Академический Документы

Профессиональный Документы

Культура Документы

Batteries: United States

Загружено:

Michael WarnerАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Batteries: United States

Загружено:

Michael WarnerАвторское право:

Доступные форматы

Freedonia Focus Reports

US Collection

Batteries:

United States

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

November 2013

CH

UR

Highlights

Industry Overview

Market Size and Trends | Product Segmentation | Market Segmentation | Technology

Trade

BR

O

Demand Forecasts

Market Environment | Product Forecasts | Market Forecasts

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition | Industry Leaders | Additional Companies Cited

www.freedoniafocus.com

Batteries: United States

ABOUT THIS REPORT

Scope & Method

This report forecasts US battery demand and shipments in US dollars at the

manufacturers level to 2017. Total demand is segmented by product in terms of:

primary alkaline

primary lithium

other primary batteries (eg, zinc-air)

secondary lead-acid

secondary rechargeable lithium

other secondary batteries such as nickel-metal hydride (Ni-MH), and

nickel-cadmium (Ni-Cad).

The terms battery and cell are used interchangeably, each denoting both single-cell

(AAA batteries, for example) and multi-cell (eg, nine-volt batteries) devices.

Total demand is also segmented by market as follows:

consumer

motor vehicles

portable devices

other markets such as industrial, government, motive power, and

backup power supplies.

To illustrate historical trends, total demand is provided in an annual series from 2002 to

2012; shipments and the various demand segments are reported at five-year intervals

for 2007 and 2012. Forecasts emanate from the identification and analysis of pertinent

statistical relationships and other historical trends/events as well as their expected

progression/impact over the forecast period. Changes in quantities between reported

years of a given total or segment are typically provided in terms of five-year compound

annual growth rates (CAGRs). For the sake of brevity, forecasts are generally stated in

smoothed CAGR-based descriptions to the forecast year, such as demand is projected

to rise 3.2% annually through 2017. The result of any particular year over that period,

however, may exhibit volatility and depart from a smoothed, long-term trend, as

historical data typically illustrate.

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

2013 by The Freedonia Group, Inc.

Batteries: United States

Sources

Batteries: United States is based on Batteries, a comprehensive industry study

published by The Freedonia Group in November 2013. Reported findings represent the

synthesis and analysis of data from various primary, secondary, macroeconomic, and

demographic sources including:

firms participating in the industry, and their suppliers and customers

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated August 2013

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

335911

335912

3691

3692

Storage Battery Manufacturing

Primary Battery Manufacturing

Storage Batteries

Primary Batteries, Dry and Wet

Copyright & Licensing

The full report is protected by copyright laws of the United States of America and

international treaties. The entire contents of the publication are copyrighted by The

Freedonia Group, Inc.

2013 by The Freedonia Group, Inc.

Batteries: United States

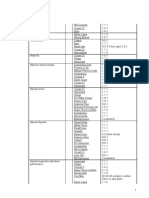

Table of Contents

Section

Page

Highlights .............................................................................................................................................................. 1

Industry Overview ................................................................................................................................................. 2

Market Size & Trends ...................................................................................................................................... 2

Chart 1 | United States: Battery Demand Trends, 2002-2012.................................................................... 2

Product Segmentation ..................................................................................................................................... 3

Chart 2 | United States: Battery Demand by Product, 2012 ....................................................................... 3

Primary Alkaline. ........................................................................................................................................ 3

Primary Lithium. ......................................................................................................................................... 4

Other Primary Batteries. ............................................................................................................................. 4

Secondary Lead-Acid. ................................................................................................................................ 5

Secondary Rechargeable Lithium. ............................................................................................................. 5

Other Secondary Batteries. ........................................................................................................................ 6

Market Segmentation....................................................................................................................................... 7

Chart 3 | United States: Battery Demand by Market, 2012 ........................................................................ 7

Motor Vehicles............................................................................................................................................ 7

Consumer. .................................................................................................................................................. 8

Portable Devices. ....................................................................................................................................... 8

Other Markets............................................................................................................................................. 9

Technology .................................................................................................................................................... 10

Trade ............................................................................................................................................................. 11

Chart 4 | United States: Battery Trade (million dollars) ............................................................................ 11

Demand Forecasts .............................................................................................................................................. 12

Market Environment ....................................................................................................................................... 12

Table 1 | United States: Key Indicators for Battery Demand (billion dollars)............................................ 12

Product Forecasts.......................................................................................................................................... 13

Table 2 | United States: Battery Demand by Product (million dollars) ..................................................... 13

Primary Alkaline. ...................................................................................................................................... 14

Primary Lithium. ....................................................................................................................................... 14

Other Primary Batteries. ........................................................................................................................... 15

Secondary Lead-Acid. .............................................................................................................................. 15

Secondary Rechargeable Lithium. ........................................................................................................... 15

Other Secondary Batteries. ...................................................................................................................... 15

Market Forecasts ........................................................................................................................................... 17

Table 3 | United States: Battery Demand by Market (million dollars) ....................................................... 17

Motor Vehicles.......................................................................................................................................... 17

Consumer. ................................................................................................................................................ 17

Portable Devices. ..................................................................................................................................... 18

Other Markets........................................................................................................................................... 18

Industry Structure ................................................................................................................................................ 20

Industry Composition ..................................................................................................................................... 20

Industry Leaders ............................................................................................................................................ 21

Johnson Controls Incorporated ................................................................................................................ 21

Exide Technologies .................................................................................................................................. 22

Energizer Holdings Incorporated .............................................................................................................. 23

Additional Companies Cited .......................................................................................................................... 24

Resources ........................................................................................................................................................... 25

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

2013 by The Freedonia Group, Inc.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Working at Heights GuidelineДокумент15 страницWorking at Heights Guidelinechanks498Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- VAM Must Sumitomo 1209 PDFДокумент4 страницыVAM Must Sumitomo 1209 PDFnwohapeterОценок пока нет

- Scuba Diving - Technical Terms MK IДокумент107 страницScuba Diving - Technical Terms MK IJoachim MikkelsenОценок пока нет

- Guide To Greyhawk PDFДокумент108 страницGuide To Greyhawk PDFAnonymous PtMxUHm9RoОценок пока нет

- Business Model Navigator Whitepaper - 2019Документ9 страницBusiness Model Navigator Whitepaper - 2019Zaw Ye HtikeОценок пока нет

- Salt: United StatesДокумент4 страницыSalt: United StatesMichael WarnerОценок пока нет

- Motor Vehicle Biofuels: United StatesДокумент4 страницыMotor Vehicle Biofuels: United StatesMichael WarnerОценок пока нет

- Polyurethane: United StatesДокумент4 страницыPolyurethane: United StatesMichael WarnerОценок пока нет

- Specialty Biocides: United StatesДокумент4 страницыSpecialty Biocides: United StatesMichael WarnerОценок пока нет

- World SaltДокумент4 страницыWorld SaltMichael WarnerОценок пока нет

- World Motor Vehicle BiofuelsДокумент4 страницыWorld Motor Vehicle BiofuelsMichael WarnerОценок пока нет

- World Medical DisposablesДокумент4 страницыWorld Medical DisposablesMichael WarnerОценок пока нет

- Education: United StatesДокумент4 страницыEducation: United StatesMichael WarnerОценок пока нет

- World LabelsДокумент4 страницыWorld LabelsMichael WarnerОценок пока нет

- World Lighting FixturesДокумент4 страницыWorld Lighting FixturesMichael WarnerОценок пока нет

- Labels: United StatesДокумент4 страницыLabels: United StatesMichael WarnerОценок пока нет

- Jewelry, Watches, & Clocks: United StatesДокумент4 страницыJewelry, Watches, & Clocks: United StatesMichael WarnerОценок пока нет

- World Material Handling ProductsДокумент4 страницыWorld Material Handling ProductsMichael WarnerОценок пока нет

- Graphite: United StatesДокумент4 страницыGraphite: United StatesMichael WarnerОценок пока нет

- World GraphiteДокумент4 страницыWorld GraphiteMichael WarnerОценок пока нет

- Public Transport: United StatesДокумент4 страницыPublic Transport: United StatesMichael WarnerОценок пока нет

- World BearingsДокумент4 страницыWorld BearingsMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- Aluminum Pipe: United StatesДокумент4 страницыAluminum Pipe: United StatesMichael WarnerОценок пока нет

- Ceilings: United StatesДокумент4 страницыCeilings: United StatesMichael WarnerОценок пока нет

- Caps & Closures: United StatesДокумент4 страницыCaps & Closures: United StatesMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- Plastic Pipe: United StatesДокумент4 страницыPlastic Pipe: United StatesMichael WarnerОценок пока нет

- World Specialty SilicasДокумент4 страницыWorld Specialty SilicasMichael WarnerОценок пока нет

- Pharmaceutical Packaging: United StatesДокумент4 страницыPharmaceutical Packaging: United StatesMichael WarnerОценок пока нет

- Municipal Solid Waste: United StatesДокумент4 страницыMunicipal Solid Waste: United StatesMichael WarnerОценок пока нет

- Motor Vehicles: United StatesДокумент4 страницыMotor Vehicles: United StatesMichael WarnerОценок пока нет

- Housing: United StatesДокумент4 страницыHousing: United StatesMichael WarnerОценок пока нет

- World HousingДокумент4 страницыWorld HousingMichael WarnerОценок пока нет

- World Drywall & Building PlasterДокумент4 страницыWorld Drywall & Building PlasterMichael WarnerОценок пока нет

- Mechanical Advantage HomeworkДокумент8 страницMechanical Advantage Homeworkafeurbmvo100% (1)

- EASA - Design OrganisationsДокумент30 страницEASA - Design Organisationsyingqi.yangОценок пока нет

- Latihan Soal BlankДокумент8 страницLatihan Soal BlankDanbooОценок пока нет

- Faujifood Pakistan PortfolioДокумент21 страницаFaujifood Pakistan PortfolioPradeep AbeynayakeОценок пока нет

- Earth Bonding LeadsДокумент2 страницыEarth Bonding LeadsrocketvtОценок пока нет

- Assignment 7 - Cocktail RecipiesДокумент20 страницAssignment 7 - Cocktail RecipiesDebjyoti BanerjeeОценок пока нет

- Fatigue Consideration in DesignДокумент3 страницыFatigue Consideration in DesigngouthamОценок пока нет

- Mobile Communication Networks: Exercices 4Документ2 страницыMobile Communication Networks: Exercices 4Shirley RodriguesОценок пока нет

- 1 Name of Work:-Improvement of Epum Road (Northern Side) Connecting With Imphal-Saikul Road I/c Pucca DrainДокумент1 страница1 Name of Work:-Improvement of Epum Road (Northern Side) Connecting With Imphal-Saikul Road I/c Pucca DrainHemam PrasantaОценок пока нет

- Microscope MaintenanceДокумент2 страницыMicroscope MaintenanceCharlyn KeithОценок пока нет

- Offsetting Macro-Shrinkage in Ductile IronДокумент13 страницOffsetting Macro-Shrinkage in Ductile IronmetkarthikОценок пока нет

- Afectiuni Si SimptomeДокумент22 страницыAfectiuni Si SimptomeIOANA_ROX_DRОценок пока нет

- En LF Drivers 10nw76 8Документ3 страницыEn LF Drivers 10nw76 8ChrisОценок пока нет

- Sermo 13 de Tempore (2 Feb in Praes)Документ1 страницаSermo 13 de Tempore (2 Feb in Praes)GeorgesEdouardОценок пока нет

- IFIS - Intraoperative Floppy Iris Syndrome Wa Wa 27-09-2008Документ18 страницIFIS - Intraoperative Floppy Iris Syndrome Wa Wa 27-09-2008JanuszОценок пока нет

- The World S Finest Ideas in Cooling!: A Division ofДокумент4 страницыThe World S Finest Ideas in Cooling!: A Division ofChiragОценок пока нет

- Leta-Leta CaveДокумент5 страницLeta-Leta CaveToniОценок пока нет

- Food Poisoning: VocabularyДокумент9 страницFood Poisoning: VocabularyHANG WEI MENG MoeОценок пока нет

- Coastal Management NotesДокумент2 страницыCoastal Management Notesapi-330338837Оценок пока нет

- RE2S PE LPG CNG SPC Part 1Документ32 страницыRE2S PE LPG CNG SPC Part 1Inversiones RinocellОценок пока нет

- Nano ScienceДокумент2 страницыNano ScienceNipun SabharwalОценок пока нет

- Varactor AssignmentДокумент9 страницVaractor Assignmentjawad_h89Оценок пока нет

- 2UEB000487 v1 Drive On GeneratorДокумент19 страниц2UEB000487 v1 Drive On GeneratorSherifОценок пока нет

- HBT vs. PHEMT vs. MESFET: What's Best and Why: Dimitris PavlidisДокумент4 страницыHBT vs. PHEMT vs. MESFET: What's Best and Why: Dimitris Pavlidissagacious.ali2219Оценок пока нет

- Art and Geography: Patterns in The HimalayaДокумент30 страницArt and Geography: Patterns in The HimalayaBen WilliamsОценок пока нет