598Оценок пока нет

- Black Money Act 2015Документ16 страницBlack Money Act 2015Dharshini AravamudhanОценок пока нет

- RR No. 16-18Документ5 страницRR No. 16-18Ckey ArОценок пока нет

- Filing of ReturnsДокумент15 страницFiling of ReturnsVaishnaviОценок пока нет

- Tax QuesДокумент3 страницыTax QuesIshaan Tandon0% (1)

- Withholding DeclarationДокумент24 страницыWithholding DeclarationAbdallah SabbaghОценок пока нет

- Taxguru - in-TaxGuru Consultancy Amp Online Publication LLPДокумент7 страницTaxguru - in-TaxGuru Consultancy Amp Online Publication LLPsamratsom1947Оценок пока нет

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Документ8 страниц8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoОценок пока нет

- Tax Declaration SampleДокумент1 страницаTax Declaration SampleLara De los Santos100% (1)

- 2.form of Appeal ACIR - MДокумент4 страницы2.form of Appeal ACIR - Mwasim nisarОценок пока нет

- HDFC Challan UM513508 PDFДокумент1 страницаHDFC Challan UM513508 PDFMd Mashuque JawedОценок пока нет

- Jai Balaji Telecom Initial Kit 2Документ9 страницJai Balaji Telecom Initial Kit 2Vinod KumarОценок пока нет

- Indirect Taxes - Transformation in GSTДокумент53 страницыIndirect Taxes - Transformation in GSTJogender Chauhan100% (1)

- Airtel Postpaid Bill.Документ3 страницыAirtel Postpaid Bill.Jasmine Singla0% (1)

- 912010058516105Документ6 страниц912010058516105Darshan DhadukОценок пока нет

- UBA Prepaid FormДокумент2 страницыUBA Prepaid FormAriky CourierОценок пока нет

- 一卡通賬戶月結單 All-In-One Card Account StatementДокумент2 страницы一卡通賬戶月結單 All-In-One Card Account StatementMolecular Trader0% (1)

- How To Save Your TaxesДокумент24 страницыHow To Save Your TaxesNarayanamurthyNandagopalОценок пока нет

- CIR Vs Seagate, GR 153866Документ3 страницыCIR Vs Seagate, GR 153866Mar Develos100% (1)

- National Income - Definitions - Lovish KakkarДокумент2 страницыNational Income - Definitions - Lovish KakkarAjuni ShahОценок пока нет

- ISO15022 Data Field DictionaryДокумент325 страницISO15022 Data Field DictionaryGustavo MedinaОценок пока нет

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterОт EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterРейтинг: 5 из 5 звезд5/5 (1)

- An Unfinished Love Story: A Personal History of the 1960sОт EverandAn Unfinished Love Story: A Personal History of the 1960sРейтинг: 5 из 5 звезд5/5 (2)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldОт EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldРейтинг: 4.5 из 5 звезд4.5/5 (1145)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesОт EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesРейтинг: 4.5 из 5 звезд4.5/5 (497)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentОт EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentРейтинг: 4.5 из 5 звезд4.5/5 (6)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchОт EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchРейтинг: 4.5 из 5 звезд4.5/5 (13)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonОт EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonРейтинг: 4.5 из 5 звезд4.5/5 (21)

- Jesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesОт EverandJesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesРейтинг: 5 из 5 звезд5/5 (5)

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherОт EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherОценок пока нет

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteОт EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteРейтинг: 4.5 из 5 звезд4.5/5 (16)

- Compromised: Counterintelligence and the Threat of Donald J. TrumpОт EverandCompromised: Counterintelligence and the Threat of Donald J. TrumpРейтинг: 4 из 5 звезд4/5 (18)

- Pagan America: The Decline of Christianity and the Dark Age to ComeОт EverandPagan America: The Decline of Christianity and the Dark Age to ComeОценок пока нет

- Bind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorОт EverandBind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorРейтинг: 3.5 из 5 звезд3.5/5 (77)

- How States Think: The Rationality of Foreign PolicyОт EverandHow States Think: The Rationality of Foreign PolicyРейтинг: 5 из 5 звезд5/5 (7)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpОт EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpРейтинг: 4.5 из 5 звезд4.5/5 (11)

- The Return of George Washington: Uniting the States, 1783–1789От EverandThe Return of George Washington: Uniting the States, 1783–1789Рейтинг: 4 из 5 звезд4/5 (22)

- Darkest Hour: How Churchill Brought England Back from the BrinkОт EverandDarkest Hour: How Churchill Brought England Back from the BrinkРейтинг: 4 из 5 звезд4/5 (31)

- Warnings: Finding Cassandras to Stop CatastrophesОт EverandWarnings: Finding Cassandras to Stop CatastrophesРейтинг: 4 из 5 звезд4/5 (10)

- The Wars of the Roosevelts: The Ruthless Rise of America's Greatest Political FamilyОт EverandThe Wars of the Roosevelts: The Ruthless Rise of America's Greatest Political FamilyРейтинг: 4 из 5 звезд4/5 (14)