Академический Документы

Профессиональный Документы

Культура Документы

Letter On Worthington Claims Final PDF

Загружено:

SuttonFakesИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Letter On Worthington Claims Final PDF

Загружено:

SuttonFakesАвторское право:

Доступные форматы

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

Aidan Earley; and Worthington Group PLC

Tel: Fax: Email: Web:

+44 (0) 20 8949 5116 +44 (0) 20 8949 5016 info@merchantlegal.com www.merchantlegal.com

22 March 2013 Confidential and Privileged Dear Sirs You have asked us to provide our preliminary views on a number of potential claims, assets and rights which are currently owned by Aidan Earley, Craig Whyte, Sevco 5088 Limited (Sevco 5088) and certain other companies some of which are planned to be assigned to Law Finance Limited and certain of its subsidiaries. These claims, assets and rights are as follows: 1. Certain media rights and the memorabilia and trophies of Glasgow Rangers together with a number of intellectual properties relating to the Glasgow Rangers brand. These rights and assets were acquired by RFC Group Ltd from RFC 2012 Plc prior to that company entering into administration in February of 2012 (the IP Claims). 2. Claims (the Asset Claims) by Sevco 5088 to all of the business and assets of RFC 2012 Plc (RFC 2012) which were either purchased by Sevco 5088 from RFC 2012 in June of 2012 and then transferred to Sevco Scotland Ltd (Sevco Scotland) or purchased by Sevco Scotland directly from RFC 2012. Sevco Scotland was incorporated on 29 May 2012 with the initial sole shareholder and director being Charles Green. It is the position of Sevco 5088 that it is the rightful owner of these assets (the Club Assets). 3. Rights to a debt of 30m and associated rights under a first fixed and floating charges over the business and assets of RFC 2012 Plc (the Security Rights). 4. The book, film and television rights relating to the two takeovers of the Rangers Football Club in May of 2011 and June of 2012 in so far as they relate to Craig Whyte and associates (Story Rights). 5. Claims which Craig Whyte has Duff and Phelps (the former administrators of RFC 2012 Plc) (Duff and Phelps Claims) 6. An economic interest in an assortment of legal claims which Craig Whyte and others intend to assert against, inter alios, Duff and Phelps (the former administrators of RFC 2012 Plc), the Scottish Daily Record and Mirror Group Newspapers and Charles Green and Imran Ahmad (the Miscellaneous Claims).

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

Note that the purpose of this letter is to give our views as to whether certain causes of action lie against a number of potential defendants. This letter has primarily been prepared by us for Aidan Earley as our client in this matter and for Worthington Group Plc. We therefore accept no liability whatsoever to any other person who may choose to rely on it (whether such liability arises from negligence or otherwise). Please note that it is not intended to waive legal privilege in this document or its contents. This document is confidential and Worthington Group PLC must not share it with any person other than its legal or financial advisers and only then with the permission of Aidan Earley. We and Counsel (John Jarvis QC and James Evans) have had the opportunity to review electronic copies of documentary and audio evidence in support of certain of the claims. That review (including some 330 pages of documents) has strengthened the views of both Counsel and ourselves as to the existence of a prima facie case in relation to the Asset Claims and to the Miscellaneous Claims against Ahmad and Green. We have not been provided with any evidence in relation to the remaining claims or title to assets or rights and accordingly, in respect thereof, we have assumed that evidence and documents of title are available to support such claims and title. For the purposes of this note we have assumed (except where expressly stated otherwise) that English law is the applicable law, but please see the comments, below, with regard to applicable law and questions of jurisdiction. With regards to the above claims and rights we would comment as follows: 1. The IP Claims

Due to the nature of these claims and the location of the assets in question it is likely that at least some of them are subject to Scots Law and jurisdiction. Assuming that the relevant acquisition contract has been completed and that it is not void or voidable (as a result, for instance, as a result of it being ultra vires) or subject to a right of rescission (as a result, for instance, of an actionable pre-contractual misrepresentation), then the plaintiffs would be able to obtain a declaration from the Court confirming that ownership of these assets is theirs and for their return or alternatively seek an order for damages for conversion in certain circumstances. Conversion is an act of deliberately dealing with a chattel in a manner inconsistent with another person's right whereby that person is deprived of the use and possession of that chattel. In order for a defendant to be liable for the tort of conversion in English law (codified in England as Wrongful Interference With Goods by section 2(2) of the Torts (Interference with Goods) Act 1977 Act) the defendant need not intend to question or deny the plaintiff's rights. It is enough that the conduct is inconsistent with those rights. Where the media or other rights have been illegally exploited for monetary gain then an alternative to seeking damages is to ask the court to require the defendants to account to

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

the plaintiff for any profits made from the exploitation. Alternatively or additionally an injunction might be sought restraining future breaches. 2. The Assets Claims

We understand that Charles Green was a director of Sevco 5088 at all relevant times as well as being a director of Sevco Scotland at the relevant time. This latter fact is important as Greens knowledge would be imputed to Sevco Scotland as a result. We have seen a copy of the signed agreement (dated 12 May 2012) (the CVA Agreement) between Sevco 5088 and RFC 2012 and its administrators pursuant to which it was agreed that Sevco 5088 and RFC 2012 would enter into an agreed form SPA to acquire the Club Assets if the proposed CVA failed. Pursuant to that SPA Sevco 5088 had the right and obligation to purchase the Club Assets. Similarly, RFC 2012 had the right and obligation to sell those assets to Sevco 5088. We have also seen transcripts of texts and copies of emails which support (a) the allegation that Green and Ahmad were effectively acting in accordance with the instructions of Craig Whyte and Aidan Earley and (b) the assertion that it was agreed between the four of them that the acquisition was to be carried out in the name of Sevco 5088. The CVA subsequently failed to receive approval and the purchase of the Club Assets went ahead. There seems to be some doubt as to whether the purchase was completed by Sevco 5088 or by Sevco Scotland. There is some hearsay evidence (press reports of statements made by the Club) that the acquisition was completed by Sevco 5088 and that a transfer of the Club Assets was subsequently made to Sevco Scotland. However, the prospectus issued by Sevco Scotlands holding company, Rangers International Football Club PLC, states that the Club Assets were acquired by Sevco Scotland directly from RFC 2012. It also states that Sevco Scotland raised 7,719,000 by the issue of 25,340,000 shares in the period to 31 August 2012. Sevco Scotlands filings with Companies House on the other hand show share issues took place between 29 May 2012 and 17 August 2012 involving the issue of some 29,340,000 shares at an aggregate subscription amount of 9,545,975. The prospectus also states that Imran Ahmad made a loan of 200,000 to Sevco 5088 on 11 May 2012, which is consistent with Aidan Earleys contention that Sevco 5088 made the initial payment to RFC 2012 required pursuant to the CVA Agreement. The prospectus does not deal with the circumstances in which Sevco Scotland came to be a party to the acquisition of these assets. The CVA proposal produced by Duff and Phelps, the administrators, and dated 29 May 2012 (the CVA Proposal) refers to the CVA Agreement and to Sevco 5088 as being a party to it. It also makes no mention of any breach of that agreement by Sevco 5088 which would seem to indicate that Sevco 5088 had by that date complied with their obligation to pay at least 2.3m into the administrators lawyers client account. In fact we have heard a recording of a conversation which took place on 31 May 2012 between

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

Craig Whyte and David Grier of Duff and Phelps which appears to confirm that a payment of 2.2m had been already been made the implication being that it was by Sevco 5088. It would appear therefore that: (a) at some point between 29 May 2012 and 14 June 2012, when the acquisition of the Club Assets is reported to have been completed, the CVA Agreement was terminated and an agreement for the acquisition of the Club Assets entered into between Sevco Scotland and RFC 2012; or (b) at some point between 29 May 2012 and 14 June 2012 the benefit of the CVA Agreement was transferred (or novated) to Sevco Scotland; or (c) the acquisition of the Club Assets was completed by Sevco 5088 on June 14 2012 pursuant to the CVA Agreement and those assets were subsequently transferred to Sevco Scotland We have been given no indication as to the existence of any reason for the termination of the CVA Agreement and no announcement appears to have been made by the Administrators or RFC 2012 in that regard. If the agreement was not terminated by RFC 2012 for breach, any termination must have been done voluntarily at the request of Sevco 5088. Such a termination by Sevco 5088 would in our view have been a disposal of a valuable asset (the right to purchase the Club Assets) and should only have been done (i) because Sevco 5088 was not in a position to complete the acquisition or (ii) for appropriate consideration. We have seen evidence (a draft placing letter) that as late as 30 May 2012 the fundraising for the transaction was been carried out by Sevco 5088. Additionally it would appear that Sevco 5088 had already by that date made a payment of some 2.2m. Neither Ahmad or Green in their dealings with Aidan Earley or Craig Whyte prior to completion of the acquisition make any mention of any difficulty with the fund raising or of the CVA Agreement being terminated(whether for breach or otherwise), which it is assumed they would have if there had been an innocent explanation for the turn of events. Furthermore, it seems unlikely that inability to raise funds was the issue. It is difficult to envisage a legitimate explanation as to why Sevco Scotland (as far as third parties were concerned was controlled and owned by Green) should have been able to complete the required fund raising whereas Sevco 5088, ostensibly controlled and owned by Green, was not able to do so. Furthermore, when after the transaction had completed, Green was asked by Aidan Earley about the involvement of Sevco Scotland in the transaction Green initially indicated that that company was a subsidiary of Sevco 5088 and that its involvement was to enable the Club Assets to be held by a Scottish registered company. It is clear that Sevco Scotland was not a subsidiary of Sevco 5088 (unless the shares in the former company were being held on trust for the latter) so that

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

statement is inaccurate. If there were an accurate and innocent explanation (such as inability to raise funds through Sevco 5088) behind the involvement of Sevco Scotland it would seem surprising that such an explanation was not volunteered by Green at that point. If there was a novation or transfer of the benefit of the CVA Agreement, then similar considerations would apply. Why did that happen? Alternatively, if the Club Assets were transferred from Sevco 5088 to Sevco Scotland post acquisition, then what was consideration for the transfer? Where is it? If it were left outstanding as a debt then why has Green applied to the Registrar of Companies to have the holder of such a valuable asset struck off? In all three scenarios the absence of consideration (together with the absence of circumstances justifying termination by RFC 2012 or voluntarily by Sevco 5088) would make the transaction void or avoidable (on the application of an administrator or liquidator) either as an illegal reduction of capital (or unlawful dividend) or as a transfer at an undervalue. The absence of proper consideration and a proper motive for the switch to Sevco Scotland would also indicate that Green was in breach of his fiduciary duties to Sevco 5088, a fact of which Sevco Scotland would have been aware. Moreover Green was not at the relevant time the sole registered shareholder of Sevco 5088 and therefore in a position to bless the transaction (and thereby waive any breach of fiduciary duty to shareholders as director in that capacity). Companies associated with Craig Whyte and Aidan Earley had become shareholders Sevco 5088 on 9th and 10th of May 2012 according to extracts from the companys books that we have been provided with. Even if he had been in a position to bless the arrangements that would not avoid the unlawful reduction of capital/unlawful dividend point or the transaction at an undervalue point. The transaction (either disposition of the assets or the benefit of the CVA Agreement) would also appear to have been carried out in breach of s190 of the Companies Act 2006 which requires shareholder approval for a transaction of that value with a company connected with a director. That means the transaction is voidable on the application of Sevco 5088 unless the rights of a bona fide purchaser without notice would be affected. Clearly Sevco Scotland is not a bona fide purchaser without value. It would appear, therefore, that the disposal of the Club Assets or the benefit of the CVA Agreement (as the case may be) was made illegally and that Sevco Scotland (through its directors) had sufficient knowledge of the illegality to make it a constructive trustee of the relevant assets. Sevco 5088 should in those circumstances be able to obtain a declaration from the Court that it is the rightful owner of the Club Assets in addition to orders for damages for losses caused to Sevco 5088 and/or damages for the tort of conversion. Alternatively, an administrator or liquidator of Sevco 5088 could make an application to the court for the return of the Club Assets or an application could be made pursuant to s190 of the Companies Act for their return. Despite the fact that the Assets consist of real property and chattels situated in Scotland, senior counsel (John Jarvis QC) is of the preliminary opinion that an action could be

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

commenced by Sevco 5088 in the English courts although ultimately proceedings might be required in Scotland to enforce the judgment of the English courts. It is important to note that Green has never provided a proper and accurate explanation of the transaction between Sevco 5088 and Sevco Scotland. He should be asked to provide that explanation and provide a copy of the relevant agreements, which belong to Sevco 5088. Indeed we cannot conceive of any innocent explanation which would address all of the points raised by us. We recommend that one of the first actions following the announcement of the transaction with Worthington is to approach the lawyers acting for Sevco 5088, at the relevant time, Field Fisher Waterhouse and ask them to provide an explanation of the circumstances surrounding the transaction and to supply copies of their files. This would have to be done as part of the process of obtaining litigation funding. In an ideal world that approach would be made at this stage, however it seems unlikely that they would comply with such a request without first discussing the issues with Green which would concede the initiative to Green enabling him to take preemptive steps which would undermine the proposed strategy. . It should be noted that if Green did as it would appear act in breach of his fiduciary duties to Sevco 5088, he would be susceptible to a claim for damages by that company. Green would also appear to have entered into a contract with Craig Whyte to establish and run Sevco 5088 and ensure that it acquired the Club Assets and thereafter to transfer control of Sevco 5088 to him. Similarly, Imran Ahmad entered into a contract with Craig Whyte to raise funds for the acquisition by Sevco 5088. It is clear that there is a prima facie case that both Green and Ahmad are in breach of contract and have committed the torts of conspiracy and deceit and potentially dishonest assistance and, in Scotland, delict. There is possibly also an action against one or both of them for breach of trust. Mr Whyte can recover damages for breach of contract on the basis of putting him into the position that he would have been in if that contract had been performed in accordance with its terms. The measure of damages would likely be the value of the shares in Sevco 5088 that Mr Whyte would have held, such shares to be valued on the basis that the company holds the Club Assets. As for the torts, Mr Whyte would be able to recover damages calculated on the basis of putting him into the position he would have been in if the torts had not been committed. Again, it would appear that the measure of damages is likely to be the value of the shares in Sevco 5088 calculated as aforesaid. In the absence of being able to show express or implied agreement as to the proper law governing the contractual relationships, the question would fall to be determined under the Rome Regulations as would the law applicable to the torts see below. Jurisdiction would fall to be determined in accordance with the Civil Jurisdiction and Judgments Act 1982.

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

Mr Earley would also appear have an action for breach of contract against Ahmad and Green in relation to the breach of their agreement with him to give him an equal share of the benefit they obtained from the transaction in question. Note that junior counsel (James Evans) had some concerns that the nature of the agreement between Craig Whyte and Ahmad and Green (which was to withhold from the administrators the identity of the principal behind the transaction) may cause some issues with regards to pleading the cases on behalf of Craig Whyte and Aidan Earley (as opposed to the Sevco 5088 claims), but senior counsel did not share the same concerns, or at least not to the same degree and felt that they should not prove an obstacle to pursuing the claims successfully. We are also of this view. 3. The Security Rights The enforcement of the Security Rights should be straightforward if it can be shown that the security was validly granted and that the security and associated debt were validly assigned and in the case of the debt still outstanding. On the assumption that the security documents are expressed to be subject to Scots law, the Scottish Courts would be the appropriate venue for enforcing those rights. Indeed, if the subject matter of the security is situate in Scotland then notwithstanding an express choice of another law, it is likely that Scottish law would be found to be the applicable law (under the principle of lex situs). 4. The Story Rights

We do not consider that we need to comment on these rights. 5. The Duff and Phelps Claims

It would appear that Duff and Phelps were negligent in the advice they gave to Craig Whyte regarding the provisions of insolvency regime in Scotland. This negligence led to Mr Whyte suffering loss in not being able to control the timing of administration of RFC 2012 PLC. We require more information about issues of causation and the loss suffered by Mr Whyte as a result of this negligent advice. 6. The Miscellaneous Claims

We do not currently have sufficient information in relation to these claims (other than the claims against Ahmad and Green as to which see comments in paragraph 2, above) to offer any meaningful comment on them. Jurisdiction and Applicable Law. The Rome I Regulations govern the question of applicable law in relation to a contract containing no choice of law. The basic rule in the Rome Convention, namely that, in the absence of choice by the parties, the applicable law is the law of the place where the party performing the service characterising the contract has his habitual residence, is preserved in Rome I. However, Rome I seeks to enhance certainty as to the applicable law by converting mere presumptions into fixed rules and abolishing the exception

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

clause. Moreover, Rome I introduces some substantive changes, such as Article 9.3, which allows the courts of the forum to give effect to the "overriding mandatory" rules of the law of another country "where the obligations have to be or have been performed", even where the applicable law has been expressly chosen by the parties. We understand that Charles Green and Imran Ahmad were at all relevant times habitually resident in England. It would be likely therefore that the contracts between them and Craig Whyte and them and Aidan Earley would be governed by English law in the absence of any agreement by the parties to the contrary. Under the Rome II Regulation, the applicable law for the resolution of non-contractual disputes is determined on the basis of where the damage occurs, or is likely to occur, regardless of the country or countries in which the act giving rise to the damage occurs. This is subject to certain exceptions where that would be inappropriate if the situation only has a tenuous connection with the country where the damage has occurred. We need to give more consideration to the application of these provisions to the various non-contractual claims referred to in this note. The Brussels Regulation does not deal with jurisdiction as between the constituent parts of the UK (England, Scotland and Northern Ireland). This is governed by Schedule 4 to the Civil Jurisdiction and Judgments Act 1982. A new Schedule 4 was introduced by the Civil Jurisdiction and Judgments Order 2001 following the Brussels Regulation coming into force. The Order is modelled on the Brussels Regulation but it is not identical to it. The principal differences between the Brussels Regulation and Schedule 4 to CJJA 1982 are as follows: Schedule 4 allocates jurisdiction in contract cases to the courts of the place of performance of the obligation (as well as to the courts of the defendant's domicile). Under rule 4 of Schedule 4 to CJJA 1982, jurisdiction in relation to proceedings which have, as their object, a decision of an organ of a company or other legal person is not exclusive (unlike Article 22(2) of the Brussels Regulation). Under rule 4, such proceedings may (rather than must) be brought in the courts of the part of the UK in which the company, legal person or association has its seat. Under rule 11 of Schedule 4 to CJJA 1982 does not reproduce Article 22(4) of the Brussels Regulation, which deals with certain proceedings relating to intellectual property rights. Proceedings concerned with the registration of or validity of patents, trade marks or designs or other similar rights are excluded from the scope of Schedule 4 altogether (section 17 and Schedule 5, para 2, CJJA). Since all the United Kingdom registers concerned with patents, trade marks and designs are located in England, the practical effect of Article 22(4) of the Brussels Regulation is to allocate exclusive jurisdiction to the English courts.

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Merchant Legal LLP 8-10 Coombe Road New Malden Surrey, KT3 4QE

Our preliminary view (a view shared by counsel) is that Schedule 4 may enable many of the actions addressed in this note to be brought in the English Courts as opposed to those of Scotland. Yours Sincerely

Richard Beresford Consultant Merchant Legal LLP

Merchant Legal LLP is a limited liability partnership registered in England and Wales at 8-10 Coombe Road, New Malden, Surrey, KT3 4QE (no. OC322062) Authorised & Regulated by the Solicitors Regulation Authority (no. 446346) The members are A. ODoherty and S. Soni Consultants: J. H. Wright, R.A.D. Beresford and J. Macdonald

Вам также может понравиться

- Attorneys For C-III Asset Management LLC: LEGAL20390473.3Документ20 страницAttorneys For C-III Asset Management LLC: LEGAL20390473.3Chapter 11 DocketsОценок пока нет

- Beware Fake Yahoo Email Prize ScamДокумент3 страницыBeware Fake Yahoo Email Prize ScamalpeshОценок пока нет

- Spinoff ChecklistДокумент2 страницыSpinoff Checklistdhunter10Оценок пока нет

- Executive CompensationДокумент21 страницаExecutive CompensationDenis UrsoОценок пока нет

- Titan Sports Inc v. Turner BroadcastingДокумент12 страницTitan Sports Inc v. Turner Broadcastingnicole hinanayОценок пока нет

- Proof of Funds October 2010 PDFДокумент2 страницыProof of Funds October 2010 PDFSuttonFakesОценок пока нет

- Rangers: New Company - The Same ClubДокумент15 страницRangers: New Company - The Same ClubRangersHistoryОценок пока нет

- Owners N Operators Guide ErjДокумент21 страницаOwners N Operators Guide Erjcjtrybiec75% (4)

- Rangers FC Memorandum and Articles of AssociationДокумент32 страницыRangers FC Memorandum and Articles of AssociationHirsutePursuitОценок пока нет

- In-House Bank & Payment Factory:: Challenges & OpportunitiesДокумент43 страницыIn-House Bank & Payment Factory:: Challenges & OpportunitiesmonaОценок пока нет

- PIBM Assignment on Marico's Parachute Coconut Oil BrandДокумент10 страницPIBM Assignment on Marico's Parachute Coconut Oil BrandNikhil Gupta100% (1)

- Banco de Oro v. Japrl (Case Digest)Документ3 страницыBanco de Oro v. Japrl (Case Digest)Leslie Joy PantorgoОценок пока нет

- TAXATION QUESTIONS & ANSWERSДокумент49 страницTAXATION QUESTIONS & ANSWERSMarc ToresОценок пока нет

- HANSSON CASE Individual AssignmentДокумент2 страницыHANSSON CASE Individual AssignmentWawerudasОценок пока нет

- Corporate Law ProjectДокумент15 страницCorporate Law Projectbhargavi mishraОценок пока нет

- SFL Constitution RulesДокумент88 страницSFL Constitution RulesHirsutePursuitОценок пока нет

- SEC Jurisdiction Over Intra-Corporate Disputes and Investment ContractsДокумент5 страницSEC Jurisdiction Over Intra-Corporate Disputes and Investment ContractsJoyceОценок пока нет

- Coll V Batangas Case DigestДокумент1 страницаColl V Batangas Case DigestRheaParaskmklkОценок пока нет

- 2008 Bar Questions and AnswersДокумент15 страниц2008 Bar Questions and AnswersimoymitoОценок пока нет

- Rangers CvaДокумент60 страницRangers CvaSteven Burns50% (2)

- Dos01 PDFДокумент1 страницаDos01 PDFSuttonFakes0% (1)

- SPL Undertaking Letter PDFДокумент3 страницыSPL Undertaking Letter PDFSuttonFakesОценок пока нет

- Morgan PDFДокумент1 страницаMorgan PDFSuttonFakesОценок пока нет

- DOS17Документ6 страницDOS17HirsutePursuitОценок пока нет

- Draft RFC Annual Report 2011 10 11 2011Документ21 страницаDraft RFC Annual Report 2011 10 11 2011HirsutePursuitОценок пока нет

- Phone CallsДокумент1 страницаPhone CallsHirsutePursuitОценок пока нет

- Sanned Initial Writ PDFДокумент12 страницSanned Initial Writ PDFSuttonFakesОценок пока нет

- Tom English Accounts PDFДокумент8 страницTom English Accounts PDFSuttonFakesОценок пока нет

- DOS10Документ1 страницаDOS10HirsutePursuitОценок пока нет

- Regan Letter PDFДокумент4 страницыRegan Letter PDFSuttonFakesОценок пока нет

- 15million in Debt Racked Up in Three Years and Apparently....Документ5 страниц15million in Debt Racked Up in Three Years and Apparently....lee_straffordОценок пока нет

- Sheffield Wednesday - An Inside Job!: CastДокумент12 страницSheffield Wednesday - An Inside Job!: Castlee_straffordОценок пока нет

- Horizon Housing REIT PLC ProspectusДокумент214 страницHorizon Housing REIT PLC ProspectusSean SongОценок пока нет

- SWFC One Chapter ClosesДокумент20 страницSWFC One Chapter Closeslee_straffordОценок пока нет

- Maintenance of CapitalДокумент36 страницMaintenance of CapitalDeeyla KamarulzamanОценок пока нет

- App 3 Civic Compliance Victoria Fraud Explained Uiysc4Документ8 страницApp 3 Civic Compliance Victoria Fraud Explained Uiysc4A & L BrackenregОценок пока нет

- Uncitral Case AnalysisДокумент4 страницыUncitral Case AnalysisSrishti NairОценок пока нет

- Capitalized Terms Used Herein and Not Otherwise Defined Shall Have The Meanings Ascribed To Them in The MotionДокумент13 страницCapitalized Terms Used Herein and Not Otherwise Defined Shall Have The Meanings Ascribed To Them in The MotionChapter 11 DocketsОценок пока нет

- LNS Commission Decision 28 02 2013Документ42 страницыLNS Commission Decision 28 02 2013TheCoplandRoadorgОценок пока нет

- Ocean Tankers V Rajah & Tann (2021) SGHC 144Документ11 страницOcean Tankers V Rajah & Tann (2021) SGHC 144Frank860610Оценок пока нет

- In The United States Bankruptcy Court For The District of DelawareДокумент12 страницIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsОценок пока нет

- Hearing Date: June 26, 2008 at 2:00 P.MДокумент17 страницHearing Date: June 26, 2008 at 2:00 P.MChapter 11 DocketsОценок пока нет

- Capitalized Terms Used Herein and Not Otherwise Defined Shall Have The Meanings Ascribed To Them in The MotionДокумент13 страницCapitalized Terms Used Herein and Not Otherwise Defined Shall Have The Meanings Ascribed To Them in The MotionChapter 11 DocketsОценок пока нет

- Usaid Monthly Report April-2015Документ7 страницUsaid Monthly Report April-2015RASHID AHMED SHAIKHОценок пока нет

- P 02 1415 08 2014eДокумент18 страницP 02 1415 08 2014ezamribakar1967_52536Оценок пока нет

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionДокумент41 страницаIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент10 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsОценок пока нет

- RFC Liquidation UpdateДокумент17 страницRFC Liquidation Updatesomei00Оценок пока нет

- Interim Order - Vikdas Industries LimitedДокумент15 страницInterim Order - Vikdas Industries LimitedShyam SunderОценок пока нет

- 10000017151Документ81 страница10000017151Chapter 11 DocketsОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент7 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsОценок пока нет

- DP 148Документ140 страницDP 148AMBОценок пока нет

- Nunc Pro TuncДокумент24 страницыNunc Pro TuncChapter 11 DocketsОценок пока нет

- (2015) Sgca 57Документ109 страниц(2015) Sgca 57Kanoknai ThawonphanitОценок пока нет

- Rawlinson and Hunter Trustees SA and Others V Akers and AnotherДокумент46 страницRawlinson and Hunter Trustees SA and Others V Akers and AnotherNiqueОценок пока нет

- Filed & Entered: SBN 143271 SBN 165797Документ19 страницFiled & Entered: SBN 143271 SBN 165797Chapter 11 DocketsОценок пока нет

- Vizio OrderДокумент44 страницыVizio OrdereriqgardnerОценок пока нет

- Royal British Bank V Turquand 1989Документ14 страницRoyal British Bank V Turquand 1989kzrdurОценок пока нет

- Jill FasslerДокумент4 страницыJill FasslerMarketsWikiОценок пока нет

- TOPIC 5-Mode of Originating ProcessДокумент18 страницTOPIC 5-Mode of Originating ProcessMorgan Phrasaddha Naidu PuspakaranОценок пока нет

- Nunc Pro Tunc To May 12, 2011Документ13 страницNunc Pro Tunc To May 12, 2011Chapter 11 DocketsОценок пока нет

- Business LawДокумент11 страницBusiness LawUynn LêОценок пока нет

- MA506 - TestДокумент13 страницMA506 - Testchetna sharmaОценок пока нет

- Qingdao Huiquan Shipping Co V Shanghai Dong He Xin Industry Group Co LTDДокумент15 страницQingdao Huiquan Shipping Co V Shanghai Dong He Xin Industry Group Co LTDjamesdumps111Оценок пока нет

- Telewest Bondholders Scheme SanctionedДокумент11 страницTelewest Bondholders Scheme SanctionedZhi EnОценок пока нет

- BSM 743 2015 - Lecture Notes 4Документ21 страницаBSM 743 2015 - Lecture Notes 4Mace StudyОценок пока нет

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Документ24 страницыThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsОценок пока нет

- Supplemental Declaration and Disclosure of Jay R. Indyke On Behalf of Cooley LLPДокумент20 страницSupplemental Declaration and Disclosure of Jay R. Indyke On Behalf of Cooley LLPChapter 11 DocketsОценок пока нет

- In The United States Bankruptcy Court For The District of DelawareДокумент30 страницIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsОценок пока нет

- Ex Parte Motion For Order Shortening Notice Period andДокумент9 страницEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsОценок пока нет

- Duane EC LetterДокумент4 страницыDuane EC LetterergodocОценок пока нет

- Dos06 PDFДокумент3 страницыDos06 PDFSuttonFakesОценок пока нет

- DOS17Документ6 страницDOS17HirsutePursuitОценок пока нет

- DOS Index PDFДокумент2 страницыDOS Index PDFSuttonFakesОценок пока нет

- Rangers FC Invoice To Ticketus 12 13 PDFДокумент1 страницаRangers FC Invoice To Ticketus 12 13 PDFSuttonFakesОценок пока нет

- Timesheet CW PDFДокумент2 страницыTimesheet CW PDFSuttonFakesОценок пока нет

- Hay McKerron Invoice 1 Revised PDFДокумент2 страницыHay McKerron Invoice 1 Revised PDFSuttonFakesОценок пока нет

- UEFA Club Monitoring 03 PDFДокумент3 страницыUEFA Club Monitoring 03 PDFSuttonFakesОценок пока нет

- Sevco 5088 Appointments Nov 2013 PDFДокумент4 страницыSevco 5088 Appointments Nov 2013 PDFSuttonFakesОценок пока нет

- UEFA Club Monitoring 03a PDFДокумент4 страницыUEFA Club Monitoring 03a PDFSuttonFakesОценок пока нет

- Hay McKerron Invoice 2 PDFДокумент1 страницаHay McKerron Invoice 2 PDFSuttonFakesОценок пока нет

- Hay McKerron Invoice 1 Revised PDFДокумент2 страницыHay McKerron Invoice 1 Revised PDFSuttonFakesОценок пока нет

- List of Determinations and Decisions RFC 2008 PDFДокумент3 страницыList of Determinations and Decisions RFC 2008 PDFSuttonFakesОценок пока нет

- Quantum PDFДокумент2 страницыQuantum PDFSuttonFakesОценок пока нет

- Chosen One PDFДокумент2 страницыChosen One PDFSuttonFakes100% (1)

- Rangers FC Invoice To Ticketus Agency PDFДокумент1 страницаRangers FC Invoice To Ticketus Agency PDFSuttonFakesОценок пока нет

- Regan Letter PDFДокумент4 страницыRegan Letter PDFSuttonFakesОценок пока нет

- Morgan Rizvi PDFДокумент1 страницаMorgan Rizvi PDFSuttonFakesОценок пока нет

- Liberty Capital Draft Funding Letter Oct 2010 PDFДокумент1 страницаLiberty Capital Draft Funding Letter Oct 2010 PDFSuttonFakesОценок пока нет

- Imran Rafat Craig Aidan Chris 2 PDFДокумент2 страницыImran Rafat Craig Aidan Chris 2 PDFSuttonFakesОценок пока нет

- DOS10Документ1 страницаDOS10HirsutePursuitОценок пока нет

- UEFA Club Monitoring 02 PDFДокумент3 страницыUEFA Club Monitoring 02 PDFSuttonFakesОценок пока нет

- Hidden Bonus Payments Season 2010 11 PDFДокумент3 страницыHidden Bonus Payments Season 2010 11 PDFSuttonFakesОценок пока нет

- DOS14Документ4 страницыDOS14HirsutePursuitОценок пока нет

- Licence Issues PDFДокумент3 страницыLicence Issues PDFSuttonFakesОценок пока нет

- Invoice Chat 2 PDFДокумент3 страницыInvoice Chat 2 PDFSuttonFakesОценок пока нет

- Darrell King PDFДокумент9 страницDarrell King PDFSuttonFakesОценок пока нет

- DOS12Документ3 страницыDOS12HirsutePursuit100% (1)

- Senate Hearing, 113TH Congress - Jpmorgan Chase Whale Trades: A Case History of Derivatives Risks and AbusesДокумент1 258 страницSenate Hearing, 113TH Congress - Jpmorgan Chase Whale Trades: A Case History of Derivatives Risks and AbusesScribd Government DocsОценок пока нет

- Iridium Enters Public Markets via GHL Acquisition CorpДокумент31 страницаIridium Enters Public Markets via GHL Acquisition CorpshtshtshtОценок пока нет

- Project Report Brahmdeep SinghДокумент69 страницProject Report Brahmdeep Singharush GargОценок пока нет

- Satyam AccountsДокумент16 страницSatyam AccountsvrushaliОценок пока нет

- Annual Report 2008Документ31 страницаAnnual Report 2008paglaummisОценок пока нет

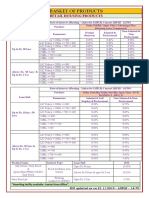

- BASKET OF RETAIL PRODUCTS RATESДокумент3 страницыBASKET OF RETAIL PRODUCTS RATESVirendra K VermaОценок пока нет

- 2016 - Product Keys For Autodesk Products - Installation, Activation & Licensing - Autodesk Knowledge NetworkДокумент9 страниц2016 - Product Keys For Autodesk Products - Installation, Activation & Licensing - Autodesk Knowledge NetworkHerman MwakoiОценок пока нет

- Organizing Genius - The Skunk WorksДокумент14 страницOrganizing Genius - The Skunk WorksAbhimanyu SinghОценок пока нет

- 2018 Annual Total Compensation Paid To JobsOhio EmployeesДокумент4 страницы2018 Annual Total Compensation Paid To JobsOhio EmployeesJo InglesОценок пока нет

- Indra Batch 20100404 April 20, 2010-pДокумент37 страницIndra Batch 20100404 April 20, 2010-pReynaldo EstomataОценок пока нет

- Banks and Brand SlogansДокумент12 страницBanks and Brand SlogansSumit Agrawal100% (2)

- AL Meezan Investment Management Limited: Fund Managers' ReportДокумент11 страницAL Meezan Investment Management Limited: Fund Managers' ReportSalman ArshadОценок пока нет

- WetFeet I-Banking Overview PDFДокумент3 страницыWetFeet I-Banking Overview PDFNaman AgarwalОценок пока нет

- PwC's Role in the Satyam ScamДокумент17 страницPwC's Role in the Satyam ScamAishwarya Baid100% (1)

- Welcome To HDFC Bank NetBanking PDFДокумент2 страницыWelcome To HDFC Bank NetBanking PDFHarvinder SinghОценок пока нет

- FoundryДокумент2 страницыFoundrypragantraОценок пока нет

- LJVVHДокумент2 страницыLJVVHLeroj HernandezОценок пока нет

- A1-Cash and Cash Equivalents - 041210Документ28 страницA1-Cash and Cash Equivalents - 041210MRinaldiAuliaОценок пока нет

- GauriДокумент12 страницGauriRahul MittalОценок пока нет