Академический Документы

Профессиональный Документы

Культура Документы

Divorce of Hero

Загружено:

Tamrika TyagiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Divorce of Hero

Загружено:

Tamrika TyagiАвторское право:

Доступные форматы

Divorce of Hero-Honda -What went wrong?

ABSTRACT The case study is based on the repositioning of the automobile brand HERO after its split from HONDA. The effect of this so called divorse effected both the companies tremandously.

KEYWORDS:

INTRODUCTION The host city for the 2012 Olympics was burning on the night of August 9. London was convulsed by the worst rioting in Britain in living memory. The morning papers were emblazoned with the silhouette of a woman jumping from a building in flames. Policemen moved through apocalyptic streets, hunting thugs and looters to the rise and fall of sirens. But in a surreal scene only Bollywood could have conjured up, a different kind of pyrotechnics was exploding on the south bank of the Thames, in the massive Millennium Dome, now called the O2 Arena. There, amidst fireworks, a laser show, prancing heroes and heroines, and the obligatory ode from A.R. Rahman, the main item descended from the rafters - Hero MotoCorp's new logo, three geometric chunks forming an isometric "H" - to the hoarse cheers of 1,300 dealers, vendors and employees led by Pawan Kant Munjal. Less than eight months earlier, Hero had announced the end of its immensely successful 27-year marriage with Honda . Munjal and his merry men were there to celebrate Hero MotoCorp, the company bornout of the divorce. As divorce parties go, this one too, was a bit over the top, brimming with optimism about the future. But no one badmouthed the erstwhile spouse. Instead, Honda was fondly remembered. That may be because Hero got a true sweetheart deal; it got to keep the house, the car and the kids. The Munjal family, the promoters of Hero, who held 26 per cent, the same as Honda, got to buy out the partner at a price significantly lower than the market price - rumours put the confidential price at half the market value. Hero can launch products with Honda technology till June 2014 and can continue to sell them for as long as it wants. Hero Honda's exports were confined to some minor markets abroad since Honda did not want a clash with its exports from Japan; Hero MotoCorp can go anywhere.

BACKGROUND It was with palpable ebullience that Pawan Kant Munjal, who was just 30 years old when his father Brij Mohan Lall forged the venture with Honda in 1984, walked on to the O2 stage and said the company held the event in London to showcase "our new global

ambitions as well as to highlight both our legacy and modernity, like London does". That's a long journey for a group that started with a small cycle repair shop in Old Delhi's Chandni Chowk a year after the Independence and later moved to Ludhiana to set up Hero Cycles. Until the tie-up with Honda, the Munjals, who came from Pakistan in the aftermath of the dreaded Partition, were known just for their Ludhiana-made cycles. Twenty-seven years later, the Munjals once again need to invoke the Ludhiana spirit - the town in Punjab is known to spawn entrepreneurs, including the country's telecom czar Sunil Mittal - to face life after Honda. Twenty-seven years later, the Munjals once again need to invoke the Ludhiana spirit - the town in Punjab is known to spawn entrepreneurs, including the country's telecom czar Sunil Mittal - to face life after Honda. They have begun on a good note, but a good divorce settlement can ensure only shortterm happiness; it does not guarantee the proverbial happily-ever-after. That is what Hero Honda's shareholder family of 67,000 would be sweating over. A part of the 30-share Sensitive index of the Bombay Stock Exchange, the Hero stock is one large cap which is actively traded and is among the top 25 stocks by trading volume.

As many of you might know, responsibilities get shared when you live as a couple. When you are single, there is always something that causes a headache. It could be the plumbing, the cooking, or the electrician may not turn up. And then there is the fine print of the divorce: Hero is paying Honda Rs 2,479 crore as licence and exports fees. That is 14 per cent of Hero's 2010/11 revenues. Ravi Sud, Hero's Chief Financial Officer, says the figure will go down to just 2.2 per cent of 2013/14 revenues on a pro-rata basis. However, this is about more than just money. This shows how dependent Hero was - and is - on Honda for technology. Among Indian two-wheeler companies, only Bajaj Auto, which morphed under Rajiv Bajaj from a scooter maker into a motorcycle company in the late 1990s, has done well on its own. It has had a technology tie-up - no equity partnership - with Kawasaki of Japan, but its biggest success of the recent years, the Pulsar, was developed inhouse.

COMPETITORS Bajaj does not even share the badge with Kawasaki any more, though it sells some highend motorcycles imported from Kawasaki under its premium 'Probiking' network.

On the other hand, Kinetic, promoted by the Pune-based Firodia family, collapsed after Honda walked out of their scooter making joint venture. LML, promoted by Kanpurbased Deepak Singhania, is making a feeble comeback with electric scooters after its Vespas disappeared in the aftermath of its breakup with Italy's Piaggio. TVS, which split with Suzuki, carries on and develops new products in house, but it has always been, despite the thrust provided by stepthroughs, a distant third in the two-wheeler market making little of Chairman Venu Srinivasan's avowed ambition to overtake Bajaj.

While Hero has done "significant" work on styling and design of its products for a few years now, Munjal admits that the company has little know-how of its own in the crucial engine and gearbox departments (see box: Cracking the Bajaj Code). Hero MotoCorp unveiled two new products in London, a scooter named Maestro and a motorcycle named Impulse. The two will wear the Hero badge - no Honda there - but have been developed in association with the Japanese company. Munjal, for his part, is not taking chances and is in advanced stages of talks for technology with a "group of Japanese companies" he wouldn't name. Ashok Taneja, Managing Director, Shriram Rings and Pistons, a long-time vendor to Hero, says that motorcycle technology is not rocket science. "Technology is not that much of a factor in motorcycle sales any longer." If you have the money, you can buy it off the shelf in Japan, South Korea, and elsewhere. Kinetic, after splitting with Honda, tied up with Hyosung of South Korea and rolled out motorcycles, including a high-end cruiser, the Aquila, priced at Rs 1.5 lakh. The same experts would also tell you that success in twowheelers is not about technology alone, sales and distribution are vital. Every village, household In the last financial year, four million motorcycles were sold outside the metros and big cities, giving 45 per cent of the total sales to rural and semiurban areas. These are markets where it is not easy to outpace a company which made its bones in cycles. If this outlet does not get you, the next one will. Hero has more than

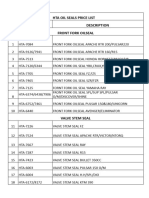

4,500 touch points across the country, almost double the 2,300 it had in early 2006, and expects to have 5,000 by March next year, including over 800 full-fledged dealers (several dealers own multiple outlets). Bajaj has 589 dealers, according to its latest annual report. "Small towns, villages we are everywhere," says Anil Dua, Senior Vice President, Marketing and Sales, Hero MotoCorp. Add to this Hero's focus on rural sales, which have increased from 45 per cent of the total in 2007 to 47 per cent, and you begin to understand why Hero Honda's share of the motorcycle market stands at 56.5 per cent, well ahead of Bajaj's 25 per cent and the below seven per cent share of Honda's fully owned subsidiary, Honda Motorcycles and Scooters India, or HMSI. In villages where Hero does not have direct presence, it has authorised representatives of dealers - Dua calls them opinion makers - who travel from place to place extolling the virtues of its motorcycles. "Our aim is Har Gaon, Har Aangan (every village, every household),"he says. Hero dealers even send mechanics every month to repair and service motorcycles in farflung villages. Vivek Goyal, owner of Autoneeds, a Hero dealer for 22 years with outlets in Delhi's middle-class borough of Patparganj and in Gurgaon, says word of mouth is always positive for Hero. "If we can sell a bike to one major household in a village, we can crack the village," he says. Even in cities, Hero is not about to slow down. Says Nikki Seghal, owner of Auto Riders, a dealership in Pune: "Was I apprehensive when I walked into that huge hall in London? Yes, I was, and so were several hundreds of other dealers. But when we saw the direction the company is taking and the new brand and the campaign, I felt quite relieved and many of the others were thrilled. I believe the problem may be one of supply in the near future." EXHIBIT 1

You see, it was not for nothing that Honda agreed to share its India profits with Hero for 27 long years. However, over those years, Munjal's ambition grew bigger than the Indian landscape. He wanted a piece of the overseas pie, which Bajaj had been devouring alone. As far back as 2001, Honda made its intentions clear when it decided to set up its wholly owned subsidiary. Despite the protection given by the government's Press Note 18, which did not allow a foreign company to set up another unit if it already had a joint venture with an Indian company in the same area, Honda managed to walk out of Kinetic and obtained a no-objection certificate from the Munjals. Confined to scooters in the first few years, HMSI started making motorcycles from 2004, coming in direct competition with Hero Honda. Bets were being placed in the market on how long it would be before Honda walked out of Hero.Eyesabroad

The process was catalysed three years ago, when Munjal, his father Brijmohan Lall and brother Sunil decided it was time to take Hero to the next level. They looked at their main rivals in the Indian market and saw Bajaj's rapid strides overseas. From almost nothing in 2002/03, Bajaj was exporting 972,000 motorcycles in 2010/11, or 29 per cent of its sales volume. Throw in threewheelers and Bajaj was raking in Rs 4,552 crore from overseas, a fivefold jump from 2005/06. Hero Honda's stymied by Honda, stood at 133,000 units last financial year, or under 2.5 per cent of sales.

EXHIBIT 2 "They (Honda) have a fully owned company, which has been around for a decade. As our joint venture was doing so well, they could not focus on it totally. We wanted to grow and they wanted to focus more on HMSI. So, after several rounds of talks in Delhi and Tokyo, we felt it would be best if we went separate ways," says Munjal.

The negotiations were long and hard. Only a core group of Hero executives were in the loop. The public domain only had stray leaks in the newspapers, which added an edge to the discussions in the joint family. "Let me just say that it made family meetings rather interesting, especially when my children, nephews and nieces asked questions based on what they had read. It was not easy keeping a straight face, because some of the reports were fairly accurate," says Munjal, no longer trying to keep his face straight.

Finally, in the full bloom of the Delhi winter on December 16 last year, during a rooftop banquet of The Taj Mahal Hotel on Mansingh Road, a sombre Munjal sent a shiver down the spines of unsuspecting stakeholders by announcing an end to the joint venture.

Intense speculation about the future of the company followed, although the stock markets largely ignored it. On the first day of trading, December 20, after the announcement was made (the announcement took place after market hours ahead of a long weekend), the Hero stock climbed 18 per cent. A prominent Indian industrialist, who has had several joint ventures of his own in the past, puts it in perspective: "Every joint venture has a half-life, some last longer than expected and some shorter, but a good joint venture is one where both partners can leave with their pride intact and having gained a lot. Could Hero have reached where it has without Honda? I think not. And I believe the experience will leave Honda a stronger player in the Indian market." Hero continues in the London spirit of ebullience. The announcement of the split has not doused demand for its motorcycles. From April to July this year, it sold nearly two million motorcycles, a 21.7 per cent rise over the same period last year, outpacing the two-wheeler market which grew 15.8 per cent. It is closing in on TVS Motor, the number two in scooters. It expects to cross six million units this financial year, a 15 per cent rise over the last. Munjal hopes exports will bring in 10 per cent of the total sales in 2015/16 a meagre figure but one which will look huge once you hear the total number Munjal hopes to sell that year: 10 million. The first big target in exports is Nigeria. "Wherever we have exported, we have seen decent sales. In Bangladesh, Nepal and Sri Lanka, we have stood our ground against cheap Chinese imports," says Munjal. The choice of Nigeria may have something to do with Bajaj's success in Africa, which gives the Pune-based company 45 per cent of its export volumes. "Africa's motorcycle market was at two million last year, of which a million were sold in Nigeria," says Dua. Adds Munjal: "It will take some time to build up our international operations, but we are beefing up our management in international sales."

Can Hero make it big abroad like Bajaj? A long-time associate of the company has a theory. "There are four factors: the quality of management, sales people on the ground, technology, and the brand. As far as the first two are concerned, Hero sets the standards. I do not believe technology is a problem. The big problem is the brand. The brand is very strong in India, but the vital question is if consumers in Africa and South America will be able to relate to it. But, it does help that the name is so easy on the tongue."

Back home, the company plans to invest Rs 4,500 crore over the next five years in two new factories in Southern and Western India and a global parts centre in Rajasthan. None of Hero's competitors is planning even half as much. Only its erstwhile partner, Honda, has elucidated its immediate expansion plans, which involve a third factory, to be set up in Karnataka, taking its installed capacity to four million a year - less than half of Munjal's 10 million. The new logo seeks to reflect Hero's legacy as well as its ambition. Munjal may need to dip into the first to realise the second.

STRENGTHS The fact that Hero was one of the first to introduce the four-stroke bikes that were known for their fuel thrift and low pollution emissions, the company has created a reliability factor for itself. HML has focused on the entry segment bikes (100-cc) which are fuel efficient, a priority for a middle-income country like India. The company has successfully targeted this segment with its hit models such as the CD-series and Splendor. Hero has also captured other segments with its mid-range bikes - Passion, Hunk, Splendor Plus, Ignitor - and high-range bikes - CBZ and Karizma.\ * Hero has created a brand recall value by its smart ad-campaigns and associations with events like cricket, hockey and the IPL * With its finance scheme - Saral Finance, it has wooed the rural population through ties with Cooperative and Grameen bank. * HML holds 47 per cent market share in the two-wheeler segment and 36 per cent market share of the total auto industry in India. Market share in the scooter segment has also risen from 2 per cent in FY06 to around 20 per cent in FY12

EXHIBIT 3

GROWTH DRIVERS Long-term growth prospects of Indian economy and favourable demographics, coupled with rising incomes are the major growth drivers for the company. With better roads connectivity in the rural areas and changing lifestyle, the demand for two-wheelers will witness a constant rise.

* The two-wheeler penetration in urban India is 20 per cent and in rural India just 10 per cent. There is still huge potential left in tapping the whole market. Thus, the entry level bikes are going to play a major role in HML's growth story * The interest rates are on the higher side and are expected to ease in the coming months if inflation comes down within the normal range. * The company plans to expand the installed capacity to 7 million from the existing 6.6 million capacity (3.4 million in FY07). Moreover, HML utilises near 90 per cent of its current capacity and hopes to sustain this * With its new licence agreement the company can now export its products overseas and has started venturing into Africa and Latin America. With rising preference for scooter in the urban areas, HML will benefit by targeting students and women for light non-geared scooters * To develop its R&D, Hero MotoCorp has started the process of building global centers. It has also formed a coalition with European firms to design engines and other parts. The company, with its experience from working with Honda, is working to launch its own products

CONCERNS The competition in the entry-level motorcycles from Indian companies such as Bajaj Auto and TVS has been intensifying over the years. HML will have to be more innovative in terms of design and mileage to attract customers. The company will also have to focus on the premium bikes since it does not offer many variants in this segment. Rising metal prices, particularly steel, copper, aluminium and nickel have resulted in the escalation of material costs. Cost of services and raw materials as a proportion of total expenditure increased from 81 per cent in FY11 to 87 per cent in FY12 and has adversely impacted Ebitda margins. Most of the parts are imported and with the falling rupee it is becoming increasingly costlier for the company. It will have to find a domestic

replacement

soon.

EXHIBIT 4 Many of the vendors are facing constraints for expansions given the high cost of debt which is expected to remain high in the coming months. The company is currently enjoying its tax-exemption agreement at the Haridwar plant which will end in FY13. This may further put pressure on margins and the effective tax rate on profit before tax could escalate from current range of 16-17 per cent to 23-25 per cent.

FINANCIALS HML has shown a healthy growth with revenues growing at an annualised rate of more than 15 per cent in the past five years and earnings at the rate of more than 20 per cent. Hero has been virtually a debt-free company for the past 11 years and net interest payment by the company has been negative in the past few years. Working capital has remained negative since FY99, signifying that it gets advance payments from dealers and enjoys credit from vendors. This not only frees up the cash and liquid assets for day-today working but also earns interest on those advances. Hero has an exceptional return of capital employed (RoCE) with 5 year average of 58 per cent.

VALUATIONS Hero MotoCorp is trading at 17.09 times its earnings which is slightly lower than its 5year median of 17.12. Also factoring the earnings growth of 23 per cent, the stock's PEG stands at 0.75 which makes it an attractive bluechip buy. It has also given a decent dividend yield of 2.13 per cent. With the interest reversal and finance cost coming down, the revenue will pick momentum realising the potential of the stocks.

Case study Questions 1) State the factors that led to the hero-honda joint venture split? Site the valid reasons for it. 2) How do you think the split has effected the companys market share? 3) Comment on the effect of split on its competitive companies.

Bibliography

The Hero Reborn. (2012, May). CFO Connect. Doval, P. (Dec.13 ,2010). Hero, Honda split terms finalised. TheTimes Of India.

Вам также может понравиться

- Russia Recorded A Trade Surplus of 17742 USD Million in January 2013Документ12 страницRussia Recorded A Trade Surplus of 17742 USD Million in January 2013Tamrika TyagiОценок пока нет

- Knight RidersДокумент13 страницKnight RidersTamrika TyagiОценок пока нет

- Doing Business in ThailandДокумент28 страницDoing Business in ThailandTamrika TyagiОценок пока нет

- ZaraДокумент12 страницZaraTamrika TyagiОценок пока нет

- Knowledge Management PDFДокумент23 страницыKnowledge Management PDFTamrika TyagiОценок пока нет

- Simplex MethodДокумент24 страницыSimplex MethodTamrika TyagiОценок пока нет

- Balance SheetДокумент2 страницыBalance SheetTamrika TyagiОценок пока нет

- Analysis of Capital Structure of Bharti AIRTEL and IDEA CellularДокумент4 страницыAnalysis of Capital Structure of Bharti AIRTEL and IDEA CellularTamrika Tyagi100% (1)

- Dispute Settlement Mechanisms in International TradeДокумент55 страницDispute Settlement Mechanisms in International TradeTamrika TyagiОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Blinker CatalogueДокумент21 страницаBlinker CatalogueCiclo CostaОценок пока нет

- Hero HondaДокумент50 страницHero HondaDinesh RamawatОценок пока нет

- PLC of ChetakДокумент10 страницPLC of Chetakera_429117565Оценок пока нет

- Sector Study ReportДокумент122 страницыSector Study ReporthappytiwariОценок пока нет

- Munjal Showa: A Seal of Quality, Commitment & CompetenceДокумент7 страницMunjal Showa: A Seal of Quality, Commitment & CompetenceGaurav ModiОценок пока нет

- Post Sales Service Hero Honda Project Report Mba MarketigДокумент82 страницыPost Sales Service Hero Honda Project Report Mba MarketigShivakumar PanshettyОценок пока нет

- TVS Company Final PPT at Bec DomsДокумент48 страницTVS Company Final PPT at Bec DomsBabasab Patil (Karrisatte)50% (4)

- 0peration Management PresentationДокумент51 страница0peration Management PresentationAlok YadavОценок пока нет

- Major Project - Stress Management HaribalajiДокумент89 страницMajor Project - Stress Management HaribalajiApparna BalajiОценок пока нет

- Platina SPCДокумент40 страницPlatina SPCstwen46699100% (5)

- Bajaj Discover 01Документ61 страницаBajaj Discover 01s sunil k kumarОценок пока нет

- Assignment On Analysis of Bajaj ScooterДокумент20 страницAssignment On Analysis of Bajaj ScooterSoumya SahuОценок пока нет

- Customer Preference of Hero Honda BikesДокумент11 страницCustomer Preference of Hero Honda BikesThirupathi Thiru100% (2)

- HTA 2 Wheeler .XLSX - SHEET 1Документ3 страницыHTA 2 Wheeler .XLSX - SHEET 1Ashok mohan gawaliОценок пока нет

- 2 Wheeler Industry - FINAL - R1Документ51 страница2 Wheeler Industry - FINAL - R1SYED FAYEZ AMEEDОценок пока нет

- 2 Wheeler SalesДокумент9 страниц2 Wheeler SalessdОценок пока нет

- PBL Honda RKДокумент55 страницPBL Honda RKgogetaОценок пока нет

- Ishan Jha - International Marketing ReportДокумент18 страницIshan Jha - International Marketing ReportISHAN JHA PGP 2020 BatchОценок пока нет

- BAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Документ88 страницBAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Chandani Thakur100% (1)

- ADL 03 - Accounting For Managers AssignmentsДокумент12 страницADL 03 - Accounting For Managers AssignmentsAishwarya Latha Gangadhar50% (4)

- Summer Training Project ReportДокумент143 страницыSummer Training Project ReportHarshit Srivastava100% (1)

- MINDA CORPORATION LIMITED (After Market Division)Документ3 страницыMINDA CORPORATION LIMITED (After Market Division)PravinОценок пока нет

- A Study On "Employee Job Satisfaction"Документ32 страницыA Study On "Employee Job Satisfaction"aurorashiva1Оценок пока нет

- Indian IndustryДокумент93 страницыIndian IndustryHitesh PantОценок пока нет

- Literature Survey of An Entrepreneur: Rahul BajajДокумент10 страницLiterature Survey of An Entrepreneur: Rahul BajajSuman ChaudharyОценок пока нет

- Samyak Agarwal (M-703) - Vaibhav Agarwal (M-704)Документ31 страницаSamyak Agarwal (M-703) - Vaibhav Agarwal (M-704)Vaibhav AgarwalОценок пока нет

- 2W Clutch Plate FinalДокумент4 страницы2W Clutch Plate FinalPALANIVELU GOVINDARAJUОценок пока нет

- Marketing Stratergy of Hero HondaДокумент103 страницыMarketing Stratergy of Hero HondaparulankitОценок пока нет

- QuestionnaireДокумент3 страницыQuestionnairehiteshp791Оценок пока нет

- Pulsar 135 Ls SPCДокумент72 страницыPulsar 135 Ls SPCMahesh RodgeОценок пока нет