Академический Документы

Профессиональный Документы

Культура Документы

CFA Pub

Загружено:

NITINАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CFA Pub

Загружено:

NITINАвторское право:

Доступные форматы

EDITORS CORNER

Rodney N. Sullivan, CFA

Editor

Global Trade Imbalances Matter

Daily calls for resolving the ongoing sovereign debt crises plaguing the global economy make clear that theyre not over yet, but a continuation of the sovereign debt crises of countries with large and rising trade decits is not necessarily a fait accompli. Mitigation of the impact of these trade imbalances requires more than aggressive monetary policy alone.1 A credible commitment by both governments and citizens to rein them in is also needed. Attempting to muddle through absent such a rm scal plan will only undermine the economic recovery.

accommodated the ongoing borrowing needs of decit countries, largely without disruptionthe borrower country (e.g., Spain) buys goods and nancing from the lender country (e.g., Switzerland). This relationship offers strong win-win potential between the borrower and lender nations. However, as we have seen in recent years, such an approach is vulnerable to a sudden stop in nancial markets whereby short-term debt nancing for the decit country is not rolled over promptly enough to maintain uidity in markets and economies. The result is a nancial liquidity crisis.

Informed Consenting Adults Consenting Adults

The current global economic slowdown is clearly a structural one, and structural transitions are rarely smooth and painless. Consider, as shown in Figure 1, the glaring global dysfunction of the United States, the United Kingdom, Australia, and Spain (among others, including Portugal and Greece) running current account decits since the mid-1980s, each with cumulative trade decits now exceeding 30% of GDP. Because a countrys excess spending over income must, by denition, be sustained by sales of foreign assets or loans from other countries, these decits translate into surplus countriespredominantly Switzerland, Japan, China, and Germanyholding more than $8 trillion in cumulative claims against decit countries.2 A country with a current account decit is a net consumer that is becoming increasingly indebted. Its spending and investment are more than its production. This outcome can occur only if other countries are lending their savings to it or if the country is running down its capital account assets.3 But a country that is running a current account surplus is accumulating wealth and staking claims on foreign assets. Until recently, global trading partners used what might be called a naive consenting adults approach to managing the enormous ow of funds between countries, whereby surplus countries It doesnt have to be so painful. The win-win relationship can be restored. Surplus countries can continue to lend freely to decit countries but only if the latter take the necessary steps to become internationally competitive, including reducing current account decits. Lender countries will lend only if they believe they are not throwing money down a bottomless pit. Even though this approach may well involve a challenging leap to a new paradigmfrom naivet to informed adulthood a credible deleveraging plan is a necessary condition for a sustainable recovery. A strategy of naive hope combined with monetary policy alone is simply not enough in an environment of rapidly rising credit needs, especially for a global economy that is so dependent on trade. Economic sustainability means nations working to ensure their international competitiveness. Like a bank, a country with a rising short-term debt position vis--vis foreign lenders is vulnerable to a catastrophic run if liquid securities are insufcient to pay off lenders. Consider Greece in 2010, Iceland in 2008, Mexico in 1994, and Chile in 1981. Concerns about such runs, of course, have featured prominently in the ongoing European economic instability because investors fear that the deterioration of one countrys trade balance will spill over into the global nancial superstructure.

The Editors Corner is a regular feature of the Financial Analysts Journal. This piece reects the views of the author and does not represent the ofcial views of the FAJ or CFA Institute.

www.cfapubs.org

2012 CFA Institute

Editors Corner

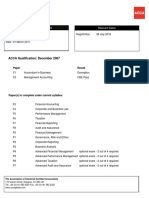

Figure 1.

Cumulative Current Accounts as a Percentage of GDP, 19702010

Cumulative Current Account (percentage of GDP) 150

100

50

50

100 70 80 United Kingdom Germany Switzerland 90 United States China Japan Australia 00 Spain 10

These examples, however, do not necessarily establish a causal link between trade imbalances and currency crises. There are cases in which even large current account decits have not led to crises. The most compelling means to an orderly reversal is for both the government and the citizens of every large net debtor nation to take steps to put into place a credible and resilient plan for repaying debt. So, decit countries can shrink their spending patterns in line with their declining wealth and surplus countries can continue to lend. Consider Ireland, a nation that has made rm commitments to repay lenders and recapitalize its banking system. Unfortunately, by declaring the euro irreversible, European policymakers have effectively undermined efforts to require those reform measures so badly needed in some countries. This result has had the effect of further hampering global economic growth and dragging down other nations. As we all know, we didnt arrive at these massive global trade imbalances overnight, and the resolution will likewise take time. But continuing to merely muddle through will serve only to hamper recovery further. Note how attempts at monetary

policy (Tempelman 2012) have proven a rather blunt tool for resolving nancial instability and unsustainable global scal imbalances. Even worse, some countries have denied the magnitude of the situation by following a status quo scal policy. Current account balances do matter. They must be accounted for because they hold macroeconomic implications both at home and abroad (Obstfeld 2012). But imbalances need not be threatening to either the international or the national economy. Containing the damage of the inexorable rebalancing of current large trade decits requires global cooperation in devising a credible scal plan to reduce decits in an orderly fashion. Alternative solutions alone (e.g., stepping harder on the monetary accelerator) will continue to prove insufcient. Informed, adult resolve is needed to avoid another wave of severely troubled countries. I thank Jerry Tempelman and Xi Li for constructive dialogue and comments. Abby Farson Pratt provided analytical support for this article.

November/December 2012

www.cfapubs.org

Financial Analysts Journal

Notes

1. There is an abundant literature on the impotence of a standalone monetary policy absent a coordinated scal policy. See, for instance, Sargent and Wallace (1981), Friedman (1968), and Sims (2012). 2. A countrys trade balance of payments represents the sum of all nancial transactions between that country and the rest of the world. The balance of payments comprises a current account and a capital account. The current account reects the difference between its national exports and imports, whereas the capital, or nancial, account reects the change in national ownership of assets. The current account, usually much larger than the capital account, is my focus here. 3. More specically, the current account balance equals the sum of the following gross ows: (Exports Imports) + (Income received on foreign assets Income paid on liabilities to foreigners) + Net transfers. Stated in terms of nancial account ows, the current account balance for a country equals (Increase in foreign assets) (Increase in foreign liabilities).

References

Friedman, Milton. 1968. The Role of Monetary Policy. American Economic Review, vol. 58, no. 1 (March):117. Obstfeld, Maurice. 2012. Does the Current Account Still Matter? American Economic Review, vol. 102, no. 3 (May):123. Sargent, Thomas J., and Neil Wallace. 1981. Some Unpleasant Monetarist Arithmetic. Federal Reserve Bank of Minneapolis Quarterly Review, vol. 5, no. 3 (Fall):117. Sims, Christopher A. 2012. Statistical Modeling of Monetary Policy and Its Effects. American Economic Review, vol. 102, no. 4 (June):11871205. Tempelman, Jerry. 2012. Against Quantitative Easing by the European Central Bank. Financial Analysts Journal, vol. 68, no. 4 (July/August):46.

[ADVERTISEMENT]

www.cfapubs.org

2012 CFA Institute

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Sperandeo, Victor - Trader Vic - Methods of A Wall Street MasterДокумент147 страницSperandeo, Victor - Trader Vic - Methods of A Wall Street Mastervinengch93% (28)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- CFA L3 Exam ResultДокумент2 страницыCFA L3 Exam ResultNITINОценок пока нет

- AccaДокумент1 страницаAccaNITINОценок пока нет

- Competition Law LLMДокумент17 страницCompetition Law LLMritu kumarОценок пока нет

- Exam History Transcript 8970940390200880587Документ2 страницыExam History Transcript 8970940390200880587NITIN100% (1)

- BCG Classics Revisited The Growth Share Matrix Jun 2014 Tcm80-162923Документ9 страницBCG Classics Revisited The Growth Share Matrix Jun 2014 Tcm80-162923NITINОценок пока нет

- IMF Financial Programming and PoliciesДокумент1 страницаIMF Financial Programming and PoliciesNITINОценок пока нет

- A Study On Role of Gold Portfolio AllocationДокумент6 страницA Study On Role of Gold Portfolio AllocationNITINОценок пока нет

- CAS ALM PresentationДокумент22 страницыCAS ALM PresentationNITINОценок пока нет

- Excel Knowledge Test: Modeloff 2012 Questions and AnswersДокумент3 страницыExcel Knowledge Test: Modeloff 2012 Questions and AnswersNITINОценок пока нет

- Infosys ReportДокумент7 страницInfosys ReportNITINОценок пока нет

- Certificado #01 100 822 1632965 - CertipediaДокумент1 страницаCertificado #01 100 822 1632965 - CertipediaNancy CruzОценок пока нет

- Mumbai Metro Rail Project: Group - 1 PGPFДокумент30 страницMumbai Metro Rail Project: Group - 1 PGPFakash srivastavaОценок пока нет

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFДокумент318 страницDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhОценок пока нет

- DailySocial Fintech Report 2019Документ51 страницаDailySocial Fintech Report 2019Clara Lila100% (3)

- Verification of InvestmentsДокумент3 страницыVerification of InvestmentsAshab HashmiОценок пока нет

- Problem 29.2Документ2 страницыProblem 29.2Arian AmuraoОценок пока нет

- AIU EssayДокумент17 страницAIU EssayGodfred AbleduОценок пока нет

- Chapter 10 (Crafting Brand Positioning)Документ52 страницыChapter 10 (Crafting Brand Positioning)Kiran RaniОценок пока нет

- Beginners Guide To SalesДокумент19 страницBeginners Guide To SalesJoannaCamyОценок пока нет

- Chapter 5Документ20 страницChapter 5Clyette Anne Flores Borja100% (1)

- Aether Industries LTD.: Complex Chemistry in The MakingДокумент10 страницAether Industries LTD.: Complex Chemistry in The MakingProlin NanduОценок пока нет

- Importance of Sales PromotionДокумент3 страницыImportance of Sales PromotionHajra KhanОценок пока нет

- 5% LDRRMF Coa CircularДокумент13 страниц5% LDRRMF Coa Circulardan neri100% (1)

- Lecture18 Safeway CaseДокумент13 страницLecture18 Safeway Casegoot11Оценок пока нет

- Harmonic Pattern by Jay PurohitДокумент35 страницHarmonic Pattern by Jay PurohitNickKr100% (5)

- Value Added Tax PracticeДокумент7 страницValue Added Tax PracticeSelene DimlaОценок пока нет

- Karl Marx's TheoryДокумент2 страницыKarl Marx's TheoryHassaan RajputОценок пока нет

- Alinma BankДокумент4 страницыAlinma BankAnonymous bwQj7OgОценок пока нет

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Документ27 страницFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsОценок пока нет

- Scarcity, Opportunity Costs, and Production Possibilities CurvesДокумент14 страницScarcity, Opportunity Costs, and Production Possibilities CurvesAhmad Mahmuz ArroziОценок пока нет

- Off-Highway ResearchДокумент30 страницOff-Highway ResearchAlireza NazariОценок пока нет

- New Microsoft Word DocumentДокумент10 страницNew Microsoft Word DocumentMukit-Ul Hasan PromitОценок пока нет

- Fin Aw7Документ84 страницыFin Aw7Rameesh DeОценок пока нет

- Pinku 123Документ91 страницаPinku 123bharat sachdevaОценок пока нет

- Oberoi Realty Annual Report 2018-19Документ220 страницOberoi Realty Annual Report 2018-19yashneet kaurОценок пока нет

- Robert Half Salary Guide 2012Документ9 страницRobert Half Salary Guide 2012cesarthemillennialОценок пока нет

- A. Traditional Approach: Scope of Financial MGTДокумент79 страницA. Traditional Approach: Scope of Financial MGTbindhujohnОценок пока нет

- PR 5 Akuntansi ManajemenДокумент2 страницыPR 5 Akuntansi ManajemenAhmad Sulthon Alauddin0% (1)

- 33 Money LessonsДокумент37 страниц33 Money Lessonsraj100% (3)