Академический Документы

Профессиональный Документы

Культура Документы

ALM Coursework Feedback 2013

Загружено:

Stanislav LazarovАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ALM Coursework Feedback 2013

Загружено:

Stanislav LazarovАвторское право:

Доступные форматы

Students are required to examine the insurance crises that took place, across global markets, over the

last two decades. Students The are encouraged to incorporate case studies in their surveys.

latter should be critically approached and nicely blended with the discussions and/or reviews offered in academic papers and the financial press.

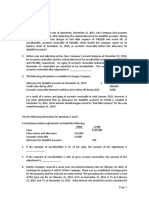

The coursework has been marked down given the help provided.As part of this pilot study, over the last 3-4 years, I didn't provide individual feedback but I think the following will act as a detailed guideline of what was expected from a thorough research paper. This kind of feedback was found to be very effective last year. Your feedback on this is always very much welcome! This year, the overall performance was good and I'm pleased with the work submitted. Your research has paid off and in certain cases some dividends. The topic had a strong vocational element and was purely research based. In general, I would expect a thorough and open-minded discussion of various insurance crises, such as: Medical Liability Insurance (2002) Lloyds Retrocession Spiral (late 80 early 90) Equitable Life (UK 2000) Drake Insurance (UK 2000) Independent insurance co. (UK 2001) Prudential (1997) Dai-Ichi (Japan 2007) Taisei (Japan 2001) Yamato Life (Japan 2008) Transit Casualty (US 1985) MBIA & AMBAC (US, 2008 - Bond insurers) American International Group (AIG US 2008) First executive life insurance corp. (US 1991) Pension benefit guaranty Corp. (PBGC, US 2003) Confederation Life Insurance Co. (Canada, 1994)

HIH (Australia 2001) Also relevant questions should embrace: What is the role of the insurance industry in our markets (as an introduction)? Do insurers have a systemic risk factor? (following the introduction) What is the impact of an insurance crisis in the economy? (does it vary according to the nature of the crisis?) Could insurer be affected by non-financial factors (think of catastrophes manmade and natural)? Natural catastrophes could be included depending on the scale

The following may provide a good source of information: Abraham, K.S. (1988) The Causes of the Insurance Crisis. Proceedings of the Academy of Political Science 37: 54-66. Berger, L.A., D. Cummins and S. Tennyson (1992) Reinsurance and the liability insurance crisis. Journal of Risk and Uncertainty 5, 253-274. Clarke, R., Warren-Boulton, F., Smith, D.D., Simon, M. (1988) Sources of the Crisis in Liability Insurance: An Empirical Analysis. Yale Journal on Regulation 5: 367-95. Coupulos, M. (1986) The American consumer pays dearly for the liability insurance crisis. Heritage Foundation Grace, F., R.W. Klein and R.D. Phillips (2003) Insurance company failures: Why do they cost so much? Financial Institutions Centre, Wharton, Uni. Penn. Griffiths, K. (2001) Independent insurance liabilities could reach 1bn. Independent (August). Plantin, G. and J.C. Rochet (2007) When insurers go bust. Princeton Uni. Press The

Lacey, N.J. (1988) Recent Evidence on the Liability Crisis. Journal of Risk and Insurance 55: 499508. Lai, G. and R.C. Witt (1992) Changed Insurer Expectations: An InsuranceEconomics View of the Commercial Liability Insurance Crisis. Journal of Insurance Regulation 10: 342-383. Lee, W. (2001) Korean experiences in life insurance sector reforms after the financial crisis. The Geneva Papers on Risk and Insurance (issues & practice) 26: 480-489. http://www.sonposoken.or.jp/content/view/full/586 IV) CASES OF NON-LIFE INSURANCE COMPANIES' FAILURES http://www.adf.com.au/archive.php?doc_id=5 The Insurance Crisis in Australia: Assessment and Proposals for Reform With Special Reference to Medical Indemnity http://www.deakin.edu.au/buslaw/aef/workingpapers/papers/2005_20.pdf The public liability crisis in 2000 (Australia) https://www.genevaassociation.org/media/623342/ga_15th_eale_seminar_la hnstein.pdf Liability and insurance crisis paper http://aria.org/rts/proceedings/1997/crisis.pdf ARIA paper on the US commercial liability insurance crisis http://www.cfeps.org/health/chapters/html/ch1.htm Health care crisis in the US HIH Royal Commission A corporate collapse and its lessons (April 2003)

Вам также может понравиться

- Competition, Regulation, and the Public Interest in Nonlife InsuranceОт EverandCompetition, Regulation, and the Public Interest in Nonlife InsuranceОценок пока нет

- Determinants of Demand For Life Insurance: The Case of CanadaДокумент22 страницыDeterminants of Demand For Life Insurance: The Case of CanadaHtet Lynn HtunОценок пока нет

- Factors Affecting Demand of Life Insurance in Developing CountriesДокумент25 страницFactors Affecting Demand of Life Insurance in Developing CountriesalizaОценок пока нет

- 255 - Dobbin Frank - The Origins of Private Social Insurance - Public Policy and Fringe Benefits in America 1920-1950Документ36 страниц255 - Dobbin Frank - The Origins of Private Social Insurance - Public Policy and Fringe Benefits in America 1920-1950Luis F CastrillonОценок пока нет

- Japanese Equities: A Practical Guide to Investing in the NikkeiОт EverandJapanese Equities: A Practical Guide to Investing in the NikkeiОценок пока нет

- Longevity Risk Rare Event Premia and SecuritizationДокумент32 страницыLongevity Risk Rare Event Premia and SecuritizationDavid DorrОценок пока нет

- Article 1Документ39 страницArticle 1Bel Bahadur BoharaОценок пока нет

- The Impact of Reinsurance For Insurance CompaniesДокумент8 страницThe Impact of Reinsurance For Insurance CompaniesAnwar AdemОценок пока нет

- Tackling The Financial Crisis: Politics of International Regulatory Change. London: RoutledgeДокумент2 страницыTackling The Financial Crisis: Politics of International Regulatory Change. London: RoutledgeManeeshaManuОценок пока нет

- Learning From the Global Financial Crisis: Creatively, Reliably, and SustainablyОт EverandLearning From the Global Financial Crisis: Creatively, Reliably, and SustainablyОценок пока нет

- Micro-Insurance: The Next Revolution?: New York UniversityДокумент20 страницMicro-Insurance: The Next Revolution?: New York UniversityRene RoigОценок пока нет

- 12 Chapter2Документ20 страниц12 Chapter2hazzampatti58Оценок пока нет

- Demand Analysis For Life Insurance in India: Some Empirical ObservationsДокумент11 страницDemand Analysis For Life Insurance in India: Some Empirical ObservationsImam AshrafОценок пока нет

- Understanding Disaster Insurance: New Tools for a More Resilient FutureОт EverandUnderstanding Disaster Insurance: New Tools for a More Resilient FutureОценок пока нет

- 1 International Insurance Markets: Between Global Dynamics and Local Contingencies-AnДокумент24 страницы1 International Insurance Markets: Between Global Dynamics and Local Contingencies-Anoxa_zОценок пока нет

- A Firm FoundationДокумент100 страницA Firm FoundationAgustin Eliasta GintingОценок пока нет

- Oxford University Press The World Bank Economic ReviewДокумент39 страницOxford University Press The World Bank Economic ReviewSugan PragasamОценок пока нет

- Beck and Webb 2003Документ39 страницBeck and Webb 2003Andrei vartanoviciОценок пока нет

- Markets in Chaos: A History of Market Crises Around the WorldОт EverandMarkets in Chaos: A History of Market Crises Around the WorldОценок пока нет

- Determinants of Financial Performance of Insurance Companies of Usa and Uk During Global Financial Crisis 20072016Документ9 страницDeterminants of Financial Performance of Insurance Companies of Usa and Uk During Global Financial Crisis 20072016Anirudh H munjamaniОценок пока нет

- Consumption by FaustinoДокумент35 страницConsumption by FaustinoBonane AgnesОценок пока нет

- Why Should One Invest in A Life Insurance Product? An Empirical StudyДокумент10 страницWhy Should One Invest in A Life Insurance Product? An Empirical StudyAtaye Waris KhanОценок пока нет

- Life Insurance Development and Economic Growth: Evidence From Developing CountriesДокумент28 страницLife Insurance Development and Economic Growth: Evidence From Developing CountriesMwila luapulaОценок пока нет

- Akh Ter 2017Документ12 страницAkh Ter 2017fahmi ilyasОценок пока нет

- Insurance Work BookДокумент8 страницInsurance Work BookBasanta K SahuОценок пока нет

- Chapter-Ii Review of Literature and Research MethodologyДокумент30 страницChapter-Ii Review of Literature and Research MethodologyRidhima KatiyarОценок пока нет

- Social Security Works For Everyone!: Protecting and Expanding America’s Most Popular Social ProgramОт EverandSocial Security Works For Everyone!: Protecting and Expanding America’s Most Popular Social ProgramРейтинг: 2 из 5 звезд2/5 (1)

- Journal Pre-Proof: Journal of Financial EconomicsДокумент60 страницJournal Pre-Proof: Journal of Financial Economicskai.xuОценок пока нет

- CHANGES IN INSURANCE SECTOR (A Study On Public Awareness)Документ47 страницCHANGES IN INSURANCE SECTOR (A Study On Public Awareness)Ramaduta80% (5)

- Role of LIC in Insurance SectorДокумент67 страницRole of LIC in Insurance SectorJay Patel85% (20)

- SR 248Документ62 страницыSR 248rifkiboyzОценок пока нет

- Berkman (2011)Документ20 страницBerkman (2011)Attaullah ShahОценок пока нет

- 14 BibliographyДокумент18 страниц14 BibliographySAGARОценок пока нет

- Geneva Papers - 2011 - Systemic Risk and The Financial CrisisДокумент39 страницGeneva Papers - 2011 - Systemic Risk and The Financial CrisisDaniel Novaes SantosОценок пока нет

- APJABSSv4i2July Dec18 - 86 99Документ15 страницAPJABSSv4i2July Dec18 - 86 99Htet Lynn HtunОценок пока нет

- TECS Assignment 1 BriefДокумент4 страницыTECS Assignment 1 Brief3081245716Оценок пока нет

- Global Financial Crisis Are Implications of Ethical Dilemmas in PracticeДокумент28 страницGlobal Financial Crisis Are Implications of Ethical Dilemmas in Practiceqosy20Оценок пока нет

- Supplemental Background Material: Life and Health Insurance FundamentalsДокумент48 страницSupplemental Background Material: Life and Health Insurance FundamentalsCarolОценок пока нет

- Profitability of Momentum Strategies An Evaluation of Alternative Explanations 2001Документ23 страницыProfitability of Momentum Strategies An Evaluation of Alternative Explanations 2001profkaplanОценок пока нет

- Longevity Risk 2007-08 UpdateДокумент6 страницLongevity Risk 2007-08 UpdateDavid DorrОценок пока нет

- 0-Goddard, McKillop, Wilson, & Finance, 2008)Документ14 страниц0-Goddard, McKillop, Wilson, & Finance, 2008)Ibrahim KhatatbehОценок пока нет

- Catbonds Natural DiversificationДокумент13 страницCatbonds Natural DiversificationSusanaОценок пока нет

- NBER Macroeconomics Annual 2019: Volume 34От EverandNBER Macroeconomics Annual 2019: Volume 34Martin EichenbaumОценок пока нет

- Social Insurance SyllabusДокумент11 страницSocial Insurance SyllabusrbugblatterОценок пока нет

- Top 10 Insurance CompaniesДокумент8 страницTop 10 Insurance CompaniesShahid ZubairОценок пока нет

- Bcom 214 Industry ReportДокумент6 страницBcom 214 Industry Reportapi-531086193Оценок пока нет

- Global TrendsДокумент10 страницGlobal TrendsDivaxОценок пока нет

- L ReviewДокумент18 страницL ReviewMia SmithОценок пока нет

- 14 - Chapter 2 PDFДокумент31 страница14 - Chapter 2 PDFRamprakash GUPTAОценок пока нет

- The AIG Bailout: William K. Sjostrom, JRДокумент49 страницThe AIG Bailout: William K. Sjostrom, JRmetilla2010Оценок пока нет

- The Demand For Insurance in United StatesДокумент26 страницThe Demand For Insurance in United StatesOwen OuyangОценок пока нет

- Conglomerates On The Riseagain - 16052012Документ37 страницConglomerates On The Riseagain - 16052012ckyeakОценок пока нет

- Economic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesДокумент52 страницыEconomic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesAchmad McFauzanОценок пока нет

- Aging Issues in the United States and JapanОт EverandAging Issues in the United States and JapanSeiritsu OguraОценок пока нет

- Investing in Junk Bonds: Inside the High Yield Debt MarketОт EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketРейтинг: 3 из 5 звезд3/5 (1)

- 3.4 AssignmentДокумент5 страниц3.4 AssignmentGPA FOURОценок пока нет

- What Is Life InsuranceДокумент28 страницWhat Is Life Insurancekoon00721Оценок пока нет

- Duration and ConvexityДокумент21 страницаDuration and ConvexityStanislav LazarovОценок пока нет

- Insurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisДокумент91 страницаInsurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisStanislav LazarovОценок пока нет

- 2012 Ny Invest Sym p2Документ11 страниц2012 Ny Invest Sym p2Stanislav LazarovОценок пока нет

- May 2009 - AnswersДокумент7 страницMay 2009 - AnswersStanislav LazarovОценок пока нет

- Example of Good Practice in Management Report Writing For Inventory Course WorkДокумент10 страницExample of Good Practice in Management Report Writing For Inventory Course WorkStanislav LazarovОценок пока нет

- Max. Loan 310,375.00 Total Finance 160,000.00Документ3 страницыMax. Loan 310,375.00 Total Finance 160,000.00Stanislav LazarovОценок пока нет

- David Gillen Vita Jan05Документ17 страницDavid Gillen Vita Jan05spratiwiaОценок пока нет

- Baby Dolls Case SolutionДокумент2 страницыBaby Dolls Case Solutionadolfpoveda50% (4)

- Respondents Memorial - RДокумент37 страницRespondents Memorial - RNiteshMaheshwariОценок пока нет

- The Power62 System 4 Forex PDFДокумент37 страницThe Power62 System 4 Forex PDFBtrades Rise-up100% (1)

- Gross Domestic Product and GrowthДокумент26 страницGross Domestic Product and Growthbea mendeaОценок пока нет

- Corporate Banking Chapter 2 PDFДокумент38 страницCorporate Banking Chapter 2 PDFMuhammad shazibОценок пока нет

- VH7 IBZy JEQLl 4 NQXДокумент14 страницVH7 IBZy JEQLl 4 NQXmadhur chavanОценок пока нет

- How To Manage Your Small Business EffectivelyДокумент3 страницыHow To Manage Your Small Business EffectivelyMudFlap gaming100% (1)

- Macro-Finance 3. Equity Premium Puzzle: Dmitry KuvshinovДокумент52 страницыMacro-Finance 3. Equity Premium Puzzle: Dmitry KuvshinovMicheal GoОценок пока нет

- The Companies Ordinance 2017 Company Limited by Shares Articles of Association of Al-Abbas Seed PROCESSING Private Limited CompaniesДокумент7 страницThe Companies Ordinance 2017 Company Limited by Shares Articles of Association of Al-Abbas Seed PROCESSING Private Limited Companiesabbs khanОценок пока нет

- SYLLBS2023Документ6 страницSYLLBS2023AMBenedicto - MCCОценок пока нет

- Unit 10Документ4 страницыUnit 10krkaОценок пока нет

- IndusInd BankДокумент67 страницIndusInd BankCHITRANSH SINGHОценок пока нет

- Case 16 Group 56 FinalДокумент54 страницыCase 16 Group 56 FinalSayeedMdAzaharulIslamОценок пока нет

- Starbucks Corporation Analysis Executive SummaryДокумент32 страницыStarbucks Corporation Analysis Executive Summarylarry_forsberg100% (4)

- Chuidian V Sandiganbayan Rule 57Документ2 страницыChuidian V Sandiganbayan Rule 57KISSINGER REYESОценок пока нет

- BUS 5111 - Financial Management - Written Assignment Unit 7Документ4 страницыBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- Sunedison MemoДокумент67 страницSunedison MemoAnonymous 5Ukh0DZОценок пока нет

- Chapter - 13 - Managing Your Own Portfolio - GitmanДокумент31 страницаChapter - 13 - Managing Your Own Portfolio - GitmanJessica Charoline PangkeyОценок пока нет

- Human Resources Development SbiДокумент8 страницHuman Resources Development SbiShraddha KshirsagarОценок пока нет

- 7110 w12 Ms 22Документ7 страниц7110 w12 Ms 22mstudy123456Оценок пока нет

- Additonal CVP QuestionsДокумент2 страницыAdditonal CVP QuestionsDianne Madrid0% (1)

- The Role, History, and Direction of Management AccountingДокумент18 страницThe Role, History, and Direction of Management AccountingRavi DesaiОценок пока нет

- Sebi Sections ListДокумент3 страницыSebi Sections ListVipul DesaiОценок пока нет

- Sri Lalitha Nissima MahimaДокумент56 страницSri Lalitha Nissima MahimaPrathap Vimarsha100% (1)

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeДокумент9 страницGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeFrancis Kyle Cagalingan SubidoОценок пока нет

- Auditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsДокумент3 страницыAuditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsLawrence YusiОценок пока нет

- Export Advance Payment - Branch ProposalДокумент2 страницыExport Advance Payment - Branch ProposalKumar SwamyОценок пока нет

- Duplichecker Plagiarism ReportДокумент2 страницыDuplichecker Plagiarism ReportErika DeboraОценок пока нет

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFДокумент4 страницыBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)